Ecosystm and Bitstamp, conducted an invitation-only Executive ThinkTank at the Point Zero Forum in Zurich. A select group of regulators and senior leaders from financial institutions from across the globe came together to share their insights and experiences on Decentralised Finance (DeFi), innovations in the industry, and the outlook for the future.

Here are the 5 key takeaways from the ThinkTank.

- Regulators: Perception vs. Reality. Regulators are generally perceived as having a bias against innovations in the Financial Services industry. In reality, they want to encourage innovation, and the industry players welcome these regulations as guardrails against unscrupulous practices.

- Institutional Players’ Interest in DeFi. Many institutional players are interested in DeFi to enable the smooth running of processes and products and to reduce costs. It is being evaluated in areas such as lending, borrowing, and insurance.

- Evolving Traditional Regulations. In a DeFi world, participants and actors are connected by technology. Hence, setting the framework and imposing good practices when building projects will be critical. Regulations need to find the right balance between flexibility and rigidity.

- The Importance of a Digital Asset Listing Framework. There has been a long debate on who should be the gatekeeper of digital asset listings. From a regulator’s perspective, the liability of projects needs to shift from the consumer to the project and the gatekeeper.

- A Simplified Disclosure Document. Major players are willing to work with regulators to develop a simple disclosure document that describes the project for end-users or investors.

Read below to find out more.

Download Pathways for Aligning Innovation and Regulation in a DeFi World as a PDF

In 2020, much of the focus for organisations were on business continuity, and on empowering their employees to work remotely. Their primary focus in managing customer experience was on re-inventing their product and service delivery to their customers as regular modes were disrupted. As they emerge from the crisis, organisations will realise that it is not only their customer experience delivery models that have changed – but customer expectations have also evolved in the last few months. They are more open to digital interactions and in many cases the concept of brand loyalty has been diluted. This will change everything for organisations’ customer strategies. And digital technology will play a significant role as they continue to pivot to succeed in 2021 – across regions, industries and organisations.

Ecosystm Advisors Audrey William, Niloy Mukherjee and Tim Sheedy present the top 5 Ecosystm predictions for Customer Experience in 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Customer Experience Trends for 2021

- Customer Experience Will Go Truly Digital

COVID-19 made the few businesses that did not have an online presence acutely aware that they need one – yesterday! We have seen at least 4 years of digital growth squeezed into six months of 2020. And this is only the beginning. While in 2020, the focus was primarily on eCommerce and digital payments, there will now be a huge demand for new platforms to be able to interact digitally with the customer, not just to be able to sell something online.

Digital customer interactions with brands and products – through social media, online influencers, interactive AI-driven apps, online marketplaces and the like will accelerate dramatically in 2021. The organisations that will be successful will be the ones that are able to interact with their customers and connect with them at multiple touchpoints across the customer journey. Companies unable to do that will struggle.

- Digital Engagement Will Expand Beyond the Traditional Customer-focused Industries

One of the biggest changes in 2020 has been the increase in digital engagement by industries that have not traditionally had a strong eye on CX. This trend is likely to accelerate and be further enhanced in 2021.

Healthcare has traditionally been focused on improving clinical outcomes – and patient experience has been a byproduct of that focus. Many remote care initiatives have the core objective of keeping patients out of the already over-crowded healthcare provider organisations. These initiatives will now have a strong CX element to them. The need to disseminate information to citizens has also heightened expectations on how people want their healthcare organisations and Public Health to interact with them. The public sector will dramatically increase digital interactions with citizens, having been forced to look at digital solutions during the pandemic.

Other industries that have not had a traditional focus on CX will not be far behind. The Primary & Resources industries are showing an interest in Digital CX almost for the first time. Most of these businesses are looking to transform how they manage their supply chains from mine/farm to the end customer. Energy and Utilities and Manufacturing industries will also begin to benefit from a customer focus – primarily looking at technology – including 3D printing – to customise their products and services for better CX and a larger share of the market.

- Brands that Establish a Trusted Relationship Can Start Having Fun Again

Building trust was at the core of most businesses’ CX strategies in 2020 as they attempted to provide certainty in a world generally devoid of it. But in the struggle to build a trusted experience and brand, most businesses lost the “fun”. In fact, for many businesses, fun was off the agenda entirely. Soft drink brands, travel providers, clothing retailers and many other brands typically known for their fun or cheeky experiences moved the needle to “trust” and dialed it up to 11. But with a number of vaccines on the horizon, many CX professionals will look to return to pre-pandemic experiences, that look to delight and sometimes even surprise customers.

However, many companies will get this wrong. Customers will not be looking for just fun or just great experiences. Trust still needs to be at the core of the experience. Customers will not return to pre-pandemic thinking – not immediately anyway. You can create a fun experience only if you have earned their trust first. And trust is earned by not only providing easy and effective experiences, but by being authentic.

- Customer Data Platforms Will See Increased Adoption

Enterprises continue to struggle to have a single view of the customer. There is an immense interest in making better sense of data across every touchpoint – from mobile apps, websites, social media, in-store interactions and the calls to the contact centre – to be able to create deeper customer profiles. CRM systems have been the traditional repositories of customer data, helping build a sales pipeline, and providing Marketing teams with the information they need for lead generation and marketing campaigns. However, CRM systems have an incomplete view of the customer journey. They often collect and store the same data from limited touchpoints – getting richer insights and targeted action recommendations from the same datasets is not possible in today’s world. And organisations struggled to pivot their customer strategies during COVID-19. Data residing in silos was an obstacle to driving better customer experience.

We are living in an age where customer journeys and preferences are becoming complex to decipher. An API-based CDP can ingest data from any channel of interaction across multiple journeys and create unique and detailed customer profiles. A complete overhaul of how data can be segregated based on a more accurate and targeted profile of the customer from multiple sources will be the way forward in order to drive a more proactive CX engagement.

- Voice of the Customer Programs Will be Transformed

Designing surveys and Voice of Customer programs can be time-consuming and many organisations that have a routine of running these surveys use a fixed pattern for the data they collect and analyse. However, some organisations understand that just analysing results from a survey or CSAT score does not say much about what customers’ next plan of action will be. While it may give an idea of whether particular interactions were satisfactory, it gives no indication of whether they are likely to move to another brand; if they needed more assistance; if there was an opportunity to upsell or cross sell; or even what new products and services need to be introduced. Some customers will just tick the box as a way of closing off a feedback form or survey. Leading organisations realise that this may not be a good enough indication of a brand’s health.

Organisations will look beyond CSAT to other parameters and attributes. It is the time to pay greater attention to the Voice of the Customer – and old methods alone will not suffice. They want a 360-degree view of their customers’ opinions.

I recently came across an article which makes 7 predictions for a post COVID world. Upon reflection, I agree with the predictions to varying degrees and decided to comment further.

First, let me share a couple of general observations. Currently, we are still in the eye of the storm. Many are unable to see any light at the end of the tunnel. There is quite a bit of negative sentiments, and some fail to see that the situation will ever improve. I am sure similar thoughts occurred during other crises: the 1918 Pandemic (Spanish Flu); the Great Depression of the 1930s; the Dot.com bust of 2001; SARS in 2003; and the Global Financial Crisis/Great US Recession of 2007. During each of these events, a sense of impending Armageddon came over much of the population. Certainly, in each instance, people did experience some personal and social permanent changes, with which they learned to adapt and cope. But, inevitably, the world did go on and Armageddon did not occur.

One of the basic truths I believe, is that humans require and crave interaction with other humans. Think about the videoconferencing applications. The use of these apps grew exponentially as the main communication channel. Instead of just audio, it was audio and video. These mediums greatly assisted society in coping and adapting. Mankind, and the Natural World, will always find a way.

Here are the predictions from the article:

- Companies that traffic in digital services and e-commerce will make immediate and lasting gains

- Remote work will become the default

- Many jobs will be automated, and the rest will be made remote-capable

- Telemedicine will become the new normal, signaling an explosion in med-tech innovation

- The nationwide student debt crisis will finally abate as higher education begins to move online

- Goods and people will move less often and less freely across national and regional borders

- After an initial wave of isolationism, multilateral cooperation may flourish

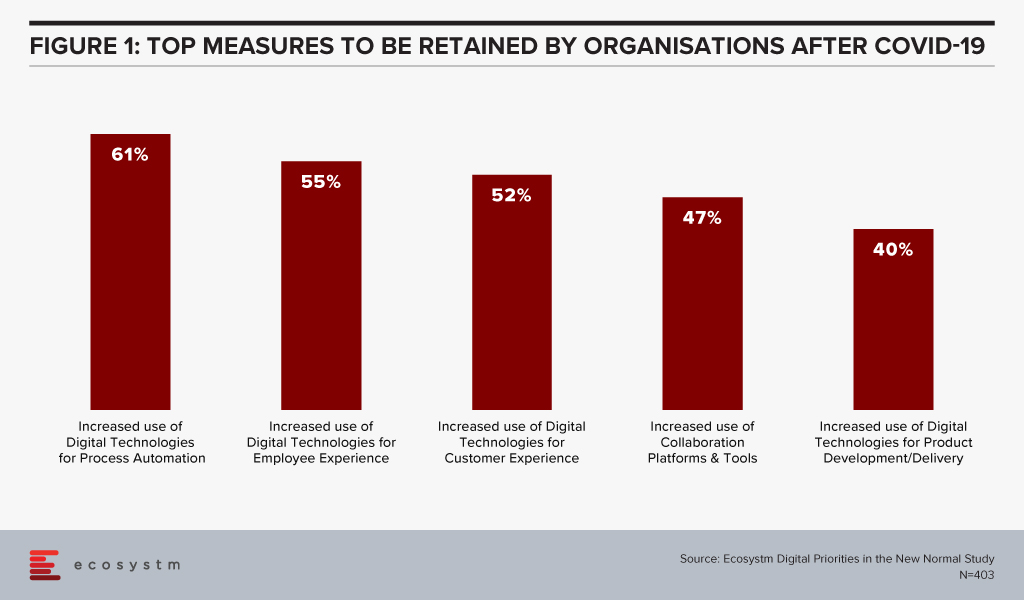

I very much agree with the author’s first prediction. This one is fairly obvious, as it has proven true throughout the crisis with providers such as Amazon, Zoom and others. It is expected to continue into the post COVID world. This is also evident from the findings of the Ecosystm research on the impacts of COVID-19. Organisations intend to continue to use digital technologies, even after the immediate crisis is over (Figure 1).

A Natural State of Equilibrium will Emerge

I believe for each of the areas described in the predictions, there will be various levels of long-term modification. None of them will return to their pre COVID-19 state, as we have all experienced going down the rabbit hole. During the pandemic, due largely to the lockdowns, the pendulum swung significantly towards one side. Many times, when people predict a new view, the current state is considered the New Normal. For me, the relevant question is: Will things stay as they are now, or will there be a new natural state of equilibrium? If so, what will it look like, in each of these areas? I don’t believe there is one answer, or one New Normal for all the dimensions being discussed. I believe a new normal state will potentially be different for each individual, each company/entity and each condition. In a post COVID-19 world there could be 50 shades of grey in each of these areas.

One of the predictions states that remote work will become the default. It must be remembered that part of work is a collaborative effort. While video conferencing has enabled collaborative efforts, the importance of the accidental interaction at the break room, printer, etc. can’t be under-estimated. It is these unscheduled interactions that enable accidental collaboration which can lead to great solutions. Thus, there will be many shades to the Future of Work – there will not be one absolute.

A similar example is a prediction for higher education. Part of the learning process a university offers is interacting with people who are not similar to your background or beliefs. That is one of the benefits of a diverse university. Similar to the corporate environment, many different types of learning environments will enable a person to gain great experiences from the time at university.

The advantage of all these alternatives will be the additional options and benefits to people post COVID compared to the pre COVID-19 world. It will present many great opportunities for entrepreneurs and innovators, as well as end-users and consumers. It will create new and iterative ‘middle spaces’. It will be possible for a David to emerge and challenge a Goliath(s).

The two Chinese characters for the word ‘crisis’ are “danger” and “opportunity”. Just as we are in a dangerous time now, it has also presented new and different opportunities. Those opportunities will continue to exist even when the danger has passed. I am also reminded of the old expression “May you live in interesting times”. It very much applies to all of us now and in the future. I wish the same for all of you.

Stay Safe. Stay Healthy. Stay Mentally Positive.

Organisations are on a fast track to digitalisation. The Ecosystm Digital Priorities in the New Normal study finds that 60% of organisations anticipate increased use of digital technologies for process automation, even after the COVID-19 restrictions are lifted. One of the key challenges that these organisations will face is the lack of internal digital skills – especially in emerging technologies. One of the success metrics of any technology adoption is employee uptake. Without the necessary skills or understanding of the benefits of emerging technology, employees will largely shy away from digital offerings, even the ones that will make their work more efficient and their lives easier.

Organisations are realising the value of making their workforce future ready.

DBS Instilling Company-Wide Digital Culture

Far-sighted companies are collaborating with technology vendors and professional training providers to promote tech awareness and education to futureproof their workforce. DBS Bank in Singapore has collaborated with AWS to train and upskill 3,000 employees – including the leadership team – with AI and machine learning skills through gamification in a DBS x AWS DeepRacer League.

The AWS DeepRacer Leagues have been previously organised in several parts of the world, but the DBS x AWS DeepRacer will be the first to be organised at this scale. The league will enable DBS employees to get their hands-on AI and machine learning tutorials online. They will then have the opportunity to test out their new skills in programming a 3D racing simulator and iteratively fine-tune their models and compete with each other. The learning program is entirely cloud-based and aims to ingrain digital skills in the workforce.

DBS has won several accolades for their digital transformation and innovation initiatives, and they continue to experiment with emerging technologies. In 2019, DBS digitalised and simplified end-to-end credit processing, setting the foundation for advanced credit risk management using data analytics and machine learning. They have also deployed an AI-powered engine for self-service digital options to its retail banking customers. Taking their employees along with them on this journey is a wise move.

Ecosystm Principal Advisor, Ravi Bhogaraju says, “With the increasing use of automation, AI and machine learning, the nature of work and businesses is transforming rapidly. This is creating opportunities for processes to be automated and increasing the use of AI and Deep Learning into the business processes of the organisation. Industry value chains are transforming – AI and machine learning is adding automation, analytics and predictive intelligence to the portfolio. The recent news of DBS and AWS partnering to upskill the bank’s workforce underscores the value of creating a future ready workforce.”

“Such upskilling efforts add industry-specific context to make them more effective. BCG refers to this as ‘Human + AI’. A recent study from BCG and MIT shows that 18% of companies in the world that are pioneering AI are making money with it. Those companies focus 80% of their AI initiatives on effectiveness and growth, taking better decisions – not replacing humans with AI to save costs.”

Government Focus on Digital Skills Upgrade

This week, Singapore also saw another initiative to bridge digital skills gaps – this time from the public sector. In 2018, the Government launched its Smart Nation Scholarship program to attract and nurture talent, and later involve them in various departments to drive Singapore’s Smart Nation initiatives. The most recent Smart Nation Scholarship program 2020 attracted 723 applicants (17% more than the previous year). This is a slightly different approach, aimed at attracting digital native employees and mentoring them for digital leadership. After completing their studies, the 15 scholarship recipients are set to join public sector agencies such as Cyber Security Agency of Singapore (CSA), Government Technology Agency (GovTech), and Infocomm Media Development Authority (IMDA), to give the younger generation an opportunity to co-create the country’s Smart Nation vision.

Bhagaraju says, “Both private and government institutions are working to enhance workforce skills, improve marketability and making the workforce future ready. Industry 4.0 and the digital revolution have created the need to address the skill gaps that have arisen. Government programs such as the Skills Future program in Singapore, Malaysia’s HRD upskilling program, and the EU-28 European Digital initiative are all making a sustained effort to promote lifelong learning and acquisition/upgrading of skills for their respective citizens with quite successful results, that will have long-term impacts.”

2020 has seen extreme disruption – and fast. The socio-economic impact will probably outlast the pandemic, but several industries have had to transform themselves to survive during these past months and to walk the path to recovery.

Against this backdrop, the Retail industry has been impacted early due to supply chain disruptions, measures such as lockdowns and social distancing, demand spikes in certain products (and diminished demands in others) and falling margins. Moreover, it is facing changed consumer buying behaviour. In the short-term consumers are focusing on essential retail and conservation of cash. The impact does not end there – in the medium and long term, the industry will face consumers who have acquired digital habits including buying directly from home through eCommerce platforms. They will expect a degree of digitalisation from retailers that the industry is not ready to provide at the moment. This raises the question on how they should transform to adapt to the New Normal and what could be a potential game-changer for them.

Translating Business Needs into Technology Capabilities

In his report, The Path to Retail’s New Normal, Ecosystm Principal Advisor, Kaushik Ghatak says, “Satisfying their old consumers, now set in their new ways, should be the ‘mantra’ for the retailers in order to survive in the New Normal.” To be able to do so they have to evaluate what their new business requirements are and translate them into technological requirements. Though it may sound simple, it may prove to be harder than usual to identify their evolving business requirements. This is especially difficult because even before the pandemic, the Retail industry was challenged with consumers who are becoming increasingly demanding, providing enhanced customer experience (CX), offering more choices and lowering prices. The market was already extremely competitive with large retailers fighting for market consolidation and smaller and more nimble retailers trying to carve out their niche.

In the New Normal, retailers will struggle to retain and grow their customer base. They will also have to focus aggressively on cost containment. A robust risk management process will become the new reality. But above all else, they will have to innovate – in their product range as well as in their processes. These are all areas where technology can help them. This can come in the form of technology partnerships, adopting hybrid models, increased usage of technology across all channels and investing in reskilling or upskilling the technology capabilities of employees.

Re-evaluating the Supply Chain

One of the first business operation to get disrupted by the current crisis was the supply chain. Ecosystm Principal Advisor, Alea Fairchild says, “Retailers are finding themselves at the front-end of the broken supply chain in the current situation and there is an enormous gap between suppliers and buyers. Retailers will have to aim to combine inventory with local sourcing and become agile and adopt change quickly. This will highlight to them the importance of transparency of information, traceability, and information flow of goods.”

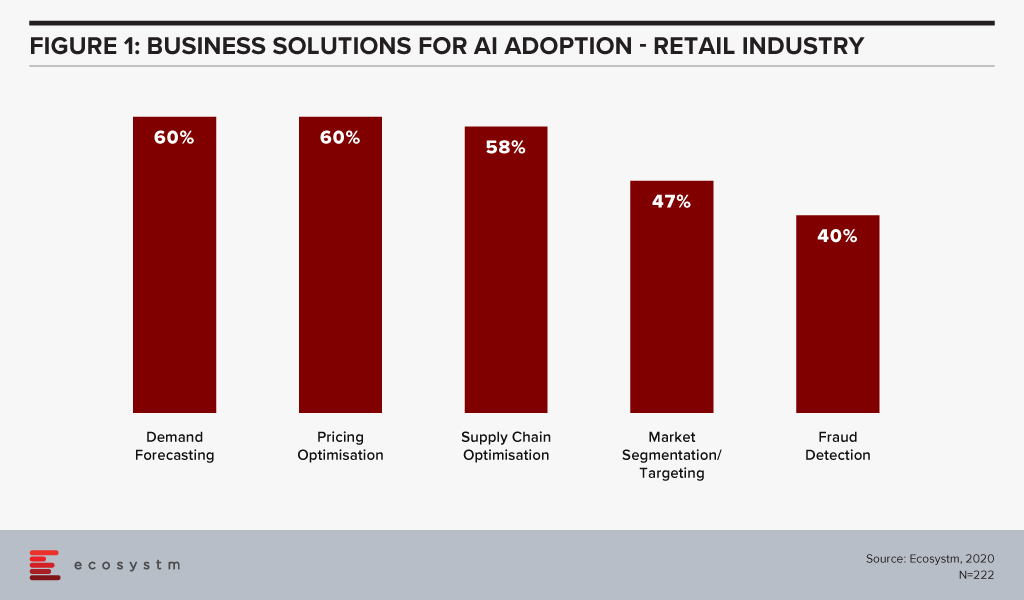

Ecosystm research shows that supply chain optimisation and demand forecasting among the top 5 business solutions that firms in Retail consider using AI for (Figure 1).

“In the New Normal, consumers are going to demand the same level of perfection that they have received and at the same cost. In order to make that possible, at the right time and at a lower cost, automation has to be implemented to improve the supply chain process, fulfill expectations and enhance visibility,” says Ghatak. “Providing differentiated CX is intimately dependent upon an aligned, flexible and efficient supply chain. Retailers will not only need to innovate at the store (physical or online) level and offer more innovative products – they will also need to have a high level of innovation in their supply chain processes.”

Digital Transformation in the Retail Industry

Ecosystm research reveals that only about 34% of global retailers had considered themselves to be digital-ready to face the challenges of the New Normal, before the pandemic. The vast majority of them admit that they still have a long way to go.

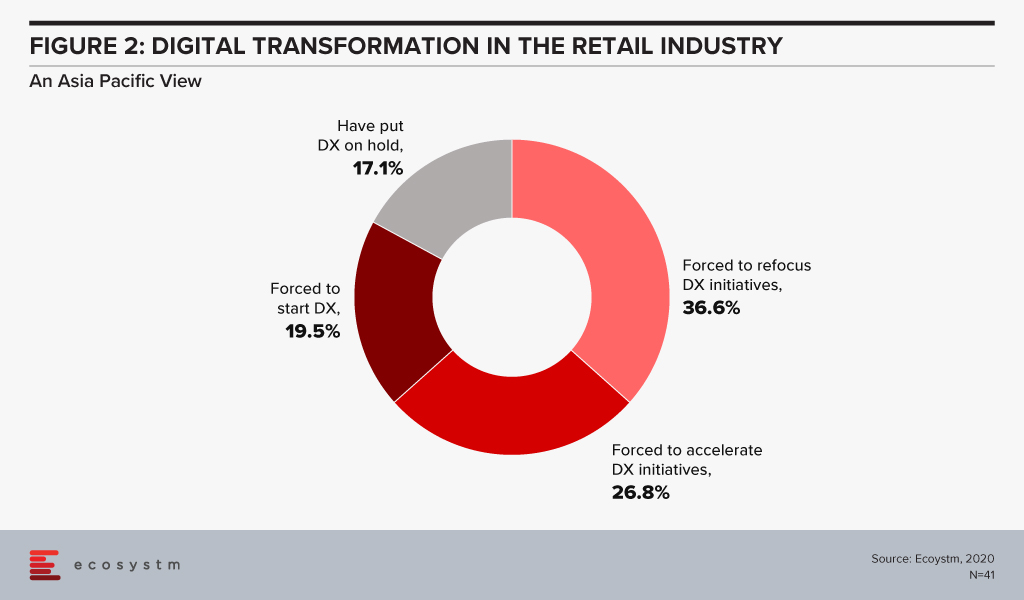

With COVID-19, the timeframes for digitalisation have imploded for most retailers. The study to evaluate the Digital Priorities in the New Normal reveals that in Asia Pacific nearly 83% of retailers have been forced to start, accelerate or refocus their Digital Transformation (DX) initiatives (Figure 2).

So, what technology areas will Retail see increased adoption oF?

Fairchild sees retailers adopt IoT, mobility, AI and solutions that deliver personalised experiences such as push notifications. What they are likely to do is blend different aspects of their physical and virtual environment to create a solution for customers. “To address in-store processing, hygiene, safety standards and compliance requirements, retailers will change their processes through a combination of resources, KPIs, automation, task management software and switching the information flow.”

Ghatak thinks automation has a significant role to play in improving both CX and the supply chain. “This is also an opportunity for retailers – both online and in-store – to create a solution experience where technologies such as Augment/Virtual Reality (AR/VR) can help. While retailers are adopting these technologies, with 5G rollouts, there is potential that the adoption will implode in a short time-frame.”

Those retailers that are not re-evaluating their business models and technology investments now will find themselves unprepared to handle the customer expectations when the global economy opens up.

The last week or so has seen a numbers of central banks (such as the US and Australia) ease their monetary policies – lowering interest rates in order to stimulate investment and economic activity. But this alone won’t be enough to slow down economic growth – the generally accepted wisdom is that governments will need to quickly roll out stimulus packages to get money into the economy faster. Some countries, like Hong Kong, have already kicked off this process – others are likely be announce packages over the next few weeks.

Typically, these stimulus packages are designed to get the economy moving again – bringing forward existing spending plans or creating new spend. Good stimulus packages will have a broad impact but also drive improved business and employment outcomes. Some are targeted towards the sectors most impacted (e.g. in Australia the seafood export market has been impacted heavily by China’s decision to stop importing any seafood; in Thailand the tourism sector is hit hard by the slowdown in arrivals from China – that makes up a large percentage of the tourists in an economy where tourism is a significant sector).

But often they are not targeted. Some governments might just let businesses write off any investment faster than usual (such as within a single financial year instead of depreciating the spend over a number of years) or will just send a cheque to every income earner. The issue with these stimulus packages is that they don’t drive a specific outcome apart from getting spend into the economy faster. Stimulus packages have an opportunity to drive change – and the COVID-19 virus has shown that some businesses are not well equipped for the digital era. They are finding it hard managing the distributed workforce when they ask their staff to work at home. There are also many challenges that governments and businesses are facing in serving customers across digital channels.

This is the opportunity for governments to stimulate the economy and help businesses improve the digital experiences of customers and employees. The world is going digital – we all know what good digital experiences look like as we have them on our smartphones in our pockets. But we also know that most companies and government agencies we deal with are not offering great digital experiences… And while we all hope that virus outbreaks such as COVID-19 don’t happen that often, we know that something like this will happen again – so it would be great if businesses were prepared for such an outcome.

Therefore now is the chance to target the stimulus packages towards both the impacted sectors of the economy as well as the areas of spend that will drive better digital experiences for customers and employees. There could be incentives to spend more on software and cloud services, spend more with consultancies or spend more with digital marketing agencies. It will also help small businesses compete with larger businesses on an equal playing field (for example, the large takeaway food outlets have an app that lets you pre-order food, but many small ones do not).

In 2009, the Australian government rolled out a stimulus package – one that was ultimately one of the major reasons the economy came through the global financial crisis without falling into recession. They gave an immediate cash stimulus to taxpayers which helped get an immediate spend in the economy. They also had a housing insulation spend which promised roof insulation for 2.7 million homes – this provided stimulus to the economy in the mid-term. They then provided new school halls, social housing and roads – which provided the stimulus in the longer term. While it can be argued that the programs were not effectively administered, the stimulus got the economy moving and also helped the government hit some longer term goals – such as reducing greenhouse gas emissions (through better housing insulation therefore less use of electricity to heat and cool homes) and also upgrading aging infrastructure in schools across the country. For many businesses, the focus today is on providing great customer experiences – and many of those experiences will be digital. Governments have the chance to use their stimulus p to accelerate that outcome.

2020 was originally forecast as a good year for technology spend. Many categories took a hit in 2019 – hardware, telecommunications, datacentres – even the software and IT services segments came down from their high growth rates of previous years. The consensus for growth in IT spend in 2020 was somewhere between 3-4%. But that growth is now under threat by the COVID-19 virus that is spreading across the globe. The 26th February was a significant day, as the number of new infections outside of China is now greater than those in China. Furthermore, the growth in infections is not isolated. Iran, Italy and South Korea all have experienced significant growth and the virus has hit Brazil, directly from Italy.

With the situation changing every day it is hard to have a firm view on how it will impact broader economic growth as well as the technology spending. Much will depend on the ability of countries to control the spread of the virus along with the fiscal stimulus packages of governments across the globe. Some countries are in a better position than others to push money into economies to keep them growing.

But even with the uncertainty, it is worth noting some feedback we are getting from tech buyers, vendors and economists. While much of this feedback is anecdotal, we believe it is indicative of trends across the market. The next few weeks are critical. If China shows that they can stop the transmission of the virus, that will help global confidence which has been hurt by the newer outbreaks in Italy, Iran and Korea.

Overall Economic Spend is Slowing

Businesses across the globe – particularly those in heavily impacted economies (such as China, Italy, Japan & South Korea) and those impacted by the slowdown in China (Thailand, Australia etc) – are putting the brakes on spending across the board. And there are not too many initiatives in businesses today that don’t involve technology. We are seeing projects delayed and – more rarely – cancelled. Several central banks, such as those in Thailand and Singapore, have lowered their growth forecasts, as has the IMF and OECD. Ratings agencies and economists have also reduced their growth forecasts for heavily impacted economies. The USA is avoiding much of the slowdown although the Nasdaq High Tech Index was down around 8-9% on the 28th February – the market has priced potential future slowdown into share prices already.

Limited Face-to-Face Collaboration Will Slow Tech Spending

We are also seeing the projects that are underway slowing down: more staff are required to work from home; experts can’t fly in to help drive projects; and without teams meeting physically, collaboration has become harder than ever before.

This doesn’t mean the projects aren’t happening – the timelines are slipping. Will this impact the overall spending in 2020? Yes! But not by much at all, as many projects these days are delivered in 3-6 months – not 24 months like years gone by. So, delivery will mostly happen in 2020, but more in the second half than the first half. But again, with the situation changing every day, the scenario might change. As soon as growth in the number of infections slows down and the travel bans are lifted, we can expect activity to slowly return. But the further out that is, the more projects will decrease scope, be cancelled or be shelved for another day.

Another factor impacting innovation and the resulting technology projects is the lack of face-to-face collaboration between management teams. Some businesses have already put into place initiatives to ensure their board and executive management do not meet face-to-face. This is because they are considered the most valuable assets to the business – and are often likely to be in the age group most heavily impacted by the coronavirus (over 50). While not suggesting that collaboration cannot happen in virtual environments, it is sometimes a shared experience or non-business interaction that might drive a new idea for the business. And that idea might end up driving tens of millions of dollars of technology spending.

Cash Flow is Impacted – Which Slows Business Investment

Cash flow is already being impacted. Small and medium enterprises (SMEs) are already feeling the pinch, and they don’t have access to the funding tools that many large businesses use to get through tough times. SMEs really represent the biggest threat to spending: if a large business has to lay off some staff, they can then get a project going as soon as the economy or their sector recovers and employ the people they need, as required. But in countries like Australia and the US, small businesses represent almost 40-50% of economic activity. If SMEs shut down or even restrict spending, it takes some time for new businesses to start up and fill in the gap they leave. SMEs don’t tend to buy software or services from the large vendors – they tend to use small and medium services and software providers – so it is these smaller technology businesses that are immediately threatened if the coronavirus spread continues. The multiplier effect quickly comes into play here to reduce consumption, employment and economic activity.

We are also aware that some businesses that are directly impacted by the virus (such as those in the travel sector) have informed their suppliers that they won’t be paying any bills until mid-year. This could also put a small technology provider under – whereas a larger one should be able to survive the cash-flow crisis. Despite most economies having a low interest rate environment, the access to capital is not easy, particularly given the risk to the overall economy. A further challenge to global expenditure and an accelerated recovery is the US elections which provide distraction to businesses in the US and globally.

Cancellation of Customer Events Will Limit Technology-Led Innovation

Many vendors have cancelled or postponed their customer events, even in relatively unaffected markets such as Australia. And nearly every vendor will attest to the spike in opportunities and deals that get signed after these events. The coming together of potential and existing customers with thought leaders, tech evangelists, bleeding edge customers and the partner ecosystem drives new ideas. Individuals get inspired to act – they hear about best and next practice and kick off conversations within their businesses. They see how technologies can impact other businesses and use those assumptions within their own business cases. Sceptical customers become converts, and those already considering projects sometimes accelerate them.

With these events cancelled tech spending will not collapse. Companies still have budgets and these budgets will be, for the most part, spent. But it is the innovative initiatives that will suffer – the exploration of new technologies or services, the experimentation and testing that won’t happen because people simply won’t know about it. This is the spending that is typically not budgeted for – the new spend that often has a big impact on business results and customer outcomes. These customer events are learning opportunities – without the events the learning will be harder and slower to push out. So, this will likely have more of an impact on spending in calendar Q2-Q4. But without other assets in the market or other chances to educate clients and prospects, this spend simply won’t happen.

The COVID-19 virus is also impacting the technology supply chain. Many technology products are manufactured in China – or rely on components manufactured in China. Factories across China have been shut down – and while some are coming back online, it is hard to know how long it will take them to get back to full capacity. Transport services in China are impacted –globally 200,000 flights have been cancelled since the public emergence of the coronavirus. Some products are waiting but just cannot be shipped. A number of vendors have flagged the impact of the slowdown to the supply chain on their revenues, including Apple and Microsoft. With limited supply, prices are rising, which slows down demand. While this may show some short-term opportunity for the cloud providers, the hardware companies and the software providers that rely on the availability of hardware will feel the impact. In the longer term, it may lead to business reviewing their supply chain and risk analysis. This presents an opportunity for India, Vietnam and other potential manufacturing hubs.

The Overall Impact of the COVID-19 Will be Real and Measurable

Ultimately, we believe that the coronavirus will wipe up to 1.5% off the total tech spending for 2020 – bringing the overall average down to between 1.5% and 2.5%. Part of this is based on the fact that technology spending is coming off a poor year. Confidence was just starting to climb with some of the hardest hit segments expected to return to growth in 2020. This confidence will disappear – and could lead to further price competition. Which is good for the buyer but bad for the whole vendor supply chain!

But again, this depends on the response of central banks and the ability of countries to control the spread of the virus. The development of a vaccine would be ideal but appears to be highly unlikely. The sooner it is brought under control – along with effective targeting of fiscal stimulus packages – the lower the impact on overall economies and the technology spending of businesses.

Some sectors will witness growth – telecoms providers, collaboration software and tool providers, remote and online education providers, cloud providers and healthtech will all witness growth – in fact many are already! Digital spending will increase as face-to-face opportunities plummet – this will drive opportunities for advertisers, digital agencies and developers.

Now is the time to make contingencies – vendors need to get better at digital marketing and selling and simpler implementation. Tech buyers and implementers need to put in place best practices for remote working – many companies witness an increase in productivity when they get remote working right.

Please let us know your feedback or thoughts in the comments section – we look forward to keeping the analysis going – and stay healthy!

This post was authored by Tim Sheedy, with valuable assistance from Phil Hassey, Sash Mukherjee and Claus Mortensen.

Most countries recognise the importance of digital technologies and have developed or are developing national digital strategies. Many of these efforts tend to be cookie-cutter approaches with a Christmas tree of initiatives. Such plans often borrow from others without customisation or contextualisation, while incorporating whatever happens to be the flavor of the month. We would argue that any attempt at a digital strategy should start with a strong sense of focus. In such endeavors, less is often more. Plans should also articulate overarching values, principles, and frameworks that can serve as a compass to set direction and bring a sense of coherence to disparate efforts by multiple stakeholders. Finally, no strategy is complete without a proper sequencing of initiatives.

Given the rapid digitalisation of economies across the world, we are fast moving from a paradigm that considers the digital economy within well-defined sectoral boundaries, to one where digital technologies are becoming ubiquitous – touching every facet of society. The phrase “digital economy” is losing significance as the economy itself becomes digital. In a context where digital technologies are getting embedded and enmeshed across the economy, the complexity of developing, coordinating and implementing national digital strategies has become a daunting task. The rapid rate at which new technologies and business models are emerging, makes it even harder for policymakers to keep pace.

In an environment of exploding complexity and rapid change, it is crucial to adopt a more structured and, in some sense, a more minimalist approach to digital strategy. Ideally, such an approach should look at digital strategy from four perspectives:

- Focus. Identification of the most critical areas that can have cascading impacts across the economy

- Guiding compass. Defining a broad set of values, principles, and frameworks to guide action by multiple players and align strategy to the achievement of societally relevant goals

- Organisational design. Redefinition and reinvention of the organisational structures of government to contend with fast moving technologies and business models

- Sequencing. Determination of the sequencing and timing of various policy interventions.

To elaborate further on these four dimensions:

Focus

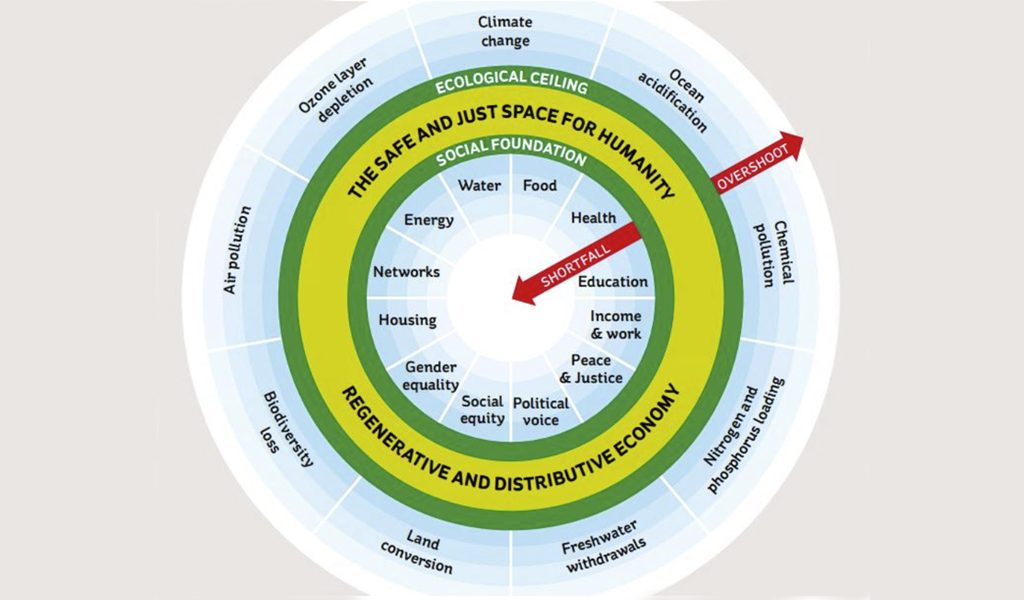

Digital technologies are not an end in themselves but are tools for achieving societal objectives. Examples of such goals are national development plans, or the United Nations Sustainable Development Goals (SDGs). Another example is Kate Raworth’s ‘Doughnut Economics’ which wisely aims to balance planetary with societal goals.

Donut Economics, Kate Raworth

Keystone Objective. National development goals/SDGs tend to be broad in their scope, and there is a danger of efforts becoming too diffuse when incorporated as part of a national digital strategy. There may, therefore, be a need to sharpen the focus further. One approach might be to identify a keystone objective which can potentially have cascading impacts across the economy and use it for providing strategic focus. Such a keystone would help reduce/eliminate redundancies and wasteful investments. In the corporate sector, Paul O’Neill’s singular focus on “zero worker injuries” while leading Alcoa is an enduring example of success.

A digital strategy that follows the various causal links to achieve the keystone goal of ‘Good Jobs for All’ as an example would end up touching upon every important aspect of the digital economy. It would be an interesting parallel to William Blake’s poem of seeing the “world in a grain of sand”.

Problem Statements. A great way of achieving focus is to identify problem statements and use them to solicit innovative solutions. Some leaders in digital government, e.g., Israel’s Ministry of Health, the Monetary Authority of Singapore, and the EU (among others) have been pursuing such an approach with a fair degree of success.

Guiding Values, Principles and Frameworks

National digital strategies would benefit from the adoption of values, principles, and frameworks that could provide broad guidance to multiple players undertaking their digitalisation initiatives. Having a directional compass would offer strategic alignment and cohesion – while allowing for innovation and creativity on the part of individual actors.

Example of Values. Values are the touchstone to decide what should be prioritised and to what purpose. Openness, positive impact, empathy, and compassion are excellent values adopted by many successful organisations.

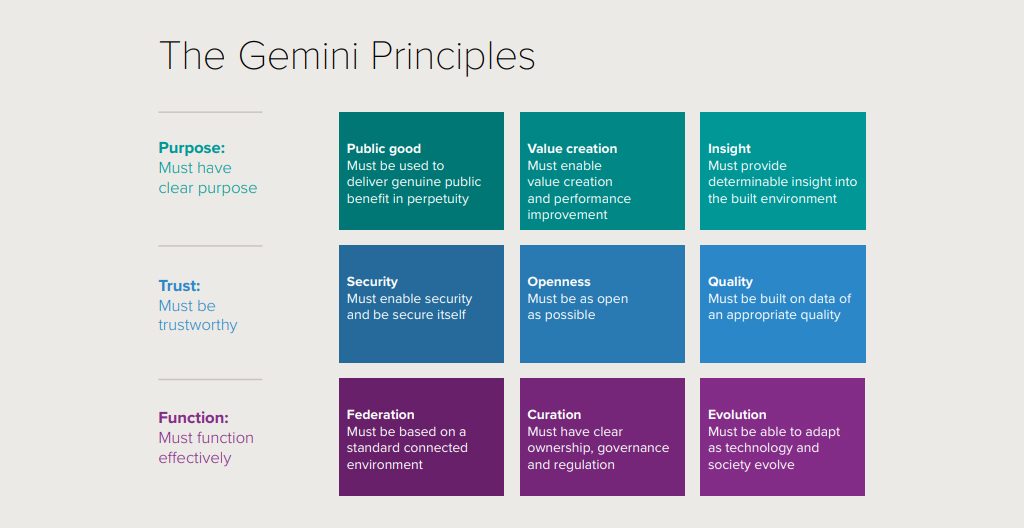

Example of Guiding Principles. The UK has recently come up with the Gemini Principles for a National Digital Twins strategy:

Gemini Principles for a National Digital Twins strategy

Example of a Framework. The OECD has formulated a six-dimensional Digital Government Framework:

1. From the digitisation of existing processes to digital by design

2. From an information-centred government to a data-driven public sector

3. From closed data and processes to open by default

4. From a government-led to a user-driven administration

5. From government as a service provider to government as a platform

6. From reactive to proactive policy making and service delivery

Organisational Design

Existing organisational structures of government are primarily designed for an analog world and need to change to become more relevant in the digital era. A good starting point for an organisational redesign is the area of digital regulation which often adopts a narrow sectoral approach that is likely to be sub-optimal. Also, the rapid pace of technological change typically results in laws and rules lagging technology.

Digital regulation needs to be designed from the ground up to be cross-sectoral, cross-border, cross-platform, public-private, and technologically oriented. Given that digital technologies are general purpose technologies, their regulation should be cross-sectoral as a horizontal, rather than as a vertical. Given that data flows are often agnostic to national boundaries, and the most valuable tech companies (e.g., social media companies) are outside most national borders, it is essential to bring a cross-border perspective to regulation. Similarly, the oversight of Over the Top content (OTTs), for example, requires cross-platform approaches.

If regulatory actions have to keep pace with technology, it will be necessary for regulators to work upstream with innovators and startups through strong public-private partnerships.

Some countries starting with the UK have established regulatory sandboxes to work closely with the private sector. Regulators will also have to leverage technology better in the future to retain their relevance. A case in point is tackling online harms. It may be impossible to prevent the spread of harmful content on social media, without the use of automated safety technologies.

Sequencing

A sound digital strategy should have a correct sequencing of actions for promoting the digital economy. Foundational elements, e.g., broadband networks, ease of data access, cybersecurity, digital skills, agile regulation, and entrepreneurship deserve precedence over other aspects.

Finally, to paraphrase Boon Siong Neo and Geraldine Chen in their book ‘Dynamic Governance,’ in developing a national digital strategy it is crucial to think ahead, think across, think big, and think again.