Hewlett Packard Enterprise (HPE) has entered into a definitive agreement to acquire Juniper Networks for USD 40 per share, totaling an equity value of about USD 14 Billion. This strategic move is aimed to enhance HPE’s portfolio by focusing on higher-growth solutions and reinforcing their high-margin networking business. HPE expects to double their networking business, positioning the combined entity as a leader in networking solutions. With the growing demand for secure, unified technology driven by AI and hybrid cloud trends, HPE aims to offer comprehensive, disruptive solutions that connect, protect, and analyse data from edge to cloud.

This would also be the organisation’s largest deal since becoming an independent company in 2015. The acquisition is expected to be completed by late 2024 or early 2025.

Ecosystm analysts Darian Bird and Richard Wilkins provide their insights on the HPE acquisition and its implications for the tech market.

Converging Networking and Security

One of the big drawcards for HPE is Juniper’s Mist AI. The networking vendors have been racing to catch up – both in capabilities and in marketing. The acquisition though will give HPE a leadership position in network visibility and manageability. With GreenLake and soon Mist AI, HPE will have a solid AIOps story across the entire infrastructure.

HPE has been working steadily towards becoming a player in the converged networking-security space. They integrated Silver Peak well to make a name for themselves in SD-WAN and last year acquiring Axis Security gave them the Zero Trust Network Access (ZTNA), Secure Web Gateway (SWG), and Cloud Access Security Broker (CASB) modules in the Secure Service Edge (SSE) stack. Bringing all of this to the market with Juniper’s networking prowess positions HPE as a formidable player, especially as the Secure Access Service Edge (SASE) market gains momentum.

As the market shifts towards converged SASE, there will only be more interest in the SD-WAN and SSE vendors. In just over one year, Cato Networks and Netskope have raised funds, Check Point acquired Perimeter 81, and Versa Networks has made noises about an IPO. The networking and security players are all figuring out how they can deliver a single-vendor SASE.

Although HPE’s strategic initiatives signal a robust market position, potential challenges arise from the overlap between Aruba and Juniper. However, the distinct focus on the edge and data center, respectively, may help alleviate these concerns. The acquisition also marks HPE’s foray into the telecom space, leveraging its earlier acquisition of Athonet and establishing a significant presence among service providers. This expansion enhances HPE’s overall market influence, posing a challenge to the long-standing dominance of Cisco.

The strategic acquisition of Juniper Networks by HPE can make a transformative leap in AIOps and Software-Defined Networking (SDN). There is a potential for this to establish a new benchmark in IT management.

AI in IT Operations Transformation

The integration of Mist’s AI-driven wireless solutions and HPE’s SDN is a paradigm shift in IT operations management and will help organisations transition from a reactive to a predictive and proactive model. Mist’s predictive analytics, coupled with HPE’s SDN capabilities, empower networks to dynamically adjust to user demands and environmental changes, ensuring optimal performance and user experience. Marvis, Mist’s Virtual Network Assistant (VNA), adds conversational troubleshooting capabilities, enhancing HPE’s network solutions. The integration envisions an IT ecosystem where Juniper’s AI augments HPE’s InfoSight, providing deeper insights into network behaviour, preemptive security measures, and more autonomous IT operations.

Transforming Cloud and Edge Computing

The incorporation of Juniper’s AI into HPE’s cloud and edge computing solutions promises a significant improvement in data processing and management. AI-driven load balancing and resource allocation mechanisms will significantly enhance multi-cloud environment efficiency, ensuring robust and seamless cloud services, particularly vital in IoT applications where real-time data processing is critical. This integration not only optimises cloud operations but also has the potential to align with HPE’s commitment to sustainability, showcasing how AI advancements can contribute to energy conservation.

In summary, HPE’s acquisition of Juniper Networks, and specifically the integration of the Mist AI platform, is a pivotal step towards an AI-driven, efficient, and predictive IT infrastructure. This can redefine the standards in AIOps and SDN, creating a future where IT systems are not only reactive but also intuitively adaptive to the evolving demands of the digital landscape.

Cyber threats are growing in volume, intensity, and complexity and are here to stay. Basic endpoint attacks are becoming intricate, multi-stage operations. Cybercriminals are launching highly coordinated and advanced attacks. This evolving threat landscape affects businesses of all sizes, jeopardising data, operations, and finances.

In the face of massive data leaks, costly ransomware payments, and an ever-expanding and complex threat landscape, the need to strengthen digital defences has driven significant advancements in cybersecurity.

Read on to find out how organisations, governments, industry associations and technology providers are evolving ways to combat cybercrime.

Download ‘Securing the Future: Cyber Resiliency in the Digital World’ as a PDF

Since officially separating from IBM in November last year, Kyndryl has been busy cementing some heavyweight partnerships. The alliances with Microsoft, Google, and VMware demonstrate its intention to build hybrid cloud solutions with whoever it needs to, rather than favouring the Big Blue or Red Hat. The SAP tie-up hints at a future of migrating ERP workloads to the cloud and even an eye on moving up the application stack. Last week Kyndryl announced it is working with Nokia to provide private 5G and LTE networks to enable Industry 4.0 solutions. The first customer reference for the partnership is Dow, deploying both real-world and proof-of-concept applications for worker safety and collaboration and asset tracking.

The Partnership

Kyndryl has a competitive networking services unit, particularly in partnership with Cisco. Its focus has been on SD-WAN, campus networks, and network management as part of broader cloud services deals. This 5G partnership with Nokia is its first serious effort to work with one of the major carrier-grade vendors using cellular technology. It creates an opportunity for Kyndryl to position itself as a provider of services that underpin IoT and edge applications, rather than only cloud, which has until now been its main strength.

Prior to the Kyndryl announcement, Nokia was already developing private 5G solutions under the moniker Digital Automation Cloud (DAC). A key customer is Volkswagen, using the network to connect robots and wireless assembly tools. Over-the-air vehicle updates are also tested over the private network. Volkswagen operates in a dedicated 3.7-3.8 GHz band, which was allocated by the Federal Network Agency in Germany. This illustrates a third option for accessing spectrum, which will become an important consideration in private 5G rollouts.

Private 5G Use Cases

Private 5G has several benefits such as low latency, long-range, support for many users per access point, and provision for devices that are mobile due to handover. It is unlikely that it will completely replace other technologies, like wireless LAN, but it is very compelling for certain use cases.

Private 5G is useful on large sites, like mines, ports, farms, and warehouses where connected machines are moving about or some devices – like perimeter security cameras – are just out of reach. Utilities, like power, gas, and water, with infrastructure that needs to be monitored over long distances, will also start looking at it as a part of their predictive maintenance and resiliency systems. Low latency will become increasingly important as we see more and more customer-facing digital services delivered on-site and autonomous robots in the production environment.

Another major benefit of private 5G compared to operating on public service is that data can remain within the organisation’s own network for as long as possible, providing more security and control.

Private 5G Gaining Popularity

There has been a lot of activity over the last year in this space, with the hyperscalers, telecom providers and network equipment vendors developing private 5G offerings.

Last year, the AWS Private 5G was announced, a managed service that includes core network hardware, small-cell radio units, SIM cards, servers, and software. The service operates over a shared spectrum, like the Citizens Broadband Radio Service (CBRS) in the US, where the initial preview will be available. CBRS is considered a lightly licenced band. This builds on AWS’s private multi-access edge compute (MEC) solution, released in conjunction with Verizon to integrate AWS Outposts with private 5G operating in licenced spectrum. A customer reference highlighted was low latency, high throughput analysis of video feeds from manufacturing robots at Corning.

Similarly, Microsoft launched a private MEC offering last year, a cloud and software stack designed for operators, systems integrators, and ISVs to deploy private 5G solutions. The system is built up of components from Azure and its acquisition of Metaswitch. AT&T is an early partner bringing a solution to the market built on Microsoft’s technology and the operator’s licenced spectrum. Microsoft highlighted use cases such as asset tracking in logistics, factory operations in manufacturing, and experiments with AI-infused video analytics to improve worker safety.

The Future

Organisations are likely to begin testing private 5G this year for Industry 4.0 applications, either at single sites in the case of factories or in select geographic areas for Utilities. Early applications will mostly focus on simple connectivity for mobile machines or remote equipment. In the longer term, however, the benefits of private 5G will become more apparent as AI applications, such as video analysis and autonomous machines become more prevalent. This will require the full ecosystem of players, including telecom providers, network vendors, cloud hyperscalers, systems integrators, and IoT providers.

The first impact of the pandemic and the disruption it caused, was organisations scrambling to empower their remote employees. Over the last 2 years, significant investments have been made on collaboration platforms and tools. Now organisations are having to work towards making these workplaces truly hybrid where organisations have to ensure that all employees get the same experience, irrespective of where they choose to work from.

In 2022, organisations will continue to invest in building the Digital Workplace and address the associated technology, people, and process challenges.

Read on to find out what Ecosystm Analysts, Audrey William, Tim Sheedy and Venu Reddy think will be the key trends for the Digital Workplace in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the Digital Workplace in 2022 as PDF

In this edition of Ecosystm RNx – an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform – we rank the Top 10 Global Cybersecurity Vendors.

If you are an End User, you are having to re-evaluate your Cybersecurity risks and measures as both solution capabilities and the threat landscape become more complex. In a fragmented market, it is difficult to select the right Cybersecurity partner to safeguard your organisation. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are Cybersecurity Vendor, you are aware that end users are looking more for Cybersecurity services than solutions – this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Last week Microsoft announced the acquisition of Nuance for an estimated USD 19.7 billion. This is Microsoft’s second largest acquisition ever, after they acquired LinkedIn in 2016. Nuance is an established name in the Healthcare industry and is said to have a presence in 10,000 healthcare organisations globally. Apart from Healthcare, Nuance has strong capabilities in Conversational AI and speech solutions to support other industries. This acquisition is in line with Microsoft’s go-to-market roadmap and strategies.

Microsoft’s Healthcare Focus

Microsoft announced their Healthcare Cloud last year and this acquisition will bolster their Healthcare offerings and market presence. Nuance’s product portfolio includes clinical speech recognition SaaS offerings – Dragon Ambient eXperience, Dragon Medical One and PowerScribe One for radiology reporting – on Microsoft Azure. The acquisition builds on already existing integrations and partnerships that were in place over the years.

“Microsoft Cloud for Healthcare offers its solution capabilities to healthcare providers using a ‘modular’ approach. Given how diverse healthcare providers are in their technology maturity and appetite for change, the more diverse the ‘modules’, the greater the opportunities for Microsoft. This partnership with Nuance also brings to the table established relationships with EHR vendors, which will be useful for Microsoft globally.

The Healthcare industry continues to struggle as the world negotiates the challenges of mass vaccination. But on the upside, the ongoing Healthcare crisis has given remote care a much-needed shot in the arm. Clinicians today will be more open to documentation and transcription services for process automation and compliance. The acquisition of Nuance’s Healthcare capabilities will definitely boost Microsoft’s market presence in provider organisations.

However, Healthcare is not the only industry that Microsoft and Nuance are focused on. The Microsoft Cloud for Retail that was launched earlier this year aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. Nuance has omnichannel customer engagement solutions that can be leveraged in Retail and other industries. As Microsoft continues to verticalise their offerings, they will consider more acquisitions that will complement their value proposition.“

Microsoft’s Focus on Conversational AI

Microsoft already has several speech recognition offerings, speech to text services, and chatbots; and they continue to invest in the Conversational AI space. They have created an open-source template for creating virtual assistants to help Bot Framework developers. In February, Microsoft announced their industry specific cloud offerings for Financial services, Manufacturing, and Non-Profit, and also introduced a series of AI and natural language features in Microsoft Outlook, Microsoft Teams, Microsoft Office Lens and Microsoft Office mobile to deliver interactive, voice forward assistive experiences.

“There is no slowing down in this space and the acquisition clearly demonstrates the vision that Microsoft is building with Nuance – a vendor that has made speech recognition, text to speech, conversational AI the foundation of the company. This is a brilliant move by Microsoft in the Conversational AI space and a win-win for both companies.

This move could also mark further inroads for Microsoft into the contact centre space. With Teams now being integrated into contact centre technologies, working with large customers using speech and conversational AI, Dynamics 365 could herald the start of more acquisitions for Microsoft to bolster a wider customer engagement vision.

The Conversational AI war is heating up and various other cloud vendors such as Google and AWS are starting to get aggressive and have made investments in recent years to enhance their Conversational AI capabilities. Google Dialogflow has been seeing rapid uptake and they now have deep partnerships with Genesys, Avaya, Cisco and other contact centre players. Microsoft coming into the game and acquiring a company with years of history and IP in the speech space, demonstrates how the cloud battle and the war between Google, Microsoft and AWS is heating up in the Conversational AI. All of a sudden you have Microsoft as a powerhouse in this game.”

Last week AT&T announced a partnership with Fortinet to expand their managed security services portfolio. This partnership provides global managed Secure Access Service Edge (SASE) solutions at scale. The solution uses Fortinet’s SASE stack which unifies software-defined wide-area network (SD-WAN) and network security capabilities into AT&T managed cybersecurity framework. Additionally, AT&T SASE and Fortinet will integrate with AT&T Alien Labs Threat Intelligence platform, a threat intelligence unit to enhance detection and response. AT&T has plans to update its managed SASE service during the year and will continue to bring more options.

Talking about the AT&T-Fortinet partnership, Ecosystm Principal Advisor, Ashok Kumar says, “This move continues the trend of the convergence of networking and security solutions. AT&T is positioning themselves well with their integrated offer of network and security services to address the needs of global enterprises.”

Convergence of Network & Security

AT&T’s improved global managed security service includes features such as secure web gateway, firewall-as-a service, cloud access security broker (CASB) and zero-trust access, which provides security teams and analysts with unified capabilities across the cloud, networks and endpoints. The solution aims to enable enterprises to create a more resilient network bringing the core capabilities of the two companies that will reduce operational costs and deliver a unified offering.

Last year AT&T also partnered with Cisco to expand its SD-WAN solution and to support AT&T Managed Services using Cisco’s vManage controller through a single management interface. Over the past years multiple vendors including Fortinet have developed comprehensive SASE solution capabilities through partnerships or acquisitions to provide a unified offering. Last year Fortinet acquired Opaq, a SASE cloud provider to bolster their security capabilities through OPAQ’s patented Zero Trust Network Access (ZTNA) cloud solution and to strengthen SD-WAN, security and edge package.

The Push Towards Flexible Networking

Kumar says, “The pandemic has created a higher demand and value for secure networking services. Enterprises experienced greater number of phishing and malware attacks last year with the sudden increase in work-from-home users. The big question enterprises need to ask themselves is whether legacy networks can support their evolving business priorities.”

“As global economies look to recover, securing remote users working from anywhere, with full mobility, will be a high priority for all enterprises. Enterprises need to evaluate mobile SASE services that provide frictionless identity management with seamless user experiences, and be compatible with the growing adoption of 5G services in 2021 and beyond.”

The Top 5 Telecommunications & Mobility Trends that will dominate the telecom industry to watch out for in 2021. Signup for Free to download the report.

BetterUp, a mobile-based professional learning and wellness platform that connects employees with career experts recently raised USD 125 million Series D funding backed by Salesforce Ventures, in partnership with ICONIQ Capital, Lightspeed Venture Partners, Threshold Ventures, and Sapphire Ventures among others, bringing the company’s valuation to USD 1.73 billion. Previously in 2012, the company had raised USD 43 million in venture capital funding with an additional Series B funding of USD 30 million in March 2018. The BetterUp platform combines behavioural science, AI, and human interaction to enhance employees’ personal and professional well-being. Recently, the company also revealed two new products – Identify AI, to help organisations determine the right people to invest in and the appropriate coaching needed through the use of AI; and Coaching Cloud for customised training for frontline, professional, and executive employees.

This announcement comes on the back of several wins for BetterUp. To boost employee performance and organisational growth NASA and the Federal Aviation Administration (FAA) partnered with BetterUp to support new ways of coaching and preparing a workforce for change. The world’s largest brewer, AB InBev has partnered with BetterUp to strengthen diversity and inclusion through BetterUp’s coaching platform.

The Need to Improve Employee Experience

The pandemic changed the working arrangement of millions of employees and industries across the globe who are now working remotely or in a hybrid environment.

Ecosystm Principal Advisor, Audrey William says, “Driving better employee experience (EX) should take centre stage this year with enterprises putting employees at the centre of all initiatives. We will see EX platforms get integrated further and deeper into workplace collaboration and HR applications. In the last 12 months, we have seen apps monitoring wellness and sleep, training and coaching, meditation, employee motivation, and so on sit within larger collaboration platforms such as Slack, Zoom, Microsoft, Cisco and others.”

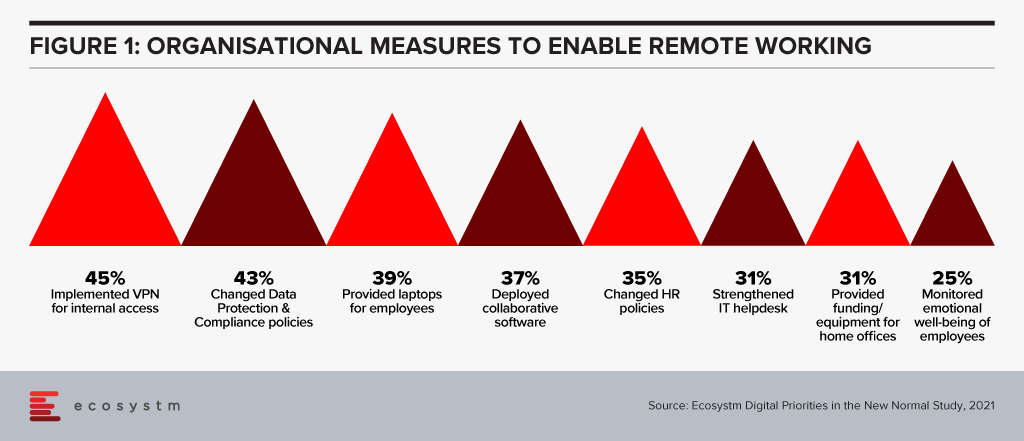

While the primary focus has been on optimising the work environment, it is time for organisations to start focusing on employee well-being. Ecosystm research shows that organisations implemented several measures to empower a remote workforce last year when the pandemic hit. But there was not enough focus on employee well-being (Figure 1).

William says, “A hybrid work environment may have negative impact on your employees. You may face issues such as longer working hours, employee burnout, lesser social engagements and connection, loneliness – and mental and emotional issues and depression”.

“Organisations that place an emphasis on the employees will see their revenues grow and also see less attrition. The more you invest in your people, the more you will get back in return. It is as simple as that! You can see that now in some organisations where employees are being given more flexibility, employers are not dictating how they should work, diversity and inclusion efforts have become mainstream, and efforts are being made to make employees feel like they belong.”

William adds, “However, Ecosystm research finds that organisations have gone back to putting customers and business growth first – losing focus on their employees. Only 27% of organisations globally say that they have improving employee experience as a key business priority in 2021. It is time for this culture and mindset to change. And solutions such as BetterUp can make a difference.”

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.