November has seen uncertainties in the technology market with news of layoffs and hiring freezes from big names in the industry – Meta, Amazon, Salesforce, and Apple to name a few. These have impacted thousands of people globally, leaving tech talent with one common question, ‘What next?’

While the current situation and economic trends may seem grim, it is not all bad news for tech workers. It is true that people strategies in the sector may be impacted, but there are still plenty of opportunities for tech experts in the industry.

Here is what Ecosystm Analysts say about what’s next for technology workers.

Today, we are seeing two quite conflicting signals in the market: Tech vendors are laying off staff; and IT teams in businesses are struggling to hire the people they need.

At Ecosystm, we still expect a healthy growth in tech spend in 2023 and 2024 regardless of economic conditions. Businesses will be increasing their spend on security and data governance to limit their exposure to cyber-attacks; they will spend on automation to help teams grow productivity with current or lower headcount; they will continue their cloud investments to simplify their technology architectures, increase resilience, and to drive business agility. Security, cloud, data management and analytics, automation, and digital developers will all continue to see employment opportunities.

If this is the case, then why are tech vendors laying off headcount?

The slowdown in the American economy is a big reason. Tech providers that are laying of staff are heavily exposed to the American market.

- Salesforce – 68% Americas

- Facebook – 44% North America

- Genesys – around 60% in North America

Much of the messaging that these providers are giving is it is not that business is performing poorly – it is that growth is slowing down from the fast pace that many were witnessing when digital strategies accelerated.

Some of these tech providers might also be using the opportunity to “trim the fat” from their business – using the opportunity to get rid of the 2-3% of staff or teams that are underperforming. Interestingly, many of the people that are being laid off are from in or around the sales organisation. In some cases, tech providers are trimming products or services from their business and associated product, marketing, and technical staff are also being laid off.

While the majority of the impact is being felt in North America, there are certainly some people being laid off in Asia Pacific too. Particularly in companies where the development is done in Asia (India, China, ASEAN, etc.), there will be some impact when products or services are discontinued.

While it is not all bad news for tech talent, there is undoubtedly some nervousness. So this is what you should think about:

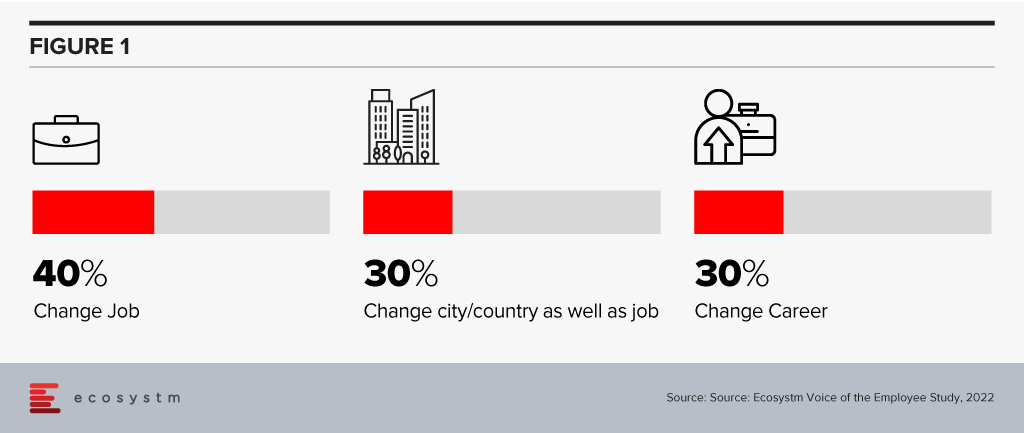

Change your immediate priorities. Ecosystm research found that 40% of digital/IT talent were looking to change employers in 2023. Nearly 60% of them were also thinking of changes in terms of where they live and their career.

This may not be the right time to voluntarily change your job. Job profiles and industry requirements should guide your decision – by February 2023, a clearer image of the job market will emerge. Till then, upskill and get those certifications to stay relevant!

Be prepared for contract roles. With a huge pool of highly skilled technologists on the hunt for new opportunities, smaller technology providers and start-ups have a cause to celebrate. They have faced the challenge of getting the right talent largely because of their inability to match the remunerations offered by large tech firms.

These companies may still not be able to match the benefits offered by the large tech firms – but they provide opportunities to expand your portfolio, industry expertise, and experience in emerging technologies. This will see a change in job profiles. It is expected that more contractual roles will open up for the technology industry. You will have more opportunities to explore the option of working on short-term assignments and consulting projects – sometimes on multiple projects and with multiple clients at the same time.

Think about switching sides. The fact remains that digital and technology upgrades continue to be organisational priorities, across all industries. As organisations continue on their digital journeys, they have an immense potential to address their skills gap now with the availability of highly skilled talent. In a recently conducted Ecosystm roundtable, CIOs reported that new graduates have been demanding salaries as high as USD 200,000 per annum! Even banks and consultancies – typically the top paying businesses – have been finding it hard to afford these skills! These industries may well benefit from the layoffs.

If you look at technology job listings, we see no signs of the demand abating!

The emergence of COVID-19 last year caused a rapid shift towards work and study from home, and a pickup in eCommerce and social media usage. Tech companies running large data centre-based “webscale” networks have eagerly exploited these changes. Already flush with cash, the webscalers invested aggressively in expanding their networks, in an effort to blanket the globe with rapid, responsive connectivity. Capital investments have soared. For the webscale sector, spending on data centres and related network technology accounts for over 40% of the total CapEx.

Here are the 3 key emerging trends in the data centre market:

#1 Top cloud providers drive webscale investment but are not alone

The webscale sector’s big cloud providers have accounted for much of the recent CapEx surge. AWS, Google, and Microsoft have been building larger facilities, expanding existing campuses and clusters, and broadening their cloud region footprint into smaller markets. These three account for just under 60% of global webscale tech CapEx over the last four quarters. Alibaba and Tencent have been reinforcing their footprints in China and expanding overseas, usually with partners. Numerous smaller cloud providers – notably Oracle and IBM – are also expanding their cloud services offerings and coverage.

Facebook and Apple, while they don’t provide cloud services, also continue to invest aggressively in networks to support large volumes of customer traffic. If we look at Facebook, the reason becomes clear: as of early 2021, they needed to support 65 billion WhatsApp messages per day, over 2 billion minutes of voice and video calls per day, and on a monthly basis their Messenger platform carries 81 billion messages.

The facilities these webscale players are building can be immense. For instance, Microsoft was scheduled to start construction this month on two new data centres in Des Moines Iowa, each of which costs over USD 1 billion and measures over 167 thousand square metres. And Microsoft is not alone in building these large facilities.

#2 Building it all alone is not an option for even the biggest players

The largest webscalers – Google, AWS, Facebook and Microsoft – clearly prefer to design and operate their own facilities. Each of them spends heavily on both external procurement and internal design for the technology that goes into their data centres. Custom silicon and the highest speed, most advanced optical interconnect solutions are key. As utility costs are a huge element of running a data centre, webscalers also seek out the lowest cost (and, increasingly, greenest) power solutions, often investing in new power sources directly. Webscalers aim to deploy facilities that are on the bleeding edge of technology. Nonetheless, in order to reach the far corners of the earth, they have to also rely on other providers’ network infrastructure. Most importantly, this means renting out space in data centres owned by carrier-neutral network operators (CNNOs) in which to install their gear.

The Big 4 webscalers do this as little as possible. For many smaller webscalers though, piggybacking on other networks is the norm. Of course, they want some of their own data centres – usually the largest ones closest to their main concentrations of customers and traffic generators. But leasing space – and functionalities like cloud on-ramps – in third-party facilities helps enormously with time to market.

Oracle is a case in point. They have expanded their cloud services business dramatically in the last few years and attracted some marquee names to their client list, including Zoom, FedEx and Cisco. To ramp up, Oracle reported a rise in CapEx, growing to USD 2.1 billion in the 12 months ended June 2021, which represents a 31% increase from the previous year. However, when compared to Microsoft’s spending this appears modest. Microsoft reported having spent USD 20.6 billion in the 12 months ended June 2021 – a 33% increase over the previous year – to help drive the growth of their Azure cloud service.

One reason behind Oracle’s more modest spending is how heavily the company has relied on colocation partners for their cloud buildouts. Oracle partners with Equinix, Digital Realty, and other providers of neutral data centre space to speed their cloud time to market. Oracle rents space in 29 Digital Realty locations, for instance, and while Equinix doesn’t quantify its partnership with Oracle, Oracle’s cloud regions across the globe access the Oracle Cloud Infrastructure (OCI) via the Equinix Cloud Exchange Fabric. Oracle also works with telecom providers; their Dubai cloud region, launched in October 2020, is hosted out of an Etisalat owned data centre.

#3 Carrier-neutral data centre investment is surging in concert with webscale/cloud growth

As the webscale sector has raced to expand over the last 2 years, companies that specialise in carrier-neutral data centres have benefited. Industry sources estimate that as much as 50% or more of the cloud sector’s total data centre footprint is actually in these third-party data centres. That is unlikely to change, especially as some CNNOs are explicitly aiming to build out their networks in areas where webscalers have less incentive to devote resources. It’s not just about the webscalers’ need for space; the need for highly responsive, low latency networks is also key, and interconnection closer to the end-user is a driver.

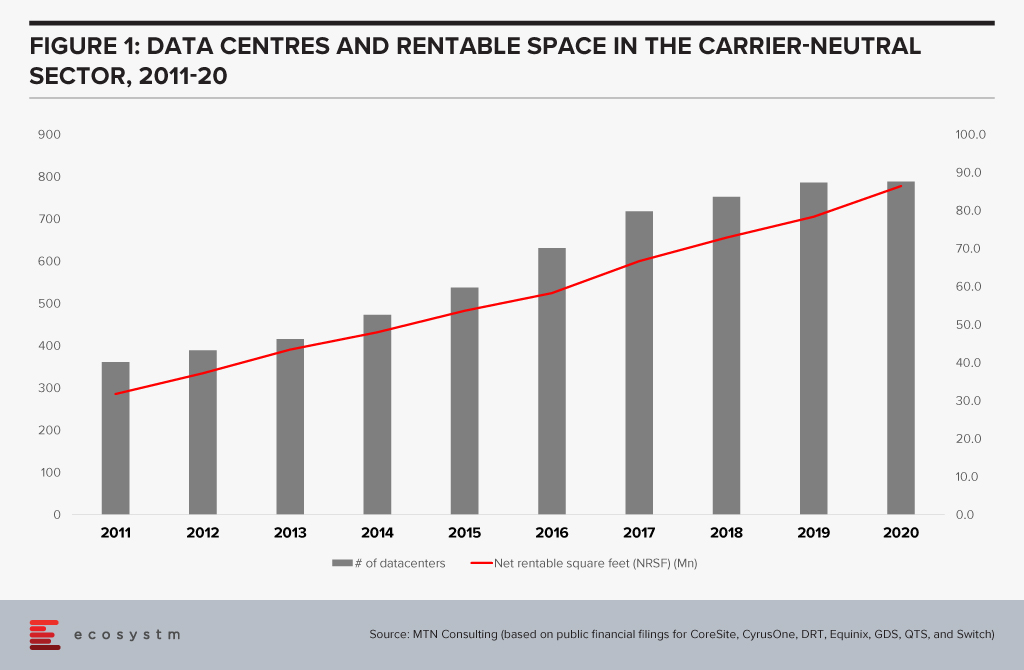

Looking at the biggest publicly traded carrier-neutral providers in the data centre sector shows that their capacity has expanded significantly in the last few years (Figure 1)

By my estimation, for the first 6 months of 2021, CapEx reported publicly for these CNNOs increased 18% against 1H20, to an estimated USD 4.1 Billion. Beyond the big public names, private equity investment is blossoming in the data centre market, in part aimed at capturing some of the demand growth generated by webscalers. Examples include Blackstone’s acquisition of QTS Realty Trust, Goldman Sachs setting up a data centre-focused venture called Global Compute Infrastructure; and Macquarie Capital’s strategic partnership with Prime Data Centers.

Some of this new investment target core facilities in the usual high-traffic clusters, but some also target smaller country markets (e.g. STT’s new Bangkok-based data centre), and the network edge (e.g. EdgeConneX, a portfolio company of private equity fund EQT Infrastructure).

EdgeConneX is a good example of the flexibility required by the market. They build smaller size facilities and deploy infrastructure closer to the edge of the network, including a PoP in Boston’s Prudential Tower. The company offers data centre solutions “ranging from 40kW to 40MW or more.” They have built over 40 data centres in recent years, including both edge data centres and a number of regional and hyperscale facilities across North America, Europe, and South America. Notably, EdgeConneX recently created a joint venture with India’s property group Adani – AdaniConneX – which looks to leverage India’s status of being the current hotspot for carrier-neutral data centre investment.

As enterprises across many vertical markets continue to adopt cloud services, and their requirements grow more stringent, the investment climate for new data centre capacity is likely to remain strong. Webscale providers will provide much of this capacity, but carrier-neutral specialists have an important role to play.

Singapore’s Health Promotion Board (HPB) and Apple announced a partnership aimed at promoting a healthy lifestyle in Singapore through an application called LumiHealth. The HPB is a statutory board under the Ministry of Health (MOH) that implements programs and policies to promote healthy lifestyle in Singapore. The two-year health program – which will go live in late-October – is a part of Singapore’s Smart Nation initiative, a national effort to harness technology for innovation, sustainability and support better living for citizens and businesses in Singapore.

Commenting on the news, Ecosystm Principal Analyst, Sash Mukherjee said that “Singapore’s MOH has been making a concerted effort to improve health outcomes through digital technology for more than 10 years now. It is time for the nation-wide health record system to be leveraged for better population health management. The ultimate goal of all healthcare systems across the world is to be sustainable – and keep citizens out of the public healthcare systems by managing their health and wellness, outside of it. Singapore is geared up to deliver on their goals for 2025; technology-enabled population health; preventive health; and early diagnosis and intervention.”

LumiHealth to promote Healthy Lifestyle

The LumiHealth app has been created and designed with a team of public health experts and physicians; and encourages users to complete wellness challenges through their Apple devices. To participate in the wellness program, users need to have an Apple Watch and the LumiHealth app. The app will provide participants with personalised coaching, and will prompt users on sleeping habits, food choices, activity goals, health screenings and relevant immunisations based on their demographic profile.

The application also has a feature called ‘intergalactic explorer’ which gamifies the experience through adventure-based tasks. The tasks are personalised based on a user’s age, gender, and weight; and can be completed through walking, swimming, running, yoga, and other activities. Completing these challenges will enable users to earn rewards and vouchers worth up to SGD380 (USD 280). The eVouchers can be used at various establishments, including food and health outlets.

Creating a customised offering, and gamifying the experience should increase user engagement, “However, the products and offerings have to be more mass-market to promote universal adoption. Relying on citizens’ personal devices and their own wellness goals will only be attractive to a certain segment – that was already focused on health and wellness to start with. In the end the success of such population health initiatives will depend on GPs and other primary care providers being able to prescribe devices and apps, being able to access the data, and being able to base their treatment protocols on that data,” explains Mukherjee.

LumiHealth data privacy and security

To enroll in the program, users need to provide consent to share their information with LumiHealth to personalise their experience and they may opt-out any time. Singapore residents above 17 years and holding a SingPass account are eligible to participate in LumiHealth. The aim is to use insights from the captured data to enable betterment of future public health efforts, reduction in preventable deaths and disabilities and improve the quality of lives. The program is voluntary and guarantees data privacy and security through encryption and systems complying with Singapore’s data privacy and security laws as the collected data will be coded, secured and stored in Singapore.

“This project took close to 2 years to come to fruition” Mukherjee said, “and will hopefully lead the way for more healthcare apps aimed at wellness and chronic disease management.”

Singapore’s Health Programs

LumiHealth will complement Singapore’s other population health initiatives that are leveraging technology to enable wellness. The National Steps challenge program encourages Singaporeans to be physically active by engaging in various levels of challenges – involving activities ranging from brisk walking, stair climbing to doing sports.

The Singapore Government has also introduced other wearable tech and apps to promote a healthier lifestyle and emotional wellbeing of Singaporeans. For example, last year, the HPB collaborated with Fitbit to leverage their devices, services and apps.

The Singapore Government has also focused on wearables and TraceTogether tokens in curbing the spread of COVID-19. In June, the TraceTogether tokens were distributed to the elderly followed by a nationwide distribution of TraceTogether tokens that kicked off this month. “The Healthcare industry is at crossroads. It has had to pivot significantly from their transformation and technology roadmap to handle the COVID-19 crisis. However, there have been important learnings from the situation that the industry will carry forward. A lesson for Singapore was the real-life application of the C3 system (Command, Control and Communication). Singapore’s response to the crisis shows how governments can use policies and technology to combat healthcare emergencies,” Mukherjee concludes.

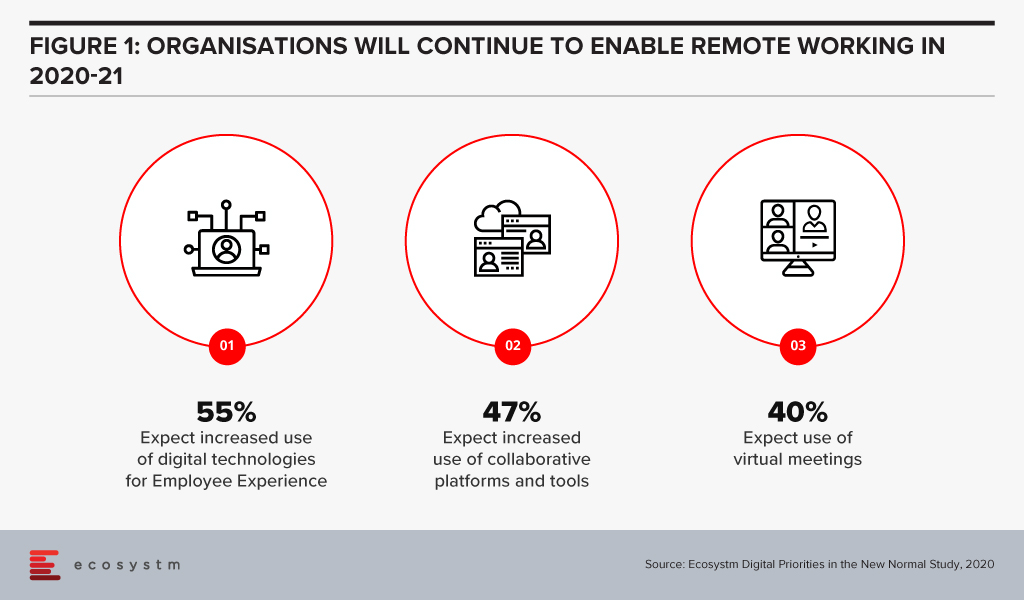

The Future of Work is here, now. Organisations were faced with unprecedented challenges of coping with the work-from-home model, when COVID-19 hit earlier this year. Many organisations managed the pivot very successfully, but all organisations were impacted in some way. Various trends have emerged over the last few months, that are likely to persist long after the immediate COVID-19 measures are removed by countries. In the Ecosystm Digital Priorities in the New Normal study, we find that organisations will continue to cater for remote employees (Figure 1) and keep a firm eye on employee experience (EX).

August has seen these clear trends in the Future of Work

#1 Tech companies leading from the front in embracing the Future of Work

As the pandemic continued to spread across the globe, various companies adopted the work from home model at a scale never seen before. While it is still unclear how the work model will look like, many companies continue to extend their remote working policies for the remaining year, and some are even thinking of making it a permanent move.

Tech companies appear to be the most proactive in extending remote working. Google, Microsoft, and AWS have all extended their work from home model till the end of the year or till the middle of next year. Earlier in the month Facebook extended its work from home program until mid-2021 and are also giving employees USD 1,000 to equip their home offices. This appears to be a long-term policy, with the company announcing in May that in the next 5-10 years, they expect 50% of their employees to be remote. Similarly, Salesforce and Uber also announced that they would be extending remote working till the mid-next year, and are providing funding for employees to set up the right work environment.

In Australia, Atlassian has made work from home a permanent option for their employees. They will continue to operate their physical offices but have given employees the option to choose where they want to work from.

Some organisations have gone beyond announcing these measures. Slack has talked about how they are evolving their corporate culture. For example, they have evolved their hiring policies and most new roles are open to remote candidates. Going forward, they are evaluating a more asynchronous work environment where employees can work the hours that make sense for them. In their communique, they are open about the fluid nature of the work environment and the challenges that employees and organisations might face as their shift their work models.

Organisations will have to evaluate multiple factors before coming up with the right model that suits their corporate culture and nature of work, but it appears that tech companies are showing the industry how it can be done.

#2 Tech companies evolve their capabilities to enable the Future of Work

Right from the start of the crisis, we have seen organisations make technology-led pivots. Technology providers are responding – and fast – to the changing environment and are evolving their capabilities to help their customers embrace the digital Future of Work.

Many of these responses have included strengthening their ecosystems and collaborating with other technology providers. Wipro and Intel announced a collaboration between Wipro’s LIVE Workspace digital workspace solution and the Intel vPro platform to enable remote IT support and solution. The solution provides enhanced protection and security against firmware-level attacks. Slack and Atlassian strengthened their alliance with app integrations and an account ‘passport’ in a joint go-to-market move, to reduce the time spent logging into separate services and products. This will enable both vendors to focus on their strengths in remote working tools and provide seamless services to their customers.

Tech companies have also announced product enhancements and new capabilities. CBTS has evolved their cloud-based unified communications, collaboration and networking solutions, with an AI-powered Secure Remote Collaboration solution, powered by Cisco Webex. With seamless integration of Cisco Webex software, Cisco Security software, and endpoints that combine high-definition cameras, microphones, and speakers, with automatic noise reduction, the solution now offers features such real-time transcription, closed captioning, and recording for post-meeting transcripts.

Communication and Collaboration tools have been in the limelight since the start of the crisis with providers such as Zoom, Microsoft Teams and Slack introducing new features throughout. In August Microsoft enhanced the capabilities of Teams and introduced a range of new features to the Teams Business Communications System. It now offers the option to host calls of up to 20,000 participants with a limit to 1,000 for interactive meetings, after which the call automatically shifts to a “view only” mode. With the possibility of remote working becoming a reality even after the crisis is over, Microsoft is looking to make Teams relevant for a range of meeting needs – from one-on-one meetings up to large events and conferences. In the near future, the solution will also allow organisations to add corporate branding, starting with branded meeting lobbies, followed by branded meeting experiences.

While many of these solutions are aimed at large enterprises, tech providers are also aware that they are now receiving a lot of business from small and medium enterprises (SMEs), struggling to make changes to their technology environment with limited resources. Juniper has expanded their WiFi 6 access points to include 4 new access points aimed at outdoor environments, SMEs, retail sites, K-12 schools, medical clinics and even the individual remote worker. While WiFi 6 is designed for high-density public or private environments, it is also designed for IoT deployments and in workplaces that use videoconferencing and other applications that require high bandwidth.

#3 The Future of Work is driving up hardware sales

Ecosystm research shows that at the start of the crisis, 76% of organisations increased investments in hardware – including PCs, devices, headsets, and conferencing units – and 67% of organisations expect their hardware spending to go up in 2020-21. Remote working remains a reality across enterprises. Despite the huge increase in demand, it became difficult for hardware providers to fulfil orders initially, with a disrupted supply chain, store closures and a rapid shift to eCommerce channels. This quarter has seen a steady rise in hardware sales, as providers overcome some of their initial challenges.

Apart from enterprise sales, there has been a surge in the consumer demand for PCs and devices. While remote working is a key contributor, online education and entertainment are mostly prompting homebound people to invest more in hardware. Even accessories such as joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft Flight Simulator launch earlier this month.

The demand for both iPad and Mac saw double-digit growth in this quarter. Around half of the customers purchasing these devices were new to the product. Apple sees the rise in demand from remote workers and students. Lenovo reported a 31% increase in Q1 net profits with demand surges in China, Europe, the Middle East and Africa.

#4 The impact on Real Estate is beginning to show

The demand for prime real estate has been hit by remote working and organisations not renewing leases or downsizing – both because most employees are working remotely and because of operational cost optimisation during the crisis. This is going to have a longer-term impact on the market, as organisations re-evaluate their need for physical office space. Some organisations will reduce office space, and many will re-design their offices to cater to virtual interactions (Figure 1). While now, Ecosystm research shows that only 16% of enterprises are expecting a reduction of commercial space, this might well change over the months to come. Organisations might even feel the need to have multiple offices in suburbs to make it convenient for their hybrid workers to commute to work on the days they have to. Amazon is offering employees additional choices for smaller offices outside the city of Seattle.

But the Future of Work and the rise of a distributed workforce is beginning to show an initial impact on the real estate industry. Last week saw Pinterest cancel a large office lease at a building to be constructed near its headquarters in San Francisco. The company felt that it might not be the right time to go ahead with the deal, as they are re-evaluating where employees would like to work from in the future. Even the termination fees of USD 89.5 million did not discourage them. They will continue to maintain their existing work premises but do not see feel that it is the right time to make additional real estate investments, as they re-evaluate where employees would like to work from in the future.

There is a need for organisations to prepare themselves for the Future of Work – now! Ecosystm has launched a new 360o Future of Work practice, leveraging real-time market data from our platform combined with insights from our industry practitioners and experienced analysts, to guide organisations as they shift and define their new workplace strategies.

Apple and Intel have signed an agreement where Apple will acquire Intel’s smartphone modem business for a deal valued at $1 billion. Apple will gain Intel’s Intellectual Property, equipment, leases, and approximately 2200 Intel employees will join Apple.

The deal is Apple’s second-largest ever after its $3.2bn purchase of Beats Electronics in 2014. The deal is expected to close at the end of the year and Intel will continue to develop modems for non-smartphone applications such as industrial equipment, autonomous vehicles and personal computers.

What Apple has really acquired from Intel?

Beyond getting 2,200 employees from Intel’s modem group along with the accompanying 17,000 patents, Apple now has the intellectual property to develop a modem that can be integrated with Apple (system-on-a-chip) or SOC.

Commenting on Apple’s acquisition of Intel modem business, Ecosystm Executive Analyst, Vernon Turner said “given its performance-driven and highly vertically integrated product line, Apple had its own ambitions to build its own modem. However, despite being capable of building chips, Apple lacked the knowledge to build a modem. To solve that issue, it would always have had to license patents from a 3rd party, unless they buy the company that has the patents instead.”

Aligning with the fifth generation

The acquisition of Intel modem business displays Apple’s ambition to ramp up on 5G technology. The foothold in the 5G modem business is also expected to reduce Apple’s reliance on Qualcomm, its modem supplier. Speaking of the competition, Apple’s global rivals in the handset business – Samsung Electronics and Huawei – already produce their own modem chips.

“Apple has a lot of catching up to Samsung and Huawei in the 5G modem market, and while it has now gained technology from Intel, there is still a significant gap and it will be a haul for Apple to suddenly catch up and overtake them,” said Turner. “Apple’s modem supplier, Qualcomm isn’t likely to be worried by this news either – it too has a lead of several years. The bottom line is that Apple didn’t have a lot of options to turn too if it wanted to be in control of as much of the phone IP stack as possible. It purchased a modem supplier that was perhaps the weakest in the market and had already thrown in the towel on their mobile modem business.”

Apple will take some time to absorb the Intel team into its business and likewise with the modem roadmap. The deal is a step in Apple’s journey to make all of its own smartphone chips and having a more self-sufficient supply chain.