Agriculture is significant to New Zealand’s economy and the Government aims to create more efficient land usage, better environmental outcomes, and to drive sustainability for food and supply chain across domestic and international markets.

In an effort to grow the agritech sector into an even stronger economic contributor, increase agritech exports and advance sustainable production in New Zealand and globally, the Government of New Zealand has committed to spend USD 7.6 million on the implementation of an Agritech Industry Transformation Plan as part of a strategy for the food and fibre industry. The plan is the culmination of views and insights representing a cross-section of more than 130 members of New Zealand’s agritech ecosystem – the Government, industry, and the Māori and wider community – providing their collective vision to focus attention on the sector for a competitive edge.

Roadmap to Accelerate New Zealand’s Agritech

To further boost the innovation in agritech and upscale the Sustainable Food & Fibre Futures (SFF Futures), an additional USD 56 million has been earmarked for smaller grassroots community projects to large-scale industry development. This will support the Government’s Fit for a better world Roadmap – a 10-year roadmap for the primary industry; and add value across the agriculture, horticulture, fisheries and marine, and forestry sectors.

The Roadmap includes objectives such as:

- Adding USD 29 billion in export earnings over the next decade (2020 to 2030) through a focus on creating value

- Reducing the biogenic methane emissions to below 10% by 2030 and restoring New Zealand’s freshwater environments

- Employing 10% more New Zealanders in the food and fibres sector by 2030, and 10,000 more by 2024

Ecosystm Principal Advisor, Jannat Maqbool says, “In addition to the current environment with COVID-19, a new generation of consumers across the globe is becoming considerate that they buy what is good for the world in the face of climate change, biodiversity loss and the degradation of waterways. The ability to manage and assure quality and safety from ‘farm to fork’ is now more important than ever, leveraging technology for traceability, risk management, and rapid response capability to meet consumer demands and relevant legislative requirements.”

Through this Industry Transformation Plan (ITP), the Government seeks to attract investments in New Zealand’s agritech intellectual property (IP), develop the necessary infrastructure, focus on export opportunities, address current concerns related to connectivity and data, and ensure a skilled workforce that is able to both develop and effectively leverage agritech.

Maqbool says, “The success of the plan will depend on how well relevant stakeholders engage and ongoing support from government to help create the conditions required for the sector to realise its potential.”

Key Milestones

The Government of New Zealand is working to retain competitiveness in global agriculture. Some key initiatives include:

Farm 2050 Country Partnership. New Zealand became the first country partner of Farm2050- a global agritech initiative that brings together farmers, researchers, the market and investors to collaborate effectively.

Western Growers partnership. Western Growers and New Zealand signed a partnership agreement to develop agritech. It also opened doors for New Zealand’s agritech researchers and companies working in the robotics and automation space to enter the US Market.

The Australia New Zealand Agritech Council. The Australia New Zealand Agritech Council was launched to help the countries work closely on agricultural practices and to cooperate on agritech.

New Zealand is fast becoming an example of how technology providers and food producers can collaborate on improving yields, optimising production methods and reducing waste, predicting demand, and safeguarding supply chains.

The COVID-19 pandemic is debilitating industries, and economies around the world are facing the prospect of a recession. Malaysia, like many other countries, is focussing on front-line medical efforts and security services to save lives and contain the deadly, rapidly spreading virus. Essential services such as food, water and energy supply, Telecommunications, Banking, eCommerce and logistics are working overtime in this new order to support basic functions. The measures put in place to mitigate the spread of the virus are obviously inhibiting other economic activities.

Until enough people develop an immunity to the virus – either through a vaccine or naturally – it is hard to envisage lifting these movement control measures and return to a pre COVID-19 state. Malaysia has a total of 4,987 positive cases, the highest in Southeast Asia and a death toll of 82 as of today. The number of the population tested remains low at 81,730 as reported by the Ministry of Health, mainly due to limited testing resources.

The biggest challenge is that this epidemic is unprecedented, and it is unclear when we can put this situation behind us. The Malaysian Industry of Economic Research (MIER) has predicted about 2.4 million job losses as well as the GDP to reduce by 2.9 percent in 2020. Public debt rise coupled by reduced income due to lower crude oil, natural gas and palm oil prices and demand, will hit the Government coffers hard. Interest rates are expected to be low through the current lockdown stage right up to the recovery stage to help support the economic recovery.

Government Initiatives for the Economy

Like many countries, Malaysia has announced economic stimulus packages to ensure help for the poor and needy, that workers do not lose their jobs and that companies avoid bankruptcy – albeit with an inevitably reduced output – to keep the economy functioning. The stimulus offered is short-term covering a few months, and more assistance will be required should the epidemic linger and for the recovery period.

The Government announced a stimulus package on the 27th February worth RM20 billion (US$4.5 billion) and another one on the 27th March worth RM230 billion (US$52.6 billion). The packages comprise of direct fiscal injection of RM25 billion (US$5.7 billion) as well as loan deferments, one-off cash assistance, credit facilities and rebates. The focus of the stimulus packages is to assist people in the lower-income (B40) and mid-income (M40) groups, aid for employees in the private sector and for traders during the movement control order (MCO) which is to run until 14th April 2020.

An additional COVID-19 stimulus package worth RM10 billion (US$2.2 billion) was announced on the 6th April to address the challenges of the small and medium enterprises (SMEs) that employ two-thirds of the workforce and contribute to 40 percent of the GDP. The wage subsidy is to benefit 4.8 million workers earning less than RM4,000 (US$915) per month. In addition, SMEs will have access to interest free loans of RM200 million (US$45.7 million) from the National Entrepreneur Group Economic Fund and a further RM500 million (US$114.4 million) via Bank Simpanan Nasional. The Government allowed 750,000 SMEs to postpone income tax payment for three months from 1st April – companies in the tourism sector are allowed to postpone income tax for six months.

Impact on Industries

Banking & Financial Services. Banking institutions will support the Government’s stimulus initiatives by providing a six months’ loan repayment moratorium, corporate loan restructuring and conversion of credit card balance to long term loans. Banking and financial institutions are focussing on business continuity planning to ensure minimal disruption to their business and customer support. Many key business processes are now being put to test in-home working with scaled-down office operations. Digital Transformation (DX) has been accelerated as a result.

Contactless payments have seen a boost and many financial institutions have increased payment limits for such payments. Early last month the World Health Organisation (WHO) and the Bank of England had issued advisories against the use of banknotes, as it could increase the chances of the virus spread, instead recommending the use of contactless payment where possible. This might give a boost to the use of Cryptocurrency and cross-border payment services in Malaysia. In 2019, cryptocurrency start-ups received an estimated 12 percent of Fintech funding – but, only three cryptocurrency exchanges were given conditional approval by the Securities Commission. The current situation may well see that changing.

Insurance. The Prime Minister announced that the Insurance industry is to create a fund of RM8 million (US$1.8 million) to cover the cost of RM300 (US$68.6) per policyholder to undergo COVID-19 tests. In addition to this, insurance companies are to offer a 3-month suspension on premiums for policyholders whose income is affected by the pandemic.

Agriculture. Even prior to COVID-19, there has been a brewing narrative against globalisation, favouring a nationalistic emphasis as reflected globally by Brexit and the China-US trade wars tension. Food security is key, and COVID-19 has further highlighted its importance with priorities shifting to local requirements over exports. The Government intends to distribute a food security fund of RM1 billion (US$228.8 million) to increase the local production of farms, fisheries and livestock. According to the Department of Statistics, Malaysia’s food and beverage imports amounted to RM54 billion (US$12.3 billion) in 2018 while food exports stood at RM35 billion (US$8.0 billion) resulting in a trade deficit of RM18.8 billion (US$4.3 billion). As countries focus on internal supplies instead of exports in the current scenario, Malaysia needs to address this risk by producing more locally.

Impact on Industry Transformation

Amidst the gloomy outlook, there are plenty of opportunities, especially to the country’s Digital Economy. Malaysia has been committed to the Digital Economy vision with the Malaysia Digital Economy Corporation (MDEC) estimating that the country’s Digital Economy is worth US$3 trillion. The COVID-19 crisis may well be the key driver in achieving that vision. DX efforts are being accelerated with businesses adopting more cloud and mobility solutions. More workloads have to be digitalised and there is greater adoption of Cloud for storage and services. AWS, Microsoft Azure and Google Cloud will be beneficiaries in this area.

I have already spoken about the Financial Services industry – other industries are also getting transformed out of a necessity to survive this crisis. The Education sector has seen an increase in access to educational content and traffic to education portals and blogs. Some schools have implemented online lessons and group chats between teachers, students and parents to ensure education continues through this pandemic. Many universities have used their e-learning platforms to move lectures online.

The Telecommunications industry is being appreciated more than ever and it is the backbone to normal life, in both a social and business sense. The Government’s stimulus package includes offers of free internet to all customers until the MCO is over at RM600 million (US$137.3 million) and an investment of about RM400 million (US$91.5 million) to improve coverage and quality of service. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period. The Axiata Group recently announced a cash fund of RM150 million (US$34.3 million) to assist micro-SMEs within the ecosystem providing eCommerce, digital payments and related services.

Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been the biggest winners so far. The home working trend should continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and the impending rollout of 5G.

The eCommerce sector should see a major improvement in Malaysia with physical channels to the market being suspended. Malaysians have not embraced eCommerce like mature economies have, and it has significant room for improvement. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. Statista reports that the average Malaysian eCommerce shopper spent just US$159 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for necessities such as online grocery, food and delivery of goods. As a consequence, the Transport & Logistics sector will have to adapt their business operations in order to ride this wave successfully.

Video streaming and gaming has also seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. There provides a tremendous opportunity for both telecom operators and content providers to increase their number of services in this area.

Malaysia, like all other countries, will have to ride out this wave. It has made a positive step in the direction with the stimulus packages, especially for the SME sector. How well the country rides this wave out will depend on how targeted the future stimulus packages are and how fast industries can transform to handle the new world order that will emerge after the COVID-19 crisis.

Deep Tech companies are aiming to transform the world through scientific, engineering and technological advances. As technology evolves, researchers are looking to apply engineering and technological advances in areas such as processing and computing architecture, semiconductors and electronics, materials science, vision and speech technologies, artificial intelligence (AI) and machine learning, and so on – for the greater good. For example, finding a cure to a disease, developing new medical devices, sensors and analytics to help farmers increase yield, or developing clean energy solutions to reduce the environmental impact are some of the areas that Deep Tech is finding real-world applications.

Deep Tech Impacting Industries Today

There are several industries that are benefitting from Deep Tech innovations today. Here are only a few examples of Deep Tech innovations in some industries:

Healthcare

The combination of computational and biotechnology is accelerating the development of new cures, augmenting R&D and improving health outcomes. Deep Tech in healthcare has multiple applications from the manufacturing of affordable medical devices to redefining healthcare. Vibrosonic, has designed what they call a “contact lens for the ear” which can be directly placed on the eardrum. Unlike other hearing aids speakers are not used to transport sound through the ear canal but the eardrums are stimulated through electric impulses. A Singapore-based biotech company X Zell has patented a “liquid biopsy”- detecting cancer from a 10ml blood sample by measuring the presence of tumour-derived Circulating Endothelial Cells (tCEC) – which reduces the need for invasive cancer detection processes.

Food and Agriculture

Food crisis is a reality today with factors such as overpopulation, urbanisation, decreasing land per capita, extreme climates and so on impacting the food and agriculture industry immensely. Deep Tech companies are working to bring us sustainable food options and building climate resilience. Cell-based meat options are being researched globally, and companies such as foodtech start-up Shiok Meats is producing meat by harvesting cells from animals with a view to be environmentally friendly and to reduce the impact on biodiversity. In agriculture, Deep Tech companies are working on technologies to develop better farming methods to improve yield and precision sensors for weather forecasting. Examples such as UbiQD, that has worked on a greenhouse quantum dot film that improves crop quality by optimising sunlight spectrum for plants to improve production, show how Deep Tech will continue to transform the industry.

Environment and Energy

Deep Tech continues to come up with solutions that will help us in climate change mitigation, development of sustainable energy and energy efficiency. Innovations include Carbon Upcycling Technologies’ solution to capture and neutralise carbon dioxide. The carbon dioxide-enriched nanoparticles are used to make commercial construction materials and even consumer products such as jewellery. Celadyne Technologies has developed hydrogen fuel cells and electrolysers with nanocomposite membranes for a more efficient, cost-effective and eco-friendly energy source.

Advanced Computing

As technology evolves, there will be a need to support even greater compute and data-intensive tasks. Deep Tech has impacted and will continue to impact advanced computing. The semiconductor and microchip industry is getting disrupted by cutting-edge global research, many by the top universities. MIT, for example, has developed a process called “remote epitaxy” to manufacture flexible chips. Potential use cases include VR-enabled contact lenses, electronic fabrics that respond to the weather, and other flexible electronics. Atom Computing is working on scalable quantum computing that will be able to scale millions of qubits using individual atoms – without scaling up the physical resources – in a single architecture.

Communication and Security

Communication and connectivity have seen a sea change in the last decade. As we wait for 5G to take off, this industry has become a playground for inventions. Aircision, is working on making 5G more accessible using its laser-based communications technology. The technology is developed to enable high-bandwidth communication and beam data between buildings thus aiming to eliminate the need for optical fibre installations and microwave. Another area that will keep getting a lot of attention from Deep Tech firms is communication security. Speqtral is working on space-based quantum networks to deliver secure encryption keys.

Examples such as these are an indication that Deep Tech is a reality today and has the potential to disrupt several industries and impact the lives of millions.

Where is Deep Tech Headed?

Government Interest in Deep Tech

Since Deep Tech is aimed at leveraging technology and engineering for sustainability and greater good, several countries are promoting Deep Tech R&D and initiatives. From emerging to mature economies, governments are supporting their Deep Tech industry. The New Zealand Government has formed a Deep Tech Incubator program. The program is headed by the Government’s innovation agency to help Deep Tech companies and to create new tech jobs.

Singapore has created a strong Deep Tech ecosystem leveraging the funding ecosystem, the presence of global corporations, research and higher learning organisations and the Government that promotes innovation and entrepreneurship. Agencies such as SGInnovate and Enterprise Singapore are working with Deep Tech startups in advanced manufacturing, urban solutions and sustainability, and healthcare and biomedical sciences. Partnerships between universities, industry bodies and research organisations further fuel this ecosystem – the Critical Analytics for Manufacturing Personalised-Medicine (CAMP) is a partnership between Singapore-MIT Alliance for Research and Technology (SMART) and A*STAR for cell therapy manufacturing. The Government also funds and incentivises Deep Tech startups. The 2020 budget announced additional funding to support Deep Tech companies under the Start-up SG Equity scheme.

As global governments get serious about the quality of their citizens’ lives and sustainability goals, they will invest in Deep Tech research.

Challenges of the Deep Tech Industry

While Deep Tech has enormous potential, mainstream adoption is still some way off. There are some unique challenges that the industry faces today. Future uptake will depend heavily on how fast the industry can circumvent these challenges. The key challenges are:

- Securing Finances. Despite initiatives by several global governments, Deep Tech projects often find it difficult to secure funding. Very often the research duration can stretch without any real guarantee of success. Funding is likelier to go to organisations developing consumer products as the ROI are seen earlier and are easier to quantify, especially in the early stages.

- Identifying Market Opportunities. Researchers who develop Deep Tech solutions and products might not be able to identify opportunities to present their development from a marketing as well as an economic perspective. Very often these companies rely on other channels or third-party services for a proper marketing and planning strategy. This is where working with incubators or government bodies becomes crucial – countries that give that opportunity through a well-defined ecosystem, will lead the Deep Tech revolution.

- Scalable Development. Many Deep Tech innovations get stuck at the proof-of-concept stage – not because they are not innovative enough, but because they are not scalable to mass production. That requires the right infrastructure as well as a deep understanding of how the products and services can be commercialised.

There are several global companies trying to disrupt entire industries with their inventive offerings. We are witnessing some novel innovations in autonomous vehicles, foodtech, computer vision, AI, weather predictions, Clean Energy solutions – the list continues – that we will benefit from in the future.

Let us know which Deep Tech companies have impressed you in the comments below.

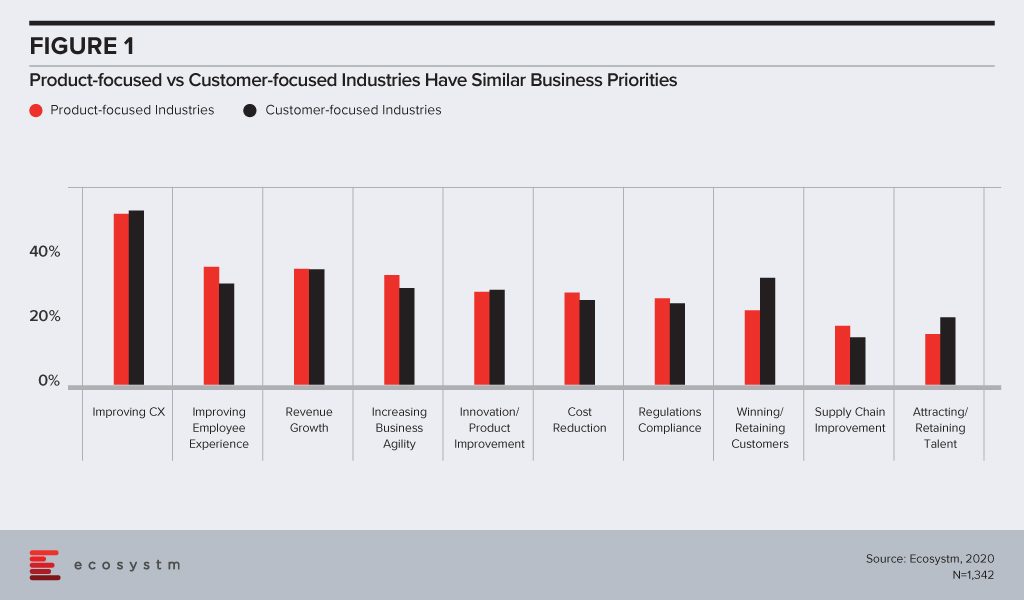

Traditional industry practices tend to divide industries into two distinct buckets – firms that are primarily focused on product design and improvement, and those that define their strategy based on customer services. Over the years, the lines distinguishing these organisations have all but disappeared. To be able to succeed in today’s competitive world, you need to continually improve your product offering – even for organisations in industries such as Manufacturing and Wholesale – and the best way to do so is to keep a firm eye on your customers. Likewise, unless you have a robust product, you will not be able to retain customers. As an example, online reviews are often critical of budget airlines, but the successful ones manage to hold on to their loyal customers doing what they set out to do – by not offering the best airline food service but by continuing to provide affordable airfares to places where their customers want to go. The Ecosystm CX study finds that even the most product-focused industries today, have improving customer experience (CX) as a key business priority (Figure 1). The two groups of industries tend to have similar priorities – the only major difference being customer-focused industries invest in more initiatives to promote customer loyalty.

In 2016, Caterpillar showed the way forward to industries that have primarily been product-focused. They started investing in technology that is not just focused on solving, but actually predicting customer issues to improve service. Even industries such as Agriculture are increasingly becoming customer-focused, as more citizens become conscious of where and how their food has been produced. Freight Farms is a good example of customer-centricity in the industry – focusing on technology to grow food in environments not considered conducive to farming such as urban localities and places with extreme climates.

Investing in the Right Technologies

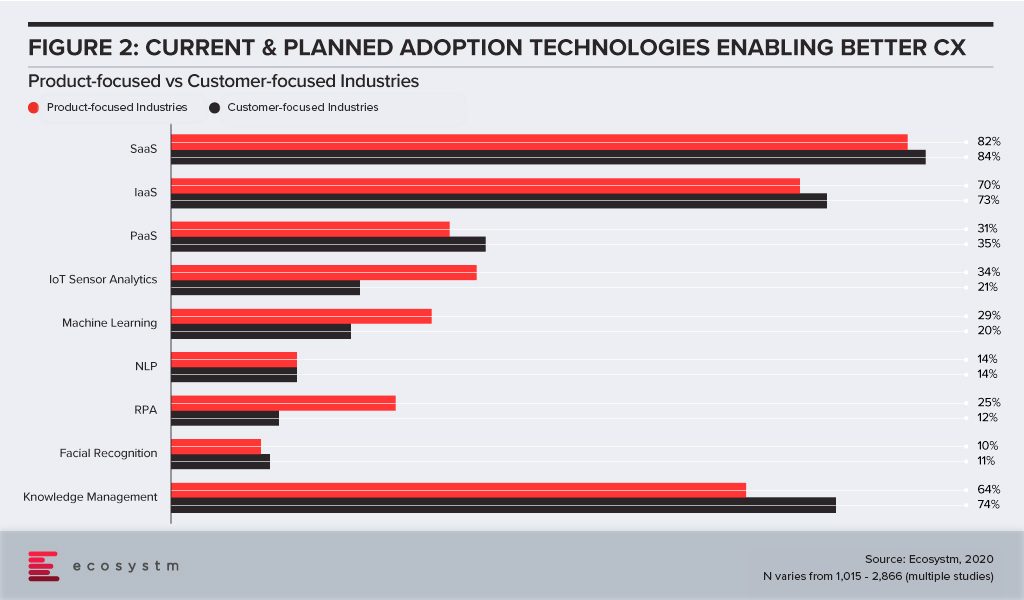

Looking at the Top 5 CX trends for 2020, we find that technologies such as Cloud and AI, and solutions such as robust knowledge management are true enablers of positive CX. So how do these two groups differ when it comes to investments in these technology areas? Customer-focused industries are slightly more enthusiastic about their Cloud investments, but only marginally (Figure 2). Obviously, they invest more in knowledge management solutions, both for CX as well as improved employee experience (EX). But surprisingly, product-focused industries also tend to invest in knowledge management, for several reasons ranging from product improvement to after-sales support.

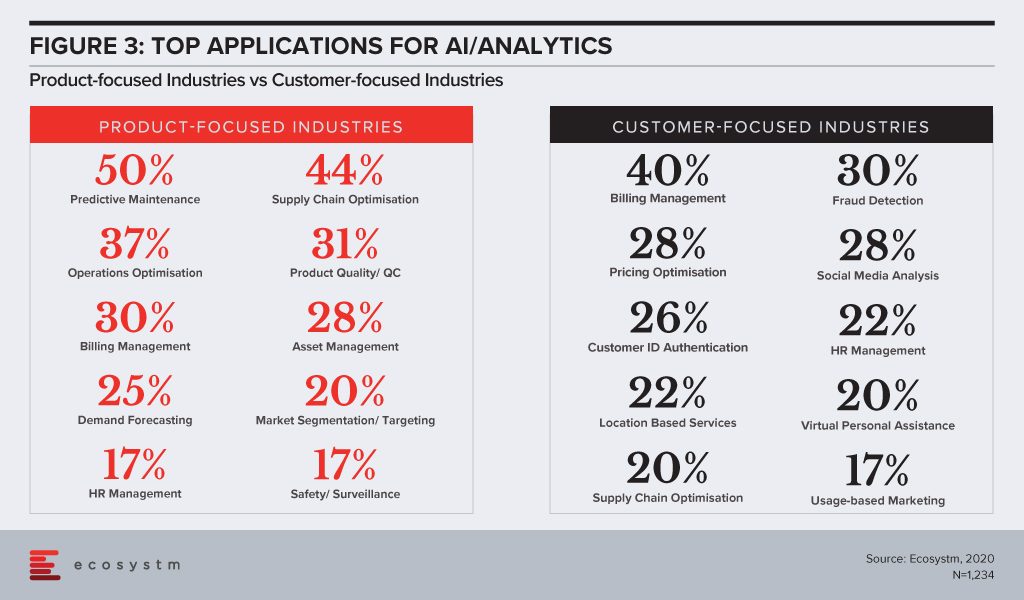

Where product-focused industries really lead is in their investments in AI/Analytics – which ties in with our observation that automation is the stepping stone for AI investments across industries. The applications of AI/Analytics are very distinct for the two groups (Figure 3). Product-based industries focus on automation and optimisation and have a clear asset focus. However, it is heartening to see some customer-centric solutions such as market segmentation. On the other hand, the top AI/Analytics application for customer-focused industries is billing management, which might significantly improve CX but falls under the purview of Finance & Operations in most organisations.

Securing Data and Building Trust

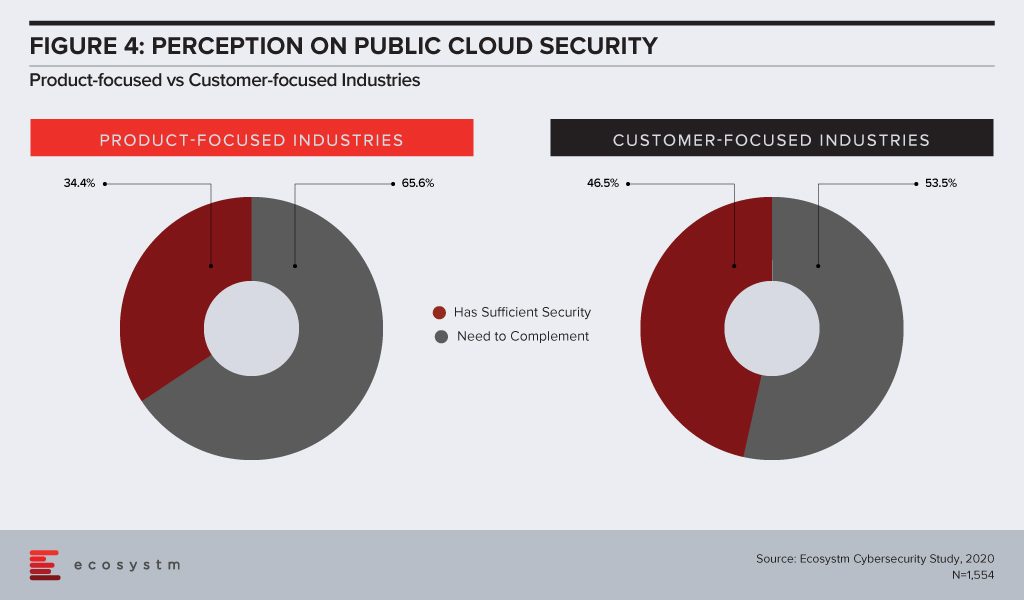

No organisation can ignore the seriousness of data breaches – whether customer data or intellectual property. Public cloud is going to be the true enabler of Digital Transformation (DX), from both cost and agility angles. Security has always been a key concern around public cloud adoption, even though organisations would mostly benefit from the robust and evolving security features of public cloud providers rather than having a go at securing their systems and data in-house and on-premises. The perception on public cloud security has changed over the years (Figure 4), but customer-focused industries appear to be savvier about the shared responsibility SLAs most public cloud providers have in place.

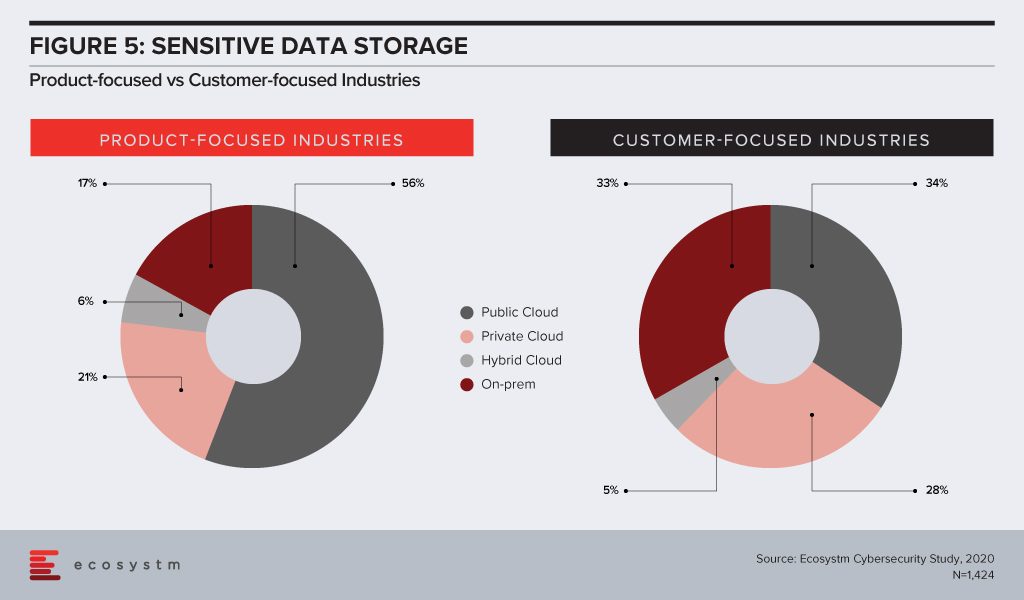

Which brings us to another important question – how much sensitive data do these organisations store on public cloud (Figure 5). Probably because they hold more customer data and must follow industry and country compliance laws that mandate how customer data should be stored and accessed, nearly a third of customer-focused organisations store sensitive data on-premises only. While their cloud adoption may be slightly higher than product-based industries, they are also more wary of storing sensitive data on the public cloud.

The differences in strategies between customer-focused and product-focused industries might have blurred over the past decade – both groups focusing on customer-centric products. Their technology priorities are still clearly distinct, however. It is important to bear this difference in mind – both for tech buyers who are looking at use cases across all industries when it comes to emerging technology adoption; as well as for tech vendors who now have to engage with stakeholders beyond the IT department.

NB: For the purpose of this blog, industries have been classified as follows: Product-focused Industries – Energy & Utilities, Manufacturing-based industries, Resource & Primary industries, Transport & Logistics, Wholesale and Construction; Customer-focused Industries – Banking & Financial industries, Retail & eCommerce, Healthcare, Government, Professional Services, Media & Telecommunications

The largest agricultural event in the southern hemisphere has just come to a close in Waikato New Zealand, across 114 hectares, with over 1,050 exhibitors, more than 125,000 visitors, including delegates from over 40 countries, and total sales revenue of around half a billion over the four days. Fieldays, an idea from the late 1960s focused on connecting farmers with innovative products and services, was officially opened by the Rt. Hon. Jacinda Ardern who spoke of the strength of New Zealand’s primary industry and its importance to the people of New Zealand. Of specific interest to me as I joined the crowds on day two, was the emerging technology innovations in agriculture on show at the Innovation Centre.

A preview of the New Zealand Agritech Story, developed along with New Zealand Trade and Enterprise (NZTE), was kicked off on a foggy Waikato morning on day two of Fieldays, providing insights into the country’s competitive advantage in Agritech along with perceptions of key global players. This was then followed by the New Zealand government announcing a new $20 million Agritech investment venture fund.

NZ Tech reports that the tech sector in New Zealand is the third largest and fastest growing export sector, worth $6.3 billion in 2015, and according to the TIN100, the Waikato, has had the fastest growing tech sector in the country two years in a row. New Zealand Agritech exports stand at $1.4 billion in 2018 and is growing – and together with a strong tech sector overall, the investment will help position New Zealand at the forefront of Agritech innovation globally.

Day two also revealed Fieldays Innovation Award winners across a range of categories including Modusense who took out the Gait International Innovation Award for Product Design and Scalability. Modusense, developed here in the Waikato, is a secure, scalable and reliable Internet of Things (IoT) device platform that provides everything needed to deploy remote data collection. In the primary industries sector, Modusense enables complete apiary health monitoring.

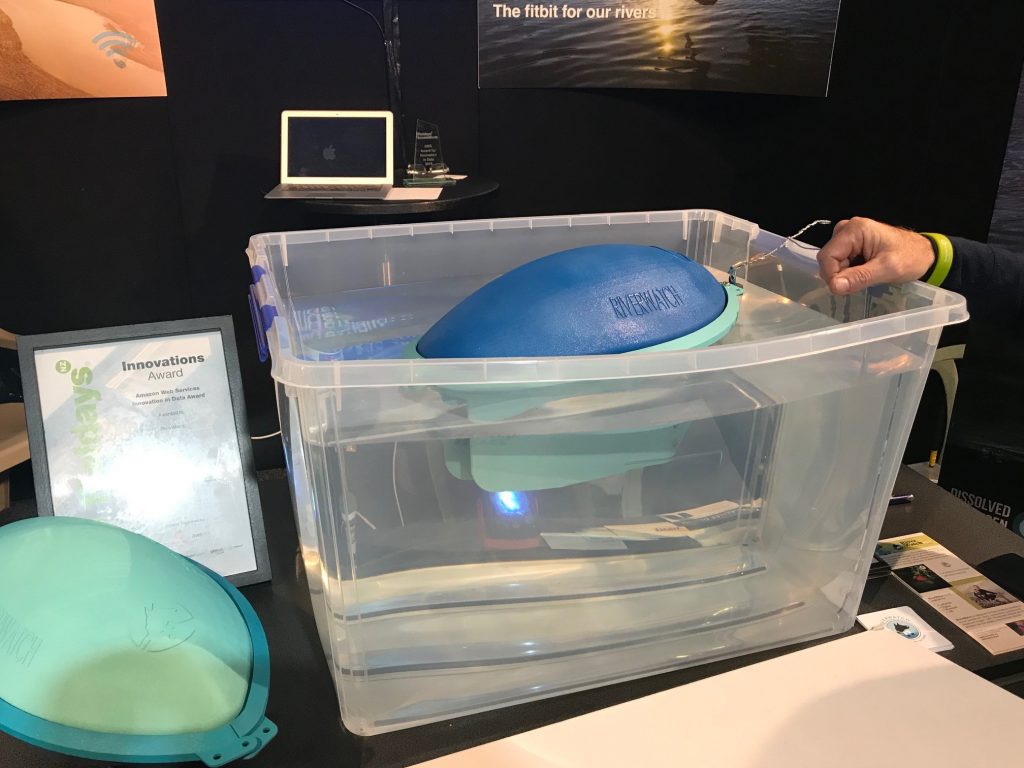

Another IoT enabled solution, RiverWatch, was awarded the AWS Innovation Award in Data for their “Fitbit for water” – an inexpensive water quality monitoring device. RiverWatch is currently running trials in the upper Waikato River in partnership with Te Arawa River Iwi Trust to look at the impacts of industry and farming on water health.

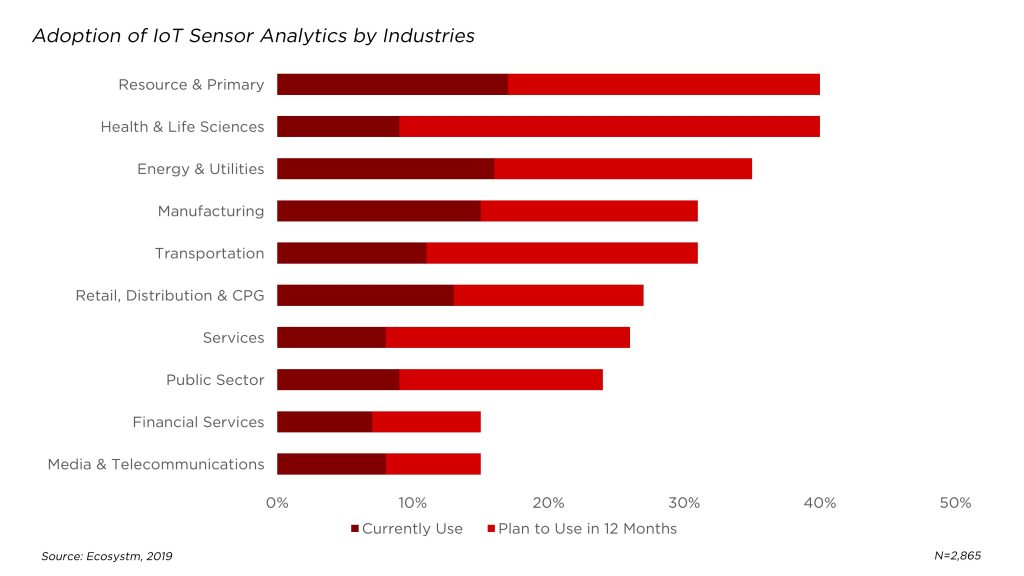

Agritech will transform the industry, and innovations such as those mentioned will further advance New Zealand’s position in the agriculture industry. The true value of Agritech will be realised when AI-enabled IoT is leveraged for cost savings through process automation, and for greater visibility of the entire supply chain. And leading organisations in the industry are aware of it. In the global Ecosystm AI study, Resource & Primary industries (including Agriculture) emerged as a leader when it comes to current and future deployments of IoT Sensor Analytics.

Innovations in IoT

Shipping and logistics in the agricultural sector present unique challenges including a lack of transparency, something that Sparrows.io is working to solve with a hardware and software solution that provides actionable insights using custom sensor modules and live tracking to enable visibility over the supply chain.

The recently launched TRex – IoT, Telemetry, Data and Messaging I/O Transceiver, was also being showcased in the Innovation Centre. Designed to be used for long range monitoring and control, the solution enables two-way messaging and is customisable to meet the needs of applications across various industry sectors including agriculture and farming.

Another innovation that caught my attention at the Innovation Centre was a water monitoring and management device designed to be connected to the irrigation system to enable effective management of water through a mesh network. Hailing from the deep south Next Farm has developed two solutions, with their Remote Irrigation Mesh (RIM) product utilising integrated farm sensor technology together with cloud-based dashboards allowing farmers to maximise the efficiency of water usage while minimising runoff.

Innovations in AI

One of my favourites from last year, Halter, were in the Mystery Creek Pavillion this year and after raising $8 million in funding to refine and further trial their solar-powered collar, for herding cows and monitoring their health, in the Waikato they are close to hitting the open market. Head of Data Science at Halter, Harry She, previously employed by NASA, oversees the development of what the team calls “cowgorithms” which form the basis of the AI underpinning much of the product functions. The collars, which can receive signals up to 8 kms away, is available free and farmers then subscribe on a monthly basis, at a cost per cow, to enable the features they require.

Another product back for another year was the PAWS® Pest Identification Sensor Pad from Lincoln Agritech which is able to identify pests, differentiating these from native species, and transmit the result to the Department of Conservation staff. Utilising machine learning and AI, amongst other technologies, the device greatly reduces surveillance workload and enables staff to detect and respond to re-invasion more rapidly.

However, as exciting as the idea of a Fitbit for cows and innovation in the pursuit of a predator-free New Zealand is, I must admit the highlight of my Fieldays visit was a team of Agribusiness students from Hamilton’s St Paul’s Collegiate school who were awarded the Fieldays Innovations Young Innovator of the Year Award for their floating electro unit “Bobble Trough” designed to keep animal water troughs clean by preventing the growth of algae and microorganisms through the release of copper ions into the water.

I am now working to secure the team’s innovation as a display in a Smart Space being launched in July as part of the Hamilton City Council’s smart cities initiative, Smart Hamilton. A space designed to provide an opportunity for the wider community to engage with technology innovation and be involved in co-creating solutions that enhance the wellbeing of Hamiltonians.

For information on emerging technology innovation in the agriculture sector in New Zealand access my other reports on technology in agriculture in New Zealand.