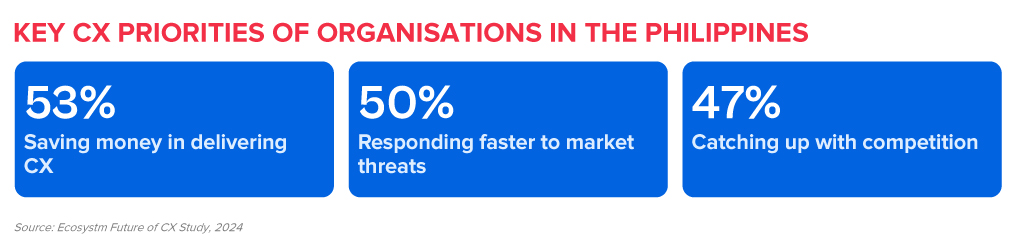

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

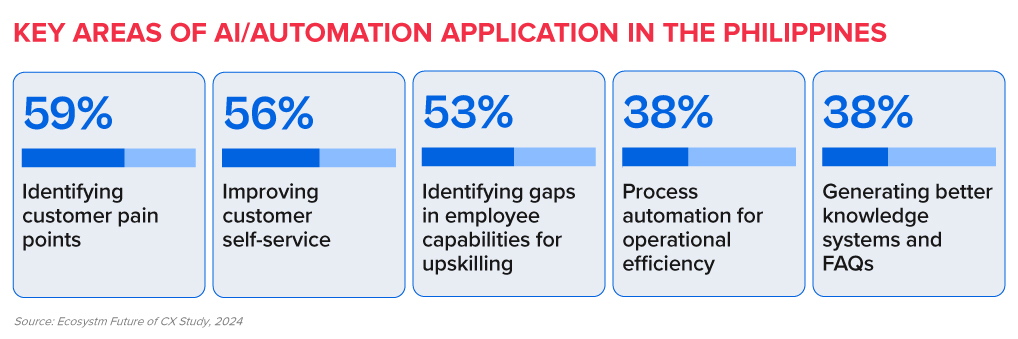

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

In my last Ecosystm Insights, I spoke about why organisations need to think about the Voice of the Customer (VoC) quite literally. Organisations need to listen to what their customers are telling them – not just to the survey questions they responded to, answering pre-defined questions that the organisations want to hear about.

The concept of customer feedback is evolving, and how organisations design and manage VoC programs must also change. Technology is now capable of enabling customer teams to tap into all those unsolicited, and often unstructured, raw feedback sources. Think contact centre conversations (calls, chats, chatbots, emails, complaints, call notes), CRM notes, online reviews, social media, etc. Those are all sources of raw customer feedback, waiting to be converted into customer insights.

Organisations can now find the capability of extracting customer insight from raw data across a wide range of solutions, from VoC platforms, data management platforms, contact centre solutions, text analytics players, etc. The expanding tech ecosystem presents opportunities for organisations to enhance their programs. However, navigating this breadth of options can also be confusing as they strive to identify the most suitable tools for their requirements.

As CX programs mature and shift from survey feedback to truly listening to customers, the demand for tech solutions tailored to various needs increases.

Where are tech vendors headed?

As part of my job as CX Consultant & Tech Advisor, I spend a lot of time working with my clients. But I also spend a lot of time speaking with technology vendors, who provide the solutions my clients need. Over the last few weeks and months there’s been a flurry of activity across the CX technology market with lots of product announcements around one specific topic. You guessed it, GenAI.

So, I invested some time in finding out how tech vendors are evolving their offerings. From Medallia, InMoment, Thematic, LiquidVoice, Concentrix, Snowflake, Nice, to Tethr – a broad variety of different vendors, but all with one thing in common; they help analyse customer feedback data.

And I like what I hear. The conversation has not been about GenAI because of GenAI, but about use cases and real-life applications for CX practitioners, including Insights & Research team, Contact Centre, CX, VoC, Digital teams, and so on. The list is long when we include everyone who has a role to play in creating, maintaining, and improving customer experiences.

It’s no wonder that many different vendors have started to embed those capabilities into their solutions and launch new products or features. The tech landscape is becoming increasingly fragmented at this stage.

What are an organisation’s tech options?

- The traditional VoC platform providers typically offer some text analytics capabilities (although not always included in the base price) and have started to tap into the contact centre solutions as well. Some also offer some social media or online review analysis, leaving organisations with a relatively good understanding of customer sentiment and a better understanding of their CX.

- Contact centre solutions are traditionally focused on analysing calls for Quality Assurance (QA) purposes and use surveys for agent coaching. Many contact centre players have evolved their portfolios to include text analytics or conversational intelligence to extract broader customer insights. Although at this stage they’re not always shared with the rest of the organisation (one step at a time…).

- Conversational analytics/intelligence providers have emerged over the last few years and are a powerhouse for contact centre and chatbot conversations. The contact centre really is the treasure trove of customer insights, although vastly underutilised for it so far!

- CRMs are the backbone of the customer experience management toolkit as they hold a vast amount of metadata. They’ve also been able to send surveys for a while now. Analysing unstructured data however (whether survey verbatim or otherwise) isn’t one of their strengths. This leaves organisations with a lot of data but not necessarily insights.

- Social media listening tools are often standalone tools used by the social media teams. There are not many instances of them being used for the analysis of other unstructured feedback.

- Digital/website feedback tools, in line with some of the above, are centred around collecting feedback, not necessarily analysing the unstructured feedback.

- Pure text analytics players are traditionally focused on analysing surveys verbatim. As this is their core offering, they tend to be proficient in it and have started to broaden their portfolios to include other unstructured feedback sources.

- Customer Data Platforms (CDP)/ Data Management Platforms (DMP) are more focused on quantitative data about customers and their experiences. Although many speak about their ability to analyse unstructured feedback as well, it doesn’t appear to be their strengths.

Conclusion

But what does that leave organisations with? Apart from very confused tech users trying to find the right solution for their organisation.

At this stage, there is immense market fragmentation, with many vendors from different core capabilities starting to incorporate capabilities to analyse unstructured data in the wake of the GenAI boom. However, a market convergence is expected.

While we watch how the market unfolds, one thing is certain. Organisations and customer teams will need to adjust – and that includes the tech stack as well as the CX program set up. With customer feedback now coming from anywhere within or outside the organisation, there is a need for a consolidated source of truth to make sense of it all and move from raw data to customer insights. While organisations will benefit immensely from a consolidated customer data repository, it’s also crucial to break down organisational silos at the same time and democratise insights as widely as possible to enable informed decision-making.

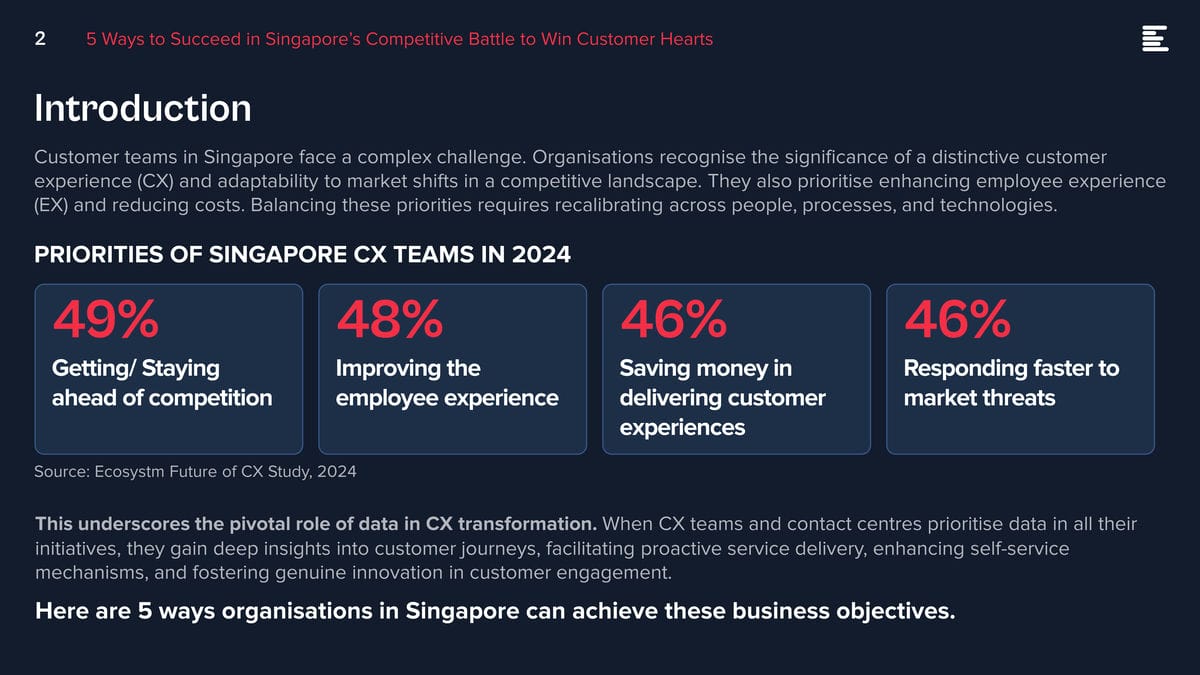

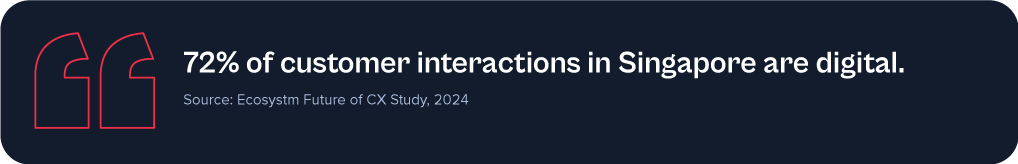

Customer teams in Singapore face a complex challenge. Organisations recognise the significance of a distinctive customer experience (CX) and adaptability to market shifts in a competitive landscape. They also prioritise enhancing employee experience (EX) and reducing costs. Balancing these priorities requires recalibrating across people, processes, and technologies.

This underscores the pivotal role of data in CX transformation. When CX teams and contact centres prioritise data in all their initiatives, they gain deep insights into customer journeys, facilitating proactive service delivery, enhancing self-service mechanisms, and fostering genuine innovation in customer engagement.

Here are 5 ways organisations in Singapore can achieve these business objectives.

Download ‘5 Ways to Succeed in Singapore’s Competitive Battle to Win Customer Hearts’ as a PDF.

#1 Build a Strategy around Voice & Omnichannel Orchestration

Customers seek flexibility to choose channels that suit their preferences, often switching between them. When channels are well-coordinated, customers enjoy consistent experiences, and CX teams and contact centre agents gain real-time insights into interactions, regardless of the chosen channel. This boosts key metrics like First Call Resolution (FCR) and reduces Average Handle Time (AHT).

This doesn’t diminish the significance of voice. Voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels. Regardless of the channel chosen, prioritising omnichannel orchestration is essential.

Ensure seamless orchestration from voice to back and front offices, including social channels, as customers switch between channels.

#2 Unify Customer Data through an Intelligent Data Hub

Accessing real-time, accurate data is essential for effective customer and agent engagement. However, organisations often face challenges with data silos and lack of interconnected data, hindering omnichannel experiences.

A Customer Data Platform (CDP) can eliminate data silos and provide actionable insights.

- Identify behavioural trends by understanding patterns to personalise interactions.

- Spot real-time customer issues across channels.

- Uncover compliance gaps and missed sales opportunities from unstructured data.

- Look at customer journeys to proactively address their needs and exceed expectations.

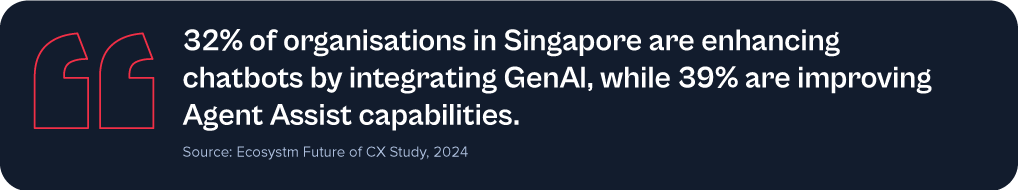

#3 Transform CX & EX with AI

GenAI and Large Language Models (LLMs) is revolutionising how brands address customer and employee challenges, boosting efficiency, and enhancing service quality.

Despite 62% of Singapore organisations investing in virtual assistants/conversational AI, many have yet to integrate emerging technologies to elevate their CX & EX capabilities.

Agent Assist solutions provide real-time insights before customer interactions, optimising service delivery and saving time. With GenAI, they can automate mundane tasks like call summaries, freeing agents to focus on high-value tasks such as sales collaboration, proactive feedback management, personalised outbound calls, and upskilling.

Going beyond chatbots and Agent Assist solutions, predictive AI algorithms leverage customer data to forecast trends and optimise resource allocation. AI-driven identity validation swiftly confirms customer identities, mitigating fraud risks.

#4 Augment Existing Systems for Success

Despite the rise in digital interactions, many organisations struggle to fully modernise their legacy systems.

For those managing multiple disparate systems yet aiming to lead in CX transformation, a platform that integrates desired capabilities for holistic CX and EX experiences is vital.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This will require organisations to re-evaluate all aspects of their CX delivery.

- Redefine the Contact Centre. Transform it into an “Intelligent” Data Hub providing unified and connected experiences. Leverage intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empower agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensure consistent omnichannel experiences through data unification and coherency. Use programmable APIs to personalise conversations and identify customer preferences for real-time or asynchronous messaging. Incorporate innovative technologies such as video to enhance the channel experience.

Customer feedback is at the heart of Customer Experience (CX). But it’s changing. What we consider customer feedback, how we collect and analyse it, and how we act on it is changing. Today, an estimated 80-90% of customer data is unstructured. Are you able and ready to leverage insights from that vast amount of customer feedback data?

Let’s begin with the basics: What is VoC and why is there so much buzz around it now?

Voice of the Customer (VoC) traditionally refers to customer feedback programs. In its most basic form that means organisations are sending surveys to customers to ask for feedback. And for a long time that really was the only way for organisations to understand what their customers thought about their brand, products, and services.

But that was way back then. Over the last few years, we’ve seen the market (organisations and vendors) dipping their toes into the world of unsolicited feedback.

What’s unsolicited feedback, you ask?

Unsolicited feedback simply means organisations didn’t actually ask for it and they’re often not in control over it, but the customer provides feedback in some way, shape, or form. That’s quite a change to the traditional survey approach, where they got answers to questions they specifically asked (solicited feedback).

Unsolicited feedback is important for many reasons:

- Organisations can tap into a much wider range of feedback sources, from surveys to contact centre phone calls, chats, emails, complaints, social media conversations, online reviews, CRM notes – the list is long.

- Surveys have many advantages, but also many disadvantages. From only hearing from a very specific customer type (those who respond and are typically at the extreme ends of the feedback sentiment), getting feedback on the questions they ask, and hearing from a very small portion of the customer base (think email open rates and survey fatigue).

- With unsolicited feedback organisations hear from 100% of the customers who interact with the brand. They hear what customers have to say, and not just how they answer predefined questions.

It is a huge step up, especially from the traditional post-call survey. Imagine a customer just spent 30 min on the line with an agent explaining their problem and frustration, just to receive a survey post call, to tell the organisation what they just told the agent, and how they felt about the experience. Organisations should already know that. In fact, they probably do – they just haven’t started tapping into that data yet. At least not for CX and customer insights purposes.

When does GenAI feature?

We can now tap into those raw feedback sources and analyse the unstructured data in a way never seen before. Long gone are the days of manual excel survey verbatim read-throughs or coding (although I’m well aware that that’s still happening!). Tech, in particular GenAI and Large Language Models (LLMs), are now assisting organisations in decluttering all the messy conversations and unstructured data. Not only is the quality of the analysis greatly enhanced, but the insights are also presented in user-friendly formats. Customer teams ask for the insights they need, and the tools spit it out in text form, graphs, tables, and so on.

The time from raw data to insights has reduced drastically, from hours and days down to seconds. Not only has the speed, quality, and ease of analysis improved, but many vendors are now integrating recommendations into their offerings. The tools can provide “basic” recommendations to help customer teams to act on the feedback, based on the insights uncovered.

Think of all the productivity gains and spare time organisations now have to act on the insights and drive positive CX improvements.

What does that mean for CX Teams and Organisations?

Including unsolicited feedback into the analysis to gain customer insights also changes how organisations set up and run CX and insights programs.

It’s important to understand that feedback doesn’t belong to a single person or team. CX is a team sport and particularly when it comes to acting on insights. It’s essential to share these insights with the right people, at the right time.

Some common misperceptions:

- Surveys have “owners” and only the owners can see that feedback.

- Feedback that comes through a specific channel, is specific to that channel or product.

- Contact centre feedback is only collected to coach staff.

If that’s how organisations have built their programs, they’ll have to rethink what they’re doing.

If organisations think about some of the more commonly used unstructured feedback, such as that from the contact centre or social media, it’s important to note that this feedback isn’t solely about the contact centre or social media teams. It’s about something else. In fact, it’s usually about something that created friction in the customer experience, that was generated by another team in the organisation. For example: An incorrect bill can lead to a grumpy social media post or a faulty product can lead to a disgruntled call to the contact centre. If the feedback is only shared with the social media or contact centre team, how will the underlying issues be resolved? The frontline teams service customers, but organisations also need to fix the underlying root causes that created the friction in the first place.

And that’s why organisations need to start consolidating the feedback data and democratise it.

It’s time to break down data and organisational silos and truly start thinking about the customer. No more silos. Instead, organisations must focus on a centralised customer data repository and data democratisation to share insights with the right people at the right time.

In my next Ecosystm Insights, I will discuss some of the tech options that CX teams have. Stay tuned!

The tech industry tends to move in waves, driven by the significant, disruptive changes in technology, such as cloud and smartphones. Sometimes, it is driven by external events that bring tech buyers into sync – such as Y2K and the more recent pandemic. Some tech providers, such as SAP and Microsoft, are big enough to create their own industry waves. The two primary factors shaping the current tech landscape are AI and the consequential layoffs triggered by AI advancements.

While many of the AI startups have been around for over five years, this will be the year they emerge as legitimate solutions providers to organisations. Amidst the acceleration of AI-driven layoffs, individuals from these startups will go on to start new companies, creating the next round of startups that will add value to businesses in the future.

Tech Sourcing Strategies Need to Change

The increase in startups implies a change in the way businesses manage and source their tech solutions. Many organisations are trying to reduce tech debt, by typically consolidating the number of providers and tech platforms. However, leveraging the numerous AI capabilities may mean looking beyond current providers towards some of the many AI startups that are emerging in the region and globally.

The ripple effect of these decisions is significant. If organisations opt to enhance the complexity of their technology architecture and increase the number of vendors under management, the business case must be watertight. There will be less of the trial-and-error approach towards AI from 2023, with a heightened emphasis on clear and measurable value.

AI Startups Worth Monitoring

Here is a selection of AI startups that are already starting to make waves across Asia Pacific and the globe.

- ADVANCE.AI provides digital transformation, fraud prevention, and process automation solutions for enterprise clients. The company offers services in security and compliance, digital identity verification, and biometric solutions. They partner with over 1,000 enterprise clients across Southeast Asia and India across sectors, such as Banking, Fintech, Retail, and eCommerce.

- Megvii is a technology company based in China that specialises in AI, particularly deep learning. The company offers full-stack solutions integrating algorithms, software, hardware, and AI-empowered IoT devices. Products include facial recognition software, image recognition, and deep learning technology for applications such as consumer IoT, city IoT, and supply chain IoT.

- I’mCloud is based in South Korea and specialises in AI, big data, and cloud storage solutions. The company has become a significant player in the AI and big data industry in South Korea. They offer high-quality AI-powered chatbots, including for call centres and interactive educational services.

- H2O.ai provides an AI platform, the H2O AI Cloud, to help businesses, government entities, non-profits, and academic institutions create, deploy, monitor, and share data models or AI applications for various use cases. The platform offers automated machine learning capabilities powered by H2O-3, H2O Hydrogen Torch, and Driverless AI, and is designed to help organisations work more efficiently on their AI projects.

- Frame AI provides an AI-powered customer intelligence platform. The software analyses human interactions and uses AI to understand the driving factors of business outcomes within customer service. It aims to assist executives in making real-time decisions about the customer experience by combining data about customer interactions across various platforms, such as helpdesks, contact centres, and CRM transcripts.

- Uizard offers a rapid, AI-powered UI design tool for designing wireframes, mockups, and prototypes in minutes. The company’s mission is to democratise design and empower non-designers to build digital, interactive products. Uizard’s AI features allow users to generate UI designs from text prompts, convert hand-drawn sketches into wireframes, and transform screenshots into editable designs.

- Moveworks provides an AI platform that is designed to automate employee support. The platform helps employees to automate tasks, find information, query data, receive notifications, and create content across multiple business applications.

- Tome develops a storytelling tool designed to reduce the time required for creating slides. The company’s online platform creates or emphasises points with narration or adds interactive embeds with live data or content from anywhere on the web, 3D renderings, and prototypes.

- Jasper is an AI writing tool designed to assist in generating marketing copy, such as blog posts, product descriptions, company bios, ad copy, and social media captions. It offers features such as text and image AI generation, integration with Grammarly and other Chrome extensions, revision history, auto-save, document sharing, multi-user login, and a plagiarism checker.

- Eightfold AI provides an AI-powered Talent Intelligence Platform to help organisations recruit, retain, and grow a diverse global workforce. The platform uses AI to match the right people to the right projects, based on their skills, potential, and learning ability, enabling organisations to make informed talent decisions. They also offer solutions for diversity, equity, and inclusion (DEI), skills intelligence, and governance, among others.

- Arthur provides a centralised platform for model monitoring. The company’s platform is model and platform agnostic, and monitors machine learning models to ensure they deliver accurate, transparent, and fair results. They also offer services for explainability and bias mitigation.

- DNSFilter is a cloud-based, AI-driven content filtering and threat protection service, that can be deployed and configured within minutes, requiring no software installation.

- Spot AI specialises in building a modern AI Camera System to create safer workplaces and smarter operations for every organisation. The company’s AI Camera System combines cloud and edge computing to make video footage actionable, allowing customers to instantly surface and resolve problems. They offer intelligent video recorders, IP cameras, cloud dashboards, and advanced AI alerts to proactively deliver insights without the need to manually review video footage.

- People.ai is an AI-powered revenue intelligence platform that helps customers win more revenue by providing sales, RevOps, marketing, enablement, and customer success teams with valuable insights. The company’s platform is designed to speed up complex enterprise sales cycles by engaging the right people in the right accounts, ultimately helping teams to sell more and faster with the same headcount.

These examples highlight a few startups worth considering, but the landscape is rich with innovative options for organisations to explore. Similar to other emerging tech sectors, the AI startup market will undergo consolidation over time, and incumbent providers will continue to improve and innovate their own AI capabilities. Till then, these startups will continue to influence enterprise technology adoption and challenge established providers in the market.

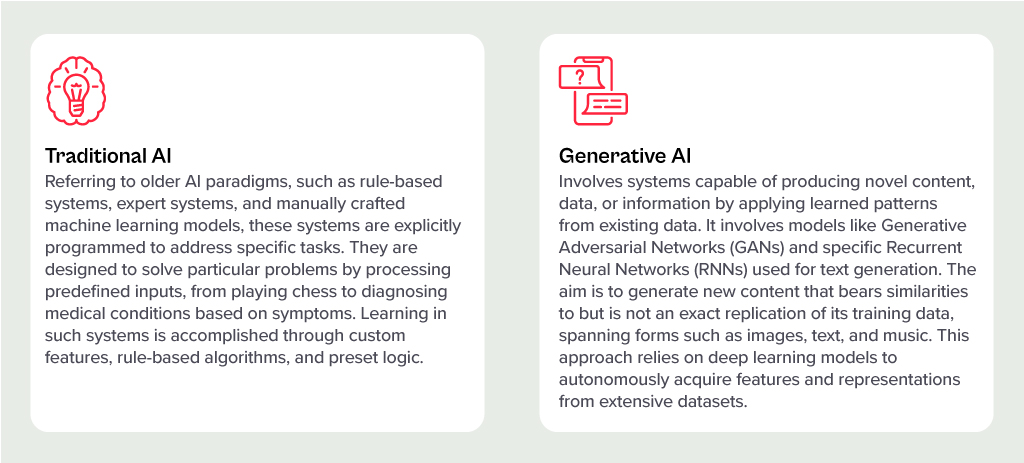

Generative AI has stolen the limelight in 2023 from nearly every other technology – and for good reason. The advances made by Generative AI providers have been incredible, with many human “thinking” processes now in line to be automated.

But before we had Generative AI, there was the run-of-the-mill “traditional AI”. However, despite the traditional tag, these capabilities have a long way to run within your organisation. In fact, they are often easier to implement, have less risk (and more predictability) and are easier to generate business cases for. Traditional AI systems are often already embedded in many applications, systems, and processes, and can easily be purchased as-a-service from many providers.

Unlocking the Potential of AI Across Industries

Many organisations around the world are exploring AI solutions today, and the opportunities for improvement are significant:

- Manufacturers are designing, developing and testing in digital environments, relying on AI to predict product responses to stress and environments. In the future, Generative AI will be called upon to suggest improvements.

- Retailers are using AI to monitor customer behaviours and predict next steps. Algorithms are being used to drive the best outcome for the customer and the retailer, based on previous behaviours and trained outcomes.

- Transport and logistics businesses are using AI to minimise fuel usage and driver expenses while maximising delivery loads. Smart route planning and scheduling is ensuring timely deliveries while reducing costs and saving on vehicle maintenance.

- Warehouses are enhancing the safety of their environments and efficiently moving goods with AI. Through a combination of video analytics, connected IoT devices, and logistical software, they are maximising the potential of their limited space.

- Public infrastructure providers (such as shopping centres, public transport providers etc) are using AI to monitor public safety. Video analytics and sensors is helping safety and security teams take public safety beyond traditional human monitoring.

AI Impacts Multiple Roles

Even within the organisation, different lines of business expect different outcomes for AI implementations.

- IT teams are monitoring infrastructure, applications, and transactions – to better understand root-cause analysis and predict upcoming failures – using AI. In fact, AIOps, one of the fastest-growing areas of AI, yields substantial productivity gains for tech teams and boosts reliability for both customers and employees.

- Finance teams are leveraging AI to understand customer payment patterns and automate the issuance of invoices and reminders, a capability increasingly being integrated into modern finance systems.

- Sales teams are using AI to discover the best prospects to target and what offers they are most likely to respond to.

- Contact centres are monitoring calls, automating suggestions, summarising records, and scheduling follow-up actions through conversational AI. This is allowing to get agents up to speed in a shorter period, ensuring greater customer satisfaction and increased brand loyalty.

Transitioning from Low-Risk to AI-Infused Growth

These are just a tiny selection of the opportunities for AI. And few of these need testing or business cases – many of these capabilities are available out-of-the-box or out of the cloud. They don’t need deep analysis by risk, legal, or cybersecurity teams. They just need a champion to make the call and switch them on.

One potential downside of Generative AI is that it is drawing unwarranted attention to well-established, low-risk AI applications. Many of these do not require much time from data scientists – and if they do, the challenge is often finding the data and creating the algorithm. Humans can typically understand the logic and rules that the models create – unlike Generative AI, where the outcome cannot be reverse-engineered.

The opportunity today is to take advantage of the attention that LLMs and other Generative AI engines are getting to incorporate AI into every conceivable aspect of a business. When organisations understand the opportunities for productivity improvements, speed enhancement, better customer outcomes and improved business performance, the spend on AI capabilities will skyrocket. Ecosystm estimates that for most organisations, AI spend will be less than 5% of their total tech spend in 2024 – but it is likely to grow to over 20% within the next 4-5 years.

COVID-19 has been a major disruption for people-intensive industries and the BPO sector is no exception. However, some of the forward-looking BPO organisations are using this disruption as an opportunity to re-evaluate how they do business and how they can make themselves resilient and future-proof. In many of these conversations, technology and process reengineering are emerging as the two common themes in their journey to transform into a New Age BPO provider.

In 2022 BPO providers will focus on mitigating their key challenges around handling client expectations, better people management and investing in the right technologies for their own transformation journeys.

Read on to find out what Ecosystm Advisors Audrey William and Venu Reddy think will be the key trends for the New Age BPO in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for the New Age BPO in 2022 as PDF

Since early 2020 nearly all organisations have strengthened their online presence and commerce abilities – irrespective of their industry. They have come to terms with the fact that the ability to win and retain customers, is largely linked to the digital customer experience (CX) they are able to deliver.

They have invested heavily in their CX roadmaps and technologies; but will find themselves solving for the same challenges they have faced the last 2 years – continued growth of digital experiences; gaining insights from customer data; customer churn; and catering to customer channel preferences.

2022 will be the time to consolidate and build the capabilities required to analyse the immense amount of customer data that they have access to – to finally be able to offer personalised customer experience.

Read on to find out what Ecosystm Advisors Audrey William and Tim Sheedy think will be the leading CX trends in 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Customer Experience in 2022 as a PDF

Cisco’s annual WebexOne conference was held on 26-27 October featuring over 30 sessions with thought leaders, guest speakers, technology partners and Cisco executives. This year’s event focused on how the company and its ecosystem of partners will continue to enable the Future of Work.

In the last year, Cisco has added more than 1,000 features to its Webex platform and made 5 key acquisitions. But from the event, it became apparent that the company is continuing to work on product differentiation and making hybrid work a more productive and human experience.

Read on to find what Ecosystm analysts, Audrey William, Sash Mukherjee, Tim Sheedy, Ullrich Loeffler and Venu Reddy found interesting about the announcements at WebexOne 2021.

To download this VendorSphere as a pdf for easier sharing, please click here.