Contact centres were already on a path to modernisation – which got accelerated by the COVID-19 crisis. The need for omnichannel delivery and better insights from customer data has forced contact centres to adopt cloud solutions. Ecosystm Principal Advisor Audrey William says, “There is still a disconnect between integrating and synchronising customer data between Sales, Marketing and Customer Teams. However, the market is starting to see contact centre vendors work closer with vendors in customer experience management segment.”

Genesys and Adobe are collaborating on integrating Genesys cloud and the Adobe Experience Platform. The deeper integration of both platforms is aimed to give organisations a better omnichannel presence. The platform is live for users and Genesys and Adobe will introduce other features and capabilities throughout 2020. Genesys is already a partner of Adobe’s Exchange Program designed for technology partners to supplement Exchange Marketplace with extensions and applications for Adobe Creative Cloud users.

Augmenting the CX journey through Data Synchronization

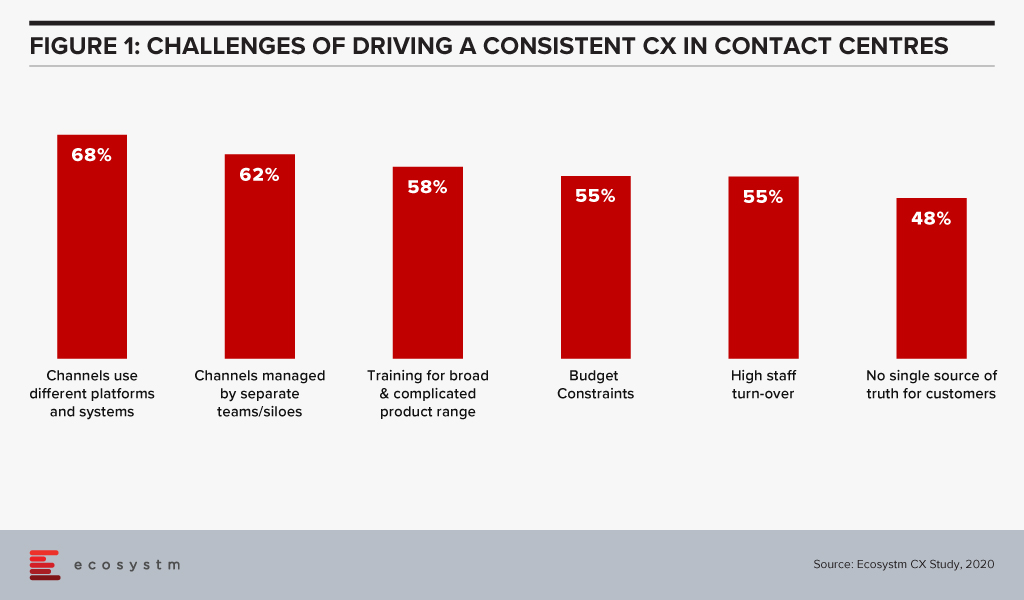

Ecosystm data finds that 62% of contact centres have driving omnichannel experience as a key customer experience (CX) priority and 57% want to analyse data across multiple data repositories. However, when asked about the challenges of driving consistent CX, data access and integration appears to be a barrier in achieving their priorities. These challenges are the reason why getting a “true view” of the customer data has been an arduous task and achieving consistent CX continues to be a struggle.

William says. “The customer data collected by a particular service or department does not always move along in real-time with the customer interactions across different touchpoints. This complicates maintaining a real-time customer profile and impacts the CX.”

“Sales and Marketing have different KPIs and tend to view customer data from different angles. The data from in-store, Marketing and Sales interactions sits within departmental silos. They may deal with the same customers and not follow them through their entire journey. This leads to missed opportunities in reaching out to them at the right time with the right products to upsell, resell or provide better CX. Data synchronisation across channels, would solve that problem.”

Integrating Genesys and Adobe Experience Platform will give organisations the capability to provide contact centre agents with real-time customer data and profiles from a single point to provide an personalised experience. The platform is powered by Genesys Predictive Engagement that uses AI to provide more intelligence based on past interactions to drive effective, data-driven conversations. In addition to this, the partnership also enables businesses and marketing departments to customise campaigns and extend their digital and voice capabilities for optimal conversions. William says, “The ability to use AI to understand customer intent, behaviour and patterns is critical as it will allow brands to re-look at how to design the customer journey. When you keep using the same and outdated profile, it will be hard to have discussions around intent, customer interest and assess how customer priorities have changed. Accurate and automate data profiling will lead to more targeted and accurate marketing campaigns.”

Genesys Deepening Industry Partnerships

Genesys is re-shaping its strategy on Contact Centre as a Service (CCaaS) offerings through partnerships and working on its vision of providing Experience as a Service to its global clients. The need for CCaaS has been accelerated by the pandemic. Last month Genesys signed a five year deal with Infosys to develop and deploy cloud CX and contact centre solutions.

Earlier this year, Genesys partnered with MAXIMUS, a US Government services provider to set up the MAXIMUS Genesys Engagement Platform, an integrated, cloud-based omnichannel contact centre solution driven by the government requirement for public sector organisations to provide seamless customer experiences similar to those offered in the private sector.

The company has also partnered with various other industry leaders like Microsoft, Google Cloud, and Zoom to roll out cloud-based innovations to benefit customers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

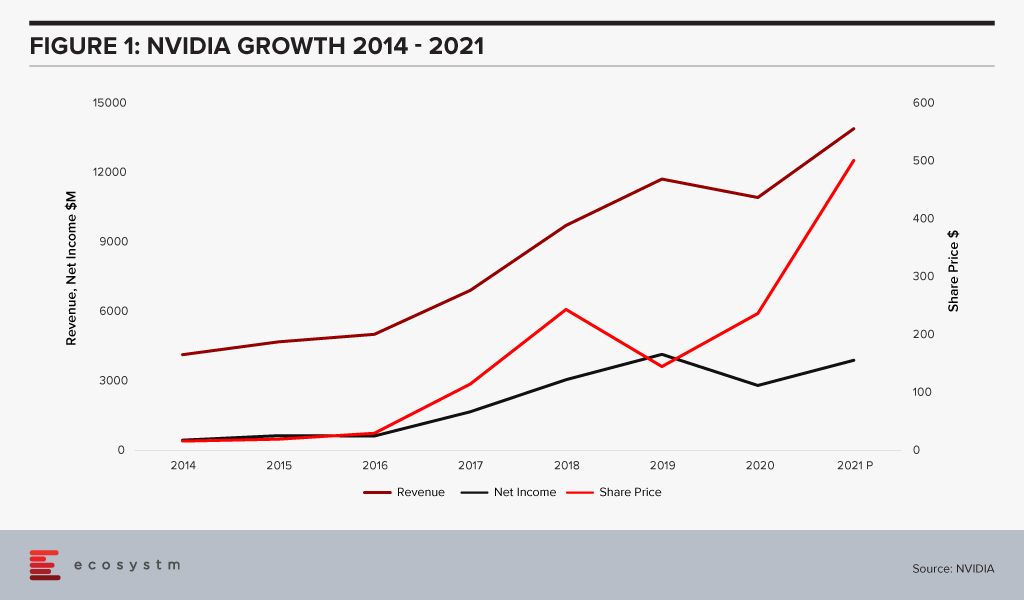

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

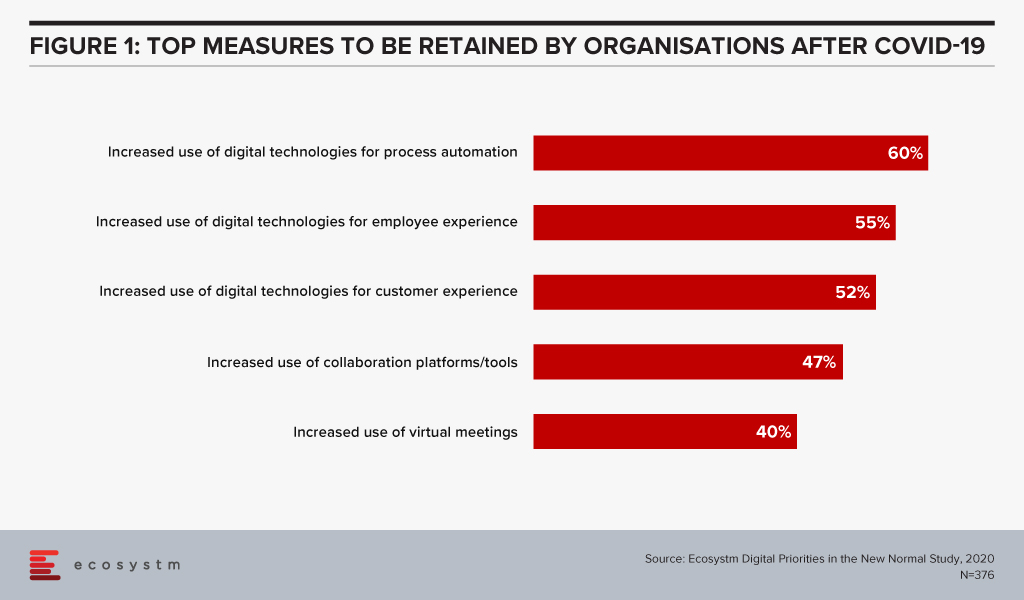

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.

Organisations are on a fast track to digitalisation. The Ecosystm Digital Priorities in the New Normal study finds that 60% of organisations anticipate increased use of digital technologies for process automation, even after the COVID-19 restrictions are lifted. One of the key challenges that these organisations will face is the lack of internal digital skills – especially in emerging technologies. One of the success metrics of any technology adoption is employee uptake. Without the necessary skills or understanding of the benefits of emerging technology, employees will largely shy away from digital offerings, even the ones that will make their work more efficient and their lives easier.

Organisations are realising the value of making their workforce future ready.

DBS Instilling Company-Wide Digital Culture

Far-sighted companies are collaborating with technology vendors and professional training providers to promote tech awareness and education to futureproof their workforce. DBS Bank in Singapore has collaborated with AWS to train and upskill 3,000 employees – including the leadership team – with AI and machine learning skills through gamification in a DBS x AWS DeepRacer League.

The AWS DeepRacer Leagues have been previously organised in several parts of the world, but the DBS x AWS DeepRacer will be the first to be organised at this scale. The league will enable DBS employees to get their hands-on AI and machine learning tutorials online. They will then have the opportunity to test out their new skills in programming a 3D racing simulator and iteratively fine-tune their models and compete with each other. The learning program is entirely cloud-based and aims to ingrain digital skills in the workforce.

DBS has won several accolades for their digital transformation and innovation initiatives, and they continue to experiment with emerging technologies. In 2019, DBS digitalised and simplified end-to-end credit processing, setting the foundation for advanced credit risk management using data analytics and machine learning. They have also deployed an AI-powered engine for self-service digital options to its retail banking customers. Taking their employees along with them on this journey is a wise move.

Ecosystm Principal Advisor, Ravi Bhogaraju says, “With the increasing use of automation, AI and machine learning, the nature of work and businesses is transforming rapidly. This is creating opportunities for processes to be automated and increasing the use of AI and Deep Learning into the business processes of the organisation. Industry value chains are transforming – AI and machine learning is adding automation, analytics and predictive intelligence to the portfolio. The recent news of DBS and AWS partnering to upskill the bank’s workforce underscores the value of creating a future ready workforce.”

“Such upskilling efforts add industry-specific context to make them more effective. BCG refers to this as ‘Human + AI’. A recent study from BCG and MIT shows that 18% of companies in the world that are pioneering AI are making money with it. Those companies focus 80% of their AI initiatives on effectiveness and growth, taking better decisions – not replacing humans with AI to save costs.”

Government Focus on Digital Skills Upgrade

This week, Singapore also saw another initiative to bridge digital skills gaps – this time from the public sector. In 2018, the Government launched its Smart Nation Scholarship program to attract and nurture talent, and later involve them in various departments to drive Singapore’s Smart Nation initiatives. The most recent Smart Nation Scholarship program 2020 attracted 723 applicants (17% more than the previous year). This is a slightly different approach, aimed at attracting digital native employees and mentoring them for digital leadership. After completing their studies, the 15 scholarship recipients are set to join public sector agencies such as Cyber Security Agency of Singapore (CSA), Government Technology Agency (GovTech), and Infocomm Media Development Authority (IMDA), to give the younger generation an opportunity to co-create the country’s Smart Nation vision.

Bhagaraju says, “Both private and government institutions are working to enhance workforce skills, improve marketability and making the workforce future ready. Industry 4.0 and the digital revolution have created the need to address the skill gaps that have arisen. Government programs such as the Skills Future program in Singapore, Malaysia’s HRD upskilling program, and the EU-28 European Digital initiative are all making a sustained effort to promote lifelong learning and acquisition/upgrading of skills for their respective citizens with quite successful results, that will have long-term impacts.”

As the search for a COVID-19 vaccine intensifies, there is a global focus on the Life Sciences industry. The industry has been hit hard this year – having to deliver overtime through a disrupted supply chain, unexpected demand spikes, and reduction of revenues from their regular streams. Life sciences organisations are already challenged by the breadth of their focus – across R&D and clinical discovery; Manufacturing & Distribution; and Sales & Marketing. Increasingly, many pharmaceutical and medtech organisations choose to outsource some of these functions, which brings to fore the need for a robust compliance framework. In the Ecosystm Digital Priorities in the New Normal Study, two-thirds of life sciences organisations mention that they have either been forced to start, accelerate or refocus their Digital Transformation initiatives – the remaining one-third have put their Digital Transformation on hold. The industry is clearly at an inflection point.

Challenges of the Life Sciences Industry

Continued Focus on R&D. Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and a global concern over rising healthcare expenditure. Apart from regulatory challenges, they also face immense competition from local manufacturers as they enter each new market.

Re-thinking their Distribution Strategy. Sales and distribution for many pharma and medtech organisations have been traditional – using agents, distributors, clinicians, and healthcare providers. But now they need to change their go-to-market strategies, target patients and consumers directly and package their product offerings into value-added services. This will require them to incorporate customer experience enhancers in their R&D, going beyond drug discovery and product innovation.

Tracking Global Regulations. Governments across the world are trying to manage their healthcare budgets. They are also more focused on chronic disease management. The focus has shifted to value-based medicine in general, but pharma and medtech products are being increasingly held accountable by health outcomes. Governments are increasingly implementing drug reforms around what clinicians can prescribe. Global Life Sciences organisations have to constantly monitor the regulations in the multiple countries where they operate and sell. They are also accountable for their entire supply chain, especially ensuring a high product quality and fraud prevention.

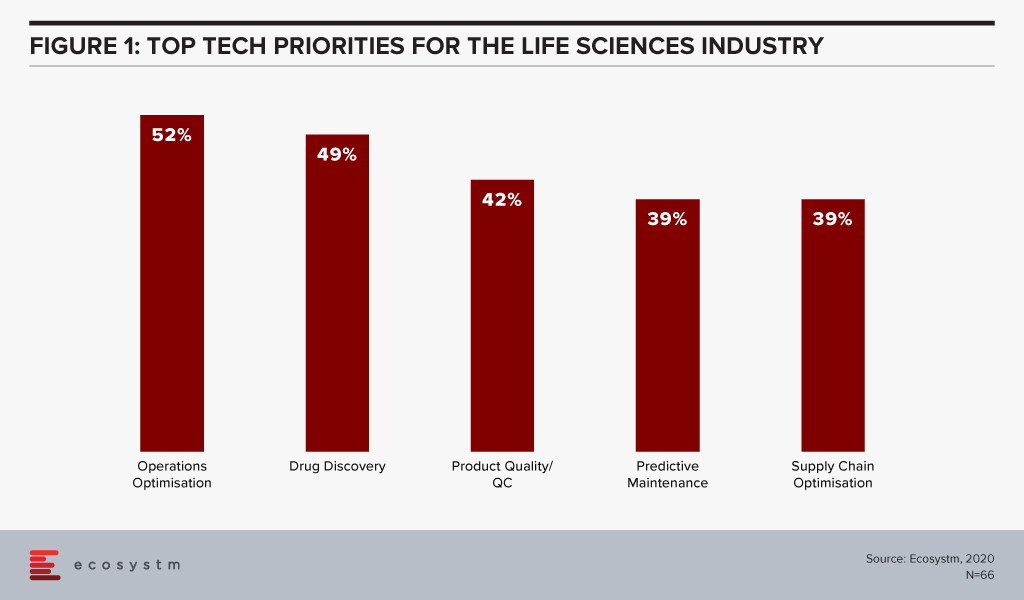

The global Ecosystm AI study reveals the top priorities for Life Sciences organisations, focused on adopting emerging technologies (Figure 1). They appear to be investing in emerging technology especially in their R&D and clinical discovery and Manufacturing functions.

Technology as an Enabler of Life Sciences Transformation

Discovery and Development

With the evolution of technology, Life Sciences organisations are able to automate much of the mundane tasks around drug discovery and apply AI and machine learning to transform their drug discovery and development process. They are increasingly leveraging their ecosystem of smaller pharma and medtech companies, research laboratories, academic institutions, and technology providers to make the process more time and cost efficient.

Using an AI algorithm, the researchers at the Massachusetts Institute of Technology have discovered an antibiotic compound that can kill many species of antibiotic-resistant bacteria. MIT’s algorithm screens millions of chemical compounds and chooses the antibiotics which have the potential to eliminate bacteria resistant to existing drugs. Harvard’s Wyss Institute for Biologically Inspired Engineering is manufacturing 3D printed organ-on-a-chip to give insights on cell, tissue, and organ biology to help the pharma sector with drug development, disease modelling and finally in the development of personalised medicine.

Life Sciences are also engaging more with technology partners – whether emerging start-ups or established players. Pfizer and Saama are working together on AI clinical data mining. The companies are developing and deploying an AI-based analytical tool where Pfizer provides clinical data and domain knowledge to train models on the Saama Life Science Analytics Cloud (LSAC). Saama was identified as a partner at a hackathon. Sanofi and Google have established a new virtual Innovation Lab to develop scientific and commercial solutions, using multiple Google capabilities from cloud computing to AI.

Tech providers also keep evolving their capabilities in the Life Sciences industry for more efficient drug discovery and better treatment protocols. Microsoft’s Project Hanover uses machine learning to develop a personalised drug protocol to manage acute myeloid leukaemia. Similarly, Apple’s ResearchKit – an open-source framework is meant to help researchers and developers create iOS-based applications in the field of medical research.

Manufacturing and Logistics

The industry also faces the challenges faced by any Manufacturing organisation and has the need to deploy manufacturing analytics, and advanced supply chain technology for better process and optimisation and agility. There is also the need for complete visibility over their supply chain and inventory for traceability, safety, and fraud prevention. Emerging technologies such as Blockchain will become increasingly relevant for real-time track and trace capability.

The MediLedger Network was established as an open network to the entire pharma supply chain. The project brings a consortium of some of the world’s largest pharmaceutical companies, and logistics providers to improve drug supply chain management.

Since the data on the distributed ledger is encrypted, it creates a secure system without any vulnerabilities. This eliminates counterfeit products and ultimately ensures the quality of the pharma products and promotes increased patient safety. To foster security and improve the supply chain, the United States Food and Drug Administration (USFDA) successfully completed a pilot with a group including IBM, KPMG, Merck and Walmart to support U.S. Drug Supply Chain Security Act (DSCSA) to trace vaccines and prescription medicines throughout the country.

Diagnostics and Personalised Healthcare

As more devices (consumer and enterprise) and applications enter the market, people will take ownership and interest in their own health outcomes. This is seeing a continued growth in online communities and comparison sites (on physicians, hospitals, and pharmaceutical products). Increasingly, insurance providers will use data from wearable devices for a more personalised approach; promoting and rewarding good health practices.

Beyond the use of wearables and health and wellness apps, we will also see an exponential increase of home-based healthcare products and services – whether for primary care and chronic disease management, or long-term and palliative care. As patients become more engaged with their care, the life sciences industry is beginning to serve them through personalised approach, medicines, right diagnosis and through advanced medical devices and products.

An online tool developed by the University of Virginia Health Systems helps identify patients that have a high risk of getting a stroke and helps them reduce that risk. This tool calculates the patient’s probability of suffering a stroke by measuring the severity of their metabolic syndrome – taking into account a number of conditions that include high blood pressure, abnormal cholesterol levels and excess body fat. Life Sciences organisations are increasingly having to invest in customer-focused solutions such as these.

Wearables with special smart software to monitor health parameters, gauge drug compatibility and monitor complications are being implemented by Life Sciences organisations. The US FDA approved a pill called Abilify MyCite fitted with a tiny ingestible sensor that communicates with a patch worn by the patient to transmit data on a smartphone. Medtech companies continue to develop FDA approved health devices that can monitor chronic conditions. Smart continuous glucose monitoring (CGM) and insulin pens send blood glucose level data to smartphone applications allowing the wearer to easily check their information and detect trends.

Technologies such as AR/VR are also enabling Life Sciences companies with their diagnostics. Regeneron Pharmaceuticals has created an AR/VR app called “In My Eyes” to better diagnose vision impairment in patients.

What is interesting about these personalised products is that not only do they improve clinical outcomes, they also give Life Sciences companies access to rich data that can be used for further product development and improvement.

The Life Sciences industry will continue to operate in an unpredictable and competitive market. This is evident by the several mergers and acquisitions that we witness in the industry. As they continue to use cutting-edge technology for their R&D practices, they will leverage technology to transform other functions as well.

One of my Twitter followers who is stressing about her kids going back to school this Fall was wondering if hotels could start offering elearning assistance as part of the re-purposing of their facilities.

Is this part of a digital hotel of the future? This digital hotel is a facility that is welcoming, hospitable, warm and can be used as a multi-functional space. Traditional revenue generation is measured in revenue from room nights, but given that instability in current demand, the facility can be re-purposed to highlight its network-enabled footprint. This is where global design strategies that leverage technology come into play, with a focus on integrative design for use. Digital classrooms, art exhibitions, alternatives to working from home – many things are possible.

With travel restrictions and hygiene and health concerns, hotels and tourism locations globally are having to pivot to a different way of doing business this year. Agility is critical, and how we measure agility and employ agility differentiate us.

I will explore the alternative view on recovery looking at the impact of COVID-19 on organisations in the hospitality industry and how they are pivoting digital priorities to adapt to the New Normal.

This post will focus on two aspects of the use of digital technology – more innovative ways to view industry recovery, and re-imaging the use of the physical asset from its traditional uses to more creative, digitally enabled functions.

Moving Towards A Different View of Recovery

Since Online Travel Agents (OTA) entered the scene, the hotel industry became obsessed with simple adjustments of rates. Revenue managers focus on analysing, forecasting, and optimising hotel inventory through availability restrictions and dynamic rates. This has become key in measuring a hotel’s demand.

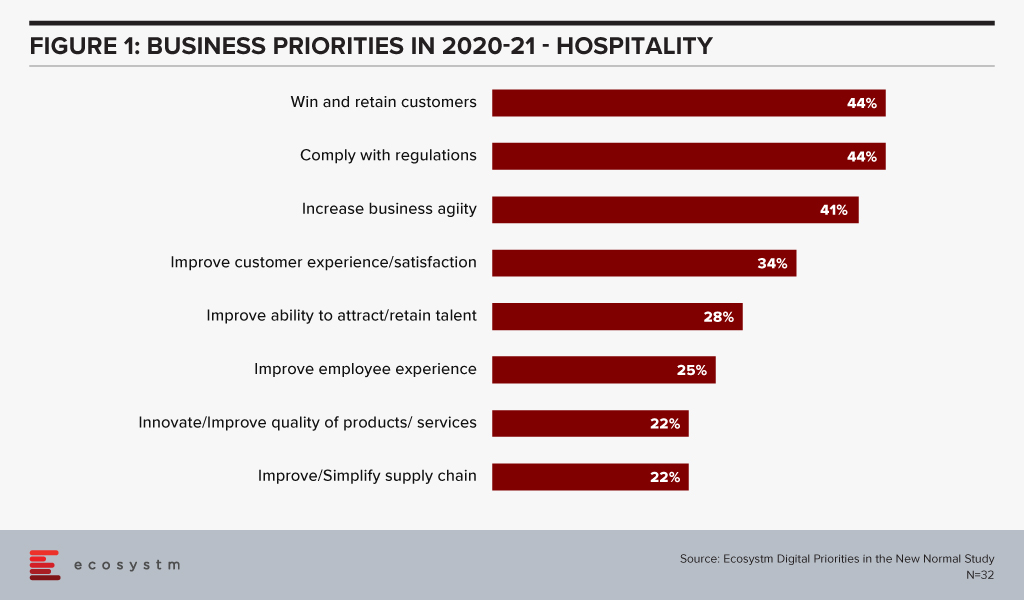

RevPAR, or revenue per available room, is one of the traditional and still the most instilled metrics in the industry. But given demand issues with the pandemic, is revenue forecasting per room the best way to examine hotel recovery? A traditional view on revenue fails when hotel closures and uncertainty on opening impact the ability to forecast and to determine capacity. As seen in Figure 1, both winning customers and increasing agility are paramount to recovery.

When a destination becomes inaccessible to the traditional clientele, your actual location becomes relevant to a different set of customers. This is for different reasons – so hotels must find different ways to leverage the resources and assets of the business.

One way of looking at this is by re-imaging the use of the physical assets and a suggested approach is looking towards profit planning and management with ProfPASF or Profit per Available Square Feet. We look at hotel construction costs this way, so it stands to reason that utilisation of the asset might also be examined from a cost benefit perspective.

Impact on Digital Transformation

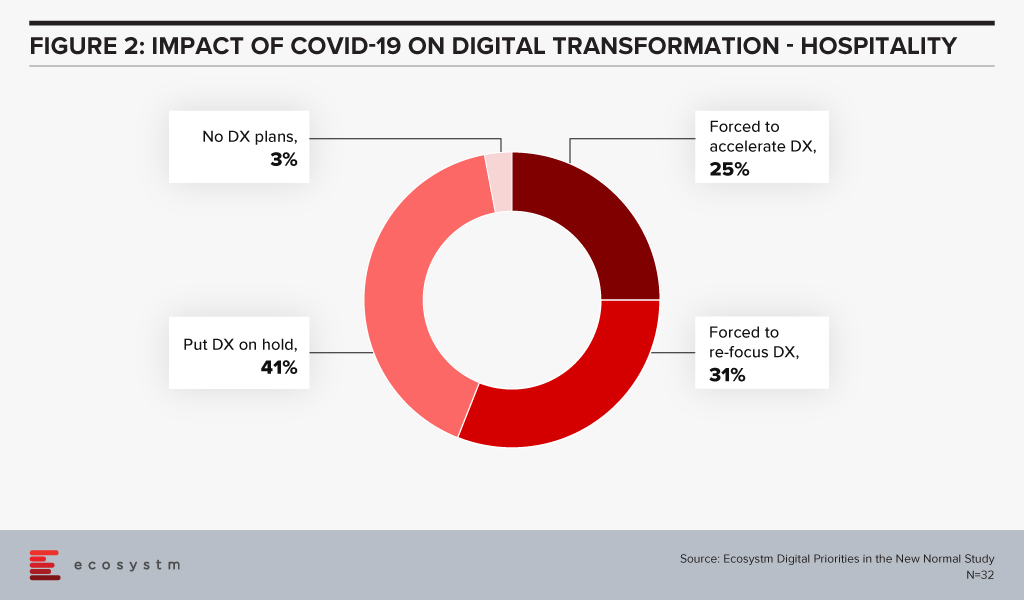

Where does technology play a role in re-imaging Hospitality? As an enabler, a facilitator, a business model supporter? How does the process of Hospitality need to change, and how can technology help? As seen in Figure 2, hotels have had to accelerate and modify their plans.

The structural assets of the business must either be repurposed or repackaged to take travel restrictions and hygiene and safety concerns into account.

There are several good examples of hotels who have had the ability financially to rethink and restructure the footprint to address issues that have come from the pandemic. The ones that already planned renovations prior to the crisis have added hygiene aspects such as improved ventilation and less porous floors and fabrics in the selection of materials used. And adding better spatial design to public spaces has allowed them to reinforce the concept of luxury. Documented renovation can be seen in innovative design work by Onyx Hospitality Group, Blink Design Group, independent brand View Hotels and Banyan Tree Holdings.

But this does not mean the hotel or destination must make the investment alone, or even all on-site. Using systems integrators and cloud resources to create digital enabled platforms for guest management, hygiene process management and physical mapping of the capacity of the facility using sensors and mobile are all methods for enabling the digital acceleration of tech investment in the property.

And personalisation of the experience is key, which leads to a discussion of personal data usage and management.

Social Distancing and the Hotel of the New Normal

Retailers, hoteliers and convention centres have the same thing in common, they are all physical locations trying to become safe yet contactless, socially distant yet memorable at the same time. As we have mentioned in previous reports, the comfort, safety and hygiene of the customer is paramount for their return to Hospitality. Using customer location data on a reliable online platform to track their movement, enable their facilities and services and limit the density of customers per square metre for health, safety and comfort are all aspects of tech-enabled social distancing.

Imagine that you are considering a day stay, for home working alternative or for having a local event. This needs to be within the sanctioned numbers of your locale. Guests want to know the population density of the location to determine their comfort level. Having a mobile app where potential visitors can see the state of the visitor density of the hotel would provide reassurance as to a safe visit.

Rich Contactless Content

With the encouragement of expanding the scope of technology and social distancing given priority, automated or contactless transaction technologies have seen an increase in implementation in the last six months. Having sensors and IoT technology implemented to see the footprint of the facility in use provides real-time insight for both the customer and the hotel, as to usage.

In order to be able to highlight the functions of both the room and the facility, augmented reality (AR) can demonstrate the use of interactive elements within hotel rooms without human contact.

AR applications within the hotel sector include offering in-house interactive elements (such as location maps and relevant points of interest). These provide digital history of the property and supply guests with relevant information when they are located within certain areas of the hotel (such as a menu if they happen to enter a restaurant).

Use of Space: Location & Hygiene for a Better Experience and as a Precaution

Hotel environments have evolved to add a healthcare layer, including well-being programs, and individual room controls. This includes materiality/ sanitised covering that protects against the spread of infection with clearly defined and explained roll-out cleaning protocols.

Accor has launched the Cleanliness & Prevention ALLSAFE label, and other brands like Hilton, Hyatt and IHG have tried to brand hygiene into the experience. But the challenge for many is how to restructure and re-image space utilisation to make it both pleasurable and secure.

Data for Purpose

With contact tracing in the news, many of us are already aware of the digital footprints we leave everywhere we go. And people have a wide variety of personal responses to this.

So how does a hotel use the information a guest either willingly offers or the hotel learns via services provided? If the hotel knows preferences prior to arrival, should they customise the room accordingly? Lighting, scent, preferred pillow choice, allergies – all are useful information. But what if preferences change or implementations are seen to be presumptuous?

Hilton is continually updating its guest technology offerings, from increasing in-app functionality to making further improvements to the entertainment system. One of their ideas is allowing guests to load personal or family pictures. These display on the TV, giving their hotel room more of a familiar sense of home.

And to be both keyless and cashless means the hotel needs to be mobile data enabled. All of this data, including mobile data, should flow like fine wine. But to do that requires knowledge, and learning – gained from experience and AI. How can I check your preferences are still the same? How should I use information I collected on you from a previous stay? Is that data kept on your mobile device, or on my hotel server? Is this in the cloud or on-premise in some manner?

Using Data and Intelligence for Personalised Experiences

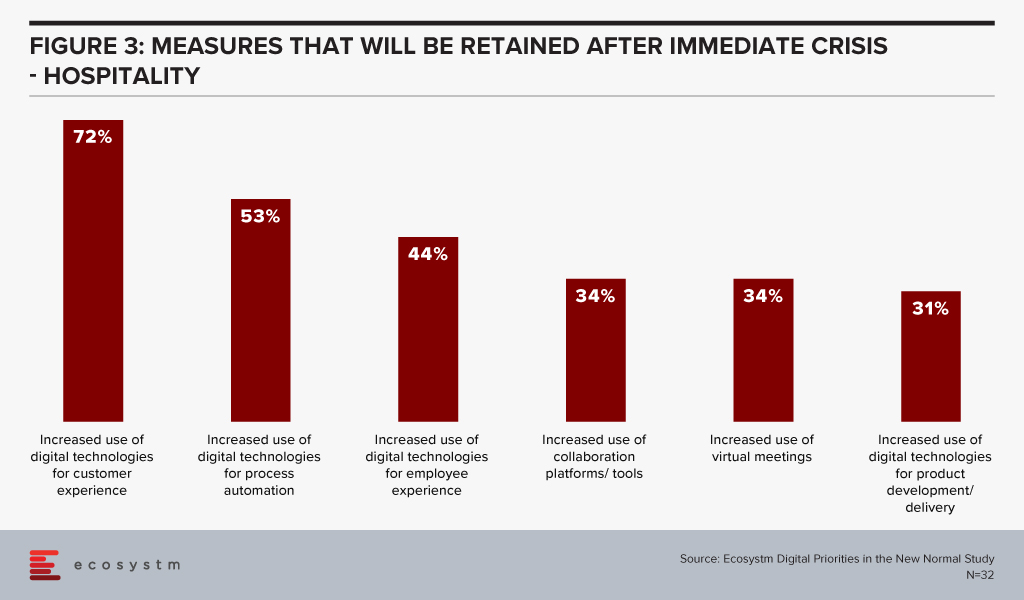

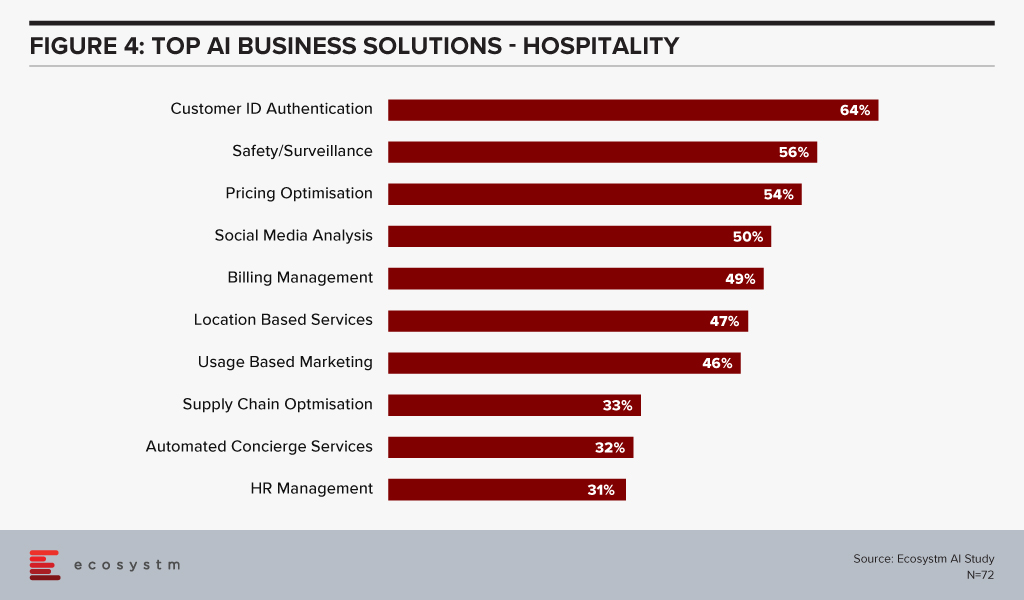

The final point shown in Figure 3 from the Ecosystm Digital Priorities in the New Normal study on technology direction from the pandemic, combined with Figure 4 from the Ecosystm AI Study showing the use of AI, highlights the need for technologies that support customer experiences and automate processes. Whether it is customer authentication at check-in, virtual customer assistance or rate pricing for appropriate engagement, technology can enable guest appreciation.

Summary – Three Post-Pandemic Takeaways

1. Demand for rooms will have to be viewed differently during this period, and cancellation policies already reflect this. To view recovery, use metrics that look at how the whole asset is being used on a physical basis.

2. Re-imagination of the physical asset will involve some agility and re-purposing within the business. Technology can help enable this, with some wise additions to add value. Voice, IoT and contactless mobile apps all are good candidates for enablement.

3. Data helps with understanding of guest preferences and can be used for staff learning and knowledge. But it must be held and used correctly. Listen carefully to what the guest is telling you and respond accordingly.

The National Australia Bank (NAB) and Microsoft announced a strategic partnership last week, to develop and architect a multicloud environment to be used by both NAB and its New Zealand counterpart, Bank of New Zealand (BNZ).

The five-year partnership will involve Microsoft and NAB sharing development costs and investments to migrate around 1,000 out of 2,600 applications from the NAB and BNZ stacks, on Microsoft Azure. By 2023, NAB aims to run 80% of its application on the cloud, build a robust cloud foundation, and enable customers to access applications and services on the cloud.

The partnership aims to support NAB’s commitment to continuous improvement and innovation, leveraging the Microsoft global engineering team. It also involves setting up of the NAB Cloud Guild program, where Microsoft will train 5,000 NAB and BNZ technologists to equip them on cloud and allied technology skills.

NAB and Microsoft have previously collaborated to improve the experience for NAB customers, through cloud-based applications. NAB’s cloud-based AI powered ATM was the result of a proof-of-concept (PoC) developed on Microsoft Azure’s cognitive services, in 2018. It involved general ATM security captures along with facial biometrics to enable customers to withdraw cash without a card or a phone.

Besides the partnership with Microsoft, NAB also uses Google Cloud for multicloud workloads as well as AWS for its AI competencies and resources across platforms. In February, NAB launched an AI-based voice service to boost the bank’s contact centre experience along with AWS.

Ecosystm Comments

Ecosystm Principal Advisor, Tim Sheedy says, “If ever there was a sign that multicloud is the predominant approach for businesses, this is it. NAB is a big AWS client – in Australia and New Zealand. They lead the way for businesses in training thousands of employees on AWS technologies through their Cloud Guild. But now Azure is also developing a strong foothold in NAB – the public cloud services market is not a one-horse race!”

“Many businesses that have standardised on – or preferred – a single cloud vendor will find that they will likely use multiple cloud environments, in the future. The key to enabling this will be the adoption of modern development environments and architectures. Containers, microservices, open-source, DevOps and other technologies and capabilities will help them run their applications, data and processes across the best cloud for them at the time – not just the one that they have used in the past.”

Sheedy thinks, “NAB’s competitive advantage will not come from whether they are using AWS or Azure – it will come from the significant time and effort they are investing in giving their employees the skills they need to take advantage of these environments to drive change at pace. Too many businesses are increasing their cloud usage without making the necessary investments to upskill their employees – if you know you are planning to spend more on the cloud, then start now in reskilling and upskilling your staff. There is already a real shortage of cloud skills and it is only going to get worse.”

Gain access to more insights from the Ecosystm Cloud Study

This week saw SAS and Microsoft announce a strategic partnership both in their technology offerings and go-to-market strategy. SAS analytical products and industry solutions will be migrated onto Microsoft Azure as the preferred cloud provider for the SAS Cloud. Microsoft hopes to leverage SAS’ industry expertise, especially in healthcare and financial services. This partnership builds on SAS integrations across Microsoft cloud solutions for Azure, Dynamics 365, Microsoft 365 and Power Platform.

Here is what our Analysts say:

“To date, the focus of cloud computing has been around providing customers with levels of agility, speed, and scalability that cannot be provided by on-premises solutions. Customers have benefitted from this cloud functionality by being able to provision new services rapidly, pivot swiftly when they need to change their business models and build resilience and flexibility into the ways in which they do business. Today, customers are asking for more. Microsoft has responded to this demand by forming or enhancing cloud partnerships with leading cloud vendors including Salesforce, SAP, Oracle, Workday, ServiceNow and Adobe, as part of an overall strategy to make it easier for customers to choose Azure as their key enterprise foundation, and to offer more functionality.

Across industries, from healthcare to financial services, businesses finally realise the potential value of data. They recognise that the most competitive businesses are those that fully leverage the data that they can access. Businesses want cloud services to offer AI and machine learning capabilities. They want to use these capabilities to become more innovative and more competitive. To do this, these cloud services need to be integrated more tightly with capabilities which Microsoft does not have.

SAS is the leader in data analytics and AI software for enterprises, so it makes perfect sense for Microsoft to partner with the company. Integrating SAS models with Microsoft’s cloud estate, in particular Azure will enable Microsoft to offer its customers more than the typical benefits of cloud services. They can offer their customers intelligent cloud services.

SAS can offer its customers a more comprehensive solution by integrating its AI and machine learning capabilities into the Microsoft cloud estate. SAS and Microsoft will combine their engineering resources to ensure that SAS’ analytics products work well on Azure. A key priority is building an Azure-optimised version of Viya, the cloud version of SAS’ core analytics toolkit. SAS will also look at ways in which it can integrate its software with the native analytics services provided in Azure.

Importantly, companies will create joint solutions across multiple verticals. An example of a joint solution is SAS’ IoT analytics and the Azure IoT platform being used to increase situational awareness of rising stream levels, to predict where flooding might occur, thus improving emergency response.

SAS software will continue to be cloud-agnostic. But, SAS itself will migrate its internal operation and its global cloud business to Azure. The expanded partnership with Microsoft does not impact SAS customers who run on AWS or GCP. But, Azure customers can expect to see benefits over time as SAS and Microsoft work closely on joint solutions.”

“The SAS and Microsoft relationship goes well beyond ‘Azure is our cloud hosting platform of choice’. It brings together Microsoft’s leading suite of AI tools and cloud infrastructure and platform capabilities and the leading analytics and intelligent applications provider. Through the combined toolset, every-day applications have the opportunity to become even more intelligent – and the industry-specific intelligent business processes that SAS is known for will be able to be hosted on the cloud, and more deeply integrated into existing solutions and PaaS services. The ability to embed SAS workloads into containers means that a broader user set can access and learn from the analytics that they provide – and automate an even greater number of business and customer processes using the AI and Analytics toolsets from both providers.

It also simplifies the management of SAS software and gives a clear and easy path to the public cloud for SAS customers who have not yet made that transition.

The partnership has the opportunity to further accelerate Microsoft’s transition towards even smarter applications. Microsoft has already been recognised in the market as having one of the better AI capabilities – mostly because of embedding intelligence into existing applications and processes. But Microsoft was never going to be able to provide the intelligence for every process in every industry. This partnership will accelerate Microsoft towards the automation of more processes that are used by customers across the spectrum of sectors and industries – and it obviously extends SAS’ reach beyond their traditional customer base.”

In his blog, The Cybercrime Pandemic, Ecosystm Principal Advisor, Andrew Milroy says, “Remote working has reached unprecedented levels as organisations try hard to keep going. This is massively expanding the attack surface for cybercriminals, weakening security and leading to a cybercrime pandemic. Hacking activity and phishing, inspired by the COVID-19 crisis, are growing rapidly.” Remote working has seen an increase in adoption of cloud applications and collaborative tools, and organisations and governments are having to re-think their risk management programs.

We are seeing the market respond to this need and May saw initiatives from governments and enterprises on strengthening risk management practices and standards. Tech vendors have also stepped up their game, strengthening their Cybersecurity offerings.

Market Consolidation through M&As Continues

The Cybersecurity market is extremely fragmented and is ripe for consolidation. The last couple of years has seen some consolidation of the market, especially through acquisitions by larger platform players (wishing to provide an end-to-end solution) and private equity firms (who have a better view of the Cybersecurity start-up ecosystem). Cybersecurity providers continue to acquire niche providers to strengthen their end-to-end offering and respond to market requirements.

As organisations cope with remote working, network security, threat identification and identity and access management are becoming important. CyberArk acquired Identity as a Service provider Idaptive to work on an AI-based identity solution. The acquisition expands its identity management offerings across hybrid and multi-cloud environments. Quick Heal invested in Singapore-based Ray, a start-up specialising in next-gen wireless and network technology. This would benefit Quick Heal in building a safe, secure, and seamless digital experience for users. This investment also shows Quick Heal’s strategy of investing in disruptive technologies to maintain its market presence and to develop a full-fledged integrated solution beneficial for its users.

Another interesting deal was Venafi acquiring Jetstack. Jetstack’s open-source Kubernetes certificate manager controller – cert-manager – with a thriving developer community of over 200 contributors, has been used by many global organisations as the go-to tool for using certificates in the Kubernetes space. The community has provided feedback through design discussion, user experience reports, code and documentation contributions as well as serving as a source for free community support. The partnership will see Venafi’s Machine Identity Protection having cloud-native capabilities. The deal came a day after VMware announced its intent to acquire Octarine to extend VMware’s Intrinsic Security Capabilities for Containers and Kubernetes and integrate Octarine’s technology to VMware’s Carbon Black, a security company which VMware bought last year.

Cybersecurity vendors are not the only ones that are acquiring niche Cybersecurity providers. In the wake of a rapid increase in user base and a surge in traffic, that exposed it to cyber-attacks (including the ‘zoombombing’ incidents), Zoom acquired secure messaging service Keybase, a secure messaging and file-sharing service to enhance their security and to build end-to-end encryption capability to strengthen their overall security posture.

Governments actively working on their Cyber Standards

Governments are forging ahead with digital transformation, providing better citizen services and better protection of citizen data. This has been especially important in the way they have had to manage the COVID-19 crisis – introducing restrictions fast, keeping citizens in the loop and often accessing citizens’ health and location data to contain the disaster. Various security guidelines and initiatives were announced by governments across the globe, to ensure that citizen data was being managed and used securely and to instil trust in citizens so that they would be willing to share their data.

Singapore, following its Smart Nation initiative, introduced a set of enhanced data security measures for public sector. There have been a few high-profile data breaches (especially in the public healthcare sector) in the last couple of years and the Government rolled out a common security framework for public agencies and their officials making them all accountable to a common code of practice. Measures include clarifying the roles and responsibilities of public officers involved in managing data security, and mandating that top public sector leadership be accountable for creating a strong organisational data security regime. The Government has also empowered citizens to raise a flag against unauthorised data disclosures through a simple incident report form available on Singapore’s Smart Nation Website.

Australia is also ramping up measures to protect the public sector and the country’s data against threats and breaches by issuing guidelines to Australia’s critical infrastructure providers from cyber-attacks. The Australian Cyber Security Centre (ACSC) especially aims key employees working in services such as power and water distribution networks, and transport and communications grids. In the US agencies such as the Cybersecurity and Infrastructure Security Agency (CISA) and the Department of Energy (DOE) have issued guidelines on safeguarding the country’s critical infrastructure. Similarly, UK’s National Cyber Security Centre (NCSC) issued cybersecurity best practices for Industrial Control Systems (ICS).

Cyber Awareness emerges as the need of the hour

While governments will continue to strengthen their Cybersecurity standards, the truth is Cybersecurity breaches often happen because of employee actions – sometimes deliberate, but often out of unawareness of the risks. As remote working becomes a norm for more organisations, there is a need for greater awareness amongst employees and Cybersecurity caution should become part of the organisational culture.

Comtech received a US$8.4 million in additional orders from the US Federal Government for a Joint Cyber Analysis Course. The company has been providing cyber-training to government agencies in the communications sector. Another public-private partnership to raise awareness on Cybersecurity announced in May was the MoU between Europol’s European Cybercrime Centre (EC3) and Capgemini Netherlands. With this MoU, Capgemini and Europol are collaborating on activities such as the development of cyber simulation exercises, capacity building, and prevention and awareness campaigns. They are also partnered on a No More Ransomware project by National High Tech Crime Unit of the Netherlands’ Police, Kaspersky and McAfee to help victims fight against ransomware threats.

The Industry continues to gear up for the Future

Technology providers, including Cybersecurity vendors, continue to evolve their offerings and several innovations were reported in May. Futuristic initiatives such as these show that technology vendors are aware of the acute need to build AI-based cyber solutions to stay ahead of cybercriminals.

Samsung introduced a new secure element (SE) Cybersecurity chip to protect mobile devices against security threats. The chip received an Evaluation Assurance Level (EAL) 6+ certification from CC EAL – a technology security evaluation agency which certifies IT products security on a scale of EAL0 to EAL7. Further applications of the chip could include securing e-passports, crypto hardware wallets and mobile devices based on standalone hardware-level security. Samsung also introduced a new smartphone in which Samsung is using a chipset from SK Telecom with quantum-crypto technology. This involves Quantum Random Number Generator (QRNG) to enhance the security of applications and services instead of using normal random number generators. The technology uses LED and CMOS sensor to capture quantum randomness and produce unpredictable strings and patterns which are difficult to hack. This is in line with what we are seeing in the findings of an Ecosystm business pulse study to gauge how organisations are prioritising their IT investments to adapt to the New Normal. 36% of organisations in the Asia Pacific region invested significantly in Mobile Security is a response to the COVID-19 crisis.

The same study reveals that nearly 40% of organisations in the region have also increased investments in Threat Analysis & Intelligence. At the Southern Methodist University in Texas, engineers at Darwin Deason Institute for Cybersecurity have created a software to detect and prevent ransomware threats before they can occur. Their detection method known as sensor-based ransomware detection can even spot new ransomware attacks and terminates the encryption process without relying on the signature of past infections. The university has filed a patent for this technique with the US Patent and Trademark Office.

Microsoft and Intel are working on a project called STAMINA (static malware-as-image network analysis). The project involves a new deep learning approach that converts malware into grayscale images to scan the text and structural patterns specific to malware. This works by converting a file’s binary form into a stream of raw pixel data (1D) which is later converted into a photo (2D) to feed into image analysis algorithms based on a pre-trained deep neural network to scan and classify images as clean or infected.