Probe Group, a Business Process Outsourcing (BPO) solutions provider and Stellar – a customer experience (CX) management organisation announced a merger to create Australia’s largest and most diverse CX provider group. The partnership will combine the experience and expertise of both companies and will employ 12,600 people to provide outsourcing of business process services for customers across six countries. Probe Group is backed by Quadrant Private Equity and Five V Capital.

Probe Group has been expanding its business presence since being acquired by Five V Capital in early 2018. At the time, Probe acquired Salmat’s Contact business, a broad-based CX operation which helped Probe expand their presence in Australia, New Zealand and the Philippines. Looking out for further opportunities, in December last year Probe Group acquired Australia-based and Philippines-focused Beepo and quickly followed this with an acquisition in January this year of the Philippines outsourcing agency MicroSourcing, a counterpart to Beepo which greatly expanded Probe’s Philippines offering. These acquisitions helped Probe extend their service offering from CX into Shared Services and Knowledge Services.

This is a brilliant move as Stellar is one of the most successful contact centre outsourcing providers in Australia. With successive growth for 22 years and having a strong footprint in both the public and private sectors, the acquisition will give Probe Group entry into some large accounts. Additionally, Probe will gain a large pool of well-trained agents in Australia and other locations across the globe.

The merger comes at an interesting time when we are seeing several organisations re-evaluate their outsourcing strategy. There is also an active interest in enhancing CX through AI/automation. Both the Probe Group and Stellar understand the Australian market and consumer sentiments and the merger is expected to drive better customer outcomes in the Australia market.

Prior to COVID-19, Probe Group employed 8,500 agents. With this acquisition, they will have 12,600 agents and an expected turnover of USD 420 million. That is not only impressive but will help Probe offer a variety of services including both onshore and offshore, to take on their rivals.

Rise of Onshore Activity will see New Shifts in CX Delivery Models

The COVID-19 pandemic has brought about several changes to the outsourcing sector. The disruption caused by services in many key offshore markets led to organisations re-evaluating their contact centre outsourcing strategy and some have started moving contact centre jobs back to Australia. Westpac is the latest organisation to announce that they are moving 1,000 jobs back to Australia. They have stated that while they expect productivity benefits over time, there is clearly a cost to adding 1,000 roles – likely an uplift of around $45 million per annum in its costs by the end of 2021.

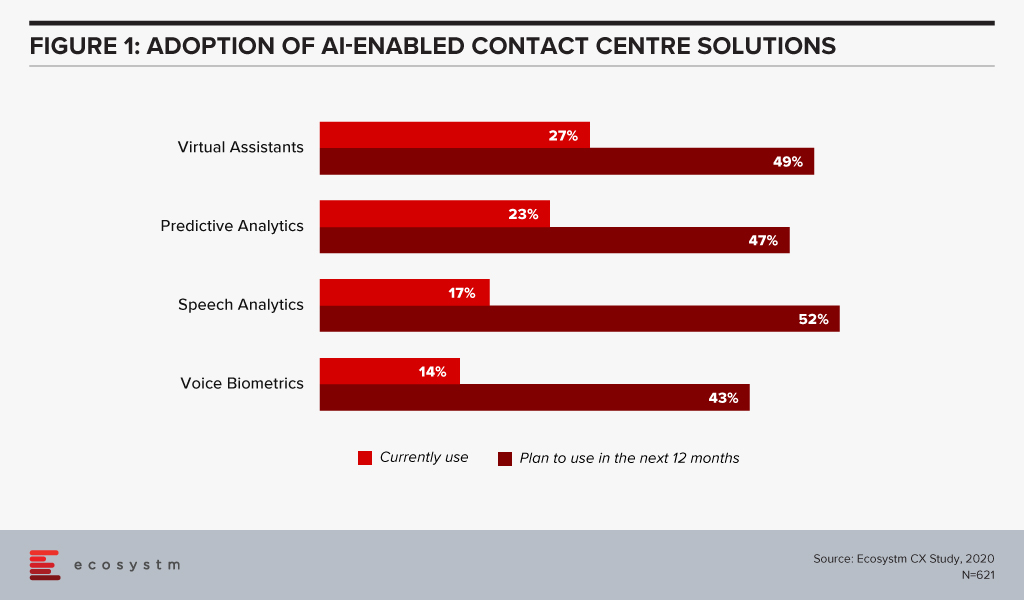

The cost element is bound to creep in over time and contact centres will ask outsourcing providers to help drive costs down. Options would include moving some services offshore, while the critical remain onshore. Striking that balance to manage costs will be important and so will be the ability to offer various options for customers. Additionally, we can expect to see an increased demand for self-service technologies. Many organisations are in the midst of re-evaluating the use of AI and automation technologies not only as a way to drive great CX but as a way to also reduce costs (Figure 1).

Contact centres are starting to realise that to modernise their contact centre, the ability to lead with machine learning and AI technologies are critical. It will drive the deployment of natural language understanding (NLU) and conversational AI, sentiment analysis, transcription capabilities – and ultimately provide intelligence about the call even prior to the call being fielded. However, it is worth noting that whilst automation is on the rise, the role of the agent is not going away anytime soon and will grow in importance. We will see the rise of the “super-agent’’ and the agent’s role will evolve over time and AI/automation will generate rich insights to help aid the agent and the contact centre team to better predict customer behaviour and patterns.

The Next Generation of Outsourcing Providers must Drive Innovation for their Customers

Companies today are not outsourcing just to save labour costs. While cost remains an important angle, it will not often be the main driver for outsourcing in the future. The next generation of outsourcing providers will have to build rich solution capabilities, customer journey maps and help customers understand how to align all channels. This involves working with many different technology providers to build the right capabilities for their client organisations. Organisations are keen to modernise their contact centre operations to achieve excellence in CX. Outsourcing providers must have the capability to deliver that innovation.

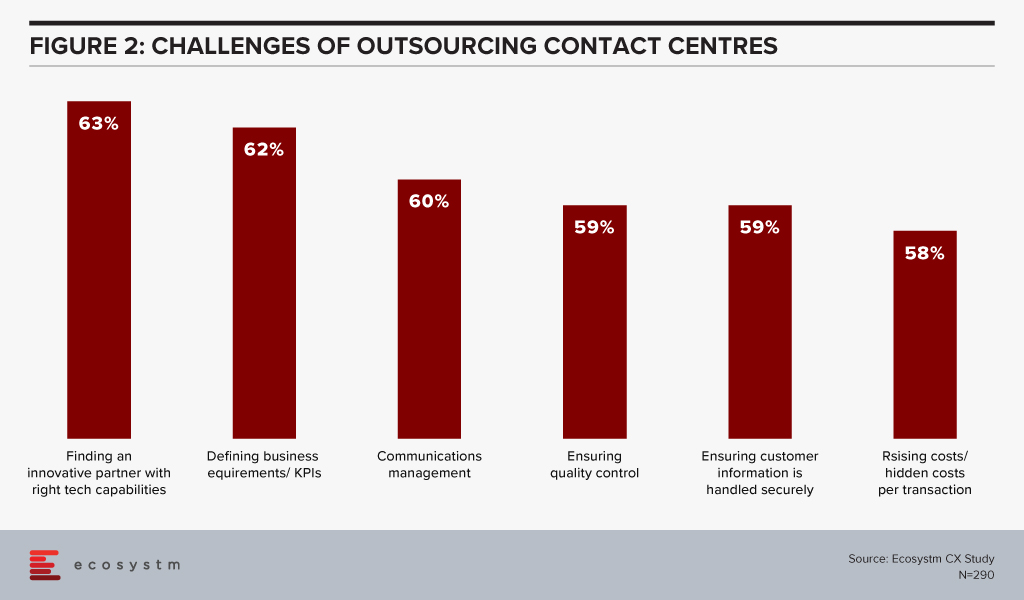

Ecosystm research finds that 63% of organisations that outsource their contact centre functions are challenged with finding the right partner that can drive innovations (Figure 2).

Contact centre outsourcing providers have a role to play in some of the following areas:

- The ability to adapt to change and take on risks together with the client

- Ensuring that all forms of security and governance measures are in place. This includes considering factors such as data security, data handling, and security features enabled across devices, applications, and the network. This is especially true for Government and Financial services contracts. Additionally, with some organisations preferring the work from a home model, there are security issues that must be addressed for the scenario.

- Helping the move from a traditional contact centre to a contact centre that delivers the highest levels of CX for its customers. Applying technologies such as AI and machine learning, NLU, biometrics, speech analytics, customer journey analytics and robotic process automation (RPA) will be key to modernisation.

- Being able to build a business continuity plan (BCP) for their customers in the event of another crisis.

Ecosystm Comment

Probe Group started off as a business specialising in outsourcing services in the credit and collections segment. Their customers in 2016 ranged from organisations across Financial Services, Utilities, and Federal and State Government. At that time, Probe employed about 300 people and their turnover was about USD 25 million. They did not rest on their laurels and realised that organic growth combined with strategic acquisitions would give them a foothold across various geographies and add new capabilities to their portfolio. With the rise in onshore activity, they will now be in a strong position to offer their customers various services and models of engagement to help drive CX excellence. The acquisition of Stellar will help Probe Group propel to greater heights and we see a new CX outsourcing giant being born.