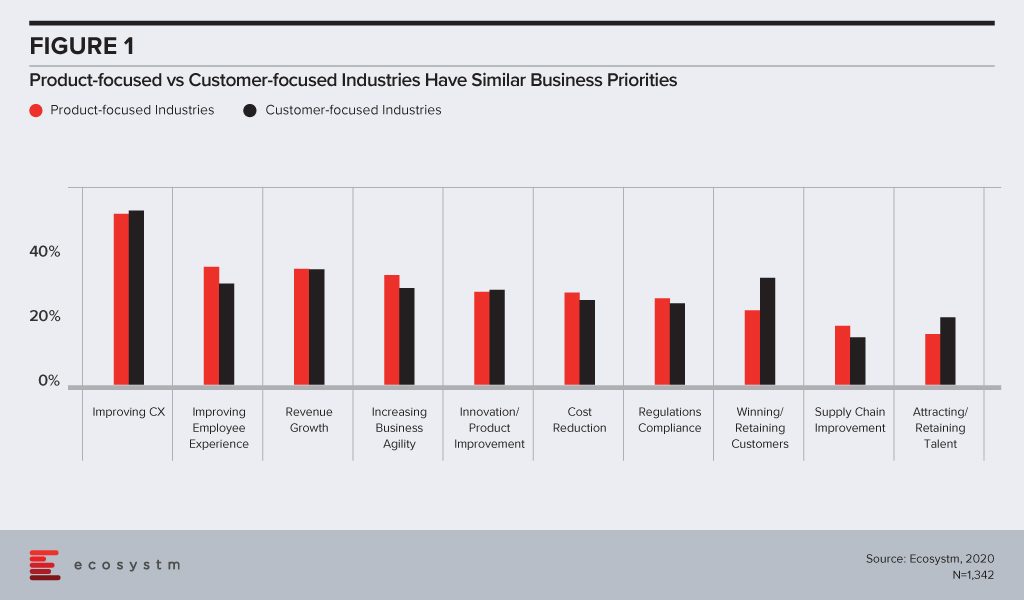

Traditional industry practices tend to divide industries into two distinct buckets – firms that are primarily focused on product design and improvement, and those that define their strategy based on customer services. Over the years, the lines distinguishing these organisations have all but disappeared. To be able to succeed in today’s competitive world, you need to continually improve your product offering – even for organisations in industries such as Manufacturing and Wholesale – and the best way to do so is to keep a firm eye on your customers. Likewise, unless you have a robust product, you will not be able to retain customers. As an example, online reviews are often critical of budget airlines, but the successful ones manage to hold on to their loyal customers doing what they set out to do – by not offering the best airline food service but by continuing to provide affordable airfares to places where their customers want to go. The Ecosystm CX study finds that even the most product-focused industries today, have improving customer experience (CX) as a key business priority (Figure 1). The two groups of industries tend to have similar priorities – the only major difference being customer-focused industries invest in more initiatives to promote customer loyalty.

In 2016, Caterpillar showed the way forward to industries that have primarily been product-focused. They started investing in technology that is not just focused on solving, but actually predicting customer issues to improve service. Even industries such as Agriculture are increasingly becoming customer-focused, as more citizens become conscious of where and how their food has been produced. Freight Farms is a good example of customer-centricity in the industry – focusing on technology to grow food in environments not considered conducive to farming such as urban localities and places with extreme climates.

Investing in the Right Technologies

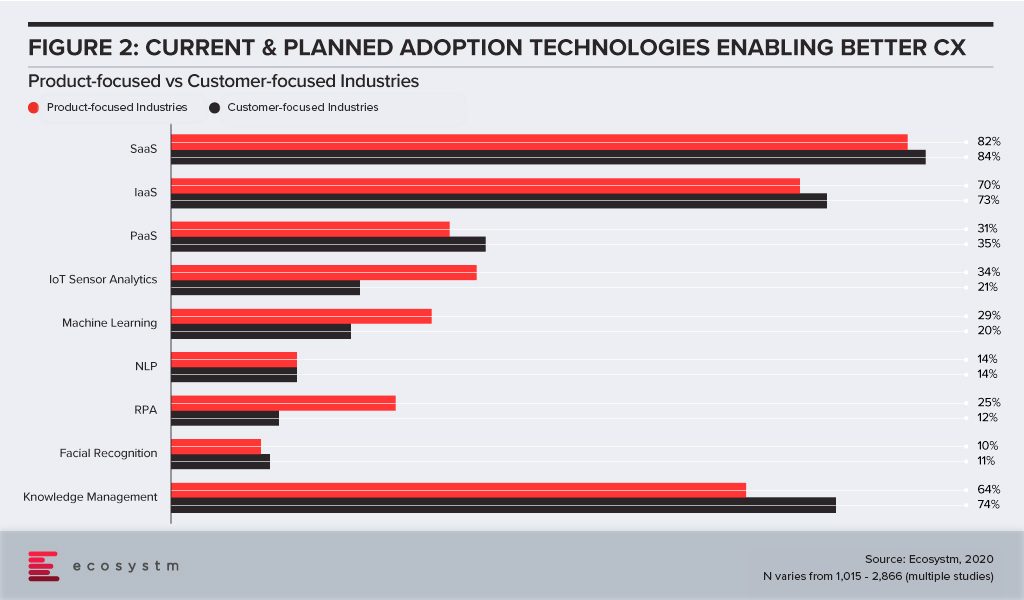

Looking at the Top 5 CX trends for 2020, we find that technologies such as Cloud and AI, and solutions such as robust knowledge management are true enablers of positive CX. So how do these two groups differ when it comes to investments in these technology areas? Customer-focused industries are slightly more enthusiastic about their Cloud investments, but only marginally (Figure 2). Obviously, they invest more in knowledge management solutions, both for CX as well as improved employee experience (EX). But surprisingly, product-focused industries also tend to invest in knowledge management, for several reasons ranging from product improvement to after-sales support.

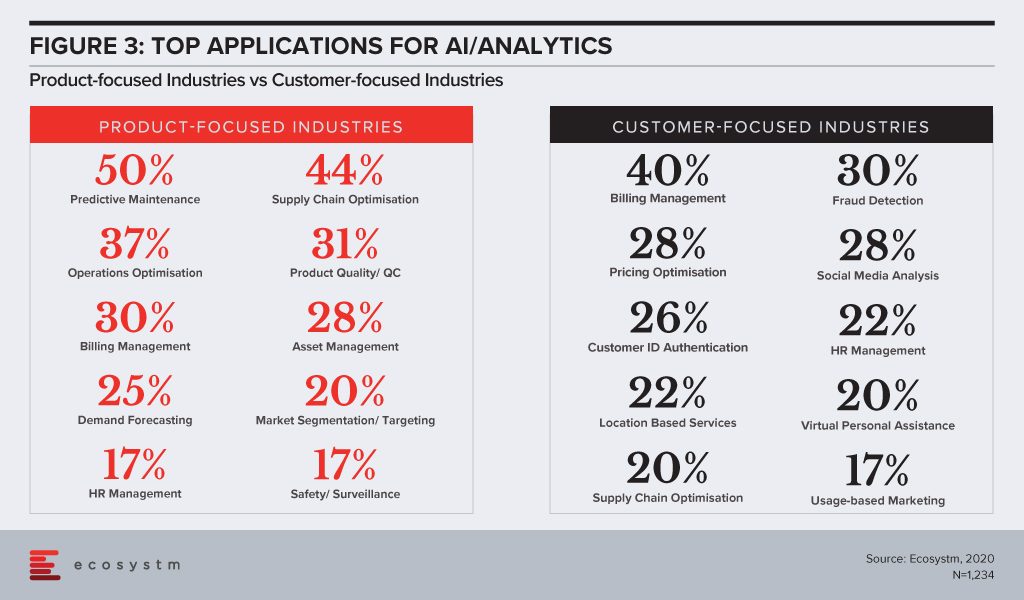

Where product-focused industries really lead is in their investments in AI/Analytics – which ties in with our observation that automation is the stepping stone for AI investments across industries. The applications of AI/Analytics are very distinct for the two groups (Figure 3). Product-based industries focus on automation and optimisation and have a clear asset focus. However, it is heartening to see some customer-centric solutions such as market segmentation. On the other hand, the top AI/Analytics application for customer-focused industries is billing management, which might significantly improve CX but falls under the purview of Finance & Operations in most organisations.

Securing Data and Building Trust

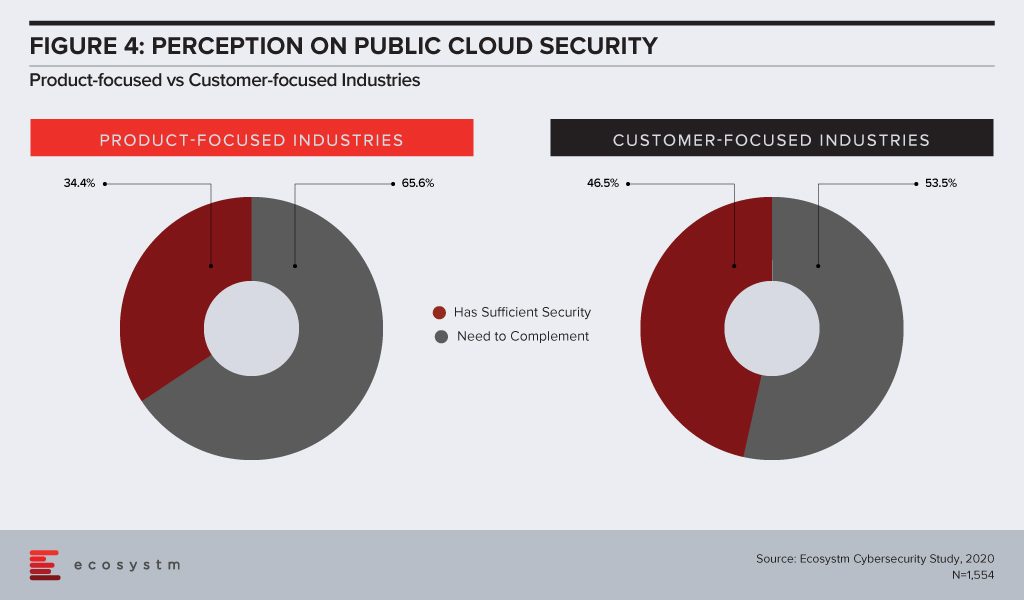

No organisation can ignore the seriousness of data breaches – whether customer data or intellectual property. Public cloud is going to be the true enabler of Digital Transformation (DX), from both cost and agility angles. Security has always been a key concern around public cloud adoption, even though organisations would mostly benefit from the robust and evolving security features of public cloud providers rather than having a go at securing their systems and data in-house and on-premises. The perception on public cloud security has changed over the years (Figure 4), but customer-focused industries appear to be savvier about the shared responsibility SLAs most public cloud providers have in place.

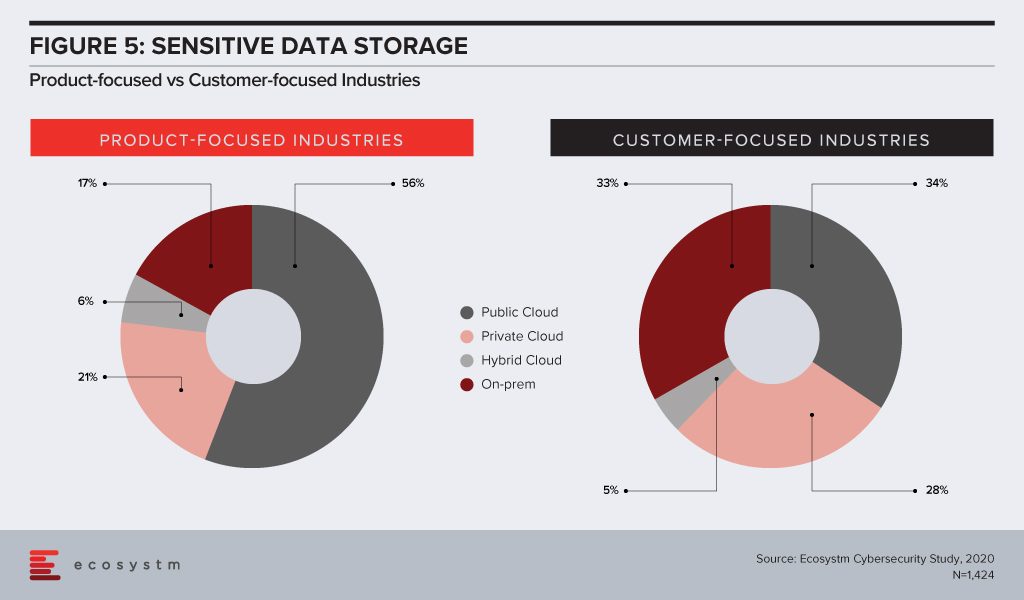

Which brings us to another important question – how much sensitive data do these organisations store on public cloud (Figure 5). Probably because they hold more customer data and must follow industry and country compliance laws that mandate how customer data should be stored and accessed, nearly a third of customer-focused organisations store sensitive data on-premises only. While their cloud adoption may be slightly higher than product-based industries, they are also more wary of storing sensitive data on the public cloud.

The differences in strategies between customer-focused and product-focused industries might have blurred over the past decade – both groups focusing on customer-centric products. Their technology priorities are still clearly distinct, however. It is important to bear this difference in mind – both for tech buyers who are looking at use cases across all industries when it comes to emerging technology adoption; as well as for tech vendors who now have to engage with stakeholders beyond the IT department.

NB: For the purpose of this blog, industries have been classified as follows: Product-focused Industries – Energy & Utilities, Manufacturing-based industries, Resource & Primary industries, Transport & Logistics, Wholesale and Construction; Customer-focused Industries – Banking & Financial industries, Retail & eCommerce, Healthcare, Government, Professional Services, Media & Telecommunications

That is great analysis Sash – a different take on the data that I haven’t seen before. Some great examples of how the product focused industries are similar too – and very different from the customer focused ones!