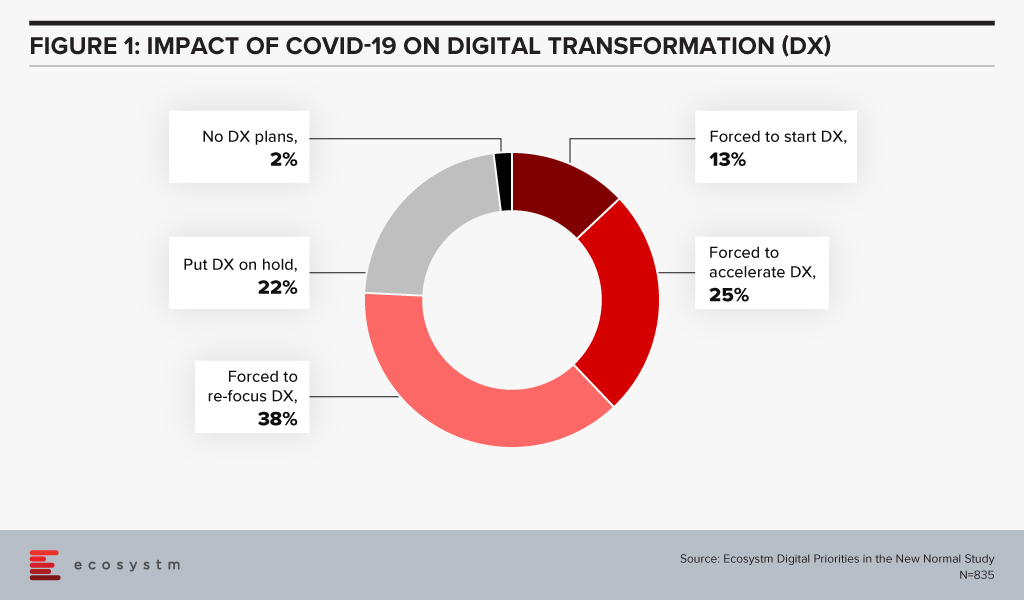

The Retail industry has had to do a sharp re-think of its digital roadmap and transformation journey – Ecosystm research shows that about 75% of retail organisations had to start, accelerate, or re-focus their digital transformation initiatives. However, that will not be enough as organisations move beyond survival to recovery – and future successes. While retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough in 2021. Ecosystm Principal Advisors, Alan Hesketh and Alea Fairchild present the top 5 Ecosystm predictions for Retail & eCommerce in 2021.

This is a summary of the predictions, the full report (including the implications) is available to download for free on the Ecosystm platform here.

The Top 5 Retail & eCommerce Trends for 2021

- There Will Only be Omnichannel Retailers

The value of an omnichannel offer in Retail has become much clearer during the COVID-19 pandemic. Retailers that do not have the ability to deliver using the channel customers prefer will find it hard to compete. As the physical channel becomes less important new revenue opportunities will open up for businesses operating in adjacent market sectors – companies such as food and grocery wholesalers will increasingly sell direct to consumers, leveraging their existing online and distribution capabilities.

Most customers transact on mobile device – either a mobile phone or tablet. New capabilities will remove some of the barriers to using these mobile devices. For one, technologies such as Progressive Web Apps (PWA) and Accelerated Mobile Pages (AMP) will provide a better customer experience on mobile platforms than existing websites, while delivering a user experience at par or better than mobile apps. Also, as retailers become AI-enabled, machine learning engines will provide purchase recommendations through smartwatches or in-home, voice-enabled, smart devices.

- COVID-19 Will Continue to be an Influence Forcing Radical Shifts

In driving the economic recovery in 2021, we will see ‘glocal’ consumption – emphasis on local retailers and global players taking local actions to win the hearts and minds of local consumers. There will be significant actions within local communities to drive consumers to support local retailers. Location-based services (LBS) will be used extensively as consumers on the high street carry more LBS-enabled devices than ever before. Bluetooth beacon technology and proximity marketing will drive these efforts. Consumers will have to opt-in for this to work, so privacy and relationship management are also important to consider.

But people still want to “physically” browse, and design aesthetics of a store are still part of the attraction. In the next 18 months, the concept of virtual stores that are digital twins will take off, particularly in the holiday and Spring clearance sales. Innovators like Matterport can help local retailers gain a more global audience with a digital twin with a limited technological investment. At a minimum, Shopify or other intermediaries will be necessary for a digital shop window.

- The Industry will See Artificial Intelligence in Everything

AI will increase its impact on Retail with an uptake in two key areas.

- Customer interactions. Retail AI will use customer data to deliver much richer and targeted experiences. This may include the ability to get to a ‘segment of one’. Tools will include chatbots that are more functional and support for voice-based commerce using mobile and in-home edge devices. Also, in-store recognition of customers will become easier through enhanced device or facial recognition. Markets where privacy is less respected will lead in this area – other markets will also innovate to achieve the same outcomes without compromising privacy but will lag in their delivery. This mismatch of capability may allow early adopters to enter other geographic markets with competitive offers while meeting the privacy requirements of these markets.

- Supply chain and pricing capabilities. AI-based machine learning engines using both internal and increased sources of external data will replace traditional math-based forecasting and replenishment models. These engines will enable the identification of unexpected and unusual demand influencing factors, particularly from new sources of external data. Modelling of price elasticity using machine learning will be able to handle more complex models. Retailers using this capability will be in a better position to optimise their customer offers based on their pricing strategies. Supply chains will be re-engineered so products with high demand volatility are manufactured close to markets, and the procurement of products with stable demands will be cost-based.

- Distribution Woes Will Continue

Third party delivery platforms such as Wish and RoseGal are recruiting additional international non-Asian suppliers to expand their portfolios. Amazon and AliExpress are leaders here, but there are many niche eCommerce platforms taking up the slack due to the uneven distribution patterns from the ongoing economic situation. Expect to see a number of new entrants taking up niche spaces in the second half of 2021, sponsored by major retail product brands, to give Amazon a run for their money on a more local basis.

As the USPS continues to be under strain, delivery companies like FedEx in the US who partner with the USPS are already suffering from the USPS’s operational slowdown, in both their customer reputation and delivery speed. In 2021, COVID-19 – and workers’ unions – will continue to impact distribution activities. Increased spending in warehouse automation and new retail footprints such as dark stores will be seen to make up for worker shortfalls.

- China’s Retail Models Will Expand into Other Markets

China’s online businesses operate in a large domestic market that is comparatively free of international competitors. Given the scale of the domestic market, these online companies have been able to grow to become substantial businesses using advanced technologies. All the Chinese tech giants – among them Alibaba, ByteDance, DiDi Chuxing, and Tencent – are expanding internationally.

China’s rapidly recovering economy puts those businesses in a strong position to fund a competitive expansion into international markets using their domestic base, particularly with their Government’s promotion of the country’s tech sector. It is harder to impose restrictions on software-based businesses, unlike the approach that we have witnessed the US Government take for hardware companies such as Huawei – placing constraints on mobile phone components and operating systems.

These tech giants also have significant experience in a Big Data environment that provides little privacy protection, as well as leading-edge AI capabilities. While they will not be able to operate with the same freedom in global markets, and there will be other large challenges in translating Chinese experience to other markets – these tech players will be able to compete very effectively with incumbent global companies. Chinese companies also continue to raise capital from US stock exchanges with The Economist reporting Chinese listings have raised close to USD 17 billion since January 2020.

Authored by Alea Fairchild and Mike Zamora

There have been a few articles recently about investment companies looking to buy large national US retail companies, for example, JC Penney and Dillards. Their historical approach was to purchase the land and develop the sites as a retail centre and operate their stores. They then lease the remaining retail space to other retailers. It is a business model which has been in use for many decades.

Historically a long and deep negative economic cycle has caused some retail operators/developers to sell part of their operations. This happened in the US in 1995 with Sears. The real estate development and investment companies’ interest is in exploring if there is a higher and better use for the properties. That is the essence of land economics, going from a lower economic use to a higher income/value use.

A key difference this time is the use of advanced technology. We see this in many dimensions: building systems and operations; retail management, social media, entertainment and food and beverage (F&B) operations.

The Smart Building revolution in Retail is about changing the management philosophy of buildings and using technology to aid in the process. The defining characteristic of building smarter is not the application of technology or a function of outcomes on energy use or maintenance. Instead, it is a commitment to leveraging the overall footprint to achieve the goals that perhaps inspired the building in the first place.

Evolution of Space for Retail Activities

The old axiom of real estate is location, location, location. This means that every retail centre will have to be assessed for its best purpose for its locations and surrounding environment. Retail has been morphing in the past few years from a traditional purpose of picking something up to an intersection of shopping and entertainment. This combines on-premise activities with a buying transaction which can be handled either onsite or online. Technology infrastructure investment opportunities are driven by optimising the customer retail experience.

Retail centres are seeking new functionality, including the adaptation of both design and use. Below are four approaches we believe can be used to assess each retail centre.

Reuse: Retail Lifecycle – Consumption to Redemption

There is a shift from consumers discovering and experiencing products in a physical retail space to retailers delivering on-demand. Many smaller retailers have capitalised on this by becoming pick-up points for online orders. They hope to increase footfall by drawing the customer into their own premises when retrieving their online delivery.

Retail centres need to expand on this trend to become a fulfilment location rather than a retail shopping space. Consumers could pick up online orders, recycle used goods, get products maintained and repaired, have appointments for personal services (dental, eye, hair, dry cleaning, etc.), try and test goods in mini-showrooms and collect points and benefits from gamification activities. By having a centralised exchange facility with multiple functionalities, consumer data can be leveraged to create marketing pull activities such as exclusive shopping events, and personalised customer service based on preferences and purchase history.

The current square meterage can be reallocated for distribution including the use of dark stores, green recycling centres for 3D printed product disposal and retail pick-up and exchange points. Staff will not be salespeople, but customer delivery service managers. The technology opportunities in this area would be re-allocation of network resources; focus on efficiency in delivery and customer satisfaction; and automation tools for customer service staff.

Redesign: Blended – Community Environment and Retail Experience

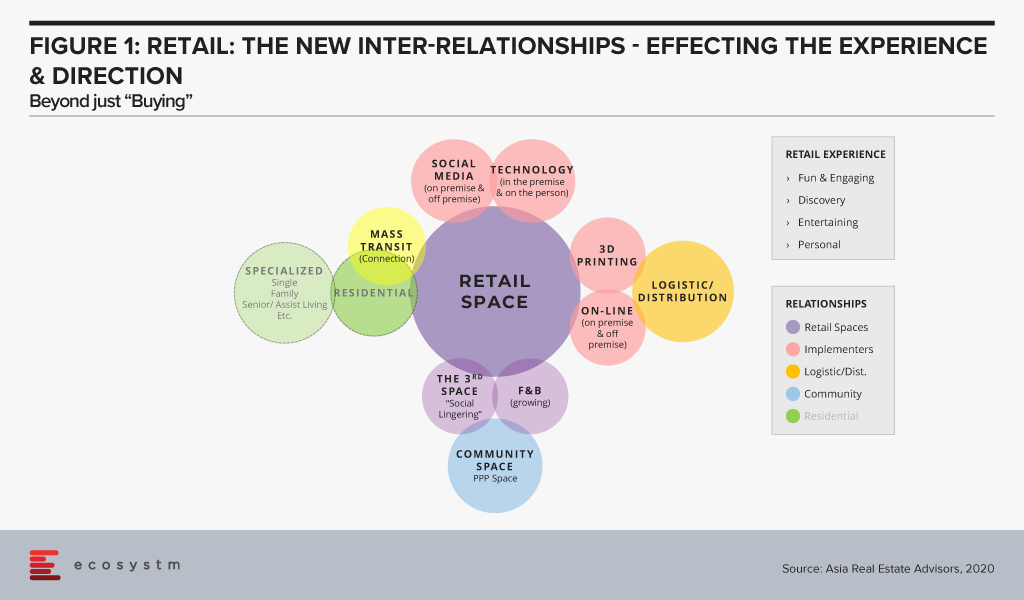

An alternative and more involved development approach would be to redesign the retail centre with deeper use cases to get more customers to come and stay longer. If a consumer stays onsite longer, there is a higher probability they will spend more at the retail centre. The future retail centre (Figure 1) would include additional space usages for a community space, a distribution centre for pick-ups, expanded F&B and remote working.

The technology opportunities are in two areas: customer experience and building operations. From a customer perspective, some technology examples would include entertainment and gaming in the F&B area, digital signage and mobile device technology to further engage people. For building operations examples could include technologies to control climate, lighting, security, energy management and building management.

Redevelop – Living Space for a Quality of Life

In some locations, the retail environment could have an oversupply of newly development retail centres. This means the optimal use for the centre would be to change it to a ‘Village Community’ – a community where people can live, work, learn and play. It would encompass multiple uses – multi-family residential units, a community centre, learning centres for younger children and a co-working area. The technology opportunies would be identical to a connected Smart City – at a lesser scale. Smart residential solutions would make the living environmental more user friendly. Retail could include digital media, mobile push features, enhanced and operational technology, energy management, climate control and security. Schools could include interactive and collaborative tools. Parks would have Wi-Fi and enhanced security. Connected Services (eg utilities, fire life safety, security and communications) could include operational technology systems for utilities, audio and video security systems and communication.

Repurpose: Knowledge & Learning Environment

For some retail centres a redevelopment may not be required, but would instead need a major repurposing of the space. The repurpose could be as a learning or healthcare centre. Learning environments require large open spaces with high ceilings for auditoriums or class rooms; common areas for gathering in between classes; onsite housing for students; food courts; and adequate parking for commuters. A healthcare environment would require patient reception, examination rooms, inpatient rooms, surgical units, and administrative offices. It could also include a medical learning centre.

The technology opportunities would be to develop a 24×7 site, with technologies to support the key purpose of the centre. The learning environment could include collaborative audio/video tools for Smart Classrooms. The social areas could including advanced food ordering and delivery systems and multiple player gaming centres for entertainment. The living areas would include systems and technology for smart living. The parking area could include enhanced security and surveillance systems, and smart parking systems. Behind the scenes, the building operations would need to upgrade energy management, building maintenance and management, digital food court operations, and a wellness air quality system.

The Future of Sustainable Retail Space

The decline of a retail centre is not necessarily a bad thing for a community. It is just the “Circle of Life” as an area evolves. Locations morph over the long-term. This has been seen in all the large cities around the world which have stood the test of time, eg. London, Paris, Amsterdam, New York, Tokyo and Beijing. The transformation also breathes fresh air into the surrounding environment. There are multiple layers of technology available to provide for an incredible Sustainable and Smart Community. It is large opportunity, not only for real estate developers, but also for technology vendors who understand the transformation process into the multiple variations of smart environments. Large real estate players and REITs will buy these retail portfolios and begin to transform older, low revenue, semi-vacant shopping centres into vibrant destination centres. Technology vendors should bring their ideas and systems to the attention of retail real estate owners early on in the the process. This will increase their chances of having their systems incorporated into the overall design concept and operational approach. It is a physical and digital transformation which improves neighborhoods, businesses and the city. It is a win for all.

Contact centres were already on a path to modernisation – which got accelerated by the COVID-19 crisis. The need for omnichannel delivery and better insights from customer data has forced contact centres to adopt cloud solutions. Ecosystm Principal Advisor Audrey William says, “There is still a disconnect between integrating and synchronising customer data between Sales, Marketing and Customer Teams. However, the market is starting to see contact centre vendors work closer with vendors in customer experience management segment.”

Genesys and Adobe are collaborating on integrating Genesys cloud and the Adobe Experience Platform. The deeper integration of both platforms is aimed to give organisations a better omnichannel presence. The platform is live for users and Genesys and Adobe will introduce other features and capabilities throughout 2020. Genesys is already a partner of Adobe’s Exchange Program designed for technology partners to supplement Exchange Marketplace with extensions and applications for Adobe Creative Cloud users.

Augmenting the CX journey through Data Synchronization

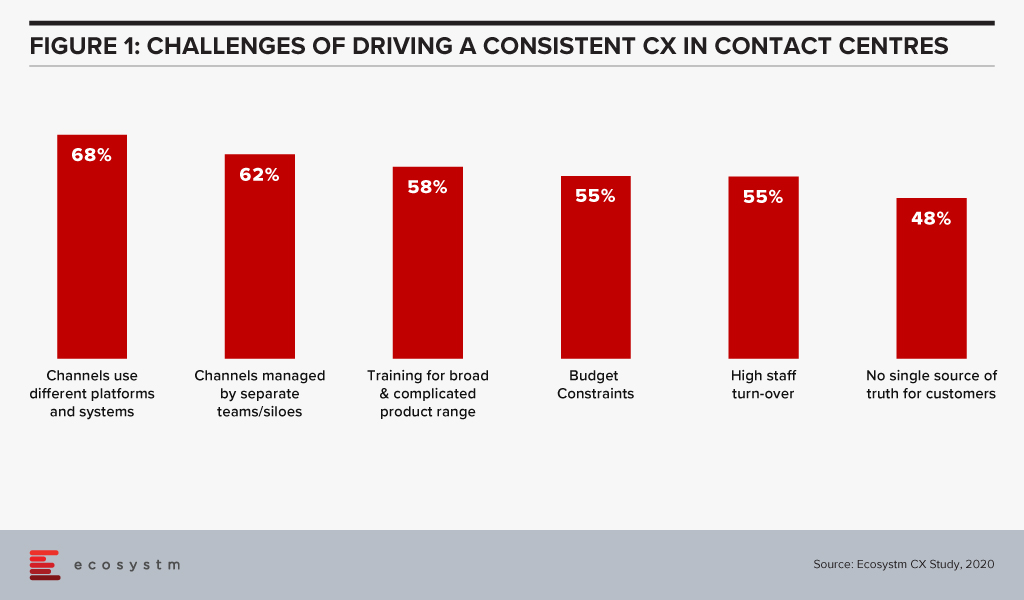

Ecosystm data finds that 62% of contact centres have driving omnichannel experience as a key customer experience (CX) priority and 57% want to analyse data across multiple data repositories. However, when asked about the challenges of driving consistent CX, data access and integration appears to be a barrier in achieving their priorities. These challenges are the reason why getting a “true view” of the customer data has been an arduous task and achieving consistent CX continues to be a struggle.

William says. “The customer data collected by a particular service or department does not always move along in real-time with the customer interactions across different touchpoints. This complicates maintaining a real-time customer profile and impacts the CX.”

“Sales and Marketing have different KPIs and tend to view customer data from different angles. The data from in-store, Marketing and Sales interactions sits within departmental silos. They may deal with the same customers and not follow them through their entire journey. This leads to missed opportunities in reaching out to them at the right time with the right products to upsell, resell or provide better CX. Data synchronisation across channels, would solve that problem.”

Integrating Genesys and Adobe Experience Platform will give organisations the capability to provide contact centre agents with real-time customer data and profiles from a single point to provide an personalised experience. The platform is powered by Genesys Predictive Engagement that uses AI to provide more intelligence based on past interactions to drive effective, data-driven conversations. In addition to this, the partnership also enables businesses and marketing departments to customise campaigns and extend their digital and voice capabilities for optimal conversions. William says, “The ability to use AI to understand customer intent, behaviour and patterns is critical as it will allow brands to re-look at how to design the customer journey. When you keep using the same and outdated profile, it will be hard to have discussions around intent, customer interest and assess how customer priorities have changed. Accurate and automate data profiling will lead to more targeted and accurate marketing campaigns.”

Genesys Deepening Industry Partnerships

Genesys is re-shaping its strategy on Contact Centre as a Service (CCaaS) offerings through partnerships and working on its vision of providing Experience as a Service to its global clients. The need for CCaaS has been accelerated by the pandemic. Last month Genesys signed a five year deal with Infosys to develop and deploy cloud CX and contact centre solutions.

Earlier this year, Genesys partnered with MAXIMUS, a US Government services provider to set up the MAXIMUS Genesys Engagement Platform, an integrated, cloud-based omnichannel contact centre solution driven by the government requirement for public sector organisations to provide seamless customer experiences similar to those offered in the private sector.

The company has also partnered with various other industry leaders like Microsoft, Google Cloud, and Zoom to roll out cloud-based innovations to benefit customers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

The COVID-19 crisis has required major resets in how organisations function – across industries and economies. In this environment of intense changes, businesses that have been agile in their operations and were better digitally enabled have thrived, while others have struggled. Irrespective of whether an organisation has been able to pivot fast to thrive or struggled to cope, it is very clear that the Future of Work is here now. Every organisation has had to make some changes to their People and work practices. It is time to (re) focus on employee experience holistically so that organisations can be ready for whatever model of work becomes prevalent in the future. I have recently published a report offering guidance to business leaders and HR Teams on how to make holistic workplace shifts, with inputs from Ecosystm Principal Advisors, Tim Sheedy and Audrey William.

Employee Experience at the Core of Customer Strategies

It has become increasingly clear that customer experience (CX) is not just about good sales skills or customer service. It is about the overall experience of the customer from start to post-purchase. Customers are focused on not just what they are buying but also on how they are treated along their entire journey. Good CX has consistently shown to help increase price premium, impulse buying, and loyalty. Consequently, one bad experience can drive a customer away forever. Customers pay for your products or services, but it is your people who can really deliver the experience.

Audrey says, “As it becomes clear that we are headed for a hybrid/blended model of work, employee experience (EX) has to be a key focus area for organisations. Organisations will have to support remote work and simultaneously evolve their physical workplaces so that employees have the choice to come into work. But business leaders and HR will definitely have to come together to re-evaluate their policies around employees and improving EX – irrespective of where they choose to work from.”

The Role of Productivity in the Digital Workplace

Productivity has been at the core of an organisation’s desire to be a digital workplace. Tim says, “A digital workplace is one that has the capability to support any employee to access the process, information or system they need on their device of choice, in their moment and location of need. In the wake of the pandemic, the digital workplace went from being a ‘good idea’ to an ‘absolute necessity’ – and the seeds were sown to build true digital workplaces, years ahead of plan.”

This is the time to retain that focus on productivity. A lot of energy is being spent in defining and measuring productivity. The focus seems to have shifted to how to get the best out of the remote/hybrid workforce. It is time for business leaders and HR to go back to the drawing board to re-define what productivity means to their organisations.

Tim says, “The focus should be on enabling productivity rather than on monitoring activity. Productivity is an outcome, not a process. So, measure the outcome, improve the process. Productivity will be driven at an organisational level through removing friction from overall operational processes, to make things more streamlined and effective to create more value.”

The True Implication of Flexibility

There has been a rapid shift in practices around working from home and flexibility. But it is time now for organisations to create a framework (policy, performance expectation and management) to manage these practices. Many companies do not really understand the implications of flexible working to their business. In fact, they may be unaware of shifts in work patterns that have taken place in the last few months and the impact these shifts are having on the business.

Framework around flexible working should be backed by data and an understanding of the feasibility of such practices. If your employee has to work on her compulsory day off, then you do not have a truly flexible work practice. This will have a negative impact on employee experience and ultimately on your business.

The Evolution of Employee Engagement

Audrey says, “One of the areas that business leaders and HR will have to bear in mind is that despite flexible working hours, employees might be overworked – it is emerging as a common problem with working from home. It is common that many employees are working longer hours.”

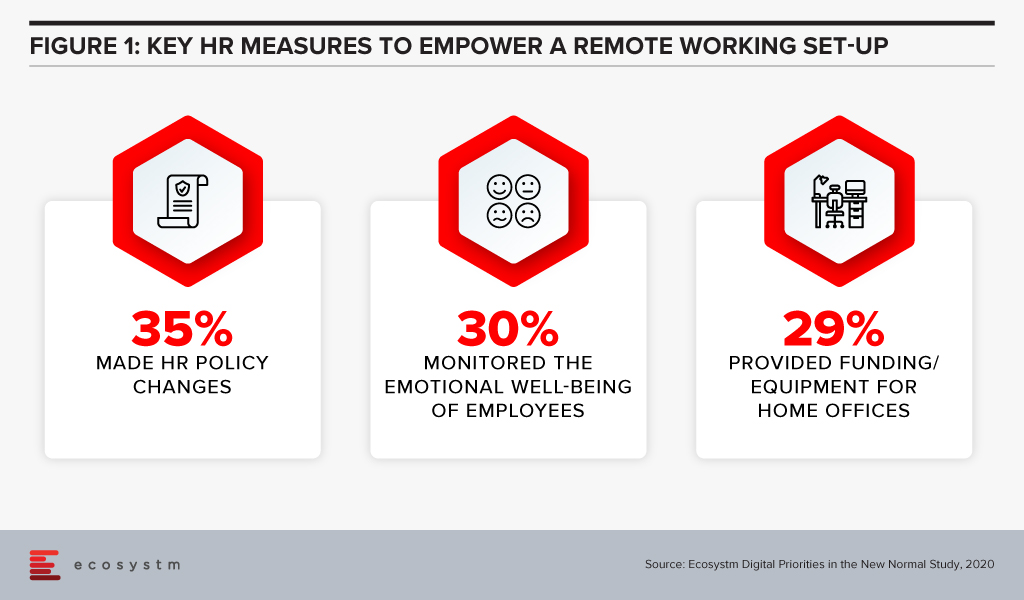

Ecosystm research finds that some organisations have been evolving their HR practices, since the start of this crisis (Figure 1).

But more needs to be done. Organisations have to work really hard to replicate their employee engagement and social hours in the virtual world. It is critical that organisations design mechanisms of keeping employees connected – to each other, as well as to the organisation. “Virtual social groups” not only provide this connection, it can also be a rich source of input for HR and wellness teams to quickly adapt their programs to meet the changing needs of employees.

Shift in Managerial Styles

Performance management has been traditionally done through annual cycles, and by monitoring and tracking. In the Future of Work, organisations will have to increasingly give their employees the choice of working from home. Meetings, check-ins, 1:1 and team huddles for close monitoring will not work in this remote/hybrid model.

It is time to stop close monitoring and really focus on outcome-based management. And this will have to start with re-skilling people managers. Training should be provided on softer skills such as emotional intelligence, being able to sense across boundaries and digital spaces, and being able to be responsive to employees’ needs. The people manager must evolve into being a coach and a mentor – internal coaching and mentoring networks will have to be established. Line managers, business leaders and HR teams will need to collaborate more to ensure that these skills are developed and that the right support system is in place.

Your CEO and Board are asking you to cut costs and do more with the IT budget.

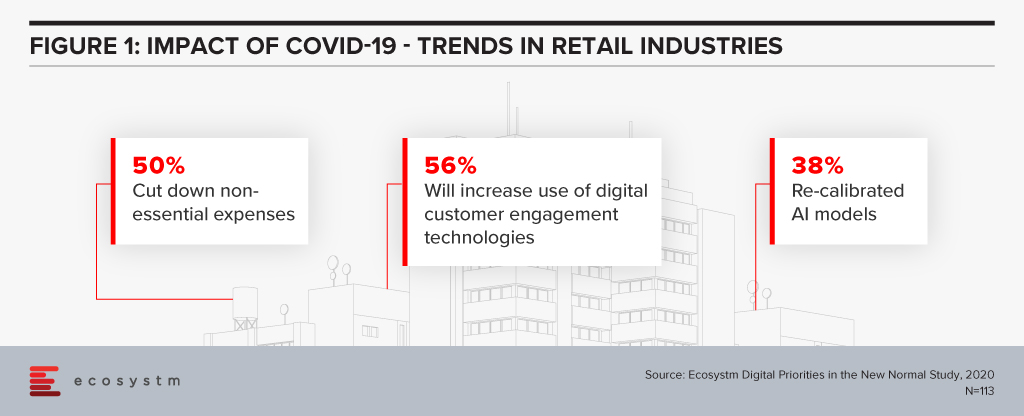

This is the usual refrain you get used to as a Chief Digital or Information Officer. COVID-19 has increased the need for cost savings, without compromising your organisation’s mission. In Ecosystm’s on-going research, Digital Priorities in the New Normal – a COVID-19 Study, there are several common themes that emerge for retailers.

The impact of the cost-cutting measures that organisations are implementing, on CDOs and CIOs has been discussed in my report Managing Costs in the New Normal, where I provide guidance on how to address the necessary cuts.

Super Retail Group (SRG) recently presented at SalesForce Live on their success in using AI to improve their customer engagement – linking digital customer engagement and re-calibration of AI models. I want to highlight a couple of aspects of SRG’s experience for those retailers addressing these themes.

Increasing Customer Engagement

In a well-run online presence, retailers acquire a significant amount of data about their customers’ online behaviour. Data such as customer’s purchase history as well as how they traverse the site, how long they remain on the site and how they leave – often without purchasing. The challenge is how you can collect and use this data to improve the customer experience (CX) and increase sales in our new normal.

SRG, trading under banners such as Super Cheap Auto, BCF and Rebel across Australasia, has adopted a Salesforce tool called Einstein to address this challenge. SRG is using this AI engine to present product recommendations in several contexts across a customer’s online journey.

The impact of COVID-19 means overall sales across the group has declined. At the same time, online sales have grown to be generating almost 20% of the overall sales. Within these online sales, the AI recommendation engine has directly influenced 1 in 5 customer purchases.

SRG has developed a significant base of customer data since they introduced omnichannel and club offers; and are now seeing the return from this investment. Recommendation engines operate best when they have quality data in volume – and the proportion of and growth in, online customers using these recommendations is a guide to the quality of the platform.

Coping with Increasing Online Demands

Ecosystm research finds that over 56% of retailers are increasing their use of digital technologies for CX and will continue to invest after the immediate crisis. As always, getting the right value from this increased expenditure will be critical to a retailer’s price competitiveness and profitability.

With online sales growing dramatically, SRG’s online share of sales has more than doubled over April and May, the potential return from an engaging online CX has increased significantly. In turn, this has increased the importance of the online CX to a retailer’s competitive positioning and market share.

Tech leaders will be expected to provide direction on how to achieve this improvement, with AI engines offering an increasingly important tool in increasing the speed of response to changing customer behaviours.

With their mapping of customer journeys, SRG has been able to target specific stages in the journey for the use of the AI recommendation engine. Their focus on increasing the size and value of a customer’s basket provides the explicit measure of success. And SRG’s customers are showing their enthusiasm for these recommendations. The share of online sales influenced by the AI engine grew by over 600% in the past 12 months.

Customer expectations are continually being redefined by their experiences across the online environment, not just by retailers. In our new normal, with online becoming significantly important, retailers need to be consistently improving their offer to remain competitive.

Our study results shows that retailers are taking this step and will need to pay careful attention to their cost base and profitability while making these changes. SRG’s success with the AI engine shows that this is possible.

Lessons to Learn

COVID-19 has changed customer behaviour significantly, and tech leaders are identifying new tools and processes to improve their CX in line with these changes. SRG has continued its customer-focused omnichannel approach by adopting the Salesforce Einstein AI engine. By using one of their key sales metrics – size and value of basket – they have been able to assess the contribution of this tool.

There are some clear lessons for other retailers from their experience:

- Be very clear on why you are introducing the new tool – how you are going to achieve value.

- Understand the foundation that you need, to introduce new technology. You will find being successful using AI without quality data in volume will be difficult.

- Experiment and learn quickly from experience gained. In this cost-constrained world, don’t over-commit to a new approach without evidence.

- Use products and services that have a low cost of entry and a variable cost model. Cloud services generally provide this cost model.

Our research, along with press release such as SRG’s, show that retail leaders are continuously improving their customer engagement. As a tech leader, you need to be aware that customers will vote with their clicks, for retailers that are delivering.

And getting those non-essential costs out has never been more critical.

The COVID-19 pandemic has presented us with a set of circumstances that we have never seen before – health, safety, and economic livelihoods are being affected. Companies are being asked to take on roles that they are not familiar with. The global situation continues to evolve rapidly, and we are all having to adapt as we go. During this time, the expectations of customers and employees are evolving in tandem. Companies should look at understanding this evolution and take fuller advantage of the opportunity this evolution will present.

CX at the Centre Stage

Customers have always been the top priority for businesses. In the last few years, we have seen the transition that organisations are making from selling to creating; evolving from selling products to solutions to experiences. This has led to reframing of the selling methodology and, consequently, the technology and people skills needed to make that happen.

While companies have been able to understand the need to make this shift intellectually, it needs to be backed by the right investments in their people and customers. However, industry estimates find that only about 10% of organisations put money where their mouth is. Those that have been able to do so, have been consistently able to meet and exceed their goals.

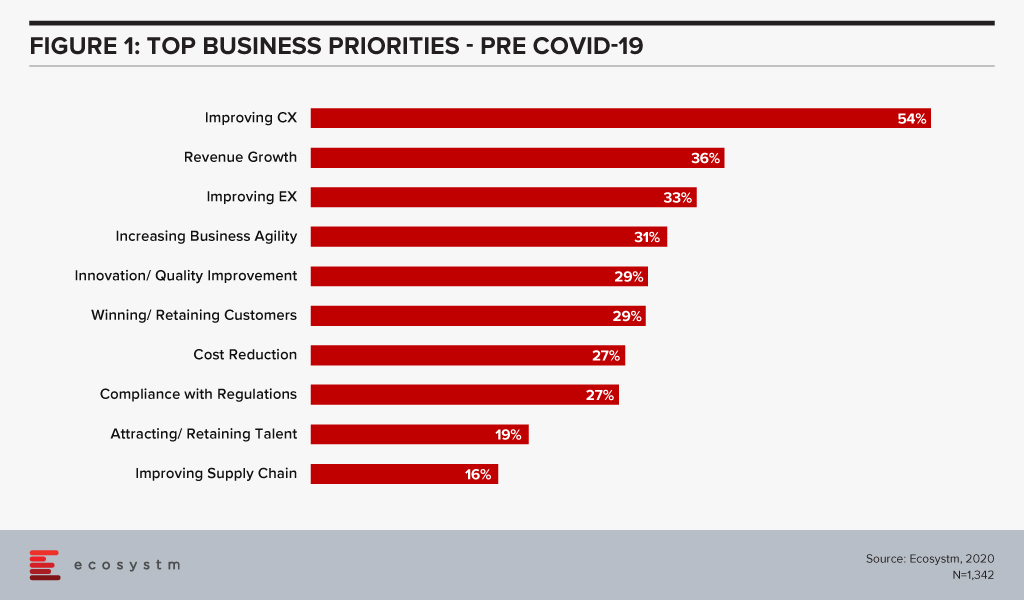

As such, investments in customer experience (CX) technology is taking centre stage. Ecosystm research finds that improving CX has been the top business priority for organisations, before COVID-19 (Figure 1).

If we take a deeper dive into CX, it becomes clear that CX is not just about good sales skills or customer service. It is about the overall experience of the customer from start to post-purchase. Customers are focussed on not just what they are buying but also on how they are treated along their entire journey. Good CX has consistently shown to help increase price premium, impulse buying and loyalty. Consequently, one bad experience can drive a customer away forever.

So, what does improving CX look like? A vast majority would think technology. That is only part of the story; the key component of making your CX strategy come to life is your people. Customers pay for your products or services, but it is your people who can really deliver the experience. Glassdoor research shows that there is a clear link between employee and customer satisfaction. On an average, a 1-point increase in company rating on Glassdoor is associated with a 1.3-point increase in customer satisfaction, measured by the American Customer Satisfaction Index (ACSI).

So, the fact that only 33% prioritise employee experience (EX) (Figure 1) shows a gap in understanding how to achieve excellent CX. In this gap lies the true opportunity of gaining sustainable competitive advantage.

Reset During COVID-19

Due to COVID-19 all of us have had to re look at who we are and how we operate. It has really changed the world of work and business, almost overnight. Companies have invested a significant amount of time on just enabling their employees to stay safe and work from home. Overnight, access to physical offices was gone and everyone was transitioned to digital workspaces.

The Ecosystm Digital Priorities in the New Normal study, that was initiated to gauge the immediate and longer term impact of the pandemic finds that during the crisis, the focus on employees increased drastically, with 75% of organisations introducing measures to manage their employees, while 30% focused more on their customers.

This is a complete reversal in the focus of the organisations. Employees have come into sharper focus. This should be good news. Yes, it is – but partly so.

Initial focus has been rightly on safety and on employees being able to work from home. This was an “adapt” mode, focussed on services like payroll, handling employee queries and onboarding without disruption. After the initial crisis-handling, organisations have been able to focus on digital learning and skills enhancement, while others have been trying to increase productivity (predominantly through giving access to collaboration tools).

The Journey Ahead

As we continue to work in the new normal, one thing comes out even stronger: the new experience needs to be seamlessly connected between all channels – and be agile and more human. It is now even more evident that organisations and people – that are its lifeblood – need to constantly adapt and pivot to meet these changing landscapes.

Customer expectations have evolved in the last few months from a cost and product view, to being loyal to companies that show more empathy and are able to solve their problems. Employee expectations have also evolved, simultaneously – and it now goes beyond a good pantry and an engaging, fun-loving environment. Employees today value connectedness, and expect the organisation to show more care (so they can do their work effectively), and create opportunities for them to grow (job security) as they continue to grapple with the situation.

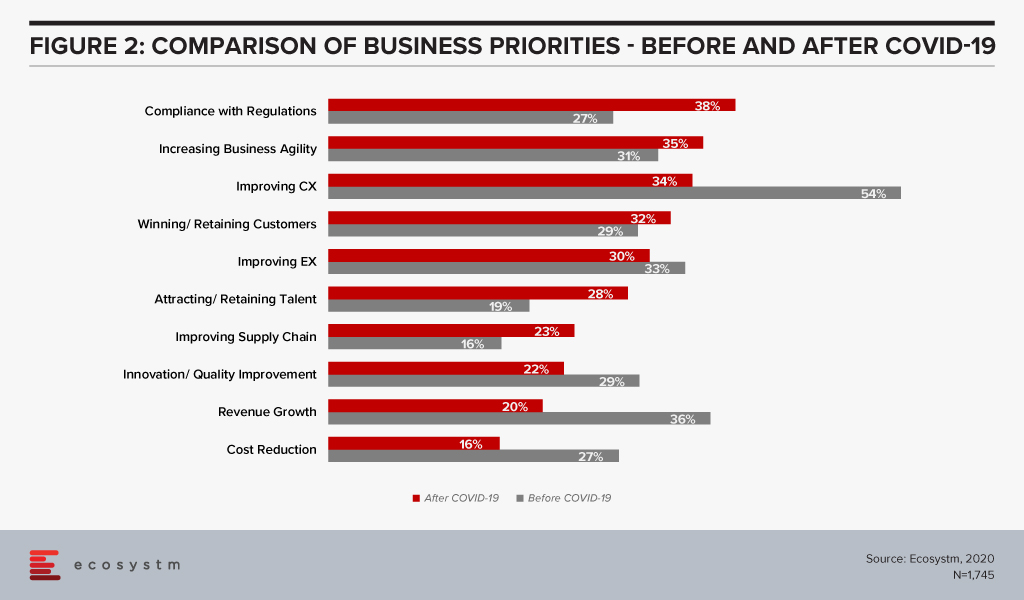

Thus, the more relevant the EX product and the faster it can adapt to the evolving situation, the better it translates into better engagement and loyalty. But what will definitely be required of organisations, is a continued focus on their employees. If we compare the business priorities before and after COVID-19, we get an indication that EX might once again be left behind in organisations’ obsession about their customers (Figure 2).

The gap is not as wide as before COVID-19 hit us – but there appears to be a shift towards a customer focus. This is evolving differently from our expectations and can potentially cause a misalignment.

Opportunity to Reshape

The reset has pushed EX and CX expectations closer to each other when it comes to designing experience with the company. The opportunity lies in taking a more holistic view of the company business – bringing HR, IT, Customer Success and Marketing teams together into agile tribes and guilds – to design a consistent CX by improving EX.

This would help to increase the speed of prototyping new experiences, and consequently drive greater visibility of what is needed – from skills to IT systems. Overall, it will drive a greater degree of connectedness between the employee and customer worlds; resulting in better engagement and loyalty.

A decade ago, the axiom of a successful business model was to identify a need, find the market and then develop an idea or product that fits into that chain. It was a process of inserting a product in the customer’s already existing experience journey with the hope that the product/idea would deliver efficiency to the client. This efficiency could be financial, operational, marketing or cost savings – the uni-product, uni-feature approach.

There has been enough said about the many companies that failed to innovate beyond their existing product/feature and failed to stay ahead of the game. Nokia and Blackberry remain at the centre of any discussion about “lack of innovation”. There are others like Kodak, Canon, Napster, Palm, Blockbuster – that were devoured by innovative competitors.

The predators were ones with the vision to see the entire value chain and not just their own product. Netflix created content and distributed it, Apple touched the lives of their customers in multiple ways and AirBnb provided accommodation inventory, choice and booking all in one. The new secret sauce is to provide the customer with an ecosystem and not a product!

The Need to Transform

Cut to the COVID era – there are many businesses facing the downturn and experiencing the “moments of truth” giving rise to a desperate attempt to innovate, transform, survive, and come out as the rising stars. Ecosystm research finds that 98% of organisations have re-evaluated their Transformation roadmap (Figure 1), while 75% have started, accelerated or refocused their DX initiatives.

New business models are evolving, and accelerating digitalisation is the result. The digital movement, be it in food delivery or payments, is here to stay. This digital acceptance and absorption exaggerate the need for business models that capture holistic ecosystems and entire customer journeys, due to reasons that separate the hunter and the hunted.

- Margins will never be the same again as in the uni-product model. Using the F&B analogy; with the increasing number of customers wanting to dine in the comfort of their homes, restaurants cannot use ambiance as the price differentiator. Since most restaurants are available on food delivery services, customers are getting brand agnostic. This is the start of commoditisation of dining. Restaurants (or food caterers now!) will need to play the price card to remain competitive resulting in compressed margins. The food delivery market is expected to grow 4-fold to USD 8 billion by 2025 but with lower margins. This example of the food delivery model will be the same as experienced by retail, apparel and other industries.

- Customer experience will still be the differentiator and lever for loyalty and repeat purchase. Factors like proximity, parking, in-store experience, and store layout are fast getting replaced by the ease of navigation, user experience, seamless check out and finally efficient and timely delivery. The ease of transaction including multiple steps of search, assessment, evaluation, payment and delivery is of paramount importance. Customers do not want fractured journeys with multiple drop-offs. A unified seamless journey will win.

- Virtual, Digital and Automation are the three mantras that management consultants are betting on. However, this trilogy will not guarantee survival since the road to recovery is not a straight one. Different work schedules, observing various curves and on what point of the curve the business, its customer and the market are at, will add to the complexity of decision making and transformation.

Given the above, an obvious strategy to beat the existential crisis is to transform and seek out sustainable operating models. However, it may not be so simple since most businesses may not be able to change models as quickly as needed. There is an inherent cost to change since the existing processes and procedures have been well oiled and smoothed over time. The much-needed change requires the infusion of the 3Ts (time, technology, training) and associated costs. Most often, there is an inverse correlation noticed between the sturdiness of the business and its ability to be flexible to change. Businesses that are “rock-solid” and profitably sturdy and stable, have high inertia of transformation versus FinTech businesses, as an example, that pride themselves with nimble operations but are financially fragile and may not be able to absorb the cost of speedy transformation.

This Sturdy-Flexible continuum is the tight rope walk that businesses will need to walk in this need for transformation. Businesses that embark on this walk alone will find it extremely painful and lonely. Especially in the case of small business owners who are scared and low on all 3Ts.

The Rise of Ecosystems

The new world has manifested that businesses that use physical space or assets as their competitive advantage are more prone to be impacted. Retail, Education, Hospitality and Entertainment are some obvious examples that have been impacted by the physicality in their propositions. Digital businesses are more agile but have suffered in their inability to scale up in time to capture the increased demand.

Fashion retailer FJ Benjamin has decided to shut 300 physical stores and rely on online sales. This strategy also helps to utilise precious time to scale diversification. Other retailers too have been going down the FJ Benjamin path and ramping up eCommerce as this trend is expected to stick beyond COVID-19.

Zouk, the renowned nightclub with 30,000 square feet of space in Singapore uses this venue as a live streaming venue during the day to host bazaars for eCommerce vendors. From June 2020, it launched an online shop selling merchandise, bottled cocktails and food from its RedTail kitchen.

Transformation of businesses will require capabilities that were not created within their models. The instinct to survive in the short term will require businesses to create symbiotic partnerships. This will require some fresh thinking by business leaders.

- Change the “Build” obsession and not try to own every leg of the customer journey. That will not only take time but also distract capital and management.

- Rethink the customer needs – and this time think of the entire journey rather than an inward view of product-market fits. Customer needs are changing at breakneck speeds, so chasing and “building” these “fits” will always remain a common string amongst laggards.

- Connect with like-minded ecosystem players and complement strengths with a single-minded focus on solving customer problems.

- View technology stacks through the lens of your partners. There may be opportunities available from near open source technology solutions.

For example, FJ Benjamin will need the last-mile-delivery capability that will be provided by partners who have optimised in that field, Zouk has tied up with Lazada to host the bazaars and GrabFood is using underutilised taxi capacity to meet the increased demand for food delivery. There are many other examples in the O2O (Offline to Online) space.

This ecosystem approach is also relevant to other sectors like Financial Services. These firms also need to understand the changing consumer needs faster, with a mantra to deliver. Aspire, originally an alternate lending platform has gone through a metamorphosis and transformed into a Neobank. From a uni-product loan provider, it is now solving for a business account, card solution, integration with expense management solutions and continue to provide loans. Capabilities not necessarily built in-house.

The changing world will give rise to business models that will integrate and complement each other. Businesses with an ecosystem mindset will be winners while others might just be relegated to oblivion.

Probe Group, a Business Process Outsourcing (BPO) solutions provider and Stellar – a customer experience (CX) management organisation announced a merger to create Australia’s largest and most diverse CX provider group. The partnership will combine the experience and expertise of both companies and will employ 12,600 people to provide outsourcing of business process services for customers across six countries. Probe Group is backed by Quadrant Private Equity and Five V Capital.

Probe Group has been expanding its business presence since being acquired by Five V Capital in early 2018. At the time, Probe acquired Salmat’s Contact business, a broad-based CX operation which helped Probe expand their presence in Australia, New Zealand and the Philippines. Looking out for further opportunities, in December last year Probe Group acquired Australia-based and Philippines-focused Beepo and quickly followed this with an acquisition in January this year of the Philippines outsourcing agency MicroSourcing, a counterpart to Beepo which greatly expanded Probe’s Philippines offering. These acquisitions helped Probe extend their service offering from CX into Shared Services and Knowledge Services.

This is a brilliant move as Stellar is one of the most successful contact centre outsourcing providers in Australia. With successive growth for 22 years and having a strong footprint in both the public and private sectors, the acquisition will give Probe Group entry into some large accounts. Additionally, Probe will gain a large pool of well-trained agents in Australia and other locations across the globe.

The merger comes at an interesting time when we are seeing several organisations re-evaluate their outsourcing strategy. There is also an active interest in enhancing CX through AI/automation. Both the Probe Group and Stellar understand the Australian market and consumer sentiments and the merger is expected to drive better customer outcomes in the Australia market.

Prior to COVID-19, Probe Group employed 8,500 agents. With this acquisition, they will have 12,600 agents and an expected turnover of USD 420 million. That is not only impressive but will help Probe offer a variety of services including both onshore and offshore, to take on their rivals.

Rise of Onshore Activity will see New Shifts in CX Delivery Models

The COVID-19 pandemic has brought about several changes to the outsourcing sector. The disruption caused by services in many key offshore markets led to organisations re-evaluating their contact centre outsourcing strategy and some have started moving contact centre jobs back to Australia. Westpac is the latest organisation to announce that they are moving 1,000 jobs back to Australia. They have stated that while they expect productivity benefits over time, there is clearly a cost to adding 1,000 roles – likely an uplift of around $45 million per annum in its costs by the end of 2021.

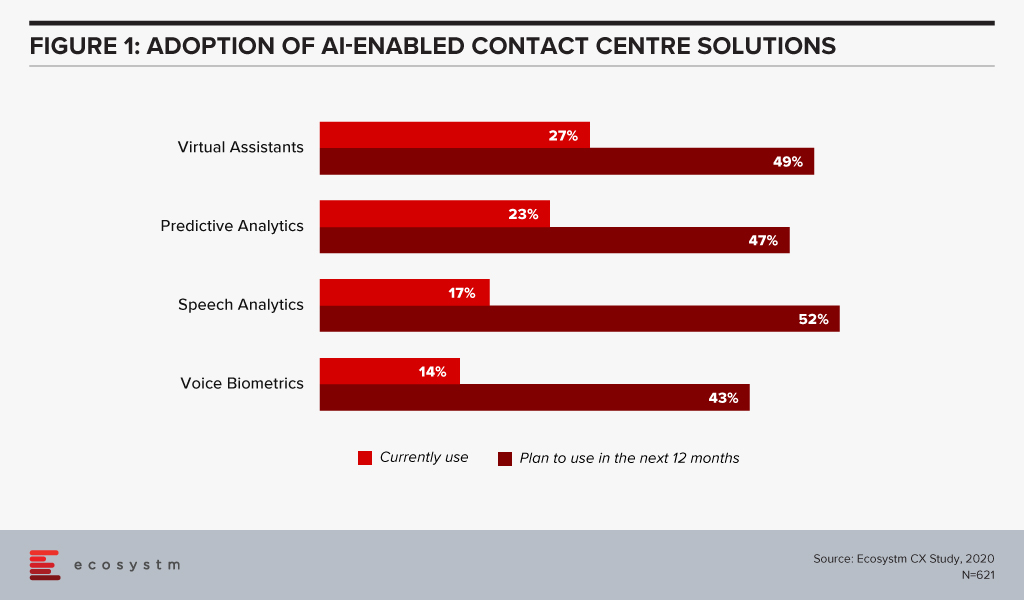

The cost element is bound to creep in over time and contact centres will ask outsourcing providers to help drive costs down. Options would include moving some services offshore, while the critical remain onshore. Striking that balance to manage costs will be important and so will be the ability to offer various options for customers. Additionally, we can expect to see an increased demand for self-service technologies. Many organisations are in the midst of re-evaluating the use of AI and automation technologies not only as a way to drive great CX but as a way to also reduce costs (Figure 1).

Contact centres are starting to realise that to modernise their contact centre, the ability to lead with machine learning and AI technologies are critical. It will drive the deployment of natural language understanding (NLU) and conversational AI, sentiment analysis, transcription capabilities – and ultimately provide intelligence about the call even prior to the call being fielded. However, it is worth noting that whilst automation is on the rise, the role of the agent is not going away anytime soon and will grow in importance. We will see the rise of the “super-agent’’ and the agent’s role will evolve over time and AI/automation will generate rich insights to help aid the agent and the contact centre team to better predict customer behaviour and patterns.

The Next Generation of Outsourcing Providers must Drive Innovation for their Customers

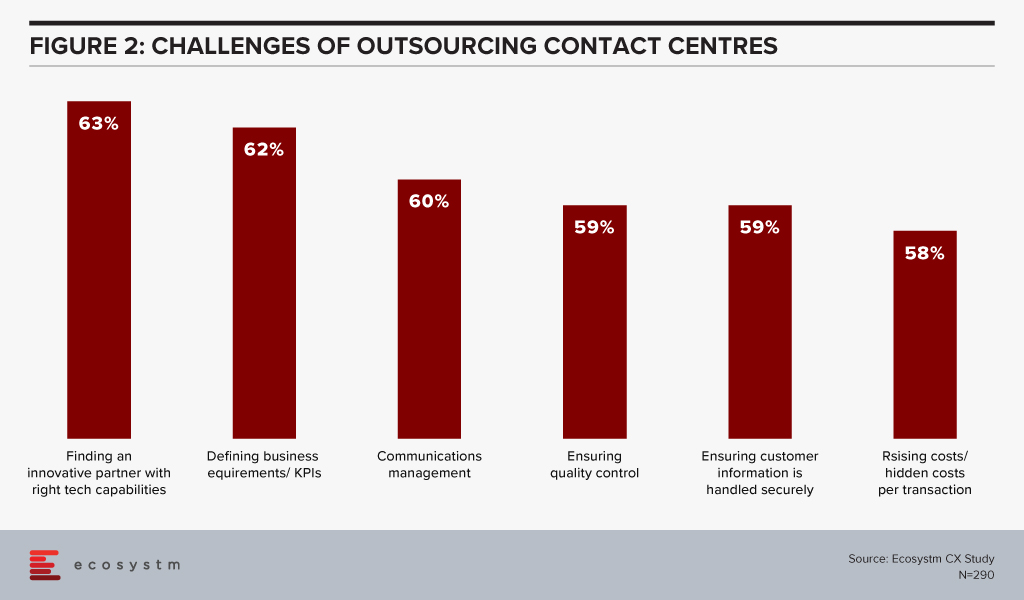

Companies today are not outsourcing just to save labour costs. While cost remains an important angle, it will not often be the main driver for outsourcing in the future. The next generation of outsourcing providers will have to build rich solution capabilities, customer journey maps and help customers understand how to align all channels. This involves working with many different technology providers to build the right capabilities for their client organisations. Organisations are keen to modernise their contact centre operations to achieve excellence in CX. Outsourcing providers must have the capability to deliver that innovation.

Ecosystm research finds that 63% of organisations that outsource their contact centre functions are challenged with finding the right partner that can drive innovations (Figure 2).

Contact centre outsourcing providers have a role to play in some of the following areas:

- The ability to adapt to change and take on risks together with the client

- Ensuring that all forms of security and governance measures are in place. This includes considering factors such as data security, data handling, and security features enabled across devices, applications, and the network. This is especially true for Government and Financial services contracts. Additionally, with some organisations preferring the work from a home model, there are security issues that must be addressed for the scenario.

- Helping the move from a traditional contact centre to a contact centre that delivers the highest levels of CX for its customers. Applying technologies such as AI and machine learning, NLU, biometrics, speech analytics, customer journey analytics and robotic process automation (RPA) will be key to modernisation.

- Being able to build a business continuity plan (BCP) for their customers in the event of another crisis.

Ecosystm Comment

Probe Group started off as a business specialising in outsourcing services in the credit and collections segment. Their customers in 2016 ranged from organisations across Financial Services, Utilities, and Federal and State Government. At that time, Probe employed about 300 people and their turnover was about USD 25 million. They did not rest on their laurels and realised that organic growth combined with strategic acquisitions would give them a foothold across various geographies and add new capabilities to their portfolio. With the rise in onshore activity, they will now be in a strong position to offer their customers various services and models of engagement to help drive CX excellence. The acquisition of Stellar will help Probe Group propel to greater heights and we see a new CX outsourcing giant being born.

2020 has seen extreme disruption – and fast. The socio-economic impact will probably outlast the pandemic, but several industries have had to transform themselves to survive during these past months and to walk the path to recovery.

Against this backdrop, the Retail industry has been impacted early due to supply chain disruptions, measures such as lockdowns and social distancing, demand spikes in certain products (and diminished demands in others) and falling margins. Moreover, it is facing changed consumer buying behaviour. In the short-term consumers are focusing on essential retail and conservation of cash. The impact does not end there – in the medium and long term, the industry will face consumers who have acquired digital habits including buying directly from home through eCommerce platforms. They will expect a degree of digitalisation from retailers that the industry is not ready to provide at the moment. This raises the question on how they should transform to adapt to the New Normal and what could be a potential game-changer for them.

Translating Business Needs into Technology Capabilities

In his report, The Path to Retail’s New Normal, Ecosystm Principal Advisor, Kaushik Ghatak says, “Satisfying their old consumers, now set in their new ways, should be the ‘mantra’ for the retailers in order to survive in the New Normal.” To be able to do so they have to evaluate what their new business requirements are and translate them into technological requirements. Though it may sound simple, it may prove to be harder than usual to identify their evolving business requirements. This is especially difficult because even before the pandemic, the Retail industry was challenged with consumers who are becoming increasingly demanding, providing enhanced customer experience (CX), offering more choices and lowering prices. The market was already extremely competitive with large retailers fighting for market consolidation and smaller and more nimble retailers trying to carve out their niche.

In the New Normal, retailers will struggle to retain and grow their customer base. They will also have to focus aggressively on cost containment. A robust risk management process will become the new reality. But above all else, they will have to innovate – in their product range as well as in their processes. These are all areas where technology can help them. This can come in the form of technology partnerships, adopting hybrid models, increased usage of technology across all channels and investing in reskilling or upskilling the technology capabilities of employees.

Re-evaluating the Supply Chain

One of the first business operation to get disrupted by the current crisis was the supply chain. Ecosystm Principal Advisor, Alea Fairchild says, “Retailers are finding themselves at the front-end of the broken supply chain in the current situation and there is an enormous gap between suppliers and buyers. Retailers will have to aim to combine inventory with local sourcing and become agile and adopt change quickly. This will highlight to them the importance of transparency of information, traceability, and information flow of goods.”

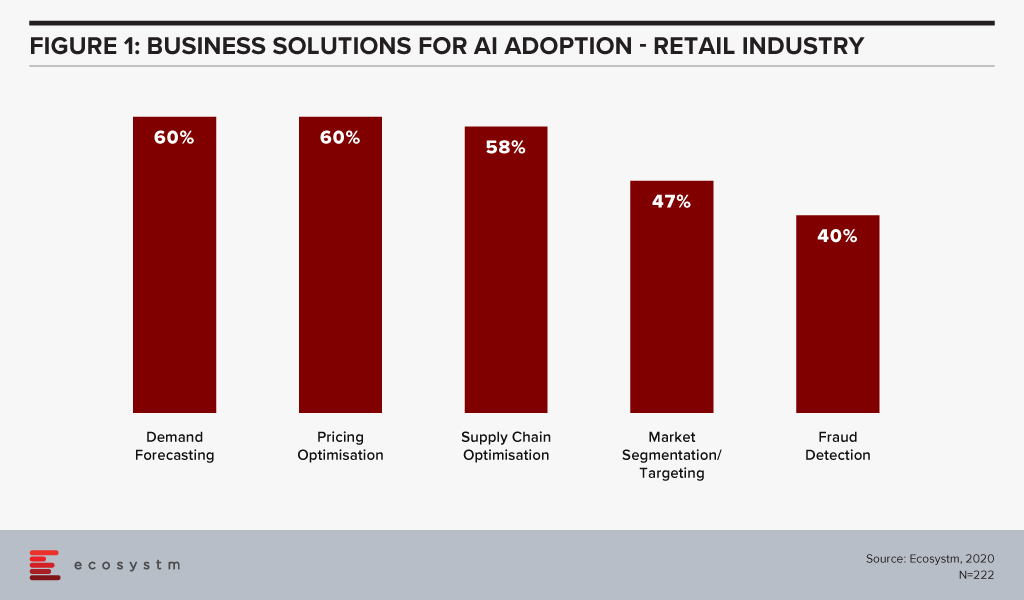

Ecosystm research shows that supply chain optimisation and demand forecasting among the top 5 business solutions that firms in Retail consider using AI for (Figure 1).

“In the New Normal, consumers are going to demand the same level of perfection that they have received and at the same cost. In order to make that possible, at the right time and at a lower cost, automation has to be implemented to improve the supply chain process, fulfill expectations and enhance visibility,” says Ghatak. “Providing differentiated CX is intimately dependent upon an aligned, flexible and efficient supply chain. Retailers will not only need to innovate at the store (physical or online) level and offer more innovative products – they will also need to have a high level of innovation in their supply chain processes.”

Digital Transformation in the Retail Industry

Ecosystm research reveals that only about 34% of global retailers had considered themselves to be digital-ready to face the challenges of the New Normal, before the pandemic. The vast majority of them admit that they still have a long way to go.

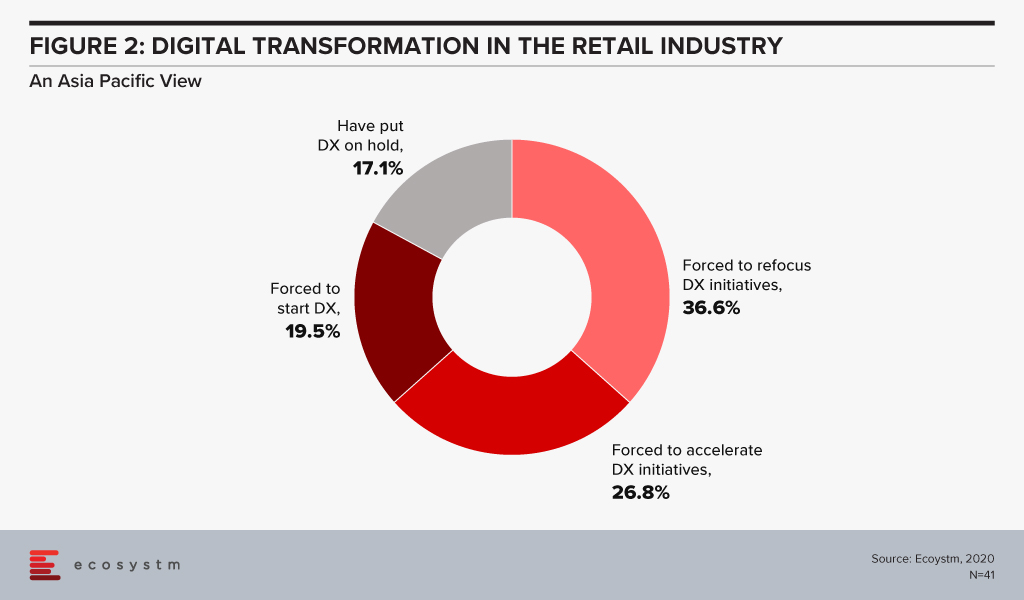

With COVID-19, the timeframes for digitalisation have imploded for most retailers. The study to evaluate the Digital Priorities in the New Normal reveals that in Asia Pacific nearly 83% of retailers have been forced to start, accelerate or refocus their Digital Transformation (DX) initiatives (Figure 2).

So, what technology areas will Retail see increased adoption oF?

Fairchild sees retailers adopt IoT, mobility, AI and solutions that deliver personalised experiences such as push notifications. What they are likely to do is blend different aspects of their physical and virtual environment to create a solution for customers. “To address in-store processing, hygiene, safety standards and compliance requirements, retailers will change their processes through a combination of resources, KPIs, automation, task management software and switching the information flow.”

Ghatak thinks automation has a significant role to play in improving both CX and the supply chain. “This is also an opportunity for retailers – both online and in-store – to create a solution experience where technologies such as Augment/Virtual Reality (AR/VR) can help. While retailers are adopting these technologies, with 5G rollouts, there is potential that the adoption will implode in a short time-frame.”

Those retailers that are not re-evaluating their business models and technology investments now will find themselves unprepared to handle the customer expectations when the global economy opens up.