I recently came across an article which makes 7 predictions for a post COVID world. Upon reflection, I agree with the predictions to varying degrees and decided to comment further.

First, let me share a couple of general observations. Currently, we are still in the eye of the storm. Many are unable to see any light at the end of the tunnel. There is quite a bit of negative sentiments, and some fail to see that the situation will ever improve. I am sure similar thoughts occurred during other crises: the 1918 Pandemic (Spanish Flu); the Great Depression of the 1930s; the Dot.com bust of 2001; SARS in 2003; and the Global Financial Crisis/Great US Recession of 2007. During each of these events, a sense of impending Armageddon came over much of the population. Certainly, in each instance, people did experience some personal and social permanent changes, with which they learned to adapt and cope. But, inevitably, the world did go on and Armageddon did not occur.

One of the basic truths I believe, is that humans require and crave interaction with other humans. Think about the videoconferencing applications. The use of these apps grew exponentially as the main communication channel. Instead of just audio, it was audio and video. These mediums greatly assisted society in coping and adapting. Mankind, and the Natural World, will always find a way.

Here are the predictions from the article:

- Companies that traffic in digital services and e-commerce will make immediate and lasting gains

- Remote work will become the default

- Many jobs will be automated, and the rest will be made remote-capable

- Telemedicine will become the new normal, signaling an explosion in med-tech innovation

- The nationwide student debt crisis will finally abate as higher education begins to move online

- Goods and people will move less often and less freely across national and regional borders

- After an initial wave of isolationism, multilateral cooperation may flourish

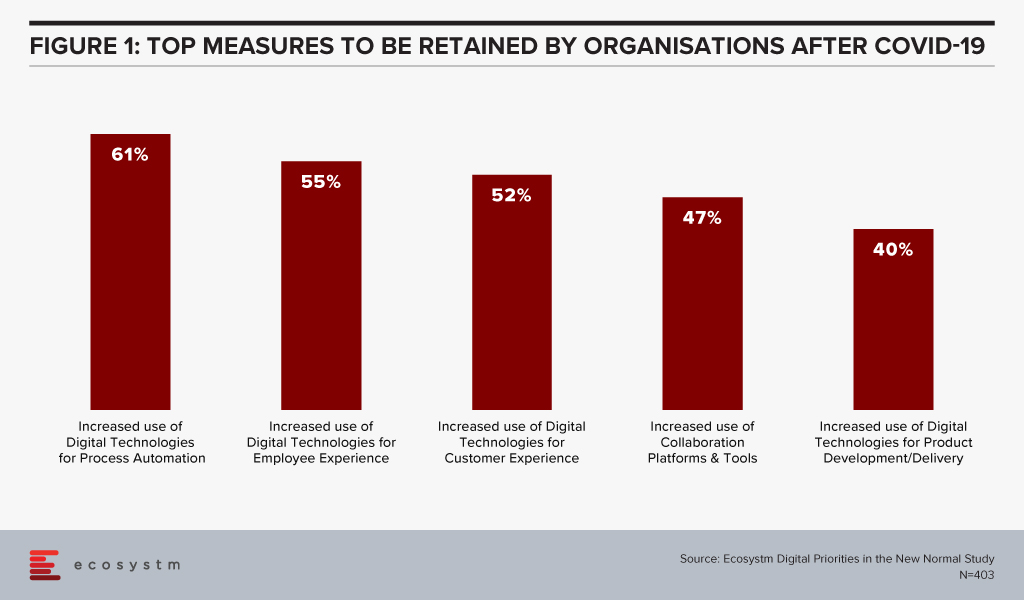

I very much agree with the author’s first prediction. This one is fairly obvious, as it has proven true throughout the crisis with providers such as Amazon, Zoom and others. It is expected to continue into the post COVID world. This is also evident from the findings of the Ecosystm research on the impacts of COVID-19. Organisations intend to continue to use digital technologies, even after the immediate crisis is over (Figure 1).

A Natural State of Equilibrium will Emerge

I believe for each of the areas described in the predictions, there will be various levels of long-term modification. None of them will return to their pre COVID-19 state, as we have all experienced going down the rabbit hole. During the pandemic, due largely to the lockdowns, the pendulum swung significantly towards one side. Many times, when people predict a new view, the current state is considered the New Normal. For me, the relevant question is: Will things stay as they are now, or will there be a new natural state of equilibrium? If so, what will it look like, in each of these areas? I don’t believe there is one answer, or one New Normal for all the dimensions being discussed. I believe a new normal state will potentially be different for each individual, each company/entity and each condition. In a post COVID-19 world there could be 50 shades of grey in each of these areas.

One of the predictions states that remote work will become the default. It must be remembered that part of work is a collaborative effort. While video conferencing has enabled collaborative efforts, the importance of the accidental interaction at the break room, printer, etc. can’t be under-estimated. It is these unscheduled interactions that enable accidental collaboration which can lead to great solutions. Thus, there will be many shades to the Future of Work – there will not be one absolute.

A similar example is a prediction for higher education. Part of the learning process a university offers is interacting with people who are not similar to your background or beliefs. That is one of the benefits of a diverse university. Similar to the corporate environment, many different types of learning environments will enable a person to gain great experiences from the time at university.

The advantage of all these alternatives will be the additional options and benefits to people post COVID compared to the pre COVID-19 world. It will present many great opportunities for entrepreneurs and innovators, as well as end-users and consumers. It will create new and iterative ‘middle spaces’. It will be possible for a David to emerge and challenge a Goliath(s).

The two Chinese characters for the word ‘crisis’ are “danger” and “opportunity”. Just as we are in a dangerous time now, it has also presented new and different opportunities. Those opportunities will continue to exist even when the danger has passed. I am also reminded of the old expression “May you live in interesting times”. It very much applies to all of us now and in the future. I wish the same for all of you.

Stay Safe. Stay Healthy. Stay Mentally Positive.

India has clearly been a target market for Facebook due to the size of the country’s untapped market and the proportion of its younger population. It is estimated that nearly 45% of the population is below 25 years – a prime target for social media and eCommerce platforms. Facebook’s Free Basic program, launched in 2016 to introduce the potential of the Internet to the underprivileged and digitally unskilled, failed primarily because it did not have knowledge of the telecommunications market in India. Facebook returned to the India market the following year, this time in collaboration with Airtel, to launch Express WiFi, aimed at setting up WiFi hotspots to provide internet in public places – again aimed at India’s connectivity issues.

Making its largest foray into the Indian market yet, last week Facebook announced that it is investing US$5.7 billion in Jio Platforms – India’s largest telecom operator – for a 9.9% minority stake. Facebook makes its intentions very clear and is targeting the 60 million small and medium enterprises (SMEs) who can be the backbone of India’s growing digital economy. This includes a rather unorganised retail sector, which has had to adopt digital at breakneck speed following the Government’s earlier financial reforms, which impacted the smaller retailers, dependent primarily on cash transactions. Facebook is by no means the only global giant with an interest in India’s retail business – with Amazon and Walmart leading the way.

The JioMart and WhatsApp Pilot

Just days after the announcement, JioMart – an eCommerce venture also a wholly-owned subsidiary of Reliance Industries, like Jio Platforms – has launched a pilot in Mumbai which allows users to order groceries through WhatsApp. Customers can now place grocery orders through WhatsApp Business with JioMart reaching out to small-scale retailers and brick and mortar stores – or “Kirana stores” as they are referred to in India – to fulfil the order. More than 1,200 local stores have been engaged for this pilot. It currently does not include a digital payment option and invoices and alerts are sent through WhatsApp. Mukesh Ambani, Chairman and MD of Reliance Industries, says that the JioMart and WhatsApp collaboration has the potential to make it possible for around 30 million neighbourhood stores to transact digitally.

India Emerging as the New Battlefield

India is an important eCommerce market for global giants such as Facebook and Amazon, who have struggled with establishing a presence in China. Walmart has also set it its sights on India, with its recent acquisition of Flipkart. Ecosystm Principal Advisor, Kaushik Ghatak says. “India represents the final frontier, where the battle lines are being drawn, and the three are heading towards a collision path. Facebook’s recent move has just upped the game for Amazon and Walmart, as well as for the eCommerce and Fintech start-ups who have been eyeing this market.”

Amazon has been the early mover, establishing its eCommerce presence in India way back in 2013. Ghatak says, “From its initial marketplace approach of curating suppliers to start selling on its platform, Amazon graduated to offering its own delivery and fulfilment services, by establishing dozens of warehouses across India. This was to ensure the quality and timeliness of deliveries, upholding its ‘Fulfilment by Amazon’ (FBA) brand promise. There was a considerable cost though, in terms of time to ramp up and investments – with the associated asset risks. Also, reaching out to the diffused retail sector, with their non-existent or very low level of digitalisation, has been difficult for all the major eCommerce players such as Amazon and Flipkart. Jeff Bezos’ announcement of an additional investment of $ 1 billion, earlier this year, to digitise SMEs, allowing them to sell and operate online, is a step to extend its reach into this diffused retail market.”

JioMart’s model, according to Ghatak is in stark contrast to Amazon’s. “JioMart’s currently ongoing pilot in Mumbai is a classic B2C marketplace model, with little or no asset risk. The orders placed by the customers are routed to the nearest Kirana store based on stock availability, with the customers going to pick up the ordered items themselves at times.”

Ecosystm Principal Advisor, Niloy Mukherjee says, “Jio has unparalleled market access in India with reports showing north of 370 million subscribers. Even at a $1.7 per month revenue from such a huge number, one can get to a $7.5 billion-dollar annual business. But even this is dwarfed by what that subscriber base itself is worth – through the data it provides, the products that can be sold and so on. Similarly, WhatsApp will prove to be more important than Facebook in India, with more than 400 million users. Using WhatsApp to get Kirana stores to do delivery can be a true game-changer.”

Talking about how this competes with Amazon, Mukherjee says, “This can eat into the business of an Amazon and my guess is, it will be far more efficient. The proximity to the customer will allow multiple deliveries per day at short notice, and fresh produce guarantees – maybe even door returns if not satisfied – that would be hard to match. Given the traffic situation in large Indian cities, delivery logistics from a more distant source will always struggle to compete. This is one tip of a multi-pronged spear – there are obviously other products that can be contemplated, leading to additional revenues.”

The Possibilities Ahead

Mukherjee explains why he thinks Facebook invested in Jio Platforms, rather than just forging a collaboration model. “Clearly both parties want to tie the other down and make sure that this alliance is long term. And this possibly means revenue will be shared instead of the usual commission model. Also, the go-to-market implications can run to more than just the Indian market. WeChat Pay is huge in China but not really elsewhere. If this works, there could be a potential “WhatsApp Pay” in the rest of the world. For Jio who already dominates the telecom landscape in India, this deal is a step towards taking their earnings to a new level, above the top end of the telecom category – they can access profit pools available to hardly any telecom provider worldwide.”

At a time when a market entry for foreign players in India is getting tougher with increasing regulatory pressures, a tie-up with the biggest player in India is indeed a very promising step – for both Facebook and Reliance. “For Facebook, this is a great opportunity to take its dependence away from a primarily ad-driven revenue model. The digitalisation of the diffused retail sector in India will open up new revenue opportunities from its WhatsApp Business App, WhatsApp Business API, and WhatsApp Pay-UPI gateway (pending regulatory approval). There is a potential of revenues from a variety of marketing services, membership fees, customer management services, product sales, commissions on transactions, and software service fees,” says Ghatak.

Talking about the potential for Reliance Industries, Ghatak says, “The technology horsepower of Facebook will help propel them ahead of Fintech and eCommerce companies in India – challenging already established players such as Amazon and Flipkart, and the newbie start-ups. Ability to drive transactions and digital payments in the diffused retail sector will open up huge revenue opportunities that were largely untapped until now, with low asset risks. Also, this sector has traditionally operated on a cash-based model and the recent COVID-19 crisis has exposed how vulnerable the sector is with a limited view of the supply chain, and limited funding for working capital. Developing relationships with the millions of Kirana stores spread across India also gives the opportunity of revenue generation through supply chain financing – a largely ignored sub-sector until now.”

Mukherjee thinks that this alliance will challenge players such as Amazon and Amazon Pay, Google Pay and PayTM. Ghatak also thinks that eventually, Jio Platform will have to either choose between or integrate the best features of WhatsApp Pay and the Jio Money Merchant payment gateways.

However, Ghatak offers a word of caution on the downside risks as well. “Partnering with Facebook is a hugely ambitious game plan for Reliance Industries. The success of its plans will also depend on how well it is able to curate the suppliers who are responsible for the actual delivery. In a consumer-driven business model, trust and customer experience cannot be compromised. The low asset, high leverage and high reach model can unravel itself if the customer gets the short end of the stick, in this rush for eCommerce domination.”

The COVID-19 pandemic is debilitating industries, and economies around the world are facing the prospect of a recession. Malaysia, like many other countries, is focussing on front-line medical efforts and security services to save lives and contain the deadly, rapidly spreading virus. Essential services such as food, water and energy supply, Telecommunications, Banking, eCommerce and logistics are working overtime in this new order to support basic functions. The measures put in place to mitigate the spread of the virus are obviously inhibiting other economic activities.

Until enough people develop an immunity to the virus – either through a vaccine or naturally – it is hard to envisage lifting these movement control measures and return to a pre COVID-19 state. Malaysia has a total of 4,987 positive cases, the highest in Southeast Asia and a death toll of 82 as of today. The number of the population tested remains low at 81,730 as reported by the Ministry of Health, mainly due to limited testing resources.

The biggest challenge is that this epidemic is unprecedented, and it is unclear when we can put this situation behind us. The Malaysian Industry of Economic Research (MIER) has predicted about 2.4 million job losses as well as the GDP to reduce by 2.9 percent in 2020. Public debt rise coupled by reduced income due to lower crude oil, natural gas and palm oil prices and demand, will hit the Government coffers hard. Interest rates are expected to be low through the current lockdown stage right up to the recovery stage to help support the economic recovery.

Government Initiatives for the Economy

Like many countries, Malaysia has announced economic stimulus packages to ensure help for the poor and needy, that workers do not lose their jobs and that companies avoid bankruptcy – albeit with an inevitably reduced output – to keep the economy functioning. The stimulus offered is short-term covering a few months, and more assistance will be required should the epidemic linger and for the recovery period.

The Government announced a stimulus package on the 27th February worth RM20 billion (US$4.5 billion) and another one on the 27th March worth RM230 billion (US$52.6 billion). The packages comprise of direct fiscal injection of RM25 billion (US$5.7 billion) as well as loan deferments, one-off cash assistance, credit facilities and rebates. The focus of the stimulus packages is to assist people in the lower-income (B40) and mid-income (M40) groups, aid for employees in the private sector and for traders during the movement control order (MCO) which is to run until 14th April 2020.

An additional COVID-19 stimulus package worth RM10 billion (US$2.2 billion) was announced on the 6th April to address the challenges of the small and medium enterprises (SMEs) that employ two-thirds of the workforce and contribute to 40 percent of the GDP. The wage subsidy is to benefit 4.8 million workers earning less than RM4,000 (US$915) per month. In addition, SMEs will have access to interest free loans of RM200 million (US$45.7 million) from the National Entrepreneur Group Economic Fund and a further RM500 million (US$114.4 million) via Bank Simpanan Nasional. The Government allowed 750,000 SMEs to postpone income tax payment for three months from 1st April – companies in the tourism sector are allowed to postpone income tax for six months.

Impact on Industries

Banking & Financial Services. Banking institutions will support the Government’s stimulus initiatives by providing a six months’ loan repayment moratorium, corporate loan restructuring and conversion of credit card balance to long term loans. Banking and financial institutions are focussing on business continuity planning to ensure minimal disruption to their business and customer support. Many key business processes are now being put to test in-home working with scaled-down office operations. Digital Transformation (DX) has been accelerated as a result.

Contactless payments have seen a boost and many financial institutions have increased payment limits for such payments. Early last month the World Health Organisation (WHO) and the Bank of England had issued advisories against the use of banknotes, as it could increase the chances of the virus spread, instead recommending the use of contactless payment where possible. This might give a boost to the use of Cryptocurrency and cross-border payment services in Malaysia. In 2019, cryptocurrency start-ups received an estimated 12 percent of Fintech funding – but, only three cryptocurrency exchanges were given conditional approval by the Securities Commission. The current situation may well see that changing.

Insurance. The Prime Minister announced that the Insurance industry is to create a fund of RM8 million (US$1.8 million) to cover the cost of RM300 (US$68.6) per policyholder to undergo COVID-19 tests. In addition to this, insurance companies are to offer a 3-month suspension on premiums for policyholders whose income is affected by the pandemic.

Agriculture. Even prior to COVID-19, there has been a brewing narrative against globalisation, favouring a nationalistic emphasis as reflected globally by Brexit and the China-US trade wars tension. Food security is key, and COVID-19 has further highlighted its importance with priorities shifting to local requirements over exports. The Government intends to distribute a food security fund of RM1 billion (US$228.8 million) to increase the local production of farms, fisheries and livestock. According to the Department of Statistics, Malaysia’s food and beverage imports amounted to RM54 billion (US$12.3 billion) in 2018 while food exports stood at RM35 billion (US$8.0 billion) resulting in a trade deficit of RM18.8 billion (US$4.3 billion). As countries focus on internal supplies instead of exports in the current scenario, Malaysia needs to address this risk by producing more locally.

Impact on Industry Transformation

Amidst the gloomy outlook, there are plenty of opportunities, especially to the country’s Digital Economy. Malaysia has been committed to the Digital Economy vision with the Malaysia Digital Economy Corporation (MDEC) estimating that the country’s Digital Economy is worth US$3 trillion. The COVID-19 crisis may well be the key driver in achieving that vision. DX efforts are being accelerated with businesses adopting more cloud and mobility solutions. More workloads have to be digitalised and there is greater adoption of Cloud for storage and services. AWS, Microsoft Azure and Google Cloud will be beneficiaries in this area.

I have already spoken about the Financial Services industry – other industries are also getting transformed out of a necessity to survive this crisis. The Education sector has seen an increase in access to educational content and traffic to education portals and blogs. Some schools have implemented online lessons and group chats between teachers, students and parents to ensure education continues through this pandemic. Many universities have used their e-learning platforms to move lectures online.

The Telecommunications industry is being appreciated more than ever and it is the backbone to normal life, in both a social and business sense. The Government’s stimulus package includes offers of free internet to all customers until the MCO is over at RM600 million (US$137.3 million) and an investment of about RM400 million (US$91.5 million) to improve coverage and quality of service. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period. The Axiata Group recently announced a cash fund of RM150 million (US$34.3 million) to assist micro-SMEs within the ecosystem providing eCommerce, digital payments and related services.

Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been the biggest winners so far. The home working trend should continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and the impending rollout of 5G.

The eCommerce sector should see a major improvement in Malaysia with physical channels to the market being suspended. Malaysians have not embraced eCommerce like mature economies have, and it has significant room for improvement. Development of the SME sector and eCommerce are twin focus areas for the Digital Economy vision. Statista reports that the average Malaysian eCommerce shopper spent just US$159 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for necessities such as online grocery, food and delivery of goods. As a consequence, the Transport & Logistics sector will have to adapt their business operations in order to ride this wave successfully.

Video streaming and gaming has also seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. There provides a tremendous opportunity for both telecom operators and content providers to increase their number of services in this area.

Malaysia, like all other countries, will have to ride out this wave. It has made a positive step in the direction with the stimulus packages, especially for the SME sector. How well the country rides this wave out will depend on how targeted the future stimulus packages are and how fast industries can transform to handle the new world order that will emerge after the COVID-19 crisis.

The COVID-19 pandemic has highlighted the importance of the telecommunications industry which has now become the backbone of the new normal, both in a social and business sense. The last few months have seen a number of changes including more video usage, location of traffic and time of traffic. Network usage is on the rise and telecom carriers are prioritising on the resilience of their networks and the quality of services offered to their customers.

What goes up must come down

According to Speedtest, global mobile and broadband speeds have suffered as a result of the increase in traffic with speeds dropping in March 2020 for mobile to 30.47 Mbps (from 31.62 Mbps in February) and fixed broadband to 74.64 Mbps (from 75.41 Mbps in February). In Southeast Asia, only Singapore and Vietnam averaged mobile speeds of 54.37 Mbps and 33.97 Mbps respectively, exceeding the global average speeds. As for fixed broadband, Singapore ranked highest globally achieving 197.26 Mbps while Thailand and Malaysia clocked 149.95 Mbps and 79.86 Mbps respectively, trumping the global average speeds.

Southeast Asian carriers increase network efficiency and quality

Singapore. The country’s ICT regulator, Infocomm Media Development Authority (IMDA), reported an increase in internet usage and its intentions to support telecom carriers in boosting network capacity to ensure essential services run smoothly. Priority will be given to high traffic and residential areas where a larger proportion of the population are working from home. The Ministry of Communications and Information (MCI) reported that Singapore has at least 30 percent buffer in network capacity even during peak periods. Major TV operators Mediacorp, Singtel and Starhub have made more content available for free during this period. This may further impact network speeds as customers are consuming more content over wifi (on mobile apps) or over the fibre networks.

Thailand. Part of the country’s public assistance measures during the pandemic, include offering about 30 million mobile subscribers 10GB free data. The National Broadcasting and Telecommunications Commission (NBTC) will also upgrade the speeds of fixed broadband to at least 100 Mbps which is expected to benefit 1.2 million household subscribers. Leading operator Advanced Info Service (AIS) recently announced that it has deployed 5G networks at hospitals to boost network capacity and speeds, and is deploying robots for telemedicine to empower the healthcare system to fight COVID-19.

Malaysia. Maxis and Telekom Malaysia (TM) reported a surge in traffic since the movement control order (MCO) was implemented by the Government on the 18th March 2020. The MCO is expected to run at least until 28th April 2020. TM cited a 30 percent increase in usage attributed to the increase in traffic for streaming, online games and teleconferencing. Leading operators Maxis, Digi, Celcom and U Mobile have offered 1GB free data during the MCO period as part of the Government’s stimulus package. Maxis, TM, Digi and Celcom have also committed significant manpower to ensure that the networks are operating efficiently and to ensure customer support. Leading TV operator Astro has made all movie, news and cartoon networks available to all its customers until the 28th April 2020.

Social distancing fillip for video conferencing

The rise of social distancing has made us all seek new ways to connect, mainly through video chat. Video conferencing traffic is on the rise as it is the next best thing to face-to-face meetings. Microsoft Teams and Zoom have been big benefactors. The American Economic Institute (AEI) notes that Zoom hit some 200 million users daily from a daily average 10 million. Microsoft Teams added some 12 million registrations to a total of 44 million.

Many predict that the home working trend will continue in the recovery stage and beyond, due to improvements in the telecommunications infrastructure and impending rollout of 5G. It is also predicted that the commercial property sector is likely to suffer due to this trend. This period also highlights the critical importance of cybersecurity with increasing occurrences of hacking and fraud. Zoom is being forced to reinforce their privacy and security measures, as an example.

COVID-19 has changed the way we web

On the social front, many are also using video conferencing to communicate with friends and family. Operators relaxing and offering additional data has undoubtedly contributed to the increase in this usage too. Now that many are homebound, network traffic in residential areas are higher than ever. In the past, peak hours of traffic at homes were at night – this has changed with adults and children homebound. Adults are using video conferencing and more voice calls; while children are using elearning, playing games or streaming videos. The European Commission had asked Netflix and other streaming platforms to reduce streaming quality to standard definition (SD). Netflix has assured that it has the capability to manage levels of streaming quality in accordance with the networks quality requirement of individual countries.

Online gaming and video streaming have emerged as winners and have seen an increase in consumption in these times as they provide for entertainment for millions stuck at home. There is tremendous opportunity for both telecom operators and content providers to increase their number of services in this area. Netflix, YouTube, Microsoft Xbox and PlayStation are among the winners in this sector. YouTube provides for a primary news source and commentary on the epidemic for many. Netflix’s stocks are near an all-time high at present.

eCommerce boost for essentials goods and services

The eCommerce sector should see a major improvement in Southeast Asia as physical channels to market have reduced. Emerging economies such as Malaysia and Thailand should see an improvement in services and embrace eCommerce like their mature counterparts. Statista reports that the average Malaysian eCommerce shopper spent just US$159 and Thailand just US$100 on online consumer goods purchases in 2018, considerably lower than the global average of US$634. There is huge opportunity to provide for basic necessities such as online grocery, food and delivery of goods. As a consequence, contactless payment and the transport and logistics sector will be forced to adapt their business operations to ride this wave successfully. As eCommerce transactions diversify and increase in emerging markets, it will give telecom providers an opportunity to keep engaging with platform players.

Telecom carriers are likely to suffer financial losses due to the scale of the disruption COVID-19 has brought about. However, there are some positives takeaways from this period. The increase of network traffic and the changing patterns have driven carriers to better understand network traffic management. The sharp consumer and business onboarding as far as applications and digital services are concerned, has given the digital economy and 5G use cases a shot in the arm. This is likely to spur innovation in services including communications, eCommerce, payments, logistics and healthcare among others.

The FMCG industry has always been competitive given the need to drive high sales volume because of the low profit margins of the products. As the industry faces changes – such as the demographics of the consumer base and the need to introduce newer sales channels – technology is playing an important role in ensuring that the organisations can remain competitive.

eCommerce Disrupting the FMCG Industry

The concept of online retail is said to have originated in some form in the 1960s. But with the growth of the access to the Internet in the 1990s and Amazon’s competitive business model, it has disrupted the retail and FMCG industries. As we see a steady growth in smartphone usage, digital payments, online banking and app-based platforms, online retail is becoming mainstream. While initially thought to be ideal for the purchase of durables and entertainment products and services (where price comparison is key), it has become common for FMCG companies to use eCommerce platforms. Even perishables are being purchased online with the rise in the number of online grocery stores. This is impacting the FMCG industry in a number of ways:

Change in Marketing Strategy

FMCG companies need to continue their traditional marketing strategy for in-store consumers. But at the same time, they need to reach out to a wider base of consumers who shop online. The profile of these consumers is different – younger and technologically savvier. They do not necessarily believe in brand loyalty. While the browse-to-buy ratio for FMCG products is high, they are having to invest in digital marketing strategies including personalised campaigns and presence in social media and online forums. Even packaging for in-store and online products need to be different for some products.

Increased Competition

An online presence means that your brand can reach a wider audience – this also means that the competition becomes tougher. Now global brands compete with brands from other countries as well as local brands on the same online platform. This raises the bar, with companies competing not only on price and product but also on delivery services and better customer feedback.

Increased Complexity of the Supply Chain

No longer can an FMCG company depend solely on trucks delivering their products to stores at a fixed time of day. As they play increasingly in the B2C space, they have to constantly be aware of seasonality and spikes. This means that their supply chain operations become that much more complicated, and they are having to spend more on logistics and transportation. There is also the need to handle a larger volume of data.

Changing Consumer Profile

As mentioned earlier, the consumer profile of the FMCG industry has changed to include younger consumers who want to shop online. It also includes consumers in newer markets made possible by eCommerce platforms. FMCG companies also have to cater to consumers who are conscious about product quality, the environment and ethics. This means they want to know where the products were grown or manufactured, their carbon footprints and generally want more traceability of the products they are purchasing. This has led governments to come up with guidelines to protect consumer rights. Recently, the UK government issued guidelines on the quality, labelling, standards and food safety including the right logos, health and identification marks.

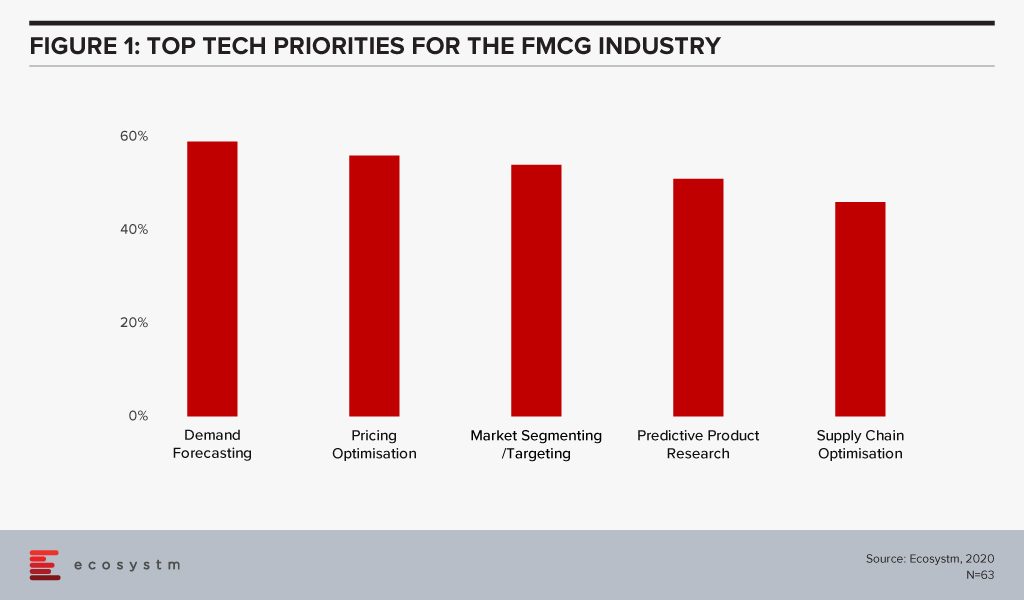

The global Ecosystm AI study reveals the top priorities for FMCG companies, focused on adopting emerging technologies (Figure 1). It is clear that their key priority is to handle the competitive market by focusing both on the consumer and the supply chain. Supply chain optimisation through demand forecasting ensures that they are not managing extra stock, and simultaneously not losing out on customers because of lack of stock. This just-in-time inventory management includes initiatives such as pricing optimisation in response to market demand, competition and – especially in the case of perishables – ensuring that stock closer to the use by date is cleared.

Technology as an Enabler of FMCG Transformation

The one advantage that FMCG companies have today is they have access to enormous customer and inventory data. As a result, they are able to leverage several emerging technologies to transform.

Digital Marketing

One area that is transforming the industry is digital marketing which includes multiple aspects such as search engine marketing, video marketing, social media activity and email marketing. While several technologies come together for a digital marketing solution and AI is a key component of the solutions, there are platforms that provide an end-to-end solution.

Digital marketing is most effective with a targeted group of customers and when organisations can identify digital or social champions. Johnson & Johnson’s Babycenter.com is a good example of how creating a digital community can help market products. The core idea behind the website is to give expecting and new mothers advice on early childhood. While on the surface it appears disassociated from Johnson & Johnson, the site almost exclusively carries their advertisements. This gives them a targeted base to push their products to. Dollar Shave Club is another example of how brands can leverage digital marketing. Their social media engagement has been so successful that they got bought over by Unilever. The digital campaign includes incentivising members with their products for posting about them on Instagram or Facebook.

Blockchain

FMCG companies are investing in Blockchain and digital ledger technologies for track and trace functionalities and operational efficiency. The technology not only helps manage the supply chain better by effective shipping timelines maintenance, delivery management and inventory management; it also helps build trust in a brand. It helps in compliance management, reduces the number or need for middlemen, easier handling of cross-border transactions and brings about an end-to-end accountability.

Danone initiated a Track & Connect service for their baby formula using Blockchain for transparency and traceability to show the authenticity of their products to parents and for a better customer experience. FMCG companies will benefit immensely from the farm-to-fork accountability concept initiated by Agriculture.

AI

From predictive analysis to machine learning to deep learning, AI is bringing a lot of benefits to FMCG companies. AI is enabling companies to discover gaps (both in their consumer interactions and in the supply chain) and make their processes intelligent – including demand forecasting, supply chain optimisation, personalised product offerings, social media analytics, consumer sentiment analytics and recommendation engines.

FMCG organisations are analysing internal and external data sources for both sales and improved customer experience. As FMCGs are forced to sell online to remain competitive, they have access to a high volume of the consumer as well as supply chain and inventory management data. Coca-Cola remains one of the leaders in the FMCG market by leveraging this data, including product research and social data mining. Even their vending machines are looking to leverage AI for personalised offerings and for loyalty programs.

The need to enhance the customer experience has also seen innovations like the Maggi Chatbot – “Kim”- that helps customers learn about Maggi recipes, ingredients, and dietary requirements, through Facebook Messenger.

FMCG companies that cannot afford to invest in technologies such as AI also have the option of leveraging the technology offerings of their online retail platform. eBay offers analytics as a service to the sellers – offering them data, metrics, and analytics to help them succeed. They also introduced computer vision technology to help sellers create clearer and more attractive images for the platform.

In this competitive market, we will see FMCG companies – and not just the big global brands but also the local producers – embrace more technology.