Hewlett Packard Enterprise (HPE) has entered into a definitive agreement to acquire Juniper Networks for USD 40 per share, totaling an equity value of about USD 14 Billion. This strategic move is aimed to enhance HPE’s portfolio by focusing on higher-growth solutions and reinforcing their high-margin networking business. HPE expects to double their networking business, positioning the combined entity as a leader in networking solutions. With the growing demand for secure, unified technology driven by AI and hybrid cloud trends, HPE aims to offer comprehensive, disruptive solutions that connect, protect, and analyse data from edge to cloud.

This would also be the organisation’s largest deal since becoming an independent company in 2015. The acquisition is expected to be completed by late 2024 or early 2025.

Ecosystm analysts Darian Bird and Richard Wilkins provide their insights on the HPE acquisition and its implications for the tech market.

Converging Networking and Security

One of the big drawcards for HPE is Juniper’s Mist AI. The networking vendors have been racing to catch up – both in capabilities and in marketing. The acquisition though will give HPE a leadership position in network visibility and manageability. With GreenLake and soon Mist AI, HPE will have a solid AIOps story across the entire infrastructure.

HPE has been working steadily towards becoming a player in the converged networking-security space. They integrated Silver Peak well to make a name for themselves in SD-WAN and last year acquiring Axis Security gave them the Zero Trust Network Access (ZTNA), Secure Web Gateway (SWG), and Cloud Access Security Broker (CASB) modules in the Secure Service Edge (SSE) stack. Bringing all of this to the market with Juniper’s networking prowess positions HPE as a formidable player, especially as the Secure Access Service Edge (SASE) market gains momentum.

As the market shifts towards converged SASE, there will only be more interest in the SD-WAN and SSE vendors. In just over one year, Cato Networks and Netskope have raised funds, Check Point acquired Perimeter 81, and Versa Networks has made noises about an IPO. The networking and security players are all figuring out how they can deliver a single-vendor SASE.

Although HPE’s strategic initiatives signal a robust market position, potential challenges arise from the overlap between Aruba and Juniper. However, the distinct focus on the edge and data center, respectively, may help alleviate these concerns. The acquisition also marks HPE’s foray into the telecom space, leveraging its earlier acquisition of Athonet and establishing a significant presence among service providers. This expansion enhances HPE’s overall market influence, posing a challenge to the long-standing dominance of Cisco.

The strategic acquisition of Juniper Networks by HPE can make a transformative leap in AIOps and Software-Defined Networking (SDN). There is a potential for this to establish a new benchmark in IT management.

AI in IT Operations Transformation

The integration of Mist’s AI-driven wireless solutions and HPE’s SDN is a paradigm shift in IT operations management and will help organisations transition from a reactive to a predictive and proactive model. Mist’s predictive analytics, coupled with HPE’s SDN capabilities, empower networks to dynamically adjust to user demands and environmental changes, ensuring optimal performance and user experience. Marvis, Mist’s Virtual Network Assistant (VNA), adds conversational troubleshooting capabilities, enhancing HPE’s network solutions. The integration envisions an IT ecosystem where Juniper’s AI augments HPE’s InfoSight, providing deeper insights into network behaviour, preemptive security measures, and more autonomous IT operations.

Transforming Cloud and Edge Computing

The incorporation of Juniper’s AI into HPE’s cloud and edge computing solutions promises a significant improvement in data processing and management. AI-driven load balancing and resource allocation mechanisms will significantly enhance multi-cloud environment efficiency, ensuring robust and seamless cloud services, particularly vital in IoT applications where real-time data processing is critical. This integration not only optimises cloud operations but also has the potential to align with HPE’s commitment to sustainability, showcasing how AI advancements can contribute to energy conservation.

In summary, HPE’s acquisition of Juniper Networks, and specifically the integration of the Mist AI platform, is a pivotal step towards an AI-driven, efficient, and predictive IT infrastructure. This can redefine the standards in AIOps and SDN, creating a future where IT systems are not only reactive but also intuitively adaptive to the evolving demands of the digital landscape.

Verint has announced the intention to acquire Conversocial, a US-based social media management system provider for USD 50 million to integrate social messaging capabilities across Verint’s cloud platform. The deal is expected to be closed in Verint’s third quarter subject to customary closing conditions and regulatory clearances.

Verint has been expanding their digital engagement capabilities through acquisitions. In June, Verint expanded their Workforce Management (WFM) offerings to include AI-driven insights for better hiring decisions through the acquisition of HireIQ. To extend Verint’s omnichannel cloud Voice of the Customer (VoC) portfolio, Verint acquired Foresee. Verint is also building IVA capabilities and recently launched a low code version of their IVA solution to make it easier for brands to build the solution without the need for technical knowledge.

The Need to Enhance Digital Engagement

Using self-service and messaging as the first point of connection to engage with a brand is growing rapidly. It accelerated during the pandemic, and it is common now for individuals to engage with their financial institution, airlines, retail and others through social media. Now that customers are demanding it, brands are lifting their game and engaging with customers on the platform of their choices. This acquisition will allow Verint to deepen their digital engagement with customers across Marketing, Contact Centres and digital functions – it follows the pulse of today’s customers.

Digital discussions are accelerating and having a platform that can orchestrate as well as understand all the data from each digital and social messaging channel is important. Verint is taking the data discussion seriously and earlier this year they launched Engagement Data Management Solution (EDM). The ‘’data’’ piece is huge and cuts across functions – from back-office communications to gathering data across all channels and touchpoints. However, where this is going wrong for some enterprises is that all the data they collect sits in multiple repositories; in some instances the data has not been analysed for years! Managing the multiple social experiences, including data management and insights from these multiple sources, will be key to delivering proactive customer experience.

The data discussion is particularly significant for a vendor such as Verint – they are well known for their speech analytics and compliance management capabilities. These are all critical to managing multiple channels of conversation. They help agents to be accurate, efficient, and compliant; allow organisations to use asynchronous channels and social messaging and digital channels; immediately rectified errors through monitoring the data on the channels and so on. More importantly, they allow organisations to pick up points from conversations that can be passed on to Marketing to gauge the effectiveness of the messaging and campaigns. Organisations can ‘’identify and fix” problems by truly listening to customers.

Why Conversocial

If we look at the Conversocial customer stories, we realise how relevant their offerings are to industry requirements. They offer brands the ability to engage through an automated channel and chatbots. Whirlpool appears to have benefited by integrating channels to deliver better customer care as well as communicating with field engineers through WhatsApp. Another customer, Freshly – a meals delivery company – saw a spike in incoming queries at the start of the pandemic. They were able to use automation to ease of the load and say that 50% of the conversations were handled in-channel through automation without the need for human agent intervention. They were also able to use Facebook Messenger as a preferred contact channel and decreased their cost-per-contact.

This acquisition demonstrates how Verint is taking the digital and the data discussion seriously. CX Vendors that do not move fast in building end-to-end digital capabilities will find it hard to compete in a highly competitive CX market.

Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

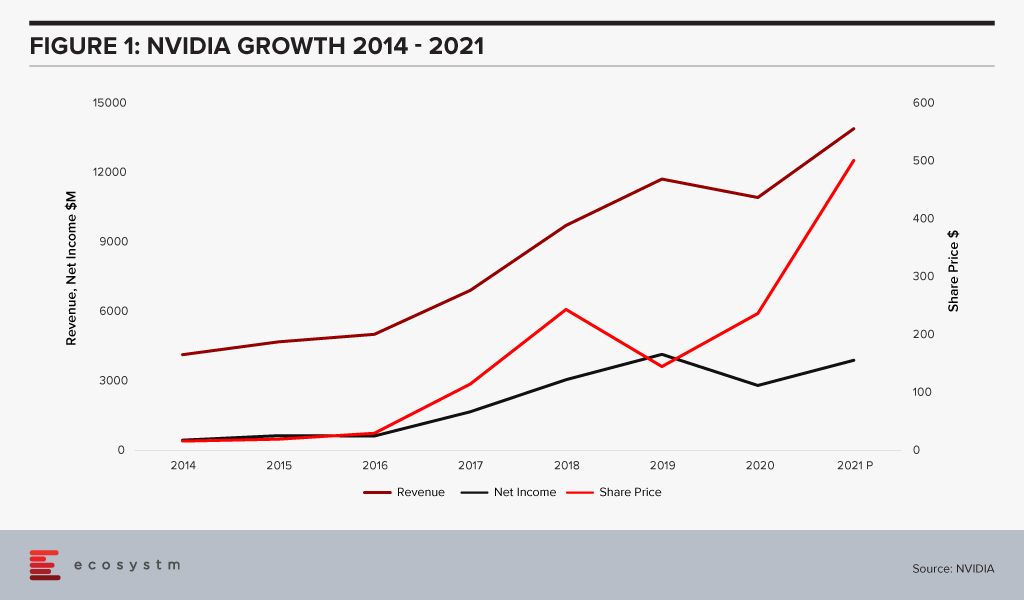

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in mergers and acquisition (M&As) activities in the cybersecurity market. Like the consolidation activity in previous booms (such as digital media and web services in the early 2000s), the cybersecurity market is booming globally and creating opportunities for cashed up vendors and private equity firms. The fragmented security market has thousands of vendors and consultancies globally. Every day a swathe of new start-ups announces their ground-breaking new technology. Coupled with significant investments globally in tertiary education and industry certifications for a growing workforce, the next generation of cybersecurity entrepreneurs are entering with force.

Earlier this month, a consortium led by private equity firm Symphony Technology Group (STG) entered into an agreement with Dell Technologies to acquire RSA for an estimated amount of USD 2 billion. Dell Technologies had expressed interest in selling RSA in November 2019, and industry sources say that the deal will be finalised at more than their initial expectations.

Dell has been focusing on their partner program and on simplifying their product portfolio offerings. The Dell Technologies Partner Program announced last year, allows enterprises to seamlessly access partner products and solutions. Regardless of the partner, all solutions under the Dell portfolio count toward the tier status and tier revenue requirements for clients. Selling RSA allows them to streamline their product portfolio and by their own assertion, Dell has not lost focus on the significance of cybersecurity. They reinforced their commitment to build automated and intelligent security into infrastructure, platforms and devices. Claus Mortensen, Principal Analyst Ecosystm says, “Dell never really figured out what to do with RSA or how to position RSA’s products relative to Dell’s and VMWare’s own products. For example, Dell has its own endpoint protection product with SecureWorks and this has a great deal of overlap with RSA.”

RSA has been one of the pathbreakers in the cybersecurity market with their SecurID offering. They also host the largest security conference. RSA Conference gets together leading experts from across the industry to discuss the current trends and challenges, as well as shape the industry through innovations. Talking about the impact of the acquisition on RSA’s brand image, Mortensen says, “It depends on what STG intends to do with the company going forward. Arguably, RSA has been a bit in the shadows of previous owners – EMC and Dell – but if the new owners have a distinct plan for RSA, the brand will benefit”.

The members of the consortium acquiring RSA is interesting in its diversity. It includes the Ontario Teachers’ Pension Plan Board (Ontario Teachers’) and AlpInvest, another private equity firm. STG’s recent acquisitions include RedSeal, a security risk management provider. Mortensen predicts that the key player in this consortium will be STG, who will bring the know-how as well as money to the table. “Ontario Teachers’ and AlpInvest appear to primarily be financial backers. In fact, less involved these two partners are in the management of RSA, the easier it will be to secure a steady future focus for the company.”

As Ecosystm has observed previously, private equity firms will play a role in consolidating the cybersecurity market. “RSA is an almost textbook candidate for an equity firm or an investment bank takeover – a company with a good line of products but with a lack of strategic focus or leadership,” says Mortensen. “If STG can provide that focus – and from that USD 2 billion payment, one would assume that they can – they should have a good chance of increasing the value of RSA. If not, chances are that RSA’s products will be sold off piecemeal in the years to come.”

Insight Partners – an American venture capital and private equity firm based in New York City – has announced that it will acquire Veeam at a valuation of US$5 billion. Last year, Insight Partners invested US$500 Million in Veeam to boost its growth as a data management solutions provider for cloud environments.

The news comes days after Insight Partners confirmed another significant acquisition of Israeli IoT security start-up, Armis at a valuation of US$1.1 billion.

The deal between the venture capital firm and the Switzerland-based cloud data management company is expected to close in the first quarter of this year. With its acquisition by Insight Partners, Veeam’s growth is expected to accelerate into new geographies especially the US market.

Veeam was founded in 2006 and has a portfolio including backup solutions, security offerings and data management solutions for virtual environments and more recently cloud native platforms such as AWS and Microsoft Azure. The company was ranked #27 on the Forbes 2019 Cloud 100 list and has a global customer base of 365,000, including 81% of the Fortune 500 companies. Veeam has partnerships with large enterprise vendors and resellers such as IBM, Dell EMC, Lenovo, HPE, NetApp and Cisco.

The acquisition comes almost a year after the initial U$500 million investment by Insight Partners and Veeam’s announcement of ‘Act II” of its growth strategy – expanding its data management capabilities from virtual environments to the cloud. This move is a logical progression of Veeam’s successful ‘Act I’ as Ullrich Loeffler, Ecosystm Chief Operating Officer mentioned in an earlier blog. However, Loeffler notes, “Executing on ‘Act II’ significantly increases the complexity of Veeam’s business across product portfolio, technology partnerships, SaaS applications and addressable markets. Insight Partners will enable Veeam to fast track this transition from the top down by leveraging additional funding and dedicated internal growth teams and experience from over 200 M&As and 40+ IPOs.”

Veeam’s leadership team is expected to change significantly with the company now moving its headquarters from Switzerland to the US. Co-founders Andrei Baronov and Ratmir Timashev will step down from their positions on the board and in the operation, making way for an US leadership team.

Phil Hassey, Principal Advisor Ecosystm, states that the new ownership and announced leadership team under CEO Bill Largent is a gamechanger for Veeam. “Veeam simply had no choice. It has had limited US penetration to date and has been restricted from growth by the ownership structure despite best efforts on their part. It has had to back out of a significant acquisition deal, divesting N2WS after failing to get full regulatory approval in the US,” Hassey says. “In my view, this acquisition is about more than Veeam’s intention to deepen its product portfolio. It is about ensuring an access to the US market in a level playing field and it will also help with the hyper cloud vendor relationships given their strong push to US Federal Government and their US home turf.”

However, while Loeffler also sees the acquisition as a step towards an IPO, he warns, “The rapid transition to a US leadership team is likely to impact Veeam’s unique company culture. Clients repeatedly state the ease of engagement as key selection criterion, besides the solution capabilities, when choosing to partner with Veeam. The fact that both co-founders will not just step off the board but also leave as Veeam employees, will create a gap which will be challenging to fill.”

Salesforce announced on Monday, June 10th (US time) the acquisition of data visualisation leader Tableau for US$15.7B. Some jaws dropped at the purchased and the price and some at the purchaser. It was inevitable that Tableau would be acquired, Oracle, IBM, or SAP could have been the suitor, but Salesforce is no surprise.

In all honesty, anyone who has watched Salesforce closely should neither be surprised or concerned by this acquisition. Salesforce is not merely your cloud CRM provider anymore. It has not been for years, but for some outdated perception is the reality.

Salesforce is an increasingly broad and complex enterprise software behemoth. It’s recently reported numbers highlight this. It is on track for US$20B in revenue by 2022, with year to year growth in the most recent quarterly reported numbers just shy of 25%. Sales and Service Cloud represent 60% of quarterly revenues, but the fastest growth is in the platform and increasingly new investment areas. What Salesforce does so well is to identify adjacencies to an evolving core product. The acquisition of Mulesoft in 2018 set the path to solving integration problems that challenged Salesforce deployment for customers. The purchase of Map Anything in April 2019, highlighted this adjacency approach as well as the ability of Salesforce’s ecosystem to develop partners through the AppExchange then acquire into Salesforce.

So how does Tableau fit into Salesforce?

For nearly US$16B, it had better be a precise fit. Tableau is the leader in data visualisation. It is not an analytics platform as such; one does not go to Tableau for deep statistical insight; instead, it uses it to communicate data to as broad an audience as possible. Salesforce has analytics capability as a core pillar, but this has been one of the more disappointing offerings from Salesforce and has far from reached the potential required. Salesforce will only benefit from a functionality and capability perspective with Tableau inside rather than as a partner or third-party application.

Quite simply across the product suite, and as a standalone offering, Tableau will significantly increase the visualisation, both automated and user-led capabilities of Salesforce. In terms of what it means for both companies, of course, there is good and bad. There is a very significant overlap in the customer bases of both products. It is not 100%, but there will be a balance of customer familiarity and the opportunity to cross-sell for Salesforce, and the extensive partner network that it oversees. There will be some cultural challenges, no doubt in the integration. Salesforce talks about Tableau as an independent organisation within Salesforce, and that will work until Mark Benioff believes it doesn’t. The internal but separate approach rarely works, and the Tableau logo will disappear at a point in time as a consequence.

There are a few differences between the integration of Tableau and the most comparable business Mulesoft. Mulesoft was literally up the street from Salesforce in San Francisco and culturally was based on many of the premises of Salesforce. For Seattle based Tableau, there will be a few differences culturally, although nothing that cannot be overcome with communication, honesty and much hard work on the cultural integration.

The on-premise and cloud capability of Tableau may disappear quicker than the road map that Tableau had, again, Salesforce places great import on the SaaS, no Software approach. Advanced analytics and AI capabilities of Tableau are not its fundamental value proposition so that Einstein will remain the lead there, with some added capability. The non-customer centric user of Tableau provides new client opportunities for Salesforce.

The final point of the acquisition is that it proves in 2019 and the future, you cannot be a one trick software firm. To remain relevant, you need multiple capabilities. Tableau struggled with this, VMware famously struggled until the “invention” of hybrid cloud to be more than virtualisation, and SAS Institute and ESRI remain the poster firms for relying on one old product suite.

Capture Point

Salesforce paid a premium for Tableau, even in a capital-rich 2019. In the world of Salesforce, that is rarely the point. One of the challenging aspects in the Salesforce 360 portfolio is fundamentally sharpened; it gains new users, new capabilities and opportunities for the core product to expand. As with all acquisition, the trick will be the integration, cultural alignment, and keeping developers and partners on board.