In the midst of the current global crisis, the Utilities industry has had to continue to provide essential public services – through supply chain disruption, reduction of demand in the commercial sector, demand spikes in the consumer sector, change in peak profiles, remote staff management, cyber-attacks and so on. Robust business continuity planning and technology adoption are key to the continued success of Utilities companies. The Ecosystm Business Pulse Study which aims to find how organisations are adapting to the New Normal finds that 6 out of 10 Utilities companies are accelerating or refocusing the Digital Transformation initiatives after the COVID-19 outbreak, underpinning the industry’s need for technology adoption to remain competitive.

Drivers of Transformation in the Utilities Industry

The Evolving Energy Industry. As consumers become more energy-conscious, many are making changes in their usage pattern to stay off the grid as much as possible, potentially reducing the customer base of Utilities companies. This increases their reliance on renewable energy sources (such as solar panels and wind turbines) and batteries, forcing Power companies to diversify and leverage other energy sources such as biomass, hydropower, solar, wind, and geothermal. The challenge is further heightened by the fast depletion of fossil fuels – it is estimated that the world will have run out of fossil fuels in 60 years. The industry is also mandated by government regulations and cleaner energy pacts that focus on climate change and carbon emission – there are strict mandates around how Utilities companies produce, deliver and consume energy.

Business Continuity & Disaster Management. Perhaps no other industry is as vulnerable to natural disasters as Utilities. One of the reasons why the industry has been better prepared to handle the current crisis is because their usual business requires them to have a strong focus on business continuity through natural disasters. This includes having real-time resource management systems and processes to evaluate the requirement of resources, as well as a plan for resource-sharing. There is also the danger of cyber-attacks which has been compounded recently by employees who have access to critical systems such as production and grid networks, working from home. The industry needs to focus on a multi-layered security approach, securing connections, proactively detecting threats and anomalies, and having a clearly-defined incident response process.

The Need to Upgrade Infrastructure. This has been an ongoing challenge for the industry – deciding when to upgrade ageing infrastructure to make production more efficient and to reduce the burden of ongoing maintenance costs. The industry has been one of the early adopters of IoT in its Smart Grid and Smart Meter adoption. With the availability of technology and advanced engineering products, the industry also views upgrading the infrastructure as a means to mitigate some of its other challenges such as the need to provide better customer service and business continuity planning. For example, distributed energy generation systems using ‘micro grids’ have the potential to reduce the impact of storms and other natural disasters – they can also improve efficiency and quality of service because the distance electricity travels is reduced, reducing the loss of resources.

The Evolving Consumer Profile. As the market evolves and the number of Energy retailers increases, the industry has had to focus more on their consumers. Consumers have become more demanding in the service that they expect from their Utilities provider. They are increasingly focused on energy efficiency and reduction of energy consumption. They also expect more transparency in the service they get – be it in the bills they receive or the information they need on outages and disruptions. The industry has traditionally been focused on maintaining supply, but now there is a need to evaluate their consumer base, to evolve their offerings and even personalise them to suit consumer needs.

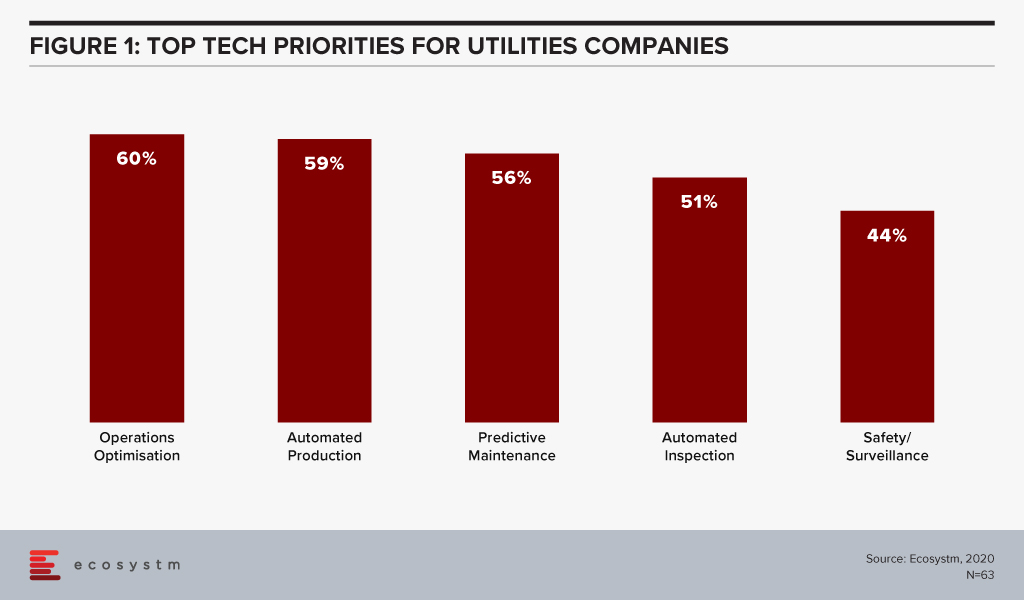

The global Ecosystm AI study reveals the top priorities for Utilities companies, that are focused on adopting emerging technologies (Figure 1). It is noticeably clear that the key areas of focus are cost optimisation (including automating production processes), infrastructure management and disaster management (including prevention).

Technology as an Enabler of Utilities Sector transformation

Utilities companies have been leveraging technology and adopting new business models for cost optimisation, employee management and improved customer experience. Here are some instances of how technology is transforming the industry:

Interconnected Systems and Operations using IoT

Utilities providers have realised that an intelligent, interconnected system can deliver both efficiency and customer-centricity. As mentioned earlier, the industry has been one of the early adopters of IoT both for better distribution management (Smart Grids) and for consumer services (Smart Meters). This has also given the organisations access to enormous data on consumer and usage patterns that can be used to make resource allocation more efficient.

For instance, the US Government’s Smart Grid Investment Grant (SGIG) program aims to modernise legacy systems through the installation of advanced meters supporting two-way communication, identification of demand through smart appliances and equipment in homes and factories, and exchange of energy usage information through smart communication systems.

IoT is also being used for predictive maintenance and in enhancing employee safety. Smart sensors can monitor parameters such as vibrations, temperature and moisture, and detect abnormal behaviours in equipment – helping field workers to make maintenance decisions in real-time, enhancing their safety.

GIS is being used to get spatial data and map project distribution plans for water, sewage, and electricity. For instance, India’s Restructured Accelerated Power Development & Reforms Program (R-APDRP) government project involves mapping of project areas through GIS for identification of energy distribution assets including transformers and feeders with actual locations of high tension and low tension wires to provide data and maintain energy distribution over a geographical region. R-APDRP is also focused on reducing power loss.

Transparency and Efficiency using Blockchain

Blockchain-based systems are helping the Utilities industry in centralising consumer data, enabling information sharing across key departments and offering more transparent services to consumers.

Energy and Utilities companies are also using the technology to redistribute power from a central location and form smart contracts on Blockchain for decisions and data storage. This is opening opportunities for the industry to trade on energy, and create contracts based on their demand and supply. US-based Brooklyn Microgrid, for example, is a local energy marketplace in New York City based on Blockchain for solar panel owners to trade excess energy generated to commercial and domestic consumers. In an initiative launched by Singapore’s leading Power company, SP Group, companies can purchase Renewable Energy Certificates (RECs) through a Blockchain-powered trading platform, from renewable producers in a transparent, centralised and inexpensive way.

Blockchain is also being used to give consumers the transparency they demand. Spanish renewable energy firm Acciona Energía allows its consumers to track the origin of electricity from its wind and solar farms in real-time providing full transparency to certify renewable energy origin.

Intelligence in Products and Services using AI

Utilities companies are using AI & Automation to both transform customer experience and automate backend processes. Smart Meters, in itself, generate a lot of data which can be used for intelligence based on demographics, usage patterns, demand and supply. This is used for load forecasting and balancing supply and demand for yield optimisation. It is also being leveraged for targeted marketing including personalised messages on Smart Energy usage.

Researchers in Germany have developed a machine learning program called EWeLiNE which is helping grid operators with a program that can calculate renewable energy generation over 48 hours from the data taken from solar panels and wind turbines, through an early warning system.

Niche providers of Smart Energy products have been working with providing energy intelligence to consumers. UK start-up Verv, as an example, uses an AI-based assistant to guide consumers on energy management by tracing the energy usage data from appliances through meters and assisting in reducing costs. Increasingly, Utilities companies will partner with such niche providers to offer similar services to their customers.

Utilities companies have started using chatbots and conversational AI to improve customer experience. For instance, Exelon in the US is using a chatbot to answer common customer queries on power outages and billing.

While the predominant technology focus of Utilities companies is still on cost optimisation, infrastructure management and disaster management, the industry is fast realising the power of having an interconnected system that can transform the entire value chain.

COVID-19 is accelerating digital transformation activities across industries. Remote working is now standard practice and digital engagement is replacing face-to-face interaction. Cloud technology has become essential rather than an option, and rollouts of new technologies such as augmented reality (AR) and intelligent automation are being expedited.

One of the industries that offer great potential for technology-driven transformation is the property sector.

Many activities within the property ecosystem have remained unchanged for decades. There are several opportunities for digital engagement and automation in this sector, ranging from the use of robots in construction to the ‘uberisation’ of the residential property customer journey.

The processes associated with buying or renting property remain cumbersome and complex for customers. Indeed, customers engage with many different organisations throughout their residential property lifecycles. When compared to some other industries, the customer experience can be poor. Components of the journey – such as property search – offer some great experiences but other parts such as exchanging contracts can rarely be described as positive customer experiences.

Although AR and virtual reality (VR) technologies can facilitate property inspection, most inspections are still undertaken on-premise, together with a real estate agent. Contract exchanges often involve interactions with legal professionals in-person. Securing a mortgage or a rental agreement also typically requires face-to-face interaction. Deposits commonly necessitate the physical presentation of a cheque.

The Uberisation of the Property Sector

So, in the residential sector, there are clear opportunities for start-ups and property search platforms to offer greatly enhanced customer experiences. The COVID-19 crisis will speed up the rate at which digital technologies are used to automate activities throughout the residential property customer journey and to engage customers digitally.

Property search platforms such as Singapore-based PropertyGuru, have been creating innovative ways of engaging customers and extending their range of services, for many years. For PropertyGuru, its news features, mortgage calculator, and ability to search for investment properties overseas, have enabled it to offer customers more value from its platform. Its PropertyGuru Lens feature uses AR and artificial intelligence (AI) to give customers a more immersive and improved experience. In common with other real estate platforms, it offers AR and VR tools for inspections.

Today’s crisis creates opportunities for platforms such as ProperyGuru to engage customers throughout their journey. It can potentially transform the residential property business, by becoming an Uber-style platform for agents, movers, shippers, storage companies, interior designers, renovation firms and all other stakeholders within the residential property ecosystem. Subject to regulation, it could also act as a mortgage broker and an agency for the exchange of contracts. In other words, it could ‘own’ the customer journey and act as a platform for all services associated with residential property. From the customer perspective, such a platform would be a welcome way of enhancing the experience associated with buying, renting, maintaining, improving, managing, and selling residential property.

IoT and the Commercial Property Sector

From a commercial property perspective, the COVID-19 crisis can also be expected to accelerate the digitalisation of many activities associated with the construction, maintenance, and management of buildings.

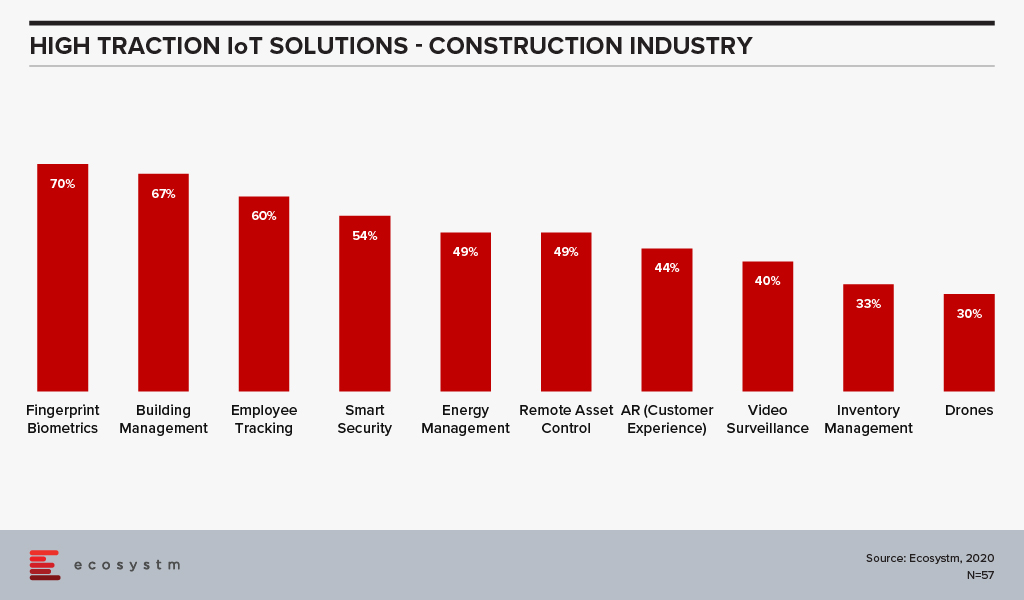

According to the findings of the Ecosystm IoT Study, the Construction industry is evaluating several technology solutions that are expected to benefit the industry (Figure 1).

While the industry views these solutions as beneficial, the adoption has so far been low. This will change. Drones have been used to inspect the outside of tall buildings for several years, but this is not yet standard practice. Structural inspections and maintenance of buildings will be automated at a much faster rate post COVID-19. IoT technology will be used for building management. Using IoT technology for the predictive maintenance and management of lighting, climate control, elevators, security, windows and doors will become standard as firms seek to reduce human interactions. Technology that measures footfall, manages safe distancing, takes peoples’ temperatures and identifies those who enter and leave buildings will be introduced, as organisations guard against disease clusters developing within or around their premises.

In essence, the COVID-19 crisis will act as a catalyst for the digital transformation of the property sector. There is a huge opportunity to create new business models not least by offering customers a digital platform on which all of their property-related needs can be addressed. For the commercial property sector, a similar platform can be offered. Additionally, many core activities ranging from construction to building management will be automated, fully leveraging robot, AI and IoT technologies.

Organisations across all industries must leverage technology to transform and be part of the digital economy. This has significantly accelerated in the last couple of months as they are forced to transform to survive in these difficult times. Digital Transformation (DX) is no longer a hype, but organisations will continue to struggle to align their transformation priorities to deliver real business impact. From experience, the needs of the Sales & Marketing teams are often lost in the midst of competing for organisational priorities with process optimisation emerging as the first choice.

Why is it necessary for Sales & Marketing to transform?

Organisations’ Business Priorities

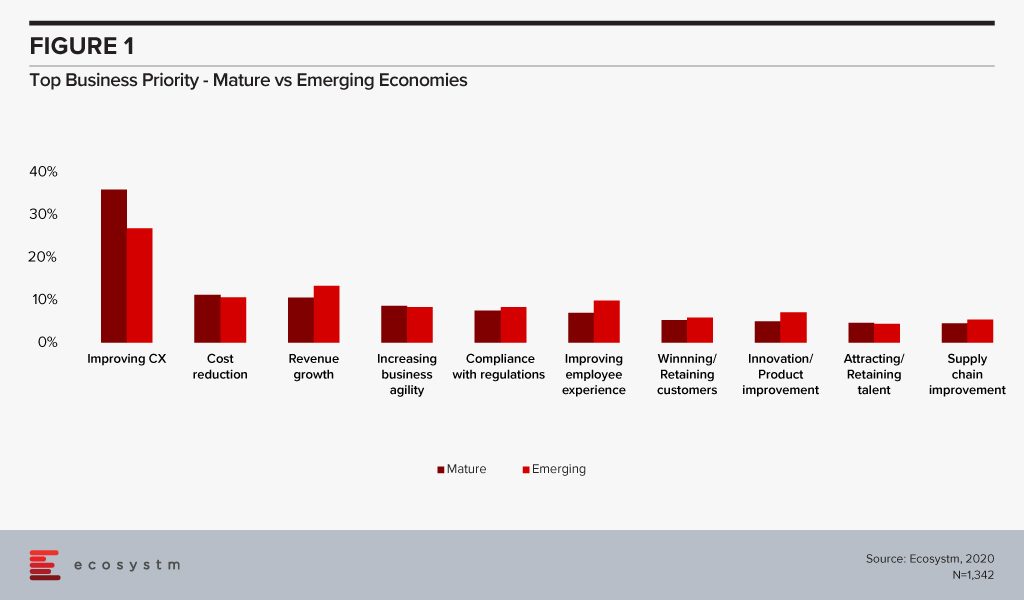

The primary reason is that organisations are responding to market pressure and putting customer experience (CX) ahead of even revenue growth as their key business priority (Figure 1).

It stands to reason that if organisations have the improvement of CX and revenue growth as their top priorities, they should involve functions that have higher customer interactions in their DX initiatives. Unfortunately, this is not often the case, even though organisations are inherently aware that their customer base is evolving. Sales & Marketing is all about meeting customer needs, solving their problems and giving them a great experience. In today’s competitive world, an organisation will fail without a customer focus.

The Evolving Consumer

Customers are challenging organisations to change the way they deliver a great experience. Take the growth of smartphone use as an example. Almost any activity will have some element of the smartphone being involved – researching a product, using an app, looking at information posted on a social media platform, engaging with friends to get opinions. This is driving organisations to respond with a ‘Mobile First’ policy and a digital nimbleness which they must equip their Sales & Marketing teams to handle.

Social and digital platforms are also forcing marketers to evolve the way they grab their customers’ attention. Customer service has tremendously benefited from the drive to go digital. It can impact every Sales & Marketing operation, beginning from first consumer touchpoint, all the way through the customer journey, post-purchase engagement and even in predicting issues to prevent them. This requires a huge degree of automation in the Sales & Marketing processes.

Emerging Ecosystems

As the digital world becomes a reality for consumers, the traditional supplier-vendor-channel model might soon become redundant. This is the age of ‘influencers’ – bloggers, customers, vendors, and paid endorsements – and an ever-evolving ecosystem. Engagement with the digital community can be a game-changer for many organisations. Such strong digital community ecosystems are hard to include in the traditional marketing model.

What should Sales & Marketing do to transform successfully?

Ecosystm Principal Advisor, Niloy Mukherjee, has some real-world advice for organisations that are looking to transform their Sales & Marketing practices.

Align with your Basic Strategy

Evaluate your key business goals and work out the changes that are required to achieve those. These changes might be so small and incremental that it may not even appear to be a ‘transformation’. Keeping an eye on the goals, will ensure that you do not invest in areas that do not necessarily need changing. It will also ensure that you simply do not replace an existing process with a new one, without first working out how that change will impact your organisation.

Think beyond features – to the Benefits

Technology investments often end up being the shiny new toy. Decision-makers in organisations may get attracted to snazzy devices and application features – and lose sight of evaluating the true benefits of the technology. For instance, the sales rep selling in-store would have a very good idea of what sells and how much stock to carry. There may be no incremental benefit in equipping the rep with an app that provides real-time sales analytics and inventory data. So, the app gets relegated to being just a feature with no real benefits. On the other hand, a field sales rep might find it extremely useful, especially in sectors that are prone to unpredictable spikes in demand.

Be ready to Invest in the change

You have evaluated the changes that your organisation needs, you have identified the technologies that can truly benefit your organisation – you must be ready to invest in that change. This is not only about financial investments – you have to invest time and in people. This requires your organisation to think of the RoI, again not only in terms of finances but also in terms of effort. Be aware that your biggest challenge in implementing the required change might be people – so invest in making them less resistant and more welcoming of the change.

There will be distractions galore in your transformation journey – emerging tech areas, solutions that seem to be working for your competitors and so on. Mukherjee proposes a simple thumb rule, “If it fits the strategy and looks feasible go with it; if it is outside the agreed strategy then think long and hard, and then turn it down – or change the strategy!”

Click here to download the full report ?

Scenario one: I have two friends in their late 50s, home on quarantine in the UK. As they need exercise, it is a wonderful time for them to update their old Nordic cross-track system. They eyeballed the website, thought it was the same footprint and weight as the existing one that was upstairs in their home and placed the order.

The delivery man left the 100kg+ package next to their doorstep doing social distancing properly. Not only is it not portable but had to be constructed piece by piece in their living room as they could not carry the bigger parts up the stairs.

Scenario two: Friends who are seasoned travelers with wandering feet want to go travelling once quarantine is over. They want to go to a resort in Cabo San Lucas, but they cannot find a good travelogue of experiences and dining options at the resort other than Yelp or TripAdvisor with very two-dimensional reviews.

As you can see from the recent article in The Times, a number of people are taking this time to plan where they want to go.

These are two examples of why now is the time for implementing a mobile AR app solution.

Invest Now in AR

At this moment you have a captive audience with more time on their hands than normal, and eager to consume. And many are building home offices or making medium-term travel plans and need more than what a flat website experience offers them.

So now is the time for investment in augmented reality mobile apps. How many firms are seeing this and what has been their experience?

Based on the tech buyer feedback from the ongoing global Ecosystm Mobility Study:

- Only about 1% of organisations have a mobile AR app, with another 5% evaluating it in 2020

- Average current implementations tend to look at a CapEx spend of about 45% – however, those who are planning to implement a mobile AR app expect to pay about 53% CapEx

- 7 out of 10 organisations say that implementation cost was less than US$10,000

- 8 out of 10 organisations say the implementation took more than 3 months (with 4 out of 10 saying it took 6 months to a year)

Extending to digital experience

Traditional print publications already understand the need to extend the digital experience for readers. The New York Times has been rethinking how it can connect the print and digital reading experiences. In partnership with Google Lens, smartphone users can access additional information online that corresponds to the print version of their New York Times Magazine. In the next three months, all New York Times Magazines will have some features that are Google Lens-enabled.

It is a great moment for both product and experiential marketers to be taking advantage of time at home by using an augmented reality mobile apps to bring the product into the home or home office, and the experience to life in your own kitchen or living room. And in return, getting great real-time feedback on what customers are looking for.

We’ve all seen the demo of the IKEA mobile app on where to place your couch. But product location placement is missing from any number of key categories. This is including computer monitors and TVs, as well as office furniture and professional lighting equipment for that better quality of video con-call.

What other kinds of market engagement uses are there?

Packaging links to AR

Create custom “trackers”, either printed or on-screen icons, when scanned with a white labeled app to trigger a video or a 3D model overlaid on the real world. Design a scannable package with customer experience in mind and include tracking engagement and sharing links. Set up an AR trigger based on a packaging feature and invite the customer to scan the same with their phones. Note that you can also add AR as a feature into your existing Android or IOS app. Dependency on dedicated app or app plug-ins is gone. Brands can now leverage the potential offered by augmented reality using just a URL. Users can open the URL in any mobile-based browser and augment interactive digital content on their camera view.

Reverse product placement

As the opposite of how locations tried to link to Pokemon Go, your product could be an element in a popular Augmented Reality game. It could attract new customers who would link to more AR provided information on the product.

Weather as a factor

These types of apps can show what the weather may be like at a location. Possible app usage for showing residential real estate. It could show impact in a flood zone as to how much water may enter the area. Or it can warn people on urgent physical issues.

Practical advice before consumption

Too much time on your hands and hate your hair? See what the color will look like before you make a hair color mistake. Perhaps more AI than AR. Note that right now you may be able to buy hair dye. But you will likely not have access to the person who can repair any mistakes you make at this point. Think carefully.

Final Thoughts

Now is this time to engage bored consumers and eager potential users. Take advantage of what this uncertain time can bring to your firm. Use Augmented Reality as a benefit to create value and content stickiness for your customers.

The current state of the world is alarming. The COVID-19 virus is not only disrupting businesses and economies – it is taking away loved ones, it is separating friends and families, it is disrupting the education of young adults and children and it is seeding fear in communities. But while the media is dominated with doom and gloom at the moment – and we do need these reports – I believe it is worth stopping for a moment to consider the fact that if the pandemic happened ten or fifteen years ago, many businesses – and government agencies – would have closed down. You could argue that the world wasn’t as globally connected then as it is now. And to an extent that is correct – the numbers of air travellers increased up until the end of 2019. But even in 2005, the world was still a very global place – economies relied on cross-border commerce as much then as they do now.

Depending on your business or industry 10-15 years ago:

- Staff couldn’t have effectively worked from home. And if they did, collaboration would have been hard (if not impossible outside of the usual voice services). Teleconference services would have needed to be booked.

- Remote access would have been painful and slow – relying heavily on VPNs over slower internet connections.

- Software would have mainly been running in company datacentres – with very little SaaS-based applications. These applications were often designed for LAN access…

- Those lucky few with a Blackberry or iPhone might have had access to email – everyone else would have needed to go into the office to get work done.

But worse than this would have been our customer engagements. While eCommerce had healthy adoption by 2005, it often relied on very manual processes – and it was mainly focused on consumer products and services – B2B adoption was still a number of years away. And, for many businesses, it represented a tiny proportion of their revenue. Small companies didn’t often have the web presence to compete with the big players. But if I look at the big fast-food giants in Australia (e.g. McDonalds and KFC) – these companies didn’t have a web or mobile ordering until a few years ago, and even more recently for home delivery services. Any company that had to shut down their face-to-face contact would have likely fallen back on their contact centres – but even these would have been impacted as the ability to route calls to remote or home-working call centre agents barely existed then – so they would have been understaffed or closed due to an infection being discovered…

Today’s digital connectivity has the opportunity to save lives. Less physical contact means less people being exposed to – and spreading – the virus.

If this pandemic had happened 10-15 years ago, many small AND large businesses would have had to shut their doors very quickly. Very early in the cycle, businesses would have had to make the decision to shut their doors straight away, or risk accelerating the infection rates by having staff continue to attend the office or contact centre. So if there is one small positive we can take away, it is that our digital investments are paying off very quickly. The ability to continue to trade, continue to sell, continue to do business in such a market as we are facing today and tomorrow is priceless. I can purchase goods and services online, register my car without leaving my desk, upgrade or change my health insurance without speaking to a single human being. Most businesses have the ability to have their employees access many of their critical applications wherever they are located. Our accountants can still pay and send bills, HR can hire for open positions, product teams can continue to innovate on the products and services they offer.

Don’t get me wrong – business survival is not guaranteed. This is why I implored governments to aim their stimulus spending towards small and medium businesses digital initiatives – as cafes, retailers, bars and restaurants close down across cities, states and countries, many are now lamenting their immature online presence, their lack of delivery and their lack of pre-ordering. If you have any doubt about this, check your local Facebook group – it is full of small businesses putting up images of menus in the hope that customers will reach out directly to keep their businesses running. If these businesses are given incentives to build digital services quickly, they might see less of a slowdown in business.

COVID-19 will definitely stress test our digital assets and strategies. Just recently, the Australian government’s citizen-facing portal crashed as too many citizens logged on to register for welfare. This forced many people out into government shop-fronts – putting themselves, the staff and all connected families and friends at risk of catching the virus. I also heard today of a bank that called many of its staff back to the office as the VPN could not cope with the number of users and volume of traffic! If you have not already, you will quickly find out how your digital capabilities are performing – where you need extra capacity, where services are running smoothly, where you need to rethink process design or where you need to consider re-crafting this approach for the fully digital era.

But stay safe – listen to the advice of medical experts and act on that advice. A senior medical officer recently stated that social distancing is the only way that we will overcome this virus – so stay safe and stay home (if you can!). But also take the time to review your digital capabilities – start making moves now to ensure they help your business stay afloat – or your government agency to keep serving citizens in times of restricted trading or shutdowns.

The FMCG industry has always been competitive given the need to drive high sales volume because of the low profit margins of the products. As the industry faces changes – such as the demographics of the consumer base and the need to introduce newer sales channels – technology is playing an important role in ensuring that the organisations can remain competitive.

eCommerce Disrupting the FMCG Industry

The concept of online retail is said to have originated in some form in the 1960s. But with the growth of the access to the Internet in the 1990s and Amazon’s competitive business model, it has disrupted the retail and FMCG industries. As we see a steady growth in smartphone usage, digital payments, online banking and app-based platforms, online retail is becoming mainstream. While initially thought to be ideal for the purchase of durables and entertainment products and services (where price comparison is key), it has become common for FMCG companies to use eCommerce platforms. Even perishables are being purchased online with the rise in the number of online grocery stores. This is impacting the FMCG industry in a number of ways:

Change in Marketing Strategy

FMCG companies need to continue their traditional marketing strategy for in-store consumers. But at the same time, they need to reach out to a wider base of consumers who shop online. The profile of these consumers is different – younger and technologically savvier. They do not necessarily believe in brand loyalty. While the browse-to-buy ratio for FMCG products is high, they are having to invest in digital marketing strategies including personalised campaigns and presence in social media and online forums. Even packaging for in-store and online products need to be different for some products.

Increased Competition

An online presence means that your brand can reach a wider audience – this also means that the competition becomes tougher. Now global brands compete with brands from other countries as well as local brands on the same online platform. This raises the bar, with companies competing not only on price and product but also on delivery services and better customer feedback.

Increased Complexity of the Supply Chain

No longer can an FMCG company depend solely on trucks delivering their products to stores at a fixed time of day. As they play increasingly in the B2C space, they have to constantly be aware of seasonality and spikes. This means that their supply chain operations become that much more complicated, and they are having to spend more on logistics and transportation. There is also the need to handle a larger volume of data.

Changing Consumer Profile

As mentioned earlier, the consumer profile of the FMCG industry has changed to include younger consumers who want to shop online. It also includes consumers in newer markets made possible by eCommerce platforms. FMCG companies also have to cater to consumers who are conscious about product quality, the environment and ethics. This means they want to know where the products were grown or manufactured, their carbon footprints and generally want more traceability of the products they are purchasing. This has led governments to come up with guidelines to protect consumer rights. Recently, the UK government issued guidelines on the quality, labelling, standards and food safety including the right logos, health and identification marks.

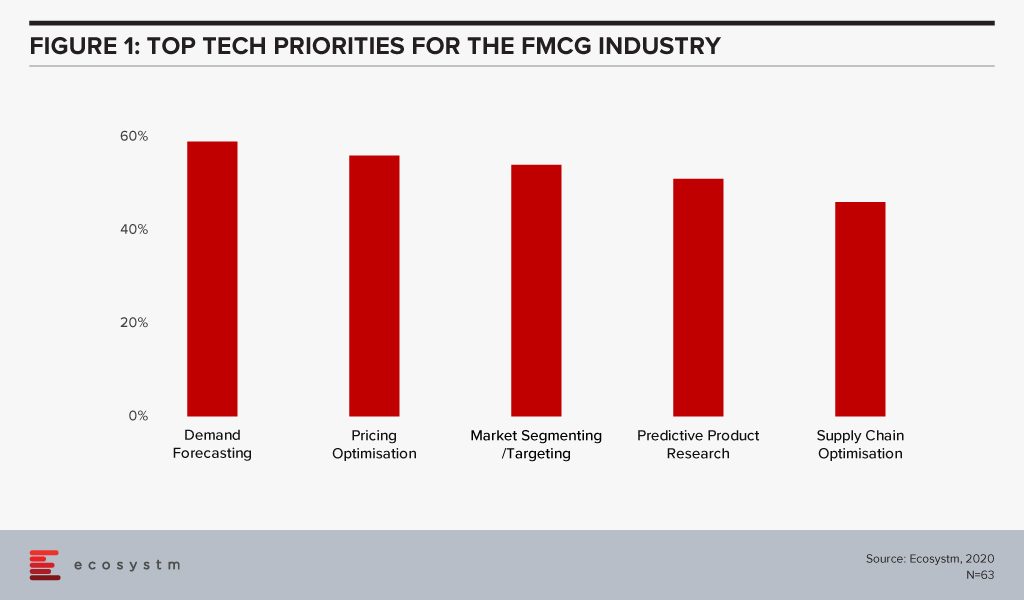

The global Ecosystm AI study reveals the top priorities for FMCG companies, focused on adopting emerging technologies (Figure 1). It is clear that their key priority is to handle the competitive market by focusing both on the consumer and the supply chain. Supply chain optimisation through demand forecasting ensures that they are not managing extra stock, and simultaneously not losing out on customers because of lack of stock. This just-in-time inventory management includes initiatives such as pricing optimisation in response to market demand, competition and – especially in the case of perishables – ensuring that stock closer to the use by date is cleared.

Technology as an Enabler of FMCG Transformation

The one advantage that FMCG companies have today is they have access to enormous customer and inventory data. As a result, they are able to leverage several emerging technologies to transform.

Digital Marketing

One area that is transforming the industry is digital marketing which includes multiple aspects such as search engine marketing, video marketing, social media activity and email marketing. While several technologies come together for a digital marketing solution and AI is a key component of the solutions, there are platforms that provide an end-to-end solution.

Digital marketing is most effective with a targeted group of customers and when organisations can identify digital or social champions. Johnson & Johnson’s Babycenter.com is a good example of how creating a digital community can help market products. The core idea behind the website is to give expecting and new mothers advice on early childhood. While on the surface it appears disassociated from Johnson & Johnson, the site almost exclusively carries their advertisements. This gives them a targeted base to push their products to. Dollar Shave Club is another example of how brands can leverage digital marketing. Their social media engagement has been so successful that they got bought over by Unilever. The digital campaign includes incentivising members with their products for posting about them on Instagram or Facebook.

Blockchain

FMCG companies are investing in Blockchain and digital ledger technologies for track and trace functionalities and operational efficiency. The technology not only helps manage the supply chain better by effective shipping timelines maintenance, delivery management and inventory management; it also helps build trust in a brand. It helps in compliance management, reduces the number or need for middlemen, easier handling of cross-border transactions and brings about an end-to-end accountability.

Danone initiated a Track & Connect service for their baby formula using Blockchain for transparency and traceability to show the authenticity of their products to parents and for a better customer experience. FMCG companies will benefit immensely from the farm-to-fork accountability concept initiated by Agriculture.

AI

From predictive analysis to machine learning to deep learning, AI is bringing a lot of benefits to FMCG companies. AI is enabling companies to discover gaps (both in their consumer interactions and in the supply chain) and make their processes intelligent – including demand forecasting, supply chain optimisation, personalised product offerings, social media analytics, consumer sentiment analytics and recommendation engines.

FMCG organisations are analysing internal and external data sources for both sales and improved customer experience. As FMCGs are forced to sell online to remain competitive, they have access to a high volume of the consumer as well as supply chain and inventory management data. Coca-Cola remains one of the leaders in the FMCG market by leveraging this data, including product research and social data mining. Even their vending machines are looking to leverage AI for personalised offerings and for loyalty programs.

The need to enhance the customer experience has also seen innovations like the Maggi Chatbot – “Kim”- that helps customers learn about Maggi recipes, ingredients, and dietary requirements, through Facebook Messenger.

FMCG companies that cannot afford to invest in technologies such as AI also have the option of leveraging the technology offerings of their online retail platform. eBay offers analytics as a service to the sellers – offering them data, metrics, and analytics to help them succeed. They also introduced computer vision technology to help sellers create clearer and more attractive images for the platform.

In this competitive market, we will see FMCG companies – and not just the big global brands but also the local producers – embrace more technology.

In the Top 5 Customer Experience Trends for 2020 Ecosystm Principal Advisors, Tim Sheedy and Audrey William say that emerging Asia will catch up with the mature economies of the world in their customer obsession. Have emerging economies really embraced Customer Experience (CX) fully or are they just responding to the hype? Do consumers really care about how they connect with brands or do organisations think product offerings is the main differentiator? The business priorities of global organisations reveal that there is a universal focus on improving CX (Figure 1). It is the top business priority across emerging and mature economies, though mature economies are still ahead in their customer focus. Organisations in emerging economies prioritise revenue growth and improving Employee Experience (EX) more than those in mature economies.

Delivering Better CX – The Challenges

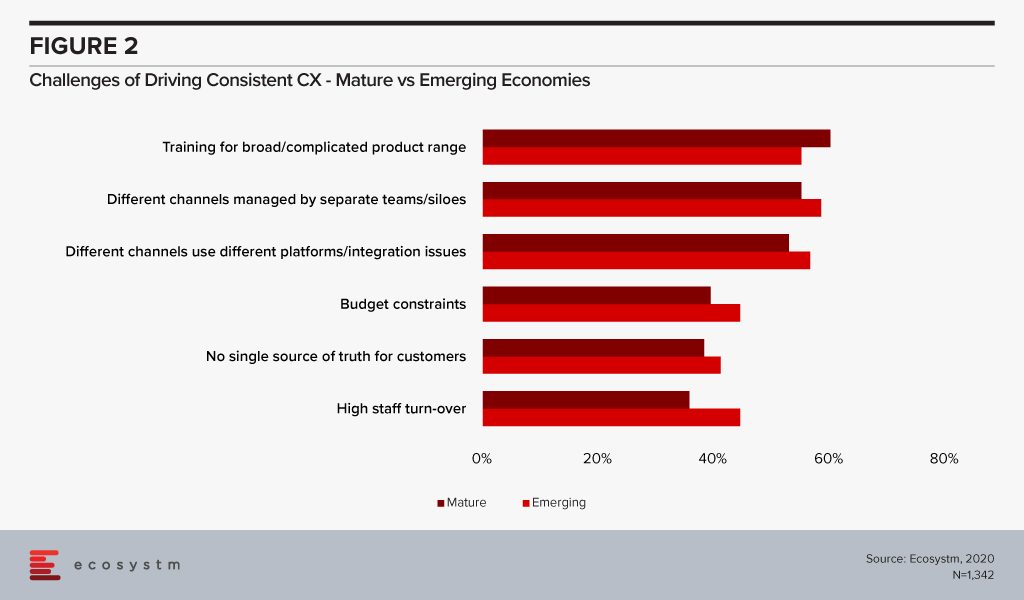

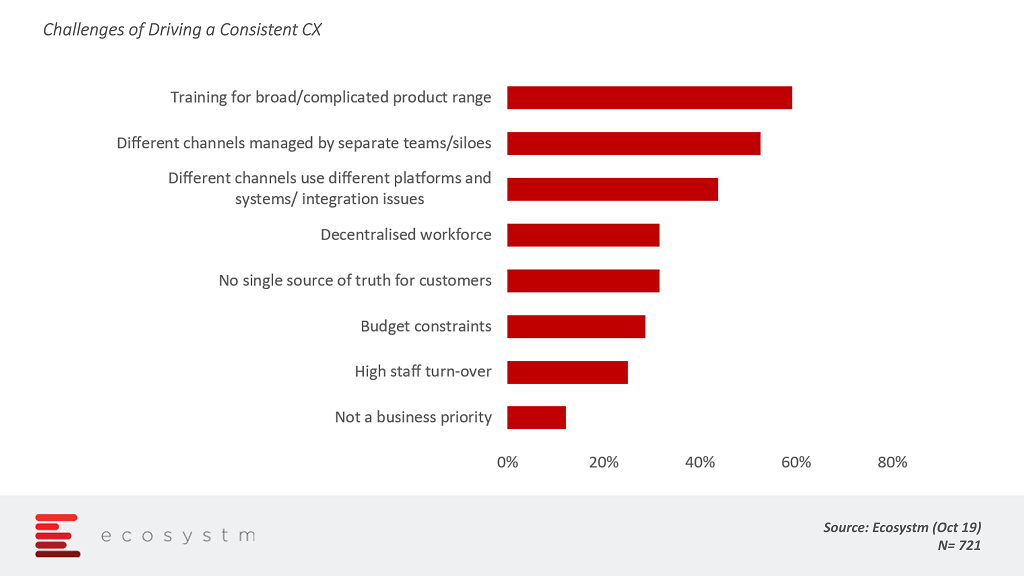

Whether these organisations can actually fulfill their CX goals, depends on what their key challenges are. In the end, what consumers want is a consistent CX – across multiple channels and touchpoints. Organisations in emerging economies seem to find it more challenging to drive a more consistent CX (Figure 2). Information siloes are a challenge across all organisations. But organisations in mature economies cite training of their agents as their biggest challenge.

A desire to improve CX must be backed with both vision and budget. The vision should be for the entire organisation to have a single source of truth – not just for the employees – but also a common source of truth that is accessible easily and consistently by customers, across multiple channels. Without this, customer self-service measures will be inadequate. Increasingly customers will want to engage with brands when they want to (very often beyond working hours), how they want to (avoid lengthy voice calls) and where they want to (web and mobile apps). Interoperability of enterprise systems and a robust knowledge base are important factors.

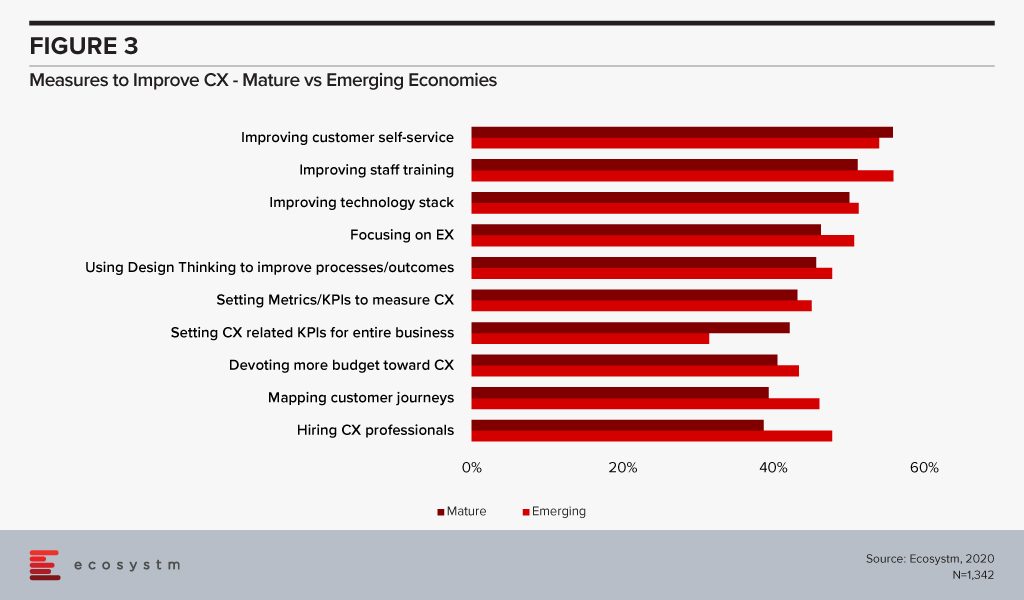

How do Organisations Improve Service Delivery?

If we compare the top CX measures by organisations in mature and emerging economies, we notice a clear difference in priority. In mature economies, organisations appear to have a clear roadmap. They focus on the customers first; followed by empowering the staff to perform their jobs better; invest in technology that will enable both; work on process optimisation; and finally set KPIs and metrics to evaluate the efficacy of the CX measures in place. Also, what they are increasingly doing is setting CX KPIs across the entire organisation – involving all stakeholders. A customer-focused business is one where everything is second to the customers and that should be built firmly into the organisational culture.

In emerging economies, organisations do not appear to follow a clear roadmap in their CX measures. While self-service is an important aspect of their CX programs, they are more tied down by improving their customer service staff capabilities. They are more challenged by high staff turnover (Figure 2) and appear to be focused on their employees in multiple ways – hiring experts, improving EX and investing in staff training. What they do far less than their counterparts from mature economies is setting organisation-wide CX KPIs.

Web apps are still the most important self-service CX touchpoint, followed by mobile apps. However, emerging economies are ahead when it comes to the importance they place on mobile apps for CX. This is reflective of the high mobile penetration in emerging economies, and the propensity to use mobile devices for all transactions – social and business.

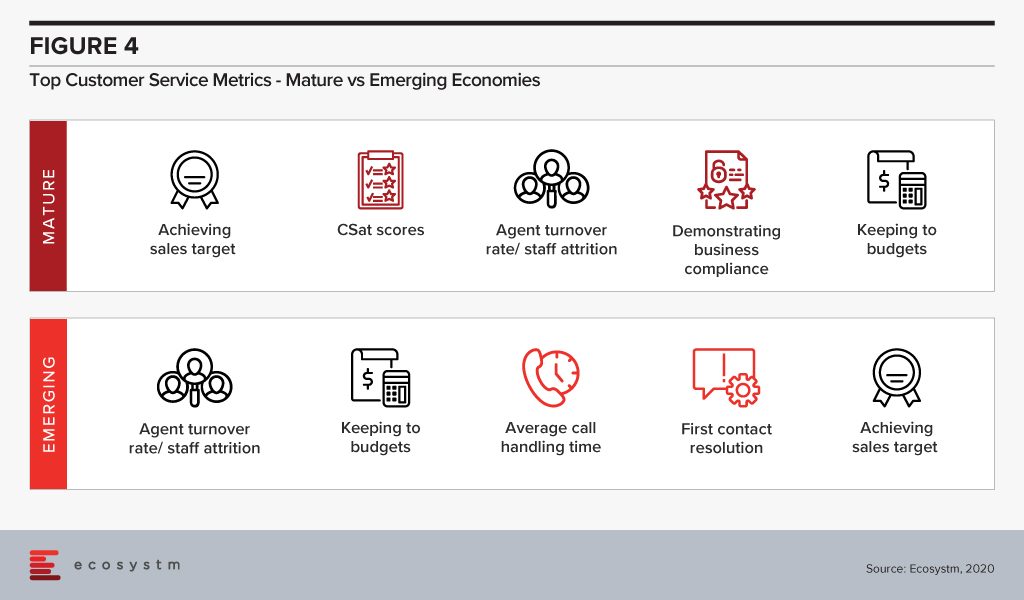

We have seen that organisations in mature economies set CX KPIs more consistently. What are the top CX metrics and are there any differences based on the maturity of the economy (Figure 4)?

Organisations in emerging economies, continue to be more concerned about attracting and retaining employees. In fact, when asked about their security concerns, these organisations cite agents leaving with data as the key challenge. In mature economies, the key security challenge is improper use of confidential customer data, which can be handled best by continued staff training. In emerging economies, while organisations measure individual areas such as average call duration and first contact resolution, they do not measure customer satisfaction, in its entirety, using CSat scores, for instance. Organisations in mature economies are better at setting KPIs for their CX initiatives and tying them down to outcomes beyond the customer service teams – such as sales and adherence to compliance requirements.

Organisations in mature economies are focused on CX, but to become truly customer-obsessed they need to:

- Evaluate what will enable them to deliver better customer self-service – it is not only about apps, but also about the knowledge base

- Create a clear CX roadmap, focused on the multiple stakeholders and the technology – the steps have to be focused and not ad-hoc

- Inculcate customer obsession across the entire organisation – not just the customer-facing teams

Increasingly organisations are looking to improve customer and employee experience over other traditional metrics such as growing revenue or reducing costs. Organisations are transitioning from business metrics to customer experience (CX) ones, and employing CX leaders. 2020 will see many businesses make significant breakthroughs in improving the CX.

The top 5 Customer Experience trends for 2020

Here are the top 5 CX trends and the related technology markets in 2020. It draws on the latest data from the global Ecosystm CX Study that is live and ongoing on the Ecosystm platform and based on qualitative analyses by Ecosystm Principal Advisors Tim Sheedy and Audrey William.

-

Asia will Catch up with North America and ANZ in Customer Obsession

Many Asian economies – particularly those in Southeast Asia – have not needed to focus too much on CX. The proportion of businesses starting to map customer journeys is accelerating, and there is a growing focus on making those journeys easier, more effective and more enjoyable. We are seeing this play out in the levels of interest in – and deployment of – cloud contact centres. Australia and New Zealand have been leading the deployments in the last two years. Deploying cloud and using machine learning and AI at the core to understand how to deliver personalised CX is part of a wider CX strategy for several organisations.

In 2020 we expect large organisations in Southeast Asia and North Asia to transform their CX and contact centre capabilities and make the move to cloud-based contact centre environments.

-

CX Initiatives will Dovetail with Broader Digital Ones

Many businesses have taken a bimodal IT approach to their technology platforms – driving customer-centric changes at pace while keeping their back-end systems slow. In the drive to make the entire business fast and innovative, these back-end systems are being modernised. But over 90% of businesses have not yet seen a customer or business benefit from this digital agenda.

This will change in 2020 as more businesses get some competitive advantage from the digital initiatives they are driving inside of their business. This will be driven by the linking of the customer-centric technology initiatives with the back-end ones. This means that customer applications will be infused with data and analytics from other systems, making them smarter and increasing the potential for automation and AI to drive down costs and increase personalisation and customisation.

-

Hyper-personalisation will Move from Concept to Reality – Powered by Customer Journey Analytics

The idea of creating unique experiences for each customer has been discussed for years – but few businesses are really doing it today. 2020 will see businesses outside of the top 5% experiment and deploy hyper-personalised CX. It will move from the top web brands to mass market as more companies invest in automation, predictive analytics and AI.

But hyper-personalisation is not possible without Customer Journey Analytics. Businesses need to understand the end-to-end journey of each customer to understand how to personalise it. Therefore, Customer Journey Analytics will take centre-stage in 2020. The challenge for years has been that customer teams have focused on the traditional inbound and outbound interaction with the customer. Brands now need to understand and personalise the experience before the customer interacts with the brand and after they are done interacting with the brand. The ability to apply machine learning and AI to offer insights to predict the movement and journey of the customer will be a significant focus – and challenge – for customer teams. Customer Journey Analytics will allow brands to deliver that “frictionless” service.

-

There will be a Renewed Focus on Compliance and Security in CX

With the recent banking royal commission hearings in Australia to GDPR and other global regulations around privacy and customer data handling, customer teams will now have to make sure that all forms of voice and non-voice interactions are monitored close to 100% of the time. Very few customer teams do that today and are at risk of non-compliance. As monitoring can be labour intensive, there will be a need for organisations to invest in analytics and AI applications around compliance and monitoring.

The recording of customer calls means that highly sensitive information could be stored for years and the risk of the contact centre breaching regulatory compliance requirements enhances. Solutions today have various ways to block the recording of key phrases or sections and some solutions apply APIs to the flow of the recording. As soon as the agent enters sensitive information such as credit card details, the recording stops to resume after the sensitive data is blocked or deleted. That way the sensitive conversation is not recorded or heard by anyone monitoring the call. Contact centres must adhere to this strictly, but few do. Businesses also need to know real time if an agent is misinforming the customer. Contact Centre Outsourcers will also have to re-look at how compliant they are and how much they have invested in securing customer data. There will be greater pressure on them to take on greater risks and share the risk burden with their clients.

-

Businesses will Use AI and Analytics to Measure CX

The drive to improve CX has every business and government department measuring the experience at every opportunity. A one-minute transaction in a store can prompt a five-minute survey asking for feedback. As a consequence, customers are experiencing survey fatigue. Surveys are also not the best way to measure how customers feel after they have interacted with a brand. Already, many will not participate unless there is a discount or incentive, which eats into future margins. Smart businesses will begin to use AI to detect emotions and mood, and analytics to measure experiences.

Download Report: The top 5 Customer Experience trends for 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 Workplace of the future Trends for 2020’ are available for download from the Ecosystm platform. Signup for Free to download the report and gain insight into ‘the top 5 Workplace of the future trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources. Download Link Below ?

Brands are not built overnight, and today’s customers tend to regard a brand’s worth by the innovativeness of the products and services and by the customer experience (CX). CX is by no means a new concept but has gained significance and organisations focus on ways to stand out from the competition and drive deeper engagement with their customers. In today’s ‘Experience’ economy CX is key to attracting new customers and retaining the ones the firms already have and cuts across the entire organisation – vertical marketing, strategy, product development or technology. Every business today needs to ‘delight’ its customers – offer a substandard experience and your brand might not survive long.

The global Ecosystm CX study discovered that improving CX is a key business priority for over 70% of organisations across industries – even in industries that are not considered customer-focused. These organisations were also asked why driving a consistent CX was challenging.

The key challenges boil down to managing the different stakeholders within the organisation – giving visibility and knowledge on all product offerings; managing the siloes created by each department and; in the end not being able to provide customers with one single source of truth. While many of these challenges are business-related, technology can be a key contributor to enhancing CX.

Technologies that can help you improve CX

There are many technologies that allow organisations to provide better CX, but the key to these technologies is how they collect, classify and provide actions on customer data. This is where AI comes into the picture, and why AI is at the heart of many CX offerings, making sense and aiding in the decision making around customer data.

AI-Enabled IoT

AI-enabled IoT devices are helping to enhance Customer Experience. The sensors in IoT devices such as wearables or personal assistants produce data which can be processed to derive useful insights, activity patterns and develop personalised communication. AI is improving the ability to take IoT generated data to personalise and customise actions and communication. For example, customers in gyms and fitness clubs can share their wearables data with their fitness trainers to customise their exercise routine and provide dietary recommendations.

Similarly, cars can be embedded with sensors which assess the users’ driving habits. This can then be used to suggest improvements to driving style or adjust insurance premiums based on how they drive.

Progressive Insurance, for instance, offers its customers discounts based on their driving through its “Snapshot” program. Progressive is using its usage-based-insurance (UBI) telematics programme to monitor how its car insurance customers drive. Using an ODB telematics dongle and machine learning, the insurer is able to judge how a driver is performing on each journey.

Location-Based Targeting

With location-based tracking technology and GPS systems on smartphones and devices, more businesses are working to enable and provide geo-location services to customers. This presents opportunities to offer personalised shopping experiences and customised promotions and offers to the customers. Businesses are already using geo-location services to extend offers to customers – such as cinemas and theatres pushing notifications on movie timings and available discounts when customers are in the vicinity.

Location-based services also help to enhance the actual shopping experience. Lowe’s has an app which allows their customers to navigate the large warehouse-like stores, helping them find products faster and easier. The app called The Lowe’s Vision: In-Store Navigation app works using a combination of VR and location-based services.

Customer-Centric AR and VR

AR and VR technologies are enhancing the way customers engage with businesses. Companies adopting AR/VR can distinguish themselves from the competition by introducing higher touchpoints and deeply personalised experiences designed specifically for their customer journey. The retail industry has been at the forefront when it comes to experimenting with AR and VR technologies, in the customer space. Retailers have rolled out applications and services that lets consumers virtually try makeup, clothing, accessories and seek out the best look for them.

Financial institutions are also leveraging AR and VR to build customer-centric solutions for self-service and user training. Citibank worked with a mixed reality technology company to develop a trading platform combining 2D and 3D working environment to extrapolate insights from data. Traders work with hundreds of financial instruments, and with the mixed reality workstation, they can quickly identify market hotspots that they should be focusing on. The consequences – better trades!

The hospitality industry is also leveraging AR to improve CX, AR-based menus is a good example. Various fine dining restaurants have started offering AR based food menus which can display virtual food items and live 3D models of food to accurately represent both the appearance and the serving portion.

Obviously, the entertainment industry will leverage mixed reality to the fullest. For instance, The New York Times leverages VR for storytelling where readers can visualise the events described in some editions of the newspaper. The technology thus allows the description of the setup of a story making the viewers witness an emotional connect with the characters.

Voice capabilities for a seamless experience

With the advent of digital voice assistants and voice recognition AI, voice recognition has opened up avenues and opportunities for businesses to enhance the way customers interact with them whether through mobile apps or their call centres.

Nowadays, voice-capable apps enable customers to interact with services very easily. A good example is Starbuck’s My Barista app, which allows customers to order via voice command or messaging. The coffee chain expanded its application by incorporating voice features to boost speed and convenience for placing and processing orders.

In conclusion, implementing technologies in a business could help businesses change the way the customers see and respond to a business. In addition to this, Improving customer service and using technologies can significantly reduce human inaccuracy, improve employee confidence and rapidly improve the character of a brand. By bridging the gap between a company and its client’s, businesses are becoming CX oriented and are dedicating themselves to enhance CX.

Besides the above, which technologies do you think are beneficial in enhancing your CX?

Let us know in your comments below.