Telecom operators are fervently working towards 5G network and services deployment in order to be an early mover in the market. Operators are investing in Digital Transformation (DX) as well as inking partnerships with other players in the ecosystem to monetise on exciting new use cases in the enterprise segment and make market inroads.

The consumer market has become a retention play and on the whole many operators are experiencing declining margins and it appears unlikely that the consumer will pay more for higher speeds. Device affordability for mass-market remains a challenge though Chinese smartphone vendors are expected to release sub US$ 300 5G smartphones later this year. 5G can be expected to arrest the lengthening consumer upgrade cycle due to the attractions of not only faster speeds but improved streaming and cloud gaming. Data services revenues will continue to generate growth but this will be offset by losses in mobile voice services.

5G – An enterprise value proposition

Telecom operators have thus far been largely unsuccessful in penetrating the enterprise ICT market due to a variety of reasons including the slow pace of innovation, lack of a one-stop-shop offering, insufficient channel to market to especially small and medium enterprises (SMEs), and lack of skills in offering non-network services. 5G technology presents operators with another opportunity to address this long-standing challenge with the flexible features of enhanced mobile broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC) and massive machine type communication (mMTC) enabling tailored network and services offerings. 5G promises to revolutionise various industry solutions based on required data rates, low latency, reliability, and machine-type communications.

Monetising 5G is a key topic among leading executives and new business models are being devised. Connectivity services will be offered with a mix and match of throughput, bandwidth volumes and latency requirements. Fixed Wireless in Southeast Asia will be very popular considering the low penetration of fibre to the home and will provide enterprises with a viable secondary connection to the internet. Popular applications including video streaming and gaming which are speed, latency and volume hungry will also be a target market for operators.

More speed, latency and number of connections

5G offers theoretical speeds of 20 times that of 4G, low latency of 1 millisecond (ms), a million connections per kilometre and is expected to power a new era of mobile Internet of Everything (IoE). Offering high speed is the initial offering to the market and operators are going to be offering minimum guaranteed speeds for the first time. A high definition movie could be downloaded in 10 seconds while low latency means better performance for live sports, gaming, mission-critical automation and driverless cars – among others.

Fixed Wireless Access is the new wireless fibre

5G will offer fixed wireless access (FWA) or “wireless fibre” to households as an alternative to fixed broadband. It can be ideal as a redundant second link offering when the primary link is down. FWA broadband services offer a serious alternative to fixed broadband services which is plagued by the high cost of civil works for fibre optic deployment and expansion of the network to reach the rural population. FWA is expected to make strong inroads into households in Southeast Asia with the exception of Singapore, as many nations lag in fixed broadband penetration. As a comparison, ITU reports that fixed broadband penetration in countries such as South Korea (41.6%) and Hong Kong (36.8%) lead their Southeast Asian counterparts – Singapore (28.0%), Vietnam (13.6%), Thailand (13.2%) and Malaysia (8.6%).

A boon for Video and Gaming industry

Gaming is huge in Southeast Asia, notably in Thailand and Indonesia, and operators can take advantage of this offering with partnerships and value-added services with cloud gaming, high bandwidth and low latency packages. With cloud gaming, gamers can access a library of popular high-quality games minus the need for expensive hardware which has been the case in the past. This platform allows content creators and publishers to access the huge Southeast Asian market and monetise.

B2B2x is not a new concept where operators partner with leading providers of video streaming services through direct billing and 5G will be able to offer low latency, for example for live events. This brings in not just a commission per subscriber but additional revenue for the additional network features such as low latency.

Video streaming providers such as Netflix, Viu, Hooq and Iflix are worthy partners for a subscription – so are ad-based video-on-demand services. Live sports streaming service also makes for a very lucrative opportunity with 5G features of high data throughput and low latency.

Readiness through digital transformation

Efforts for preparedness for this business shift means significant operational and technology platform improvements, operating on the cloud, ease of incorporating the partner ecosystem and supporting a multitude of pricing models. DX should run parallel to the build of 5G public and private networks for a telecom provider to be in a leadership position and for them to be able to fully monetise 5G. Operators will be making major changes to OSS and BSS to support 5G use cases with the ultimate goal of ensuring customer-centricity.

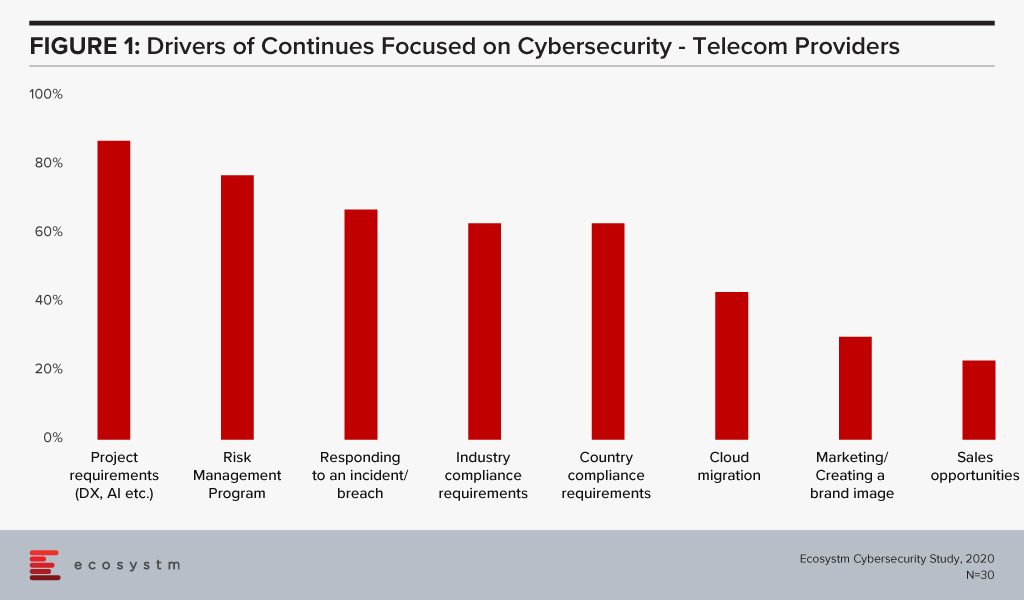

Ecosystm research finds that nearly two-thirds of telecom providers are looking to increase their cybersecurity spending in the year. It is also clear that the biggest driver of that spend are their DX projects (Figure 1).

Cybersecurity is of paramount importance more than ever now with the increase in devices, software-based network services and edge computing. It is essential that a robust cybersecurity framework is in place as 5G will drive DX in enterprises, power the Digital Economy and provide the critical core infrastructure for Industry 4.0. Operators need to ramp up investment in cybersecurity technology, processes and people. A telecom operator’s compromised security can have country-wide, and even global consequences. As networks become more complex with numerous partnerships, there is a need for strategic planning and implementation of cybersecurity, with clear accountability defined for each party.