The impact of AI on Customer Experience (CX) has been profound and continues to expand. AI allows a a range of advantages, including improved operational efficiency, cost savings, and enhanced experiences for both customers and employees.

AI-powered solutions have the capability to analyse vast volumes of customer data in real-time, providing organisations with invaluable insights into individual preferences and behaviour. When executed effectively, the ability to capture, analyse, and leverage customer data at scale gives organisations significant competitive edge. Most importantly, AI unlocks opportunities for innovation.

Read on to discover the transformative impact of AI on customer experiences.

Click here to download ‘Customer Experience Redefined: The Role of AI’ as a PDF

The Retail industry has faced significant challenges in recent times. Retailers have had to deliver digital experiences and delivery models; navigate global supply chain disruptions; accommodate the remote work needs of their employees; and keep up with rapidly changing customer expectations. To remain competitive, many retailers have made significant investments in technology.

However, despite these investments, many retailers have struggled to create market differentiation. The need for innovation and constant evolution remains.

As retailers cope with hypersonalisation trends, supply chain vulnerabilities, and the rise of ESG consciousness, the industry is seeing several instances on innovation.

Read on to find out how brands such as Clinique, Gucci, Tommy Hilfiger, Nike, Woolworths, Prada, Levi Strauss, Mahsenei Hashuk and Instacart are using emerging technologies such as the Metaverse and Generative AI to create the much-needed market edge.

Download “The Future of Retail” as a PDF

Over the last 2 years, the primary focus for Retail & eCommerce organisations has been on creating the right customer experience and digital engagements – mainly to survive.

In 2022 the focus will be on creating market differentiation. This will extend to business strategies and process optimisation. The Retail & eCommerce industry will explore ways to leverage data to empower multiple roles across the organisation and engage with customers irrespective of where they are on their customer journeys.

Read on to find out what Ecosystm Analysts Alan Hesketh, Niloy Mukherjee and Tim Sheedy think will be the leading trends in the Retail & eCommerce industry in 2022.

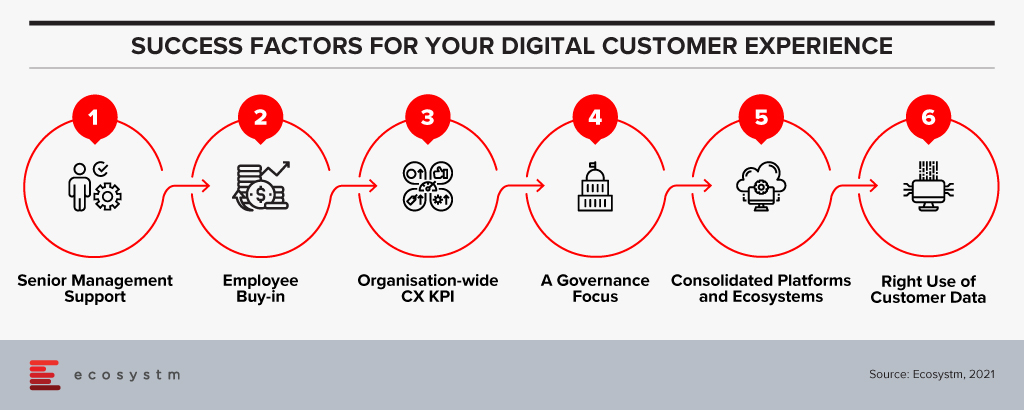

Consistent customer and brand experiences should be at the heart of every digital strategy. In the first part of this feature, we explored the barriers to creating memorable customer experience (CX). Here we look at what organisations who have mastered the art of great CX have in common.

Best Practices

Through Ecosystm research and interviews with organisations we have found that businesses that are already creating a consistent, effective, and memorable digital customer experience have these traits in common:

Had CEO and Board-level support for their strategy. Your ability to create a memorable and consistent digital experience lives and dies by the support of your senior management team. Without the CEO telling the rest of the business that this is a priority, the employees simply won’t come along for the ride.

Gained Employee support for the strategy. There is no point in creating a digital customer strategy at the Board and senior management level if it is not consistent with the lived experience of employees. An Australian bank made the mistake of making all their digital experience decisions at the most senior levels without taking the employees on the journey too. Change needs buy-in from all levels of the business – so make sure all levels are heard and that they understand why and how you will change the way they work and deliver customer value.

Made the delivery of a brand-consistent experience into a key KPI. In these businesses, a consistent CX is a given. That doesn’t mean they are not personalising their customer experiences or optimising them for specific touchpoints – it means that collaboration with other teams and channels is a base expectation. Changes are not made without the knowledge of other teams.

Prioritised governance over management. The risk of collaboration and including many people in decisions is that it slows decisions down and impacts business agility. To enable their collaborative approach to digital experience delivery, these businesses have set rules and guardrails into their decision-making processes to ensure they continue to deliver on-brand and consistent experiences. Many also have created cross-channel teams or sewn their digital skills across the different channel teams to ensure consistency of customer experience.

Consolidated on fewer platforms and CX ecosystems. Five years ago, businesses needed to source smaller, more innovative CX software and cloud components just to keep up with customer expectations. The trendsetters had built their own CX capabilities and weren’t relying on the traditional ISVs for their CX innovation. Smaller providers were emerging to fill these gaps for businesses who were not digitally native. Sourcing best-practice solutions is much easier today. Some of those smaller vendors have emerged to create their own platforms and CX ecosystems, and other suppliers have acquired and innovated their own software to meet and exceed customer requirements. For example, you no longer need multiple content management systems or platforms – a single content source can now meet the different needs of your different channel teams and feed consistent content to all customers tailored to their journey stage or chosen touchpoint.

Used data for their customers – not against them. Many personalisation or automation attempts have failed. Not because they used the wrong data, but because they were driving the wrong outcome. They were designed to corner a customer into a decision, versus helping them make the best decision for their circumstance. We all know what that looks like – if an interaction feels “creepy” like they are following you around the web and across touchpoints, or they seem to know too much about you. This is when a business is using data against you to try to force an action. Smart businesses use data to help customers achieve their goals – in the knowledge that happy customers will not only return to the business or brand, but also tell their friends and family about the experience.

Creating a consistent and on-brand digital experience will drive many positive outcomes for your customers and your business. Your customers will know what to expect and be comfortable in their interactions with your brand in whatever channel or touchpoint they desire – with the knowledge that the experience will be consistent and integrated and their time will not be wasted. They’ll return to your business over and over again. The consistent experience will also drive down your costs – with less rework, fewer platforms to support, more automation and hopefully a simpler technology architecture. Done right, it will also create a single unifying digital initiative across the business that will help to break down barriers, improve collaboration, and unlock innovation in and between your business teams.

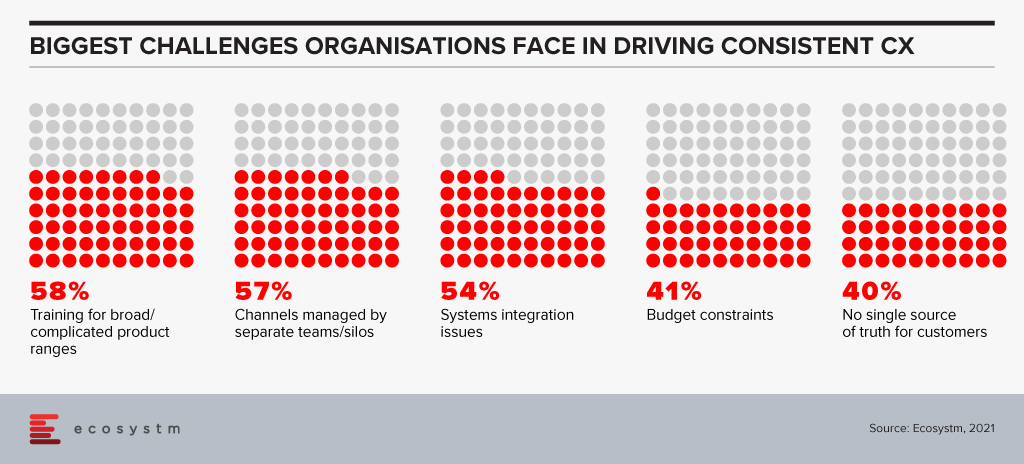

More than ever before you are having to cater to digital-savvy customers and create a competitive edge through the customer experience (CX) that you provide. In this two-part feature, I explore the barriers organisations face in their goal to create a memorable CX; and what the organisations that are getting it right have in common.

Spend on digital services, technologies, platforms, and solutions is skyrocketing. As businesses adapt to a new normal, they are increasing their spend on digital strategies and initiatives well beyond the increase they witnessed in 2020 when all customer and employee experiences went digital-only. But many digital and technology professionals I meet or interview maintain that their digital experiences are poor – offering inconsistent and fragmented experiences.

The Barriers

Digital, CX and tech leaders highlight their laundry list of challenges in getting their digital experiences to deliver a desired and on-brand customer experience:

A poorly informed view of the customer and their journey. Sometimes the customer personas and journey maps are simply wrong – they were developed by people with an agenda or a fixed idea of what problems need solving.

Inconsistent data. Too much, too little, or plain incorrect data means that automation or personalisation initiatives will fail. Poor access to data or lack of data sharing between teams, applications and processes means that businesses cannot even begin to build a consistent CX.

Too many applications and platforms. As digital initiatives took hold, technology teams witnessed an explosion of applications and platforms all conquering small elements of the digital journey. While they might be great at what they do, they sometimes make it impossible to create a simple and consistent customer journey. Some are beyond the control of the technology team – some are even introduced by partners and agencies.

Inconsistent content. For many businesses, content is at the heart of their digital experience and commerce strategy. But too often, that content is poorly planned, managed, and coordinated. Different teams and individuals create content; this content is then inconsistently delivered across customer touchpoints; the content is created for a single channel or touchpoint; and delivers to customers at the wrong stage of the journey.

Little co-ordination across channels. Contact centres, retail or other physical locations and digital teams often don’t sing from the same songbook. Not only is the customer experience inconsistent across different physical and digital touchpoints, but it may even be inconsistent across digital touchpoints – chat, web and mobile offer different experiences – even different parts of the web experience can be inconsistent!

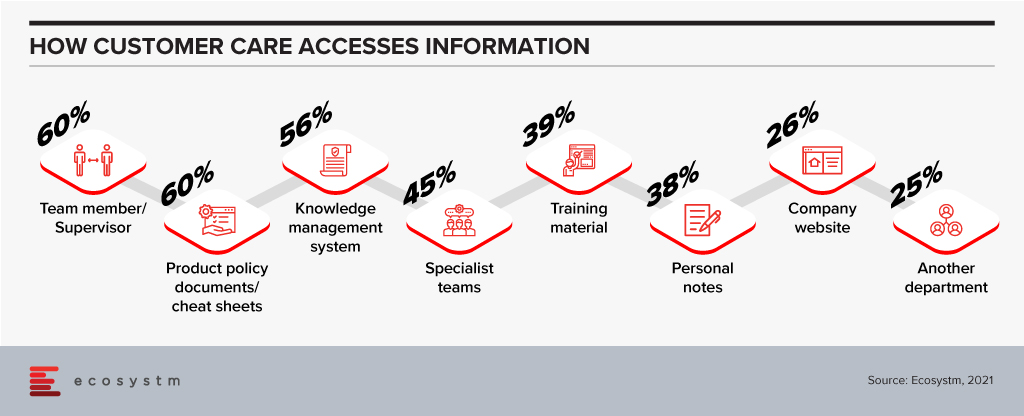

Knowledge is not shared between channels. Smart customers will “game” a company – finding the best offer across different customer touchpoints. But more often than not, inconsistent knowledge leads to very poor customer experiences. For example, a telecom provider might give different or conflicting information about their plans across web, mobile, contact centre and retail outlets; and with the increasing popularity of marketplaces, customers receive inconsistent product information when they deal with the brand directly than through the marketplace. Knowledge systems are often created to serve individual channels and are not trusted by customer service or retail representatives. We see this in Ecosystm data – when customer service agents are asked a question, they don’t know the answer to, the first place they look is NOT their Knowledge Management tool.

Poor prioritisation of customer pain points. Customer teams may find that it is easier to tackle the small customer challenges and score easy points – and just deprioritise the bigger ones that will take significant effort and require considerable change. Unifying the customer journey between the contact centre and digital is one big challenge that many businesses continue to delay.

And it gets worse… According to Ecosystm data, 55% of organisations consider getting board and management buy-in as their biggest CX challenge. This means that Chief Digital Officers, CX professionals and digital teams are still spending a disproportionate amount of time selling their vision and strategy to the senior management teams!

But some organisations are getting it right – creating a memorable digital experience that retains their customers and attracts more. I will talk about what is working for them in the next feature.

If you are a digital leader in the Financial Services industry (FSI), you have already heard this from your customers: ‘Why is it that Netflix and Amazon can make more relevant and personalised offers than my bank or wealth manager?’ Digital first players are obsessed with using data to understand their customer’s commercial and consumer behaviour. Financial Services will need to become just as obsessed with personalisation of offerings and services if they want to remain relevant to their customers. Ecosystm research finds that leveraging data to offer personalised service and product offerings to their clients is the leading digital priority in more than 50% of FSI organisations.

Banks, particularly, are both in a strong position and have a strong incentive to offer this personalisation. Their retail customers’ expectations are now shaped by the experience they have received from their favorite digital first firms, and they are making it increasingly clear that they expect personalised offerings from their banks. Furthermore, they are well positioned as a facilitator of commercial relationships between two segments of customers – consumers and merchants. The amount of data they hold on consumer interactions is comprehensive – and more importantly they are a trusted custodian of their customers’ data and privacy.

The Barriers to Personalisation

So, what is stopping them? Here are three insights from over 12 years of experience driving digitisation of Financial Services:

- Systems Legacy. Often the data and core banking systems do not allow for easy access and analysis of the required data across the data sets required (eg. Consumers and Merchants).

- Investment Priorities. There is still a significant investment happening in compliance and modernisation of core banking systems. Too often the focus of these programs can be myopic, and banks miss the opportunity to solve multiple pain points with their investments driven by overly focused problem statements.

- Culture and Purpose. Are banks stuck in a paradigm of their own making – defining their business models by what has served them well in the past? Will Amazon think about its provision of working capital to their small and medium business partners the same way as a bank does?

Vendor Focus – Crayon Data

Thankfully, there is a new breed of tech vendors who is making it easier for banks to drive personalisation of their offerings and connect customers from across segments. Crayon Data is a good example, with their maya.ai engine unearthing the preferences of customers and matching them to offerings from qualified merchants. It benefits all parties:

- The Consumer receives relevant offers, is served from discovery to fulfillment on a single platform and all personal data and information guarded by their bank.

- For Merchants, it allows them to reach the right customers at the right moment, develop valuable marketing and insights and all this directly from their bank partner’s platform.

- For Banks, it provides a scalable model for offer acquisition and easily configurable and measurable consumer engagement.

maya.ai leverages patented AI to create a powerful profile of each customer based on their buying habits and comparing these with millions of other consumers drawn in from their unstructured data sets and graph-based methodology. They then use their algorithms to assist their Financial Services client to make relevant offerings from qualified merchants to consumers in the right channel, at the right moment. All of this is done without exposing personal client information, as the data sets are based on behaviour rather than identity.

Conclusion

There are significant considerations for banks in offering these types of capabilities, such as:

- Privacy. While the technology operates on non-identifiable information, the perception of clients being ‘stalked’ by their bank in order to drive business to a merchant is one that would need to be managed carefully.

- Consumer opt-out. The ability for customers to opt out of this type of service is critical.

- Consumer financial wellbeing. It may be in the best interests of some consumer to not receive merchant offers, for instance where they are managing to a strict budget. These considerations can be baked into the overall customer journey (eg. prompts when the consumer is nearing their self-imposed monthly budget for a category), but care will need to be taken to keep customers’ best interests at heart.

While there are multiple challenges to overcome, the fact remains that personalisation is quickly becoming a core expectation for consumers. How will banks respond, and will we see AI use cases like Crayon Data become more prominent?

In 2020, much of the focus for organisations were on business continuity, and on empowering their employees to work remotely. Their primary focus in managing customer experience was on re-inventing their product and service delivery to their customers as regular modes were disrupted. As they emerge from the crisis, organisations will realise that it is not only their customer experience delivery models that have changed – but customer expectations have also evolved in the last few months. They are more open to digital interactions and in many cases the concept of brand loyalty has been diluted. This will change everything for organisations’ customer strategies. And digital technology will play a significant role as they continue to pivot to succeed in 2021 – across regions, industries and organisations.

Ecosystm Advisors Audrey William, Niloy Mukherjee and Tim Sheedy present the top 5 Ecosystm predictions for Customer Experience in 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Customer Experience Trends for 2021

- Customer Experience Will Go Truly Digital

COVID-19 made the few businesses that did not have an online presence acutely aware that they need one – yesterday! We have seen at least 4 years of digital growth squeezed into six months of 2020. And this is only the beginning. While in 2020, the focus was primarily on eCommerce and digital payments, there will now be a huge demand for new platforms to be able to interact digitally with the customer, not just to be able to sell something online.

Digital customer interactions with brands and products – through social media, online influencers, interactive AI-driven apps, online marketplaces and the like will accelerate dramatically in 2021. The organisations that will be successful will be the ones that are able to interact with their customers and connect with them at multiple touchpoints across the customer journey. Companies unable to do that will struggle.

- Digital Engagement Will Expand Beyond the Traditional Customer-focused Industries

One of the biggest changes in 2020 has been the increase in digital engagement by industries that have not traditionally had a strong eye on CX. This trend is likely to accelerate and be further enhanced in 2021.

Healthcare has traditionally been focused on improving clinical outcomes – and patient experience has been a byproduct of that focus. Many remote care initiatives have the core objective of keeping patients out of the already over-crowded healthcare provider organisations. These initiatives will now have a strong CX element to them. The need to disseminate information to citizens has also heightened expectations on how people want their healthcare organisations and Public Health to interact with them. The public sector will dramatically increase digital interactions with citizens, having been forced to look at digital solutions during the pandemic.

Other industries that have not had a traditional focus on CX will not be far behind. The Primary & Resources industries are showing an interest in Digital CX almost for the first time. Most of these businesses are looking to transform how they manage their supply chains from mine/farm to the end customer. Energy and Utilities and Manufacturing industries will also begin to benefit from a customer focus – primarily looking at technology – including 3D printing – to customise their products and services for better CX and a larger share of the market.

- Brands that Establish a Trusted Relationship Can Start Having Fun Again

Building trust was at the core of most businesses’ CX strategies in 2020 as they attempted to provide certainty in a world generally devoid of it. But in the struggle to build a trusted experience and brand, most businesses lost the “fun”. In fact, for many businesses, fun was off the agenda entirely. Soft drink brands, travel providers, clothing retailers and many other brands typically known for their fun or cheeky experiences moved the needle to “trust” and dialed it up to 11. But with a number of vaccines on the horizon, many CX professionals will look to return to pre-pandemic experiences, that look to delight and sometimes even surprise customers.

However, many companies will get this wrong. Customers will not be looking for just fun or just great experiences. Trust still needs to be at the core of the experience. Customers will not return to pre-pandemic thinking – not immediately anyway. You can create a fun experience only if you have earned their trust first. And trust is earned by not only providing easy and effective experiences, but by being authentic.

- Customer Data Platforms Will See Increased Adoption

Enterprises continue to struggle to have a single view of the customer. There is an immense interest in making better sense of data across every touchpoint – from mobile apps, websites, social media, in-store interactions and the calls to the contact centre – to be able to create deeper customer profiles. CRM systems have been the traditional repositories of customer data, helping build a sales pipeline, and providing Marketing teams with the information they need for lead generation and marketing campaigns. However, CRM systems have an incomplete view of the customer journey. They often collect and store the same data from limited touchpoints – getting richer insights and targeted action recommendations from the same datasets is not possible in today’s world. And organisations struggled to pivot their customer strategies during COVID-19. Data residing in silos was an obstacle to driving better customer experience.

We are living in an age where customer journeys and preferences are becoming complex to decipher. An API-based CDP can ingest data from any channel of interaction across multiple journeys and create unique and detailed customer profiles. A complete overhaul of how data can be segregated based on a more accurate and targeted profile of the customer from multiple sources will be the way forward in order to drive a more proactive CX engagement.

- Voice of the Customer Programs Will be Transformed

Designing surveys and Voice of Customer programs can be time-consuming and many organisations that have a routine of running these surveys use a fixed pattern for the data they collect and analyse. However, some organisations understand that just analysing results from a survey or CSAT score does not say much about what customers’ next plan of action will be. While it may give an idea of whether particular interactions were satisfactory, it gives no indication of whether they are likely to move to another brand; if they needed more assistance; if there was an opportunity to upsell or cross sell; or even what new products and services need to be introduced. Some customers will just tick the box as a way of closing off a feedback form or survey. Leading organisations realise that this may not be a good enough indication of a brand’s health.

Organisations will look beyond CSAT to other parameters and attributes. It is the time to pay greater attention to the Voice of the Customer – and old methods alone will not suffice. They want a 360-degree view of their customers’ opinions.