Despite financial institutions’ unwavering efforts to safeguard their customers, scammers continually evolve to exploit advancements in technology. For example, the number of scams and cybercrimes reported to the police in Singapore increased by a staggering 49.6% to 50,376 at an estimated cost of USD 482M in 2023. GenAI represents the latest challenge to the industry, providing fraudsters with new avenues for deception.

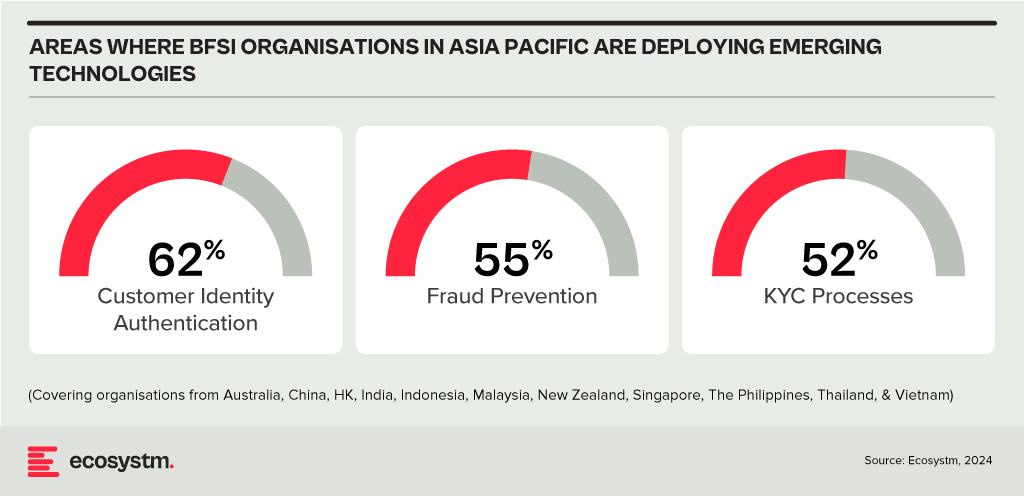

Ecosystm research shows that BFSI organisations in Asia Pacific are spending more on technologies to authenticate customer identity and prevent fraud, than they are in their Know Your Customer (KYC) processes.

The Evolution of the Threat Landscape in BFSI

Synthetic Identity Fraud. This involves the creation of fictitious identities by combining real and fake information, distinct from traditional identity theft where personal data is stolen. These synthetic identities are then exploited to open fraudulent accounts, obtain credit, or engage in financial crimes, often evading detection due to their lack of association with real individuals. The Deloitte Centre for Financial Services predicts that synthetic identity fraud will result in USD 23B in losses by 2030. Synthetic fraud is posing significant challenges for financial institutions and law enforcement agencies, especially with the emergence of advanced technologies like GenAI being used to produce realistic documents blending genuine and false information, undermining Know Your Customer (KYC) protocols.

AI-Enhanced Phishing. Ecosystm research reveals that in Asia Pacific, 71% of customer interactions in BFSI occur across multiple digital channels, including mobile apps, emails, messaging, web chats, and conversational AI. In fact, 57% of organisations plan to further improve customer self-service capabilities to meet the demand for flexible and convenient service delivery. The proliferation of digital channels brings with it an increased risk of phishing attacks.

While these organisations continue to educate their customers on how to secure their accounts in a digital world, GenAI poses an escalating threat here as well. Phishing schemes will employ widely available LLMs to generate convincing text and even images. For many potential victims, misspellings and strangely worded appeals are the only hint that an email from their bank is not what it seems. The maturing of deepfake technology will also make it possible for malicious agents to create personalised voice and video attacks.

Identity Fraud Detection and Prevention

Although fraudsters are exploiting every new vulnerability, financial organisations also have new tools to protect their customers. Organisations should build a layered defence to prevent increasingly sophisticated attempts at fraud.

- Behavioural analytics. Using machine learning, financial organisations can differentiate between standard activities and suspicious behaviour at the account level. Data that can be analysed includes purchase patterns, unusual transaction values, VPN use, browser choice, log-in times, and impossible travel. Anomalies can be flagged, and additional security measures initiated to stem the attack.

- Passive authentication. Accounts can be protected even before password or biometric authentication by analysing additional data, such as phone number and IP address. This approach can be enhanced by comparing databases populated with the details of suspicious actors.

- SIM swap detection. SMS-based MFA is vulnerable to SIM swap attacks where a customer’s phone number is transferred to the fraudster’s own device. This can be prevented by using an authenticator app rather than SMS. Alternatively, SIM swap history can be detected before sending one-time passwords (OTPs).

- Breached password detection. Although customers are strongly discouraged to reuse passwords across sites, some inevitably will. By employing a service that maintains a database of credentials leaked during third-party breaches, it is possible to compare with active customer passwords and initiate a reset.

- Stronger biometrics. Phone-based fingerprint recognition has helped financial organisations safeguard against fraud and simplify the authentication experience. Advances in biometrics continue with recognition for faces, retina, iris, palm print, and voice making multimodal biometric protection possible. Liveness detection will grow in importance to combat against AI-generated content.

- Step-up validation. Authentication requirements can be differentiated according to risk level. Lower risk activities, such as balance check or internal transfer, may only require minimal authentication while higher risk ones, like international or cryptocurrency transactions may require a step up in validation. When anomalous behaviour is detected, even greater levels of security can be initiated.

Recommendations

- Reduce friction. While it may be tempting to implement heavy handed approaches to prevent fraud, it is also important to minimise friction in the authentication system. Frustrated users may abandon services or find risky ways to circumvent security. An effective layered defence should act in the background to prevent attackers getting close.

- AI Phishing Awareness. Even the savviest of customers could fall prey to advanced phishing attacks that are using GenAI. Social engineering at scale becomes increasingly more possible with each advance in AI. Monitor emerging global phishing activities and remind customers to be ever vigilant of more polished and personalised phishing attempts.

- Deploy an authenticator app. Consider shifting away from OTP SMS as an MFA method and implement either an authenticator app or one embedded in the financial app instead.

- Integrate authentication with fraud analytics. Select an authentication provider that can integrate its offering with analytics to identify fraud or unusual behaviour during account creation, log in, and transactions. The two systems should work in tandem.

- Take a zero-trust approach. Protecting both customers and employees is critical, particularly in the hybrid work era. Implement zero trust tools to prevent employees from falling victim to malicious attacks and minimising damage if they do.

The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

For the last two years organisations have been forced to invest on digital services for their customers and giving their employees access to the right technologies to allow them to work from home – or from anywhere they choose to. Organisations find that they have to continue to evolve – and are now looking to build a ‘Digital Workplace’ that caters to the hybrid workplace.

As organisations in ASEAN define the work model that works for their business operations, work culture and organisational goals, there are a few areas that they must focus on.

Here are 5 insights from the Ecosystm Voice of the Employee Study that will help you shape your Digital Workplace.

- Evolve the physical workplace. 72% of knowledge workers in ASEAN will work both remotely and from the office.

- Build a true hybrid work culture. As organisations form their Digital Workplace strategy, they will have to ensure that the workplace is as comfortable as home offices!

- Focus on employee wellbeing. Only 25% of organisations in ASEAN have made changes to their HR policies in the last two years.

- Invest in the right technologies. To build that resilient hybrid workplace, organisations will first have to conduct a gap analysis and consolidation of their tech investments over the last two years.

- Continue to monitor employee behaviour patterns. As organisations work towards a ‘Return to Work’ policy, they will see significant changes in employee usage behaviour patterns. If the right cyber practices are not in place, this could leave organisations vulnerable again.

Read on for more insights