Customer Experience (CX) has become a bit of a buzzword, which is fantastic! More and more businesses are recognising the importance of understanding their customers’ experiences and implementing a customer-centric organisational mindset. But how do organisations evaluate their success? Here are some tips on how the Voice of Customer (VoC) program can be used to assess whether your customer strategy is right and your improvement efforts are bearing fruit.

Understand who your customers are and what they experience

You will need to understand your customers’ experience during interactions, e.g. a visit to the website to find information, a call to the contact centre to get a query resolved, or a walk-in at the store to ask for help; and for specific life stages or journeys, e.g. how was their onboarding experience, what they value about the products and services etc.

There are different ways to form a rough or a more precise picture of your customers. Two popular approaches are:

- Data-based segmentations. This is based on behaviour seen in your backend system. It can be as basic as knowing your customer’s age bracket, gender, location, and annual spend.

- Research facilitated personas. These sophisticated personas will tell you things like, “Tech Savvy Joe is in his mid-20’s, lives in an affluent area, loves caramel frappuccinos with extra cream, uses your coffee shop app regularly to check for great deals and visits your cafe 13 times every month”, placing him in the “high value” category.

Once you have a rough, or precise idea of who your customers are, you can start thinking about the experiences your customers are having, and the experiences you’d like them to have.

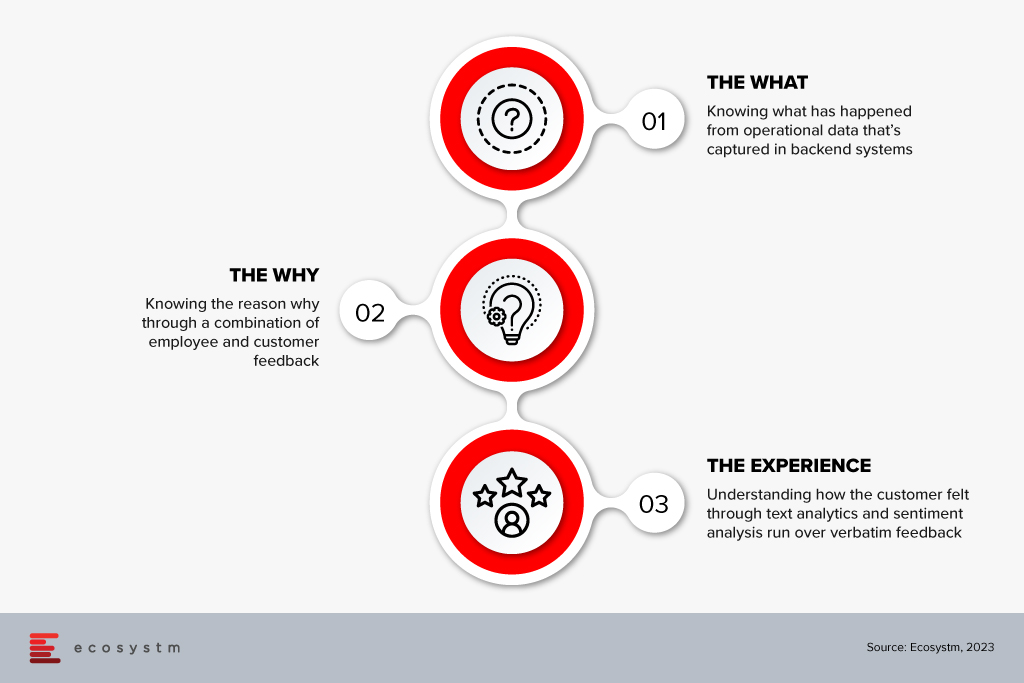

X & O Data: Completing the picture

Now, how do you know what an experience was like for your customer? You can ask them, and then you can observe them. We call this the X (experience) and the O (operational) data. And there are 3 fundamental things to understand within X & O data.

But how do we measure this experience? How do we capture, track and measure how the customer felt?

Let’s look into metrics.

Choose the right metric: NPS, CES or CSAT

Choosing the right metrics for the job is crucial for the success of the VoC program, as well as the ability to measure CX success overall. NPS, CSAT and CES are the 3 most frequently used customer feedback measures. They are complementary in nature, as they measure slightly different aspects of the customer experience.

- NPS (Net Promoter Score). How likely are customers to recommend the brand’s products and services to friends and family.

- CES (Customer Effort Score). How easy/difficult was it for the customer to get the query resolved.

- CSAT (Customer Satisfaction Score). How satisfied was the customer with the service received.

Using them in conjunction can be a great way to measure customer success. CSAT and CES are often used to explain the overall NPS number in more detail. While NPS is a rigid metric designed as an overall brand health measure for a business, CSAT and CES are more specific measures that can be adapted to a given situation, e.g. product reviews, service interactions with call centre agents, website interactions, store visits and so on.

NPS is a long-term measure, as the likelihood to recommend a brand isn’t based on a single interaction. A history of interactions, touchpoints, word of mouth, etc. form a brand perception. And all those interactions and touchpoints that form a customer’s recommendation can be tracked and measured through CSAT and CES – they are able to provide actionable insights to pinpoint pain points and detect opportunities for improvement.

Due to the long-term and high-level nature of the NPS score, this metric is best used in relationship or benchmark surveys. In a touchpoint environment, CES and CSAT are more powerful and insightful.

Identify and prioritise improvement initiatives

Equipped with customer and employee feedback on specific customer pain points you can then dig deeper into root causes and build initiatives to address those. But typically you will end up with a list of initiatives and face prioritisation challenge. Depending on the stakeholder you ask, you’ll get contradictory views on what’s most important. Some of the prioritisation metrics that you are likely to use will be cost, timeframe and resources required to implement change.

You can use your customer feedback metrics again to help with the prioritisation. Combining the score with the volume of feedback mentioning a specific pain point provides you with an “impact” for the customer. Combining the impact of the pain point on the customer, with the impact it has on the business provides a clear picture to form a priority list.

Some Real-life Examples

Problem. “Rude agent” – Low CSAT scores

- Root cause analysis. Agent not trained in dealing with difficult situations/customers; lacks the knowledge to deal with specific queries; feels undervalued; gets frustrated and overwhelmed

- Potential fix. CSR training

- Result. Reflected in an improved CSAT scores as the agent is equipped to handle difficult situations/customers and complex scenarios

Problem. “Hard to find things on the website” – High CES scores (high effort)

- Root cause analysis. Customer/UX research to understand what customers struggle with

- Potential fix. Website redesign for specific journeys/queries

- Result. Reflected in an improved CES as it’s now easier for customers to find what they want on the website

Conclusion

While you will see your CES and CSAT score improving quite quickly as a result of your changes, the NPS score is typically slower to respond. As mentioned earlier, a service interaction to get a query resolved is only one of many signals impacting the likelihood to recommend a brand. Just because one interaction was pleasant, doesn’t mean you’re out of the woods. You will need to deliver again and again to shift your NPS over time. Not just in terms of customer service, but also advertising, product design, quality of service, etc.

November has seen uncertainties in the technology market with news of layoffs and hiring freezes from big names in the industry – Meta, Amazon, Salesforce, and Apple to name a few. These have impacted thousands of people globally, leaving tech talent with one common question, ‘What next?’

While the current situation and economic trends may seem grim, it is not all bad news for tech workers. It is true that people strategies in the sector may be impacted, but there are still plenty of opportunities for tech experts in the industry.

Here is what Ecosystm Analysts say about what’s next for technology workers.

Today, we are seeing two quite conflicting signals in the market: Tech vendors are laying off staff; and IT teams in businesses are struggling to hire the people they need.

At Ecosystm, we still expect a healthy growth in tech spend in 2023 and 2024 regardless of economic conditions. Businesses will be increasing their spend on security and data governance to limit their exposure to cyber-attacks; they will spend on automation to help teams grow productivity with current or lower headcount; they will continue their cloud investments to simplify their technology architectures, increase resilience, and to drive business agility. Security, cloud, data management and analytics, automation, and digital developers will all continue to see employment opportunities.

If this is the case, then why are tech vendors laying off headcount?

The slowdown in the American economy is a big reason. Tech providers that are laying of staff are heavily exposed to the American market.

- Salesforce – 68% Americas

- Facebook – 44% North America

- Genesys – around 60% in North America

Much of the messaging that these providers are giving is it is not that business is performing poorly – it is that growth is slowing down from the fast pace that many were witnessing when digital strategies accelerated.

Some of these tech providers might also be using the opportunity to “trim the fat” from their business – using the opportunity to get rid of the 2-3% of staff or teams that are underperforming. Interestingly, many of the people that are being laid off are from in or around the sales organisation. In some cases, tech providers are trimming products or services from their business and associated product, marketing, and technical staff are also being laid off.

While the majority of the impact is being felt in North America, there are certainly some people being laid off in Asia Pacific too. Particularly in companies where the development is done in Asia (India, China, ASEAN, etc.), there will be some impact when products or services are discontinued.

While it is not all bad news for tech talent, there is undoubtedly some nervousness. So this is what you should think about:

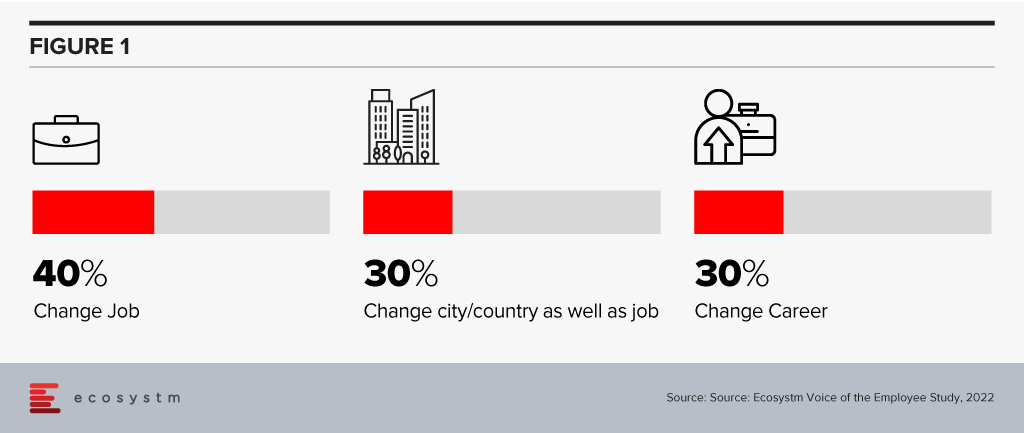

Change your immediate priorities. Ecosystm research found that 40% of digital/IT talent were looking to change employers in 2023. Nearly 60% of them were also thinking of changes in terms of where they live and their career.

This may not be the right time to voluntarily change your job. Job profiles and industry requirements should guide your decision – by February 2023, a clearer image of the job market will emerge. Till then, upskill and get those certifications to stay relevant!

Be prepared for contract roles. With a huge pool of highly skilled technologists on the hunt for new opportunities, smaller technology providers and start-ups have a cause to celebrate. They have faced the challenge of getting the right talent largely because of their inability to match the remunerations offered by large tech firms.

These companies may still not be able to match the benefits offered by the large tech firms – but they provide opportunities to expand your portfolio, industry expertise, and experience in emerging technologies. This will see a change in job profiles. It is expected that more contractual roles will open up for the technology industry. You will have more opportunities to explore the option of working on short-term assignments and consulting projects – sometimes on multiple projects and with multiple clients at the same time.

Think about switching sides. The fact remains that digital and technology upgrades continue to be organisational priorities, across all industries. As organisations continue on their digital journeys, they have an immense potential to address their skills gap now with the availability of highly skilled talent. In a recently conducted Ecosystm roundtable, CIOs reported that new graduates have been demanding salaries as high as USD 200,000 per annum! Even banks and consultancies – typically the top paying businesses – have been finding it hard to afford these skills! These industries may well benefit from the layoffs.

If you look at technology job listings, we see no signs of the demand abating!