Two weeks ago, Michael Dell made the big announcement that Dell Technologies would spin off their shareholding in VMware, leading to a share price spike for both companies. A lot has already been written about the move – we would like to highlight a market-based view which we feel will be significant for the two companies going forward.

First let us break down the facts around the deal:

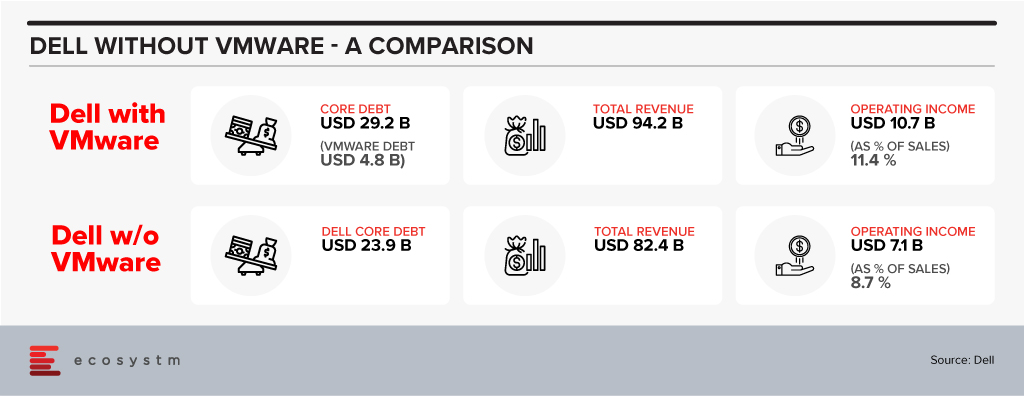

As has been analysed threadbare the deal reduces the total debt Dell is carrying and will even reduce the ratio of Dell debt to EBITDA. As a result, it is highly likely that Dell’s credit rating will move up from their current BB+ level to investment grade – which can have a lot of implications for future capital raising. There is also a buzz in the market that Dell Technologies may also sell off Boomi soon and write down another USD 3 Billion approximately in debt.

It is interesting to note that the company has been willing to let go off VMware even though it will dilute their profitability ratios – VMWare business being obviously more profitable than Dell’s traditional businesses which are heavily based on products.

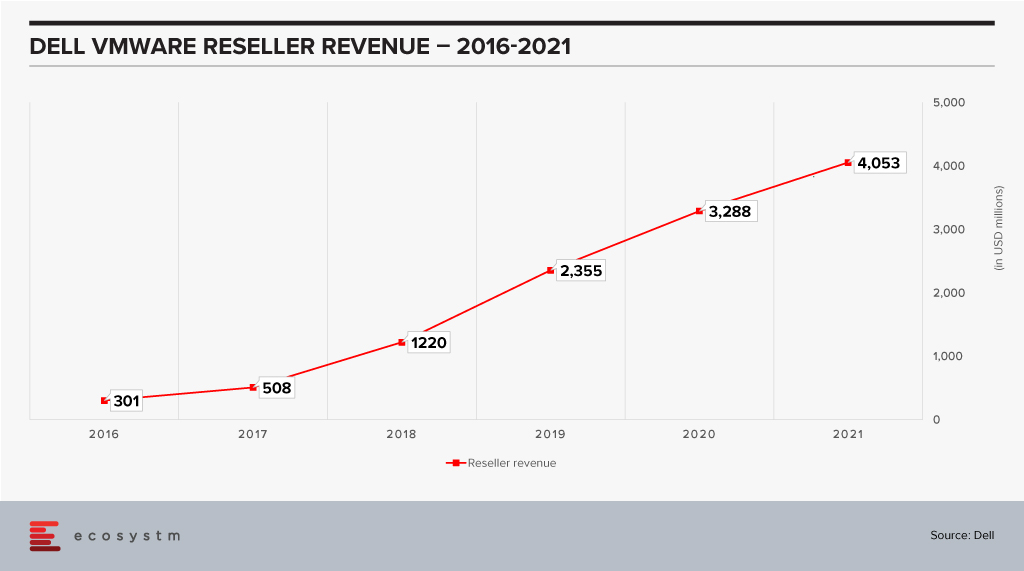

The last few years has seen Dell reselling a fair amount of VMware products. From a number of perspectives Dell has been a key reseller for VMware and now contributes almost 34% of VMware’s revenues.

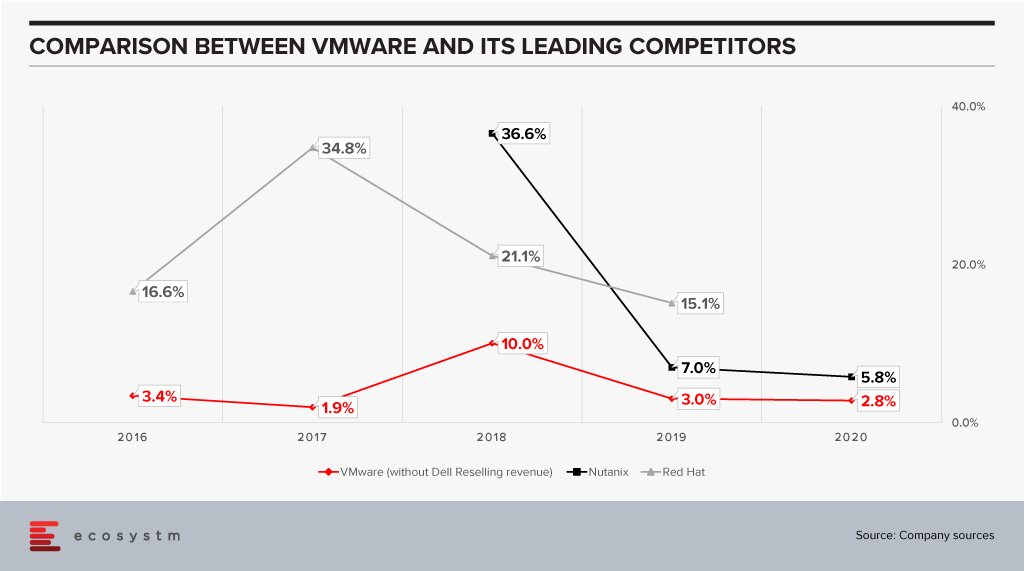

This chart is a testament to the power of execution that is inherent within Dell. This performance was aided by market growth – but even then it is remarkable how Dell has been able to scale up taking VMware to their customers. The two companies have very different sales cycles. A VMware sale typically has a longer cycle with a completely different set of touchpoints from the boxes that Dell is so good at selling – which have shorter cycles. The sales cycle for EMC products is closer to VMware’s which would have helped. The sales of the VXRail hyperconverged appliance have also jumped in recent times and this would have driven an equivalent spike in VMware revenues. It is still a remarkable achievement to be able to bring these three diverse groups together and grow revenue.

Market Impact of the Spin-Off

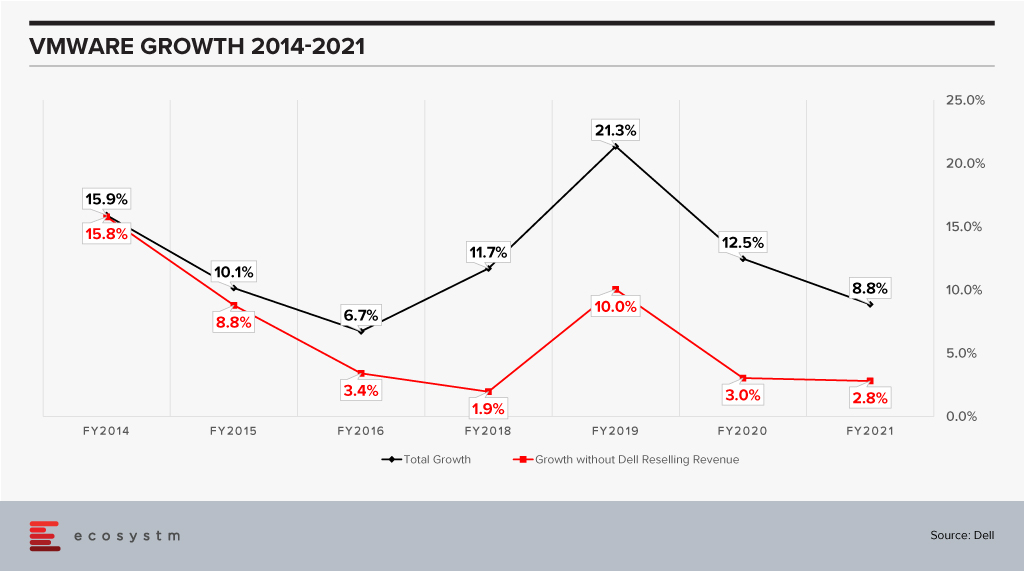

Does it make sense then for VMware to part with their largest reseller? Would it not be better for VMware to continue to drive this and use Dell’s execution skills to drive more growth? Data suggests that there could be another twist to this story.

VMware has been growing impressively as a company when one looks at the black line and while the growth has slowed in percentage terms, this is on a much higher revenue base. FY2021 revenue is close to 2x the revenue in FY2014. However, when one considers it without the Dell reselling revenue (the red line) it looks a lot less impressive especially in the last couple of years when it is an anemic 3%. When comparing this growth we also see a slowdown of sorts in recent years for VMware.

Til Dell acquired EMC – and VMware in consequence – they were working closely with other vendors such as Nutanix and driving solid growth for them. As they pivoted to doing more with VMware, did this then mean that other vendors – of either bare metal or cloud – drifted away from VMware?

Anecdotal evidence suggests that vendors such as HPE became more cautious and tried to diversify their business. It is entirely possible that if we looked at VMware as two separate businesses – one with Dell and one independent – the independent business has been losing share in the last few years.

The optical separation from Dell may then help VMware in rebuilding stronger relationships with the other players in the market including the hyperscalers. This may fuel further VMware growth. To do that VMware will have to manage a balancing act:

- On the one hand keep growing their reseller revenue with Dell. They are on a good wicket so far and need to make sure this continues. While the revenue from appliances – which come loaded with VMware – is a sure-fire proposition, other growth needs to be harvested carefully. Dell has a multitude of offerings and taking their eyes of the VMware ball is super easy.

- Build trust and closer ties with the other vendors to keep driving revenue. VMware’s leadership in the market means they already have ties with other industry leaders like HPE, AWS and so on. These will need to become much deeper; VMware will need to build the trust that they will give these vendors equal status even as they are building new appliances with Dell.

The one complicating factor here is that Michael Dell remains the Chairman of the Board of VMware. This may give other vendors pause and they may still want to keep their options open instead of putting all eggs into the VMware basket.

Ecosystm Comments

VMware is at a fairly critical inflection point in their business. The growth of cloud technologies still bodes well for virtual machines which has been their mainstay, but this is also likely to drive growth for more containerisation. They have great products for that part of the business also. However, as container adoption is likely to explode VMware would not want vendors to shift, to say Red Hat, and develop deeper partnerships with them or other competitors. They would like to keep the vendors on VMware – be it a virtual machine or a container. One does feel the future battle for VMware really rests on how well they will be able to grow in the container space. This will have to be done while continuing to innovate to keep the lead in the virtual machine space. Doing it will be quite a feat!!

Finally, what then of Dell? The company seems to have a talent for running businesses which are in long-term secular decline – but running those businesses well. Their PC business is delivering almost 7% operating income and has continued to show growth. The PC market last year was on fire thanks to the pandemic which dramatically increased the demand for devices – growth was double digits for a market which has declined almost every year since 2011. As Dell is fond of saying the PC industry has sold over 5 billion machines since the PC was declared dead!

The server market seems to have stagnated over the last couple of years which is a bit of a surprise given the growth in cloud. Dell’s revenue has declined two years in a row pointing to possible issues which need fixing in that part of the business.

As the company focuses on these key challenges in the market it probably makes sense for them to lower their debt and earn more freedom to operate. One never knows – given the number of surprises that Michael Dell has engineered over the last decade such as taking Dell private, acquiring EMC, stabilising it, then going public again, making a windfall in the process – if he has some other rabbits yet to be pulled out of his hat!!!

Access insights on adoption of key Cloud solutions in regions/countries and industries. Insights include drivers and inhibitors of adoption, budget allocation, and preferred implementation partners.

2020 was a strange year for retail. Businesses witnessed significant disruption to supply chains, significant swings in demand for products (toilet paper, puzzles, bikes etc!) and then sometimes incredible growth – as disposable income increased as many consumers are no longer taking expensive holidays. Overall, it was a mixed year, with many retailers closing down and others reporting record sales. The grocery sector boomed – with many restaurants and fast-food providers closed, sometimes the supermarkets were some of the few remaining open retailers.

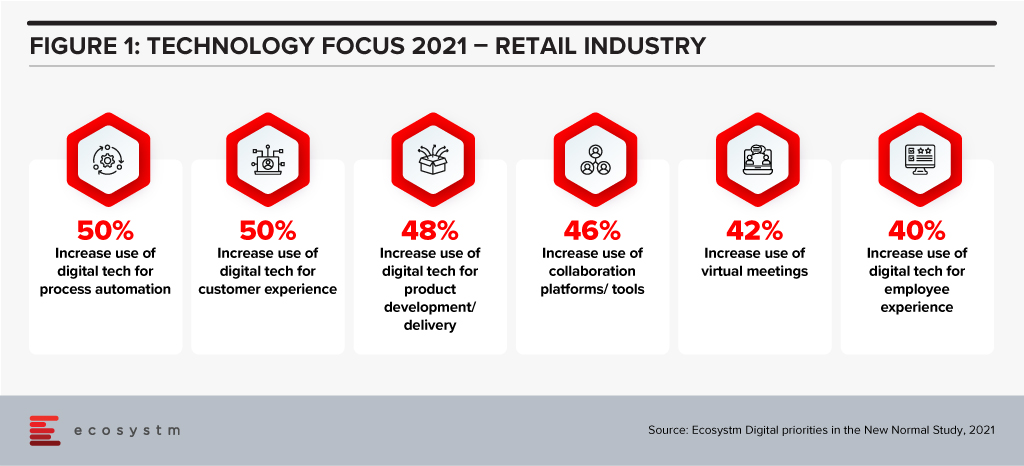

For many retailers, technology has become a key enabler to their transformation, survival and success (Figure 1).

Woolworths, Australia’s largest retailer, operates across the grocery, department store, drinks, and hospitality sectors. They hold a significant market share in most markets that they operate in. The company had a strong 2019/20 (financial year runs from July 2019 to June 2020) with sales up 8% – and in the first half of the 2020/21 financial year, sales were up nearly 11%. But the company is not resting on its laurels – one of its 6 key priorities is to “Accelerate Digital, eCom and convenience for our increasingly connected customers”. This requires more than just a deep technology investment, but a new culture, new skills, and new ways of working.

Woolworths’ Employee Focus

Woolworths has committed to invest AUD 50 million in upskilling and reskilling their employees in areas such as digital, data analytics, machine learning and robotics over the next three years. The move comes as a response to the way the Retail industry has been disrupted and the need to futureproof to stay relevant and successful. The training will be provided through online platforms and through collaborations with key learning institutions.

The supermarket giant is one of Australia’s largest private employers with more than 200,000 employees. Under Woolworths’ ‘Future of Work Fund’ their staff will be trained across supply chain, store operations, and support functions to enhance delivery and decision-making processes. The retailer will also create an online learning platform that will be accessible by Woolworths employees as well as by other retail and service companies to support the ecosystem. Woolworths has plans to upskill their staff in customer service abilities, leadership skills and agile ways of working.

Woolworths’ upskilling program will also support employees who were impacted by Woolworths planned closures of Minchinbury, Yennora, and Mulgrave distribution centres due in 2025.

Woolworths’ Tech Focus

Woolworths has been ramping up their technology investments and having tech-savvy employees will be key to their future success. In October 2020, Woolworths deployed micro automation technology to revamp their eCommerce facility in Melbourne to speed up the fulfilment of online grocery orders, and front and back-end operations. Woolworths also partnered with Dell Technologies in November 2020 to bring together their private and public cloud onto a single platform to improve mission-critical processes, applications and support inventory management operations across its retail stores.

Future of Work

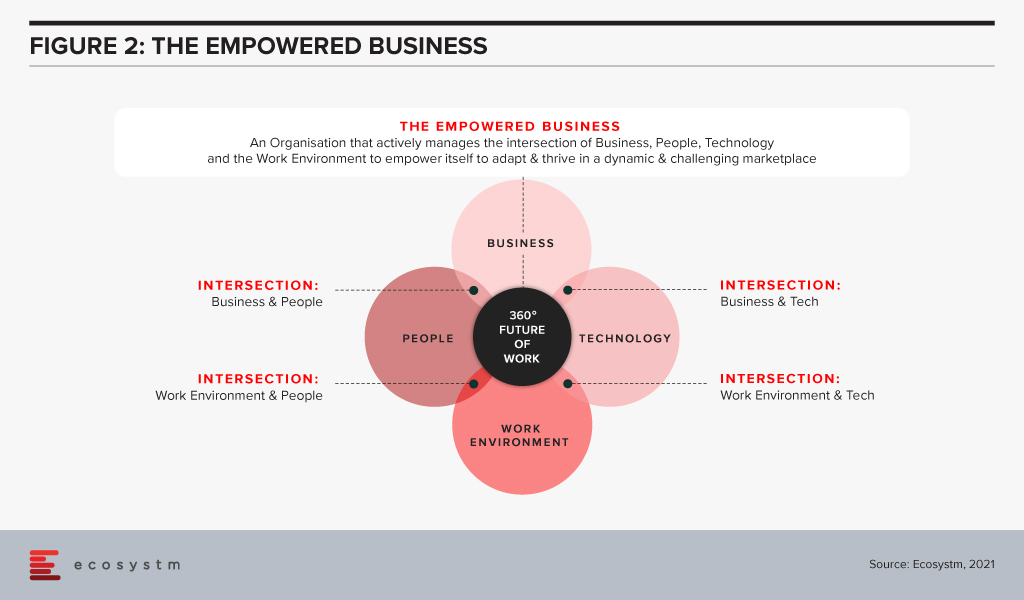

For many years, Ecosystm has been advising our clients to invest more in the skills of the business. Every business will be using more cloud next year than they are this year; they will suffer more cybersecurity incidents; they will use more AI and machine learning; they will automate more processes than are automated today. More of their customer engagements will be digital, and more insight will be required to drive better outcomes for customers and employees. This all needs new skills – or more people trained on skills that some in the business already understand. But too many businesses don’t train in advance – instead waiting for the need and paying external consultants or expensive new hires for their skills. Empowered businesses – ones that are creating a future-ready, agile business – invest in their people, work environment, business processes and technology to create an environment where innovation, transformation and business change are accepted and encouraged (Figure 2).

Empowered businesses can adapt to new challenges, new market conditions and respond to new competitive threats. By taking these steps to upskill and empower their employees, Woolworths is building towards empowering their own business for long term success.

Transform and be better prepared for future disruption, and the ever-changing competitive environment and customer, employee or partner demands in 2021. Download Ecosystm Predicts: The top 5 Future of Work Trends For 2021.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in mergers and acquisition (M&As) activities in the cybersecurity market. Like the consolidation activity in previous booms (such as digital media and web services in the early 2000s), the cybersecurity market is booming globally and creating opportunities for cashed up vendors and private equity firms. The fragmented security market has thousands of vendors and consultancies globally. Every day a swathe of new start-ups announces their ground-breaking new technology. Coupled with significant investments globally in tertiary education and industry certifications for a growing workforce, the next generation of cybersecurity entrepreneurs are entering with force.

Earlier this month, a consortium led by private equity firm Symphony Technology Group (STG) entered into an agreement with Dell Technologies to acquire RSA for an estimated amount of USD 2 billion. Dell Technologies had expressed interest in selling RSA in November 2019, and industry sources say that the deal will be finalised at more than their initial expectations.

Dell has been focusing on their partner program and on simplifying their product portfolio offerings. The Dell Technologies Partner Program announced last year, allows enterprises to seamlessly access partner products and solutions. Regardless of the partner, all solutions under the Dell portfolio count toward the tier status and tier revenue requirements for clients. Selling RSA allows them to streamline their product portfolio and by their own assertion, Dell has not lost focus on the significance of cybersecurity. They reinforced their commitment to build automated and intelligent security into infrastructure, platforms and devices. Claus Mortensen, Principal Analyst Ecosystm says, “Dell never really figured out what to do with RSA or how to position RSA’s products relative to Dell’s and VMWare’s own products. For example, Dell has its own endpoint protection product with SecureWorks and this has a great deal of overlap with RSA.”

RSA has been one of the pathbreakers in the cybersecurity market with their SecurID offering. They also host the largest security conference. RSA Conference gets together leading experts from across the industry to discuss the current trends and challenges, as well as shape the industry through innovations. Talking about the impact of the acquisition on RSA’s brand image, Mortensen says, “It depends on what STG intends to do with the company going forward. Arguably, RSA has been a bit in the shadows of previous owners – EMC and Dell – but if the new owners have a distinct plan for RSA, the brand will benefit”.

The members of the consortium acquiring RSA is interesting in its diversity. It includes the Ontario Teachers’ Pension Plan Board (Ontario Teachers’) and AlpInvest, another private equity firm. STG’s recent acquisitions include RedSeal, a security risk management provider. Mortensen predicts that the key player in this consortium will be STG, who will bring the know-how as well as money to the table. “Ontario Teachers’ and AlpInvest appear to primarily be financial backers. In fact, less involved these two partners are in the management of RSA, the easier it will be to secure a steady future focus for the company.”

As Ecosystm has observed previously, private equity firms will play a role in consolidating the cybersecurity market. “RSA is an almost textbook candidate for an equity firm or an investment bank takeover – a company with a good line of products but with a lack of strategic focus or leadership,” says Mortensen. “If STG can provide that focus – and from that USD 2 billion payment, one would assume that they can – they should have a good chance of increasing the value of RSA. If not, chances are that RSA’s products will be sold off piecemeal in the years to come.”