2024 has started cautiously for organisations, with many choosing to continue with tech projects that have already initiated, while waiting for clearer market conditions before starting newer transformation projects. This means that tech providers must continue to refine their market messaging and enhance their service/product offerings to strengthen their market presence in the latter part of the year. Ecosystm analysts present five key considerations for tech providers as they navigate evolving market and customer trends, this year.

Navigating Market Dynamics

Continuing Economic Uncertainties. Organisations will focus on ongoing projects and consider expanding initiatives in the latter part of the year. This means that tech providers should maintain visibility and trust with existing clients. They also need to help their customers meet multiple KPIs.

Popularity of Generative AI. For organisations, this will be the time to go beyond the novelty factor and assess practical business outcomes, allied costs, and change management. Tech providers need to include ROI discussions for short-term and mid-term perspectives as organisations move beyond pilots.

Infrastructure Market Disruption. Tech leaders will keep an eye out for advancements and disruptions in the market (likely to originate from the semiconductor sector). The disruptions might require tech vendors to re-assess the infrastructure partner ecosystem.

Need for New Tech Skills. Tech leaders will evaluate Generative AI’s impact on AIOps and IT Architecture; invest in upskilling for talent retention. Tech providers must prioritise creating user-friendly experiences to make technology accessible to business users. Training and partner enablement will also need a higher focus.

Increased Focus on Governance. Tech leaders will consult tech vendors on how to implement safeguards for data usage, sharing, and cybersecurity. This opens up opportunities in offering governance-related services.

5 Key Considerations for Tech Vendors

#1 Get Ready for the Year of the AI Startup

While many AI companies have been around for years, this will be the year that many of them make a significant play into enterprises in Asia Pacific. This comes at a time when many organisations are attempting to reduce tech debt and simplify their tech architecture.

For these AI startups to succeed, they will need to create watertight business cases, and do a lot of the hard work in pre-integrating their solutions with the larger platforms to reduce the time to value and simplify the systems integration work.

To respond to these emerging threats, existing tech providers will need to not only accelerate their own use of AI in their platforms, but also ramp up the education and promotion of these capabilities.

#2 Lead With Data, Not AI Capabilities

Organisations recognise the need for AI to enhance their workforce, improve customer experience, and automate processes. However, the initial challenge lies in improving data quality, as trust in early AI models hinges on high-quality training data for long-term success.

Tech vendors that can help with data source discovery, metadata analysis, and seamless data pipeline creation will emerge as trusted AI partners. Transformation tools that automate deduplication and quality assurance tasks empower data scientists to focus on high-value work. Automation models like Segment Anything enhance unstructured data labeling, particularly for images. Finally synthetic data will gain importance as quality sources become scarce.

Tech vendors will be tempted to capitalise on the Generative AI hype but for sake of positive early experiences, they should begin with data quality.

#3 Prepare Thoroughly for AI-driven Business Demand

Besides pureplay AI opportunities, AI will drive a renewed and increased interest in data and data management. Tech and service providers can capitalise on this by understanding the larger picture around their clients’ data maturity and governance. Initial conversations around AI can be door openers to bigger, transformational engagements.

Tech vendors should avoid the pitfall of downplaying AI risks. Instead, they should make all efforts to own and drive the conversation with their clients. They need to be forthcoming about their in-house responsible AI guidelines and understand what is happening in AI legislation world-wide (hint: a lot!)

Tech providers must establish strong client partnerships for AI initiatives to succeed. They must address risk and benefit equally to reap the benefits of larger AI-driven transformation engagements.

#4 Converge Network & Security Capabilities

Networking and security vendors will need to develop converged offerings as these two technologies increasingly overlap in the hybrid working era. Organisations are now entering a new phase of maturity as they evolve their remote working policies and invest in tools to regain control. They will require simplified management, increased visibility, and to provide a consistent user experience, wherever employees are located.

There has already been a widespread adoption of SD-WAN and now organisations are starting to explore next generation SSE technologies. Procuring these capabilities from a single provider will help to remove complexity from networks as the number of endpoints continue to grow.

Tech providers should take a land and expand approach, getting a foothold with SASE modules that offer rapid ROI. They should focus on SWG and ZTNA deals with an eye to expanding in CASB and FWaaS, as customers gain experience.

#5 Double Down on Your Partner Ecosystem

The IT services market, particularly in Asia Pacific, is poised for significant growth. Factors, including the imperative to cut IT operational costs, the growing complexity of cloud migrations and transformations, change management for Generative AI capabilities, and rising security and data governance needs, will drive increased spending on IT services.

Tech services providers – consultants, SIs, managed services providers, and VARs – will help drive organisations’ tech spend and strategy. This is a good time to review partners, evaluating whether they can take the business forward, or whether there is a need to expand or change the partner mix.

Partner reviews should start with an evaluation of processes and incentives to ensure they foster desired behaviour from customers and partners. Tech vendors should develop a 21st century partner program to improve chances of success.

The process of developing advertising campaigns is evolving with the increasing use of artificial intelligence (AI). Advertisers want to optimise the amount of data at their disposal to craft better campaigns and drive more impact. Since early 2020, there has been a real push to integrate AI to help measure the effectiveness of campaigns and where to allocate ad spend. This now goes beyond media targeting and includes planning, analytics and creative. AI can assist in pattern matching, tailoring messages through AI-enabled hyper-personalisation, and analysing traffic to communicate through pattern identification of best times and means of communication. AI is being used to create ad copy; and social media and online advertising platforms are starting to roll out tools that help advertisers create better ads.

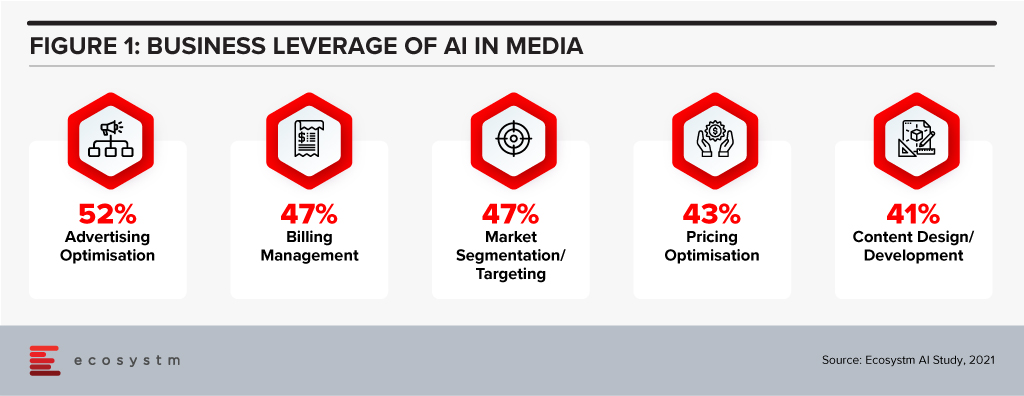

Ecosystm research shows that Media companies report optimisation, targeting and administrative functions such as billing are aided by AI use (Figure 1). However, the trend of Media companies leveraging AI for content design and media analysis is growing.

WPP Strengthening Tech Capabilities

This week, WPP announced the acquisition of Satalia, a UK-based company, who will consult with all WPP agencies globally to promote AI capabilities across the company and help shape the company’s AI strategy, including research and development, AI ethics, partnerships, talent and products.

It was announced that Satalia, whose clients include BT, DFS, DS Smith, PwC, Gigaclear, Tesco and Unilever, will join Wunderman Thompson Commerce to work on the technology division of their global eCommerce consultancy. Prior to the acquisition, Satalia had launched tools such as Satalia Workforce to automate work assignments; and Satalia Delivery, for automated delivery routes and schedules. The tools have been adopted by companies including PwC, DFS, Selecta and Australian supermarket chain Woolworths.

Like other global advertising organisations, WPP has been focused on expanding the experience, commerce and technology parts of the business, most recently acquiring Brazilian software engineering company DTI Digital in February. WPP also launched their own global data consultancy, Choreograph, in April. Choreograph is WPP’s newly formed global data products and technology company focused on helping brands activate new customer experiences by turning data into intelligence. This article from last year from the WPP CTO is an interesting read on their technology strategy, especially their move to cloud to enable their strategy.

Ethics & AI – The Right Focus

The acquisition of Satalia will give WPP and opportunity to evaluate important areas such as AI ethics, partnerships and talent which will be significantly important in the medium term. AI ethics in advertising is also a longer-term discussion. With AI and machine learning, the system learns patterns that help steer targeting towards audiences that are more likely to convert and identify the best places to get your message in front of these buyers. If done responsibly it should provide consumers with the ability to learn about and purchase relevant products and services. However, as we have recently discussed, AI has two main forms of bias – underrepresented data and developer bias – that also needs to be looked into.

Summary

The role of AI in the orchestration of the advertising process is developing rapidly. Media firms are adopting cloud platforms, making IP investments, and developing partnerships to build the support they can offer with their advertising services. The use of AI in advertising will help mature and season the process to be even more tailored to customer preferences.