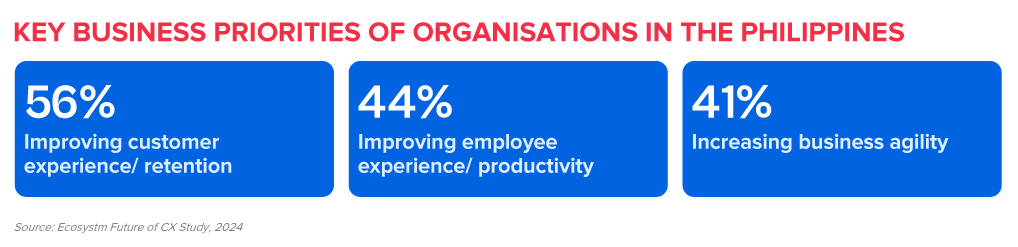

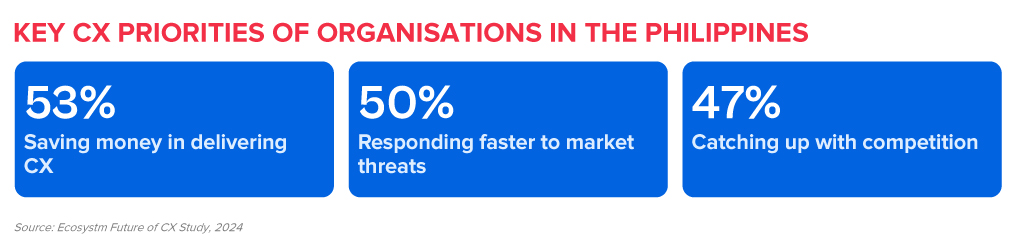

The Philippines, renowned as a global contact centre hub, is experiencing heightened pressure on the global stage, leading to intensified competition within the country. Smaller BPOs are driving larger players to innovate, requiring a stronger focus on empowering customer experience (CX) teams, and enhancing employee experience (EX) in organisations in the Philippines.

As the Philippines expands its global footprint, organisations must embrace progressive approaches to outpace rivals in the CX sector.

These priorities can be achieved through a robust data strategy that empowers CX teams and contact centres to glean actionable insights.

Here are 5 ways organisations in the Philippines can achieve their CX objectives.

Download ‘Securing the CX Edge: 5 Strategies for Organisations in the Philippines’ as a PDF.

#1 Modernise Voice and Omnichannel Orchestration

Ensuring that all channels are connected and integrated at the core is critical in delivering omnichannel experiences. Organisations must ensure that the conversation can be continued seamlessly irrespective of the channel the customer chooses, without losing the context.

Voice must be integrated within the omnichannel strategy. Even with the rise of digital and self-service, voice remains crucial, especially for understanding complex inquiries and providing an alternative when customers face persistent challenges on other channels.

Transition from a siloed view of channels to a unified and integrated approach.

#2 Empower CX Teams with Actionable Customer Data

An Intelligent Data Hub aggregates, integrates, and organises customer data across multiple data sources and channels and eliminates the siloed approach to collecting and analysing customer data.

Drive accurate and proactive conversations with your customers through a unified customer data platform.

- Unifies user history across channels into a single customer view.

- Enables the delivery of an omnichannel experience.

- Identifies behavioural trends by understanding patterns to personalise interactions.

- Spots real-time customer issues across channels.

- Uncovers compliance gaps and missed sales opportunities from unstructured data.

- Looks at customer journeys to proactively address their needs.

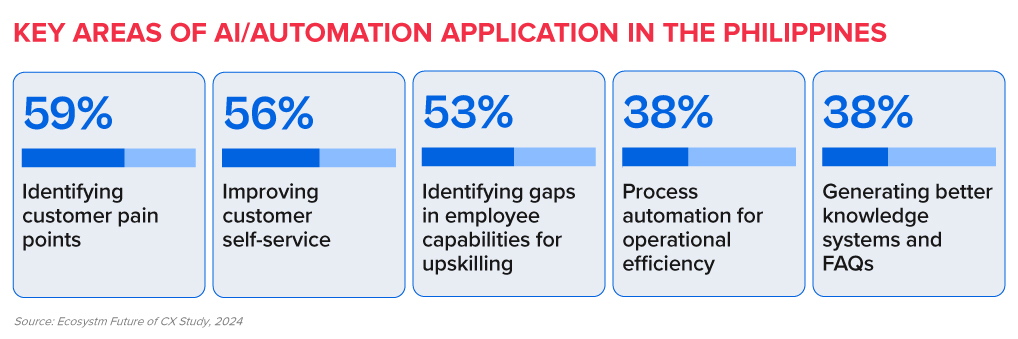

#3 Transform CX & EX with AI/Automation

AI and automation should be the cornerstone of an organisation’s CX efforts to positively impact both customers and employees.

Evaluate all aspects of AI/automation to enhance both customer and employee experience.

- Predictive AI algorithms analyse customer data to forecast trends and optimise resource allocation.

- AI-driven identity validation reduces fraud risk.

- Agent Assist Solutions offer real-time insights to agents, enhancing service delivery and efficiency.

- GenAI integration automates post-call activities, allowing agents to focus on high-value tasks.

#4 Augment Existing Systems for Success

Many organisations face challenges in fully modernising legacy systems and reducing reliance on multiple tech providers.

CX transformation while managing multiple disparate systems will require a platform that integrates desired capabilities for holistic CX and EX experiences.

A unified platform streamlines application management, ensuring cohesion, unified KPIs, enhanced security, simplified maintenance, and single sign-on for agents. This approach offers consistent experiences across channels and early issue detection, eliminating the need to navigate multiple applications or projects.

Capabilities that a platform should have:

- Programmable APIs to deliver messages across preferred social and messaging channels.

- Modernisation of outdated IVRs with self-service automation.

- Transformation of static mobile apps into engaging experience tools.

- Fraud prevention across channels through immediate phone number verification APIs.

#5 Focus on Proactive CX

In the new CX economy, organisations must meet customers on their terms, proactively engaging them before they initiate interactions. This requires a re-evaluation of all aspects of CX delivery.

- Redefine the Contact Centre. Transforming it into an “Intelligent” Data Hub providing unified and connected experiences; leveraging intelligent APIs to proactively manage customer interactions seamlessly across journeys.

- Reimagine the Agent’s Role. Empowering agents to be AI-powered brand ambassadors, with access to prior and real-time interactions, instant decision-making abilities, and data-led knowledge bases.

- Redesign the Channel and Brand Experience. Ensuring consistent omnichannel experiences through unified and coherent data; using programmable APIs to personalise conversations and discern customer preferences for real-time or asynchronous messaging; integrating innovative technologies like video to enrich the channel experience.

In my last Ecosystm Insights, I spoke about why organisations need to think about the Voice of the Customer (VoC) quite literally. Organisations need to listen to what their customers are telling them – not just to the survey questions they responded to, answering pre-defined questions that the organisations want to hear about.

The concept of customer feedback is evolving, and how organisations design and manage VoC programs must also change. Technology is now capable of enabling customer teams to tap into all those unsolicited, and often unstructured, raw feedback sources. Think contact centre conversations (calls, chats, chatbots, emails, complaints, call notes), CRM notes, online reviews, social media, etc. Those are all sources of raw customer feedback, waiting to be converted into customer insights.

Organisations can now find the capability of extracting customer insight from raw data across a wide range of solutions, from VoC platforms, data management platforms, contact centre solutions, text analytics players, etc. The expanding tech ecosystem presents opportunities for organisations to enhance their programs. However, navigating this breadth of options can also be confusing as they strive to identify the most suitable tools for their requirements.

As CX programs mature and shift from survey feedback to truly listening to customers, the demand for tech solutions tailored to various needs increases.

Where are tech vendors headed?

As part of my job as CX Consultant & Tech Advisor, I spend a lot of time working with my clients. But I also spend a lot of time speaking with technology vendors, who provide the solutions my clients need. Over the last few weeks and months there’s been a flurry of activity across the CX technology market with lots of product announcements around one specific topic. You guessed it, GenAI.

So, I invested some time in finding out how tech vendors are evolving their offerings. From Medallia, InMoment, Thematic, LiquidVoice, Concentrix, Snowflake, Nice, to Tethr – a broad variety of different vendors, but all with one thing in common; they help analyse customer feedback data.

And I like what I hear. The conversation has not been about GenAI because of GenAI, but about use cases and real-life applications for CX practitioners, including Insights & Research team, Contact Centre, CX, VoC, Digital teams, and so on. The list is long when we include everyone who has a role to play in creating, maintaining, and improving customer experiences.

It’s no wonder that many different vendors have started to embed those capabilities into their solutions and launch new products or features. The tech landscape is becoming increasingly fragmented at this stage.

What are an organisation’s tech options?

- The traditional VoC platform providers typically offer some text analytics capabilities (although not always included in the base price) and have started to tap into the contact centre solutions as well. Some also offer some social media or online review analysis, leaving organisations with a relatively good understanding of customer sentiment and a better understanding of their CX.

- Contact centre solutions are traditionally focused on analysing calls for Quality Assurance (QA) purposes and use surveys for agent coaching. Many contact centre players have evolved their portfolios to include text analytics or conversational intelligence to extract broader customer insights. Although at this stage they’re not always shared with the rest of the organisation (one step at a time…).

- Conversational analytics/intelligence providers have emerged over the last few years and are a powerhouse for contact centre and chatbot conversations. The contact centre really is the treasure trove of customer insights, although vastly underutilised for it so far!

- CRMs are the backbone of the customer experience management toolkit as they hold a vast amount of metadata. They’ve also been able to send surveys for a while now. Analysing unstructured data however (whether survey verbatim or otherwise) isn’t one of their strengths. This leaves organisations with a lot of data but not necessarily insights.

- Social media listening tools are often standalone tools used by the social media teams. There are not many instances of them being used for the analysis of other unstructured feedback.

- Digital/website feedback tools, in line with some of the above, are centred around collecting feedback, not necessarily analysing the unstructured feedback.

- Pure text analytics players are traditionally focused on analysing surveys verbatim. As this is their core offering, they tend to be proficient in it and have started to broaden their portfolios to include other unstructured feedback sources.

- Customer Data Platforms (CDP)/ Data Management Platforms (DMP) are more focused on quantitative data about customers and their experiences. Although many speak about their ability to analyse unstructured feedback as well, it doesn’t appear to be their strengths.

Conclusion

But what does that leave organisations with? Apart from very confused tech users trying to find the right solution for their organisation.

At this stage, there is immense market fragmentation, with many vendors from different core capabilities starting to incorporate capabilities to analyse unstructured data in the wake of the GenAI boom. However, a market convergence is expected.

While we watch how the market unfolds, one thing is certain. Organisations and customer teams will need to adjust – and that includes the tech stack as well as the CX program set up. With customer feedback now coming from anywhere within or outside the organisation, there is a need for a consolidated source of truth to make sense of it all and move from raw data to customer insights. While organisations will benefit immensely from a consolidated customer data repository, it’s also crucial to break down organisational silos at the same time and democratise insights as widely as possible to enable informed decision-making.

In recent years, organisations have had to swiftly transition to providing digital experiences due to limitations on physical interactions; competed fiercely based on the customer experiences offered; and invested significantly in the latest CX technologies. However, in 2024, organisations will pivot their competitive efforts towards product innovation rather than solely focusing on enhancing the CX.

This does not mean that organisations will not focus on CX – they will just be smarter about it!

Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy present the top 5 Customer Experience trends in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 CX Trends in 2024’ as a PDF.

#1 Customer Experience is Due for a Reset

Organisations aiming to improve customer experience are seeing diminishing returns, moving away from the significant gains before and during the pandemic to incremental improvements. Many organisations experience stagnant or declining CX and NPS scores as they prioritise profit over customer growth and face a convergence of undifferentiated digital experiences. The evolving digital landscape has also heightened baseline customer expectations.

In 2024, CX programs will be focused and measurable – with greater involvement of Sales, Marketing, Brand, and Customer Service to ensure CX initiatives are unified across the entire customer journey.

Organisations will reassess CX strategies, choosing impactful initiatives and aligning with brand values. This recalibration, unique to each organisation, may include reinvesting in human channels, improving digital experiences, or reimagining customer ecosystems.

#2 Sentiment Analysis Will Fuel CX Improvement

Organisations strive to design seamless customer journeys – yet they often miss the mark in crafting truly memorable experiences that forge emotional connections and turn customers into brand advocates.

Customers want on-demand information and service; failure to meet these expectations often leads to discontent and frustration. This is further heightened when organisations fail to recognise and respond to these emotions.

Sentiment analysis will shape CX improvements – and technological advancements such as in neural network, promise higher accuracy in sentiment analysis by detecting intricate relationships between emotions, phrases, and words.

These models explore multiple permutations, delving deeper to interpret the meaning behind different sentiment clusters.

#3 AI Will Elevate VoC from Surveys to Experience Improvement

In 2024, AI technologies will transform Voice of Customer (VoC) programs from measurement practices into the engine room of the experience improvement function.

The focus will move from measurement to action – backed by AI. AI is already playing a pivotal role in analysing vast volumes of data, including unstructured and unsolicited feedback. In 2024, VoC programs will shift gear to focus on driving a customer centric culture and business change. AI will augment insight interpretation, recommend actions, and predict customer behaviour, sentiment, and churn to elevate customer experiences (CX).

Organisations that don’t embrace an AI-driven paradigm will get left behind as they fail to showcase and deliver ROI to the business.

#4 Generative AI Platforms Will Replace Knowledge Management Tools

Most organisations have more customer knowledge management tools and platforms than they should. They exist in the contact centre, on the website, the mobile app, in-store, at branches, and within customer service. There are two challenges that this creates:

- Inconsistent knowledge. The information in the different knowledge bases is different and sometimes conflicting.

- Difficult to extract answers. The knowledge contained in these platforms is often in PDFs and long form documents.

Generative AI tools will consolidate organisational knowledge, enhancing searchability.

Customers and contact centre agents will be able to get actual answers to questions and they will be consistent across touchpoints (assuming they are comprehensive, customer-journey and organisation-wide initiatives).

#5 Experience Orchestration Will

Accelerate

Despite the ongoing effort to streamline and simplify the CX, organisations often implement new technologies, such as conversational AI, digital and social channels, as independent projects. This fragmented approach, driven by the desire for quick wins using best-in-class point solutions results in a complex CX technology architecture.

With the proliferation of point solution vendors, it is becoming critical to eliminate the silos. The fragmentation hampers CX teams from achieving their goals, leading to increased costs, limited insights, a weak understanding of customer journeys, and inconsistent services.

Embracing CX unification through an orchestration platform enables organisations to enhance the CX rapidly, with reduced concerns about tech debt and legacy issues.

The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

In my last Ecosystm Insight, I spoke about the 5 strategies that leading CX leaders follow to stay ahead of the curve. Data is at the core of these CX strategies. But a customer data breach can have an enormous financial and reputational impact on a brand.

Here are 12 essential steps to effective governance that will help you unlock the power of customer data.

- Understand data protection laws and regulations

- Create a data governance framework

- Establish data privacy and security policies

- Implement data minimisation

- Ensure data accuracy

- Obtain explicit consent

- Mask, anonymise and pseudonymise data

- Implement strong access controls

- Train employees

- Conduct risk assessments and audits

- Develop a data breach response plan

- Monitor and review

Read on to find out more.

Download ‘A 12-Step Plan for Governance of Customer Data’ as a PDF

In her earlier Ecosystm Insight Melanie Disse spoke about how to measure customer experience (CX) success through an effective Voice of Customer (VoC) program.

In this Ecosystm byte, Melanie talks about why every VoC program needs to have an Insight to Action framework at its core, to detect and drive continuous improvement opportunities and positively impact organisations’ bottom line.

Read on to find out more about the “Listen – Analyse – Act” VoC Insights to Action framework. Each phase of the framework has its own challenges, and the success of the entire framework depends on the quality of each phase.

Download 3-Phases-from-VoC-Insights-to-Action as a PDF

Customer experience (CX) is an integral part of a brand today – and excellence in CX is a moving target (think how tools such as ChatGPT can revolutionise communications and CX). Organisations will find themselves aiming for personalised CX across channels of preference, with convenience, empathy, and speed at the core.

Here are the top 5 trends for the Experience Economy for 2023 according to Ecosystm analysts Audrey William, Melanie Disse, and Tim Sheedy.

- Organisations Will Focus on Building a “One CX Workforce”

- AI Will Lead Voice of Customer Programs

- Metadata Will Become Important

- The Conversational AI Market Will Mature

- Organisations Will Go Back to Focusing on Web Experience

Read on for more details.

Download Ecosystm Predicts: The Top 5 Trends for the Experience Economy in 2023 as a PDF

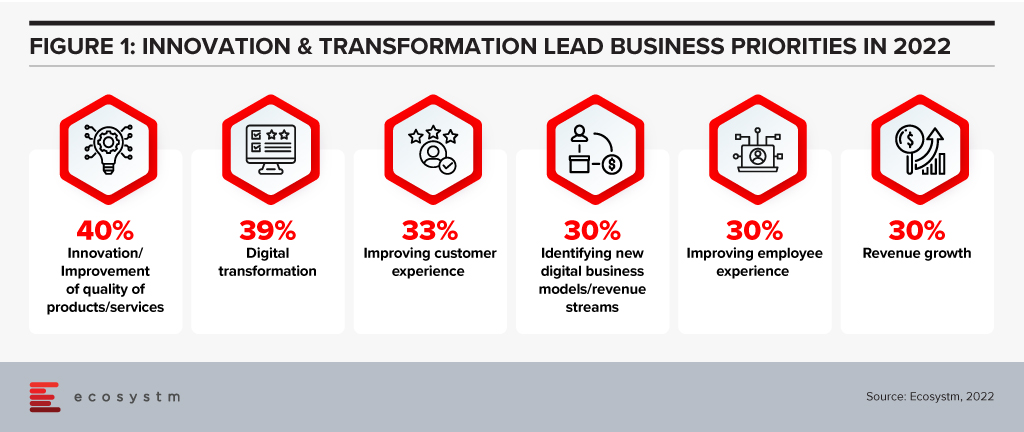

Organisations in Australia and New Zealand (ANZ) are focusing their digital transformation efforts on continued innovation in the experiences they deliver to their customers and employees.

Innovation has been at the core of organisations’ survival strategies – now it will be the means to gain competitive advantage and is getting prioritised over resiliency, business continuity and compliance.

Here are 5 insights on where ANZ organisations are headed in the tech priorities and investments, based on the findings of the Ecosystm Digital Enterprise Study, 2022.

- Tech Teams in ANZ are restructuring after a two-year struggle and as they face skills shortage.

- Tech investments are focusing on experience and digital workplace and customer experience technologies are seeing continued growth.

- Hybrid cloud investments are focused on augmenting existing infrastructure – whether public or on-prem

- Sales & Marketing are leveraging data & AI solutions the most; IT Ops and SecOps will see un uptick in 2023

- Cybersecurity practices are not evolving fast enough with only 9% of organisations having implemented Zero Trust

More insights into the ANZ tech market below.

Click here to download The Future of the Digital Enterprise – Australia & New Zealand as a PDF

The last few months have been full of bad news for some of the organisations currently recognised as the most innovative firms on the planet. Netflix has been losing subscribers, Amazon’s revenue growth is slowing dramatically, and Tesla now has serious competition in the EV market, with its dominance beginning to wane. In Australia – my home country – some of the “fintech” banks have closed their virtual doors over the past six months, leaving the market to the traditional players.

And many of the traditional businesses are turning themselves around. Foxtel, the “legacy” cable TV provider in Australia, has grown its subscriber base by 19% off the back of its streaming services – where subscriber numbers are growing at over 60% YoY. ComfortDelgro – a transport provider based out of Singapore – is seeing its revenue start to increase again after being hit hard by digital competitors and the pandemic. CBA’s “Ceba” virtual assistant is winning plaudits in Australia and globally.

It’s Not Too Late to Catch-up!

In many respects, the fact that the digital disruptors got SO far ahead is an indication of just how slow the rest of the market was to respond, and a credit to the significant investments these innovators made to get ahead. But now that the rest of the market is catching up shows that there is no secret sauce when it comes to innovation. What Uber, Tesla, Amazon and every other digital innovator has done is replicable. Your business just needs to make the necessary changes to give you the ability to catch up to the digital innovators in your industry – do it well and you will even keep up with them or get ahead. And innovation is the leading business priority for most organisations today!

What all of the digital disruptors did fifteen years ago, and many other businesses have done since then, is develop the ability to create and improve digital customer experiences at pace. Nearly every customer experience is digital – at least in part. So creating great digital experiences will go a long way to creating great customer experiences. Sounds easy right?

However, what this actually means is they changed their culture, structure, KPIs, technology, skills and the nature of their business. Many organisations have beaten the path to becoming digital businesses – in fact, it is a well-worn path. When you set off on the journey you are no longer taking risks or heading out alone. There is a very clear playbook as to how to become a digital business today.

What Does a Digital Business Look Like?

If you are part of your organisation’s tech team and wondering how digital your business is, ask these questions:

- Do you mainly deploy new technology services with the Waterfall project methodology?

- Do all of the development work with the IT team (and not in business or customer teams)?

- Does it take months or years to deploy new services?

- Are your KPIs the same as they were 5-10 years ago?

If the answer to some or all of these questions is YES, then it is likely that you are working for a business that will not catch up with or get ahead of your competitors. You might have a few initiatives that see you make some ground on them – but innovation today is not about leaps and bounds – it is about continual improvement. If you catch up today but don’t have the ability to continually improve, you will have fallen behind again tomorrow…

The good news is it is never too late to start this journey. It typically starts from the top of your business – the CIO cannot make the entire business agile. The head of the digital cannot change the culture of the entire organisation. But the IT and digital teams can get the ball rolling by changing their structure and work processes. Start by moving some developers into the Customer Experience team (if you have one!). Stop funding projects and start funding squads, tribes and teams. Structure the team around the customer journey – or at least make it easier for customers to get value from the digital assets and services you offer. Hopefully, someone will notice the fact that the tech team is helping a business unit or team to operate with agility and they’ll start asking why they cannot have that same ability?

And by then the ball is rolling down the hill and you are on your way to being a digital business – and on your way to giving customers the products, services and experiences they demand today and tomorrow.