Over the past 3-4 weeks I have spent some time using Samsung DeX (shortened from “Desktop eXperience”) as my primary desktop environment. DeX has been around for a number of years, and I have dabbled with it from time-to-time – but I have never really taken it seriously. My (incorrect!) opinion was that a mobile chipset isn’t powerful enough for a PC-like experience. But for most of the last year, I have been using a Samsung Galaxy Book S laptop as my primary computing device – and this Windows 10 laptop runs an ARM processor which is the very same processor that powers many Samsung and other Android phones. Microsoft also has an ARM-based PC that I have used successfully (the Surface Pro X) which prompted me to rethink the opportunities for DeX. A number of clients also asked for my thoughts on DeX so I figured it is time to take it seriously as a potential end-user computing environment.

This Ecosystm Insight is a summary of the client report and is the first of a few Insights into DeX. In future, I plan to trial the dual-monitor ability for DeX (developed by VoIP – an Australian ICT consultancy). These Ecosystm Insights won’t cover how to use Samsung DeX. If you are looking for this information, Gizmodo has published a good piece here.

The Trial

In trialling Samsung DeX I attempted to cover all usage scenarios, including:

- Native DeX with the phone connected to a DeX station and both wired and wireless keyboard/mouse, using both wi-fi and 4G (I live literally 50 metres outside of 5G coverage!)

- DeX through Windows 10 using both wi-fi and 4G and a wired mouse and keyboard

- Native DeX connected to a monitor using the Microsoft wireless display adapter (again using both wi-fi and 4G)

In the native DeX environment I worked in the traditional Microsoft productivity apps, collaboration apps (such as Teams, Zoom, Webex, Google Meet), Google productivity apps, web applications (sales, CRM & ERP), file sharing applications (OneDrive, Google Drive), imaging applications (photos, video, image sharing), social applications (Twitter, LinkedIn, Facebook, Instagram etc) and other native Android apps – some of which were optimised for DeX, and some of which were not. I tried to imitate the information worker’s experience; and that of a site or specialist user. I used it as a primary computing environment for most of my work for 3-4 weeks. I didn’t just consume content, but also created content – I needed to be able to sign and attach Adobe documents, create new reports, conduct deep data analysis in Excel and create figures and move them between Excel, Word and PowerPoint. I created and shared leads in CRM systems, did company accounting in a financial application and even had some time to try out some gaming applications.

I have also trialled a Citrix and Amazon virtual desktop in all environments – running productivity applications, finance applications, graphics intensive applications and web apps.

Findings

My broad finding is that DeX is not a desktop replacement for power users – but there are plenty of roles within your business who would find that DeX is a capable environment that will allow them to get their job done.

I was planning to discuss the positive features of DeX, but the reality is that it is simpler to understand its limitations. And, most limitations are related to the Android applications or network lag introduced in virtual desktop environments using 4G.

- The Microsoft productivity applications in Android are all scaled back versions of the desktop applications. They do not contain many of the features and functions that the desktop versions have. For example, when I needed to format headings in a report, the fast format options (e.g. to make text a “heading 2”) don’t exist in the Android version of Microsoft Word. Power users will find these applications don’t deliver all of the functions they need to get their job done.

- Those who need broader functionality beyond the Android applications will benefit from a virtual desktop environment. Both Citrix Workspace and Amazon Workspaces delivered a very usable Windows 10 experience (although I found the base configuration to be a little slow). For existing users of virtual desktops, it is a no-brainer to roll them out to mobile devices if required. But would you add a virtual desktop environment to your existing desktop fleet just to enable DeX? I can’t answer that – as it is another environment to manage and support for your end-user computing and IT support teams. But again, for power users, this is not an ideal environment. It does EVERYTHING you want it to do – but it might not do it fast enough to satisfy all users.

- It’s not a mobile environment. This isn’t something you use on your phone (although I believe you can use it on some Samsung tablets). You need a monitor, keyboard, and ideally a separate mouse for DeX to work. It doesn’t replace a laptop for a mobile worker.

- DeX does not natively support dual screens or monitors. I found that I would switch back to my PC when I needed the productivity of two screens, as I personally find application switching on a single screen to be a productivity killer. BUT – this is changing – VoIP has developed a capability to run DeX across dual monitors (I will be testing this shortly and will post the results).

- When using DeX natively and not using a virtual desktop, the screen sharing features of collaboration apps don’t work in the way you expect. The screen that is shared is NOT the DeX desktop screen but the horizontal mobile phone screen. This is a significant issue if you want to share a Word, PowerPoint, or Excel file or another “full desktop screen” application. DeX users can view other people’s shared screens, but not share the screen effectively themselves.

- DeX introduces a new environment for your helpdesk to support. DeX isn’t Windows, it isn’t cloud, and it isn’t exactly native Android. Your tech support team will need to be trained on DeX and be required to learn a new user environment. It introduces an additional OS into the mix. That means at least some service desk technicians will need to be trained on the environment. As it is still running in Android, it doesn’t particularly require specific QA or testing for your business mobile applications. But to take full advantage of the larger screen real estate that DeX facilitates, you may need to make some changes to how applications perform in DeX.

Despite these challenges, DeX is a very capable environment. Running a virtual desktop was a breeze and performed far better than I would have imagined. I was worried about lag and had introduced many opportunities for it to run slowly – a wireless mouse and keyboard, wireless display adapter, running over wi-fi, and 4G using a virtual desktop in the cloud – and the lag was barely noticeable. I was impressed with this and understand how DeX could even be used to support legacy applications and environments too.

The convenience of having your phone at your fingertips – being able to respond to text messages on the large screen, taking calls using the same Bluetooth headphones that you use to watch video content on the larger screen, not to mention the security of taking your “PC” with you in your pocket when you head out to lunch or home for the day – adds to the value of DeX. The concept of a “PC in your pocket” has been around for a while – however most Samsung mobile users don’t realise that they have one there already!

Target Roles

Who are the business roles or personas who could benefit from it? The simple answer is that anyone who uses a desktop part-time would benefit from DeX. Many businesses have shared PCs for multiple users or dedicated PCs for users who don’t use a PC full-time. These might be site managers in constriction, store managers in retail, nurses, security staff, librarians, government or council workers. The significant factors that define potential DeX users are:

- They spend a fair amount of time away from a PC

- They still need a PC for reporting, document sharing, content creation etc

- They return to a fixed site regularly (like a store, office, site office etc)

Again, it is worth noting that DeX doesn’t replace a laptop or tablet. It is not for mobile computing – it replicates fixed computing environments in a more mobile and potentially cost-effective form factor. Remember that the employees need a screen, mouse, and keyboard (you can use the phone as a mouse, but it is not ideal). They also need the charging cable to connect to the computer. If they are making regular video calls then I suggest a phone holder that allows the charging cable to stay connected and the phone to be angled so as others can see their face (wireless chargers tend to sit too far back).

And while DeX is a secure solution, and can benefit from Samsung’s Knox security platform and capabilities, pairing DeX with a secure branch of one style solution – such as that offered by Asavie, now a part of Akamai – has the ability to add end-to-end security and secure application/data access that your employees desire and your business needs.

The opportunities for DeX outweigh the challenges. I am certain that most businesses have potential DeX users – employees who reluctantly carry around a laptop, or who have to come back to a location for their computing. They might be employees who use their phones for image capture and spend much of their time transferring photos to a PC to store them into a corporate system (such as an OH&S team member, or a repair and maintenance provider for a company). It could be a brand salesperson who spends time in various retailers or on the road but still need computing for product training, entering sales figures, and other administrative tasks.

If your business already offers Samsung devices to your employees, switching on DeX is a no-brainer. Start with a trial in a limited employee pool to determine the specific challenges and opportunities within your business. If you are already using virtual desktops, then this is the easiest way to start – roll out the app to your Samsung mobile devices and you have a ready-made portable computer in your employees’ pockets.

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

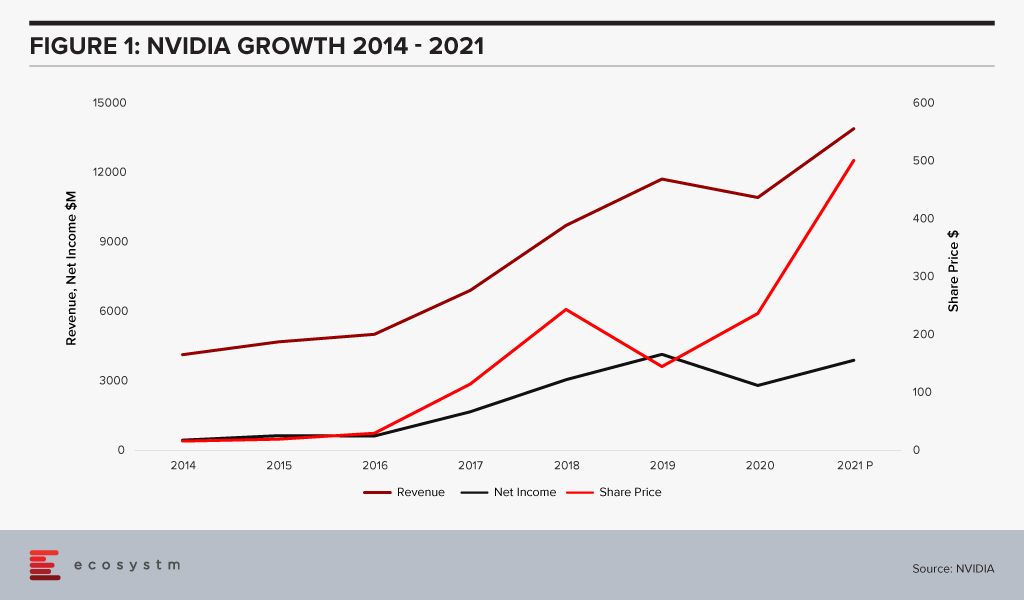

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

Vodafone and Arm announced a strategic agreement at MWC19 to work on simplifying IoT services and reduce the costs confronted by the organisations on the implementation of IoT.

The Vodafone-Arm agreement expands on the previous collaboration which was on integrated SIM (iSIM) technology, a system on chip(SOC) design which can be reprogrammed with respect to the requirements. The iSIM allows customers to remotely provision and manage IoT devices across the globe which proposes reduced complexities and offers significant cost reduction.

To carry on the existing relationships this agreement is expected to bring Vodafone’s IoT global platform and Arm’s IoT software services to offer organisations a world of connected systems. This characterises a major initiative enabling a wide ecosystem of manufacturers to tap into the potential of trillions of connected devices.

Speaking on the subject, Ecosystm’s Executive Analyst, Vernon Turner thinks that “this announcement will help customers who look to and need a cellular-based IoT solution. Traditionally, mobile devices require a physical process to change their SIM (Subscriber Identity Module) card when there is a change of ownership or carrier, but in a world of trillions of connected devices, this is just not practical.”

Arm’s announcement of its iSIM is the latest in a series of announcements to resolve the size, cost, and scalability of SIM cards. SIM cards are critical for secure identity so the challenge has been to create a cost-effective IoT System On Chip (SOC) that has the SIM function embedded on it. Through its Kigen product family, Arm’s tech buyers will be able to build solutions on the latest cellular standards and specification suitable to run on 5G and backward compatible networks.

Vodafone’s customers will now be able to create a cellular-based IoT solution that can be continuously connected and deployed globally, giving them better investment protection and reduced operational costs. In addition, customers will have the choice of managing these devices through a ‘single pane of glass’ on either Vodafone’s IoT platform or Arm’s Pelion IoT Platform.

“Any time complexity is removed from an IT or mobile solution, customers respond by deploying and using that solution more” says Vernon. “ SoC-based solutions tend to have more functionality that allows for innovation, so we should expect to see an uptick in cellular-based IoT deployments”