In this Insight, guest author Anupam Verma talks about how a smart combination of technologies such as IoT, edge computing and AI/machine learning can be a game changer for the Financial Services industry. “With the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.”

The number of IoT devices have now crossed the population of planet earth. The buzz around the Internet of Things (IoT) refuses to go down and many believe that with 5G rollouts and edge computing, the adoption will rise exponentially in the next 5 years.

The IoT is described as the network of physical objects (“things”) embedded with sensors and software to connect and exchange data with other devices over the internet. Edge computing allows IoT devices to process data near the source of generation and consumption. This could be in the device itself (e.g. sensors), or close to the device in a small data centre. Typically, edge computing is advantageous for mission-critical applications which require near real-time decision making and low latency. Other benefits include improved data security by avoiding the risk of interception of data in transfer channels, less network traffic and lower cost. Edge computing provides an alternative to sending data to a centralised cloud.

In the 5G era, a smart combination of technologies such as IoT, edge computing and AI/machine learning will be a game changer. Multiple uses cases from self-driving vehicles to remote monitoring and maintenance of machinery are being discussed. How do we see IoT and the Edge transforming Financial Services?

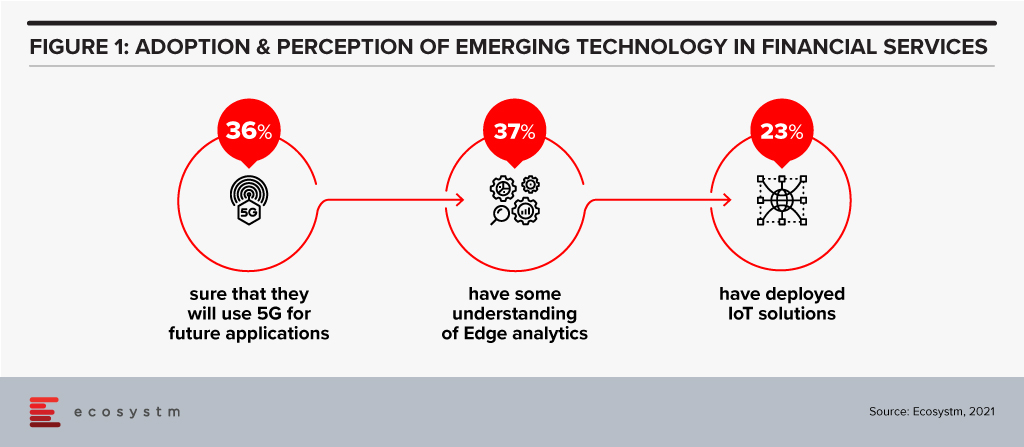

Before we go into how these technologies can transforming the industry, let us look at current levels of perception and adoption (Figure 1).

There is definitely a need for greater awareness of the capabilities and limitations of these emerging technologies in the Financial Services.

Transformation of Financial Services

The BFSI sector is increasingly moving away from selling a product to creating a seamless customer journey. Financial transactions, whether it is payment, transfer of money, or a loan can be invisible, and Edge computing will augment the customer experience. This cannot be achieved without having real-time data and analytics to create an updated 360-degree profile of the customer at all times. This data could come from multiple IoT devices, channels and partners that can interface and interact with the customer. A lot of use cases around personalisation would not be possible without edge computing. The Edge here would mean faster processing and smoother experience leading to customer delight and a higher trust quotient.

With IoT, customers can bank anywhere anytime using connected devices like wearables (smartwatches, fitness trackers etc). People can access account details, contextual offers at their current location or make payments without even needing a smartphone.

Use Cases of IoT & Edge in Financial Services

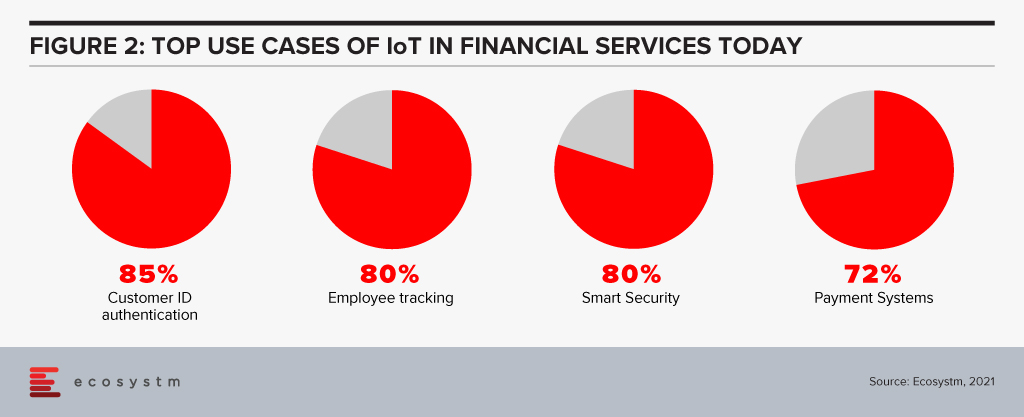

IT and Digital Leaders in Financial Services are aware of the benefits of IoT and there are some use cases that most of them think will help transform Financial Services (Figure 2).

However, there are many more potential use cases. Here are some use cases whose volume will only grow every day to fuel incessant data generation, consumption and processing at the Edge.

- Smart Homes. IoT devices like Alexa/Google Home have capabilities to become “bank in a speaker” with edge computing.

- In-Sync Omnichannels. IoT devices can be synced with other banking channels. A customer may start a transaction on an IoT device and complete it in a branch. Facial recognition can be used to identify the customer after he/she walks in and synced IoT devices will ensure that the transaction is completed without any steps repeated (zero re-work) thereby enhancing customer satisfaction.

- Virtual Relationship Managers. In a digital branch, the customer may use Virtual Reality (VR) headsets to engage with virtual relationship managers and relevant experts. Gamification using VR can be amazingly effective in the area of financial literacy and financial planning.

- Home and Auto Purchase. VR may also find use in home and auto purchase processes with financing built into it. The entire customer journey will have a much smoother experience with edge computing.

- Auto and Health Insurance. Companies can use IoT (device installed in the vehicle) plus edge computing to monitor and improve driving behaviour, eventually rewarding safety with lower premiums. The growth in electric mobility will continue to provide the basis for auto insurance. Companies can use wearables to monitor crucial health parameters and exercising habits. The creation of real-time dynamic rewards around it can change behaviour towards a healthier lifestyle. Awareness, longevity, rising costs and pandemic will only fuel this sector’s growth.

- Payments. Device to device contactless payment protocol is picking up and IoT and edge computing can create next-gen revolution in payments. Your EV could have an embedded wallet and pay for its parking and toll.

- Branch/ATM. IoT sensors and CCTV footage from branches/ATMs can be utilised in real-time to improve branch productivity as well as customer engagement, at the same time enhancing security. It could also help in other situations like low cash levels in ATMs and malfunctions. Sending live video streams for video analytics to the cloud can be expensive. By processing data within the device or on-premises, the Edge can help lower costs and reduce latency.

- Trading in Securities. Another area where response time matters is algorithmic trading. Edge computing will help to quickly process and analyse a large amount of data streaming real-time from multiple feeds and react appropriately.

- Trade Finance. Real-time tracking of goods may add a different dimension to the risk, pricing and transparency of supply chains.

Cloud vs Edge

The decision to use cloud or edge will depend on multiple considerations. At the same time, all the data from IoT devices need not go to the cloud for processing and choke network bandwidth. In fact, some of this data need not be stored forever (like video feeds etc). As a result, with the rise in the number of IoT devices and increasing financial access, edge computing will find its place in the sun and complement (and not compete) with cloud computing.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

More than ever before you are having to cater to digital-savvy customers and create a competitive edge through the customer experience (CX) that you provide. In this two-part feature, I explore the barriers organisations face in their goal to create a memorable CX; and what the organisations that are getting it right have in common.

Spend on digital services, technologies, platforms, and solutions is skyrocketing. As businesses adapt to a new normal, they are increasing their spend on digital strategies and initiatives well beyond the increase they witnessed in 2020 when all customer and employee experiences went digital-only. But many digital and technology professionals I meet or interview maintain that their digital experiences are poor – offering inconsistent and fragmented experiences.

The Barriers

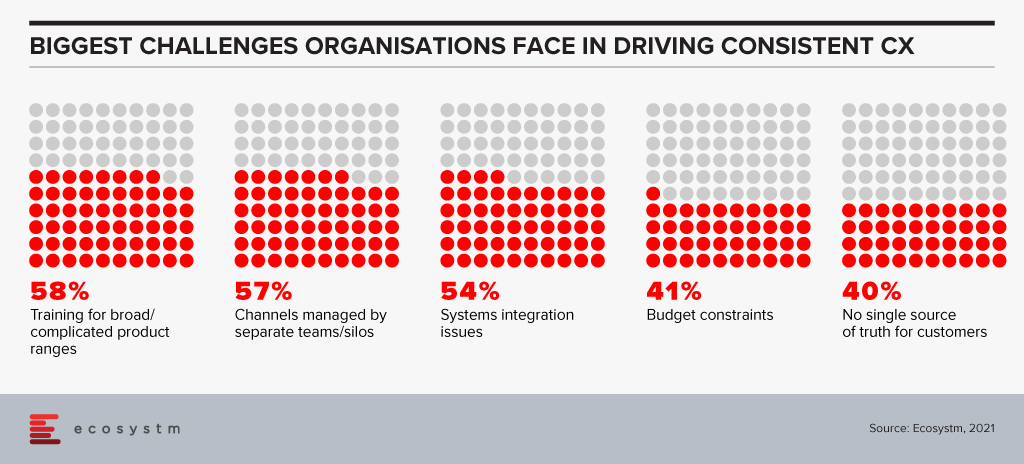

Digital, CX and tech leaders highlight their laundry list of challenges in getting their digital experiences to deliver a desired and on-brand customer experience:

A poorly informed view of the customer and their journey. Sometimes the customer personas and journey maps are simply wrong – they were developed by people with an agenda or a fixed idea of what problems need solving.

Inconsistent data. Too much, too little, or plain incorrect data means that automation or personalisation initiatives will fail. Poor access to data or lack of data sharing between teams, applications and processes means that businesses cannot even begin to build a consistent CX.

Too many applications and platforms. As digital initiatives took hold, technology teams witnessed an explosion of applications and platforms all conquering small elements of the digital journey. While they might be great at what they do, they sometimes make it impossible to create a simple and consistent customer journey. Some are beyond the control of the technology team – some are even introduced by partners and agencies.

Inconsistent content. For many businesses, content is at the heart of their digital experience and commerce strategy. But too often, that content is poorly planned, managed, and coordinated. Different teams and individuals create content; this content is then inconsistently delivered across customer touchpoints; the content is created for a single channel or touchpoint; and delivers to customers at the wrong stage of the journey.

Little co-ordination across channels. Contact centres, retail or other physical locations and digital teams often don’t sing from the same songbook. Not only is the customer experience inconsistent across different physical and digital touchpoints, but it may even be inconsistent across digital touchpoints – chat, web and mobile offer different experiences – even different parts of the web experience can be inconsistent!

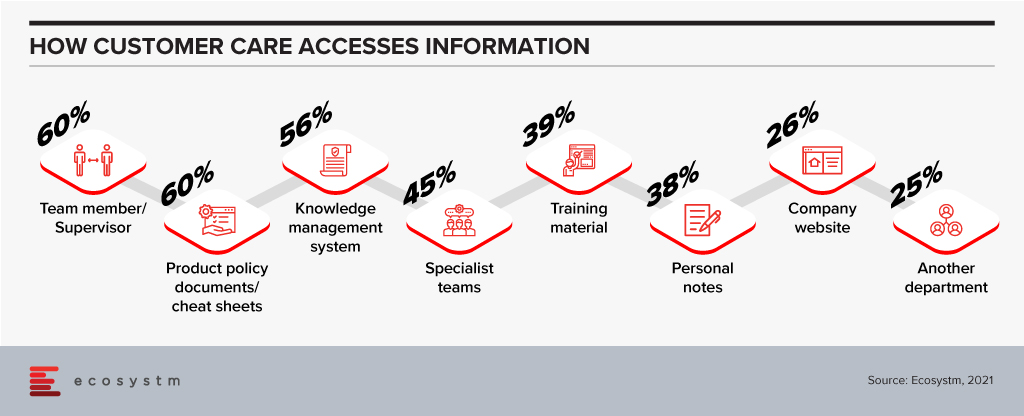

Knowledge is not shared between channels. Smart customers will “game” a company – finding the best offer across different customer touchpoints. But more often than not, inconsistent knowledge leads to very poor customer experiences. For example, a telecom provider might give different or conflicting information about their plans across web, mobile, contact centre and retail outlets; and with the increasing popularity of marketplaces, customers receive inconsistent product information when they deal with the brand directly than through the marketplace. Knowledge systems are often created to serve individual channels and are not trusted by customer service or retail representatives. We see this in Ecosystm data – when customer service agents are asked a question, they don’t know the answer to, the first place they look is NOT their Knowledge Management tool.

Poor prioritisation of customer pain points. Customer teams may find that it is easier to tackle the small customer challenges and score easy points – and just deprioritise the bigger ones that will take significant effort and require considerable change. Unifying the customer journey between the contact centre and digital is one big challenge that many businesses continue to delay.

And it gets worse… According to Ecosystm data, 55% of organisations consider getting board and management buy-in as their biggest CX challenge. This means that Chief Digital Officers, CX professionals and digital teams are still spending a disproportionate amount of time selling their vision and strategy to the senior management teams!

But some organisations are getting it right – creating a memorable digital experience that retains their customers and attracts more. I will talk about what is working for them in the next feature.

It is true that the Retail industry is being forced to evolve the experiences they deliver to their customers. However, if Retail organisations are only focused on creating digital experiences, they are not creating the differentiation that will be required to leap ahead of the competition.

It is time for Retail organisations to leverage data to empower multiple roles across the organisation to prepare for the different ways customers want to engage with their brands.

So what are the phases of customer engagement? How are companies such as Singapore Airlines and TikTok preparing for the future of Retail?

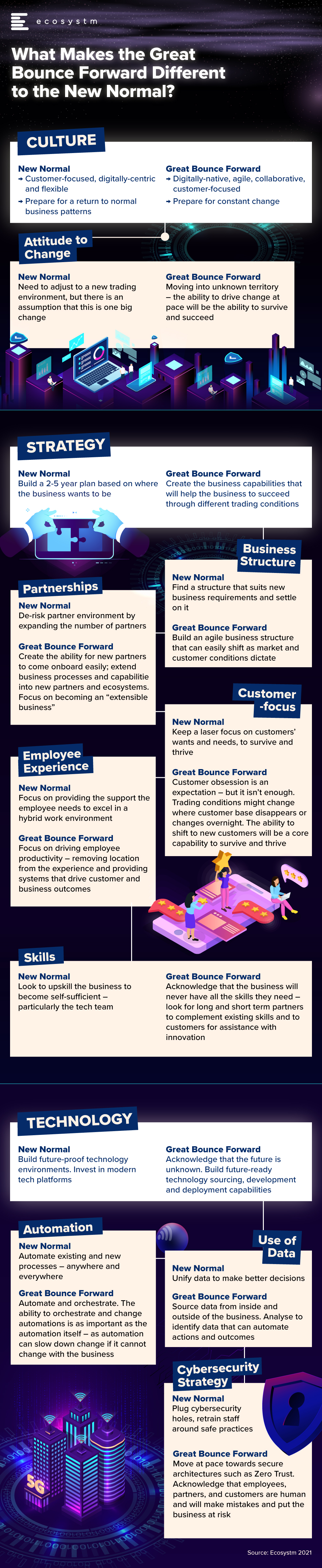

One of the main questions that I have faced over the past week, since I wrote the Ecosystm Insight – Welcome to the Great Bounce Forward – is “How is this different to the “New Normal”? Many have commented that the concept of the Great Bounce Forward is more descriptive and more positive than the term “New Normal” – but I believe they are different, and require different strategies and mindsets.

This is a brief summary of some of the major differences between the New Normal and the Great Bounce Forward. I look forward with excitement and some trepidation towards this future. One where business success will be dictated not only by our customer obsession, but also the ability of our business to pivot, shift, change and adapt.

I can’t tell you what will happen in the future – a green revolution? Another pandemic? A major war? A global recession? Market hypergrowth? All the people living life in peace? Imagine that…

What I can tell you is what your organisation needs to do to be able to meet all of these challenges head-on and set yourself up for success. And to me, that won’t look like the new normal. There is nothing normal about these business capabilities at all.

Customer Experience teams are focused on creating a great omnichannel experience for their customers – allowing customers to choose their preferred channel or touchpoint. And many of these teams are aware of the challenges of omnichannel – often trying to prise the experience from one channel into another. Too often we create sub-optimal experiences, forcing customers to work harder for the outcome than if they were using other channels.

I know there have been times when I have found it easier to jump in the car and drive to a store or service centre, rather than filling in a convoluted online form or navigating a complex online buying process. I constantly crave larger screens as full web experiences are often better than mobile web experiences (although perhaps that is my ageing eyes!).

One of the factors that came out in a study conducted by Ecosystm and Sitecore is that customers don’t just want personalised experiences – they want optimised experiences. They want to have the right experience on the right device or touchpoint. It is not about the same experience everywhere – the focus should be on optimising experiences for each channel.

We call this “opti-channel”.

Use an Opti-Channel Strategy to Guide Investment and Effort

This is what you are probably doing already – but by accident. I suggest you formalise that strategy. Design customer experiences that are optimised for the right channel or touchpoint – and personalised for each customer. Stop forcing customers into sub-optimal experiences because you were told to make every customer experience an omnichannel one.

The move towards opti-channel accelerates your ability to provide the best experience for each customer, as you ask the important question “Does this channel suit this experience for this customer?” before the fact – not after the experience has been designed. It also eliminates the rework of existing experiences for new channels and provides clear guidance on the next-best action for each employee.

There Will be Conflict Between Opti-Channel and Personalisation

The challenge for opti-channel strategies will be to align them to your personalisation strategy. How will it work when you have analytics driving your personalisation strategy that say customer X wants a fully digital experience but your opti-channel strategy says part of the digital experience is sub-standard? And the answer to this lies in understanding the scope of your experience creation – are you trying to improve the existing experience or are you looking to create a new improved experience?

- If you are improving the existing experience, then you have less license to shift transactions and customer between channels – even if it is a better experience.

- If you are creating a new experience, you have the opportunity to start again with the overall experience and prove to customers that the new experience is actually a better one.

For example, when airlines moved away from in-person check-in to self-check-in kiosks, there was an initial uproar from customers who had not yet experienced it – claiming that it was less personal and less human. But the reality is that the airlines took the check-in screen that the agents were using and made it customer-facing. Travellers can now see the seats and configuration and select what is best for them.

This experience was reinvented again when the check-in moved to web and mobile. By turning the screen around to the customer, the experience actually felt more human and personal – not less. And by scattering agents around the screens and including a human check-in desk for the “exceptions”, the airlines could continue to optimise AND personalise the experience as required.

Opti-Channel Opens Many New Business Opportunities

Your end-state experience should consider what is the best channel or touchpoint for each step in a journey – then determine the logic or ability to shift channels. Pushing customers from a chatbot to web chat is easy. Moving from in-store to online might be harder, but there are currently some retailers looking to merge the in-store and digital experience – from endless aisle solutions to nearly 100% digital in-store. Some shoe and clothing stores offer digital foot and body scans in-store that help customers choose the right size when they shop online. And we are beginning to see the rollout of “magic mirrors” – such as one retailer who has installed them in fitting rooms and you can virtually try different colours of the same item without actually getting them off the shelf.

Businesses are trying to change customer behaviour – whether it is getting them into stores or mainly shopping online or encouraging them to call the contact centre or to even visit a service centre. Creating reasons for why that might be a better option, while also providing scaled-back omnichannel options is a great way to meet the needs of existing customers, create brand loyalty and attract new customers to your company or brand.

Uniphore, a provider of Conversational Automation solutions, has announced their intention to acquire Jacada, an Israel-based autonomous customer experience solution provider. Jacada’s low-code/no-code platform will help Uniphore solve complex contact centre challenges using AI and automation. Jacada’s strengths include a low-code optimised interface and AI-enabled contact centre capabilities leading to automation across agent and customer engagements, enhanced knowledge-based guidance for agents and end-to-end analytics and insights.

Jacada has been in the market for around three decades and over time they have built various unified desktop and process optimisation products including RPA for customer service and support.

The acquisition follows Uniphore’s USD 140 million Series D funding round led by Sorenson Capital Partners in March 2021. Earlier this year, Uniphore acquired Emotion Research Lab to add AI and machine learning video capabilities that identify the emotion and engagement levels over video-based communications.

Growing Importance of Agent Assist Solutions

With agents facing pressure in offering customers satisfactory outcomes and at the same time having to manage the high volume of inbound transactions, Agent Assist solutions are high on the agenda for organisations. Remote working has made things even more complex where agents are cut off from their supervisors and not able to walk up to them to seek guidance. These “immediate challenges” have not yet been addressed in every contact centre even a year after the crisis. This presents a good opportunity for Uniphore to own the front and back-office integration piece. The back-office integration segment has become increasingly important as there is a need to fulfill customer requests by ensuring the conversation thread with back-office systems is followed through and communicated back to the agent. This need was heightened during the pandemic due to delays in product arrivals, in shipments, and other delays and miscommunication.

The big challenge also lies in making Agent Assist help the agent perform better and not make their lives more stressful! The design element of Agent Assist is critical. The solution must fit well into the other systems and applications such as CRM, Knowledge Management, and Speech Analytics. You don’t want another solution being pushed on to the agents when they are under pressure to meet customer demands during a 15-minute call.

Conversational Automation and Agent Assist must be evaluated carefully as you are integrating the solution into multiple environments with the clear objective of ensuring that agents only get the right information, in a manner that makes sense for them and at appropriate intervals.

The Growing Importance of Low-code No-code (LCNC)

As contact centres focus on business agility and pivoting fast to cope with sudden market shifts, organisations will benefit from moving programming closer to the contact centre – requiring very little assistance from IT teams.

Having a LCNC platform will now allow Uniphore to build front and back-office experiences in a multi-vendor environment. The need to use intelligent APIs to build workflows is high on the agenda and it helps eradicate the costly efforts and time spent on developers to further extract and build new capabilities at speed.

Jacada has been pushing their value proposition on RPA and Conversational Automation for some time now and this blends well with where Uniphore is going with AI and Automation in the contact centre space. The acquisition will also give Uniphore access to other contact centre technologies that will help them to compete better with a wider range of solutions. With the challenges in managing the agent experience, we can also expect the Workforce Experience Management (WEM) segment to play an important role and intersect with Agent Assist to manage and elevate the agent experience.

Many years ago – back in 2003 – I spent some quality time with BMC at their global analyst event in Phoenix, Arizona and they introduced the concept of “Business Service Management” (BSM). I was immediately a convert – that businesses can focus their IT Service Management initiatives on the business and customer services that the technology supports. Businesses that use BSM can have an understanding of the impact and importance of technology systems and assets because there is a direct link between these assets and the systems they support. A router that supports a customer payment platform suddenly becomes a much higher priority than one that supports an employee expense platform.

But for most businesses, this promise was never delivered. Creating a BSM solution became a highly manual process – mapping processes, assets, and applications. Many businesses that undertook this challenge reported that by the time they had mapped their processes, the map was out of date – as processes had changed; assets had been retired, replaced, or upgraded; software had been moved to the cloud or new modules had been implemented; and architectures had changed. Effectively their BSM mapping was often a pointless task – sometimes only delivering value in the slow to change systems – back-end applications and infrastructure that delivers limited value and has a defined retirement date.

The Growth of Digital Business Strategies

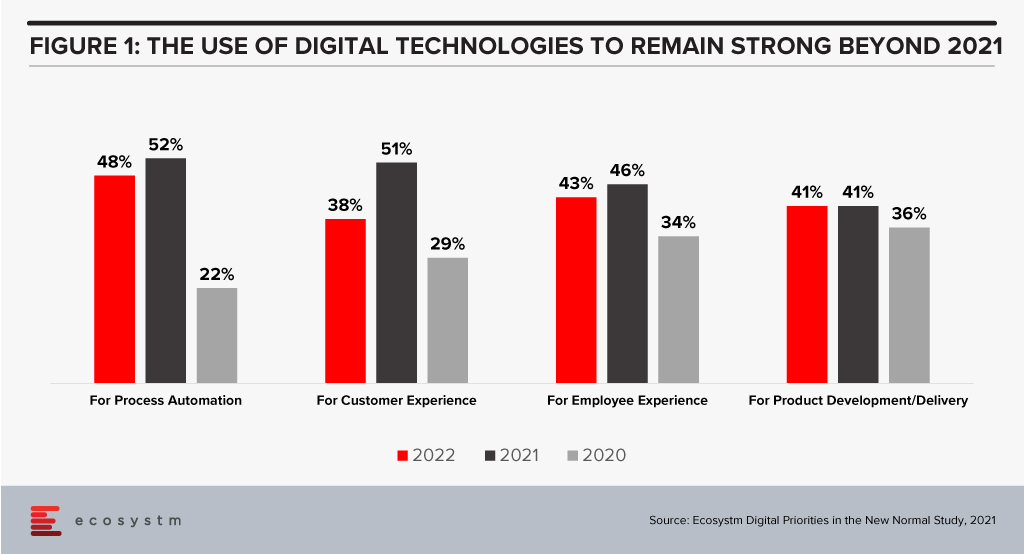

Our technology systems are becoming more important than ever as digital business strategies are realised and digital interactions with customers, employees, and partners significantly increase. Many businesses expect their digital investments to remain strong well into 2022 (Figure 1). More than ever, we need to understand the link between our tech systems and the business and customer services they support.

I recently had the opportunity to attend a briefing by ServiceNow regarding their new “AI-Powered Service Operations” that highlighted their service-aware CMDB – adding machine learning to their service mapping capabilities. The upgraded offering has the ability to map entire environments in hours or minutes – not months or weeks. And as a machine learning capability, it is only likely to get smarter – to learn from their customers’ use of the service and begin to recognise what applications, systems, and infrastructure are likely to be supporting each business service.

This heralds a new era in service management – one where the actual business and customer impact of outages is known immediately; where the decision to delay an upgrade or fix to a known problem can be made with a full understanding of the impacts. At one of my previous employers, email went down for about a week. It was finally attributed to an upgrade to network equipment that sat between the email system and the corporate network and the internet. The tech teams were scratching their heads for days as there was no documented link between this piece of hardware and the email system. The impact of the outage was certainly felt by the business – but had it happened at the end of the financial year, it could have impacted perhaps 10-20% of the business bookings as many deals came in at that time.

Being able to understand the link between infrastructure, cloud services, applications, databases, middleware and business processes and services is of huge value to every business – particularly as the percentage of business through digital channels and touchpoints continues to accelerate.

Back in 2019 – when life was simpler and customers only expected minor miracles from the brands they interacted with – personalisation of the customer experience (CX) was a “good idea but the time has not yet come” for the majority of marketing and CX professionals.

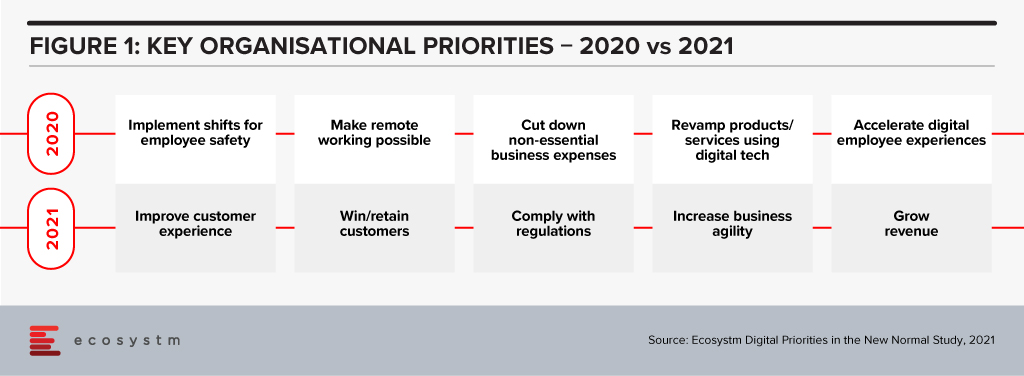

Fast forward 24 months and the world has changed – in more ways than we could have imagined! For a start, CX dropped off the top business priority during 2020 as businesses adapted to the changing market and employee experiences. But as some economies start to create a new sense of normal, CX has returned to the top of the list of business priorities (Figure 1) – renewing pressure on CX teams to create great experiences for customers.

In 2020 many marketing teams went back to the drawing board to create truly meaningful customer experiences. Suddenly “trust” was a core expectation of a brand, and that lens allowed marketers and CX teams to rethink what a personalised experience looks like. It is no longer about selling more products and creating more chances for commerce – it is now about creating an experience that makes brands easy to deal with. It is about understanding the customer and creating an optimised experience when they want or need to interact with the brand. A great personalised experience feels normal today – it has lost the “creepy” edge and is now about the brand giving customers the service, products, or levers that they need when and where they need them.

For some brands and customers, a personalised experience is about getting out of the way of customers and just giving them the outcome they desire. For others it is about creating a memorable journey. Some customers require that extra hand holding along the way and need to be nudged in the right direction, and just need to be left alone to make their decisions – not requiring that extra EDM, alert or message.

In some sectors – such as Banking and eCommerce – if you are not personalising your CX you are a long way behind, but in others, such as Government and Insurance, personalisation is only beginning to gain traction today, and will see slow and steady growth over the next few years.

Good Data is Key to a Great Personalisation Strategy

Lack of data is the primary reason personalisation fails and why some marketing teams have abandoned their personalisation efforts. The right data may not exist completely within your business – you may need to partner or work with ecosystem providers to create a complete view of your customers – and new restrictions around the use of cookies is making this harder to achieve. Forward thinking businesses have already forged partnerships with third parties and partners to share relevant data to help them create the personalised experience their customers demand.

Personalisation Should Apply Across the Customer Journey

A clear understanding of brand values, customer desires and ideal customer journeys is also important to ensure personalised experiences meet the needs of customers. Creating a personalised experience that deviates from brand values means that either brands don’t understand their customers, or customer experience professionals don’t understand their brands (or both!).

Personalisation needs to focus on the entire customer journey – from prospect through to customer and even through to churn. While you have significantly more data about your customers than your prospects, a personalised experience for non-customers is still possible and sets the scene for better and easier CX once your prospects take the longer journey with your brand. Creating a personalised churn experience – making the departure from your brand memorable, friendly and easy – provides the perfect springboard for return and tells your customers that you care about them through the entire journey.

Build a Proof of Concept for Personalisation

If you have not yet started personalising your customer’s experience, now is the perfect time to build a Proof of Concept (POC) demonstrating the business and customer outcomes you can achieve. This will help the CX and/or marketing teams to understand what data you need to collect from existing systems and processes – or source externally to create the desired experience. Initially your personalisation experience may target a limited number of key personas – but it should have the capability to roll out to all customers and/or prospects, eventually considering many scenarios and requirements. It should continue to learn and adapt. Too many businesses discovered during the pandemic that static personalisation programs will fail when market conditions change.

The POC can provide the data that your senior leadership will need to deepen their investments in and think of personalisation as a business capability – not a single project. They can demonstrate the ROI (or lack of return) and will help to guide the larger spend should the POC be a success.

Invest in Behavioural Science Skills

Building a successful personalisation strategy often goes beyond simply listening to the experts within the business and even listening to your customers. Often your customers don’t know what affects their behaviour – and will mis-report motivations or mis-attribute actions. It is important to understand the science behind behaviour – what is possible, what can work, what is guidance and what is coercion. These experts, along with your legal or privacy teams, can help to set up the guide rails for the personalisation program to operate within, and help you create customer journeys where customers can achieve their desired outcomes.

Target Consent as a Key Customer KPI

Consent is a key enabler of deep personalisation capabilities. While some level of personalisation without formal consent can be created, the real benefits of personalised journeys come with consent to use customer data to offer better services. Many businesses ask for consent in the sign-up process, but often it feels like wishful thinking – not a serious attempt to offer a better customer experience. Businesses that make “Consent to Use Data” a CX KPI think more broadly of the customer journey, the brand promise and what that means to levels of consent. It isn’t a “tick-a-box” activity at sign-up – it considers what the customer wants to get out of the engagement or a longer relationship. It focuses on helping customers achieve their instant goals more effectively and the benefits the data can bring to nurture a longer-term relationship.

Businesses that seek a higher level of consent use more tangible outcomes, simpler language and no “sweeping statements” in their consent request. They are explicit how they will use data and what data they will use. Sometimes they don’t even ask for consent to use data at sign-up – they ask after they have formed a relationship and the customer has developed a level of trust in the brand or company.

Start Your Personalisation Journey Today

Your competitors are already thinking about personalisation – some have even implemented personalised elements within their existing or new customer journeys. Personalisation – while easier than ever – is still a significant capability to build within your business. You are likely to need new technology tools and/or platforms, new skills, and new budgets. The impact for your customers – and therefore for your business – can be significant. And the impact of no action can potentially be damaging. Start your personalisation journey today to help your business take the next step towards becoming a customer-obsessed, agile, and digital business.

In this first edition of Ecosystm RNx we rank the Top 10 Global Cloud Vendors.

Ecosystm RNx is an objective vendor ranking based on in-depth and quantified ratings from technology decision-makers on the Ecosystm platform.

If you are an technology user, this Cloud Vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are a Cloud Vendor, this is an opportunity to understand how your customers rate you on capabilities and their overall customer experience.