Ecosystm had predicted that in 2020, AI and analytics would be a top priority for organisations as they embarked or continued on their Digital Transformation journeys. What we saw instead was organisations collecting the right data – but handling more pressing matters this year. They focused more on cybersecurity frameworks, enabling remote employees and the shifts in product and service delivery. In 2021, as organisations work their way to recovery, they will re-evaluate their AI and automation roadmaps, more actively. Ecosystm Advisors Alea Fairchild, Andrew Milroy and Tim Sheedy present the top 5 Ecosystm predictions for AI & Automation in 2021.

This is a summary of the AI & Automation predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 AI & Automation Trends for 2021

- AI Will Move from a Competitive Advantage to a Must-Have

The best practices and leading-edge technology-centric implementations, over the years gives a very good indication of market trends. In 2018 and 2019 AI-centric engagements were few and far between – they were still in the “innovation stage” as trials and small projects. In 2020, AI was mentioned in most applications, showcased as best practices. AI is currently a competitive advantage for businesses. CIOs and their businesses are using AI to get ahead of their competitors and highlighting these practices for external recognition.

That also means that it is a matter of time before AI becomes a standard practice – processes are smart “out-of-the-box”; intelligent applications are an expectation, not the exception; systems learn because that is how they were designed, not as an overlay. If your competitors are using AI today to get ahead of you, then you need to also use AI to catch up and keep up. In 2021, having a smart business will not get you ahead of the pack – it will move you into it.

- AI Will Thrive in Areas where the Cost of Failure is Low

While organisations will be forced to adopt AI to remain competitive, initial exploration of AI solutions will be in areas that they consider low risk. The Financial Services, Retail, and other transaction-oriented industries will use AI to drive improved personalisation, increase customer retention, and improve their ability to lower risk and combat fraud. These are process-driven areas, where manual processes are being enhanced and enriched by AI. Although machine learning and other AI technologies will help improve the speed and quality of services, they will not be a replacement for many of the more complex business practices that companies and their employees frequently overlook to automate. The ‘low hanging fruit’ to add AI to will come first, with various degrees of success.

There will be industries and processes where organisations will be more skeptical about adopting AI. If Google finds a wrong translation or gives a wrong link, it is not a big concern, unlike a wrong diagnosis or wrong medication. In areas that are crucial to our well-being – such as healthcare – AI does not yet have the trust for acceptance of society. There are still questions around ethics and algorithm concerns.

- Technology Providers Will Stop Talking about AI

Technology vendors highlight what they consider their key differentiators, that show that they are ahead of the game. When every piece of software and hardware is intelligent, vendors will stop talking about the fact that they are intelligent. This may not fully happen in 2021 – but ENOUGH technology will be intelligent for those who have not yet made their software smart to understand that they cannot talk about its intelligent capabilities as that just shows they are behind the market.

The good news is that the less we hear about AI, the more intelligent applications will become. AI is quickly becoming a core capability and a base expectation. Systems that learn and adapt will be standard very soon – but be wary, as significant market changes can break these systems! Many companies learned that the pandemic broke their algorithms as times were no longer “normal”.

- Enterprises Will Seek Hyperautomation Solutions

RPA will increasingly become part of large enterprise application implementations. Technology vendors are adding RPA functionality either organically or through acquisitions to their enterprise application suites. RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft, and IBM. Rather than having an operative enter data into multiple systems, a bot can be created to do this. Large software vendors are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors.

As the RPA offerings continue to mature, enterprises seek to scale implementations and to automate non-repetitive processes, which require more intelligence. They will seek to automate more processes at scale. They will demand solutions that process unstructured data, handle exceptions, and continuously learn, further increasing productivity. Intelligent automation typically incorporates AI, particularly voice and vision capabilities and uses machine learning to optimise processes. Hyperautomation turbo charges intelligent automation by automating multiple processes at scale – and will become core to digital transformation initiatives in 2021.

- Businesses Will Put “Automation Targets” in Place

2020 was the year that many businesses started seeing some broad and tangible benefits from their automation initiatives. Automation was one of the big winners of the year, as many businesses took extra steps to take humans out of processes – particularly those humans that had to be in a specific location, such as a warehouse, the finance team, the front desk and so on (because of the pandemic, they were often working at home instead). Senior management is seeing the benefits of automation, and they will start to ask their teams why more processes are not automated Therefore we will start to see managers put targets around a certain percentage of tasks automated in an area – e.g. 70% of contact centre processes will be automated, 90% of the digital customer experience for a certain outcome will be automated and so on. Achieving these numbers may not be easy, but the targets will change the mindset of people designing, implementing, and improving processes.

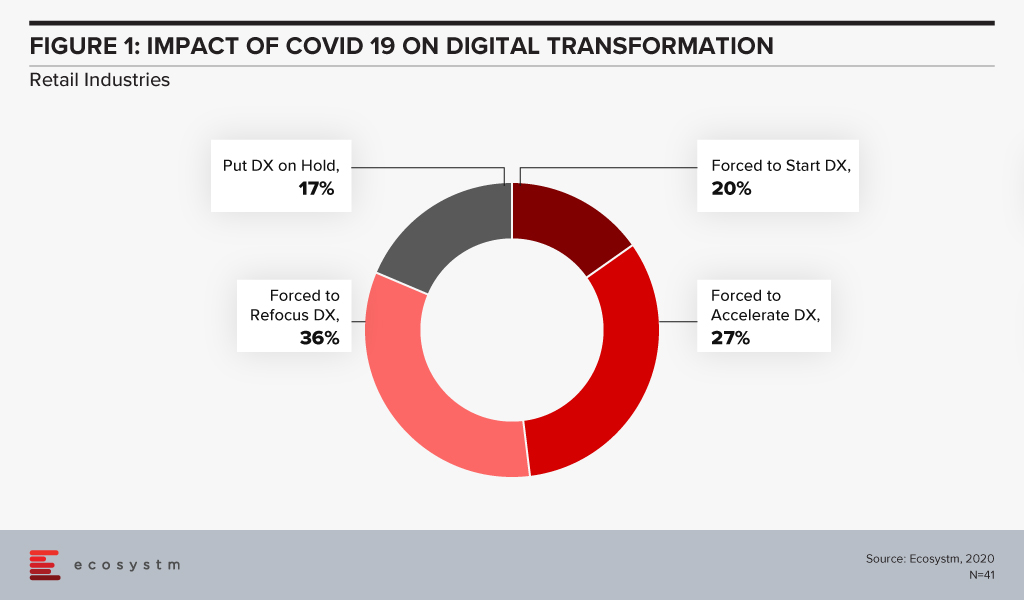

The Retail industry has been one of the hardest-hit industries during the COVID-19 crisis. The industry had to pivot faster than many to cater to an evolving market need and customer expectation, amidst social distancing measures and supply chain disruption. Ecosystm’s Digital Priorities in the New Normal study finds that nearly 83% of organisations in Asia Pacific’s Retail industries were forced to work on digital transformation (DX) in the aftermath of the crisis (Figure 1).

Retail organisations that had not walked the DX path found themselves struggling to cope in recent times. Ecosystm Principal Advisor, Alan Hesketh says, “Digital transformation in retail, as represented by deep customer understanding and omnichannel operations, is far from new. Industry leaders launched these activities almost 20 years ago and continue to aggressively develop these capabilities. Retailers not actively leveraging these capabilities to understand their customer preferences are at a massive competitive disadvantage.”

Anta Group Accelerates DX

The Anta Group, a sports products manufacturer based in China with over 12,500 stores, has launched a group-wide digital platform designed and deployed by IBM Services based on SAP S/4HANA. The initial phase of Anta Group’s DX included creating intelligent workflows and was completed in January 2020. This enabled the company to adjust its retail operations and switch to quickly to online channels during the COVID-19 pandemic.

Like any retail organisation, the Anta Group realised that their product offerings had to be diverse to cater to an evolving customer base. This growth required an upgrade to a group-level management platform to help the business run more efficiently across the entire value chain of procurement, supply, production and sales. The SAP S/4HANA platform gives the senior management a single view of data across business units to help with better decision making regarding production and sales optimisation. The company claims to have improved its supply chain efficiency by 80%, that has led to faster delivery and business growth even in these difficult times.

IBM Services has a role to play in providing the business intelligence required for agile decision-making. By integrating data from multiple sources – retail stores, multi-brand products, channels, customers, suppliers and finance teams – on the one platform can help Anta Group to settle accounts quickly and issue business analysis reports for different entities as well as a real-time view of the operation across the organisation.

Hesketh says, “Retailers must have an accurate, timely understanding of their customers’ behaviour and resulting sales performance. COVID-19 has dramatically increased the volatility of sales, making rapid recognition of changes essential. For those lagging in their digital transformation to acquire this understanding, an attractive option is partnering with organisations with demonstrated relevant capabilities; in this case with SAP, for the capabilities and performance of their in-memory product, and IBM for their configuration and implementation expertise.”

IBM and SAP evolving their partnership

In 2016, IBM and SAP had expressed intentions of increasing investments to help their customers on their DX journeys. As some economies move into the recovery phase, all businesses will be forced to transform – or keep transforming if they are already along that path. Last month saw IBM and SAP announce the evolution of their partnership with new offerings to help businesses transform faster. The next evolution of the IBM and SAP partnership aims to focus on faster DX time to value, innovation through industry-specific offerings, customer and employee experiences and providing flexibility and choice to organisations to run their workloads in hybrid cloud environments.

Hesketh adds, “But the product and implementation partners are, while important, not the real determinant of the success of DX activity and time to value. Retailers must recognise and commit to the strategic reshaping of their business, taking their large workforces with them on the journey. This is a high-risk change. A strong relationship between product vendor and implementation partner, as SAP and IBM demonstrate here, assists in reducing, not removing, this risk.”

This week saw SAS and Microsoft announce a strategic partnership both in their technology offerings and go-to-market strategy. SAS analytical products and industry solutions will be migrated onto Microsoft Azure as the preferred cloud provider for the SAS Cloud. Microsoft hopes to leverage SAS’ industry expertise, especially in healthcare and financial services. This partnership builds on SAS integrations across Microsoft cloud solutions for Azure, Dynamics 365, Microsoft 365 and Power Platform.

Here is what our Analysts say:

“To date, the focus of cloud computing has been around providing customers with levels of agility, speed, and scalability that cannot be provided by on-premises solutions. Customers have benefitted from this cloud functionality by being able to provision new services rapidly, pivot swiftly when they need to change their business models and build resilience and flexibility into the ways in which they do business. Today, customers are asking for more. Microsoft has responded to this demand by forming or enhancing cloud partnerships with leading cloud vendors including Salesforce, SAP, Oracle, Workday, ServiceNow and Adobe, as part of an overall strategy to make it easier for customers to choose Azure as their key enterprise foundation, and to offer more functionality.

Across industries, from healthcare to financial services, businesses finally realise the potential value of data. They recognise that the most competitive businesses are those that fully leverage the data that they can access. Businesses want cloud services to offer AI and machine learning capabilities. They want to use these capabilities to become more innovative and more competitive. To do this, these cloud services need to be integrated more tightly with capabilities which Microsoft does not have.

SAS is the leader in data analytics and AI software for enterprises, so it makes perfect sense for Microsoft to partner with the company. Integrating SAS models with Microsoft’s cloud estate, in particular Azure will enable Microsoft to offer its customers more than the typical benefits of cloud services. They can offer their customers intelligent cloud services.

SAS can offer its customers a more comprehensive solution by integrating its AI and machine learning capabilities into the Microsoft cloud estate. SAS and Microsoft will combine their engineering resources to ensure that SAS’ analytics products work well on Azure. A key priority is building an Azure-optimised version of Viya, the cloud version of SAS’ core analytics toolkit. SAS will also look at ways in which it can integrate its software with the native analytics services provided in Azure.

Importantly, companies will create joint solutions across multiple verticals. An example of a joint solution is SAS’ IoT analytics and the Azure IoT platform being used to increase situational awareness of rising stream levels, to predict where flooding might occur, thus improving emergency response.

SAS software will continue to be cloud-agnostic. But, SAS itself will migrate its internal operation and its global cloud business to Azure. The expanded partnership with Microsoft does not impact SAS customers who run on AWS or GCP. But, Azure customers can expect to see benefits over time as SAS and Microsoft work closely on joint solutions.”

“The SAS and Microsoft relationship goes well beyond ‘Azure is our cloud hosting platform of choice’. It brings together Microsoft’s leading suite of AI tools and cloud infrastructure and platform capabilities and the leading analytics and intelligent applications provider. Through the combined toolset, every-day applications have the opportunity to become even more intelligent – and the industry-specific intelligent business processes that SAS is known for will be able to be hosted on the cloud, and more deeply integrated into existing solutions and PaaS services. The ability to embed SAS workloads into containers means that a broader user set can access and learn from the analytics that they provide – and automate an even greater number of business and customer processes using the AI and Analytics toolsets from both providers.

It also simplifies the management of SAS software and gives a clear and easy path to the public cloud for SAS customers who have not yet made that transition.

The partnership has the opportunity to further accelerate Microsoft’s transition towards even smarter applications. Microsoft has already been recognised in the market as having one of the better AI capabilities – mostly because of embedding intelligence into existing applications and processes. But Microsoft was never going to be able to provide the intelligence for every process in every industry. This partnership will accelerate Microsoft towards the automation of more processes that are used by customers across the spectrum of sectors and industries – and it obviously extends SAS’ reach beyond their traditional customer base.”

Artificial Intelligence has come a long way and was one of the growing areas in 2019. Over the last few years, we have seen a growing number of AI based platforms, applications and tools that developers and scientists have worked to mimic a human brain. We believe that in 2020, AI will come out from the experimentation stage to the implementation and businesses will make deeper investments in AI to embed them in business applications.

This article presents the Top 5 Artificial Intelligence Trends for 2020 for the AI/Analytics market in 2020. It is based on the latest data from the global Ecosystm AI Study, and qualitative research by Ecosystm Principal Advisor Tim Sheedy.

The Top 5 Artificial Intelligence Trends for 2020

Here are the Top 5 Artificial Intelligence trends for 2020 that we believe will impact both businesses and consumers in 2020.

-

Digital Transformation puts Analytics Back on Top of the Tech Priority List

In an effort to help the business operate faster, IT teams are looking to better analytics to drive functions and decisions more accurately. While many business teams deploy their own technologies and systems – only the IT team is in a higher position to gather data from multiple systems of record in order to create the detailed insights that business users demand. Getting a view across the entire customer journey means analysing data across many systems – both front and back-end. Business teams struggle to get these types of insights on their own, which is why IT excels at providing great analytics to help make better and faster decisions.

Just like in previous generations of BI, the analytics market is starting to consolidate. While the ability to display data visually will always be important, it is the analytics that drives automated decisions that will often be of the most business value.

-

Automation will Lead Organisations to AI

RPA is increasingly moving beyond the usual task and process automation, to now being a business transformation lever. Additionally, there is an immense focus on incorporating AI/machine learning within RPA to make automation smart and intelligent. This allows software robots to mimic human behaviour and handle complex use cases, which was earlier not possible without human intervention.

Businesses will spend more money on their simple automation activities (RPA and analytics applications that do not learn) – but those that have already invested in automation are likely to want to take the next steps to AI.

-

AI will Start to be Embedded in Most Business Applications

To date AI has been an overlay to most applications – data is extracted from processes, learnings are made, and then the process is altered based on those learnings. In 2020 we will see mass availability of self-learning intelligent applications. The standard ERP, CRM, SCM, knowledge management solution and other business applications will have embedded intelligence. This will make it easier and faster for businesses to get the benefits of machine learning and AI without the need to hire expensive data scientists, or the requirement to learn the tools and platforms required for creating smart applications.

-

2020 will see the Democratisation of AI

Typically organisations required data scientists, AI coders, AI platforms and so on to do well in AI but with the increasing availability of AI in business applications, typical business users will begin to get a glimpse of what will be available at their fingertips in the next few years.

We expect templatised approaches to machine learning and associated technologies. Business users and data owners will be able to create algorithms that will improve business and customer outcomes. In some cases, we even expect AI to be available to consumers. We will start to see banking and finance applications that help better money management through learning – not just basic analytics, we will see more intelligent services in the market in 2020.

-

More Businesses Will Require AI on the Edge

In the next decade or two, it is estimated that there will be 100 billion IoT devices generating and exchanging data into the cloud, without any human intervention. With so many IoT devices generating a huge quantum of data, decisions will need to be made in real-time and the current cloud environments will be a bottleneck in data processing due to latency rates, network speed and traditional data architectures. To overcome this, Edge Computing solutions will be essential to work with a variety of sensor and data input devices, information processing and decisions driven by machine learning and AI, and additionally work with cloud for the next level of analytics, decisions and management.

Ecosystm in partnership with SGInnovate, the government-backed organisation that promotes Deep Tech in Singapore, released a series of four reports covering areas of mutual interest: Cybersecurity, Artificial Intelligence, Cities of the Future and Healthtech. ‘Ecosystm Predicts: The top 5 Artificial Intelligence trends for 2020’ report is a part of this collaboration and is available for download from Ecosystm and SGInnovate websites.

Download Report: The Top 5 Artificial Intelligence Trends for 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Artificial Intelligence Trends for 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the Top 5 Artificial Intelligence Trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources. Download Link Below ?

In a move that feels “back to the future”, Salesforce has agreed to acquire Tableau Software Inc for US$15.3 billion in a deal that is expected to close in the third quarter of 2019. It seems all independent BI and analytics companies (except SAS!) eventually get snapped up – Business Objects by SAP, Hyperion by Oracle, Cognos by IBM. The move comes less than a week after Google acquired BI and analytics provider Looker.

Today, many businesses use Tableau (over 86,000), including a lot of Salesforce customers. They have chosen Tableau because it is easy to deploy and use, and like Salesforce own applications, it targets the ultimate decision maker – the business user – and sometimes even the consumer. Recent research into the BI systems integrators in Asia Pacific shows that Tableau is one of the leading analytics platforms for the partner community in the region – the big SIs have many people focused on Tableau. But that dominance is being challenged by a re-energised Microsoft, whose Power BI is also witnessing strong growth – and who is typically the price leader in the market.

For Salesforce customers, there is some overlap between products – their own Einstein Analytics tools do much of what Tableau can do – although Tableau helps customers see insights from data stored both on the cloud and inside their own data centres. It also moves Salesforce closer to the Customer 360 vision – the ability to get a view of customers across the Commerce, Marketing and Service Clouds. Salesforce customers not using Tableau today will get a better user experience by using Tableau as the visualisation platform.

History has shown that it is hard to make such acquisitions successful. Tableau was a huge success because it was independent. The same was for Business Objects and Cognos before their acquisitions. History has shown that when the large BI and analytics vendors are acquired, others move into that space. While Salesforce has announced they will run Tableau as a separate business, it will no longer be independent. Partners will need to be maintained and provided a growth path – and partners are the cornerstone of Tableau’s success. Some of these partners might have strong ties to other software or cloud platforms too such as SAP, Oracle, AWS or Google. Customers of Tableau might feel sales pressure to move to a Salesforce environment – and will likely see Salesforce integration happen at a deeper level than on other platforms.

Tableau’s independence will disappear. However keeping Tableau as a separate business may not be the long term goal for Salesforce – it might be to offer the best application and analytics solution in the market – to make the entire suite more attractive to more potential buyers and users. It may be to take Salesforce beyond the current users in their customers to many other users who may not need the full application but need the analytics and visualisations that the data can provide. If this is the case, then the company is onto a winner with the Tableau acquisition.

BUT…

The long term goal is not analytics reports delivered to employees. It is not visualisation. It is automation. It is applications doing smart, AI-driven analysis, and deciding for employees. It is about taking the human out of the process. In a factory you don’t need a report to tell you a machine is down – you need to book a repair person automatically – or a service technician to visit before the machine has even broken down. And you don’t need a visualised report to show that a machine is beyond its life expectancy. You need the machine replaced before it fails catastrophically.

Too often, we are putting humans in processes where they are not required. We are making visualisations more attractive and easier to consume when, in reality, we just needed the task automated. While we employ humans, there will be a need to make decisions more effectively, and we will still require tools like Tableau. But don’t let the pretty pictures distract you from the main prize – intelligent automation.

If you would like to speak to Tim Sheedy or another analyst at Ecosystm about what the acquisition Tableau by Salesforce might mean to your business or industry, please feel free to schedule an inquiry call on the profile page.