Agents are the most valuable assets in a contact centre. In the current environment, the biggest threat is agents getting infected, causing the closure of contact centres for weeks or possibly even longer. We are already seeing the impact of that with offices being shut, students not going to school and industry gatherings and events being put on hold or cancelled. So having a business continuity plan (BCP) is critical. The BCP should include ways to continue to engage with customers.

The contact centre manages live interactions. Every second there are voice calls coming in, emails received and self-service tools being accessed. It is important to have multiple backup plans – both from a people and a technology perspective – to keep operations running effectively, without calls being put on hold too long or with other channels going unanswered. Contact centres battle with these challenges every day and the situation will get far more serious with the ongoing changes we are witnessing.

Some important considerations include:

Having a backup plan allowing agents working from home

More contact centres today are gearing up to agents working from home, but the process is not an easy one. To begin with, the initial set up includes having the right connectivity and a reliable network. Ensuring that the agent has the right working environment with minimal distraction is crucial. A good quality headset can help. A poor-quality headset will only create unwanted problems with understanding customer issues and handling them. Other concerns include security, tracking how data is being handled, agent under-performance and safety of the agents from an operational and health perspective. Measures such as listening to call recordings and storing them centrally are growing in importance. Multi-factor authentication and analytics using agent logs are some measures that can be put in place.

While there are lots of tools and technologies to monitor and check on agents, the key for home-based agents will be trust. Some outsourced contact centre providers that have been using home-based agents for years have stated that having trust and not micromanaging the agents, is essential for the model to work. Some contact centres have also deployed a BYOD policy for home-based agents assuming the right security, device management, application management and authentication measures are in place.

Organisations should also consider actively recruiting additional home-based agents. These agents could be retirees, currently unemployed or people with mobility issues who prefer to work from home.

Given the difference in the working environment, the metrics used to measure agent performance needs to be modified to be more realistic and fair to both agents and organisations.

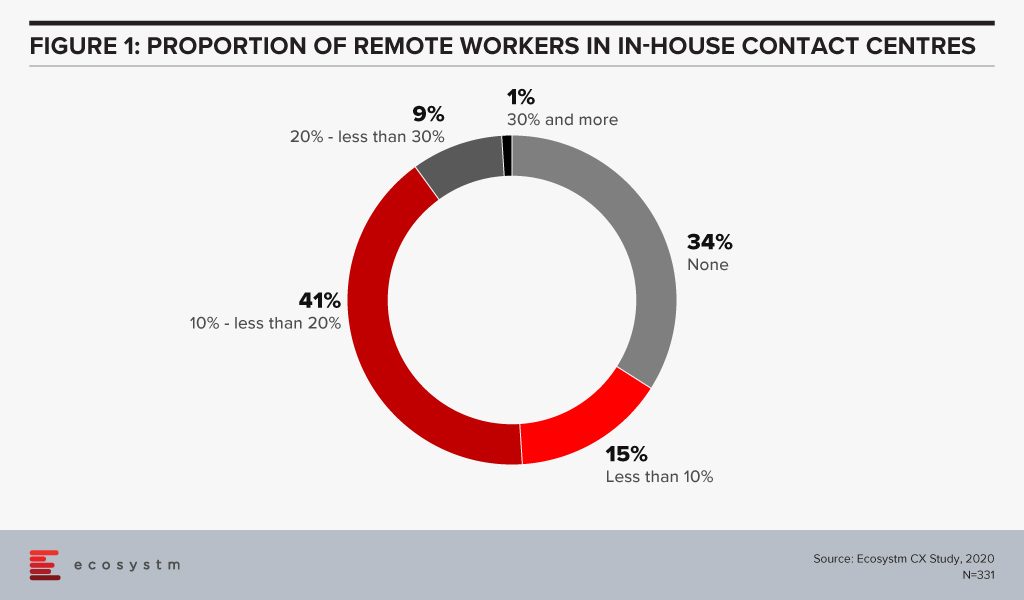

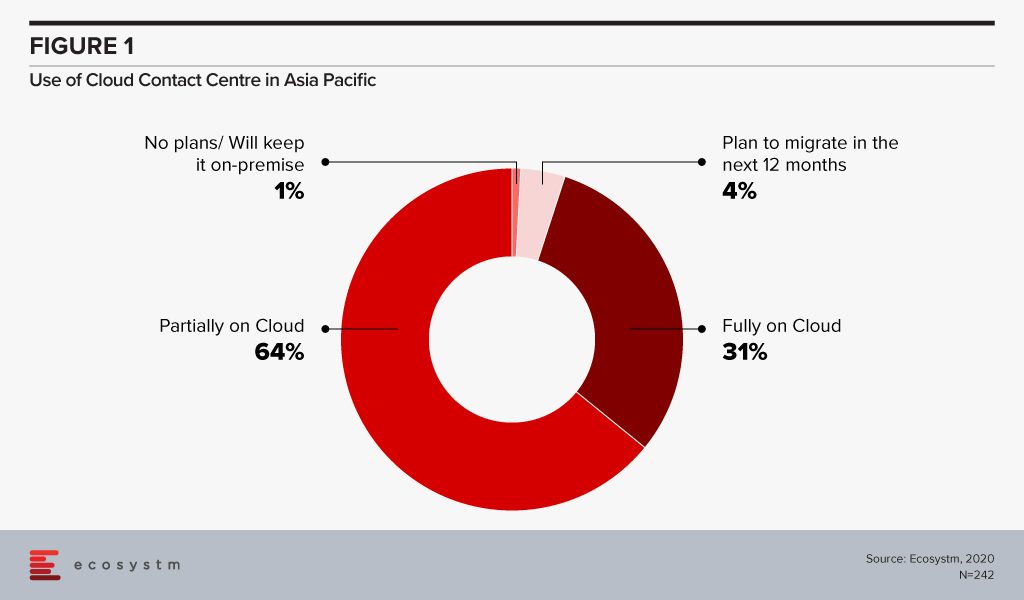

Employing home-based agents will drive employment amidst challenges in the economy. Ecosystm research finds that more than a third of organisations do not have provisions for agents working remotely (Figure 1).

For a long time, the industry has talked about the rise of home-based agents and while it has received positive momentum, it has never really taken off in a big way. This time it will.

Managing spikes in voice and non-voice calls

In industries such as healthcare and airlines, call volumes are exceeding normal volumes. Having the ability to deflect the calls to other non-voice channels will be important. It might need the Interactive Voice Response (IVR) scripts to be changed from time to time to manage the flow of the calls. This is when cloud architecture becomes important. The cloud model can be used to make changes to call workflows easily. The sudden peaks will also require changing the channels easily and without intervention from IT. This is where the agility of cloud comes in as it allows changes and additions – for example when 500 agents need to be added or moved to work on other areas – to be made more easily. Ecosystm research finds that currently, only a third of organisations have their contact centre solutions fully on a cloud, with another 66% with partial cloud solutions. This is set to change with the rise in the number of home-based agents.

There should be thought and planning on how to deflect voice calls to other self-service channels. In the current environment, some organisations deploy a call back option when there is an overflow calls. Similarly looking at deflecting voice calls to self-service channels to ease the load on agents should be evaluated.

Managing back up locations (onshore and offshore)

Contact centre operators are looking at ways to isolate agents and keep them safe. Apart from very strict hygiene measures, organisations are also restricting agents to their specific floor. Some are looking at having agents split into different centres, to contain the risk of mass infection.

Several contact centre operators are building contingency plans to route calls to outside the onshore location in case the situation in a site or a cluster worsens.

For back-end contact centre activities and non-voice calls, taking the load off from the current onshore setup and pushing them offshore, can be an option. The best place to start would be by evaluating each client contract and SLAs especially on security, regulation and privacy issues regarding customer data-handling.

There will be a lot to be considered too should the country go into the full lock-down mode as we are starting to see with a few countries. This makes the case for employing home-based agents stronger.

Using messaging apps, the website and FAQs for daily notifications

Many contact centres are informing citizens and customers about the changes in business operations, services offered, refunds, where to go for help, what do to in an emergency and other essential information through the website, app or the updated FAQ. This will help reduce unnecessary voice and non-voice enquiries to the contact centre. During an emergency, it is normal that phone queries will rise and developing a detailed FAQ is critical to counter that. The more detailed the FAQ giving essential information, the more agents will be able to focus on the more essential day to day activities. Several companies are now sending pop-ups within apps about daily changes to avoid an overflow of inbound enquiries.

Virtual Assistants and Conversational AI can help to ease the load

The more intelligent the virtual assistant and conversational AI platform, the more a customer will be able to get the right response. The challenge has been that many platforms are poorly designed and customers get frustrated because they are unable to get the basic information they need. In times of high inbound activity, if answers to simpler queries can be provided through a chatbot, it can help ease the load on agents. It is good to start planning for this as it will take some time to get the virtual assistant platform up and running and even longer for the algorithms to learn from historical patterns to work well. While it may not be the perfect solution now, planning for a Conversational AI can bring some sort of balance back to the contact centre. Having a solid knowledge management system at the back-end cannot be compromised. Without a good knowledge management system, the virtual assistant solution will force customers to leave the self-service platform and place a call to the contact centre, defeating its very purpose.

The challenging situation we are in is undoubtedly putting pressure on contact centres. It is not uncommon now for customers to be put on hold – for more than two hours and in some extreme cases more than 7 hours! In times like this, understanding data and the patterns around data from each customer touchpoint will help plan the next steps on how best to navigate the situation. Testing and pre-testing the channels and the changes made before they go live must be done rigorously.

Whilst these are very challenging times for the economy, the good news is that contact centres are successfully piloting or have already implemented some or all of the above discussed here. Outsourced contact centre providers are running pilots across various locations and applying technology to deal with the challenges they are witnessing daily. Technology has also come a long way in the contact centre space, and by the application of the right technologies, scale, and business continuity measures, resilience can be achieved.

This blog was created with input from CX leaders across the entire Asia Pacific region. The author wishes to thank everyone for their valuable input.

In the ‘Top 5 Customer Experience Trends for 2020’ that I authored with Tim Sheedy, we had spoken about the need for businesses to understand the end-to-end journey of each customer and to evaluate how to personalise it. To be able to personalise customer experience (CX), organisations need to get feedback from their customers. However, today’s customers are experiencing survey fatigue! Surveys are always the best way to measure how customers feel after they have interacted with a brand. Already, many will not participate unless there is a discount or incentive, which eats into future margins. Smart businesses will begin to use AI to detect emotions and mood, and analytics to measure experiences.

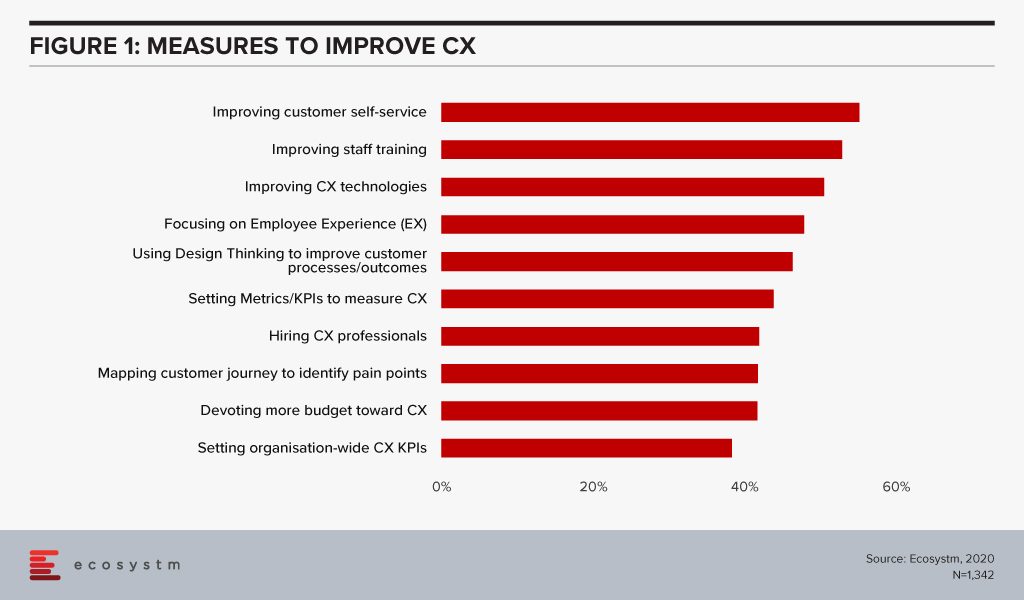

The challenge for years has been that customer teams have focused on the traditional inbound and outbound customer interactions. Ecosystm research finds that while organisations are investing in improving customer self-service, not all of these organisations focus on customer journey mapping and analysis (Figure 1).

Brands now need to understand and personalise the experience before the customer interacts with the brand and after they are done interacting with the brand. The ability to apply machine learning and AI to offer insights to predict the movement and journey of the customer will be a significant focus – and challenge – for customer teams. Customer Journey Analytics will allow brands to deliver that “frictionless” service.

Detecting the problem earlier in the CX loop or before the call is placed to the contact centre has significant benefits. The emotion of the customer at every part of their journey and not just when they call the contact centre needs to be captured in real-time and analysed to address the problem as soon as it arises. For example, if it can be identified prior to the customer calling the airlines to complain about a booking, the agent can call the customer preemptively to inform the customer the problem will be fixed and even go the extra mile to give the customer a discount or a good seat. Another scenario is when a hotel customer has had a bad experience with the meal they ordered, their feedback to the frontline staff earlier in the loop can be passed on and before they check out of the hotel, incentives such as free vouchers can be used to improve the CX. When such measures are taken earlier in the CX journey, the customer will go a long way to buy more products and services from the organisation. This can have an impact too on post-experience surveys or Net promoter scores (NPS).

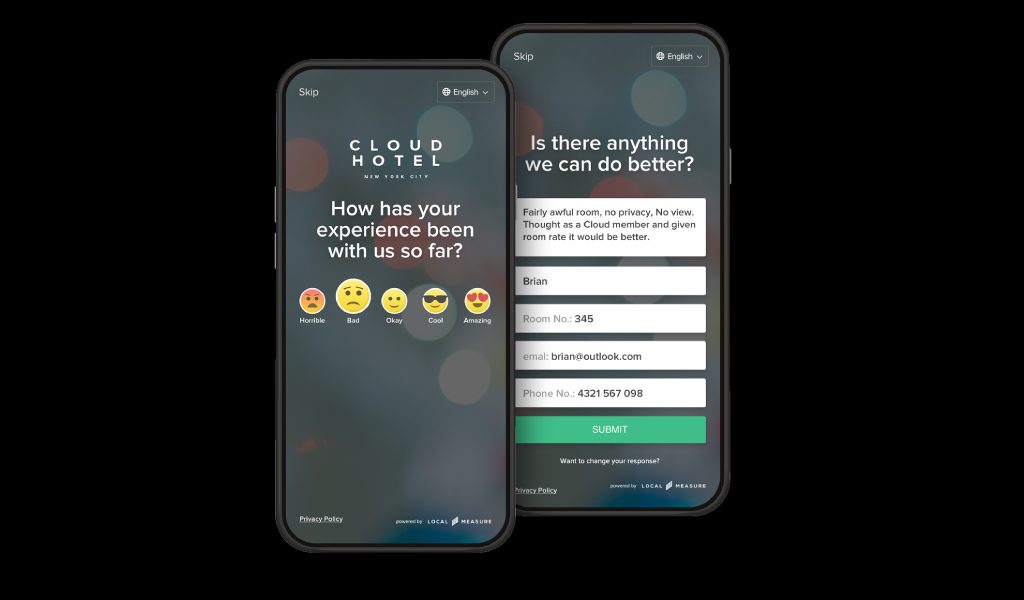

As organisations design, customer feedback platforms for customers such as simple surveys through an app or as a prompt on the mobile device or laptop, the look and feel of the platform combined with simplicity cannot be ignored. The design has to be carefully thought about and should be intuitive and also easy for the customer to enter the feedback.

Niche Vendors will play a crucial role in connecting the missing dots in CX

There are niche vendors emerging in this space and we can expect more players to emerge that will develop applications that can address CX issues very early in the journey of the customer. For example, Australian vendor Local Measure’s solution is used to capture feedback during the different points of a customer’s journey, especially in the tourism, hospitality, retail and entertainment industries. One of their solutions, Pulse is a real-time feedback tool to help improve satisfaction while customers are still on site. The company works in collaboration with Cisco and when customers log on to wifi on a site, a pop up appears on their screen to ask customers how their experience has been so far. By rating the experience using emojis (happy, sad, etc), the front desk staff or personnel within the premises, can see the feedback in real time. This can send alerts that will trigger that something has gone wrong to frontline staff or the contact centre team. The idea is to drive a positive outcome for the customer, identify problems early in the journey and address the problems immediately for higher customer satisfaction.

Figure 2: Local Measure’s Real-Time Customer Feedback Tool

The company has clients such as Dubai-based Majid Al Futtaim that includes 13 major entertainment and retail-focused hotels, serving 1.6 million guests annually. Instead of giving feedback only at check-out, the Pulse feedback screen displays on guests’ computers or mobile devices as they log in to the hotel’s Wi-Fi, asking them to leave feedback on their experience. Novotel Bangkok Sukhumvit 20 has also implemented the solution so that staff can view feedback immediately as responses come through on their mobile devices, and after addressing the issues they can mark each response as ‘actioned’, providing visibility to the whole team.

The Local Measure solution integrates into Cisco’s Wifi offering and when the customer opts a pop up will appear on their screen to lead the customer to the Local Measure platform. Products such as this help fill the gaps where the complaint by the customer can be escalated to the contact centre very early in the journey of the customer. Contact centre vendors have not addressed this space in a dedicated manner and we can expect more niche vendors to make their mark in this space. The data collected include real-time feedback, social media alerts, post-event experience and location analytics. When this data is further integrated into CRM and with the data gathered from the contact centre channels, organisations will be able to gain a better understanding of the customer journeys and analyse what should be done better.

As larger contact centre solution providers realise the value of such niche offerings that help connect the CX dots, they will look to acquire some of these niche solution providers in the customer experience segment. Cisco’s acquisition of Cloud Cherry last year, is an example. The solution allows organisations to listen to their customers across 17 different channels (e.g. email, chat, web) along the entire journey and leverage the Cisco’s contact centre solution to drive better. NICE acquired Satmetrix two years ago, to further enhance its presence in the CX management space.

CX is becoming a company-wide initiative

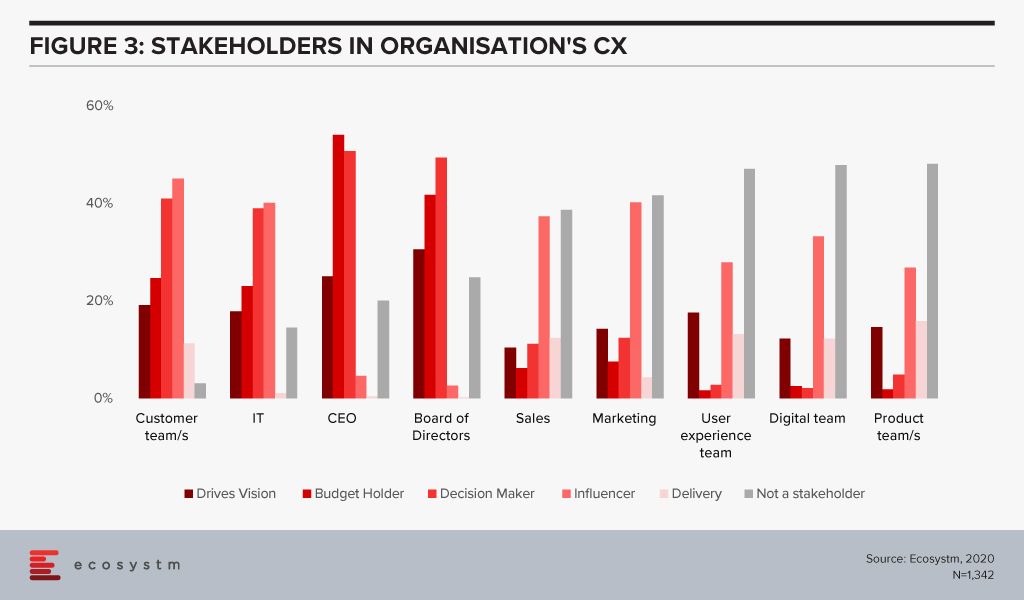

Technologies across customer journey analytics and CX management have often been sold to the marketing and sales teams. As companies look to complete the full loop of understanding the customer journey, the solution must be integrated into the contact centre teams. Based on the global Ecosystm CX Study, the marketing, sales, product, customer service, digital and UX teams are becoming influencers in CX (Figure 3). The Board and CEO are starting to play an important role in decision making. As organisations look to further drive greater CX, more teams across the organisation are starting to realise the need to collaborate to deliver on the vision.

Moving the needle from being Reactive to Proactive in CX will be important

The traditional way of getting feedback after the customer has had the experience or after the customer has spoken to the agent is one of the reasons why organisations are finding it hard to deal with customer frustrations. Being proactive rather than reactive is how customer journey analytics and CX management technologies can help organisations address these issues. AI and machine learning will play an important part in this area moving forward as after the call is placed to the customer, data around customer emotions, sentiments, tone of the voice and keywords used in the discussion, can help in better understanding of how to provide a solution or solve the customers’ challenges.

On December 18, AWS launched Amazon Connect in ASEAN from the Singapore region. I was invited to the ASEAN launch of Connect in Singapore 3 weeks ago where Pasquale DeMaio, GM of Amazon Connect and Robert Killory, ASEAN Solutions Lead presented to analysts.

Pasquale told the audience that the Amazon Connect solution used today has been built over 10 years ago to serve Amazon’s internal needs of servicing millions of customer interactions for their e-commerce transactions. At that time Amazon could not find a solution that was pure cloud-based, cost-effective, scalable and that was easy to use. Since launching Amazon Connect a few years ago, AWS has seen not just small and medium enterprises using Connect – larger organisations have embraced the solution as well.

Amazon Connect has a list of notable clients – Intuit, Rackspace, John Hancock, CapitalOne, GE Appliances, Subway and many others. Intuit, as an example, has had difficulties running experiments in the past and proofs of concept were expensive, complex and time-consuming. With Amazon Connect these run on a test environment allowing their engineers to experiment and if they do not work out, it does not cost Intuit a lot of money to spin up a proof of concept. Philippines telecommunications provider, Globe Telecom wanted to automate and improve their services for their broadband and residential services. It was taking about 2-3 days from payment to the restoration of services. Amazon Connect was deployed to solve this problem by understanding the customer data when calls came through to the contact centre and by using APIs and the Connect suite of applications, there was deep integration with the CRM systems and other platforms that held various pools of data. This produced a faster and scalable way of integrating the payment process and customer service.

The demo of the solution showcased how features such as Amazon Lex can build conversational interfaces for an organisation’s applications powered by the same deep learning technologies like Alexa. With Amazon Lex and Polly, organisations can now build a chatbot without knowing or understanding code.

The Amazon Connect Solution – scaling to become more feature-rich

At ReInvent in Las Vegas in December 2019, Andy Jassy the CEO of AWS unveiled a new offering for their contact centre customers called Contact Lens. The solution is a set of machine learning capabilities integrated into Amazon Connect. The service can be activated through a single click in Connect and can analyse, transcribe calls including previously recorded calls. Jassy also talked about how it allows users to determine the sentiment of the call, pick up on long periods of silence, and times when an agent and customer are talking over the top of each other. These additions can help supervisors understand the challenges faced by agents that can then be addressed during training and coaching sessions. The machine learning models that power Contact Lens for Amazon Connect have been trained specifically to understand the nuances of contact centre conversations including multiple languages and custom vocabularies.

Several other announcements have also been made recently:

- Web and Mobile Chat for customers is a single unified contact centre service for voice and chat. Agents have a single user interface for both voice and chat, reducing the number of screens they have to interact with.

- Amazon Transcribe now supports 31 languages including Indonesian, Malay, Japanese, Korean, and several Indian languages. These are important languages as they expand further across ASEAN and the rest of Asia, given the diversity of languages spoken in the region. Contact centres can convert call recordings into text and analyse the data for actionable intelligence.

Deepening their relationship with Salesforce

At Dreamforce 2019 late last year, Salesforce announced that they will be offering AWS telephony and call transcription services with Amazon Connect as part of their Service Cloud call centre solution. The announcement indicates how the CRM world and the contact centre segments are starting to get closer. CRM vendors are starting to realise that whilst they own the agent at the desktop who have access to the CRM solution, the data from the calls and the actual calls are important. Voice/Telephony is also witnessing greater innovation with vendors in the contact centre space applying machine learning and AI to voice so that intelligence is gathered prior to the call coming to the contact centre and the agent is further empowered through prompts that they can apply when speaking to a customer. As CRM integrates deeper with contact centre solutions, the tight integration between these two solutions cannot be ignored. Salesforce is partnering to innovate in the voice space by applying machine learning at the core of all they do. This is a big announcement given the sheer size of both companies and how both companies are innovating in the contact centre space.

Cloud Contact Centre is high on the agenda in Asia Pacific

Ecosystm’s CX research finds that most organisations in Asia Pacific are at the inflection point of moving from an on-premise environment to a cloud model. Only 1% of CX decision-makers want to keep their contact centres on-premise – many organisations are evaluating which contact centre vendor they should use to migrate to the cloud. Some countries may see higher adoption than others. Australia and New Zealand have higher cloud contact centre adoption. In ASEAN many organisations are starting to build a wider CX strategy beyond the contact centre including areas such as customer journey analytics and data-driven personalised CX.

Ecosystm comments

In Australia, Amazon Connect has grown its customer base and these include some large enterprises. Big wins in the last 2 years include National Australia Bank and NSW Health. NSW Health shifted its IT service desk and shared services contact centres onto a new cloud-based contact centre platform as part of a broader digital transformation.

AWS has been gearing up for the launch in ASEAN over the last 6 months. The region is very competitive with some long-standing contact centre players having a large share and installed base in the large and medium enterprise accounts. The launch indicates how serious they are about growing their contact centre business in the region. There has been good progress so far in Singapore and the Philippines. Amazon Connect will look to grow its presence in Indonesia, Malaysia, Thailand, and Vietnam in the months to come. The market dynamics in each Asian country is unique and AWS will work with partners such as Accenture, Deloitte, DXC, ECS, NTT and VoiceFoundry to grow their presence in the region. Some of the more traditional partners will need education and upskilling to understand the Amazon Connect value proposition

Poly’s CEO Joe Burton was in Sydney recently to meet with staff, customers and partners. I had the privilege of interviewing him about the roadmap ahead for the company. Plantronics acquired Polycom for $2 billion at the end of March 2018 and earlier this year at Enterprise Connect, Poly was unveiled as the new brand – the coming together of Plantronics and Polycom. The company prides themselves on the strong engineering heritage they have across their product portfolio. Poly is playing in a large addressable market and these segments include unified communications (UC), video, headsets and contact centres.

Big news last week – Poly and Zoom partnership

At Zoomtopia last week, Zoom announced purpose-built appliances for their Zoom Rooms conference room system. These appliances are custom developed hardware that lets users gather room intelligence and analytics and will simplify installation and management of large-scale conference room deployments. One of the major partnerships for this was with Poly. Joe Burton was on stage with Eric Yuan the CEO of Zoom to unveil the Poly Studio X Series – The X30 (for smaller rooms) and the X50 (for midsize conference rooms).

What is promising about this offering is that the whole concept of launching a meeting by connecting to a screen has become simple. In a world where user experience is everything, simplicity and quality are what end-users expect. The Poly Studio X Series are all-in-one video bars that will simplify the Zoom Rooms experience and will feature Poly Meeting AI capabilities. Some of the features include advanced noise suppression to make it easier to hear human voices while simultaneously blocking out background noise.

For Poly, this is a great partnership given Zoom’s good growth in the Asia Pacific region. Poly is also increasingly deepening their relationships with other major players in the Video and UC market including Microsoft.

Flexible Workspaces and Contact Centres drives the headset market in Asia Pacific

According to JLL, the flexible space sector in Asia Pacific is expanding rapidly. From 2014 to 2017, flexible space stock across the region recorded a CAGR of 35.7% in Asia Pacific – much higher than in the United States (25.7%) and Europe (21.6%) over the same period. When you consider the changes in the modern workplace which include the rise of open flexible workplaces, remote and home working and the rise of freelancers, providing a seamless experience for the office worker will be important – it should be the same for a contractor as it is for full-time staff. As we move into more mobile and agile work practices and with the rise of open offices, headsets will play an important role for the office worker. More organisations across Asia are investing in headsets and whilst it may sound simple to just buy the headsets, it is more sophisticated than that. There is no one-size-fits-all headset and IT managers will have to invest in headsets to suit the persona of employees taking into account the role, workload, use of voice and video services and ultimately their comfort level. Vendors in the headset space are heavily investing in easy-to-use features, more automation, deep workflow integration and machine learning to deliver that experience. The opportunity for headsets does not stop there. In the contact centre space as agents spend long hours on calls, designing the right headset with feature rich AI capabilities will go a long way especially for training and coaching.

The one area Burton emphasised on is how AI and analytics is transforming this market and Poly investing in building these features into the headsets. Some of these examples include:

- Tracking conversations by using analytics to gain insights into long pauses of silence and “overtalking”. The analytics generated from these insights can help for training and coaching.

- AI can help track user behaviour patterns related to noise, volume and mute functions. These patterns can be used to detect problems during the call and could lead to possible training sessions for the agents. It is a great mechanism for supervisors to understand and work through where agents are struggling during the call.

Partnerships to expand their reach into the contact centre markets in the Asia Pacific region will be important. The market for contact centres is seeing a big shift and new entrants are making their presence felt in the Asia Pacific region. Poly will need to capitalise on this and expand their partnerships beyond the traditional vendors to expand their footprints across the contact centre markets.

Asia Pacific – an important growth theatre

Poly continues to win and have some large-scale deployments in Japan, China, India, and ANZ. They have also made several strides to develop what is best fit for the local market in terms of user requirements. With a deep understanding of the Chinese market, Poly released the Poly G200 in September this year which is tailor-made for the Chinese users with easy to use and collaborate solutions. The Poly G200 is the first and significant customised product launched in China, after Poly announced their ‘In China, for China’ strategy. This is a logical move given China is an important market and one that presents its own unique business dynamics.

Conclusion

The shift to mobility and the cloud has changed everything and is driving a new level of user experience. The ability to offer the same and frictionless experience when on the desktop, mobile device as well as other applications is what is driving fierce competition in the market. Users get frustrated when they cannot launch a video session instantly or when there is poor quality in audio. These may sound simple but addressing these frustrations are critical. Vendors in the UC, Collaboration and Video space are working hard to make sure that the experience is seamless when they are inside the office, out of the office and when they are working in open plan offices. Ultimately users want their daily office communication and collaboration solutions to work seamlessly and to integrate well into the various workflows such as Microsoft Teams.

On the contact centre front, Digital and AI initiatives are taking centre stage in nearly every conversation I have had with end-users. Company-wide CX strategy and customer journey mapping and analytics are what CX decision makers are talking about most. Poly is addressing that segment of the market by providing quality headsets coupled with AI to help in coaching and training by identifying trends and bridging the training gaps. There are new vendors starting to disrupt the status quo of some of the more traditional vendors in the contact centre market and hence deepening the partnerships with these new vendors in the contact centre space will be important.

Poly has a good addressable market to go after in unified communications and collaboration with their headsets and extensive range of video solutions. The most important part will be deepening the partnerships with the wide range of vendors in this space and engineering their products to be tightly integrated with their partner ecosystems’. The release of the Studio X series at Zoomtopia is a good example. I am confident that the road ahead for Poly is promising given the deep engineering capabilities the company invests in and how they are taking their partnerships seriously.

I was a guest last week at the NICE Interactions Summit in Sydney and it was great to hear from executives from NICE talk about the journey the company is taking their customers on. Australia and New Zealand are witnessing good adoption of cloud contact centres and many organisations (as covered in some of previous blogs) are at the inflection point of investing in a cloud contact centre, machine learning, customer journey mapping and predictive analytics technologies to drive greater customer experience (CX). Across Asia Pacific and in the ASEAN region, more organisations are at the verge of embarking on transformational CX projects to help them raise the bar on CX in a highly competitive environment. We can expect the adoption of cloud contact centres to grow rapidly in the next few years across the Asia Pacific region as companies move from expensive and traditional legacy environments to agile platforms.

Investing in Analytics and Cloud

Darren Rushworth, NICE’s Managing Director APAC, talked about how NICE has moved from being an infrastructure player to become an analytics company and talked about the acquisitions that are helping them alleviate their game in CX. Key acquisitions since 2016 have been instrumental to shaping their offerings and these include Nexidia, an Interaction Analytics software company and InContact, a cloud contact centre vendor. In 2019 NICE acquired Brand Embassy, whose technology brings to CXone a full range of integrated channels, enabling any digital channel to be integrated into customer service operations. In a Mobile First economy where customers want the applications of their choice, allowing customers to use the social media or messaging application of their choice in their contact centre interactions, will be critical. The Brand Embassy platform supports more than 30 channels and these include Facebook Messenger, Twitter, Apple Business Chat, WhatsApp, LinkedIn, SMS, email, and live chat. This is an important acquisition and not many contact centres have addressed the issue of allowing multiple forms of messaging to be used when customers want to communicate an issue or get answer to a query. Customers are gravitating towards social media platforms and messaging apps for daily communication and being able to integrate those channels to the contact centre is important.

The Move to the Cloud with NICEinContact

It was interesting to hear Tracy Duthie, Head of Service Development at 2degrees Mobile talk about why they deployed a NICEinContact solution. She talked about 2degrees having too many legacy systems that were not all integrated. The problems with not having the systems integrated drove the team to think hard about embarking on a journey with NICE. The objective was to grow their market share and to drive greater contact centre efficiency. She mentioned that 2degrees were keen on a SaaS option and it was not just about replacing the legacy solution. The move to the cloud as many organisations are starting to tell me, is to drive transformation and further innovation including deploying agile methodologies to deliver great CX. Also because this was a cloud deployment, they invested heavily in the network. This is an important aspect for an organisation when embarking on a cloud journey especially for mission critical applications such as voice, video and collaboration applications where latency and jitter can spoil the experience. Many times, I have heard customers blame the vendor for the technology. For cloud voice, video and other contact centre applications to work well in real time, the investment in the network must not be compromised especially when working on a tight budget. When this aspect is ignored, the problems discussed early are bound to arise. She also highlighted how important it was to eventually get the agents on board the new deployment and they adopted an open culture of allowing the agents to provide feedback and an open dialogue was initiated. As this was a big change from when they were running the contact centre in a traditional environment, the change management aspect was critical for the agents.

Compliance is something that has to be adhered to seriously

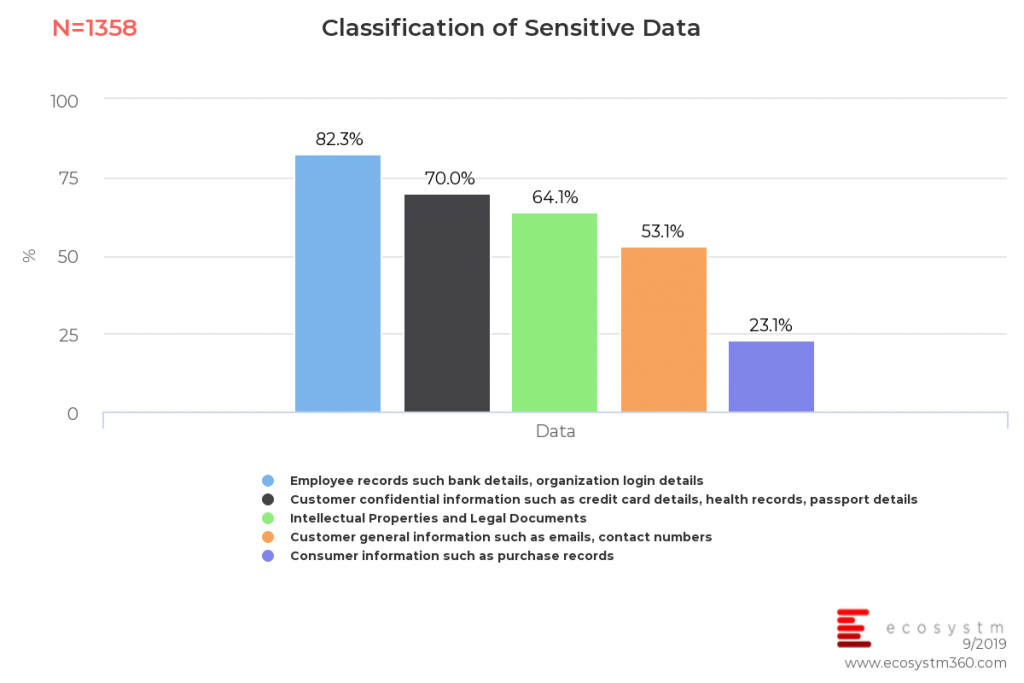

Efrat Kanner-Nissimov from NICE presented on driving a proactive compliance culture. This is a highly talked about area in the contact centre, given the increase in legislation around privacy and all countries having strict legislation around customer data and data privacy. Contact centres store sensitive customer information and knowing when to dispose off that data or for how long the data can be kept is an aspect that cannot be ignored. With what the banks have been through in Australia in recent times with the Royal Commission, serious questions around compliance and how compliant the agents are cannot be ignored. Ecosystm research finds that several organisations fail to identify what could be sensitive information. The journey towards a compliant environment starts with data classification, long before security roadmaps and solution implementations.

There is a greater emphasis on compliance and whilst many contact centres will claim that they have the processes in place, some of these have not been looked at for years. Compliance impacts the IT Manager, the agents, the Supervisor and ultimately the business. An automated compliance solution will help detect violations, prevent errors and allow for better visibility across different systems. She presented how Macy’s claims to have reduced their infrastructure and storage costs by 40%, through automating and deleting interactions that were no longer required. This helped lower IT costs and reduced time on audits. With the emphasis today on data privacy, data storage, data deletion and being compliant when you talk to your customers, the CX agents have a critical role to play in ensuring compliance.

Ecosystm comment:

Organisations across the Asia Pacific region are re-inventing how they look at CX as mentioned in my previous blogs. Banks, airlines, retailers, telcos and organisations from other verticals are investing in projects to drive transformation in CX. Applying deep analytics along every step of a customer’s journey will help the contact centre and the wider organisation better serve customers. The traditional methods of just looking at inbound and outbound interactions and setting KPIs for that, are no longer enough to drive this new vision. Machine learning, customer journey mapping and analytics, as well as shifting to the cloud is needed to drive transformation and agile ways of running CX. The Brand Embassy acquisition is an important one for NICE given one of the challenges not addressed by contact centres is integrating the various social and messaging applications and making them available to customers as a way to interact with the brand. This is an area contact centres have been looking to resolve.

In a highly competitive CX market where CRM, analytics, cloud and machine learning technologies are important aspects of a CX journey, NICE is investing in these areas to further strengthen their cloud contact centre value proposition. Compliance as highlighted earlier cannot be ignored and it is an area contact centres will be looking to invest in due to the multiple strict regulations underway across the Asia Pacific region surrounding how customers data is treated.

Cisco announced their plans to acquire CloudCherry to bolster their contact centre portfolio. Launched in Chennai in 2014, CloudCherry is a customer experience (CX) management startup that helps organisations understand the various factors influencing CX. CloudCherry has employees in Chennai, Bengaluru, Singapore and Malaysia, besides the US and their team of around 90 employees will join Cisco’s contact centre solution practice as part of the acquisition

Using artificial intelligence (AI) as the underlying solution to CloudCherry’s open API platform allows for various customer data sets from CRM systems to other communication touchpoints in the contact centre to be analysed in real-time for the organisation to deliver a personalised CX. When agents can understand what is taking place in real-time and when the contact centre team has one integrated point of data injecting analytics, improving the ability to drive greater loyalty and eventually higher revenues.

Some of CloudCherry’s offerings are:

- Measuring customer journeys. CloudCherry provides the opportunity to follow the customer across 17 different channels, driving contextual real-time conversations with customers on the channels they choose. It is important to understand the micro journeys – for example, their customer PUMA sells products online and in physical stores and may have two micro journeys in addition to an overall customer journey map for:

- Online customers

- In-store customers

- Blended customers

- Predictive Analytics. Their predictive engine is based on customer feedback, their actions and their purchasing data. With advanced predictive analytics, CX teams can derive what is needed to increase the ROI.

- Questionnaire builder. They have the capability to respond to feedback collected from surveys in real-time. There are set conditions for survey questions so that when triggered by customer response, the concerned employee or department is quickly notified regarding it. For instance, when a customer gives a low rating on store cleanliness or staff behaviour, an alert can be immediately sent to the concerned employee to follow up and take corrective action. At the same time, even positive feedback can be noted in order to recognise and reward employees.

- Sentiment Analysis. This helps organisations tap into machine learning and deep learning to identify customer sentiment associated with open-text responses and brand conversations.

These are just some of the applications and tools the CloudCherry platform offers to their customers.

Leading with data will be critical to driving personalised CX

CX decision-makers and buyers of contact centre and CX technologies have an important role to play in the next few years to look at re-inventing how they view CX. This means re-looking at the ways they have been running contact centres in the traditional way and making investments towards the cloud, machine learning and predictive analytics.

- By having rich analytics, mobile conversation through the app can be richer. A Mobile-led CX approach is key in today’s world where most people spend hours on a phone.

- Issues can be prevented before they happen if in-store transactions are monitored and dissatisfied customers can be identified. The organisation has the ability to reach out to the customer through any touchpoint to mention proactively that they are aware of the issues that just happened and what they can do to help solve the negative experience. Proactive notifications demonstrate how a brand takes it, customers, seriously

- Leveraging AI as the underlying platform to understand customer behaviour is going to be the next battleground for CX vendors. The challenge so far has been that many organisations have invested in several data and CRM tools from various vendors. When agents have to view customer information, they are dealing with data in an unsynchronised format. This explains why when we contact a contact centre, we sometimes have to repeat ourselves and state the problem we are facing. Or worse than that, the agent has no idea that we had a problem a week ago and spoke to 2 agents. These frustrations are real and still happen today.

- Contact centre of the future will not be reactive but proactive in helping understand customer sentiment in real-time to make the necessary adjustments and actions needed to solve the issue the customer is facing. The deep analytics platform for CX also means that agents will be empowered with information and bots can be placed to help agents say the right things or make suggestions to customers. The use cases to help deliver personalised CX are enormous.

Ecosystm comment

This is an important and good acquisition for Cisco. Cisco has a vast set of customers globally and in the Asia Pacific region in the collaboration, voice and contact centre space. This acquisition marks how they are investing in enhancing their existing contact centre portfolio to use machine learning, cognitive and predictive analytics to alleviate their offerings. The contact centre is a key part of Cisco’s larger collaboration portfolio.

According to the company, Cisco products support more than 30,000 contact centre customers and more than 3 million contact centre agents around the world. Vasili Triant, VP and GM of Cisco Contact Centre solutions mentioned in a blog recently that the acquisition will augment Cisco’s contact centre portfolio with advanced analytics, journey mapping and sophisticated survey capabilities whether their customers are using Webex Contact Centre in the cloud or their hosted and on-premises solutions.

The market for predictive analytics and customer analytics in the contact centre and across the CX segment will be big and we are at the beginning of a new era of organisations using data as the platform to deliver a new way of engaging with customers. CloudCherry offers a CX management platform that uses predictive analytics to derive insights for contact centre agents. The market for deep analytics is becoming an important area of investment for organisations as a way to decrease customer frustration. It is by applying analytics before, during and after the call that will allow contact centres to deliver a personalised CX as was mentioned in my last blog. This is the reason why a data-driven culture will be key to driving rich outcomes for the contact centre. Contact centres will have to lead with analytics so that every experience across every single touchpoint the customer has with the brand is analysed and observed in real-time. We will see many contact centre vendors and players in the CRM space acquire companies with capabilities like what CloudCherry offers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

As companies grapple with finding the right balance between managing multiple touchpoints and driving great customer experience (CX), the importance of getting the flow consistent – right communication to the client without spending too much time on re-directing calls or asking questions about a previous call or experience via a touchpoint – is becoming critical. The desire to impress a customer the first time they come into contact with a touchpoint is an area companies are looking to invest in. Using data as a means to understand customer sentiment before the call comes in will give the agent information to prepare them for making appropriate decisions during and after the call.

Case Study – Carsales

I was recently invited to an AWS Connect, Zendesk and Voice Foundry event in Sydney and it was great to hear from Carsales about how they re-invented CX. Prior to making the leap to deploying the solution from AWS Connect and Zendesk, they had been running their contact centre for years using a traditional contact centre platform. Some of the issues they have faced over the years included the following:

- Difficult and costly to customise

- Expensive support costs

- Expensive and difficult integrations

- Difficult to extract reporting

- Downtime for upgrades

- Difficult to use

These issues are common challenges posed by traditional contact centre platforms. High costs of maintenance and expensive integration costs are some of the challenges I hear of when speaking to end-users. The contact centre and CX industry are at an inflection point where organisations are evaluating how best to drive great CX and at the same time considering how to work with vendors that can help drive innovation in CX. Carsales eventually shortlisted 4 players before making the decision on which cloud provider to work with. They ended up working with Zendesk and AWS Connect.

Carsales recognised the need for a CX solution that could use the data they already have on their customers in Zendesk and Salesforce CRM systems to create a unique experience for each interaction. It was important for them to have a solution that would simplify data warehousing and analytics to make it easier to get a full view of the customer. By integrating the CRM application to AWS Connect as the CX orchestration engine. to bring the contact centre and CRM applications together helped Carsales deliver a personalised CX for their customers.

WHY AWS Connect?

These have come off the points mentioned by Carsales as to why they selected AWS Connect:

- Cloud-Based (accessible anywhere)

- No downtime for upgrades

- Access to Data (Lambda and APIs) via ZenDesk and Salesforce

- Easy UI

- Support from implementation partner Voice Foundry

- Affordable solution

- Access to great technology such as Speech to Text (Polly), Speech Recognition (Lex) and Analytics (Transcribe and Comprehend)

- Scalable and customisable call flows

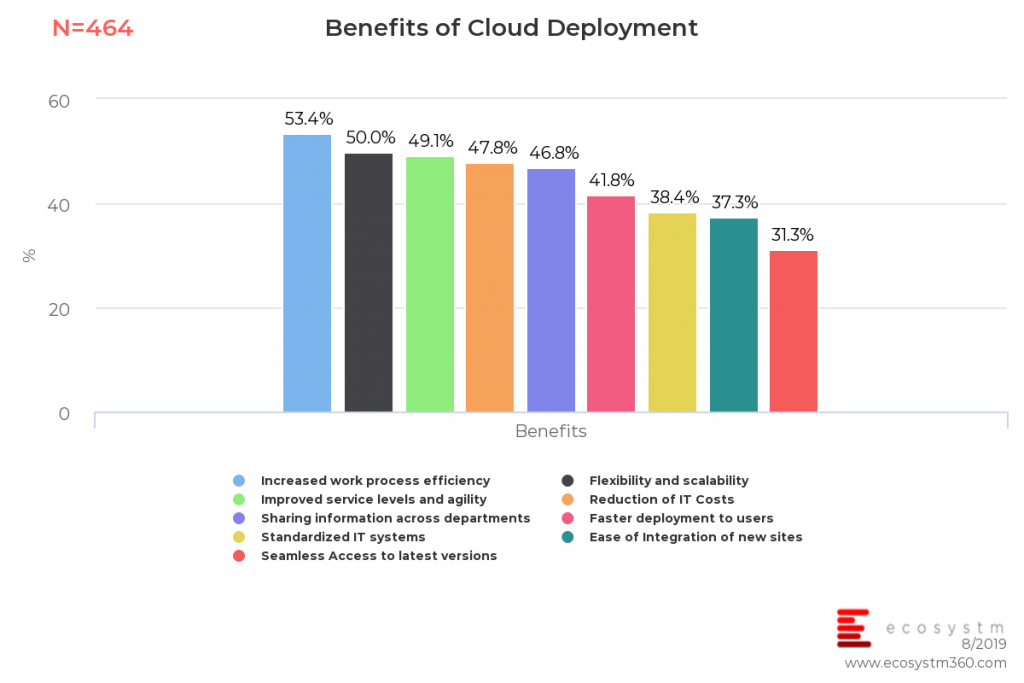

In the global Ecosystm Cloud study, as depicted by the chart below, about 53% of organisations state that increased work processes and efficiency are a key benefit of the cloud. Nearly half the organisations rate flexibility and scalability and improved service levels and agility as the main benefits of a cloud deployment.

Implementation Learnings

What Carsales found about the AWS Connect solution, is how changes can be made easily. Most configurations can be made by the contact centre staff and there is no need to go to IT. Their primary aim was to deliver a personalised CX by accessing data from other internal systems (CRM, proprietary databases, etc) and the solution addressed this need.

The advice that Carsales gives to others implementing a Cloud Contact Centre are:

- Ensure that you have invested in the network to support voice over IP.

- Make sure that your headsets are compatible to ensure full functionality.

- Engage with a partner rather than implementing the platform on your own. Although you can implement AWS Connect solution on your own, it can be difficult. Voice Foundry was a great implementation partner.

The Importance of Data-Driven CX

The market is witnessing a shift where organisations are looking for new and more agile platforms for CX. The challenges, as highlighted by Carsales – such as existing solutions being difficult and costly to customise – are some of the common challenges we are hearing from organisations about the limitations of traditional telephony and contact centre solutions. Whilst the traditional vendors still have a majority share of the market, that is changing. Some of the new cloud contact centre vendors are offering new and dynamic ways of driving a better experience for the users of the technology – from agents to those that manage the contact centre solution. The ability to add agents when needed has become easier (without intervention from IT) and cloud provides better security due to the multiple back-ups and redundancies it offers. The ability to reduce maintenance and customise applications with new agile methodologies and APIs are driving a new era in the contact centre market. The single most important area is deep analytics. The ability to have deep analytics to understand the customer better as a starting point before a call, during a call and after the call is critical. Artificial intelligence can be used to better understand customer sentiment and detect trends in customer data.

The shift from traditional contact centres to cloud contact centres is happening and no longer just with mid-market companies. Large organisations are making the shift to the cloud as the benefits are apparent. Implementing a data-driven culture is key to driving a personalised CX. The tight integration between CRM databases and the applications in the contact centre is becoming more important than ever.

Zoom is no stranger in today’s world of video and collaboration. Organisations would have heard of Zoom, trialled the product or are now users of the product for video collaboration. Zoom’s success is built on the simplicity of their technology and the ability of the solution to be deeply embedded within workflows. They have put some serious thoughts into user design and how that experience through the app or when launching the solution from the PC/ laptop allows for a smooth integration to email, calendars as well as other popular collaboration applications (including Slack). The market for cloud videoconferencing is growing rapidly. As the market shifts towards new and more agile ways of working and as co-working spaces rise globally, the need to collaborate and communicate instantaneously without too much hassle and interruptions will be critical. We are living in an era where it will be all about the experience.

Zoom’s share value has risen more than 120% from the $36 IPO debut price. Zoom has been focusing on building a base of high-value customers (those that spend more than USD 100,000 per year for services). In the last quarter alone the number of high-value customers went up by over 17%.

Rapid expansion outside of the ANZ region

Zoom has witnessed rapid growth in the ANZ region in recent years. Demand for the solution continues to come from both medium and large enterprises. Japan will be an important market for Zoom and they are starting to work with some big names in the market such as Rakuten and are expanding on growing their partner network. With a good data centre footprint which is critical for video and collaboration, other key markets for Zoom in Asia include India, South East Asia, Hong Kong and China. Their wins in these markets are from some of the biggest brands and conglomerates. Zoom’s growth in Asia is demonstrating how their cloud-based video solution is becoming the preferred platform, even if IT has already invested in other cloud video offerings. Demand is coming from the lines of business and not necessarily through IT. That is a big differentiator – Zoom being used by lines of business changes the entire sales process. It is now driven by word of mouth and individual user experience and LOBs which then becomes a companywide opportunity for Zoom. When you put that into context, the sheer numbers in terms of users within an organisation becomes large.

The launch of Zoom Phone

Zoom launched their Zoom Phone cloud phone service in Australia, supporting local phone numbers and PSTN access with new metered and unlimited call plans. Customers have the option of using their own carrier or using a Zoom number. The launch of Zoom phone should not be taken lightly by their competitors as they have so far succeeded in pulling customers to their app and impressing them with the user experience. Once the customer is locked into Zoom, the user experience has somehow led them to want to use it even more. With the launch of voice, they are now pushing themselves deeper into an account by creating upsell opportunities in workplace video, collaboration and voice technologies. This allows them to take on UC players across the stack of video, voice and collaboration.

Accelerating deep partnerships with leading cloud innovators

Zoom has strong partnerships with leading cloud platforms. Zoom’s partnership with Dropbox allows customers of both services to start a Zoom Meeting while viewing or working on shared files via shortcuts built into Dropbox’s viewer tool. The Atlassian partnership, for instance, allows Jira Ops to be integrated with Zoom. Users will be able to start a meeting directly from a Jira Ops ticket with anyone associated with the ticket. These are some of the partnerships and it demonstrates how Zoom has thought about other critical cloud apps that are important for day-to-day work and collaboration and the ability that can make Zoom the app that can provide that in-between integration for collaboration.

Ecosystm Comments

Zoom’s architecture is video-first, cloud-native and optimised to process and deliver high-quality video across devices. They reported recently that their approach to video has been uniquely different from that taken by others who have attempted to add a video to an aging, pre-existing conference call or chat tool. Zoom developed a proprietary multimedia router optimised for the cloud that separates content processing from the transporting and mixing of streams.

With the launch of Zoom Phone and the adoption they are witnessing of their video platform, Zoom is set to be a leading provider in video and voice collaboration. We can expect Zoom to further build on the office collaboration stack in the near future. As organisations start deploying solutions from cloud innovators such as AWS, Slack, Microsoft, Google and others, Zoom stands out from that standpoint. They are a cloud innovator that has thought about the issues of the past and the pain points of those using video. The thinking behind user design and simplicity and the integration to workflows has paved the way for the success they are seeing today.

As they grow their presence with some of the largest brands and Fortune 500 companies in the Asia Pacific region, they will also start attracting partners who will want to be part of that journey with them so it’s a win-win for both parties. These partnerships will include a range – from the existing players in the video to other workplace collaboration vendors.

For the fiscal year ended January 31, 2019, Zoom reported that 55% of their 344 high-end customers started with at least one free host prior to subscribing. These 344 customers also contributed to 30% of revenue in that fiscal year.

The journey has just started for Zoom in Asia Pacific and we can expect the next 12 months to be good for them as they expand rapidly across the region.

8×8 an enterprise communications player in the areas of voice, video, chat and contact centre solutions announced the acquisition Wavecell, a Singapore-based global Communications Platform-as-a-Service (CPaaS) provider last week. The deal is estimated to be for about USD 125 million in cash and stocks.

With this acquisition, 8×8 can leverage their CPaaS platform capabilities to enable companies to develop and embed communications features more easily. Enterprises can get direct access to pre-built features via Application Programming Interfaces (APIs) leveraging CPaaS. These APIs let developers pay for the services they need when building voice, video, chat, SMS, and web capabilities. By using a cloud CPaaS, developers can also eliminate lengthy development times and reduce time to market.

What does this acquisition mean for 8×8 in the Asia Pacific region?

- Establishes their presence in the rapidly growing CPaaS space. The CPaaS market is growing rapidly which includes key players like Twillio and Vonage. The Wavecell acquisition will allow 8×8 to offer a platform for providing SMS, messaging, voice, and video APIs globally to both enterprises and developers. Wavecell offers a complete CPaaS solution including a cloud API platform with SMS, chat apps, video interaction and voice APIs that enable mission-critical enterprise applications such as Application-to-Person (A2P) messaging, omnichannel customer journeys and multi-factor authentication at scale.

- Expands their footprint in the Asia Pacific region. With this acquisition, 8×8 will now have a good footprint in markets which includes Singapore, Indonesia, Philippines, Thailand, and Hong Kong. 8×8 is active mainly in the ANZ region. Wavecell has more than 500 enterprise including names such as Paidy, Tokopedia and Lalamove. Wavecell also brings an R&D centre in Asia which allows 8×8 to further accelerate growth in product innovation and delivery.

- Gives access to a large enterprise developer community. Wavecell have built a robust enterprise developer community over the past several years which has leveraged their API platform and software development kits. 8×8 can now enable application providers, enterprise developers, and customers to access and natively integrate their enterprise applications with 8×8’s voice, video and messaging services.

- Provides global coverage for multi-channel communications. Wavecell has established relationships with 192 network operators worldwide and business partners such as WhatsApp. Its carrier-grade infrastructure enables customers to share more than two billion messages per year across these channels. This global network enables Wavecell customers such as Lalamove, to use SMS to immediately notify customers of their ordering and delivery requests. The acquisition extends 8×8’s global carrier relationships and network support to hundreds of additional carriers, enabling 8×8 to further optimise their global service delivery for enterprise customers anywhere they operate around the world.

Ecosystm Comments

The CPaaS market is growing rapidly globally. Developers want to easily add real-time communication capabilities such as voice, video and chat apps through APIs with a faster time to market. The ability to do it easily and to be able to scale without a lengthy implementation cycle and at an affordable cost is becoming key. This acquisition will help 8×8 compete in the growing CPaaS market where players such as Twillio and Vonage are growing their presence rapidly.

The enterprise communications and contact centre segments are highly competitive spaces in Asia Pacific with several new entrants in the region in the last 18 months. These players, mainly from North America, offer strong capabilities in the areas of voice, video, collaboration and contact centres. 8×8 has been strong predominantly in the ANZ region. They have plans to open an office in Japan later this year. The Wavecell acquisition will help 8×8 expand and open doors for their core product offerings in South East Asia and Hong Kong. Wavecell’s large customer base of over 500 customers will give 8×8 an opportunity to upsell their enterprise and contact centre applications.

Some customers are still buying enterprise and contact centre technology from various vendors depending on who is the right vendor for voice, video, contact centre and other applications as opposed to working with one vendor for their end-to-end solution. 8×8’s advantage against some of their competitors is that they own the entire stack of their offerings. That has been important to some of their customers who have said that it has also benefited them from a security perspective. Most of their clients who have moved to their platform have done so due to scalablity, ease of implementation and fast deployment times.

This acquisition is definitely a step in the right direction for 8×8.