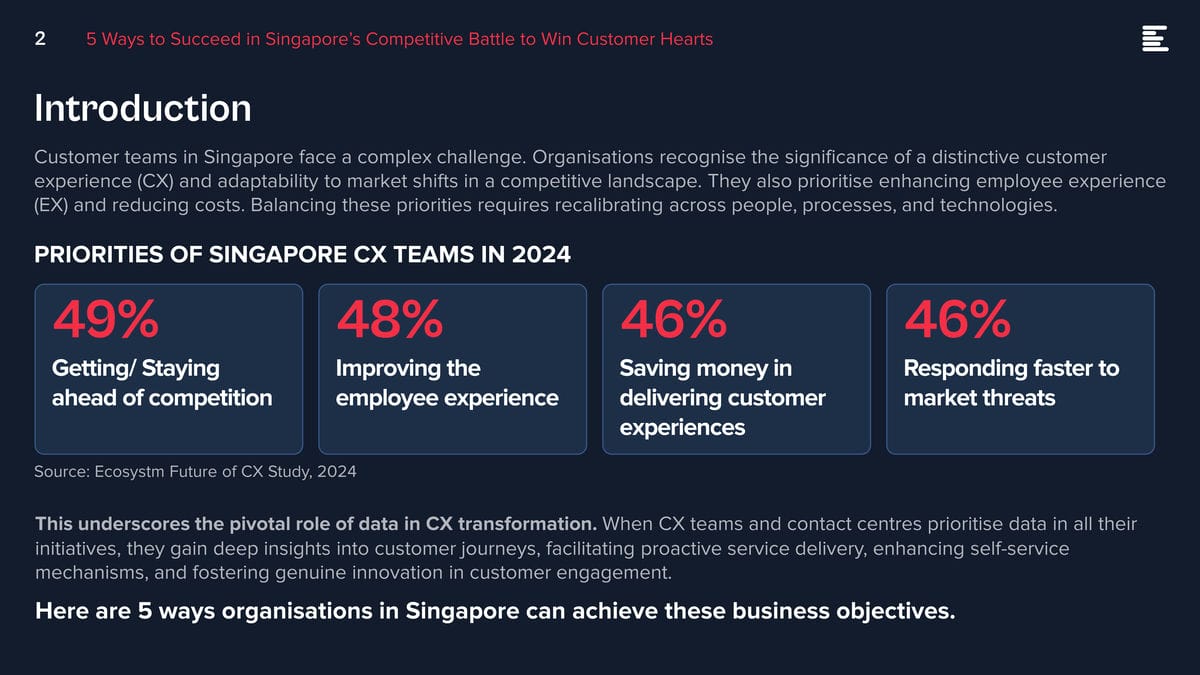

Customer teams in Singapore face a complex challenge. Organisations recognise the significance of a distinctive customer experience (CX) and adaptability to market shifts in a competitive landscape. They also prioritise enhancing employee experience (EX) and reducing costs. Balancing these priorities requires recalibrating across people, processes, and technologies.

This underscores the pivotal role of data in CX transformation. When CX teams and contact centres prioritise data in all their initiatives, they gain deep insights into customer journeys, facilitating proactive service delivery, enhancing self-service mechanisms, and fostering genuine innovation in customer engagement.

Here are 5 ways organisations in Singapore can achieve these business objectives.

Download ‘5 Ways to Succeed in Singapore’s Competitive Battle to Win Customer Hearts’ as a PDF.

#1 Build a Strategy around Voice & Omnichannel Orchestration

Customers seek flexibility to choose channels that suit their preferences, often switching between them. When channels are well-coordinated, customers enjoy consistent experiences, and CX teams and contact centre agents gain real-time insights into interactions, regardless of the chosen channel. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

This doesn’t diminish the significance of voice. Voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels. Regardless of the channel chosen, prioritising omnichannel orchestration is essential.

Ensure seamless orchestration from voice to back and front offices, including social channels, as customers switch between channels.

#2 Unify Customer Data through an Intelligent Data Hub

Accessing real-time, accurate data is essential for effective customer and agent engagement. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

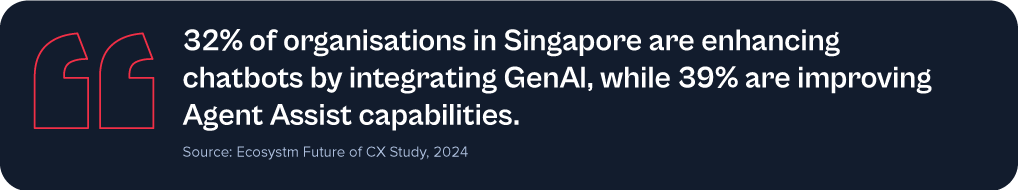

#3 Transform CX & EX with AI

GenAI and Large Language Models (LLMs) is revolutionising how brands address customer and employee challenges, boosting efficiency, and enhancing service quality.

Despite 62% of Singapore organisations investing in virtual assistants/conversational AI, many have yet to integrate emerging technologies to elevate their CX & EX capabilities.

Agent Assist solutions provide real-time insights before customer interactions, optimising service delivery and saving time. With GenAI, they can automate mundane tasks like call summaries, freeing agents to focus on high-value tasks such as sales collaboration, proactive feedback management, personalised outbound calls, and upskilling.

Going beyond chatbots and Agent Assist solutions, predictive AI algorithms leverage customer data to forecast trends and optimise resource allocation. AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks.

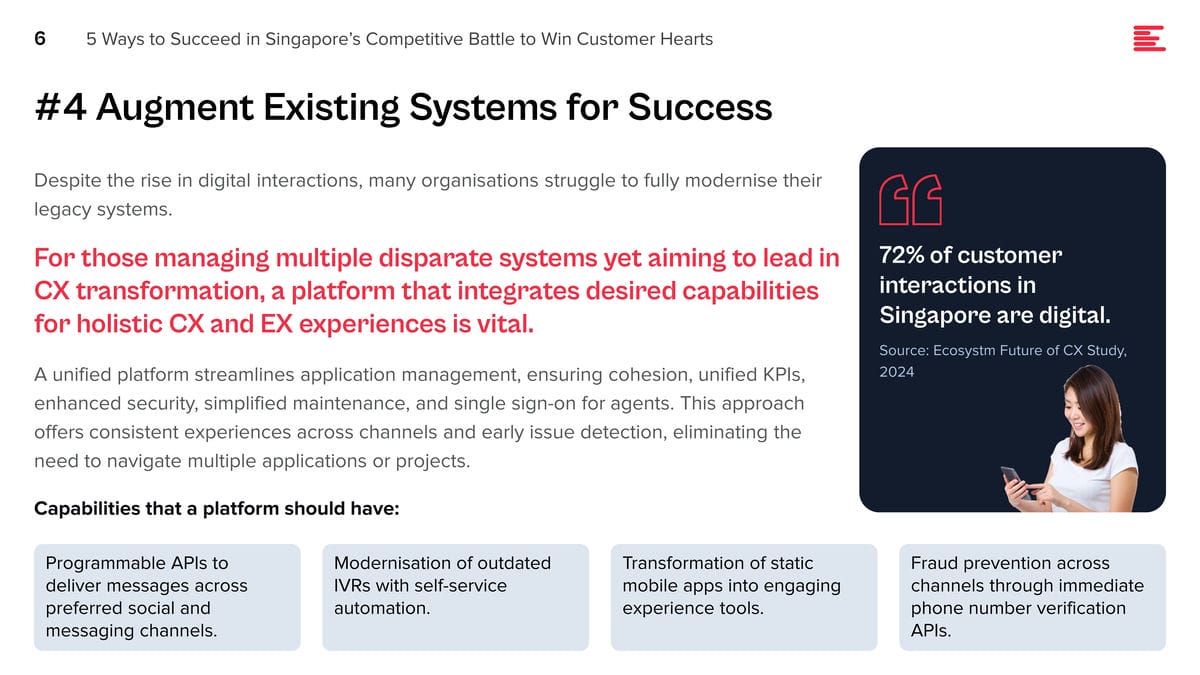

#4 Augment Existing Systems for Success

Despite the rise in digital interactions, many organisations struggle to fully modernise their legacy systems.

For those managing multiple disparate systems yet aiming to lead in CX transformation, a platform that integrates desired capabilities for holistic CX and EX experiences is vital.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This will require organisations to re-evaluate all aspects of their CX delivery.

- Redefine the Contact Centre. Transform it into an “Intelligent” Data Hub providing unified and connected experiences. Leverage intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empower agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensure consistent omnichannel experiences through data unification and coherency. Use programmable APIs to personalise conversations and identify customer preferences for real-time or asynchronous messaging. Incorporate innovative technologies such as video to enhance the channel experience.

An Update (1 October 2021): This acquisition did not go through even after the boards of directors of both companies had approved it. It was voted down by Five9 shareholders, citing growth and valuation concerns. This is an unusual example of an acquisition not going through because of unwillingness of one of the companies. In recent times, regulators have stopped some acquisitions. Incidentally, there were some concerns raised by the by Federal Communications Commission (FCC) as Zoom is based in US. but has product development operations in China.

The partnership arrangement between the two companies will continue including support for integrations between their respective Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS) solutions and joint go-to-market initiatives.

Zoom has announced their intention to acquire cloud contact centre service provider Five9 in an all-stock deal for about USD 14.7 Billion. This is Zoom’s largest-ever acquisition as the communications platform continues to expand their services and launch new products. The deal is expected to be completed in the first half of 2022 and Five9 will be an operating unit of Zoom.

The last year has seen Zoom scaling up their product offerings, including cloud calling solution – Zoom Phone, conference hosting solution – Zoom Rooms, and applications and productivity tools – Zoom Apps and Zoom Marketplace. Zoom also acquired real-time translation startup Kites GmbH to offer multi-language translation capabilities, and Keybase – a secure messaging and file-sharing service to build end-to-end encryption for its video conferencing platform.

Ecosystm Analysts share their thoughts on Zoom’s strategy and roadmap, how Five9 will augment Zoom’s capabilities, and the impact the acquisition will have on Zoom’s competitors and the market.

Why Contact Centre?

Ecosystm Principal Advisor Tim Sheedy says, “Zoom is moving beyond its period of ‘organic hypergrowth’ brought on by the pandemic. While the paying customer base for their core video collaboration service will continue to grow, growth rates are likely to begin to track the market. To grow beyond market rates, Zoom needs to move into new markets – through product development or acquisition.”

Talking about the importance of voice services, Sheedy adds, “Voice services are an obvious adjacent market to help drive growth, and Zoom already has seen some success with their Zoom phone service and associated devices – in fact, they already have 1.5 million users. The Five9 acquisition gives the company a stronger and deeper capability in the voice sector; buying them a significant chunk of the voice services in business – the contact centre. In many businesses, the contact centre already accounts for over 50% of their voice minute usage, so winning this space will go a long way towards winning the overall voice and collaboration supplier in enterprises.”

Ecosystm Principal Advisor Audrey William predicts exciting times ahead for Zoom. “With Zoom already having a platform for video, then bringing voice into that equation and now a contact centre solution, makes them take on their competitors in an all-native cloud stack. There is a still a large installed base of on-prem UC customers and with Zoom seeing success with Zoom phones in the short time frame since its launch, this is where this will get exciting for Zoom. The telephony piece is still important in the race to simplify how we work, communicate, and collaborate today. It is that same voice/telephony discussion that can lead to a routing discussion, which then leads to a contact centre discussion.”

Ecosystm research shows that 54% of organisations are challenged in their customer experience delivery because of integration issues between multiple platforms. William sees this as an opportunity for Zoom. “The use cases to integrate workflows into the video environment is going to be important for Zoom. Video is now being used to solve customer service issues like letting the agents take over the screen to see how to help solve the customer problem immediately by using video and contact centre applications. The ability to bring this natively together will be very powerful. Zoom is investing heavily into apps and working to partner with ISVs who can develop workflows suitable for easy customer communication in specific industries such as Healthcare and Financial Services.”

Why Five9?

Five9 is considered a pioneer in cloud contact centre solutions and owns a comprehensive suite of applications for contact centre delivery and customer management operations across different channels. Five9 has made several acquisitions and enhancements to their CCaaS solution in recent years to make their stack more complete with richer AI offerings. They include Inference Solutions to offer their customers a Conversational AI solution and Whendu’s iPaaS platform which provides a no-code, visual application workflow tool.

William says, “More contact centres want to do away with monolithic IVR systems that confuse customers with too many long menus. The Agent Assist solutions are also gaining importance especially in the hybrid work model where agents face challenges working in isolation and not being on a floor with their colleagues and managers.”

Five9 has acquired a cloud workforce optimisation provider Virtual Observer. “So, we are not looking at just a basic level contact centre solution but an offering with important capabilities demanded by customers,” says William. “During the investor call this week, Zoom’s Eric Yuan and Rowan Trollope made it clear that they have been listening to customer feedback on how effective it would be to have a single platform that can accommodate UC and contact centres in the cloud. Zoom also sees Five9 as a good fit culturally; and their goal now will be to disrupt all legacy systems with cloud-native communications.”

What lies ahead?

William thinks that Zoom’s competitors will be watching this integration closely, especially those that lack an all-in-one native cloud UCaaS and CCaaS stack. “However, some of Zoom’s competitors have an established base of large enterprise customers and have done well to grow revenues and defend their base over the years. Working with in-country partners and ISVs will be critical for Zoom’s growth across regions.”

Sheedy thinks that the most important takeaway from this acquisition is not that Zoom is moving into the contact centre space. “It is that Zoom realises they have a “once in a generation” opportunity to grow beyond their core and cement their position as a supplier of collaboration and communication services – and that they are willing to flex their balance sheet and share price to create their future. The competition – from Microsoft in particular – will be strong. Google, AWS, Salesforce, and Facebook are also making a play for this market. Zoom has found themselves in their current position of strength due to good luck and good timing – and they appear to be telling the market that they aren’t going to give up their leadership without a significant battle.”

“Enterprises will be the true winners in this battle – with better, more integrated, lower cost and easier to implement communications and collaboration solutions for their employees and customers,” adds Sheedy.