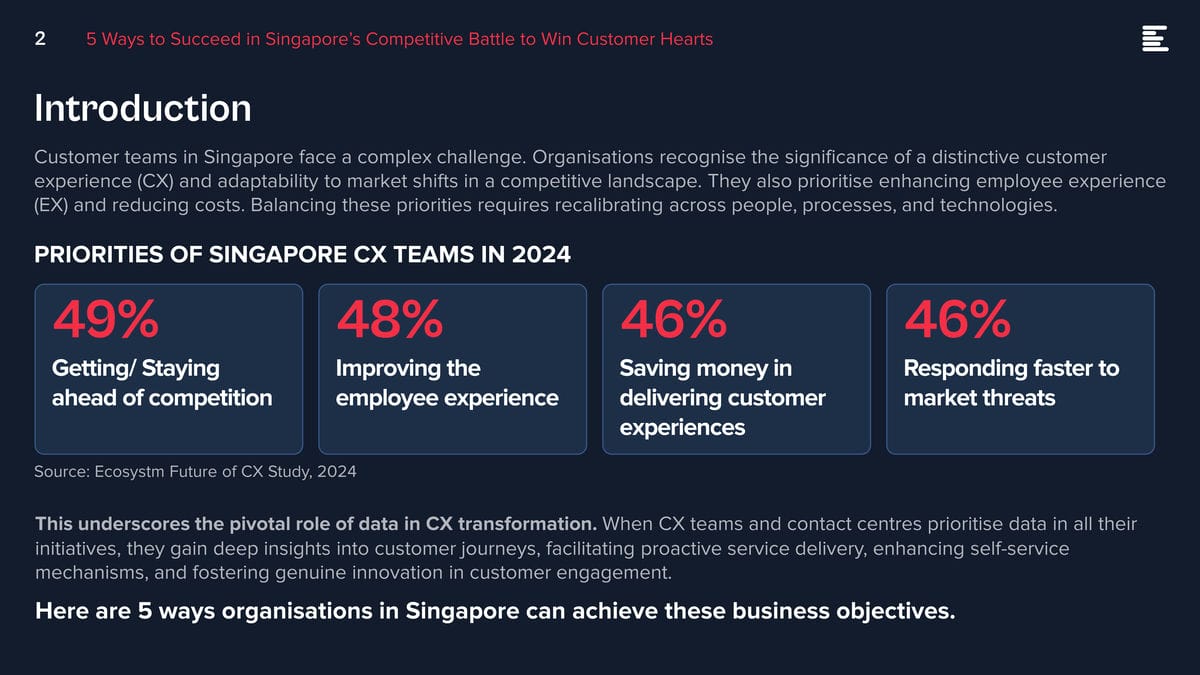

Customer teams in Singapore face a complex challenge. Organisations recognise the significance of a distinctive customer experience (CX) and adaptability to market shifts in a competitive landscape. They also prioritise enhancing employee experience (EX) and reducing costs. Balancing these priorities requires recalibrating across people, processes, and technologies.

This underscores the pivotal role of data in CX transformation. When CX teams and contact centres prioritise data in all their initiatives, they gain deep insights into customer journeys, facilitating proactive service delivery, enhancing self-service mechanisms, and fostering genuine innovation in customer engagement.

Here are 5 ways organisations in Singapore can achieve these business objectives.

Download ‘5 Ways to Succeed in Singapore’s Competitive Battle to Win Customer Hearts’ as a PDF.

#1 Build a Strategy around Voice & Omnichannel Orchestration

Customers seek flexibility to choose channels that suit their preferences, often switching between them. When channels are well-coordinated, customers enjoy consistent experiences, and CX teams and contact centre agents gain real-time insights into interactions, regardless of the chosen channel. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

This doesn’t diminish the significance of voice. Voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels. Regardless of the channel chosen, prioritising omnichannel orchestration is essential.

Ensure seamless orchestration from voice to back and front offices, including social channels, as customers switch between channels.

#2 Unify Customer Data through an Intelligent Data Hub

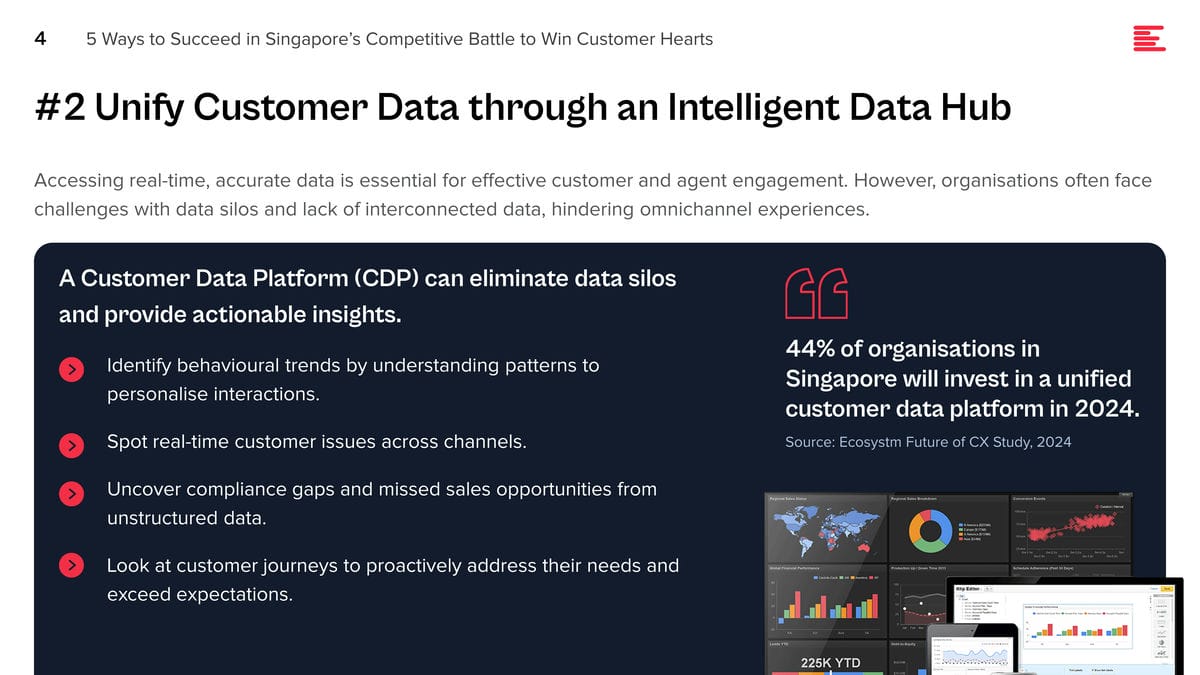

Accessing real-time, accurate data is essential for effective customer and agent engagement. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

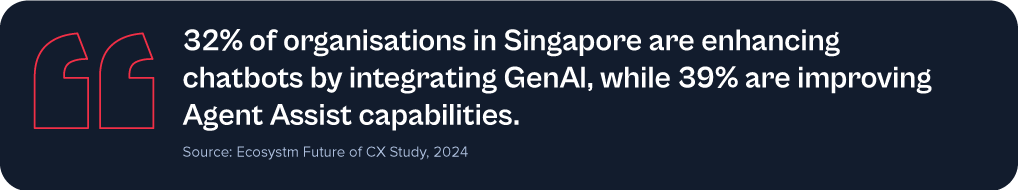

#3 Transform CX & EX with AI

GenAI and Large Language Models (LLMs) is revolutionising how brands address customer and employee challenges, boosting efficiency, and enhancing service quality.

Despite 62% of Singapore organisations investing in virtual assistants/conversational AI, many have yet to integrate emerging technologies to elevate their CX & EX capabilities.

Agent Assist solutions provide real-time insights before customer interactions, optimising service delivery and saving time. With GenAI, they can automate mundane tasks like call summaries, freeing agents to focus on high-value tasks such as sales collaboration, proactive feedback management, personalised outbound calls, and upskilling.

Going beyond chatbots and Agent Assist solutions, predictive AI algorithms leverage customer data to forecast trends and optimise resource allocation. AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks.

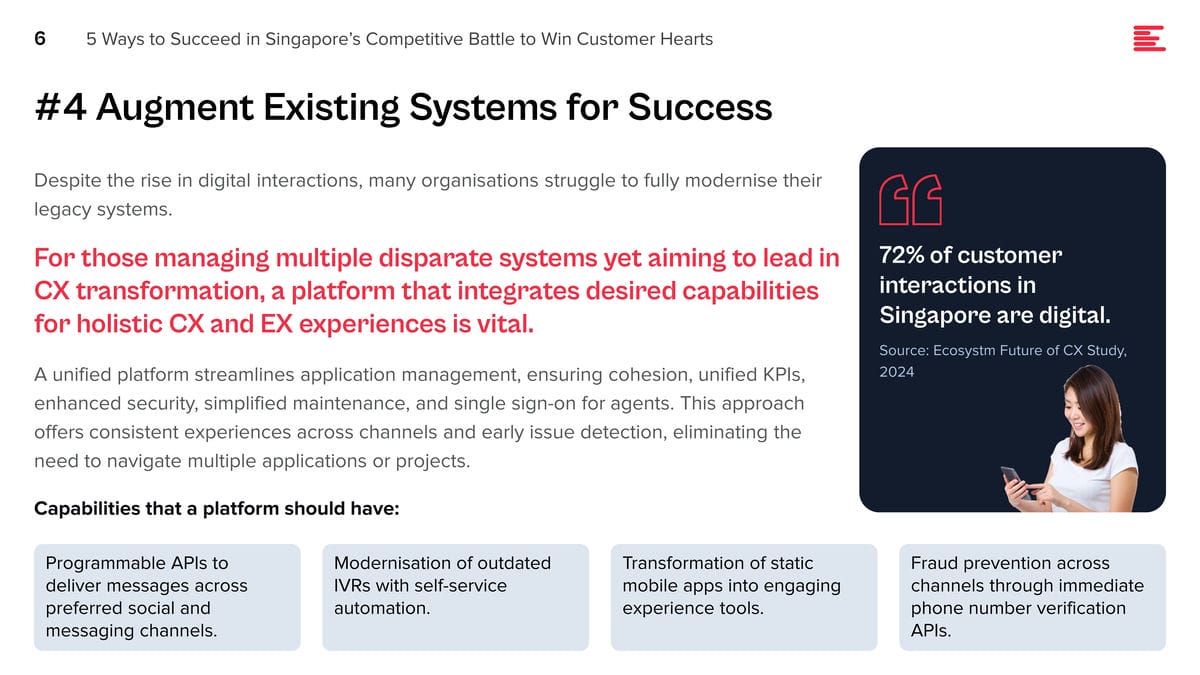

#4 Augment Existing Systems for Success

Despite the rise in digital interactions, many organisations struggle to fully modernise their legacy systems.

For those managing multiple disparate systems yet aiming to lead in CX transformation, a platform that integrates desired capabilities for holistic CX and EX experiences is vital.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This will require organisations to re-evaluate all aspects of their CX delivery.

- Redefine the Contact Centre. Transform it into an “Intelligent” Data Hub providing unified and connected experiences. Leverage intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empower agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensure consistent omnichannel experiences through data unification and coherency. Use programmable APIs to personalise conversations and identify customer preferences for real-time or asynchronous messaging. Incorporate innovative technologies such as video to enhance the channel experience.

2024 and 2025 are looking good for IT services providers – particularly in Asia Pacific. All types of providers – from IT consultants to managed services VARs and systems integrators – will benefit from a few converging events.

However, amidst increasing demand, service providers are also challenged with cost control measures imposed in organisations – and this is heightened by the challenge of finding and retaining their best people as competition for skills intensifies. Providers that service mid-market clients might find it hard to compete and grow without significant process automation to compensate for the higher employee costs.

Why Organisations are Opting for IT Service

- Organisations are seeking further cost reductions. Managed services providers will see more opportunities to take cost and complexity out of organisation’s IT functions. The focus in 2024 will be less on “managing” services and more on “transforming” them using ML, AI, and automation to reduce cost and improve value.

- Big app upgrades are back on the agenda. SAP is going above and beyond to incentivise their customers and partners to migrate their on-premises and hyperscale hosted instances to true cloud ERP. Initiatives such as Rise with SAP have been further expanded and improved to accelerate the transition. Salesforce customers are also looking to streamline their deployments while also taking advantage of the new AI and data capabilities. But many of these projects will still be complex and time-consuming.

- Cloud deployments are getting more complex. For many organisations, the simple cloud migrations are done. This is the stage of replatforming, retiring, and refactoring applications to take advantage of public and hybrid cloud capabilities. These are not simple lift and shift – or switch to SaaS – engagements.

- AI will drive a greater need for process improvement and transformation. This will happen along with associated change management and training programs. While it is still early days for GenAI, before the end of 2024, many organisations will move beyond experimentation to department or enterprise wide GenAI initiatives.

- Increasing cybersecurity and data governance demands will prolong the security skill shortage. More organisations will turn to managed security services providers and cybersecurity consultants to help them develop their strategy and response to the rising threat levels.

Choosing the Right Cost Model for IT Services

Buyers of IT services must implement strict cost-control measures and consider various approaches to align costs with business and customer outcomes, including different cost models:

Fixed-Price Contracts. These contracts set a firm price for the entire project or specific deliverables. Ideal when project scope is clear, they offer budget certainty upfront but demand detailed specifications, potentially leading to higher initial quotes due to the provider assuming more risk.

Time and Materials (T&M) Contracts with Caps. Payment is based on actual time and materials used, with negotiated caps to prevent budget overruns. Combining flexibility with cost predictability, this model offers some control over total expenses.

Performance-Based Pricing. Fees are tied to service provider performance, incentivising achievement of specific KPIs or milestones. This aligns provider interests with client goals, potentially resulting in cost savings and improved service quality.

Retainer Agreements with Scope Limits. Recurring fees are paid for ongoing services, with defined limits on work scope or hours within a given period. This arrangement ensures resource availability while containing expenses, particularly suitable for ongoing support services.

Other Strategies for Cost Efficiency and Effective Management

Technology leaders should also consider implementing some of the following strategies:

Phased Payments. Structuring payments in phases, tied to the completion of project milestones, helps manage cash flow and provides a financial incentive for the service provider to meet deadlines and deliverables. It also allows for regular financial reviews and adjustments if the project scope changes.

Cost Transparency and Itemisation. Detailed billing that itemises the costs of labour, materials, and other expenses provides transparency to verify charges, track spending against the budget, and identify areas for potential savings.

Volume Discounts and Negotiated Rates. Negotiating volume discounts or preferential rates for long-term or large-scale engagements, makes providers to offer reduced rates for a commitment to a certain volume of work or an extended contract duration.

Utilisation of Shared Services or Cloud Solutions. Opting for shared or cloud-based solutions where feasible, offers economies of scale and reduces the need for expensive, dedicated infrastructure and resources.

Regular Review and Adjustment. Conducting regular reviews of the services and expenses with the provider to ensure alignment with the budget and objectives, prepares organisations to adjust the scope, renegotiate terms, or implement cost-saving measures as needed.

Exit Strategy. Planning an exit strategy that include provisions for contract termination, transition services, protects an organisation in case the partnership needs to be dissolved.

Conclusion

Many businesses swing between insourcing and outsourcing technology capabilities – with the recent trend moving towards insourcing development and outsourcing infrastructure to the public cloud. But 2024 will see demand for all types of IT services across nearly every geography and industry. Tech services providers can bring significant value to your business – but improved management, monitoring, and governance will ensure that this value is delivered at a fair cost.

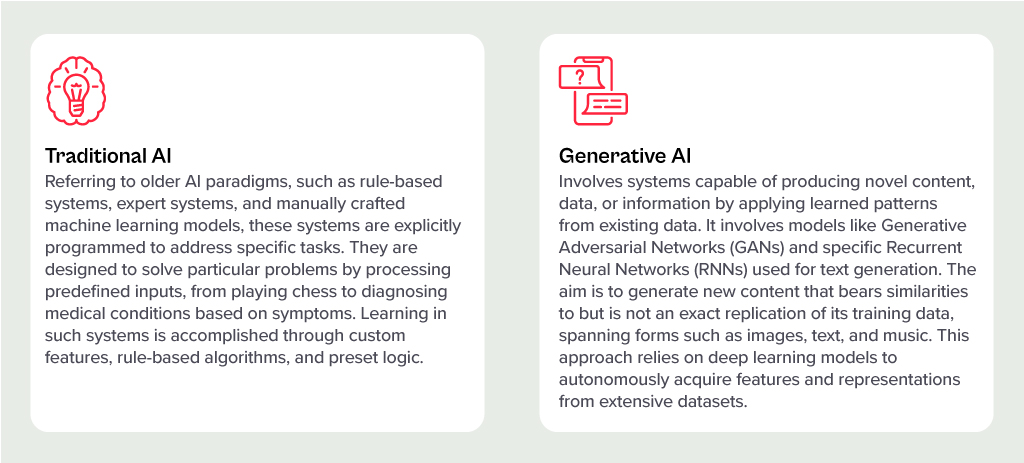

Generative AI has stolen the limelight in 2023 from nearly every other technology – and for good reason. The advances made by Generative AI providers have been incredible, with many human “thinking” processes now in line to be automated.

But before we had Generative AI, there was the run-of-the-mill “traditional AI”. However, despite the traditional tag, these capabilities have a long way to run within your organisation. In fact, they are often easier to implement, have less risk (and more predictability) and are easier to generate business cases for. Traditional AI systems are often already embedded in many applications, systems, and processes, and can easily be purchased as-a-service from many providers.

Unlocking the Potential of AI Across Industries

Many organisations around the world are exploring AI solutions today, and the opportunities for improvement are significant:

- Manufacturers are designing, developing and testing in digital environments, relying on AI to predict product responses to stress and environments. In the future, Generative AI will be called upon to suggest improvements.

- Retailers are using AI to monitor customer behaviours and predict next steps. Algorithms are being used to drive the best outcome for the customer and the retailer, based on previous behaviours and trained outcomes.

- Transport and logistics businesses are using AI to minimise fuel usage and driver expenses while maximising delivery loads. Smart route planning and scheduling is ensuring timely deliveries while reducing costs and saving on vehicle maintenance.

- Warehouses are enhancing the safety of their environments and efficiently moving goods with AI. Through a combination of video analytics, connected IoT devices, and logistical software, they are maximising the potential of their limited space.

- Public infrastructure providers (such as shopping centres, public transport providers etc) are using AI to monitor public safety. Video analytics and sensors is helping safety and security teams take public safety beyond traditional human monitoring.

AI Impacts Multiple Roles

Even within the organisation, different lines of business expect different outcomes for AI implementations.

- IT teams are monitoring infrastructure, applications, and transactions – to better understand root-cause analysis and predict upcoming failures – using AI. In fact, AIOps, one of the fastest-growing areas of AI, yields substantial productivity gains for tech teams and boosts reliability for both customers and employees.

- Finance teams are leveraging AI to understand customer payment patterns and automate the issuance of invoices and reminders, a capability increasingly being integrated into modern finance systems.

- Sales teams are using AI to discover the best prospects to target and what offers they are most likely to respond to.

- Contact centres are monitoring calls, automating suggestions, summarising records, and scheduling follow-up actions through conversational AI. This is allowing to get agents up to speed in a shorter period, ensuring greater customer satisfaction and increased brand loyalty.

Transitioning from Low-Risk to AI-Infused Growth

These are just a tiny selection of the opportunities for AI. And few of these need testing or business cases – many of these capabilities are available out-of-the-box or out of the cloud. They don’t need deep analysis by risk, legal, or cybersecurity teams. They just need a champion to make the call and switch them on.

One potential downside of Generative AI is that it is drawing unwarranted attention to well-established, low-risk AI applications. Many of these do not require much time from data scientists – and if they do, the challenge is often finding the data and creating the algorithm. Humans can typically understand the logic and rules that the models create – unlike Generative AI, where the outcome cannot be reverse-engineered.

The opportunity today is to take advantage of the attention that LLMs and other Generative AI engines are getting to incorporate AI into every conceivable aspect of a business. When organisations understand the opportunities for productivity improvements, speed enhancement, better customer outcomes and improved business performance, the spend on AI capabilities will skyrocket. Ecosystm estimates that for most organisations, AI spend will be less than 5% of their total tech spend in 2024 – but it is likely to grow to over 20% within the next 4-5 years.

Data & AI initiatives are firmly at the core of any organisation’s tech-led transformation efforts. Businesses today realise the value of real-time data insights to deliver the agility that is required to succeed in today’s competitive, and often volatile, market.

But organisations continue to struggle with their data & AI initiatives for a variety of reasons. Organisations in ASEAN report some common challenges in implementing successful data & AI initiatives.

Here are 5 insights to build scalable AI.

- Data Access a Key Stumbling Block. Many organisations find that they no longer need to rely on centralised data repositories.

- Organisations Need Data Creativity. A true data-first organisation derives value from their data & AI investments across the entire organisation, cross-leveraging data.

- Governance Not Built into Organisational Psyche. A data-first organisation needs all employees to have a data-driven mindset. This can only be driven by clear guidelines that are laid out early on and adhered to by data generators, managers, and consumers.

- Lack of End-to-End Data Lifecycle Management. It is critical to have observability, intelligence, and automation built into the entire data lifecycle.

- Democratisation of Data & AI Should Be the Goal. The true value of data & AI solutions will be fully realised when the people who benefit from the solutions are the ones managing the solutions and running the queries that will help them deliver better value to the business.

Read below to find out more.

Download 5 Insights to Help Organisations Build Scalable AI – An ASEAN View as a PDF

November has seen uncertainties in the technology market with news of layoffs and hiring freezes from big names in the industry – Meta, Amazon, Salesforce, and Apple to name a few. These have impacted thousands of people globally, leaving tech talent with one common question, ‘What next?’

While the current situation and economic trends may seem grim, it is not all bad news for tech workers. It is true that people strategies in the sector may be impacted, but there are still plenty of opportunities for tech experts in the industry.

Here is what Ecosystm Analysts say about what’s next for technology workers.

Today, we are seeing two quite conflicting signals in the market: Tech vendors are laying off staff; and IT teams in businesses are struggling to hire the people they need.

At Ecosystm, we still expect a healthy growth in tech spend in 2023 and 2024 regardless of economic conditions. Businesses will be increasing their spend on security and data governance to limit their exposure to cyber-attacks; they will spend on automation to help teams grow productivity with current or lower headcount; they will continue their cloud investments to simplify their technology architectures, increase resilience, and to drive business agility. Security, cloud, data management and analytics, automation, and digital developers will all continue to see employment opportunities.

If this is the case, then why are tech vendors laying off headcount?

The slowdown in the American economy is a big reason. Tech providers that are laying of staff are heavily exposed to the American market.

- Salesforce – 68% Americas

- Facebook – 44% North America

- Genesys – around 60% in North America

Much of the messaging that these providers are giving is it is not that business is performing poorly – it is that growth is slowing down from the fast pace that many were witnessing when digital strategies accelerated.

Some of these tech providers might also be using the opportunity to “trim the fat” from their business – using the opportunity to get rid of the 2-3% of staff or teams that are underperforming. Interestingly, many of the people that are being laid off are from in or around the sales organisation. In some cases, tech providers are trimming products or services from their business and associated product, marketing, and technical staff are also being laid off.

While the majority of the impact is being felt in North America, there are certainly some people being laid off in Asia Pacific too. Particularly in companies where the development is done in Asia (India, China, ASEAN, etc.), there will be some impact when products or services are discontinued.

While it is not all bad news for tech talent, there is undoubtedly some nervousness. So this is what you should think about:

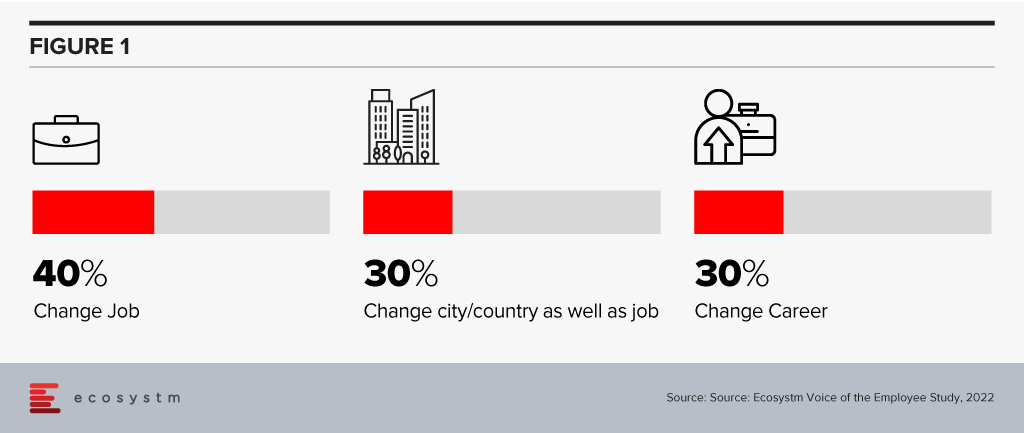

Change your immediate priorities. Ecosystm research found that 40% of digital/IT talent were looking to change employers in 2023. Nearly 60% of them were also thinking of changes in terms of where they live and their career.

This may not be the right time to voluntarily change your job. Job profiles and industry requirements should guide your decision – by February 2023, a clearer image of the job market will emerge. Till then, upskill and get those certifications to stay relevant!

Be prepared for contract roles. With a huge pool of highly skilled technologists on the hunt for new opportunities, smaller technology providers and start-ups have a cause to celebrate. They have faced the challenge of getting the right talent largely because of their inability to match the remunerations offered by large tech firms.

These companies may still not be able to match the benefits offered by the large tech firms – but they provide opportunities to expand your portfolio, industry expertise, and experience in emerging technologies. This will see a change in job profiles. It is expected that more contractual roles will open up for the technology industry. You will have more opportunities to explore the option of working on short-term assignments and consulting projects – sometimes on multiple projects and with multiple clients at the same time.

Think about switching sides. The fact remains that digital and technology upgrades continue to be organisational priorities, across all industries. As organisations continue on their digital journeys, they have an immense potential to address their skills gap now with the availability of highly skilled talent. In a recently conducted Ecosystm roundtable, CIOs reported that new graduates have been demanding salaries as high as USD 200,000 per annum! Even banks and consultancies – typically the top paying businesses – have been finding it hard to afford these skills! These industries may well benefit from the layoffs.

If you look at technology job listings, we see no signs of the demand abating!

Organisations have relied heavily on technology to survive and succeed over the last 2 years.

Many tech providers have led the way – showing by example how strategies and technologies have to be shaped. They have also worked at improving their product and services offerings, introduced newer features and acquired companies to support market needs and grow their market share.

What should they do differently in 2022 to continue to succeed?

Ecosystm analysts think that a mere focus on products and features will not help. This is the time to focus on softer aspects such as skills, alignment with customer priorities, and an overhaul of channel programs.

Here is what Tech Providers should focus on in 2022 for continued success:

- Build relationships with Business

- Increase Automation to curb the effects of the Great Resignation

- Syndicate Skills; not just Software

- Focus on Channel Partners – and Pricing

- Be Local and Industry-Specific

Read on to find out what Alan Hesketh, Darian Bird, Niloy Mukherjee, Peter Carr and Tim Sheedy have to say to Tech Providers.

Click here to download Growing your Market Share in 2022 as a PDF.

AI has become intrinsic to our personal lives – we are often completely unaware of technology’s influence on our daily lives. For enterprises too, tech solutions often come embedded with AI capabilities. Today, an organisation’s ability to automate processes and decisions is often dependent more on their desire and appetite for tech adoption, than the technology itself.

In 2022 the key focus for enterprises will be on being able to trust their Data & AI solutions. This will include trust in their IT infrastructure, architecture and AI services; and stretch to being able to participate in trusted data sharing models. Technology vendors will lead this discussion and showcase their solutions in the light of trust.

Read what Ecosystm analysts, Darian Bird, Niloy Mukherjee, Peter Carr and Tim Sheedy think will be the leading Data & AI trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Data & AI in 2022 as PDF

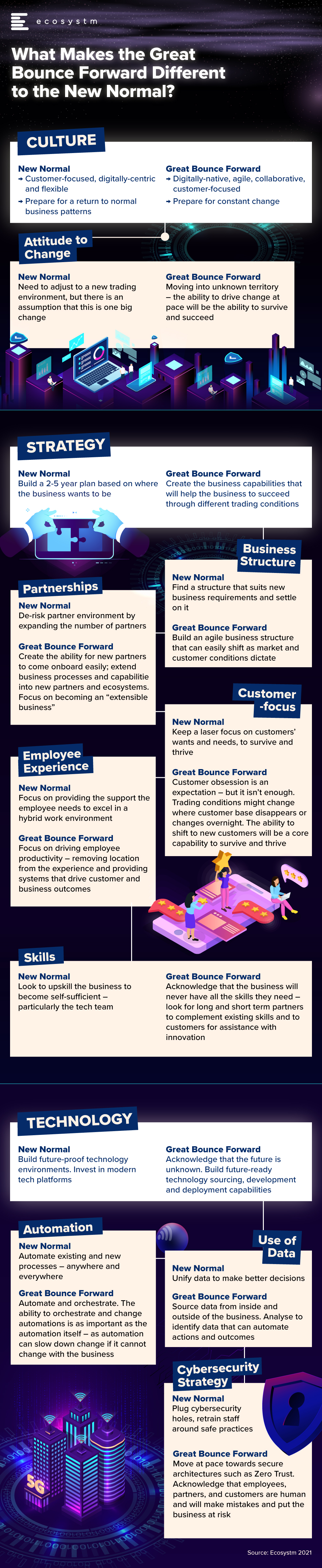

One of the main questions that I have faced over the past week, since I wrote the Ecosystm Insight – Welcome to the Great Bounce Forward – is “How is this different to the “New Normal”? Many have commented that the concept of the Great Bounce Forward is more descriptive and more positive than the term “New Normal” – but I believe they are different, and require different strategies and mindsets.

This is a brief summary of some of the major differences between the New Normal and the Great Bounce Forward. I look forward with excitement and some trepidation towards this future. One where business success will be dictated not only by our customer obsession, but also the ability of our business to pivot, shift, change and adapt.

I can’t tell you what will happen in the future – a green revolution? Another pandemic? A major war? A global recession? Market hypergrowth? All the people living life in peace? Imagine that…

What I can tell you is what your organisation needs to do to be able to meet all of these challenges head-on and set yourself up for success. And to me, that won’t look like the new normal. There is nothing normal about these business capabilities at all.

As economies around the world are beginning to recover from the recessions and slowdowns caused by the pandemic, we are beginning to witness, what I like to call, the “Great Bounce Forward”.

Why the Great Bounce Forward? Because too many businesses, journalists and economists are talking about businesses “bouncing back”. But there is no bounce back. We are bouncing into the “economic unknown”. The trading conditions we see today are nothing like what they were at the beginning of 2020. While many people refer to the “new normal” I have heard few talks about how they are or will benefit from these new market conditions.

Bouncing back may not be relevant as we negotiate the economic unknown – it is time to evaluate how we can bounce forward!

Leaping Ahead Through Digital First

Customer interactions have changed – digital-first is now a requirement – and many customers expect a personalised and optimised experience. Many companies are starting to personalise experiences today – thinking they are “delighting customers” through personalised transactions and journeys. But you don’t delight customers by giving them what they want – you disappoint them if you don’t offer a true personalised experience.

Digital changes are coming thick and fast. For example, Australia Post has announced that online sales are currently 20% higher than what they were at the previous highest peak in December 2020. Yes – much of Australia is in a lockdown, but online sales are dwarfing what they were during lockdowns in 2020.

But it is not just about offering online sales. In the digital world, customers now expect to be able to track packages, get alerts when they are delivered, and have access to easy and free returns. Again – if you don’t do this today, you are creating poor customer experiences and are most likely losing business to those that offer great experiences.

Here is what organisations are witnessing:

The need to evolve their CRM solution. Salespeople expect the CRM to give them insights on who to sell to, why to sell to them and what approach will work best. CRM systems that don’t provide this analysis are letting businesses and salespeople down.

Analytics has to be turned into actions. More businesses are telling their analytics partners to stop telling them what to do, and just do it! Automating the outcomes of BI and analytics is beginning to be expected.

Ease of use has become essential. Interactions and processes need to be intelligent and easy to automate. We no longer throw teams of people at challenges – we automate the outcomes and use technology to deliver entirely new experiences without teams of employees pulling strings behind the scenes.

Process and technology changes happen quickly and seamlessly. We have been taught this by Zoom, Microsoft, AWS and Google. If you aren’t doing this today, you are behind the market and behind the expectations of your employees and customers.

Ecosystems are emerging to enable this agility and innovation. We can now innovate with a growing range of partners. Companies can partner for a single sale and move on. Start-ups are being embraced by dinosaurs, and competitors are becoming partners. More companies than ever are involving their own customers in their innovation processes. Ecosystems are changing the ability of technology and business teams to offer new and improved services to customers and employees.

Time for a Shift in Organisational Culture

Seemingly, the world changed overnight. But many of these changes have been in the works for years. It just took a global crisis to highlight how important they are and how much organisations need to change to embrace these opportunities. The only thing holding businesses back from thriving in the Great Bounce Forward are their people and culture. If you can embrace these changes, your businesses will move forward and emerge as different companies to the ones that entered the pandemic in early 2020. You’ll be more open, agile, innovative and digitally aware. You’ll be able to move in new, unheralded directions, driving improved customer, shareholder, or citizen value.

So stop thinking about how your business will bounce back. Make plans for it to bounce forward into the unknown.