In a move that feels “back to the future”, Salesforce has agreed to acquire Tableau Software Inc for US$15.3 billion in a deal that is expected to close in the third quarter of 2019. It seems all independent BI and analytics companies (except SAS!) eventually get snapped up – Business Objects by SAP, Hyperion by Oracle, Cognos by IBM. The move comes less than a week after Google acquired BI and analytics provider Looker.

Today, many businesses use Tableau (over 86,000), including a lot of Salesforce customers. They have chosen Tableau because it is easy to deploy and use, and like Salesforce own applications, it targets the ultimate decision maker – the business user – and sometimes even the consumer. Recent research into the BI systems integrators in Asia Pacific shows that Tableau is one of the leading analytics platforms for the partner community in the region – the big SIs have many people focused on Tableau. But that dominance is being challenged by a re-energised Microsoft, whose Power BI is also witnessing strong growth – and who is typically the price leader in the market.

For Salesforce customers, there is some overlap between products – their own Einstein Analytics tools do much of what Tableau can do – although Tableau helps customers see insights from data stored both on the cloud and inside their own data centres. It also moves Salesforce closer to the Customer 360 vision – the ability to get a view of customers across the Commerce, Marketing and Service Clouds. Salesforce customers not using Tableau today will get a better user experience by using Tableau as the visualisation platform.

History has shown that it is hard to make such acquisitions successful. Tableau was a huge success because it was independent. The same was for Business Objects and Cognos before their acquisitions. History has shown that when the large BI and analytics vendors are acquired, others move into that space. While Salesforce has announced they will run Tableau as a separate business, it will no longer be independent. Partners will need to be maintained and provided a growth path – and partners are the cornerstone of Tableau’s success. Some of these partners might have strong ties to other software or cloud platforms too such as SAP, Oracle, AWS or Google. Customers of Tableau might feel sales pressure to move to a Salesforce environment – and will likely see Salesforce integration happen at a deeper level than on other platforms.

Tableau’s independence will disappear. However keeping Tableau as a separate business may not be the long term goal for Salesforce – it might be to offer the best application and analytics solution in the market – to make the entire suite more attractive to more potential buyers and users. It may be to take Salesforce beyond the current users in their customers to many other users who may not need the full application but need the analytics and visualisations that the data can provide. If this is the case, then the company is onto a winner with the Tableau acquisition.

BUT…

The long term goal is not analytics reports delivered to employees. It is not visualisation. It is automation. It is applications doing smart, AI-driven analysis, and deciding for employees. It is about taking the human out of the process. In a factory you don’t need a report to tell you a machine is down – you need to book a repair person automatically – or a service technician to visit before the machine has even broken down. And you don’t need a visualised report to show that a machine is beyond its life expectancy. You need the machine replaced before it fails catastrophically.

Too often, we are putting humans in processes where they are not required. We are making visualisations more attractive and easier to consume when, in reality, we just needed the task automated. While we employ humans, there will be a need to make decisions more effectively, and we will still require tools like Tableau. But don’t let the pretty pictures distract you from the main prize – intelligent automation.

If you would like to speak to Tim Sheedy or another analyst at Ecosystm about what the acquisition Tableau by Salesforce might mean to your business or industry, please feel free to schedule an inquiry call on the profile page.

Over the last few years, there has been a noticeable increase in the number of educational institutions adopting technology to deliver solutions such as learning management, collaboration and support activities. The ubiquity of cloud solutions allows institutions to focus on enhancing the educational experience for students, teachers and administration through emerging teaching methods such as online platforms, interactive systems, and remote management of mission-critical projects and research.

Drivers of Transformation in Education

Education systems, depending on the country, face several problems ranging from achieving universal education goals, limited access to resources, student retention, student recruitment, to conducting cutting-edge research. Moreover, today’s students are millennials and post-millennials, who are digital natives – pushing educational institutions to adopt technology to attract the right cohort and provide an education that equips the students for the workplace of the future. The industry is being driven to transform to keep up with student expectations on delivery, access to the resource, and how they choose to communicate with their educators and peers. Cloud-based offerings are helping educational institutions to overcome these challenges. The top drivers of Education are:

- Personalised Learning. Modern pedagogy encourages personalised learning, where students can choose their own learning path. With the growth of virtual learning environments and eLearning technologies, institutions are able to change the ways they teach, tailoring the curriculum to individual needs, monitoring an individual’s learning journey and providing just-in-time feedback.

- Collaborative Education. Collaborative education principles are based on the premise that many students learn better by communicating with their peer network and not in silos. Also, increasingly, especially at the primary and secondary levels, parents are regarded as a significant stakeholder in a child’s education.

- Efficient Delivery. Most educational institutions are focused on efficient delivery, not only to be more financially sustaining but also so that students, teachers and administration have the ability to access information, including content and learning management systems, anytime and anywhere. The focus is on creating more a flexible work environment and increasing practicality and ease of use for students and educators.

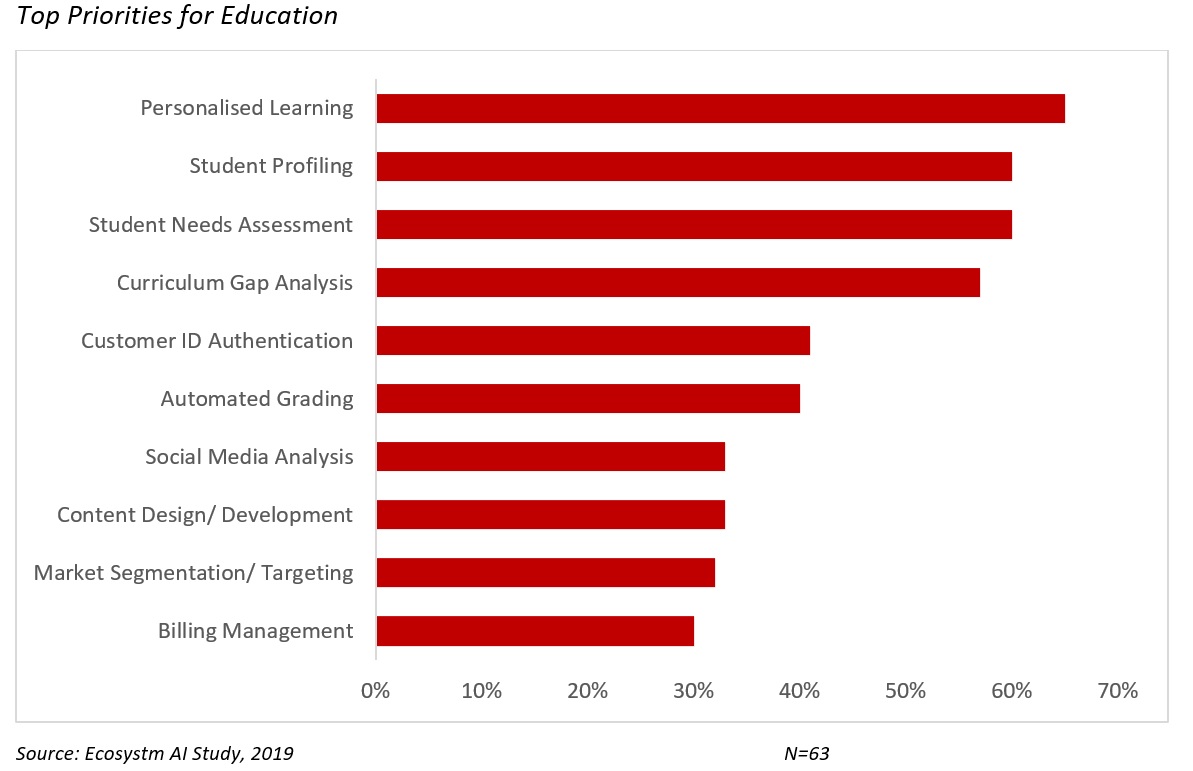

The global Ecosystm AI study reveals the top priorities for educational institutions focused on adopting emerging technologies.

Cloud as an Enabler of Transformation

Cloud gives access to an immense knowledge base that students, educators, and institutions as a whole can leverage. The reach and availability of connectivity has increased the number of users of cloud-based education solutions for remote learning, which helps in the goal of personalised learning. Cloud solutions can also fulfil the demand for collaborative education with reliable and scalable infrastructure. It enables a more collaborative teaching and learning approach, with easy maintenance and management of monitoring and control solutions. Moreover, it promotes efficient delivery as educational institutions look to migrate legacy systems onto the cloud, and increasingly procure SaaS solutions. Cloud not only reduces the burden on an institution’s CapEx but is increasingly being seen as an essential enabler of digital transformation (DX).

In fact, the key benefits that educational institutions are realising from cloud adoption, according to the global Ecosystm Cloud study, are:

- Increased work process efficiency. As the industry becomes more complicated with the advances in pedagogy and technology, cloud is helping institutions to streamline workflows and enabling the participation of multiple stakeholders, some on campus and some remote. One must not forget that education requires an immense amount of administrative work, by both teachers and allied workforce.

- Improved service levels and business agility. The scalability that Cloud provides, especially during high-volume periods such as admissions and examinations, gives educational institutions the ability to be agile. Also, back-up and disaster recovery are key in education, and many institutions start their Cloud journey with storage and back up.

- Simplified sharing of systems/information across departments. Information sharing across different departments becomes easier with the rising penetration of mobile devices such as phones, tablets, and laptops in the classrooms for both students and teachers. Cloud technology ensures that the data shared between devices occurs safely and efficiently.

Examples of Transformation in Education

Virtual Classrooms and Schools

Unlike traditional methods of teaching, virtual classrooms are enabling students to learn and access content without their presence in schools or universities and from anywhere across the globe. The benefit of virtual schools and classrooms is that they do not require any heavy infrastructure or technical equipment to run. In a virtual world, teachers and students can connect with each other in a fast, flexible, and cost-effective way. It enables teachers to host live chats, share lectures and videos, create interactive learning activities and receive instant student feedback.

For example, Florida Virtual School is a full-time online school providing virtual K-12 education to students all over the world. It is a recognised eLearning school and provides custom solutions to meet students’ requirements. This model is being replicated globally especially in remote areas where an actual school premise may not be feasible or is too expensive.

Research & Experimentation

The remote handling of projects and experiments is enabling education institutions to overcome the challenge of carrying them out in a controlled and safe environment. ChemCollective, a project of the National Science Digital Library in the US, enables students to interact with a flexible learning environment in which students can access online chemistry labs to apply formulas, perform experiments and learn in realistic and engaging ways, like working scientists.

Open Education Resources

Cloud is enabling the development of open source content for schools and colleges. The challenge with the existing books and lectures is that they get dated. Cloud is enabling a wealth of content through open repositories and legal protocols to allow a community to collaborate and update the information. Open educational resources (OERs) are developed and can be modified by the creators and administrators. The community can contribute to maps, slides, worksheets, podcasts, syllabi or even textbooks. The copyright is associated via legal tools such as Creative Commons licenses, so others can freely access, reuse, translate, and modify them.

As textbooks and course material can now be updated in real-time and offered through a cloud-based subscription model, this now opens up new streams of revenue for publishers. However, this then raises the conversation that textbook prices are increasing while students have no option to purchase second-hand books or sell books once they are done with them.

MOOCs

Massive Open Online Courses (MOOCs) platforms both provide content to students in areas of personal interest and additional sources of revenue to renowned global institutions. A quick look at Coursera’s website shows online courses from reputed institutions such as MIT and Johns Hopkins University. There are still providers such as the Khan Academy that do not actively monetise the material they provide, but increasingly institutions look at MOOC to generate more revenues, by offering remote learning options to individuals, as well as by collaborating with local universities to make their courses available to overseas students – a previously untapped market.

Cloud computing is transforming the classroom and learning experiences the way educators, curriculum leads, and specialists recommend. The technology has a huge role to play in enabling transformation in Education – for national education systems, for educational institutions, and ultimately for the students.

How else do you think Cloud can transform the education industry? Let us know in your comments below.

The 5th VeeamON event held in Miami Beach recently, attracted around 2,000 customers and partners. The 2-day conference is the annual Veeam gathering of mainly IT admins to learn about and get certification for Veeam’s latest product releases. Veeam Co-Founder and EVP, Sales and Marketing, Ratmir Timashev provided Veeam’s update on business affairs and strategy.

Business Updates

What Timashev describes as Veeam’s ‘Act I’ has seen them emerge as a leader in backup and availability solutions for virtual environments over the last 10 years. ‘Act I’ further helped Veeam reach the milestone of US$1 billion in sales – over the current 12 months period – which elevates Veeam into an exclusive club of only 34 software companies that have achieved this milestone (and very few privately owned software companies have achieved this globally). Going forward, Veeam will continue to focus on their Hybrid Cloud strategy and what they describe as ‘Act II’ of their growth journey.

In line with the market moving from on-premises to cloud to hybrid environments, the next phase of growth will focus on adding hybrid cloud functionality to their existing hypervisor- and physical agent-centred software portfolio. By continuing their strategy on partnering and channels, the solutions are designed to make it easy for service providers to deliver Veeam as managed services to the market.

Ecosystm Comment. Ecosystm’s ongoing Cloud research shows that almost 100% of companies have shifted at least one workload onto the cloud which makes cloud undoubtedly mainstream. Despite that broad adoption we see cloud maturity still at an early stage as the number of SaaS workloads and the complexity of on-premises and cloud integration will increase over time. Our research shows that companies currently use an average of 3 separate SaaS applications which is expected to double over the next 12 months.

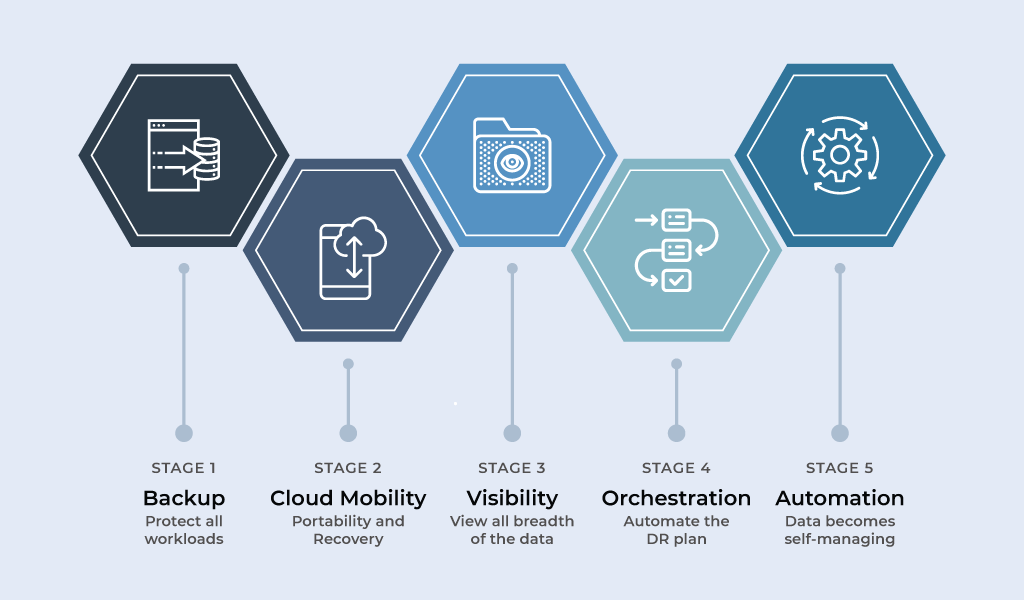

Stages of Cloud Management

Organisations’ requirements to manage their data assets in the hybrid world will mature in tandem with their expanded cloud footprint. Veeam describes this path as the ‘5 Stages of Cloud Management’.

Figure 1: Veeam’s Stages of Cloud Management

Veeam sees the majority of the market currently sitting at stage 1 or 2 providing a strong pipeline and growth path in taking customers along their ‘Act II’ journey.

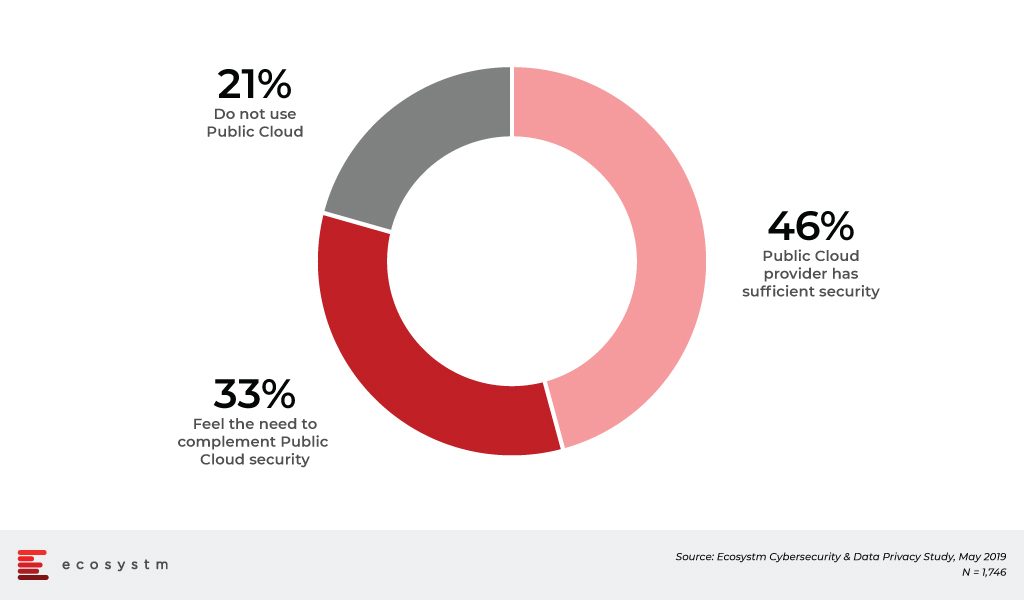

Ecosystm Comment. We would raise some caution as the execution of this strategy may play out as more challenging than anticipated. Our research shows that a majority of companies – especially in emerging markets – see cloud as a means to shift the responsibility of data protection and availability, onto their cloud providers. The ongoing global Ecosystm Cybersecurity research reveals that nearly half the organisations rely solely on their public cloud provider to secure even their most sensitive data.

Figure 2: Perception on Public Cloud Security

This finding is concerning when competitiveness has increasingly moved away from the traditional measures such as cost, quality and time to a company’s data and IP assets. So Veeam is urged to equip their partners and sales team with a strong educational message that the responsibility of data protection and availability cannot be shifted solely onto the cloud provider. The responsibility and accountability remains with the organisation and has to be managed across the increasingly hybrid environments.

Product Announcements

Keeping with the tradition, Veeam leveraged VeeamON 2019 as the platform for a number of product releases and announcements. In alignment with the business strategy, most of the new features support data management in hybrid cloud environments as well as new integrations and features for SaaS and Cloud platforms.

The most anticipated release of version 10 of Veeam’s flagship Availability Suite has not yet happened. Announced at VeeamON 2017, Version 10 will be released towards the second half of 2019. While the delay may be of concern, we would give Veeam credit for adopting a true SaaS model for their product development process. They have constantly released newer features and functionality to the current suite, opting to release some features faster to market to answer to specific customer demands at the time, such as centralised agent management support and Universal Storage API support. The key new features of Availability Suite 9.5 Update 4 include easy management of cloud migration and cloud mobility, cloud-native backup, cost-effective data retention, and portable cloud-ready licensing, increased security and data governance.

Veeam Availability Orchestrator v2 is the second generation of Veeam’s DR orchestration platform reducing the manual processes to achieve auditable DR, operational recovery and platform migrations. With increasing industry regulations this capability could give organisations of all sizes and resources the tools to prove and proactively remediate service level agreement (SLA) attainment for internal and external compliance regulations and audits with extensive reporting and compliance capabilities.

Nutanix Mine with Veeam is another product which received a lot of interest at VeeamON. With availability announced for late 2019, Mine is a partnership with Nutanix to provide more comprehensive and affordable solutions for secondary storage layers. Similar joint offerings have also been announced with ExaGrid. Mine provides Nutanix hyper-converged infrastructure with highly integrated Veeam Backup & Replication solutions to provide easy deployment and scaling, faster time to value and standardised IT operations management.

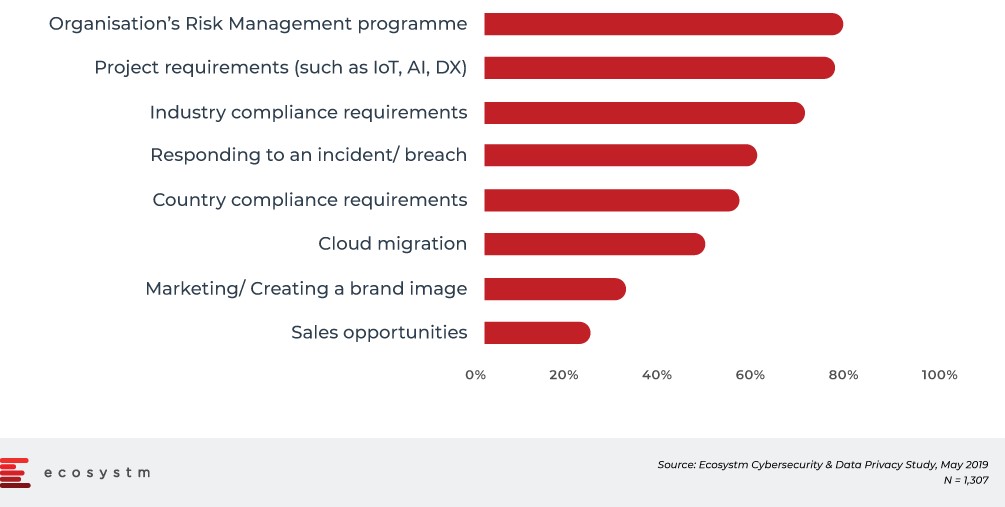

Ecosystm Comment. Ecosystm’s research shows that regulatory requirements are key to organisations’ propensity to invest in data protection and availability solutions. They are often built into the organisations’ risk management programmes as well.

Figure 3: Drivers of Continued Focus on Cybersecurity

Availability Orchestrator v2 presents a strong entry point for Veeam to start the discussions for a more holistic data management solution. Providing the automation of the DR orchestration, scenario planning and auditable DR documentation strengthens Veeam’s claim to be the rightful owner of the Governance, Risk & Compliance (GRC) discussion. Furthermore, although it may be from leftfield, Ecosystm sees a great opportunity for some partnerships with Cybersecurity insurance companies to make Veeam Availability Orchestrator an accepted standard for Cybersecurity premium assessments and rebates. Ecosystm has seen a rapid rise of Cybersecurity insurance adoption with nearly 50% of global organisations already signed on to different policies. With adoption expected to accelerate over the coming years, Cybersecurity insurers could present a new route to market that is not in competition to its existing network of more than 60,000 partners.

Looking Ahead

Veeam has announced ‘Act II’ as the second stage of growth to carry on from their initial virtual machine-centred availability solution. The strategy follows the natural evolution and path of the market and will not require a major rethink or restructure of the Veeam business.

What is changing is the scale of business in geographical coverage, product portfolio and most importantly the Veeam partner ecosystem. In the same way that Veeam expanded their breadth in ‘Act I’ from the original VMware hypervisor backup to the broader hypervisor market and core infrastructure integrations, ‘Act II’ will require expansion across the key cloud platforms, exponentially growing SaaS landscape and the different tiered infrastructure providers.

Veeam’s product development teams have been one of the main beneficiaries of Veeam’s $500 million fund raising exercise earlier in 2019 (investors include Insight Venture Partners & Canada Pension Plan Investment Board) as they invested further in organic internal development instead of acquiring and integrating third party capabilities.

Geographical expansion is another area where the $500 million has been invested in. Veeam currently sits at 350,000 customers with 4,000 being added on a monthly basis. Emerging markets such as Asia Pacific are the engines of the growth but there are still markets and partnerships to be explored and developed. Across Asia Pacific alone Veeam opened 4 new offices in the first 5 months of 2019 and further expansions are planned for the months to come. The race for scale is essential to execute on ‘Act II’ but it brings operational challenges to scale in tandem with their operations while maintaining the culture that made Veeam what they are.

Ecosystm Comment. There is no doubt that there is a lot of work ahead of Veeam in executing on ‘Act II’. We have seen early proof that execution is following strategy, with new partnerships in the tiered storage space (such as Nutanix and ExaGrid), new products focussed across mainstream SaaS applications such as Office365 and tighter cloud integrations with Azure and AWS. There is currently lesser compatibility with Alibaba Cloud and no integration with Google which would be essential to accelerate their growth especially in Asia Pacific which has been highlighted as Veeam’s growth engine. The SaaS landscape presents an even tougher challenge for Veeam. Veeam Backup for Office365 has demonstrated the strong opportunity of workload-based availability solutions but developing the same capability across hundreds or thousands of diverse SaaS applications will present challenges. At the same time, we agree with Veeam’s focus on going deep into their solutions integration with the key partners and workloads that present the greatest opportunity today rather than spreading resources to put breadth over depths at this stage.

In 2013 Ratmir Timashev predicted to reach $1 billion within 6 years which was achieved just in time for VeeamON 2019. There were no new predictions made for ‘Act II’ but we see Veeam on the right path to announce tangible progress on their ‘Act II’ execution at VeeamON 2020 in Las Vegas.

With understanding and acceptance of blockchain increasing, enterprises have started adopting blockchain to store digital records in a secure and auditable manner. In May 2018, we saw Microsoft’s blockchain workbench focused on integrating data and systems and deployment of contracts and blockchain networks. In October 2018, Microsoft Azure joined forces with Nasdaq to integrate blockchain technology into Nasdaq’s framework with an expectancy to speed-up transactions on the stock exchange.

Following these announcements, this month Microsoft unveiled its fully managed Azure Blockchain Service, a package designed to simplify the processes and eliminate the pain points of blockchain networks. Microsoft Azure blockchain service will provide the required infrastructure, connection to services to develop, run and take advantage of applications on its Cloud-based platform.

To leverage blockchain Microsoft and J.P. Morgan announced a partnership to accelerate the adoption of enterprise blockchain. Quorum, an Ethereum-based distributed ledger protocol developed by J.P. Morgan will be the first ledger available through Azure Blockchain Service, on the cloud.

Joining the bandwagon, Starbucks will use Azure and the Ethereum blockchain to track coffee from farm to the cup. In the same way, with a forward-thinking approach, Microsoft and GE Aviation collaborated to bring blockchain into aviation. GE Aviation has built a supply chain track-and-trace blockchain with the help of Microsoft Azure to monitor and collate data in relation to aircraft engine parts, life cycle, when to repair, this technology that the group has come up with is termed as ‘TRUEngine’.

Unfolding blockchain for “regular” businesses and SMEs

Blockchain technology, by its very nature leads itself to the digital transformation journey of an enterprise. Blockchain can address some of the pitfalls of digital transformation such as identity, security, and trust. From digital identity to tokenisation to using smart contracts to automate businesses, blockchain technology is swiftly establishing itself as a key enabler of the emerging digitised enterprise.

|

Speaking on the subject, Ecosystm’s Principal Advisor, Amit Sharma thinks that “For Small and Mid-Size Enterprise (SMEs), blockchain can simplify and automate processes related to Trade Finance which would mean less paperwork and automation in supply chains and it also opens up a huge alternative finance channel to deal with their cash flow challenges.” |

Overall the blockchain network should facilitate the interworking between IT systems, financial systems and ledgers that are today primarily managed in silos and require heavy manual processes.

Are we already there?

“All disruptive technology has a ‘tipping point’ – the exact moment when it moves from early adopters to widespread acceptance. We are now approaching the tipping point for blockchain. Even though the development of blockchain for business is still in its early stages, business leaders have swiftly moved from understanding blockchain and its potential uses to running pilots,” says Sharma.

Blockchain has attracted attention across industries such as financial services, transportation and shipping, healthcare, energy and utilities, and supply chain management.

These share some common themes. Blockchain is a natural fit for use cases that are transactional but with a high degree of process complexity or volume. Blockchain will become the default technology wherever there is a need to ensure the integrity of data.

Blockchain Adoption by Organisations

Despite the flurry of activity and promising initial developments, blockchain faces a number of obstacles that will need to be overcome before companies choose to adopt it on a broader scale. Its decentralised network runs counter to the current business emphasis on centralising data or functions to support security efforts. Users and operators alike must shift their mindset to embrace and trust the system.“Among blockchain’s selling points is its security: high encryption and protocols. Since the general public largely doesn’t understand how the technology works, many still have concerns with data privacy and cyber security” says Sharma. “As with all new technology, when it comes to blockchain, business leaders should view any initial use cases as part of their enterprise risk management. Executives are attuned to the business and risk implications of blockchain. And in many cases, blockchain, like other technology platforms and systems, can be covered under existing insurance programs.”

Implementation by the large technology providers

“With the large technology providers such as Microsoft and AWS now offering BaaS (Blockchain-as-a-Service) over multiple frameworks supported by a ‘Pay as you use’ model, this technology is much more accessible. Pre-built integrations to the network and infrastructure services that are being offered by some of these players will significantly reduce the development time and cost for enterprise customers” says Sharma.

The next several years could see blockchain move from testbed to becoming an essential business tool, so staying abreast of the latest developments and how it is being used will be critical.

Rightly so, the first day of the Mobile World Conference was taken up by more and more air time on the ever coming 5G networks. Was 2019 going to be the year when operators around the world would finally deploy 5G in volume? The booths in the halls at the Fira Grand would indicate that ‘if you build it, they will come’. Indeed the speculation that 5G is the next big game changer is over – it is the game changer for this next turn of the technology dial.

However, let’s assume that the 5G hype is in the rear view mirror and we look to see what could be ahead of us in the mobile and telecom industry. At the end of the first day of this year’s MWC, I may have seen the future opportunity – and it is awesome! Pat Gelsinger asked the question “why can’t we build the telco networks like the clouds have been built for with scalability, flexibility, efficiency, and agility”? It’s a very fair question. After all, we do have Network Function Virtualization (NFV), and we will have new 5G services, so why not a new telco cloud?

I spent time with two companies that may show us a glimpse of the future network and cloud infrastructure. The first is the Israeli software startup, DriveNets with its solution “Network Cloud”. DriveNets is focused on helping service providers disaggregate proprietary routers from their networks as they move to 5G. DRiveNet’s Network Cloud solution aims to disrupt the current network business model by separating network costs (e.g. proprietary hardware functions) to create network functions from its software stack and two ‘white label’ hardware building blocks. The entire network infrastructure is software-centric allowing for agility, scalability, and normalizing costs with business growth.

However, Network DriveNets is an unusual startup in that it came out of stealth mode with $110 million in its first round of funding. The company was founded in 2015 by Ido Susan who should be familiar to Cisco watchers as he sold his first startup, Intucell (self-optimising network technology), to them for $475 million in 2013. DriveNets other co-founder, Hillel Kobrinsky founded Interwise (web conferencing) which was snapped up by AT&T for $121 million. To that end, the company is well funded and has the ability to sustain itself long enough to potentially disrupt the $50 billion network hardware business.

The second is Rakuten Mobile, a well-known name in Japan, but the first mobile virtual network operator (MVNO) to launch there in over 10 years. MNOs are not new so what makes Rakuten different? The company’s CTO, Tareq Amen explained to me that they are building the world’s first end-to-end fully virtualized cloud-native network running all of its workloads in the cloud. Being a fully virtualized network enables Network Function Virtualization to take advantage of cloud computing basis assets where a service delivery platform can be implemented, customized and scaled at speed. Finally, all of Rakuten’s core technology including its Radio Access Network (RAN – a topic that has been highly discussed at this year’s MWC) on 5G thus delivering immediate and actual 5G services. This compares to most of the rest of the industry who will have to build an uncomfortable transformation roadmap from 2/3G and LTE to 5G. While Amen’s strategy is compelling, there are a few technical hurdles to overcome. For example, enterprise-grade 5G indoor coverage isn’t fully there yet so Amen will have to rely on the operators that he is competing against who have that real estate.

So why highlight DriveNet and Rakuten in the same blog? In Rakuten’s case the CAPEX and OPEX business models for operators may be turned on their heads by the fact that its network is taking all of the competitive advantages of 5G while offering customers as disruptive pricing models and services. In a country such as Japan where traditional operators have struggled to modernize their networks, this could be a competitive threat. Equally, there could be a global rise in copy-cat pure 5G/cloud-based MVNOs spring up and fiercely compete against the incumbent local operators as well as give other MVNOs a tough time. As for DriveNets – it’s simple…it’s software and virtualization of the switch and router market which is very appealing to the service providers. It will commoditize the hardware, lowering their costs while allowing them to continue to focus on new 5G services.

IBM is aggressively pushing their products and services with multiple partnerships being announced over the last few months.

In the recent announcement, HCL Technologies and IBM stated that they were collaborating to assist organisations on their hybrid cloud journey. The joint services will offer seamless integration of their customers’ cloud across any private, public and on-premise environment. The hybrid cloud approach is aimed at eliminating the concerns of mixing the different cloud environments yet maintaining scalability and security. HCL will feature new refactoring and re-platforming services to allow organisations to migrate, integrate and manage apps and workloads on IBM’s cloud.

Speaking on the subject, Phil Hassey, Principal Advisor ,Ecosystm, thinks that “the most attractive aspect of this collaboration is that it will bring together the best of both vendors. IBM has such a long history in Infrastructure Management, whereas HCL has – most particularly in the past 5 years or so – built up capability in the space.”

The good news for tech buyers is that they will derive benefits from HCL’s customer knowledge and hands-on approach with the combination of IBM technology, cloud and – of course – Watson. HCL has acquired significant IBM assets that they could extract more value from. The infusion of AI into hybrid cloud will lead to increased automation, improved outcomes and effective investments by clients.

When we look at the individual benefits to IBM and HCL from this deal, Hassey says, “IBM needs new customer logos and HCL can provide that. Conversely, IBM can provide larger enterprise clients to HCL. However, it is not a straight customer swap, they will work to maintain relationships independently.”

IBM is pushing hard towards their plans to capture more market with many big deals announced recently – and undoubtedly many more yet to happen. It is well-documented that IBM has gone through many reinventions but is still deeply entrenched in many of the world’s largest organisations. “IBM is such a large machine that different aspects and offerings are always operating at different speeds”, says Phil. “It needs to accelerate the uptake of Watson, and Watson being available on any cloud will help this.”

The hybrid cloud is desperately looking for big scale integration and transformation capabilities, so this agreement between HCL and IBM will hopefully help kickstart that.

The growth in public cloud platforms and applications is just starting to hit its strides. In 2019, more companies will spend more money moving more of their applications and processes across to the public cloud. Many cloud markets will move into hypergrowth. Cloud computing adoption is moving beyond the fast adopters to the mass market – so dynamics are changing. Our top five predictions for 2019 are:

Many SaaS Applications Will Move into Hypergrowth

If you think that the software-as-a-service (SaaS) market is a mature one, think again. Yes, cloud-based solution providers such as Salesforce have a lot of customers for their CRM and Marketing platforms, as do vendors such as Microsoft and Google for their collaboration suites – but even the cloud-based CRM market is set to explode in 2019 as the number of companies looking to deploy SaaS-based applications nearly doubles. Most companies across the globe still have most of their applications hosted in their own or partner data centres. The opportunity in the SaaS market is still huge – and will be that way for years to come. SaaS-based BI & Analytics will move from 10% of companies using it today to 21% in 2019, marketing applications from 10% to 24% and UC&C from 11% to 21%.

Security Will Return to Being the Number One Barrier to Public Cloud Adoption

As the cloud providers start to penetrate the “mass market” – involving companies that are not fast adopters and do not push the envelope and procrastinate over big technology or business decisions – expect the question of security to come up again. And again. And again… When public cloud first entered the business consciousness 10-12 years ago, security was the number one reason why companies did not embrace it. It slipped down the list over the past few years as more leading, fast moving businesses overcame this objection – but with more companies looking to implement public cloud services, more of the objectors are coming back out of the woodwork to make security a number one blocker again.

Partners Will Come Back into Fashion for Cloud Deployments

The very first companies to move to public cloud platforms or software typically used a partner – they were going where few had been before, and they relied on the expertise of external providers to help them make the move. But the past five or so years have seen many businesses eschew partners in the move to the public cloud – as they looked to learn the skills that they require both to make the transition and for the ongoing management and automation of the cloud environment, themselves. But as the market for public cloud software and platforms moves into hypergrowth, more companies will look to partners to help them with the transition to cloud – and more importantly – the ongoing management of their cloud environments.

Cloud Ecosystems Will Accelerate the Adoption of Artificial Intelligence Solutions

Today nearly every software provider is looking at the opportunity to make their software smart – to have the software learn, predict, personalise, see, sense or converse. Some have started by building their own AI tools – but these companies are learning that these tools are more lines of code that need to be maintained, secured, evolved and improved. Smart ISVs are building their AI capabilities using the tools that already exist on the public cloud platforms. In fact, this move is seeing more ISVs move away from hosting the cloud version of their software from their own cloud platform to one of the big five or six public cloud platforms. As more ISVs make their software intelligent, more customers will be able to adopt AI solutions that are embedded in their existing software tools and platforms.

Companies Move to the Cloud for the Features and Functions, but Will Stay for the User Experience

While companies might move to the public cloud because of the features, functions, technical capabilities or in-country data centres, what keeps customers on cloud platforms is the user experience. Some of the global public cloud platforms and software providers have not created the best user experience – yes, the technologists and developers might love them, but cloud usage is quickly moving beyond the technology team. AI tools need to be used by data scientists and product managers, while automation tools will be used by Customer Experience professionals. Business analysts want to be able to create or vary processes without the intervention of the IT team or cloud management partner. User experience will be key to increasing cloud usage within existing customers.

For access to the full report, please follow this link.