Two weeks ago, Michael Dell made the big announcement that Dell Technologies would spin off their shareholding in VMware, leading to a share price spike for both companies. A lot has already been written about the move – we would like to highlight a market-based view which we feel will be significant for the two companies going forward.

First let us break down the facts around the deal:

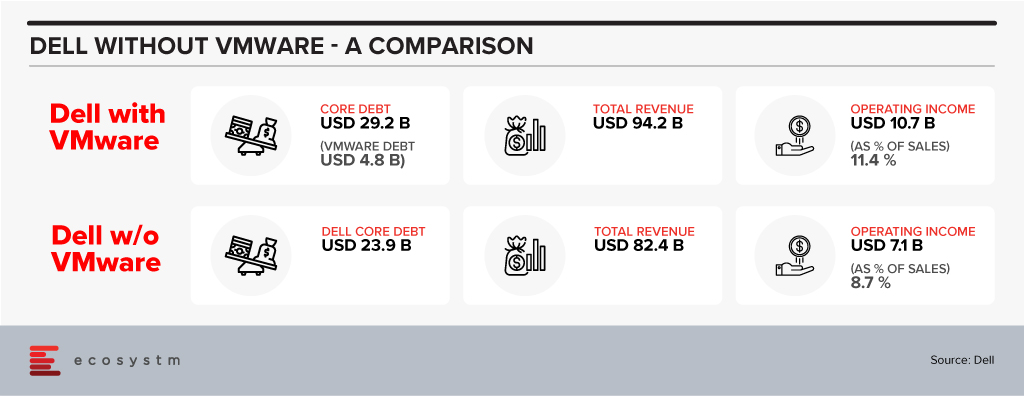

As has been analysed threadbare the deal reduces the total debt Dell is carrying and will even reduce the ratio of Dell debt to EBITDA. As a result, it is highly likely that Dell’s credit rating will move up from their current BB+ level to investment grade – which can have a lot of implications for future capital raising. There is also a buzz in the market that Dell Technologies may also sell off Boomi soon and write down another USD 3 Billion approximately in debt.

It is interesting to note that the company has been willing to let go off VMware even though it will dilute their profitability ratios – VMWare business being obviously more profitable than Dell’s traditional businesses which are heavily based on products.

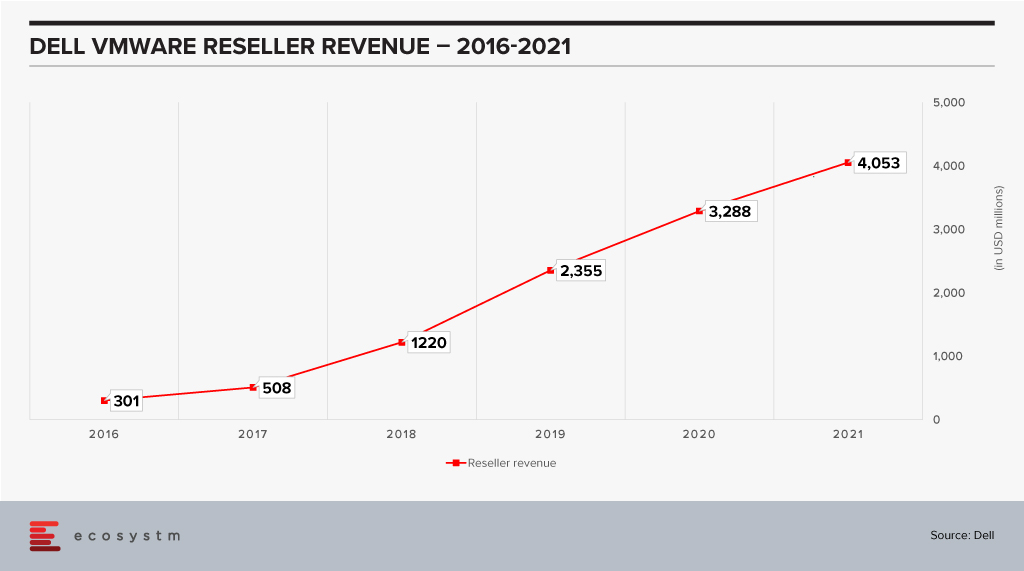

The last few years has seen Dell reselling a fair amount of VMware products. From a number of perspectives Dell has been a key reseller for VMware and now contributes almost 34% of VMware’s revenues.

This chart is a testament to the power of execution that is inherent within Dell. This performance was aided by market growth – but even then it is remarkable how Dell has been able to scale up taking VMware to their customers. The two companies have very different sales cycles. A VMware sale typically has a longer cycle with a completely different set of touchpoints from the boxes that Dell is so good at selling – which have shorter cycles. The sales cycle for EMC products is closer to VMware’s which would have helped. The sales of the VXRail hyperconverged appliance have also jumped in recent times and this would have driven an equivalent spike in VMware revenues. It is still a remarkable achievement to be able to bring these three diverse groups together and grow revenue.

Market Impact of the Spin-Off

Does it make sense then for VMware to part with their largest reseller? Would it not be better for VMware to continue to drive this and use Dell’s execution skills to drive more growth? Data suggests that there could be another twist to this story.

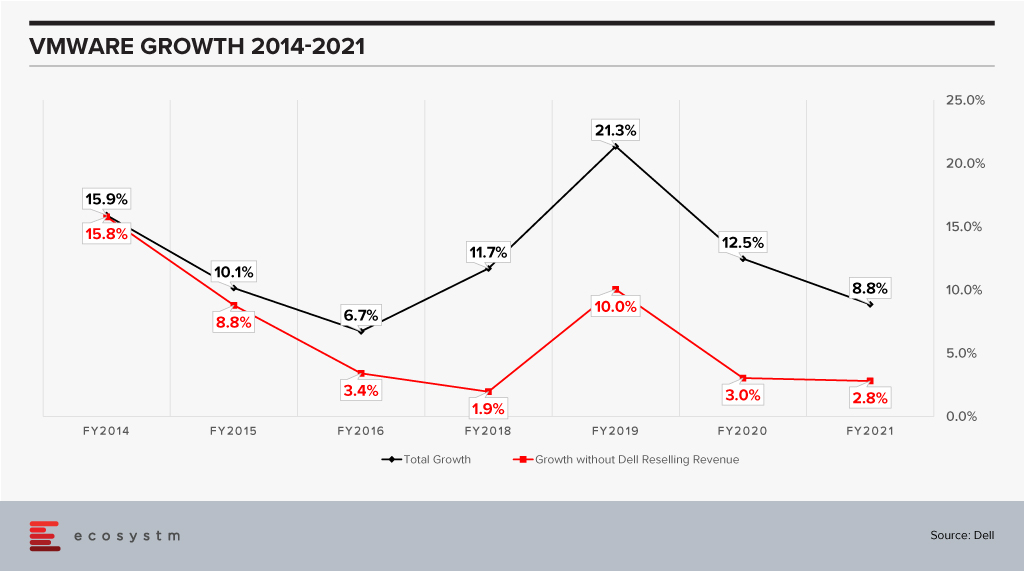

VMware has been growing impressively as a company when one looks at the black line and while the growth has slowed in percentage terms, this is on a much higher revenue base. FY2021 revenue is close to 2x the revenue in FY2014. However, when one considers it without the Dell reselling revenue (the red line) it looks a lot less impressive especially in the last couple of years when it is an anemic 3%. When comparing this growth we also see a slowdown of sorts in recent years for VMware.

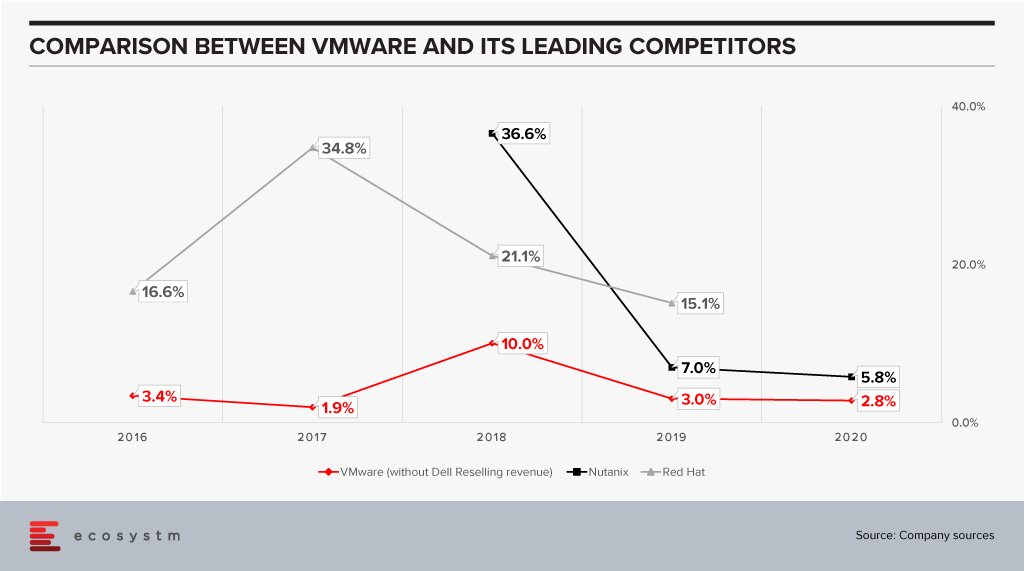

Til Dell acquired EMC – and VMware in consequence – they were working closely with other vendors such as Nutanix and driving solid growth for them. As they pivoted to doing more with VMware, did this then mean that other vendors – of either bare metal or cloud – drifted away from VMware?

Anecdotal evidence suggests that vendors such as HPE became more cautious and tried to diversify their business. It is entirely possible that if we looked at VMware as two separate businesses – one with Dell and one independent – the independent business has been losing share in the last few years.

The optical separation from Dell may then help VMware in rebuilding stronger relationships with the other players in the market including the hyperscalers. This may fuel further VMware growth. To do that VMware will have to manage a balancing act:

- On the one hand keep growing their reseller revenue with Dell. They are on a good wicket so far and need to make sure this continues. While the revenue from appliances – which come loaded with VMware – is a sure-fire proposition, other growth needs to be harvested carefully. Dell has a multitude of offerings and taking their eyes of the VMware ball is super easy.

- Build trust and closer ties with the other vendors to keep driving revenue. VMware’s leadership in the market means they already have ties with other industry leaders like HPE, AWS and so on. These will need to become much deeper; VMware will need to build the trust that they will give these vendors equal status even as they are building new appliances with Dell.

The one complicating factor here is that Michael Dell remains the Chairman of the Board of VMware. This may give other vendors pause and they may still want to keep their options open instead of putting all eggs into the VMware basket.

Ecosystm Comments

VMware is at a fairly critical inflection point in their business. The growth of cloud technologies still bodes well for virtual machines which has been their mainstay, but this is also likely to drive growth for more containerisation. They have great products for that part of the business also. However, as container adoption is likely to explode VMware would not want vendors to shift, to say Red Hat, and develop deeper partnerships with them or other competitors. They would like to keep the vendors on VMware – be it a virtual machine or a container. One does feel the future battle for VMware really rests on how well they will be able to grow in the container space. This will have to be done while continuing to innovate to keep the lead in the virtual machine space. Doing it will be quite a feat!!

Finally, what then of Dell? The company seems to have a talent for running businesses which are in long-term secular decline – but running those businesses well. Their PC business is delivering almost 7% operating income and has continued to show growth. The PC market last year was on fire thanks to the pandemic which dramatically increased the demand for devices – growth was double digits for a market which has declined almost every year since 2011. As Dell is fond of saying the PC industry has sold over 5 billion machines since the PC was declared dead!

The server market seems to have stagnated over the last couple of years which is a bit of a surprise given the growth in cloud. Dell’s revenue has declined two years in a row pointing to possible issues which need fixing in that part of the business.

As the company focuses on these key challenges in the market it probably makes sense for them to lower their debt and earn more freedom to operate. One never knows – given the number of surprises that Michael Dell has engineered over the last decade such as taking Dell private, acquiring EMC, stabilising it, then going public again, making a windfall in the process – if he has some other rabbits yet to be pulled out of his hat!!!

Access insights on adoption of key Cloud solutions in regions/countries and industries. Insights include drivers and inhibitors of adoption, budget allocation, and preferred implementation partners.

Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.