A decade ago, the axiom of a successful business model was to identify a need, find the market and then develop an idea or product that fits into that chain. It was a process of inserting a product in the customer’s already existing experience journey with the hope that the product/idea would deliver efficiency to the client. This efficiency could be financial, operational, marketing or cost savings – the uni-product, uni-feature approach.

There has been enough said about the many companies that failed to innovate beyond their existing product/feature and failed to stay ahead of the game. Nokia and Blackberry remain at the centre of any discussion about “lack of innovation”. There are others like Kodak, Canon, Napster, Palm, Blockbuster – that were devoured by innovative competitors.

The predators were ones with the vision to see the entire value chain and not just their own product. Netflix created content and distributed it, Apple touched the lives of their customers in multiple ways and AirBnb provided accommodation inventory, choice and booking all in one. The new secret sauce is to provide the customer with an ecosystem and not a product!

The Need to Transform

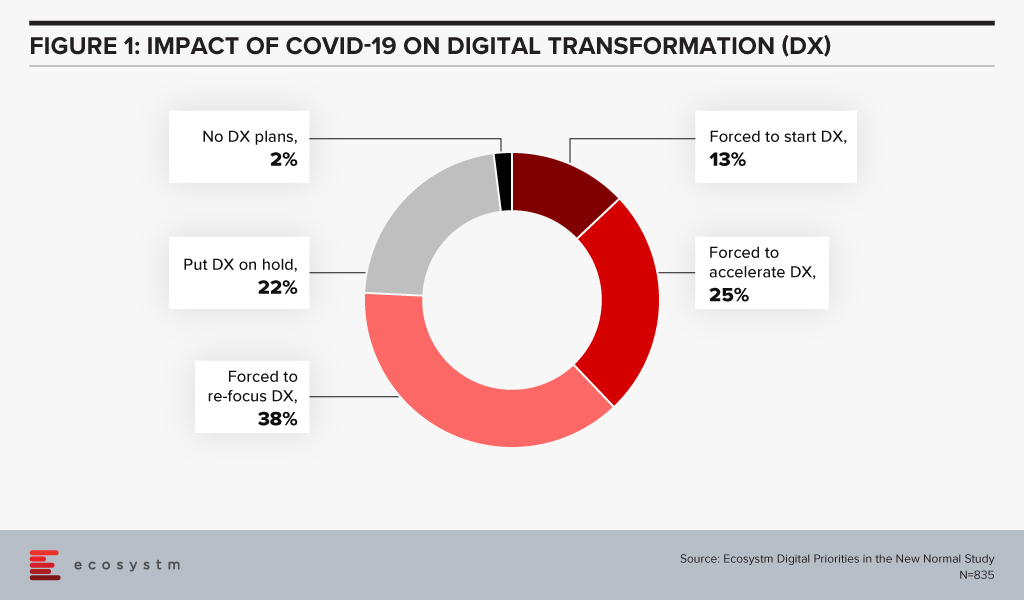

Cut to the COVID era – there are many businesses facing the downturn and experiencing the “moments of truth” giving rise to a desperate attempt to innovate, transform, survive, and come out as the rising stars. Ecosystm research finds that 98% of organisations have re-evaluated their Transformation roadmap (Figure 1), while 75% have started, accelerated or refocused their DX initiatives.

New business models are evolving, and accelerating digitalisation is the result. The digital movement, be it in food delivery or payments, is here to stay. This digital acceptance and absorption exaggerate the need for business models that capture holistic ecosystems and entire customer journeys, due to reasons that separate the hunter and the hunted.

- Margins will never be the same again as in the uni-product model. Using the F&B analogy; with the increasing number of customers wanting to dine in the comfort of their homes, restaurants cannot use ambiance as the price differentiator. Since most restaurants are available on food delivery services, customers are getting brand agnostic. This is the start of commoditisation of dining. Restaurants (or food caterers now!) will need to play the price card to remain competitive resulting in compressed margins. The food delivery market is expected to grow 4-fold to USD 8 billion by 2025 but with lower margins. This example of the food delivery model will be the same as experienced by retail, apparel and other industries.

- Customer experience will still be the differentiator and lever for loyalty and repeat purchase. Factors like proximity, parking, in-store experience, and store layout are fast getting replaced by the ease of navigation, user experience, seamless check out and finally efficient and timely delivery. The ease of transaction including multiple steps of search, assessment, evaluation, payment and delivery is of paramount importance. Customers do not want fractured journeys with multiple drop-offs. A unified seamless journey will win.

- Virtual, Digital and Automation are the three mantras that management consultants are betting on. However, this trilogy will not guarantee survival since the road to recovery is not a straight one. Different work schedules, observing various curves and on what point of the curve the business, its customer and the market are at, will add to the complexity of decision making and transformation.

Given the above, an obvious strategy to beat the existential crisis is to transform and seek out sustainable operating models. However, it may not be so simple since most businesses may not be able to change models as quickly as needed. There is an inherent cost to change since the existing processes and procedures have been well oiled and smoothed over time. The much-needed change requires the infusion of the 3Ts (time, technology, training) and associated costs. Most often, there is an inverse correlation noticed between the sturdiness of the business and its ability to be flexible to change. Businesses that are “rock-solid” and profitably sturdy and stable, have high inertia of transformation versus FinTech businesses, as an example, that pride themselves with nimble operations but are financially fragile and may not be able to absorb the cost of speedy transformation.

This Sturdy-Flexible continuum is the tight rope walk that businesses will need to walk in this need for transformation. Businesses that embark on this walk alone will find it extremely painful and lonely. Especially in the case of small business owners who are scared and low on all 3Ts.

The Rise of Ecosystems

The new world has manifested that businesses that use physical space or assets as their competitive advantage are more prone to be impacted. Retail, Education, Hospitality and Entertainment are some obvious examples that have been impacted by the physicality in their propositions. Digital businesses are more agile but have suffered in their inability to scale up in time to capture the increased demand.

Fashion retailer FJ Benjamin has decided to shut 300 physical stores and rely on online sales. This strategy also helps to utilise precious time to scale diversification. Other retailers too have been going down the FJ Benjamin path and ramping up eCommerce as this trend is expected to stick beyond COVID-19.

Zouk, the renowned nightclub with 30,000 square feet of space in Singapore uses this venue as a live streaming venue during the day to host bazaars for eCommerce vendors. From June 2020, it launched an online shop selling merchandise, bottled cocktails and food from its RedTail kitchen.

Transformation of businesses will require capabilities that were not created within their models. The instinct to survive in the short term will require businesses to create symbiotic partnerships. This will require some fresh thinking by business leaders.

- Change the “Build” obsession and not try to own every leg of the customer journey. That will not only take time but also distract capital and management.

- Rethink the customer needs – and this time think of the entire journey rather than an inward view of product-market fits. Customer needs are changing at breakneck speeds, so chasing and “building” these “fits” will always remain a common string amongst laggards.

- Connect with like-minded ecosystem players and complement strengths with a single-minded focus on solving customer problems.

- View technology stacks through the lens of your partners. There may be opportunities available from near open source technology solutions.

For example, FJ Benjamin will need the last-mile-delivery capability that will be provided by partners who have optimised in that field, Zouk has tied up with Lazada to host the bazaars and GrabFood is using underutilised taxi capacity to meet the increased demand for food delivery. There are many other examples in the O2O (Offline to Online) space.

This ecosystem approach is also relevant to other sectors like Financial Services. These firms also need to understand the changing consumer needs faster, with a mantra to deliver. Aspire, originally an alternate lending platform has gone through a metamorphosis and transformed into a Neobank. From a uni-product loan provider, it is now solving for a business account, card solution, integration with expense management solutions and continue to provide loans. Capabilities not necessarily built in-house.

The changing world will give rise to business models that will integrate and complement each other. Businesses with an ecosystem mindset will be winners while others might just be relegated to oblivion.