Ecosystm launches the Trending-Vendor series showcasing the Top 5 disruptive vendors that are shaking up their market segment. Our first Trending-Vendor RNx is focused on Robotic Process Automation (RPA) – Ecosystm research shows that process automation is the biggest driver for tech adoption, with a staggering 127% investment growth in 2021. The Ecosystm RNx – Top 5 Trending-Vendor for RPA evaluates Automation vendors based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an End User and looking to automate your back-end or customer processes, this vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience, integration capabilities, and strategy.

If you are an RPA vendor, you operate in a competitive work with several enterprise vendors vying for a larger share of the pie – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

The pandemic crisis has rapidly accelerated digitalisation across all industries. Organisations have been forced to digitalise entire processes more rapidly, as face-to-face engagement becomes restricted or even impossible.

The most visible areas where face-to-face activity is being swiftly replaced by digital alternatives include conferencing and collaboration, and the use of digital channels to engage with customers, suppliers, and other stakeholders.

For example, the crisis has made it difficult – even impossible, sometimes – for contact centre agents to physically work in contact centres, and they often do not have the tools to work effectively from home. This challenge is particularly apparent for offshore contact centres in the Philippines and India. The creation of chatbots has reduced the need for customer service staff and enabled data to by entered into front-office systems, and analysed immediately.

Less visible are back-office processes which are commonly inefficient and labour-intensive. Remote working makes some back-office workflows challenging or impossible. For example, some essential finance and accounting workflows involve a mix of digital communications, printing, scanning, copying and storage of physical documents – making these workflows inefficient, difficult to scale and labour-intensive. This has been highlighted during the pandemic. RPA adoption has grown faster than expected as organisations seek to resolve these and other challenges – often caused by inefficient workflows being scrambled by the crisis.

The RPA Market in Asia Pacific

There are many definitions of the RPA market, but it can broadly be defined as the use of software bots to execute processes which involve high volumes of repeatable tasks, that were previously executed by humans. When processes are automated, the physical location of employees and other stakeholders becomes less important. RPA makes these processes more agile and flexible and makes businesses more resilient. It can also increase operational efficiency, drive business growth, and enhance customer and employee experience.

RPA is a comparatively new and fast-growing market – this is leading to rapid change. In its infancy, it was basically the digitalisation of BPO. It was viewed as a way of automating repetitive tasks, many of which had been outsourced. While its cost saving benefits remain important as with BPOs, customers are now seeking more. They want RPA to help them to improve or transform front-office, back-office and industry-specific processes throughout the organisation. RPA vendors are addressing these enhanced requirements by blending RPA with AI and re-branding their offerings as intelligent automation or hyper-automation.

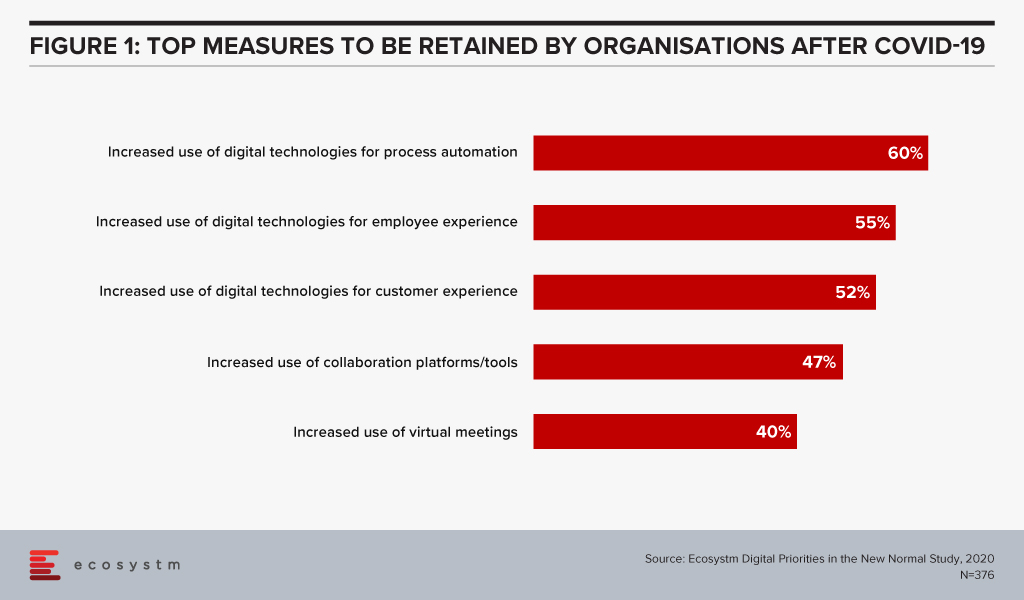

Asia Pacific organisations have been relatively slow to adopt RPA, but this is changing fast. The findings of the Ecosystm Digital Priorities in the New Normal study show that in the next 12 months, organisations will continue to focus on digital technologies for process automation (Figure 1).

The market is growing rapidly with large global RPA specialists such as UiPath, Automation Anywhere, Blue Prism and AntWorks experiencing high rates of growth in the region.

RPA vendors in Asia Pacific, are typically addressing immediate, short-term requirements. For example, healthcare companies are automating the reporting of COVID-19 tests and ordering supplies. Chatbots are being widely used to address unprecedented call centre volumes for airlines, travel companies, banks and telecom providers. Administrative tasks increasingly require automation as workflows become disrupted by remote working.

Companies can also be expected to scale their current deployments and increase the rate at which AI capabilities are integrated into their offerings

RPA often works in conjunction with major software products provided by companies such as Salesforce, SAP, Microsoft and IBM. For example, some invoicing processes involve the use of Salesforce, SAP and Microsoft products. Rather than having an operative enter data into multiple systems, a bot can be created to do this.

Large software vendors such as IBM, Microsoft, Salesforce and SAP are taking advantage of this opportunity by trying to own entire workflows. They are increasingly integrating RPA into their offerings as well as competing directly in the RPA market with pureplay RPA vendors. RPA may soon be integrated into larger enterprise applications, unless pureplay RPA vendors can innovate and continually differentiate their offerings.