As they continue to promote innovation in the Financial Services industry, the Monetary Authority of Singapore (MAS) introduced the Financial Sector Technology and Innovation Scheme 3.0 (FSTI 3.0) earlier this week, pledging up to SGD 150 million over three years. FSTI 3.0 aims to boost innovation by supporting projects that use cutting-edge technologies or have a regional scope, while strengthening the technology ecosystem in the industry. This initiative includes three tracks:

- Enhanced Centre of Excellence track to expand grant funding to corporate venture capital entities

- Innovation Acceleration track to support emerging tech based FinTech solutions, and

- Environmental, Social, and Governance (ESG) FinTech track to accelerate ESG adoption in fintech

Additionally, FSTI 3.0 will continue to support areas like AI, data analytics, and RegTech while emphasising talent development. We can expect to see transformative financial innovation through greater industry collaboration.

MAS’ Continued Focus on Innovation

Over the years, the MAS has consistently been a driving force behind innovation in the Financial Services industry. They have actively promoted and supported technological advancements to enhance the industry’s competitiveness and resilience.

The FinTech Regulatory Sandbox framework offers a controlled space for financial institutions and FinTech innovators to test new financial products and services in a real-world setting, with tailored regulatory support. By temporarily relaxing specific regulatory requirements, the sandbox encourages experimentation, while ensuring safeguards to manage risks and uphold the financial system’s stability. Upon successful experimentation, entities must seamlessly transition to full compliance with relevant regulations.

Innovation Labs serve as incubators for new ideas, fostering a culture of experimentation and collaboration. They collaborate with disruptors, startups, and entrepreneurs to develop groundbreaking solutions. Labs like Accenture Innovation Hub, Allianz Asia Lab, Aviva Digital Garage, ANZ Innovation Lab, and AXA Digital Hive drive create prototypes, and roll out market solutions.

Building an Ecosystem

Partnerships between financial institutions, technology companies, startups, and academia contribute to Singapore’s economic growth and global competitiveness while ensuring adaptive regulation in an evolving landscape. By creating a vibrant ecosystem, MAS has facilitated knowledge exchange, collaborative projects, and the development of innovative solutions. For instance, in 2022, MAS partnered with United Nations Capital Development Fund (UNCDF) to build digital financial ecosystems for MSMEs in emerging economies.

This includes supporting projects that address environmental, social, and governance (ESG) concerns within the financial sector. For instance, MAS worked with the People’s Bank of China to establish the China-Singapore Green Finance Taskforce (GFTF) to enhance collaboration in green and transition finance. The aim is to focus on taxonomies, products, and technology to support the transition to a low-carbon future in the region, co-chaired by representatives from both countries.

MAS has also promoted Open Banking and API Frameworks to encourage financial institutions to adopt open banking practices enabling easier integration of financial services and encouraging innovation by third-party developers. This also empowers customers to have greater control over their financial data while fostering the development of new financial products and services by FinTech companies.

Regulators in Asia Pacific Taking a Proactive Approach

While Singapore is at the forefront of financial innovations, other regulatory and government bodies in Asia Pacific are also taking on an increasingly proactive role in nurturing innovation. This stance is being driven by a twofold objective – to accelerate economic growth through technological advancements and to ensure that innovative solutions align with regulatory requirements and safeguard consumer interests.

Recognising the potential of fintech to enhance financial services and drive economic growth, the Hong Kong Monetary Authority (HKMA) established the Fintech Facilitation Office (FFO) to facilitate communication between the fintech industry and traditional financial institutions. The central bank’s Smart Banking Initiatives, including the Faster Payment System, Open API Framework, and the Banking Made Easy initiative that reduces regulatory frictions help to enhance the efficiency and interoperability of digital payments.

The Financial Services Agency of Japan (FSA) has been actively working on creating a regulatory framework to facilitate fintech innovation, including revisions to existing laws to accommodate new technologies like blockchain. In 2020, FSA launched the Blockchain Governance Initiative Network (BGIN) to facilitate collaboration between the government, financial institutions, and the private sector to explore the potential of blockchain technology in enhancing financial services.

The Central Bank of the Philippines (Bangko Sentral ng Pilipinas – BSP) has launched an e-payments project to overcome challenges hindering electronic retail purchases, such as limited interbank transfer facilities, high bank fees, and low levels of trust among merchants and consumers. The initiative included the establishment of the National Retail Payment System, a framework for retail payment, and the introduction of automated clearing houses like PESONet and InstaPay. These efforts have increased the percentage of retail purchases made electronically from 1% to over 10% within five years, demonstrating the positive impact of effective cooperation and innovative policies in driving a shift towards a cash-lite economy.

The promotion of fintech innovation highlights a collective belief in its potential to transform finance and boost economies. As regulations adapt for technologies like blockchain and open banking, the Asia Pacific region is promoting collaboration between traditional financial institutions and emerging fintech players. This approach underscores a commitment to balance innovation with responsible oversight, ensuring that advanced financial solutions comply with regulatory standards.

The ongoing Ecosystm State of ESG Study throws up some interesting data about organisations in Asia Pacific.

We see ESG more firmly entrenched in organisational strategies; organisations leading with Social and Governance initiatives that are easily integrated within their CSR policies; and supply chain partners driving change.

Download ‘Sustainable Asia Pacific: The ESG Growth Story’ as a PDF

In this Insight, our guest author Anupam Verma talks about how the Global Capability Centres (GCCs) in India are poised to become Global Transformation Centres. “In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be ‘Digital Transformation Centres’ for global businesses.”

India has a lot to offer to the world of technology and transformation. Attracted by the talent pool, enabling policies, digital infrastructure, and competitive cost structure, MNCs have long embraced India as a preferred destination for Global Capability Centres (GCCs). It has been reported that India has more than 1,700 GCCs with an estimated global market share of over 50%.

GCCs employ around 1 million Indian professionals and has an immense impact on the economy, contributing an estimated USD 30 billion. US MNCs have the largest presence in the market and the dominating industries are BSFI, Engineering & Manufacturing, Tech & Consulting.

GCC capabilities have always been evolving

The journey began with MNCs setting up captives for cost optimisation & operational excellence. GCCs started handling operations (such as back-office and business support functions), IT support (such as app development and maintenance, remote IT infrastructure, and help desk) and customer service contact centres for the parent organisation.

In the second phase, MNCs started leveraging GCCs as centers of excellence (CoE). The focus then was product innovation, Engineering Design & R&D. BFSI and Professional Services firms started expanding the scope to cover research, underwriting, and consulting etc. Some global MNCs that have large GCCs in India are Apple, Microsoft, Google, Nissan, Ford, Qualcomm, Cisco, Wells Fargo, Bank of America, Barclays, Standard Chartered, and KPMG.

In the post-COVID world, industry boundaries are blurring, and business models are being transformed for the digital age. While traditional functions of GCCs will continue to be providing efficiencies, GCCs will be “Digital Transformation Centres” for global businesses.

The New Age GCC in the post-COVID world

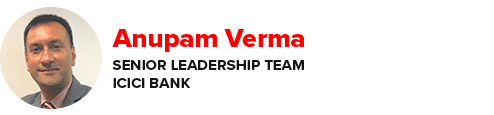

On one hand, the pandemic broke through cultural barriers that had prevented remote operations and work. The world became remote everything! On the other hand, it accelerated digital adoption in organisations. Businesses are re-imagining customer experiences and fast-tracking digital transformation enabled by technology (Figure 1). High digital adoption and rising customer expectations will also be a big catalyst for change.

In last few years, India has seen a surge in talent pool in emerging technologies such as data analytics, experience design, AI/ML, robotic process automation, IoT, cloud, blockchain and cybersecurity. GCCs in India will leverage this talent pool and play a pivotal role in enabling digital transformation at a global scale. GCCs will have direct and significant impacts on global business performance and top line growth creating long-term stakeholder value – and not be only about cost optimisation.

GCCs in India will also play an important role in digitisation and automation of existing processes, risk management and fraud prevention using data analytics and managing new risks like cybersecurity.

More and more MNCs in traditional businesses will add GCCs in India over the next decade and the existing 1,700 plus GCCs will grow in scale and scope focussing on innovation. Shift of supply chains to India will also be supported by Engineering R & D Centres. GCCs passed the pandemic test with flying colours when an exceptionally large workforce transitioned to the Work from Home model. In a matter of weeks, the resilience, continuity, and efficiency of GCCs returned to pre-pandemic levels with a distributed and remote workforce.

A Final Take

Having said that, I believe the growth spurt in GCCs in India will come from new-age businesses. Consumer-facing platforms (eCommerce marketplaces, Healthtechs, Edtechs, and Fintechs) are creating digital native businesses. As of June 2021, there are more than 700 unicorns trying to solve different problems using technology and data. Currently, very few unicorns have GCCs in India (notable names being Uber, Grab, Gojek). However, this segment will be one of the biggest growth drivers.

Currently, only 10% of the GCCs in India are from Asia Pacific organisations. Some of the prominent names being Hitachi, Rakuten, Panasonic, Samsung, LG, and Foxconn. Asian MNCs have an opportunity to move fast and stay relevant. This segment is also expected to grow disproportionately.

New age GCCs in India have the potential to be the crown jewel for global MNCs. For India, this has a huge potential for job creation and development of Smart City ecosystems. In this decade, growth of GCCs will be one of the core pillars of India’s journey to a USD 5 trillion economy.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Senior Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

Moving from a product or regional focus to an industry focus appears to be the “strategy du jour” for many technology vendors today. For some it is a new strategy – with the plan to improve customer focus and increase growth; for others it is the pendulum moving back to where they were five or ten years ago as they bounce from being industry-centric to product-centric to geography-centric and back again.

Getting your industry focus right is much harder than it seems – and has to be timed with client needs and market opportunity. The need to focus on the industry varies for different technology products, services and capabilities. For example, most technology buyers want their vendors to understand what their business does and how they add value to customers – that is a given and industry-aligned Sales teams make a lot of sense. Many tech buyers also want certain software functions to align directly to their processes – there is little appetite to customise ERP and financial suites to specific industry needs and processes – and tech vendors should support these out-of-the-box or cloud needs.

Industry Solutions May Not Drive Competitive Advantage

If the industry solution you are selling is the same as what any of their competitors can buy from you, then organisations get the exact same benefit as the market – no more, no less. For example, about 10-15 years ago, large telecom providers around the globe made significant investments in CRM platforms (often from Siebel) – bringing in one of a few large global systems integrators to deploy their standard processes and systems. These CRMs were supposed to provide business and customer benefit, and drive competitive advantage. And while they did deliver positive change (often at SIGNIFICANT cost!) when every telecom provider was using the same solution with the same or similar processes, any competitive advantage was lost.

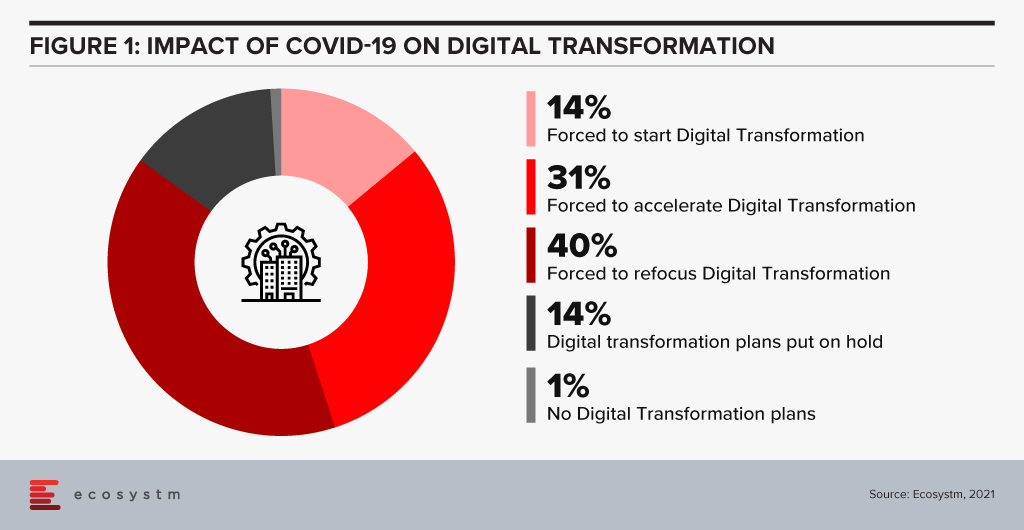

Industry Solutions are Often the Sign of a Mature Market

The widely accepted hypothesis is that the technology innovation and adoption happens in waves. The market has 5-7 year waves of innovation, followed by 5-7 year waves of deployment, adoption and consolidation.

The Innovation Phase. In this stage new companies emerge, new products or services are launched and leading/bleeding edge companies embrace these new technologies to drive competitive advantage and business growth. They experiment with new technologies that drive new business capabilities – sometimes failing, but always pushing the envelope for business innovation and forging the path for mass market adoption. In this stage there is often little demand for industry solutions – as both the providers and buyers of the solutions are still working out where the business benefit is; where the technology might be able to drive change or help them get ahead of competitors. If you examine the growth of a company such as Salesforce, you see that the early stage products are targeted towards a generic market – customers are expected to customise the solution based on their needs and individual requirements. In 2002 I worked for a challenger telecom provider that had deployed a traditional Peoplesoft CRM capability, and I was part of the team that brought Salesforce into the business – and as a cloud-based solution, we saw the competitive advantage was the pace at which we could customise the product (by excluding IT teams and processes). However, the solution was a “one-size-fits-all” product. The innovation stage is typically characterised by high growth of smaller vendors and technology service providers who challenge the status quo.

The Deployment, Adoption and Consolidation Phase. This stage of market growth is when the mass market starts to adopt these solutions. Many of these buyers walk the paths that have been forged before them by the more innovative, leading edge businesses. This stage typically sees less innovation, less experimentation, and more standard deployments. To make the solutions more palatable and easier to sell to the mass market tech vendors typically pre-configure or customise the solutions to specific needs – for business teams, roles or industries. It is usually in this stage of market growth and deployment that the industry solutions see significant interest and adoption. This is where the mass market gets access to the business benefits the more innovative businesses received many years earlier (and often profited from in this time). In my example of the Salesforce deployment in 2002, over the following years many partners started to create industry solutions, and eventually Salesforce themselves sold industry-specific solutions – or at least targeted certain products and capabilities at specific industries and provided accelerated deployment models to drive advantage at a faster rate. The deployment and consolidation stage of market growth is typically characterised by steady, slow growth across the entire market as benefits are being driven to all providers (product vendors and solutions or implementation providers). Legacy providers either play catch up or suffer declining business as they realise the solution they sell no longer provides the business and customer the benefits that it used to.

Industry Focus Should be Aligned to Customer Segments, Solution Type and Geography

The decision to sell industry-focused solutions should be driven by the type of solution you are selling; the business benefit you are promising; and the type of business you are targeting the solution towards. Businesses that are more innovative will still buy some pre-configured, industry-specific solutions that don’t differentiate their business or drive competitive advantage. But where they expect competitive advantage, they need to stand apart – to be the only business with that capability.

It is also worth understanding that an innovation in one market might be standard practice in another (and vice-versa). Countries across the globe and specifically here in Asia Pacific have different approaches to technology and innovation. China and parts of Southeast Asia are often innovators – pushing the boundaries of new and emerging tech to do things we never thought possible (in the same way Silicon Valley traditionally has done). Australia and India are traditional markets that adopt industry solutions after they have been tried and tested by others. Innovation in Japan seems to happen in stages and at pace but only once every 10-15 years or so. New Zealand and Singapore are generally more nimble economies where businesses often have to be innovative to gain global competitive advantage quickly.

Evidence indicates that the rate of innovation is increasing across the entire region – even in the less innovative economies. The window for industry solutions is much smaller regardless of location – as the next new innovation is just around the corner. Even the large, traditionally less agile businesses are driving innovation programs – for example, many of the big financial services “dinosaurs” such as DBS and Commonwealth Bank often win tech innovation awards and offer market-leading customer experiences.

Use this lens to better develop your industry approach. The depth of your industry solution or capability will dictate the opportunities that you will drive based on the type of customer and technology stage. Do you want to drive innovation or efficiency in your clients? Do you want to win the big “safer” deals – but be thought of as a technology solution provider; or win the smaller deals in companies that will become the market leaders of tomorrow – and be considered a market leader and king maker? Understanding your own business goals, the current sales and delivery capabilities, and the capacity to change will help your company create a go-to-market strategy that suits your current and future customers and will likely dictate the growth rate of your business over the next 5-7 years.

Keep yourself abreast with the latest industry trends

Ecosystm market insights, data, and reports are jam-packed with industry analysis and digital trends across several industry verticals to help you keep tabs on the fast-paced world of tech.

Five9, a cloud-based contact centre solutions provider announced the acquisition of intelligent virtual agent (IVA) platform provider, Inference Solutions for about USD 172 million. Five9 and Inference Solutions have been partnering for the last couple of years, with Five9 being a reseller for Inference Solutions’ IVA platform. The acquisition is expected to provide a boost to Five9’s AI portfolio, automate contact centre agent activities and provide AI-based omnichannel self-service solutions.

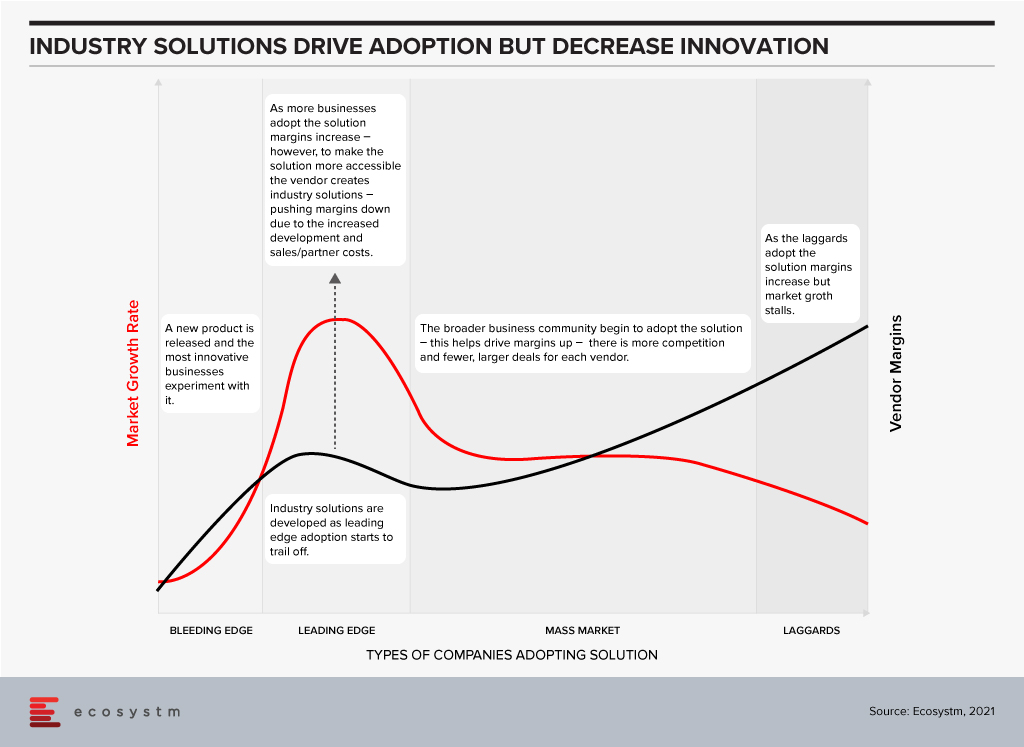

The need to drive greater automation in the contact centre is high on the agenda, and this acquisition demonstrates how important AI and automation is to contact centre modernisation. The old-fashioned ways of long wait times, being passed on through different menus on the IVR and being asked to repeat yourself through the older speech recognition engines is starting to not only frustrate customers but will become obsolete. Based on Ecosystm’s research, close to 60% of contact centres globally stated that investing in machine learning and AI is a top customer experience priority in the next 12 months.

Inference has come a long way since its inception at Telstra Labs

Inference Solutions (founded in 2005) was spun out of Telstra Labs. It has since expanded to the US and developed a suite of solutions in the IVA segment. They have a good partnership strategy with the leading telecom providers globally as well as the UC/contact centre vendors. Inference Solutions uses resellers such as service providers, UC, and contact centre software providers – and these include AT&T, Cisco (Broadsoft), Momentum Telecom, Nextiva, 8×8 and many others. The Inference Studio solution will see a new release in the next few months where the solution will come pre-built with the ability for the contact centre team to pre-load the contact centre conversations. These can be conversations that have been going on for 6 months or longer. The Studio solution will then be able to analyse and understand the underlying intent of the conversation, match the intent so that it can be used to auto train the bots accurately. That process of matching the intent and training is expensive and if you can automate some elements of that, it will bring the cost of the deployment down. Its solution integrates into NLP engines from Google, AWS, and IBM. In Australia they continue to work on patents in close partnerships with Melbourne University and RMIT. Throughout its journey, Inference has built a good base of customers in the US, UK, and Australia.

Five9 to accelerate on its vision of AI and Cloud

Contact centre modernisation is high on the agenda for many organisations and this will lead them to build AI and automation at the core of their customer strategies. The discussion spans across the CEO, Digital and Innovation, and the Contact Centre teams.

Five9 had acquired Whendu, an iPaaS platform provider empowering businesses and developers with no-code, visual application workflow tool, optimised for contact centres in November 2019, and Virtual Observer, an innovative provider of cloud-based workforce optimisation, also known as Workforce Engagement Management (WEM) in February of this year.

The pandemic has resulted in increased engagement of contact centres with customers. Companies are gradually looking for ways to automate tasks, deliver better communication, speech and text recognition, decipher languages, and implement solutions mimicking humans. As a solution to these challenges, IVAs are being viewed as efficient and effective digital workers for a modern contact centre. IVAs represent increased throughput, more accurate results, and better-informed agents.

Successful use cases have shown that conversational AI can reduce calls and repetitive queries by 70-90%. IVRs with monolithic, complicated menus will start becoming unpopular and force contact centres to embark on a modernisation and automation strategy. If we evaluate the shift in priorities after COVID-19, we see that organisations are ramping up their self-service capabilities and their adopt of AI and machine learning (Figure 1).

The acquisition will give Five9 a foothold in the Asia Pacific region with an initial focus on the Australia market. The Australia market is by far the most advanced cloud contact centre market in the Asia Pacific. Five9 gains a team of staff that will help them fuel the contact centre modernisation discussion across the Asia Pacific. As the region has a complex market, the need to work with local carriers and partners will be critical for further expansion. Five9 has made an important acquisition in building in IVA capability into its CCaaS solution.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

Focused on Digital Transformation? It is now more about how fast you can react to market shifts by using specific infrastructural resources.

This period is about digital acceleration. Cloud automation, artificial intelligence (AI), robotic process automation (RPA) and machine learning are all means to accelerate using infrastructure scalability.

Digital acceleration addresses the pace of change

Enterprises are searching to find unique and innovative ways to leverage cloud infrastructures with automation and intelligence. This is both to modernise and to optimise business processes while decreasing expenses. The speed at which the economic landscape has changed during the pandemic has removed debates on cloud usage:

- Remote work from home (WFH) with the need for video conferencing and collaboration tools has been supported by cloud

- Record amounts of SPAM and hacking attempts during the pandemic have leveraged cloud implementations for key security controls

- Tracking apps and classification and encryption of personally identifiable information (PII) via mobile devices are using cloud technology for greater automation and use of AI

Bandwidth and capacity are needed now. The ability to pivot, turn and shoot forward is critical to surviving and thriving in today’s radically changed marketplace. Cloud enablement can deliver enhanced customer experiences, monetise data assets, and can create new revenue streams by enabling new business models.

Cloud enablement explained

Digital acceleration is driven by cloud enablement, amplifying the enterprise value in the infrastructural investment.

Cloud enablement is an ongoing operational model. It incorporates orchestration, correctly organising teams, and a shift away from thinking only about platforms. The cloud platform is now a launchpad, not the main choice that has to be made. Orchestration is around the business and the business model, not just the technology.

Creating a cloud enablement strategic vision can identify where you need to go. It can provide the necessary requirements for expertise along the journey and deliver rapid, meaningful automation services engagements to deliver unbreakable delivery pipelines and agile cloud operations.

But this also involves managing and adjusting on the fly. Initial platform decisions, rolling out countless configuration changes and adjusting to new cloud investments make cloud enablement a tricky road to manage. Enterprises need to be cloud-smart towards their own business model and their strategy. Whatever configuration (on-prem, hybrid, private, public) combination works is dependent on many factors, including industry, size of the enterprise, employee resources and location.

The goal is implementing secure, flexible, scalable, and cost-effective cloud solutions. To do this requires regular cloud enablement audits as to the state of play and measuring successes.

Building and maintaining modern IT

Modern IT is hybrid and all the pieces that collect and manage the data need to be properly and securely managed. Just as technological (and economic) disruption has generally led to automation and the elimination of outdated processes, it has also always created new ideas and innovations.

One way to make your organisation more data-centric and digital is to selectively invest in those technology choices that are most adaptable and flexible to business needs. Data is the most strategic of assets and can be empowered by increasingly sophisticated intelligent operations. Process automation and AI help put that data to work by adding valued intelligence and encapsulating information.

Hybrid cloud coordination automated

Hybrid cloud coordination is an increasing enterprise demand, particularly in the Asia Pacific region, leading to enhanced data centres with joint customer support like the new Tokyo interconnection with Oracle and Microsoft Azure. The key to successfully monitoring a distributed cloud ecosystem is not only in gathering data on usage; it’s about knowing which questions to ask to make it more efficient and effective. This includes tracking connectivity speeds, creating common technical support and using single sign-on for better security. Here both AI and automation can help.

In Asia Pacific, the multi-cloud theme is being promoted heavily among integration providers with solutions that can plug into multiple clouds with virtual machine usage. Enterprises value enabled automated orchestration between cloud platforms. There will be a continued need for integrated tools across public and private clouds. This includes advanced analytics and AI as important aspects of an IT infrastructural investment.

Your choice of vendor for AI & Automation

In my opinion, AWS has the broadest AI service capabilities in the Asia Pacific cloud/ AI space, when compared to Microsoft, Google, and IBM. AWS provides users with pre-trained AI services for computer vision, language, recommendations, and forecasting to build, train, and deploy machine learning models at scale.

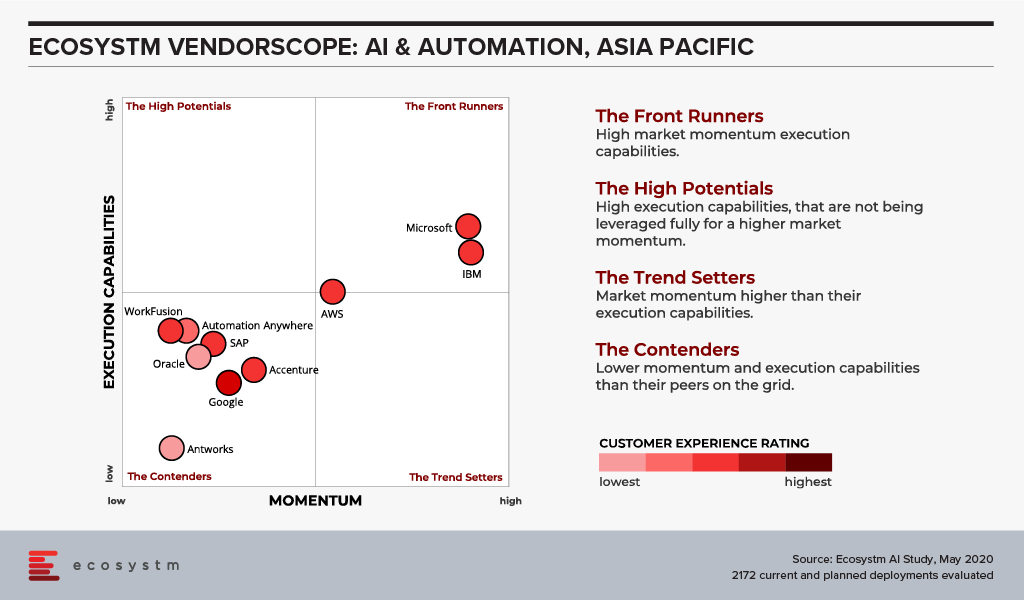

The Ecosystm VendorScope (Figure 1) rates the leading AI & Automation vendors in Asia Pacific based solely on quantifiable feedback from those who actually procure technology. It becomes clear from the responses that many organisations still start their AI journey through Automation.

Most organisations understand the importance of leveraging AI to gain competitive advantage. But they do not necessarily know where to start. The secret is that AI is about intelligent process automation, and the firms who understand this are not the ones automating tasks. The use of RPA with vendors such as Antworks, WorkFusion, Arago and Automation Anywhere, leverages automated reasoning using knowledge-based problem-solving engines. These vendors add RPA to AI, not the other way around.

And domain-specific service providers have been creating the synergies for enterprises to link intelligent automation software and industry knowledge to create the necessary end-to-end workflows. An innate understanding of the specific business process is key to leveraging intelligent automation.

Focusing on developing a modern data supply chain process, with actionable analytics insights built into the infrastructure, can aid the development of self-service business intelligence capabilities along with visual data discovery solutions.

Cloud enablement solutions generate maximum business value by enabling IT with scalability and flexibility. This can reduce maintenance and security costs. A focus on cloud intelligence and scalability allows IT departments to concentrate more on innovative solutions, insights and systems that drive significant business growth. Now is the time, and speed is of the essence.

Ecosystm Vendorscope: AI & Automation

Sign up for Free to download the Ecosystm Vendorscope: AI & Automation report.

Poly’s CEO Joe Burton was in Sydney recently to meet with staff, customers and partners. I had the privilege of interviewing him about the roadmap ahead for the company. Plantronics acquired Polycom for $2 billion at the end of March 2018 and earlier this year at Enterprise Connect, Poly was unveiled as the new brand – the coming together of Plantronics and Polycom. The company prides themselves on the strong engineering heritage they have across their product portfolio. Poly is playing in a large addressable market and these segments include unified communications (UC), video, headsets and contact centres.

Big news last week – Poly and Zoom partnership

At Zoomtopia last week, Zoom announced purpose-built appliances for their Zoom Rooms conference room system. These appliances are custom developed hardware that lets users gather room intelligence and analytics and will simplify installation and management of large-scale conference room deployments. One of the major partnerships for this was with Poly. Joe Burton was on stage with Eric Yuan the CEO of Zoom to unveil the Poly Studio X Series – The X30 (for smaller rooms) and the X50 (for midsize conference rooms).

What is promising about this offering is that the whole concept of launching a meeting by connecting to a screen has become simple. In a world where user experience is everything, simplicity and quality are what end-users expect. The Poly Studio X Series are all-in-one video bars that will simplify the Zoom Rooms experience and will feature Poly Meeting AI capabilities. Some of the features include advanced noise suppression to make it easier to hear human voices while simultaneously blocking out background noise.

For Poly, this is a great partnership given Zoom’s good growth in the Asia Pacific region. Poly is also increasingly deepening their relationships with other major players in the Video and UC market including Microsoft.

Flexible Workspaces and Contact Centres drives the headset market in Asia Pacific

According to JLL, the flexible space sector in Asia Pacific is expanding rapidly. From 2014 to 2017, flexible space stock across the region recorded a CAGR of 35.7% in Asia Pacific – much higher than in the United States (25.7%) and Europe (21.6%) over the same period. When you consider the changes in the modern workplace which include the rise of open flexible workplaces, remote and home working and the rise of freelancers, providing a seamless experience for the office worker will be important – it should be the same for a contractor as it is for full-time staff. As we move into more mobile and agile work practices and with the rise of open offices, headsets will play an important role for the office worker. More organisations across Asia are investing in headsets and whilst it may sound simple to just buy the headsets, it is more sophisticated than that. There is no one-size-fits-all headset and IT managers will have to invest in headsets to suit the persona of employees taking into account the role, workload, use of voice and video services and ultimately their comfort level. Vendors in the headset space are heavily investing in easy-to-use features, more automation, deep workflow integration and machine learning to deliver that experience. The opportunity for headsets does not stop there. In the contact centre space as agents spend long hours on calls, designing the right headset with feature rich AI capabilities will go a long way especially for training and coaching.

The one area Burton emphasised on is how AI and analytics is transforming this market and Poly investing in building these features into the headsets. Some of these examples include:

- Tracking conversations by using analytics to gain insights into long pauses of silence and “overtalking”. The analytics generated from these insights can help for training and coaching.

- AI can help track user behaviour patterns related to noise, volume and mute functions. These patterns can be used to detect problems during the call and could lead to possible training sessions for the agents. It is a great mechanism for supervisors to understand and work through where agents are struggling during the call.

Partnerships to expand their reach into the contact centre markets in the Asia Pacific region will be important. The market for contact centres is seeing a big shift and new entrants are making their presence felt in the Asia Pacific region. Poly will need to capitalise on this and expand their partnerships beyond the traditional vendors to expand their footprints across the contact centre markets.

Asia Pacific – an important growth theatre

Poly continues to win and have some large-scale deployments in Japan, China, India, and ANZ. They have also made several strides to develop what is best fit for the local market in terms of user requirements. With a deep understanding of the Chinese market, Poly released the Poly G200 in September this year which is tailor-made for the Chinese users with easy to use and collaborate solutions. The Poly G200 is the first and significant customised product launched in China, after Poly announced their ‘In China, for China’ strategy. This is a logical move given China is an important market and one that presents its own unique business dynamics.

Conclusion

The shift to mobility and the cloud has changed everything and is driving a new level of user experience. The ability to offer the same and frictionless experience when on the desktop, mobile device as well as other applications is what is driving fierce competition in the market. Users get frustrated when they cannot launch a video session instantly or when there is poor quality in audio. These may sound simple but addressing these frustrations are critical. Vendors in the UC, Collaboration and Video space are working hard to make sure that the experience is seamless when they are inside the office, out of the office and when they are working in open plan offices. Ultimately users want their daily office communication and collaboration solutions to work seamlessly and to integrate well into the various workflows such as Microsoft Teams.

On the contact centre front, Digital and AI initiatives are taking centre stage in nearly every conversation I have had with end-users. Company-wide CX strategy and customer journey mapping and analytics are what CX decision makers are talking about most. Poly is addressing that segment of the market by providing quality headsets coupled with AI to help in coaching and training by identifying trends and bridging the training gaps. There are new vendors starting to disrupt the status quo of some of the more traditional vendors in the contact centre market and hence deepening the partnerships with these new vendors in the contact centre space will be important.

Poly has a good addressable market to go after in unified communications and collaboration with their headsets and extensive range of video solutions. The most important part will be deepening the partnerships with the wide range of vendors in this space and engineering their products to be tightly integrated with their partner ecosystems’. The release of the Studio X series at Zoomtopia is a good example. I am confident that the road ahead for Poly is promising given the deep engineering capabilities the company invests in and how they are taking their partnerships seriously.