Any new technology that changes our businesses or society for the better often has a potential dark side that is viewed with suspicion and mistrust. The media, especially on the Internet, is eager to prey on our fears and invoke a dystopian future where technology has gotten out of control or is used for nefarious purposes. For examples of how technology can be used in an unexpected and unethical manner, one can look at science fiction movies, Artificial Intelligence (AI) vs AI chatbots conversations, autonomous killer robots, facial recognition for mass surveillance or the writings of Sci-Fi authors such as Isaac Asimov and Iain M. Banks that portrays a grim use of technology.

This situation is only exacerbated by social media and the prevalence of “fake news” that can quickly propagate incorrect, unscientific or unsubstantiated rumours.

As AI is evolving, it is raising some new ethical and legal questions. AI works by analysing data that is fed into it and draws conclusions based on what it has learned or been trained to do. Though it has many benefits, it may pose a threat to humans, data privacy, and the potential outcomes of the decisions. To curb the chances of such outcomes, organisations and policymakers are crafting recommendations about ensuring the responsible and ethical use of AI. In addition, governments are also taking initiatives to take it a step further and working on the development of principles, drafting laws and regulations. Tech developers are also trying to self-regulate their AI capabilities.

Amit Gupta, CEO, Ecosystm interviewed Matt Pollins, Partner of renowned law firm CMS where they discussed the implementation of regulations for AI.

To maximise the benefits of science and technology for the society, in May 2019, World Economic Forum (WEF) – an independent international organisation for Public-Private Cooperation – announced the formation of six separate fourth industrial revolution councils in San Francisco.

The goal of the councils is to work on a global level around new technology policy guidance, best policy practices, strategic guidelines and to help regulate technology under six domains – AI, precision medicine, autonomous driving, mobility, IoT, and blockchain. There is participation of over 200 industry leaders from organisations such as Microsoft, Qualcomm, Uber, Dana-Farber, European Union, Chinese Academy of Medical Sciences and the World Bank, to address the concerns around absence of clear unified guidelines.

Similarly, the Organization for Economic Co-operation and Development (OECD) created a global reference point for AI adoption principles and recommendations for governments of countries across the world. The OECD AI principles are called “values-based principles,” and are clearly envisioned to endorse AI “that is innovative and trustworthy and that respects human rights and democratic values.”

Likewise, in April, the European Union published a set of guidelines on how companies and governments should develop ethical applications of AI to address the issues that might affect society as we integrate AI into sectors like healthcare, education, and consumer technology.

The Personal Data Protection Commission (PDPC) in Singapore presented the first edition of a Proposed Model AI Governance Framework (Model Framework) – an accountability-based framework to help chart the language and frame the discussions around harnessing AI in a responsible way. We can several organisations coming forward on AI governance. As examples, NEC released the “NEC Group AI and Human Rights Principles“, Google has created AI rules and objectives, and the Partnership on AI was established to study and plan best practices on AI technologies.

What could be the real-world challenges around the ethical use of AI?

Progress in the adoption of AI has shown some incredible cases benefitting various industries – commerce, transportation, healthcare, agriculture, education – and offering efficiency and savings. However, AI developments are also anticipated to disrupt several legal frameworks owing to the concerns of AI implementation in high-risk areas. The challenge today is that several AI applications have been used by consumers or organisations only for them to later realise that the project was not ethically fit. An example is the development of a fully autonomous AI-controlled weapon system which is drawing criticism from various nations across the globe and the UN itself.

“Before an organisation embarks on the project, it is vital for a regulation to be in place right from the beginning of the project. This enables the vendor and the organisation to reach a common goal and understanding of what is ethical and right. With such practices in place bias, breach of confidentiality and ethics can be avoided” says Ecosystm Analyst, Audrey William. “Apart from working with the AI vendor and a service provider or systems integrator, it is highly recommended that the organisation consult a specialist such as Foundation for Responsible Robotics, Data & Society, AI Ethics Lab that help look into the parameters of ethics and bias before the project deployment.”

Another challenge arises from a data protection perspective because AI models are fed with data sets for their training and learning. This data is often obtained from usage history and data tracking that may compromise an individual’s identity. The use of this information may lead to a breach of user rights and privacy which may leave an organisation facing consequences around legal prosecutions, governance, and ethics.

One other area that is not looked into is racial and gender bias. Phone manufacturers have been criticised in the past on matters of racial and gender bias, when the least errors in identification occur with light-skinned males. This opened conversations on how the technology works on people of different races and genders.

San Francisco recently banned the use of facial recognition by the police and other agencies, proposing that the technology may pose a serious threat to civil liberties. “Implementing AI technologies such as facial recognition solution means organisations have to ensure that there are no racial bias and discrimination issues. Any inaccuracy or glitches in the data may tend to make the machines untrustworthy” says William.

Given what we know about existing AI systems, we should be very concerned that the possibilities of technology breaching humanitarian laws, are more likely than not.

Could strong governance restrict the development and implementation of AI?

The disruptive potential of AI poses looming risks around ethics, transparency, and security, hence the need for greater governance. AI will be used safely only once governance and policies have been framed, mandating its use.

William thinks that, “AI deployments have positive implications on creating better applications in health, autonomous driving, smart cities, and a eventually a better society. Worrying too much about regulations will impede the development of AI. A fine line has to be drawn between the development of AI and ensuring that the development does not cross the boundaries of ethics, transparency, and fairness.”

While AI as a technology has a way to go before it matures, at the moment it is the responsibility of both organisations and governments to strike a balance between technology development and use, and regulations and frameworks in the best interest of citizens and civil liberties.

Singapore is encouraging the adoption of technology in the legal sector for higher efficiencies. In May, the Ministry of Law (MinLaw), Enterprise Singapore, the Infocomm Media Development Authority (IMDA) and the Law Society of Singapore (LawSoc) announced the launch of a new SmartLaw Guild to encourage law firms to adopt technology.

The SmartLaw Guild brings together case studies from the legal industry and organises knowledge sharing sessions. Speaking at the launch of SmartLaw Guild, Communications and Information Minister S Iswaran, said that the majority of legal practices in Singapore are catered to the SME sector given that 90% of organisations in Singapore fall under the category. The Government is making an effort in the evolution of technology to support the SME legal practices. Mr. Iswaran also encouraged practicing lawyers to take advantage of the skills training provided by the IMDA’s Techskills Accelerator initiative in areas such as cybersecurity, AI and data science.

Why have Law Firms been Slow in Tech Uptake?

A LawSoc survey held in 2018 showed that the adoption of technology helps in the delivery of legal services but only an estimated 12% of law firms in Singapore appears to have adopted digital technology till date. Hence, to encourage digitalisation of the legal industry, legal firms in Singapore will benefit from the SGD 3.68 million fund that has been set aside, to provide them with funding support for adopting technology solutions.

Commenting on the announcement, Ecosystm VP & General Counsel, Nandini Navale said “Across jurisdictions, law firms are bound to licensing and regulatory conditions and have to follow strict standards of professional ethics, confidentiality, and care to clients. This could be a possible reason for their ‘abundantly cautious’ approach towards the adoption of new technology and digitalisation. A glitch or even a minor fault in the technology could result in the loss of license to practise, breach of regulatory obligations, reputational damage or can compromise the interest/privacy of clients. Therefore, AI and technology in systems and processes will have to be proven reliable and fail-safe as a condition for the implementation in the legal sector.”

Law has been a conservative industry. This is fast changing, however with the “BigLaw” in countries investing heavily in technology and looking to implement AI to help their legal staff perform due diligence and research, provide additional legal insights and in process automation in legal work.

Advanced technology solutions powered by AI are enhancing business capabilities and the adoption of AI in the legal industry can help in a quicker resolution of disputes and more consistent outcomes. “AI is capable of transforming the legal sector. The technology could be used to sift through volumes of case law and litigation history, and help lawyers to interpret, prepare and support their positions. Legal issues spotters are being utilised in the contract due diligence and review, legal-tech being deployed for routine and low-value work. Applications for time trackers, billing and invoicing, and legal data analytics are also being adopted” says Navale “The Singapore Government is indeed walking the talk – an example of this is the introduction of the Venture Capital Investment Model Agreements (VIMA) documentation.” The initiative was launched in 2018 by the Singapore Academy of Law (SAL) and the Singapore Venture Capital & Private Equity Association (SVCA) which comprises a set of standard documents that improve the process of structuring a deal and transactions for venture capital firms, start-ups, and SMEs. The core working group for the initiative adopted technology and created a questionnaire that guides through the documentation with auto-versioning and customisation to save time, cost and effort.

How have some Disruptive Technologies Impacted the Legal Industry?

Amit Gupta, CEO, Ecosystm interviewed Matt Pollins, Partner of renowned law firm CMS where they discussed the legal implications of AI as well as the uptake of new technologies in the legal industry.

What do you think are the implications of technology adoption in the legal industry?

Let us know in your comments below.

I was invited recently by NEC to attend their briefing where Walter Lee, their Evangelist and Government Relations Leader presented to analysts and journalists about how they are winning large contracts across various sectors in the areas of biometrics and surveillance. Biometrics is not just used as a way to drive greater security, but is also helping increase speed in processing times, reducing waiting period in queues and used as a way to drive efficiency and reduce costs which was highlighted by Lee through the various projects NEC had won recently.

NEC’s Artificial intelligence (AI) engine, NeoFace’s strength lies in its tolerance of poor-quality images. The NeoFace solution can match images with low resolutions down to 24 pixels between the eyes and this has allowed it to demonstrate the matching accuracy which is hard to achieve for most vendors offering Facial Recognition solutions. It is its ability to work across various challenges around low resolution, light and images that has allowed NEC to be one of the leading suppliers of Facial Recognition solutions globally.

Key Case Studies Presented

In 2018 Delta Airlines launched the first ‘biometric terminal’ in the US at the international terminal in Atlanta’s Hartsfield-Jackson airport. The biometric push according to Lee replaces tickets and customers now check in by using their face. The system recognises their face and they are checked in. Customers no longer need to use their passports to get through checkpoints around the airport. Lee emphasised on how it takes 9 minutes to board an international flight. Apart from driving identification and security, this use case highlights how airports around the world can increase efficiency in their overall check in and boarding processes at airports. Other core benefits derived from this implementation include better security for border control, seamless service, speed of boarding (savings of 9 minutes per flight). Privacy issues were addressed with regards to where the data was residing and how long the data would be kept for and in this case the data was kept for only 24 hours.

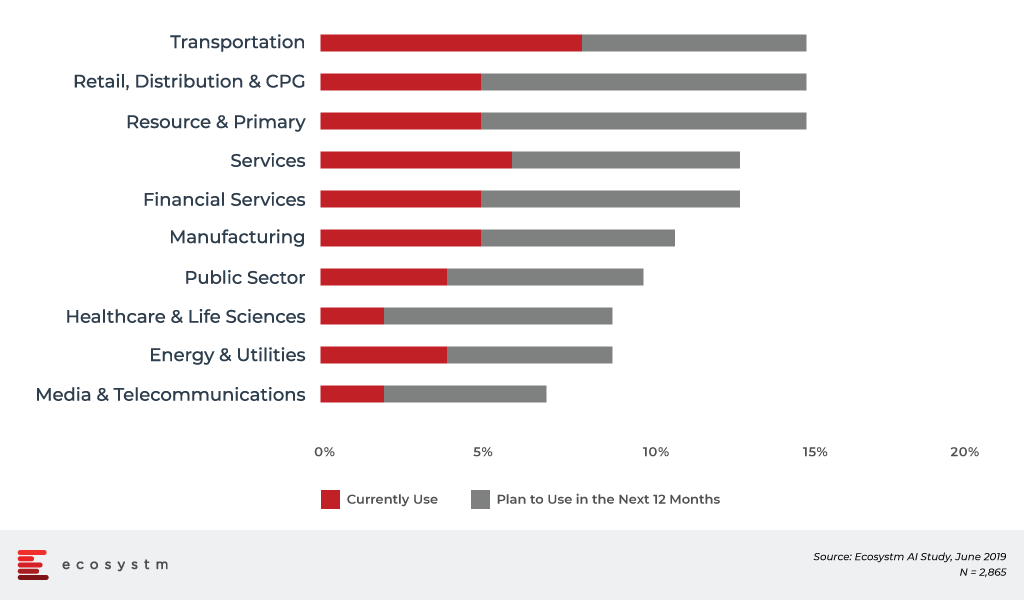

According to the global Ecosystm AI study of current and planned Facial Recognition adoption by industry, the transportation industry is leading the number of deployments globally.

Adoption of Facial Recognition by Industries

Another case study presented is the upcoming 2020 Summer Olympic and Paralympic Games in Tokyo., for which NEC will provide the Facial Recognition solution. The solution will be used to identify over 300,000 people at the games including athletes and officials. It is the first time that Facial Recognition technology will be used for this purpose at an Olympic Games. The NEC solution will allow the matching of tens of thousands of faces in a nano second according to Lee.

The Tokyo 2020 implementation will involve linking photo data with an IC card to be carried by accredited people. NEC says that it has the world’s leading face recognition tech based on benchmark tests from the US’s National Institute of Standards and Technology (NIST).

Ecosystm Comment.

NEC has years of experience in biometrics and Facial Recognition. Not many vendors have solutions that can capture vast amounts of images in a nano second. Their solutions are used by some of the largest organisations in the world. NEC has also perfected the art of handling low resolution images which if not analysed accurately can lead to unintended consequences. The ability to process low resolution images with speed and accuracy is not something that is easily achievable. Security and the rise of terrorism are some of the needs as to why Facial Recognition is important. Additionally, speed and efficiency in administrating passenger boarding at airports whilst ensuring that the security and identity checks have been made is important. The Delta Airlines case study is a great example of how there can be a savings of 9 minutes per flight. NEC continues to gain traction in the market and the Ecosystm AI study has them as one of the top vendors being evaluated for planned implementations for Facial Recognition globally.

The benefits of Facial Recognition solutions are huge – however there must be greater scrutiny around the possible outcomes of AI. Whilst regulation on AI is still at its infancy, 2019 and 2020 will see greater scrutiny and regulation around AI implementations. These will be directed towards protecting individual’s data but also there will be greater emphasis on addressing issues around privacy, ethics and bias in AI implementations. Feeding the machine with the right data (unbiased and ethical) and measuring the various outcomes before the project goes live must be looked at with greater diligence.

2 weeks ago, San Francisco became the first US city to ban the use of Facial Recognition technology by the police and local government agencies. One of the reasons for the ban was with regard to bias. When designing the systems, if technology specialists feed the wrong information for example recognising only a certain skin colour, then the problem of making the wrong and unwanted assumptions start arising. The ecosystem of players in the AI industry ranging from government, academia right down to vendors have a greater role to play in ensuring ethics and bias issues are addressed from the onset of the project. There are consultants in the market as I highlighted in my recent Ecosystm report, that prepare companies for the impact of ethics, fairness and bias. We can expect more of such consultancies and specialist agencies to grow in the market.

NEC has taken this into consideration and published a set of principles for the application of biometrics and AI. The “NEC Group AI and Human Rights Principles” will guide the company along the lines of privacy and human rights. These initiatives were led by the Digital Trust Business Strategy Division, in collaboration with several other divisions within the company, as well as industry stakeholders including industry experts and non-profit organisations.

This is an abstract of my presentation in Dubai on 23rd April 2019. I want to convey my special thanks to Dr. Eesa Bastaki, President of the University of Dubai for inviting me on the occasion. It was a magnificent experience delivering at such a great University.

In the year 2016, I considered Rio as the first Internet of Things (IoT) Olympic games in my article “The future of “The Internet of Olympic Games”. In Rio, we saw how athletes, coaches, judges, fans, stadiums, and cities benefited from IoT technology and solutions which transformed the way we see and experience sports. Next year we will have another opportunity to validate my predictions for the upcoming Tokyo 2020 Summer Olympics. Therefore, we may designate Tokyo as the first Artificial Intelligent (AI) Olympic Games.

During my presentation at the University of Dubai, I explained to the audience how incredible IoT and AI technologies are and to what extent they are impacting our sports experience. I elaborated on IoT and AI’s significant role in health management, improving aptitude, coaching, and training. These technologies are enabling athletes to improve performance, coaching for better preparation, fewer judgment errors, and a better experience for spectators. I also commented on the importance of IoT and AI to enhance the security of teams, audience, stadium, and cities altogether.

With the use of IoT and AI we are creating a world of smart things transforming sports business where every thousandth part of a second is crucial to predict the outcomes of a race, a match or a bet. I cited various examples on how different sports are utilising IoT and AI, and not in the least I shared a vision of the future that’s like 10-15 years onwards from the present – Can you envision a world of a real and virtual world of sports integrated together? Can you visualise robots and humans or super-humans playing together?

On the other side, speaking of the challenges involved with AI, IoT, and machine learning models for sporting, I conveyed the dark side of these technologies. We cannot forget the fact that the sports industry is a market and therefore enterprises, Governments, and individuals may make erroneous uses of these technologies.

In summary, it in this session I shared my point of view on-

- How IoT and AI will transform coaches, athletes, judges, and fans.

- How IoT and AI will attract the audience to the stadiums

- How IoT and AI will transform the Industry?

- How AI is changing the future of sports betting?

How IoT and AI will transform athletes, coaches, judges and fans?

Athletes

While the true essence of a sport still lies in the talent and perseverance of athletes, it is often no longer enough. Therefore, athletes will continue to demand increasingly sophisticated technologies and cutting-edge training techniques to improve performance. For example, we may see biomechanical machine learning models of players to predict and prevent potential career-threatening physical and mental injuries or can even detect early signs of fatigue or stress-induced injuries. It can also be used to estimate players’ market values to make the right offers while acquiring new talent.

Coaches

Coaches are consuming AI to identify patterns in opponents’ tactics, strengths and weaknesses while preparing for games. This helps coaches to devise detailed game plans based on their assessment of the opposition and maximise the likelihood of victory. In many leading teams, AI systems are used to constantly analyse the stream of data collected by wearables to identify the signs that are indicative of players developing musculoskeletal or cardiovascular problems. This will enable teams to maintain their most valuable assets in prime condition through long competitive seasons.

Judges

We tend to think that technology is helping us to make decisions in sports more accurate and justified. That´s why we look at the inventions such as from Paul Hawkins – creator of Hawk-Eye, a technology that is now an integral part of the spectator’s experience when watching sport live or more recently VAR in soccer.

The use of technology is allowing the decision makers to experience the game with multiple cameras angles in real-time combined with the aggregated data from various sensors (stadiums, things, and athletes) thus making them make more objective and accurate decisions.

We as spectators or fans need more transparency about the exercise’s difficulty, degree of compliance and final score. And we have the technology to do it.

The IoT and AI technology don’t claim to be infallible – just very, very reliable and judges also need to be adapted to new technologies.

Fans

Without fans, sports would find it difficult to exist. It is understandable companies are also targeting fans with IoT and AI to keep them engaged whether in the stadium or at home.

How IoT and AI will attract the audience to the stadiums?

The stadiums, sports clubs and many leagues across the globe are incorporating technologies both inside and outside the stadium areas to boost the unique experiences for fans and not only during the gameplay.

The challenge is how to combine the latest technologies with old-school stuff to please supporters from both newer and older gen. people looking forward to witnessing a game in a stadium?

How will the stadiums of the future be? I read numerous initiatives of big clubs and leagues, but I am excited about the future stadium of Real Madrid. I wish the club would allow me to advise them how to create a smart intelligent Global environment to provide each fan with an individual experience, know who is in the crowd, learn fan behaviors to anticipate their needs.

How IoT and AI will transform the Industry?

“As long as sports remain a fascination for the masses, businesses will always have the opportunity to profit from it. As long as there is profiting to be gained from the world of sports, the investment in and incorporation of technology for sports will continue.”

I went through an article warning about an entirely new world order that is being formed right now. The author explained how 9 companies are responsible for the future of AI. Three of the companies are Chinese (Baidu, Alibaba, and Tencent, often collectively referred to as BAT), while the other six are American (Google, Amazon, IBM, Facebook, Apple, and Microsoft, often referred as the G.Mafia). The reason is obvious, as far as AI is about optimisation using the data that’s available, these 9 companies will manage most of the sports data generated in the world.

Collaboration is needed now to stop this threat and to address the democratisation of AI in sports. It is important that companies and Governments around the globe work together to create guiding principles for the development and use of AI and not only in Sports. This means we need regulations but in a different way. We do not want AI power to lie only in a handful of lawmakers, renowned and smart people who lack skills in IoT and AI.

Will AI change the future of sports betting?

The impact of technology on sports cannot be specifically measured, but some technological innovations do raise questions about fairness. Are we still comparing apples with apples? Is it right to compare the speed of an athlete wearing high-tech running shoes to one without?

Whether we like it or not, technology will continue to enhance the athlete’s performance. And at some point, we will have to put specific rules and regulations in place about which tech enhancements are allowed.

There is a downside to advanced technology being introduced to sports. Nowadays, Machine Learning models are routinely used to predict the results of games. Sports betting is a competitive world itself among fans, but AI can substantially tilt that playing field.

I am afraid that IoT and AI companies may spoil the result predictions but more concerned about the manipulation of competitiveness that AI algorithms could bring with the Terabytes of data collected with IoT devices and other sources like social media networks, without the permission of the users.

The sports industry is already generating billions of dollars every year and without control and awareness, we could find the future generation of ludopaths and a small number of service providers controlling the game.

Let me know what else would you like to see in my future posts. Leave your comments below.

I ran several roundtables over the past few weeks speaking to business and technology leaders about their AI investments – and one factor came up many times – that it is hard to build a business case for AI because 70% accuracy was not good enough…

What this means is that companies have thousands of things to automate. Most of those automations in the short-medium term will deliver 100% accuracy using RPA and other simple automation tools. Every time you run that process you know the outcome.

Along Comes AI and Machine Learning

These dumb processes can now learn – they can be smart. But originally they won’t deliver 100% accuracy. They might only deliver 60-70% to start with – climbing perhaps to 90%. The benefits of these smart, learning processes can amaze – costs can fall, processes can improve, outcomes can accelerate. But traditionally we have built technology business cases delivering 100% accuracy and outcomes.

So we need a new way to think about AI and a different language to use about the way it works. The people who sign off on the business cases might not understand AI – they will come to the business case with the same lens they use for all technology investments (and evidently – all business investments). We also need to be better at selling the benefits to our leaders. CEOs and Managing Directors in the roundtables are surprised to hear that AI won’t deliver 100% accuracy – they said unless they know more about the capability, savings and outcomes that the solution might drive, they are unlikely to fund it.

Make Your Dumb Processes Smart

I take this as good news. It means we have moved beyond the hype of AI – the need to “do AI in our business” that drove many of the poorer chatbots and machine learning projects. It means that businesses review AI investments in the same way as any business investment. But it also means we can’t over-promise or under-deliver on AI. Woodside did this with their initial foray into AI, and they are still playing catch up today.

While there are many opportunities to use “dumb automation” and save money, reduce or redeploy headcount – or have employees focus on higher value activities or make real differences to customer experiences – there are as many opportunities to make dumb processes smart. Being able to automatically read PDF or paper-based invoices – processes usually done by humans – could be a huge saving for your business. OK – maybe you can’t redeploy 100% of the staff, but 70% is still a big saving. Being able to take human error out of processes will often help to save money at two steps on the process – automating the human input function up front and also getting rid of the need to fix the mistake.

Start Your AI Journey With The Low Hanging Fruit

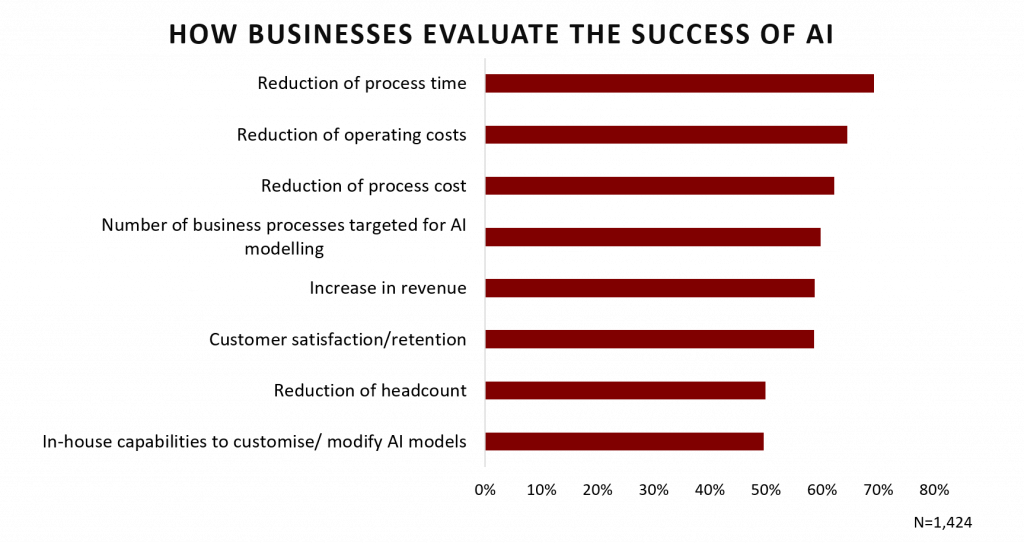

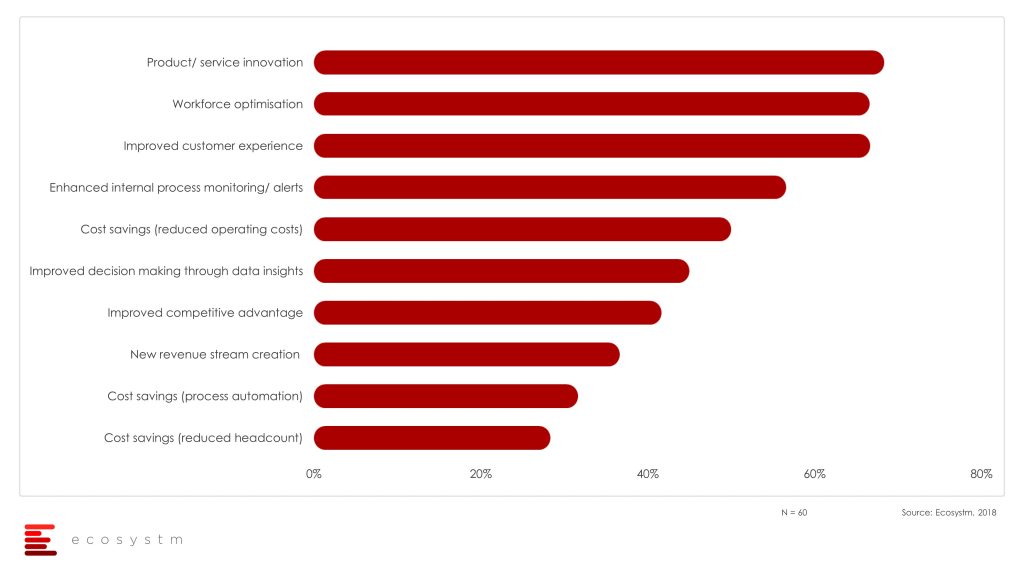

Ecosystm’s Global Ongoing AI study has shown that most businesses are focusing their AI investments on internal initiatives – on reducing process time, cost savings and driving productivity – which makes the most sense today. They are the easier business cases to build and the easiest benefits to explain.

Perhaps AI is also a chance for businesses to acknowledge that “efficient” does not always mean “good”. Many of the processes we automated or coded to ensure 100% compliance don’t give customers or employees what they are looking for. And maybe making the customer happy 70% of the time is better than not making them happy at all…

If you’d like to dig deeper into Ecosystm’s reports exploring the data from our ongoing AI study – check them out here (you’ll need to register if you have not already – it is free to register, but some content is premium):

4 Vendors Emerge as Leaders: Understanding the AI Vendor landscape

Use Cases Drive AI Software Adoption: Understanding The Industry Landscape

Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.

I recently published my predictions on AI (see blog here and download or view the more comprehensive report here). The prediction that got the most feedback and discussion concerns the likelihood of a large acquisition or merger based on AI assets. With AWS, Microsoft, Google and IBM dominating Ecosystm’s list of current and future preferred AI suppliers in our AI study, other companies (such as SAP, Oracle, SAS and Salesforce) want to be the choice for AI platform. As we published our AI predictions, this one was already coming true (to an extent anyway!) with SAP’s acquisition of Qualtrics.

But the question has been asked “why is AI so important”. And my answer to that question is “because, for software companies, AI is the end game…”

What do I mean by that? Well we are not too far away from a day where traditional enterprise applications are no longer relevant. ERP, CRM, HRM, SCM etc will all disappear and be replaced by an AI engine. The purpose of those traditional systems was to simplify, codify, and automate business and customer processes. ERP, CRM, and the rest are already starting to use algorithms to drive semi-custom (typically pre-coded) business processes. But in the mid-term future, we will have a time where the entire process is intelligent – where the system/application creates the best business process for the customer on the fly. I’ll take you through an example:

A customer comes to your website – the site will look at the information it has on the customer (either as a registered customer or a non-registered one, where it will scour cookies, IP addresses, location, social information – Facebook, Pinterest, Google etc) and then will create an experience designed for that customer – e.g. it might know the customer is based in New York City, is a Mets and Rangers fan, viewed posts on Facebook about global warming, is female, 42 years old, has kids etc. It uses the language of the customer, words that they would relate to, and the level of detail they would expect. It puts the products or services forward that best match that customer’s potential needs.

The customer orders 10 identical products as gifts for friends for Christmas – but the provider does not have a location with any more than 4 of those products – so the intelligent system sources the 10 from different locations and organises multiple shipments. One of the locations can’t ship until after xmas – but the intelligent system decides that the customer is important so puts in a request for Uber to pick up from that location and do the delivery. However, there is no automatic integration with Uber – so the intelligent system creates a real time custom integration with Uber.

The customer also asks the question if they can pay with AliPay – which the supplier does not accept as standard – however again the intelligent system creates a real time integration with AliPay in order to complete the transaction. The customer gets the goods they want – quickly – and gets to pay in the way they want. The system accounts for the revenue and moves it to the right bank accounts, co-ordinates follow-up orders with suppliers, and adds the sales information to the real-time sales analytics. It also crafts a unique email welcoming the customer and adds them to the customer database.

The intelligent system created a unique process in real-time as it interacted with the customer using text, images, video and voice. The system understands what your business is trying to achieve and what the rules are.

Such a capability is not that far away – and it makes existing enterprise applications and integration platforms redundant. THIS is why AI is the end game – if you aren’t the chosen AI platform in your customers, you might not be in your customers plans for much longer.

In most organisations that transition will be slow – applications will get smarter, and will move from standardised processes to unique processes slowly. These organisations will start from their application investments and work outwards from there. But other companies will start from their cloud-based AI platforms and partners – and reinvent their businesses in the cloud on these platforms. Others will do both – and at some stage in the future need to decide on which AI platform they standardise on…

Therefore mergers and acquisitions in the AI market are inevitable. Applications, cloud and analytics providers will build and buy capabilities, customers and market share in order to position themselves as the key AI platform in their clients. For many technology vendors, the next few years will be integral to their long term success. AI will change the technology provider landscape as we know it today – get strapped in for a fun ride!

There is no argument that the healthcare industry is ripe for Digital Transformation, especially because the needs and concerns of the industry have remained essentially consistent over the last few decades, in spite of tremendous technological advancements. Healthcare organisations have access to higher volumes of data than ever before. While a decade ago healthcare organisations were at a data creation stage, they will now shift focus on data management, extracting intelligence out of the data collated, and the use of that intelligence to transform their organisations and the industry, as a whole. So, what can the industry expect in 2019?

- India will Receive a Lot of Attention from Technology Vendors

At the turn of this decade, there was a plethora of healthcare IT vendors, driven by investments in the Affordable Care Act in the US. The industry has since become far more consolidated. A similar situation will open up in the Indian market. What is popularly being termed as ‘Modicare’ is narrower in scope and has a long way to go in terms of policy as well as planning. However, it will create a ripple effect and get vendors – especially the smaller ones – very interested in India in 2019. Every large global insurance company has a presence in India, attracted by the population base. It will be similar for healthcare technology vendors. - CX will go Beyond Managing Patient Experience to Providing Personalised Healthcare

Improving customer experience (CX) is a key objective for most healthcare organisations. This has been compounded by how technologically savvy people have become over the years. Patients often do their own research before they even visit their doctors. While most physicians consider this a bit of a nuisance, it is increasingly going to be the way forward. Patients are also expecting better experience, when it comes to access of timely alerts and information, education, and access to their reports. Healthcare organisations will eventually go beyond patient experience to personalised healthcare and deeper customer engagements. While this will become most apparent for chronic disease management, it will go into spaces such as predicting patient risk over the next few years. - Operations will Lead Investments in IoT ….

The global Ecosystm IoT Study reveals that of the healthcare organisations that have embarked on their IoT journeys, 2/3rd are still at the evaluation stage. What then are the drivers for healthcare organisations to adopt IoT? The top three drivers tell us that the key stakeholder is not the clinical departments, but Operations. Struggling with the workforce constraints, IoT is deemed as the technology that will allow better optimisation and innovative ways of providing customer care to improve patient experience. Internal process monitoring emerges as a key driver, in an industry where medical error monitoring and reporting is an important mandate.

- But Diagnostics will Sneak in as the Gateway to AI Investments

The two key areas where AI will see the easiest application in healthcare are in diagnostics and clinical decision support. Diagnostics using machine learning, predictive analytics and pattern recognition can be utilised effectively for clinical decision support. IoT sensor analytics, image analytics and machine learning, will start getting used to improve the efficiency and the reliability of the diagnostic processes. Algorithms can be applied to large data sets, especially in auxillary departments such as Radiology, Pathology and Cardiology, to augment clinician inputs. - Security will Play Spoilsport for Investments in Clinical Intelligence

As health management software gets more and more networked, security has to keep pace with the functional aspects of deployed applications and implementing organisations will ignore this aspect as their peril. The data breach in Singapore is not by any means an isolated episode, and especially mature economies with well-defined health data protection laws will pause before using cloud options for clinical data management. This is true across industries as my colleague points out in the cloud predictions for 2019.

Artificial Intelligence (AI) will change the way businesses operate, and the way customers interact with your company or brands. It will also create new markets and eradicate existing ones. 2019 will be the year that some AI technologies approach mass-market adoption. It will also be the year that businesses start to sort out their data requirements for AI, amid a complex data privacy regulatory environment. But most of all, 2019 will be the year that AI starts to impact employee and customer experiences – from the board room to the living room. Our top five predictions for 2019 are:

Machine Learning and IoT Sensor Analytics Will Drive AI Growth In 2019

The Global Ecosystm AI Study shows that the growth in AI over the next 12 months will come from Machine Learning (ML), as this capability is applied to a plethora of problems and challenges across the business. IoT Sensor Analytics will also see strong growth – due to the growth in IoT implementations and subsequent exponential growth of the data coming off these sensors and the desire to do something intelligent/different with this data.

The Growth in IoT Will Fuel the Growth in AI

Today, many organisations are deploying IoT solutions. These sensors are already creating – and will continue to create large amounts of data. While these sensors today are, for the most part, one-way (i.e. collect and analyse data), we are getting closer to the point where many of these sensors will be bi-directional (i.e. sense and respond). Businesses will look to AI tools – particularly IoT Sensor Analytics and ML – to help them learn from that data and respond accordingly. In many ways the future success of IoT and AI are interdependent.

In the Short Term, AI Will Create More Jobs than it Removes

Much of the media focus on AI has been around the jobs that will disappear in economies driven by AI and the automation that it will enable. But in 2019 (and over the next few years), AI will create more jobs than it removes. How is this? Firstly, we are seeing AI do a lot of jobs that are not even done today – analysing images for trends that humans did not see, looking for correlations in data sets that we did not know existed. Secondly, even where automation and AI are driving productivity, the vast majority of organisations are taking the opportunity to reskill those people. AI-driven profit will be ploughed back into businesses and create more employment opportunities – some of which we can imagine today and some we cannot. Thirdly, there is the vast hiring that organisations have started to undertake to bring on board the skills they will need to make their business smarter with AI. Many of these jobs today are in addition to, not replacing existing resources.

Bimodal IT Departments Will Slow Down AI Implementations

Many of the digital capabilities that businesses have been building over the past five or so years have not required active participation by the IT team. What started as “shadow IT” initiatives became the standard way to deliver customer and business value as smart organisations pushed their technology resources into the product and customer teams, so they could drive innovation at pace. But AI initiatives involve training algorithms with data – the more data the better the algorithms. Business leaders will need to work with IT to get access to this data – that typically resides in “back-end” systems – to train their models. At this step, many bimodal IT departments will kick the project into slow mode, because the data sits in “slow mode” back-end systems. The project will be managed with “slow mode” processes, using heavy-handed governance and processes to turn what could have been a six-week project into a six month one.

A Merger of Massive Scale Will be Driven by AI Assets

According to the Global Ecosystm AI Study, Microsoft, IBM, AWS and Google account for 62% of current and planned AI implementations – and that dominance is set to continue for the foreseeable future. This means a lot of other big companies miss out. SAP, Oracle and Salesforce are hoping that AI will help them get deeper within their existing customers and also expand beyond their current client base. Therefore, we expect a massive merger (in USD billions) driven by the AI customers and assets of the technology vendor. Technology companies that are used to dominating their industries – Cisco, HPE, Dell EMC, SAS and others could be left behind if they do not get scale quickly in the AI space – so a major merger is on the cards.

For access to the full report, please follow this link.