Recently IBM and Vodafone announced a new strategic commercial agreement, as a joint venture, to provide their clients with the ability to integrate multiple clouds that have a need to access emerging technologies such as 5G, AI, Edge Computing and Software Defined Networking. Under an eight-year engagement valued $550 million (€480 million), IBM will provide managed services to Vodafone Business’ cloud and hosting unit.

Businesses are becoming more and more challenged to run their operations and business processes in a seamless manner as data is distributed and managed across more and more clouds. Together, Vodafone Business and IBM aim to remove these complexities to support the basis of any digital transformation and enable a company to share data freely and securely across its organization.

On the surface, this announcement makes sense if you are a Vodafone business customer who wants to take the next step in a digital transformation journey. The convergence of multi-clouds has the ability for companies to enrich their own data management systems with external sources. With the purchase of Red Hat late in 2018, IBM now has the ability and credibility to offer that capability. However, as many IoT-based solutions create the data to fuel these cloud processes, IBM has not had a clear Edge Computing or network connectivity strategy. This is where Vodafone can help IBM connect the edge of the network to the enterprise systems. This announcement seems like a complimentary win-win situation for both sets of IBM and Vodafone customers.

Red Hat is undoubtedly one of the premier cloud management companies and IBM invested heavily in its multi-cloud connectivity assets. IBM is hoping that the deeper that Red Hat is involved in the multi-cloud connectivity market, the more it will pull through IBM’s high-value business services in cognitive computing and machine learning and other compute-intensive technologies.

However, this market is still shaking itself out and there are many other competitive offerings to Red Hat. There are startups such as RightScale and Morpheus who can offer up multi-cloud management. Alternatively, as a mature company, VMware competes head to head with Red Hat and has had a long-standing partnership with Vodafone. In particular, VMware and Vodafone have partnered in telco specific functions such as NFV and 5G.

To understand the importance of VMware in the midst of this announcement is to appreciate the end-to-end customer experience that VMware can bring to telco customers such as Vodafone. As 5G rolls out and NFV-based network slicing becomes a valuable onboarding differentiator VMware could offer its vCloud NFV solution to Vodafone’s customers. Vodafone’s customers could have access to the same multi-cloud services from VMware and not IBM while obtaining AI, cognitive and ML services available from the major public cloud providers (such as AWS, Google and Microsoft). VMware’s position at the edge of the network would, therefore, appear to leapfrog IBM’s position. Vodafone Business’ customers could bypass IBM and its cloud services strategy. At the end of the day, IBM could be left with only the managed services contract while missing out on analytics and cognitive business services.

To negate this scenario, IBM will have to lead more and more with Red Hat and be willing to downplay the cognitive and machine learning services. Business solutions in vertical markets such as agriculture are extremely price sensitive and customers will look closely at the cost of connectivity followed by the cost of data acquisition to enrich their business outcomes. We believe that if the cost to run data science and cognitive services are too expensive, then Vodafone customers will seek the same tools and services from other cloud service providers and not IBM.

Finally

Our advice to tech buyers who are in the midst of business transformation should consider how they fuel their decision-making engines for analytics, machine learning, and cognitive computing. Real-time processing and dissemination of business outcomes is one of the table stakes for a successful digital company. As a result of that, seamless end-to-end processing across a complex and distributed enterprise infrastructure is a challenge that needs to be overcome. Tech buyers should ask if IBM’s edge computing strategy and Vodafone’s connectivity are mature enough to funnel IoT-data generated smart data to a broad inter-cloud infrastructure.

My return to CES, the Consumer Electronic Show, was something that I had been looking forward to for some time. After all, it had been almost 4 years since I attended the last CES when the Internet of Things (IoT) was the latest solution looking for problems to be solved. As an industry analyst whose passion for IoT is well known, I was frustrated at the weak offerings, poor quality demos and wasted money at the booths. CES had halls and halls of IoT ‘stuff’ that made little or no sense to me, with almost no chance of these startups being around in 2019. But, that’s what these shows are meant to do.

Roll forward to 2019 and my mission was very specific. I was only interested in two major things – 5G and autonomous/self driving vehicles. I was determined not to get soaked up in the awesome glory of 8K televisions, and kitchens that would even scare off Chef Gordon Ramsey! 5G has been positioned as the natural platform for IoT innovation – fast, high capacity connectivity for applications such as autonomous vehicles, video and medical services. However, at this year’s CES, it seemed that the technology world and the trade press had finally gotten into the same room and realized (just like IoT) that 5G can mean many things. To that point, businesses were keen to call their new technology offerings that can be called 5G, 5G. I could see history repeating itself – hype and confusion this year, followed by disillusion and disappointment next year.

Let’s start with AT&T. When is 5G not 5G – when it is 5G E? AT&T insists on using the term 5G for its advanced 4G LTE network. I assume that if AT&T’s commercials say that 5G E is 5G then who are we to doubt them! In my humble opinion it is misleading and muddies the waters into convincing customers that they already have 5G. (By the way the ‘E’ stands for Evolution, or as one journalist put it “it’s a work in progress towards 5G’. Other global operators also made claims that they too were the first to market or the first to have a customer. However, 5G from a marketing aspect was a bust at this year’s CES. It was supposed to be a leading theme, but in reality it lacked reality. Perhaps selling to consumers is easier than selling to enterprise customers who know that 5G will require an upgrade of the entire network infrastructure, which in turn will take time.

Despite the marketing and messaging confusion, 5G is the underpinning technology of some very exciting technologies being shown at CES – in particular in the transportation industry. Here there was proof that progress has been made in the last 4 years. It was clear that core technologies such as mapping and location tracking have made it possible for the auto industry to think about services both inside the vehicle and outside it. Companies such as TomTom, Naver Labs and HERE showed the levels of progress that they have made in navigation, mobility services, and fleet management. Adjacent technologies for EV (Electric Vehicle) combined with advanced high quality mapping, make it possible to know better where to recharge and how to accurately navigate highways as efficiently as possible.

Innovation in this space takes on a new meaning when the vehicle isn’t a concept car, but rather a fully laden truck. At CES there was no shortage of trucking companies showing off their highly connected vehicles. For example, Paccar Inc., the parent of Peterbilt Motors Co. and Kenworth Truck Co. had an exhibit that featured a pair of battery-electric Peterbilt models and a hydrogen-electric truck from Kenworth and Toyota. Autonomous truck startup TuSimple also returned to CES, where it offered demonstrations of the sensors and machine vision behind its self-driving technology and announced plans to expand its US fleet to 40 trucks by June.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

At CES, autonomous vehicle concepts from all of the global car brands were on display. Typically the German and Asian manufacturers showed a wide range of vehicles that continued to look like ‘travel pods’ or people movers rather than traditional automobiles, while US-based brands tended to focus on the infotainment services within the car. In summary, CES’s auto offerings showed that there is a very strong ecosystem of partners determined to change the way that we get from point A to point B in a safe and sustainable manner. In parallel, the ability to extend vehicle ride sharing across multiple modes of transportation including bicycles and helicopters (Bell’s Nexus product) is driven by high speed, real-time and accurate data fed from thousands of intelligent sensors.

In conclusion, CES confirmed for me that despite the technical greatness of 5G, telecom operators continue to appear to be lost in their positioning of the product. Part of this may be stemming from the significant investment and consequently the risk of return on that investment. Part of it may be – like IoT – defining what 5G is really all about. Early IoT success stories have shown that it’s as much about positioning the business value around the data as it is about connectivity. Finally, CES showed me that while fully autonomous driving societies are several decades away, the strong industrial ecosystems that exist today are making significant progress towards that future.

Recently I attended Ericsson’s Industry Analyst Day in Boston where Ericsson’s leaders updated the analyst community on the state of the company both globally and in North America. They also deep dived into the network evolution to 5G, AI, Automated Operations,5G and IoT Industry Innovation. With my focus on IoT, I was keen to hear what was new in IoT platforms, cellular connectivity, secure IoT 5G services, and Industry 4.0 use cases.

Corporate Update:

As part of the very public turnaround plan, Helena Norrman, Ericsson’s SVP and Chief Marketing and Communications Officer and Head of Marketing and Corporate Relations announced the following: Ericsson’s focused strategy continue to be based on a vision to empower an intelligent, sustainable connected world while enabling the full value of connectivity for service providers. Results of the strategy included accelerated cost cut – which was on plan to reduce expenses by 10 Billion Swedish Kroners (SEK), with an improved cash position by over 11 Billion SEK.

While not out of the woods yet, it appeared that the renewed focus on business efficiency, improved end-customer experience and new revenue streams has given Ericsson a level of optimism that hasn’t been seen for at least 4 years. For example, Norrman shared that Ericsson’s networks had become 50% more efficient in energy consumption on footprint and operations optimization. She indicated that new digital services were being rolled out 86% faster than before. Finally, she indicated that Ericsson had achieved 201% RoI in the first year for an IoT-based factory maintenance system.

In his update, Niklas Heuveldop, President and Head of Ericsson North America, suggested that there might be continued changes for the big 4 US-based telecom operators. With a background of a six-fold increase in mobile data, mobile revenue remains flat, blended ARPUs declining, and cellular connections (including IoT) growing by 4.4% from 398 million 3Q-2016 to 434 million 2Q-2018, he indicated that operators would have to look for new revenue streams to stay profitable. This was on top of a new operator market that may change structurally as a result of the T-Mobile/Sprint merger (offering a broad range of spectrum for both consumer and enterprise customers), and the arrival of new wireless network operators.

5G and IoT

The day was dominated with the business opportunities based off 5G networks, as Ericsson continues to look to expand the addressable markets by enabling new revenue streams. For example the combined Critical and Massive IoT markets based off 5G networks could range between $200 – $600 Billion as part of scale driven and performance driven opportunities in markets such as Industry 4.0.

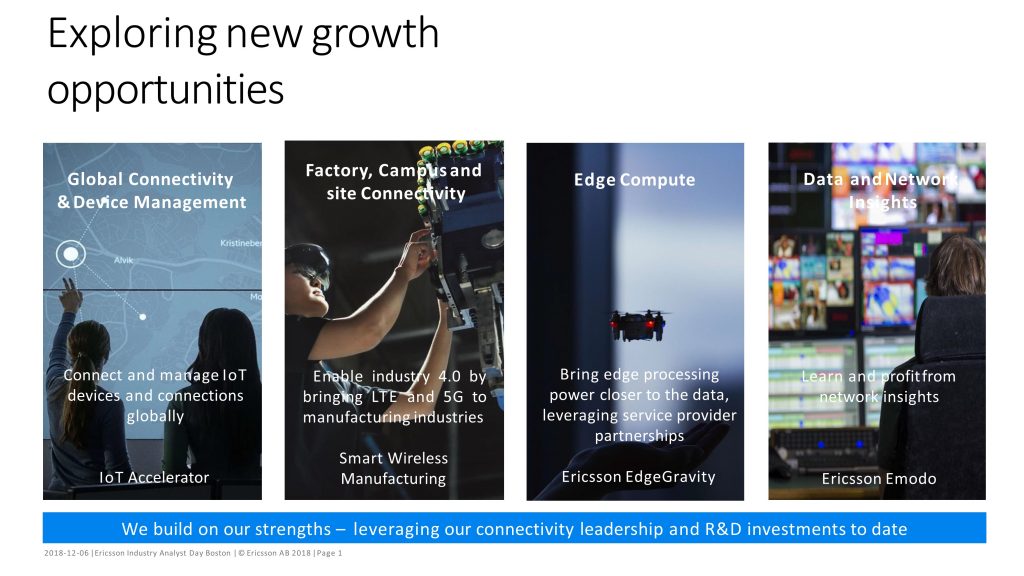

However, this is a new looking Ericsson who shared its new IoT strategy. Jeff Travers, head of IoT, was clear that IoT would follow a path of disciplined growth with goals to:

- Capture new revenues through rapid innovation building on 5G and IoT

- Make our primary customers, services providers, succeed in new value pools

- Use a lean startup approach to validate and scale ideas.

These goals would be achieved off the backs of things that Ericsson does well:

- Build a connectivity platform:- IoT Accelerator

- Be the forefront partner in Industry 4.0 wireless connectivity

- Aggressively position itself as a leading partner in Edge Computing for its operator customers and network partners: – Ericsson EdgeGravity

- Processing and providing network insights and analytics :- Ericsson Emodo

Analyst Opinion:

5G and IoT have been pushed by the major operators for some time and the industry has been holding its breath as vendor after vendor attempts to craft a profitable business strategy and identify use cases that deliver an acceptable RoI. Most have not yet either reached scale because of the lack of readiness of the whole ICT infrastructure once IoT devices are connected. Too much emphasis has been placed on too few IoT applications at the edge of the network. Too much hope has been placed on Edge Computing without meeting customers’ needs of an end-to-end solution.

However, we belief that Ericsson’s clear focus on connecting IoT devices, while maximizing the edge computing needs through local analytics while enabling operators to partners with cloud service providers will open up vertical industries such as manufacturing to IoT deployments. Ericsson’s solution for wireless capabilities within Industry 4.0 could be readily accepted by customers who want to transform themselves to digital-based businesses.