The tech industry tends to move in waves, driven by the significant, disruptive changes in technology, such as cloud and smartphones. Sometimes, it is driven by external events that bring tech buyers into sync – such as Y2K and the more recent pandemic. Some tech providers, such as SAP and Microsoft, are big enough to create their own industry waves. The two primary factors shaping the current tech landscape are AI and the consequential layoffs triggered by AI advancements.

While many of the AI startups have been around for over five years, this will be the year they emerge as legitimate solutions providers to organisations. Amidst the acceleration of AI-driven layoffs, individuals from these startups will go on to start new companies, creating the next round of startups that will add value to businesses in the future.

Tech Sourcing Strategies Need to Change

The increase in startups implies a change in the way businesses manage and source their tech solutions. Many organisations are trying to reduce tech debt, by typically consolidating the number of providers and tech platforms. However, leveraging the numerous AI capabilities may mean looking beyond current providers towards some of the many AI startups that are emerging in the region and globally.

The ripple effect of these decisions is significant. If organisations opt to enhance the complexity of their technology architecture and increase the number of vendors under management, the business case must be watertight. There will be less of the trial-and-error approach towards AI from 2023, with a heightened emphasis on clear and measurable value.

AI Startups Worth Monitoring

Here is a selection of AI startups that are already starting to make waves across Asia Pacific and the globe.

- ADVANCE.AI provides digital transformation, fraud prevention, and process automation solutions for enterprise clients. The company offers services in security and compliance, digital identity verification, and biometric solutions. They partner with over 1,000 enterprise clients across Southeast Asia and India across sectors, such as Banking, Fintech, Retail, and eCommerce.

- Megvii is a technology company based in China that specialises in AI, particularly deep learning. The company offers full-stack solutions integrating algorithms, software, hardware, and AI-empowered IoT devices. Products include facial recognition software, image recognition, and deep learning technology for applications such as consumer IoT, city IoT, and supply chain IoT.

- I’mCloud is based in South Korea and specialises in AI, big data, and cloud storage solutions. The company has become a significant player in the AI and big data industry in South Korea. They offer high-quality AI-powered chatbots, including for call centres and interactive educational services.

- H2O.ai provides an AI platform, the H2O AI Cloud, to help businesses, government entities, non-profits, and academic institutions create, deploy, monitor, and share data models or AI applications for various use cases. The platform offers automated machine learning capabilities powered by H2O-3, H2O Hydrogen Torch, and Driverless AI, and is designed to help organisations work more efficiently on their AI projects.

- Frame AI provides an AI-powered customer intelligence platform. The software analyses human interactions and uses AI to understand the driving factors of business outcomes within customer service. It aims to assist executives in making real-time decisions about the customer experience by combining data about customer interactions across various platforms, such as helpdesks, contact centres, and CRM transcripts.

- Uizard offers a rapid, AI-powered UI design tool for designing wireframes, mockups, and prototypes in minutes. The company’s mission is to democratise design and empower non-designers to build digital, interactive products. Uizard’s AI features allow users to generate UI designs from text prompts, convert hand-drawn sketches into wireframes, and transform screenshots into editable designs.

- Moveworks provides an AI platform that is designed to automate employee support. The platform helps employees to automate tasks, find information, query data, receive notifications, and create content across multiple business applications.

- Tome develops a storytelling tool designed to reduce the time required for creating slides. The company’s online platform creates or emphasises points with narration or adds interactive embeds with live data or content from anywhere on the web, 3D renderings, and prototypes.

- Jasper is an AI writing tool designed to assist in generating marketing copy, such as blog posts, product descriptions, company bios, ad copy, and social media captions. It offers features such as text and image AI generation, integration with Grammarly and other Chrome extensions, revision history, auto-save, document sharing, multi-user login, and a plagiarism checker.

- Eightfold AI provides an AI-powered Talent Intelligence Platform to help organisations recruit, retain, and grow a diverse global workforce. The platform uses AI to match the right people to the right projects, based on their skills, potential, and learning ability, enabling organisations to make informed talent decisions. They also offer solutions for diversity, equity, and inclusion (DEI), skills intelligence, and governance, among others.

- Arthur provides a centralised platform for model monitoring. The company’s platform is model and platform agnostic, and monitors machine learning models to ensure they deliver accurate, transparent, and fair results. They also offer services for explainability and bias mitigation.

- DNSFilter is a cloud-based, AI-driven content filtering and threat protection service, that can be deployed and configured within minutes, requiring no software installation.

- Spot AI specialises in building a modern AI Camera System to create safer workplaces and smarter operations for every organisation. The company’s AI Camera System combines cloud and edge computing to make video footage actionable, allowing customers to instantly surface and resolve problems. They offer intelligent video recorders, IP cameras, cloud dashboards, and advanced AI alerts to proactively deliver insights without the need to manually review video footage.

- People.ai is an AI-powered revenue intelligence platform that helps customers win more revenue by providing sales, RevOps, marketing, enablement, and customer success teams with valuable insights. The company’s platform is designed to speed up complex enterprise sales cycles by engaging the right people in the right accounts, ultimately helping teams to sell more and faster with the same headcount.

These examples highlight a few startups worth considering, but the landscape is rich with innovative options for organisations to explore. Similar to other emerging tech sectors, the AI startup market will undergo consolidation over time, and incumbent providers will continue to improve and innovate their own AI capabilities. Till then, these startups will continue to influence enterprise technology adoption and challenge established providers in the market.

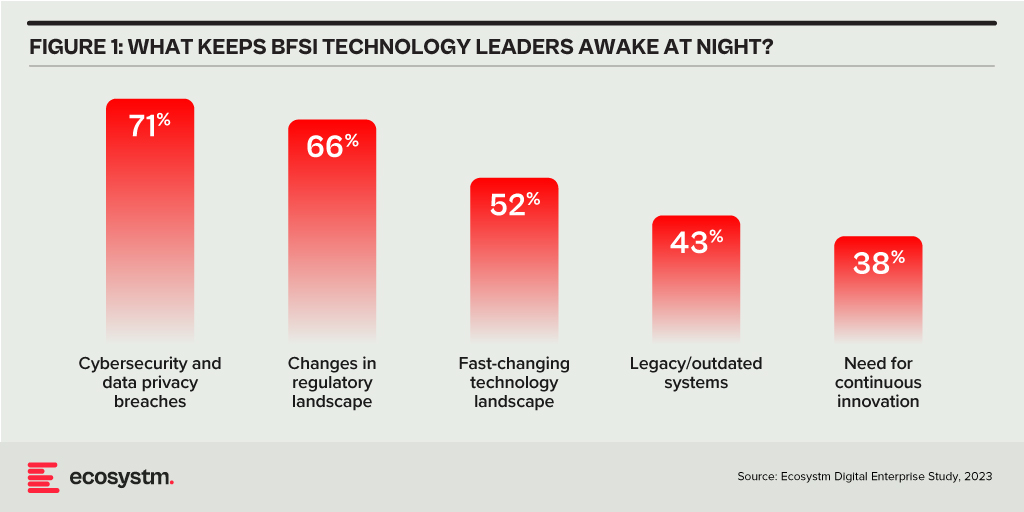

Trust in the Banking, Financial Services, and Insurance (BFSI) industry is critical – and this amplifies the value of stolen data and fuels the motivation of malicious actors. Ransomware attacks continue to escalate, underscoring the need for fortified backup, encryption, and intrusion prevention systems. Similarly, phishing schemes have become increasingly sophisticated, placing a burden on BFSI cyber teams to educate employees, inform customers, deploy multifactor authentication, and implement fraud detection systems. While BFSI organisations work to fortify their defences, intruders continually find new avenues for profit – cyber protection is a high-stakes game of technological cat and mouse!

Some of these challenges inherent to the industry include the rise of cryptojacking – the unauthorised use of a BFSI company’s extensive computational resources for cryptocurrency mining.

Building Trust Amidst Expanding Threat Landscape

BFSI organisations face increasing complexity in their IT landscapes. Amidst initiatives like robo-advisory, point-of-sale lending, and personalised engagements – often facilitated by cloud-based fintech providers – they encounter new intricacies. As guest access extends to bank branches and IoT devices proliferate in public settings, vulnerabilities can emerge unexpectedly. Threats may arise from diverse origins, including misconfigured ATMs, unattended security cameras, or even asset trackers. Ensuring security and maintaining customer trust requires BFSI organisations to deploy automated and intelligent security systems to respond to emerging new threats.

Ecosystm research finds that nearly 70% of BFSI organisations have the intention of adopting AI and automation for security operations, over the next two years. But the reality is that adoption is still fairly nascent. Their top cyber focus areas remain data security, risk and compliance management, and application security.

Addressing Alert Fatigue and Control Challenges

According to Ecosystm research, 50% of BFSI organisations use more than 50 security tools to secure their infrastructure – and these are only the known tools. Cyber leaders are not only challenged with finding, assessing, and deploying the right tools, they are also challenged with managing them. Management challenges include a lack of centralised control across assets and applications and handling a high volume of security events and false positives.

Software updates and patches within the IT environment are crucial for security operations to identify and address potential vulnerabilities. Management of the IT environment should be paired with greater automation – event correlation, patching, and access management can all be improved through reduced manual processes.

Security operations teams must contend with the thousands of alerts that they receive each day. As a result, security analysts suffer from alert fatigue and struggle to recognise critical issues and novel threats. There is an urgency to deploy solutions that can help to reduce noise. For many organisations, an AI-augmented security team could de-prioritise 90% of alerts and focus on genuine risks.

Taken a step further, tools like AIOps can not only prioritise alerts but also respond to them. Directing issues to the appropriate people, recommending actions that can be taken by operators directly in a collaboration tool, and rules-based workflows performed automatically are already possible. Additionally, by evaluating past failures and successes, AIOps can learn over time which events are likely to become critical and how to respond to them. This brings us closer to the dream of NoOps, where security operations are completely automated.

Threat Intelligence and Visibility for a Proactive Cyber Approach

New forms of ransomware, phishing schemes, and unidentified vulnerabilities in cloud are emerging to exploit the growing attack surface of financial services organisations. Security operations teams in the BFSI sector spend most of their resources dealing with incoming alerts, leaving them with little time to proactively investigate new threats. It is evident that organisations require a partner that has the scale to maintain a data lake of threats identified by a broad range of customers even within the same industry. For greater predictive capabilities, threat intelligence should be based on research carried out on the dark web to improve situational awareness. These insights can help security operations teams to prepare for future attacks. Regular reporting to keep CIOs and CISOs informed of the changing threat landscape can also ease the mind of executives.

To ensure services can be delivered securely, BFSI organisations require additional visibility of traffic on their networks. The ability to not only inspect traffic as it passes through the firewall but to see activity within the network is critical in these increasingly complex environments. Network traffic anomaly detection uses machine learning to recognise typical traffic patterns and generates alerts for abnormal activity, such as privilege escalation or container escape. The growing acceptance of BYOD has also made device visibility more complex. By employing AI and adopting a zero-trust approach, devices can be profiled and granted appropriate access automatically. Network operators gain visibility of unknown devices and can easily enforce policies on a segmented network.

Intelligent Cyber Strategies

Here is what BFSI CISOs should prioritise to build a cyber resilient organisation.

Automation. The volume of incoming threats has grown beyond the capability of human operators to investigate manually. Increase the level of automation in your SOC to minimise the routine burden on the security operations team and allow them to focus on high-risk threats.

Cyberattack simulation exercises. Many security teams are too busy dealing with day-to-day operations to perform simulation exercises. However, they are a vital component of response planning. Organisation-wide exercises – that include security, IT operations, and communications teams – should be conducted regularly.

An AIOps topology map. Identify where you have reliable data sources that could be analysed by AIOps. Then select a domain by assessing the present level of observability and automation, IT skills gap, frequency of threats, and business criticality. As you add additional domains and the system learns, the value you realise from AIOps will grow.

A trusted intelligence partner. Extend your security operations team by working with a partner that can provide threat intelligence unattainable to most individual organisations. Threat intelligence providers can pool insights gathered from a diversity of client engagements and dedicated researchers. By leveraging the experience of a partner, BFSI organisations can better plan for how they will respond to inevitable breaches.

Conclusion

An effective cybersecurity strategy demands a comprehensive approach that incorporates technology, education, and policies while nurturing a culture of security awareness throughout the organisation. CISOs face the daunting task of safeguarding their organisations against relentless cyber intrusion attempts by cybercriminals, who often leverage cutting-edge automated intrusion technologies.

To maintain an advantage over these threats, cybersecurity teams must have access to continuous threat intelligence; automation will be essential in addressing the shortage of security expertise and managing the overwhelming volume and frequency of security events. Collaborating with a specialised partner possessing both scale and experience is often the answer for organisations that want to augment their cybersecurity teams with intelligent, automated agents capable of swiftly

The global economy remains fragile due to multiple factors; and banking organisations will need to weather the storm. While large and well-capitalised banks are expected to fare better, there is a need for the industry to pursue new sources of value beyond traditional boundaries.

Banking industry leaders should be bold, proactive, and envision possibilities beyond current uncertainties. Technology has a key role to play in turning their innovation and resiliency goals into reality.

Read on to find out how the National Australia Bank, the Scottish National Investment Bank, the ANZ Bank, the Swiss National Bank, Mastercard, and the French banking group Crédit Agricole are leading the charge in driving innovation within the banking industry by investing in new technologies and exploring business models to better serve their customers.

Download ‘The Future of Banking’ as a PDF

November has seen uncertainties in the technology market with news of layoffs and hiring freezes from big names in the industry – Meta, Amazon, Salesforce, and Apple to name a few. These have impacted thousands of people globally, leaving tech talent with one common question, ‘What next?’

While the current situation and economic trends may seem grim, it is not all bad news for tech workers. It is true that people strategies in the sector may be impacted, but there are still plenty of opportunities for tech experts in the industry.

Here is what Ecosystm Analysts say about what’s next for technology workers.

Today, we are seeing two quite conflicting signals in the market: Tech vendors are laying off staff; and IT teams in businesses are struggling to hire the people they need.

At Ecosystm, we still expect a healthy growth in tech spend in 2023 and 2024 regardless of economic conditions. Businesses will be increasing their spend on security and data governance to limit their exposure to cyber-attacks; they will spend on automation to help teams grow productivity with current or lower headcount; they will continue their cloud investments to simplify their technology architectures, increase resilience, and to drive business agility. Security, cloud, data management and analytics, automation, and digital developers will all continue to see employment opportunities.

If this is the case, then why are tech vendors laying off headcount?

The slowdown in the American economy is a big reason. Tech providers that are laying of staff are heavily exposed to the American market.

- Salesforce – 68% Americas

- Facebook – 44% North America

- Genesys – around 60% in North America

Much of the messaging that these providers are giving is it is not that business is performing poorly – it is that growth is slowing down from the fast pace that many were witnessing when digital strategies accelerated.

Some of these tech providers might also be using the opportunity to “trim the fat” from their business – using the opportunity to get rid of the 2-3% of staff or teams that are underperforming. Interestingly, many of the people that are being laid off are from in or around the sales organisation. In some cases, tech providers are trimming products or services from their business and associated product, marketing, and technical staff are also being laid off.

While the majority of the impact is being felt in North America, there are certainly some people being laid off in Asia Pacific too. Particularly in companies where the development is done in Asia (India, China, ASEAN, etc.), there will be some impact when products or services are discontinued.

While it is not all bad news for tech talent, there is undoubtedly some nervousness. So this is what you should think about:

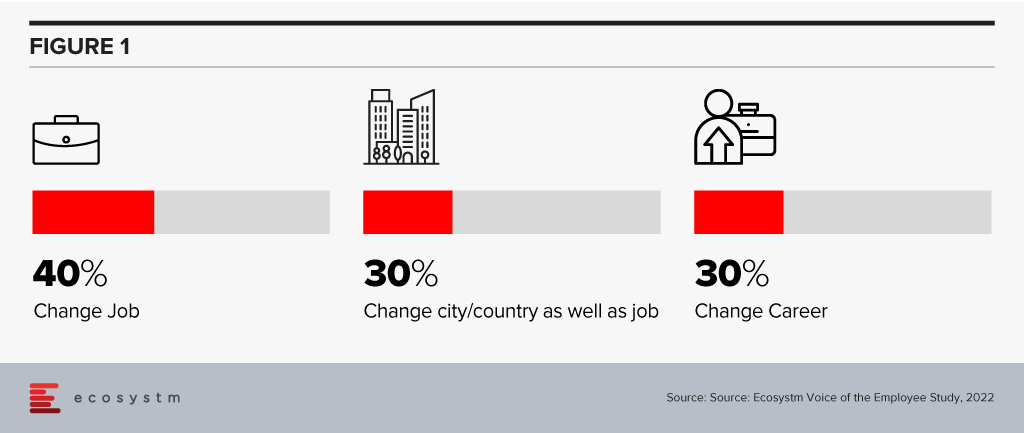

Change your immediate priorities. Ecosystm research found that 40% of digital/IT talent were looking to change employers in 2023. Nearly 60% of them were also thinking of changes in terms of where they live and their career.

This may not be the right time to voluntarily change your job. Job profiles and industry requirements should guide your decision – by February 2023, a clearer image of the job market will emerge. Till then, upskill and get those certifications to stay relevant!

Be prepared for contract roles. With a huge pool of highly skilled technologists on the hunt for new opportunities, smaller technology providers and start-ups have a cause to celebrate. They have faced the challenge of getting the right talent largely because of their inability to match the remunerations offered by large tech firms.

These companies may still not be able to match the benefits offered by the large tech firms – but they provide opportunities to expand your portfolio, industry expertise, and experience in emerging technologies. This will see a change in job profiles. It is expected that more contractual roles will open up for the technology industry. You will have more opportunities to explore the option of working on short-term assignments and consulting projects – sometimes on multiple projects and with multiple clients at the same time.

Think about switching sides. The fact remains that digital and technology upgrades continue to be organisational priorities, across all industries. As organisations continue on their digital journeys, they have an immense potential to address their skills gap now with the availability of highly skilled talent. In a recently conducted Ecosystm roundtable, CIOs reported that new graduates have been demanding salaries as high as USD 200,000 per annum! Even banks and consultancies – typically the top paying businesses – have been finding it hard to afford these skills! These industries may well benefit from the layoffs.

If you look at technology job listings, we see no signs of the demand abating!

In this blog, our guest author Shameek Kundu talks about the importance of making AI/ machine learning models reliable and safe. “Getting data and algorithms right has always been important, particularly in regulated industries such as banking, insurance, life sciences and healthcare. But the bar is much higher now: more data, from more sources, in more formats, feeding more algorithms, with higher stakes.”

Building trust in algorithms is essential. Not (just) because regulators want it, but because it is good for customers and business. The good news is that with the right approach and tooling, it is also achievable.

Getting data and algorithms right has always been important, particularly in regulated industries such as banking, insurance, life sciences and healthcare. But the bar is much higher now: more data, from more sources, in more formats, feeding more algorithms, with higher stakes. With the increased use of Artificial Intelligence/ Machine Learning (AI/ML), today’s algorithms are also more powerful and difficult to understand.

A false dichotomy

At this point in the conversation, I get one of two reactions. One is of distrust in AI/ML and a belief that it should have little role to play in regulated industries. Another is of nonchalance; after all, most of us feel comfortable using ‘black-boxes’ (e.g., airplanes, smartphones) in our daily lives without being able to explain how they work. Why hold AI/ML to special standards?

Both make valid points. But the skeptics miss out on the very real opportunity cost of not using AI/ML – whether it is living with historical biases in human decision-making or simply not being able to do things that are too complex for a human to do, at scale. For example, the use of alternative data and AI/ML has helped bring financial services to many who have never had access before.

On the other hand, cheerleaders for unfettered use of AI/ML might be overlooking the fact that a human being (often with a limited understanding of AI/ML) is always accountable for and/ or impacted by the algorithm. And fairly or otherwise, AI/ML models do elicit concerns around their opacity – among regulators, senior managers, customers and the broader society. In many situations, ensuring that the human can understand the basis of algorithmic decisions is a necessity, not a luxury.

A way forward

Reconciling these seemingly conflicting requirements is possible. But it requires serious commitment from business and data/ analytics leaders – not (just) because regulators demand it, but because it is good for their customers and their business, and the only way to start capturing the full value from AI/ML.

1. ‘Heart’, not just ‘Head’

It is relatively easy to get people excited about experimenting with AI/ML. But when it comes to actually trusting the model to make decisions for us, we humans are likely to put up our defences. Convincing a loan approver, insurance under-writer, medical doctor or front-line sales-person to trust an AI/ML model – over their own knowledge or intuition – is as much about the ‘heart’ as the ‘head’. Helping them understand, on their own terms, how the alternative is at least as good as their current way of doing things, is crucial.

2. A Broad Church

Even in industries/ organisations that recognise the importance of governing AI/ML, there is a tendency to define it narrowly. For example, in Financial Services, one might argue that “an ML model is just another model” and expect existing Model Risk teams to deal with any incremental risks from AI/ML.

There are two issues with this approach:

First, AI/ML models tend to require a greater focus on model quality (e.g., with respect to stability, overfitting and unjust bias) than their traditional alternatives. The pace at which such models are expected to be introduced and re-calibrated is also much higher, stretching traditional model risk management approaches.

Second, poorly designed AI/ML models create second order risks. While not unique to AI/ML, these risks become accentuated due to model complexity, greater dependence on (high-volume, often non-traditional) data and ubiquitous adoption. One example is poor customer experience (e.g., badly communicated decisions) and unfair treatment (e.g., unfair denial of service, discrimination, misselling, inappropriate investment recommendations). Another is around the stability, integrity and competitiveness of financial markets (e.g., unintended collusion with other market players). Obligations under data privacy, sovereignty and security requirements could also become more challenging.

The only way to respond holistically is to bring together a broad coalition – of data managers and scientists, technologists, specialists from risk, compliance, operations and cyber-security, and business leaders.

3. Automate, Automate, Automate

A key driver for the adoption and effectiveness of AI/ ML is scalability. The techniques used to manage traditional models are often inadequate in the face of more data-hungry, widely used and rapidly refreshed AI/ML models. Whether it is during the development and testing phase, formal assessment/ validation or ongoing post-production monitoring, it is impossible to govern AI/ML at scale using manual processes alone.

o, somewhat counter-intuitively, we need more automation if we are to build and sustain trust in AI/ML. As humans are accountable for the outcomes of AI/ ML models, we can only be ‘in charge’ if we have the tools to provide us reliable intelligence on them – before and after they go into production. As the recent experience with model performance during COVID-19 suggests, maintaining trust in AI/ML models is an ongoing task.

***

I have heard people say “AI is too important to be left to the experts”. Perhaps. But I am yet to come across an AI/ML practitioner who is not keenly aware of the importance of making their models reliable and safe. What I have noticed is that they often lack suitable tools – to support them in analysing and monitoring models, and to enable conversations to build trust with stakeholders. If AI is to be adopted at scale, that must change.

Shameek Kundu is Chief Strategy Officer and Head of Financial Services at TruEra Inc. TruEra helps enterprises analyse, improve and monitor quality of machine

Have you evaluated the tech areas on your AI requirements? Get access to AI insights and key industry trends from our AI research.

As the Knowledge Partner for the Singapore Fintech Festival, Ecosystm has a finger on the pulse of the Financial Services industry.

In this Ecosystm Bytes, we focus on how the Banking industry will look in the decade ahead, why it continues to struggle with compliance and customer experience, and where technology is helping.

Ecosystm Predicts: The Top 5 FinTech Trends for 2021

In 2021, one of the prevalent shifts we are witnessing in banking services is the switch towards automation to enhance the services and customer experience. Want to know more? Create your free account on the Ecosystm platform to access The Top 5 FinTech Trends for 2021 and more from the Ecosystm Predicts Series.

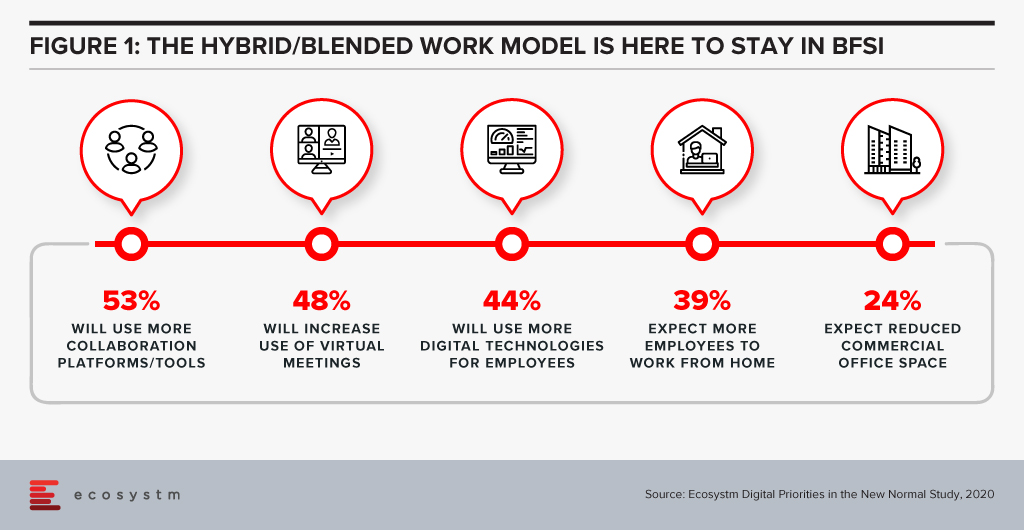

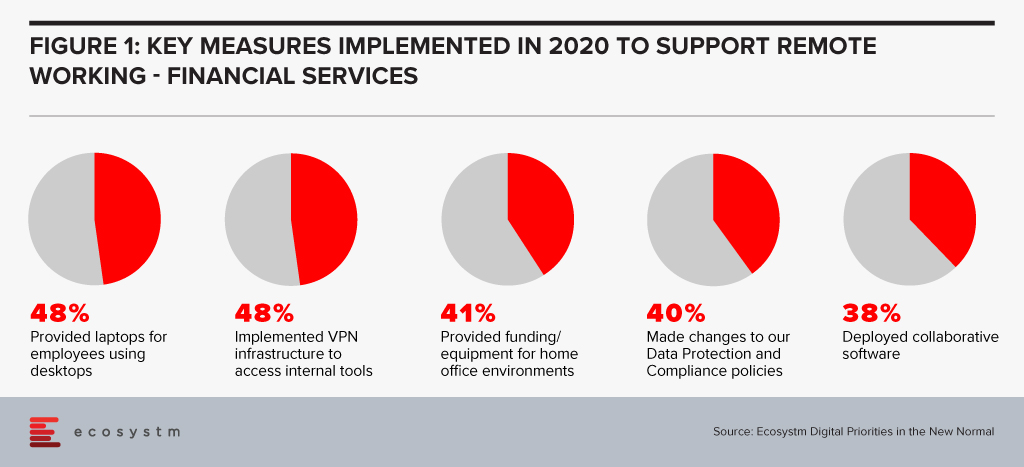

Financial services institutions made a fast switch to remote working when the pandemic forced widespread lockdowns across the globe. The adoption of remote working was nascent in the industry, and there was a need for a fast pivot by both the organisations and employees (Figure 1).

However, this has also exposed the industry to technology-related risks. Ecosystm Principal Advisor, Gerald Mackenzie says, “The move to a more virtualised working environment has been a trend taking shape for many years and like so many trends, it needed an impetus to make it a norm; in this case COVID-19.”

“Many, if not most, financial institutions have been shifting to more cloud-based and modularised Banking-as-a-Service (BaaS) models and these trends will only accelerate as we need to manage risks inherent in conducting financial services via remote working environments. For example, critical capabilities such as Advisor to Client communications need to be verifiable and auditable whether they are happening inside or outside of the office and I predict regulators will be pushing financial institutions to ensure these standards become the norm rather than the exception.”

Singapore Addresses Risk in the Financial Industry

To manage and mitigate risks that could emerge from the extensive remote working adoptions by FIs, The Monetary Authority of Singapore (MAS) and The Association of Banks in Singapore (ABS) jointly released a paper titled Risk Management and Operational Resilience in a Remote Working Environment. This is also in line with the previous collaboration between MAS and ABS in May 2020 to establish the Return to Onsite Operations Taskforce (ROOT). ROOT sought to strengthen and implement safe management and operational resilience measures as well as endorsement of industry best practices.

The paper seeks to create awareness amongst financial institutions on key remote working risks in the domains of technology, operations, security, fraud, staff misconduct, legal and regulatory risks. MAS encourages them to take pre-emptive measures to adopt good practices on managing risks.

Mackenzie adds, “Of course, some of the issues are difficult to solve. For example, staff accessing client data from their homes creates inherent vulnerabilities and the ways to ensure staff have suitable ‘in-home’ working environments to effectively manage these risks can be challenging and expensive. There are great opportunities for innovators to adapt solutions to solve these problems in what will undoubtedly be a growing investment area for many Financial Institutions.” The paper also examines various controls on the people and culture leveraging examples drawn from the experiences of ABS member banks to address evolving risks. For instance, FIs can implement security controls on staff infrastructure including their personal devices, verify in-person meetings against original documents, timely response strategies for recovery teams, legal risks and more.

To keep pace with the changing trends in technology deployment, risk management, and cybersecurity, MAS has been regularly working and engaging with experts to introduce guidelines, principles and best practices for financial institutions. In February, MAS issued a consultation paper proposing revisions to enhance the current requirements for enterprise risk management, investment risk management and public disclosure practices for insurers. Similarly, in January, MAS issued risk management best practice and standards to guide financial institutions in managing technology risk and maintain IT and cyber resilience.

Get insights on the technology areas in the Financial services industry that will see continued investments, as organisations get into the recovery phase.

Organisations are finding that the ways to do work and conduct business are evolving rapidly. It is evident that we cannot use the perspectives from the past as a guide to the future. As a consequence both leaders and employees are discovering and adapting both their work and their expectations from it. In general, while job security concerns still command a big mindshare, the simpler productivity measures are evolving to more nuanced wellness measures. This puts demands on the CHRO and the leadership team to think about company, customer and people strategy as one holistic way of working and doing business.

Organisations will have to re-think their people and technology to evolve their Future of Work policies and strategise their Future of Talent. There are multiple dimensions that will require attention.

Hybrid is Becoming Mainstream

It is clear that hybrid workplaces are here to stay. Ecosystm research finds that in 2021 BFSI organisations will use more collaboration tools and platforms, and virtual meetings (Figure 1). Nearly 40% expect more employees to work from home, but only about a quarter of organisations are looking to reduce their physical workspaces. Organisations will give more choice to employees in the location of their work – and employees will choose to work from where they are more productive. The Hybrid model will be more mainstream than it has been in the last few months.

Companies are coming to terms with the fact that there is no single answer to operating in the new world. Experimentation and learnings are continuously captured to create the right workforce and workplace model that works best. Agility both in terms of being able to undersand the market as well as quickly adapt is becoming quite important. Thus being able to use different models and ways of working at the same time is the new norm.

Technology and Talent are Core

Talent and tech are the two core pillars that companies need to look at to be successful against their competition. It is becoming imperative to create synergy between the two to deliver a superior value proposition to customers. Companies that are able to bring the customer and employee experience journeys together will be able to create better value. HR tech stacks need to evolve to be more deliberate in the way they link the employee experience, customer experience, and the culture of the organisation. That’s how the Employee Value Proposition (EVP) comes to life on a day-to-day basis to the employers. With evolving work models, the tech stack is a key EVP pillar.

Governments will also need to partner with industry to make such talent available. Singapore is rolling out a new “Tech.Pass” to support the entry of up to 500 proven founders, leaders and experts from top tech companies into Singapore. Its an extension of the Tech@SG program launched in 2019, to provide fast-growing companies greater assurance and access to the talent they need. The EDB will administer the pass, supported by the Ministry of Manpower.

Attracting the Right Talent

Talent has always been difficult to find. Even with globalisation, significant investment of time and resources is needed to find and relocate talent to the right geography. In many instances this was not possible given the preferences of the candidates and/or the hiring managers. COVID-19 has changed this drastically. Remote working and distributed teams have become acceptable. With limitations on immigration and travel for work, there is a lot more openness to finding and hiring talent from outside the traditional talent pool.

However it is not as simple as it seems. The cost per applicant (CPA) – the cost to convert a job seeker to a job applicant – had been averaging US$11-12 throughout 2019 according to recruiting benchmark data from programmatic recruitment advertising provider, Appcast. But, the impact of COVID-19 saw the CPA reach US$19 in June – a 60% increase. I expect that finding right talent is going to be a “needle in a haystack” issue. But this is only one side of the coin – the other aspect is that the talent profile needed to be successful in roles that are all remote or hybrid is also significantly different from what it was before. Companies need to pay special attention to what kind of people they would like to hire in these new roles. Without this due consideration it is very likely that there would be difficulty in on-boarding and making these new hires successful within the organisation.

Automation Augmentation and Skills

The pace at which companies are choosing to automate or apply AI is increasing. This is changing the work patterns and job requirements for many roles within the industry. According to the BCG China AI study on the financial sector 23% of the roles will be replaced by AI by 2027. The roles that will not be replaced will need a higher degree of soft skills, critical thinking and creativity. However, automation is not the endgame. Firms that go ahead with automation without considering the implications on the business process, and the skills and roles it impacts will end up disrupting the business and customer experience. Firms will have to really design their customer journeys, their business processes along with roles and capabilities needed. Job redesign and reskilling will be key to ensuring a great customer experience

Analytics is Inadequate Without the Right Culture

Data-driven decision-making as well as modelling is known to add value to business. We have great examples of analytics and data modelling being used successfully in Attrition, Recruitment, Talent Analytics, Engagement and Employee Experience. The next evolution is already underway with advanced analytics, sentiment analysis, organisation network analysis and natural language processing (NLP) being used to draw better insights and make people strategies predictive. Being able to use effective data models to predict and and draw insights will be a key success factor for leadership teams. Data and bots do not drive engagement and alignment to purpose – leaders do. Working to promote transparency of data insights and decisions, for faster response, to champion diversity, and give everyone a voice through inclusion will lead to better co-creation, faster innovation and an overall market agility.

Creating a Synergy

We are seeing a number of resets to what we used to know, believe and think about the ways of working. It is a good time to rethink what we believe about the customer, business talent and tech. Just like customer experience is not just about good sales skills or customer service – the employee experience and role of Talent is also evolving rapidly. As companies experiment with work models, technology and work environment, there will a need to constantly recalibrate business models, job roles, job technology and skills. With this will come the challenge of melding the pieces together within the context of the entire business without falling into the trap of siloed thinking. Only by bringing together businesses processes, talent, capability evolution, culture and digital platforms together as one coherent ecosystem can firms create a winning formula to create a competitive edge.

Singapore FinTech Festival 2020: Talent Summit

For more insights, attend the Singapore FinTech Festival 2020: Infrastructure Summit which will cover topics on Founders success and failure stories, pandemic impact on founders and talent development, upskilling and reskilling for the future of work.

The COVID-19 pandemic is debilitating industries, and economies around the world are facing the prospect of a recession. Malaysia, like many other countries, is focussing on front-line medical efforts and security services to save lives and contain the deadly, rapidly spreading virus. Essential services such as food, water and energy supply, Telecommunications, Banking, eCommerce and logistics are working overtime in this new order to support basic functions. The measures put in place to mitigate the spread of the virus are obviously inhibiting other economic activities.

Until enough people develop an immunity to the virus – either through a vaccine or naturally – it is hard to envisage lifting these movement control measures and return to a pre COVID-19 state. Malaysia has a total of 4,987 positive cases, the highest in Southeast Asia and a death toll of 82 as of today. The number of the population tested remains low at 81,730 as reported by the Ministry of Health, mainly due to limited testing resources.

The biggest challenge is that this epidemic is unprecedented, and it is unclear when we can put this situation behind us. The Malaysian Industry of Economic Research (MIER) has predicted about 2.4 million job losses as well as the GDP to reduce by 2.9 percent in 2020. Public debt rise coupled by reduced income due to lower crude oil, natural gas and palm oil prices and demand, will hit the Government coffers hard. Interest rates are expected to be low through the current lockdown stage right up to the recovery stage to help support the economic recovery.

Government Initiatives for the Economy

Like many countries, Malaysia has announced economic stimulus packages to ensure help for the poor and needy, that workers do not lose their jobs and that companies avoid bankruptcy – albeit with an inevitably reduced output – to keep the economy functioning. The stimulus offered is short-term covering a few months, and more assistance will be required should the epidemic linger and for the recovery period.

The Government announced a stimulus package on the 27th February worth RM20 billion (US$4.5 billion) and another one on the 27th March worth RM230 billion (US$52.6 billion). The packages comprise of direct fiscal injection of RM25 billion (US$5.7 billion) as well as loan deferments, one-off cash assistance, credit facilities and rebates. The focus of the stimulus packages is to assist people in the lower-income (B40) and mid-income (M40) groups, aid for employees in the private sector and for traders during the movement control order (MCO) which is to run until 14th April 2020.

An additional COVID-19 stimulus package worth RM10 billion (US$2.2 billion) was announced on the 6th April to address the challenges of the small and medium enterprises (SMEs) that employ two-thirds of the workforce and contribute to 40 percent of the GDP. The wage subsidy is to benefit 4.8 million workers earning less than RM4,000 (US$915) per month. In addition, SMEs will have access to interest free loans of RM200 million (US$45.7 million) from the National Entrepreneur Group Economic Fund and a further RM500 million (US$114.4 million) via Bank Simpanan Nasional. The Government allowed 750,000 SMEs to postpone income tax payment for three months from 1st April – companies in the tourism sector are allowed to postpone income tax for six months.

Impact on Industries

Banking & Financial Services. Banking institutions will support the Government’s stimulus initiatives by providing a six months’ loan repayment moratorium, corporate loan restructuring and conversion of credit card balance to long term loans. Banking and financial institutions are focussing on business continuity planning to ensure minimal disruption to their business and customer support. Many key business processes are now being put to test in-home working with scaled-down office operations. Digital Transformation (DX) has been accelerated as a result.

Contactless payments have seen a boost and many financial institutions have increased payment limits for such payments. Early last month the World Health Organisation (WHO) and the Bank of England had issued advisories against the use of banknotes, as it could increase the chances of the virus spread, instead recommending the use of contactless payment where possible. This might give a boost to the use of Cryptocurrency and cross-border payment services in Malaysia. In 2019, cryptocurrency start-ups received an estimated 12 percent of Fintech funding – but, only three cryptocurrency exchanges were given conditional approval by the Securities Commission. The current situation may well see that changing.

Insurance. The Prime Minister announced that the Insurance industry is to create a fund of RM8 million (US$1.8 million) to cover the cost of RM300 (US$68.6) per policyholder to undergo COVID-19 tests. In addition to this, insurance companies are to offer a 3-month suspension on premiums for policyholders whose income is affected by the pandemic.

Agriculture. Even prior to COVID-19, there has been a brewing narrative against globalisation, favouring a nationalistic emphasis as reflected globally by Brexit and the China-US trade wars tension. Food security is key, and COVID-19 has further highlighted its importance with priorities shifting to local requirements over exports. The Government intends to distribute a food security fund of RM1 billion (US$228.8 million) to increase the local production of farms, fisheries and livestock. According to the Department of Statistics, Malaysia’s food and beverage imports amounted to RM54 billion (US$12.3 billion) in 2018 while food exports stood at RM35 billion (US$8.0 billion) resulting in a trade deficit of RM18.8 billion (US$4.3 billion). As countries focus on internal supplies instead of exports in the current scenario, Malaysia needs to address this risk by producing more locally.

Impact on Industry Transformation

Amidst the gloomy outlook, there are plenty of opportunities, especially to the country’s Digital Economy. Malaysia has been committed to the Digital Economy vision with the Malaysia Digital Economy Corporation (MDEC) estimating that the country’s Digital Economy is worth US$3 trillion. The COVID-19 crisis may well be the key driver in achieving that vision. DX efforts are being accelerated with businesses adopting more cloud and mobility solutions. More workloads have to be digitalised and there is greater adoption of Cloud for storage and services. AWS, Microsoft Azure and Google Cloud will be beneficiaries in this area.

I have already spoken about the Financial Services industry – other industries are also getting transformed out of a necessity to survive this crisis. The Education sector has seen an increase in access to educational content and traffic to education portals and blogs. Some schools have implemented online lessons and group chats between teachers, students and parents to ensure education continues through this pandemic. Many universities have used their e-learning platforms to move lectures online.

The Telecommunications industry is being appreciated more than ever and it is the backbone to normal life, in both a social and business sense. The Government’s stimulus package includes offers of free internet to all customers until the MCO is over at RM600 million (US$137.3 million) and an investment of about RM400 million (US$91.5 million) to improve coverage and quality of service. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period. The Axiata Group recently announced a cash fund of RM150 million (US$34.3 million) to assist micro-SMEs within the ecosystem providing eCommerce, digital payments and related services.

Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been the biggest winners so far. The home working trend should continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and the impending rollout of 5G.

The eCommerce sector should see a major improvement in Malaysia with physical channels to the market being suspended. Malaysians have not embraced eCommerce like mature economies have, and it has significant room for improvement. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. Statista reports that the average Malaysian eCommerce shopper spent just US$159 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for necessities such as online grocery, food and delivery of goods. As a consequence, the Transport & Logistics sector will have to adapt their business operations in order to ride this wave successfully.

Video streaming and gaming has also seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. There provides a tremendous opportunity for both telecom operators and content providers to increase their number of services in this area.

Malaysia, like all other countries, will have to ride out this wave. It has made a positive step in the direction with the stimulus packages, especially for the SME sector. How well the country rides this wave out will depend on how targeted the future stimulus packages are and how fast industries can transform to handle the new world order that will emerge after the COVID-19 crisis.