In our previous Ecosystm Insights, Ecosystm Principal Advisor, Gerald Mackenzie, highlighted the key drivers for boosting ESG maturity and the need to transition from standalone ESG projects to integrating ESG goals into organisational strategy and operations.

This shift can be difficult, requiring an alignment of ESG objectives with broader strategic aims and using organisational capabilities effectively. The solution involves prioritising essential goals, knitting them into overall business strategy, quantifying success metrics, and establishing incentives and governance for effective execution.

The benefits are proven and significant. Stronger Customer and Employee Value Propositions, better bottom line, improved risk profile, and more attractive enterprise valuations for investors and lenders.

According to Gerald, here are 5 things to keep in mind when starting on an ESG journey.

Download ‘Embedding Sustainability in Corporate Strategy and Operations’ as a PDF

It is not hyperbole to state that AI is on the cusp of having significant implications on society, business, economies, governments, individuals, cultures, politics, the arts, manufacturing, customer experience… I think you get the idea! We cannot understate the impact that AI will have on society. In times gone by, businesses tested ideas, new products, or services with small customer segments before they went live. But with AI we are all part of this experiment on the impacts of AI on society – its benefits, use cases, weaknesses, and threats.

What seemed preposterous just six months ago is not only possible but EASY! Do you want a virtual version of yourself, a friend, your CEO, or your deceased family member? Sure – just feed the data. Will succession planning be more about recording all conversations and interactions with an executive so their avatar can make the decisions when they leave? Why not? How about you turn the thousands of hours of recorded customer conversations with your contact centre team into a virtual contact centre team? Your head of product can present in multiple countries in multiple languages, tailored to the customer segments, industries, geographies, or business needs at the same moment.

AI has the potential to create digital clones of your employees, it can spread fake news as easily as real news, it can be used for deception as easily as for benefit. Is your organisation prepared for the social, personal, cultural, and emotional impacts of AI? Do you know how AI will evolve in your organisation?

When we focus on the future of AI, we often interview AI leaders, business leaders, futurists, and analysts. I haven’t seen enough focus on psychologists, sociologists, historians, academics, counselors, or even regulators! The Internet and social media changed the world more than we ever imagined – at this stage, it looks like these two were just a rehearsal for the real show – Artificial Intelligence.

Lack of Government or Industry Regulation Means You Need to Self-Regulate

These rapid developments – and the notable silence from governments, lawmakers, and regulators – make the requirement for an AI Ethics Policy for your organisation urgent! Even if you have one, it probably needs updating, as the scenarios that AI can operate within are growing and changing literally every day.

- For example, your customer service team might want to create a virtual customer service agent from a real person. What is the policy on this? How will it impact the person?

- Your marketing team might be using ChatGPT or Bard for content creation. Do you have a policy specifically for the creation and use of content using assets your business does not own?

- What data is acceptable to be ingested by a public Large Language Model (LLM). Are are you governing data at creation and publishing to ensure these policies are met?

- With the impending public launch of Microsoft’s Co-Pilot AI service, what data can be ingested by Co-Pilot? How are you governing the distribution of the insights that come out of that capability?

If policies are not put in place, data tagged, staff trained, before using a tool such as Co-Pilot, your business will be likely to break some privacy or employment laws – on the very first day!

What do the LLMs Say About AI Ethics Policies?

So where do you go when looking for an AI Ethics policy? ChatGPT and Bard of course! I asked the two for a modern AI Ethics policy.

You can read what they generated in the graphic below.

I personally prefer the ChatGPT4 version as it is more prescriptive. At the same time, I would argue that MOST of the AI tools that your business has access to today don’t meet all of these principles. And while they are tools and the ethics should dictate the way the tools are used, with AI you cannot always separate the process and outcome from the tool.

For example, a tool that is inherently designed to learn an employee’s character, style, or mannerisms cannot be unbiased if it is based on a biased opinion (and humans have biases!).

LLMs take data, content, and insights created by others, and give it to their customers to reuse. Are you happy with your website being used as a tool to train a startup on the opportunities in the markets and customers you serve?

By making content public, you acknowledge the risk of others using it. But at least they visited your website or app to consume it. Not anymore…

A Policy is Useless if it Sits on a Shelf

Your AI ethics policy needs to be more than a published document. It should be the beginning of a conversation across the entire organisation about the use of AI. Your employees need to be trained in the policy. It needs to be part of the culture of the business – particularly as low and no-code capabilities push these AI tools, practices, and capabilities into the hands of many of your employees.

Nearly every business leader I interview mentions that their organisation is an “intelligent, data-led, business.” What is the role of AI in driving this intelligent business? If being data-driven and analytical is in the DNA of your organisation, soon AI will also be at the heart of your business. You might think you can delay your investments to get it right – but your competitors may be ahead of you.

So, as you jump head-first into the AI pool, start to create, improve and/or socialise your AI Ethics Policy. It should guide your investments, protect your brand, empower your employees, and keep your business resilient and compliant with legacy and new legislation and regulations.

In my last Ecosystm Insight, I spoke about the 5 strategies that leading CX leaders follow to stay ahead of the curve. Data is at the core of these CX strategies. But a customer data breach can have an enormous financial and reputational impact on a brand.

Here are 12 essential steps to effective governance that will help you unlock the power of customer data.

- Understand data protection laws and regulations

- Create a data governance framework

- Establish data privacy and security policies

- Implement data minimisation

- Ensure data accuracy

- Obtain explicit consent

- Mask, anonymise and pseudonymise data

- Implement strong access controls

- Train employees

- Conduct risk assessments and audits

- Develop a data breach response plan

- Monitor and review

Read on to find out more.

Download ‘A 12-Step Plan for Governance of Customer Data’ as a PDF

With organisations facing an infrastructure, application, and end-point sprawl, the attack surface continues to grow; as do the number of malicious attacks. Cyber breaches are also becoming exceedingly real for consumers, as they see breaches and leaks in brands and services they interact with regularly. 2023 will see CISOs take charge of their cyber environment – going beyond a checklist.

Here are the top 5 trends for Cybersecurity & Compliance for 2023 according to Ecosystm analysts Alan Hesketh, Alea Fairchild, Andrew Milroy, and Sash Mukherjee.

- An Escalating Cybercrime Flood Will Drive Proactive Protection

- Incident Detection and Response Will Be the Main Focus

- Organisations Will Choose Visibility Over More Cyber Tools

- Regulations Will Increase the Risk of Collecting and Storing Data

- Cyber Risk Will Include a Focus on Enterprise Operational Resilience

Read on for more details.

Download Ecosystm Predicts: The Top 5 Trends for Cybersecurity & Compliance in 2023 as a PDF

In this Insight, guest author Anupam Verma talks about the technology-led evolution of the Banking industry in India and offers Cloud Service Providers guidance on how to partner with banks and financial institutions. “It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.”

India has been witnessing a digital revolution. Rapidly rising mobile and internet penetration has created an estimated 1 billion mobile users and more than 600 million internet users. It has been reported that 99% of India’s adult population now has a digital identity in the form of Aadhar and a large proportion of the adult Indians have a bank account.

Indians are adapting to consume multiple services on the smartphone and are demanding the same from their financial services providers. COVID-19 has accelerated this digital trend beyond imagination and is transforming India from a data-poor to a data-rich nation. This data from various alternate sources coupled with traditional sources is the inflection point to the road to financial inclusion. Strong digital infrastructure and digital footprints will create a world of opportunities for incumbent banks, non-banks as well as new-age fintechs.

The Cloud Imperative for Banks

Banks today have an urgent need to stay relevant in the era of digitally savvy customers and rising fintechs. This journey for banks to survive and thrive will put Data Analytics and Cloud at the front and centre of their digital transformation.

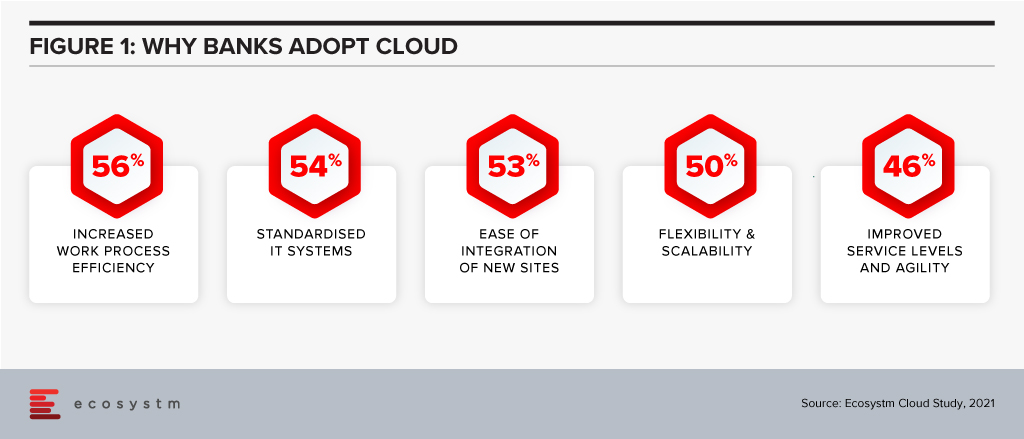

A couple of years ago, banks viewed cloud as an outsourcing infrastructure to improve the cost curve. Today, banks are convinced that cloud provides many more advantages (Figure 1).

Banks are also increasingly partnering with fintechs for applications such as KYC, UI/UX and customer service. Fintechs are cloud-native and understand that cloud provides exponential innovation, speed to market, scalability, resilience, a better cost curve and security. They understand their business will not exist or reach scale if not for cloud. These bank-fintech partnerships are also making banks understand the cloud imperative.

Traditionally, banks in India have had concerns around data privacy and data sovereignty. There are also risks around migrating legacy systems, which are made of monolithic applications and do not have a service-oriented architecture. As a result, banks are now working on complete re-architecture of the core legacy systems. Banks are creating web services on top of legacy systems, which can talk to the new technologies. New applications being built are cloud ready. In fact, many applications may not connect to the core legacy systems. They are exploring moving customer interfaces, CRM applications and internal workflows to the cloud. Still early days, but banks are using cloud analytics for marketing campaigns, risk modelling and regulatory reporting.

The remote working world is irreversible, and banks also understand that cloud will form the backbone for internal communication, virtual desktops, and virtual collaboration.

Strategy for Cloud Service Providers (CSPs)

It is estimated that India’s public cloud services market is likely to become the largest market in the Asia Pacific behind only China, Australia, and Japan. Ecosystm research shows that 70% of banking organisations in India are looking to increase their cloud spending. Whichever way one looks at it, cloud is likely to remain a large and growing market. The Financial Services industry will be one of the prominent segments and should remain a focus for cloud service providers (CSPs).

I believe CSPs targeting India’s Banking industry should bucket their strategy under four key themes:

- Partnering to Innovate and co-create solutions. CSPs must work with each business within the bank and re-imagine customer journeys and process workflow. This would mean banking domain experts and engineering teams of CSPs working with relevant teams within the bank. For some customer journeys, the teams have to go back to first principles and start from scratch i.e the financial need of the customer and how it is being re-imagined and fulfilled in a digital world.

CSPs should also continue to engage with all ecosystem partners of banks to co-create cloud-native solutions. These partners could range from fintechs to vendors for HR, Finance, business reporting, regulatory reporting, data providers (which feeds into analytics engine).

CSPs should partner with banks for experimentation by providing test environments. Some of the themes that are critical for banks right now are CRM, workspace virtualisation and collaboration tools. CSPs could leverage these themes to open the doors. API banking is another area for co-creating solutions. Core systems cannot be ‘lifted & shifted’ to the cloud. That would be the last mile in the digital transformation journey. - Partnering to mitigate ‘fear of the unknown’. As in the case of any key strategic shift, the tone of the executive management is important. A lot of engagement is required with the entire senior management team to build the ‘trust quotient’ of cloud. Understanding the benefits, risks, controls and the concept of ‘shared responsibility’ is important. I am an AWS Certified Cloud Practitioner and I realise how granular the security in the cloud can be (which is the responsibility of the bank and not of the CSP). This knowledge gap can be massive for smaller banks due to the non-availability of talent. If security in the cloud is not managed well, there is an immense risk to the banks.

- Partnering for Risk Mitigation. Regulators will expect banks to treat CSPs like any other outsourcing service providers. CSPs should work with banks to create robust cloud governance frameworks for mitigating cloud-related risks such as resiliency, cybersecurity etc. Adequate communication is required to showcase the controls around data privacy (data at rest and transit), data sovereignty, geographic diversity of Availability Zones (to mitigate risks around natural calamities like floods) and Disaster Recovery (DR) site.

- Partnering with Regulators. Building regulatory comfort is an equally important factor for the pace and extent of technology adoption in Financial Services. The regulators expect the banks to have a governance framework, detailed policies and operating guidelines covering assessment, contractual consideration, audit, inspection, change management, cybersecurity, exit plan etc. While partnering with regulators on creating the framework is important, it is equally important to demonstrate that banks have the skill sets to run the cloud and manage the risks. Engagement should also be linked to specific use cases which allow banks to effectively compete with fintech’s in the digital world (and expand financial access) and use cases for risk mitigation and fraud management. This would meet the regulator’s dual objective of market development as well as market stability.

Financial Services is a large and growing market for CSPs. Fintechs are cloud-native and certain sectors in the industry (like non-banks and insurance companies) have made progress in cloud adoption. It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

If you are a digital leader in the Financial Services industry (FSI), you have already heard this from your customers: ‘Why is it that Netflix and Amazon can make more relevant and personalised offers than my bank or wealth manager?’ Digital first players are obsessed with using data to understand their customer’s commercial and consumer behaviour. Financial Services will need to become just as obsessed with personalisation of offerings and services if they want to remain relevant to their customers. Ecosystm research finds that leveraging data to offer personalised service and product offerings to their clients is the leading digital priority in more than 50% of FSI organisations.

Banks, particularly, are both in a strong position and have a strong incentive to offer this personalisation. Their retail customers’ expectations are now shaped by the experience they have received from their favorite digital first firms, and they are making it increasingly clear that they expect personalised offerings from their banks. Furthermore, they are well positioned as a facilitator of commercial relationships between two segments of customers – consumers and merchants. The amount of data they hold on consumer interactions is comprehensive – and more importantly they are a trusted custodian of their customers’ data and privacy.

The Barriers to Personalisation

So, what is stopping them? Here are three insights from over 12 years of experience driving digitisation of Financial Services:

- Systems Legacy. Often the data and core banking systems do not allow for easy access and analysis of the required data across the data sets required (eg. Consumers and Merchants).

- Investment Priorities. There is still a significant investment happening in compliance and modernisation of core banking systems. Too often the focus of these programs can be myopic, and banks miss the opportunity to solve multiple pain points with their investments driven by overly focused problem statements.

- Culture and Purpose. Are banks stuck in a paradigm of their own making – defining their business models by what has served them well in the past? Will Amazon think about its provision of working capital to their small and medium business partners the same way as a bank does?

Vendor Focus – Crayon Data

Thankfully, there is a new breed of tech vendors who is making it easier for banks to drive personalisation of their offerings and connect customers from across segments. Crayon Data is a good example, with their maya.ai engine unearthing the preferences of customers and matching them to offerings from qualified merchants. It benefits all parties:

- The Consumer receives relevant offers, is served from discovery to fulfillment on a single platform and all personal data and information guarded by their bank.

- For Merchants, it allows them to reach the right customers at the right moment, develop valuable marketing and insights and all this directly from their bank partner’s platform.

- For Banks, it provides a scalable model for offer acquisition and easily configurable and measurable consumer engagement.

maya.ai leverages patented AI to create a powerful profile of each customer based on their buying habits and comparing these with millions of other consumers drawn in from their unstructured data sets and graph-based methodology. They then use their algorithms to assist their Financial Services client to make relevant offerings from qualified merchants to consumers in the right channel, at the right moment. All of this is done without exposing personal client information, as the data sets are based on behaviour rather than identity.

Conclusion

There are significant considerations for banks in offering these types of capabilities, such as:

- Privacy. While the technology operates on non-identifiable information, the perception of clients being ‘stalked’ by their bank in order to drive business to a merchant is one that would need to be managed carefully.

- Consumer opt-out. The ability for customers to opt out of this type of service is critical.

- Consumer financial wellbeing. It may be in the best interests of some consumer to not receive merchant offers, for instance where they are managing to a strict budget. These considerations can be baked into the overall customer journey (eg. prompts when the consumer is nearing their self-imposed monthly budget for a category), but care will need to be taken to keep customers’ best interests at heart.

While there are multiple challenges to overcome, the fact remains that personalisation is quickly becoming a core expectation for consumers. How will banks respond, and will we see AI use cases like Crayon Data become more prominent?

Back in 2019 – when life was simpler and customers only expected minor miracles from the brands they interacted with – personalisation of the customer experience (CX) was a “good idea but the time has not yet come” for the majority of marketing and CX professionals.

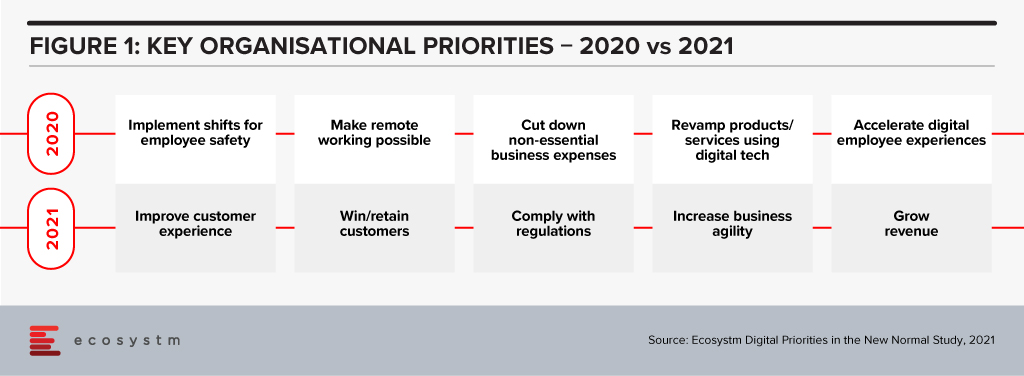

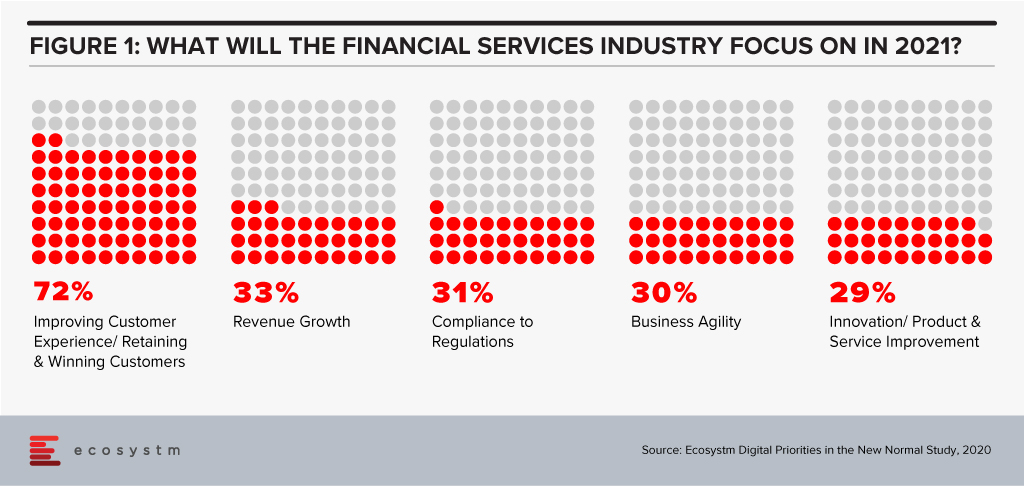

Fast forward 24 months and the world has changed – in more ways than we could have imagined! For a start, CX dropped off the top business priority during 2020 as businesses adapted to the changing market and employee experiences. But as some economies start to create a new sense of normal, CX has returned to the top of the list of business priorities (Figure 1) – renewing pressure on CX teams to create great experiences for customers.

In 2020 many marketing teams went back to the drawing board to create truly meaningful customer experiences. Suddenly “trust” was a core expectation of a brand, and that lens allowed marketers and CX teams to rethink what a personalised experience looks like. It is no longer about selling more products and creating more chances for commerce – it is now about creating an experience that makes brands easy to deal with. It is about understanding the customer and creating an optimised experience when they want or need to interact with the brand. A great personalised experience feels normal today – it has lost the “creepy” edge and is now about the brand giving customers the service, products, or levers that they need when and where they need them.

For some brands and customers, a personalised experience is about getting out of the way of customers and just giving them the outcome they desire. For others it is about creating a memorable journey. Some customers require that extra hand holding along the way and need to be nudged in the right direction, and just need to be left alone to make their decisions – not requiring that extra EDM, alert or message.

In some sectors – such as Banking and eCommerce – if you are not personalising your CX you are a long way behind, but in others, such as Government and Insurance, personalisation is only beginning to gain traction today, and will see slow and steady growth over the next few years.

Good Data is Key to a Great Personalisation Strategy

Lack of data is the primary reason personalisation fails and why some marketing teams have abandoned their personalisation efforts. The right data may not exist completely within your business – you may need to partner or work with ecosystem providers to create a complete view of your customers – and new restrictions around the use of cookies is making this harder to achieve. Forward thinking businesses have already forged partnerships with third parties and partners to share relevant data to help them create the personalised experience their customers demand.

Personalisation Should Apply Across the Customer Journey

A clear understanding of brand values, customer desires and ideal customer journeys is also important to ensure personalised experiences meet the needs of customers. Creating a personalised experience that deviates from brand values means that either brands don’t understand their customers, or customer experience professionals don’t understand their brands (or both!).

Personalisation needs to focus on the entire customer journey – from prospect through to customer and even through to churn. While you have significantly more data about your customers than your prospects, a personalised experience for non-customers is still possible and sets the scene for better and easier CX once your prospects take the longer journey with your brand. Creating a personalised churn experience – making the departure from your brand memorable, friendly and easy – provides the perfect springboard for return and tells your customers that you care about them through the entire journey.

Build a Proof of Concept for Personalisation

If you have not yet started personalising your customer’s experience, now is the perfect time to build a Proof of Concept (POC) demonstrating the business and customer outcomes you can achieve. This will help the CX and/or marketing teams to understand what data you need to collect from existing systems and processes – or source externally to create the desired experience. Initially your personalisation experience may target a limited number of key personas – but it should have the capability to roll out to all customers and/or prospects, eventually considering many scenarios and requirements. It should continue to learn and adapt. Too many businesses discovered during the pandemic that static personalisation programs will fail when market conditions change.

The POC can provide the data that your senior leadership will need to deepen their investments in and think of personalisation as a business capability – not a single project. They can demonstrate the ROI (or lack of return) and will help to guide the larger spend should the POC be a success.

Invest in Behavioural Science Skills

Building a successful personalisation strategy often goes beyond simply listening to the experts within the business and even listening to your customers. Often your customers don’t know what affects their behaviour – and will mis-report motivations or mis-attribute actions. It is important to understand the science behind behaviour – what is possible, what can work, what is guidance and what is coercion. These experts, along with your legal or privacy teams, can help to set up the guide rails for the personalisation program to operate within, and help you create customer journeys where customers can achieve their desired outcomes.

Target Consent as a Key Customer KPI

Consent is a key enabler of deep personalisation capabilities. While some level of personalisation without formal consent can be created, the real benefits of personalised journeys come with consent to use customer data to offer better services. Many businesses ask for consent in the sign-up process, but often it feels like wishful thinking – not a serious attempt to offer a better customer experience. Businesses that make “Consent to Use Data” a CX KPI think more broadly of the customer journey, the brand promise and what that means to levels of consent. It isn’t a “tick-a-box” activity at sign-up – it considers what the customer wants to get out of the engagement or a longer relationship. It focuses on helping customers achieve their instant goals more effectively and the benefits the data can bring to nurture a longer-term relationship.

Businesses that seek a higher level of consent use more tangible outcomes, simpler language and no “sweeping statements” in their consent request. They are explicit how they will use data and what data they will use. Sometimes they don’t even ask for consent to use data at sign-up – they ask after they have formed a relationship and the customer has developed a level of trust in the brand or company.

Start Your Personalisation Journey Today

Your competitors are already thinking about personalisation – some have even implemented personalised elements within their existing or new customer journeys. Personalisation – while easier than ever – is still a significant capability to build within your business. You are likely to need new technology tools and/or platforms, new skills, and new budgets. The impact for your customers – and therefore for your business – can be significant. And the impact of no action can potentially be damaging. Start your personalisation journey today to help your business take the next step towards becoming a customer-obsessed, agile, and digital business.

Woolworths have announced the adoption of a new Software-as-a-Service capability from One Door to support the quality and compliance of their in-store merchandising. There are some valuable lessons from this announcement for other retailers.

The power of data, particularly as the capability of specialist AI tools improves, continues to help retailers improve their offering to customers.

SaaS Capabilities Offer Performance Improvements

Woolworths are working on improving the compliance of product merchandising in-store using One Door Visual Merchandising solution.

One Door will improve the accuracy of data available to both the in-store teams and for the central supermarket merchandising team. The supply chain in Woolworths is already highly automated but getting the shelf presence right is dependent on the quality of data being captured. While store teams already use a range of electronic tools to capture this information, the compliance with store planograms and visual merchandising standards has been difficult to automate.

One Door’s solution provides a single source of this information in an easy to use digital format. The AI tools that One Door have developed appear to be able to show the degree of compliance of the actual shelf layout and stock position.

For store teams, One Door will simplify tracking layout changes by highlighting them and making the data available on the shop floor. This should deliver productivity benefits to the store – benefits that can be reinvested in new activities or on better customer service.

Store teams will be able to verify that third party merchandisers are compliant. Major product manufacturers often use their own merchandising teams in supermarkets and One Door will provide a simple mechanism to verify they have done their jobs properly.

The central merchandise teams will be able to quickly get data-driven feedback on how the stores are making planned changes, as well as verifying the quality of compliance with their store layouts.

All of these factors should mean that the product that is available in-store is presented in the manner that the merchandising teams have defined, and the customers will see a more consistent presentation of products.

Integration is Critical for Rapid Deployment

Effective integration with existing systems and new cloud capabilities is critical to support the real-time operation in Retail.

The ability to introduce and scale up new capabilities that can be delivered by cloud services such as One Door will only be effective if integration is simple and quick. This requires compatibility at a number of levels including data semantics and the ability to exchange data effectively. Woolworths have been growing their capability for managing and supporting APIs that will make this integration smoother.

In addition, the cloud service providers have made the development of integration capabilities an investment priority.

The introduction of One Door is showing how the company can integrate new capability and introduce it to almost 10% of their stores as a pilot capability, with the full deployment to be completed across their chain during 2022.

Other retailers who don’t have this capability to integrate cloud services quickly, reliably and cost-effectively are going to lag companies that have invested to achieve this capability.

CIOs and CDOs should be leading their organisations in the development of a rich and scalable set of APIs to enable the integration of this type of high-value specialised solution.

Deployment without Consistent Architectures will be Complex

Rapid deployment of new capabilities requires a well-architected cloud, network, and edge infrastructure – and a well-trained team.

It is highly likely that the deployment of the One Door solution will be delivered over the existing Woolworths infrastructure. The capability is delivered from the cloud, with little or no deployment costs or time required. With the existing network and hybrid cloud capabilities that Woolworths have developed this type of rollout will be a relatively simple technical activity.

The integration of the service into the Woolworths environment is likely to be the most complex activity to make sure accurate data is exchanged.

It doesn’t take long to identify a wide range of different digital initiatives that Woolworths are pursuing. With the platform that they have established, they are well-positioned to take advantage of new capabilities as start-ups and existing suppliers develop them.

Every retailer needs to maintain their focus on their digital capabilities. As companies such as One Door develop AI-based enhancements, CIOs and their teams need to be ready to integrate these capabilities quickly.

Strong architectures for both infrastructure and digital services are needed to achieve these outcomes.

Recommendations for Retailers

Retail organisations continue to find new ways to leverage the power of the data that they are able to collect. The flexibility that SaaS developments deliver will be essential to maintaining an organisation’s competitive positioning.

CIOs and their teams need to lead their organisations and ecosystems by:

- Identifying new SaaS capabilities that support the strategic positioning of their companies

- Preparing their environments by supporting a rich set of APIs to support the rapid integration of these new capabilities

- Developing and maintaining strong architectures that provide organisations a solid framework to develop within

Checkout Alan’s previous insight on Woolworths micro automation technology adopted to speed up the fulfilment of online grocery orders

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.