Why do we use AI? The goal of a business in adding intelligence is to enhance business decision-making, and growing revenue and profit within the framework of its business model.

The problem many organisations face is that they understand their own core competence in their own industry, but they do not understand how to tweak and enhance business processes to make the business run better. For example, AI can help transform the way companies run their production lines, enabling greater efficiency by enhancing human capabilities, providing real-time insights, and facilitating design and product innovation. But first, one has to be able to understand and digest the data within the organisation that would allow that to happen.

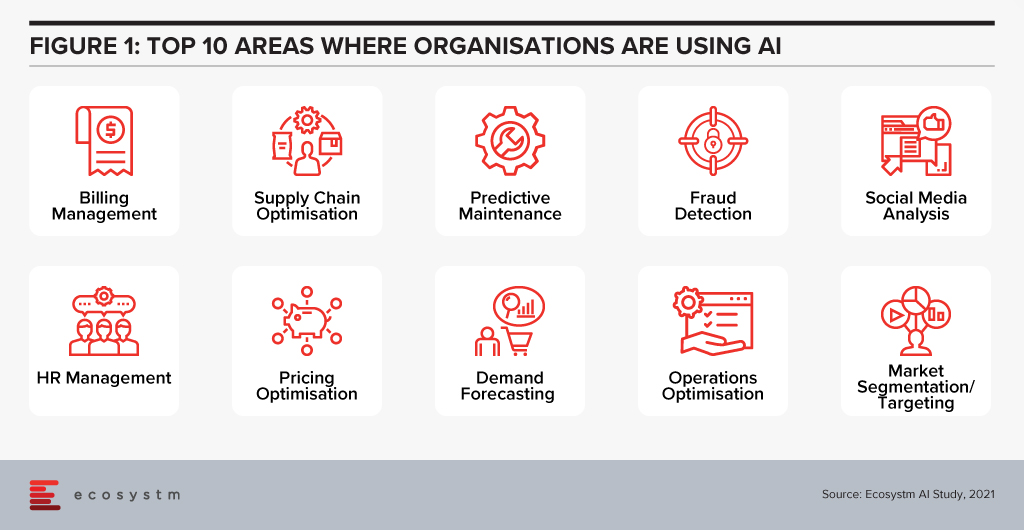

Ecosystm research shows that AI adoption crosses the gambit of business processes (Figure 1), but not all firms are process optimised to achieve those goals internally.

The initial landscape for AI services primarily focused on tech companies building AI products into their own solutions to power their own services. So, the likes of Amazon, Google and Apple were investing in people and processes for their own enhancements.

As the benefits of AI are more relevant in a post-pandemic world with staff and resource shortages, non-tech firms are becoming interested in applying those advantages to their own business processes.

AI for Decisions

Recent start-up ventures in AI are focusing on non-tech companies and offering services to get them to use AI within their own business models. Peak AI says that their technology can help enterprises that work with physical products to make better, AI-based evaluations and decisions, and has recently closed a funding round of USD 21 million.

The relevance of this is around the terminology that Peak AI has introduced. They call what they offer “Decision Intelligence” and are crafting a market space around it. Peak’s basic premise was to build AI not as a business goal for itself but as a business service aided by a solution and limited to particular types of added value. The goal of Peak AI is to identify where Decision Intelligence can add value, and help the company build a business case that is both achievable and commercially viable.

For example, UK hard landscaping manufacturer Marshalls worked with Peak AI to streamline their bid process with contractors. This allows customers to get the answers they need in terms of bid decisions and quotes quickly and efficiently, significantly speeding up the sales cycle.

AI-as-a-Service is not a new concept. Canadian start-up Element AI tried to create an AI services business for non-tech companies to use as they might these days use consulting services. It never quite got there, though, and was acquired by ServiceNow last year. Peak AI is looking at specific elements such as sales, planning and supply chain for physical products in how decisions are made and where adding some level of automation in the decision is beneficial. The Peak AI solution, CODI (Connected Decision Intelligence) sits as a layer of intelligence that between the other systems, ingesting the data and aiding in its utilisation.

The added tool to create a data-ingestion layer for business decision-making is quite a trend right now. For example, IBM’s Causal Inference 360 Toolkit offers access to multiple tools that can move the decision-making processes from “best guess” to concrete answers based on data, aiding data scientists to apply and understand causal inference in their models.

Implications on Business Processes

The bigger problem is not the volume of data, but the interpretation of it.

Data warehouses and other ways of gathering data to a central or cloud-based location to digest is also not new. The real challenge lies with the interpretation of what the data means and what decisions can be fine-tuned with this data. This implies that data modelling and process engineers need to be involved. Not every company has thought through the possible options for their processes, nor are they necessarily ready to implement these new processes both in terms of resources and priorities. This also requires data harmonisation rules, consistent data quality and managed data operations.

Given the increasing flow of data in most organisations, external service providers for AI solution layers embedded in the infrastructure as data filters could be helpful in making sense of what exists. And they can perhaps suggest how the processes themselves can be readjusted to match the growth possibilities of the business itself. This is likely a great footprint for the likes of Accenture, KPMG and others as process wranglers.

ServiceNow announced their intention to acquire robotic process automation (RPA) provider, Intellibot, for an undisclosed sum. Intellibot is a significant tier 2 player in the RPA market, that is rapidly consolidating into the hands of the big three – UiPath, Automation Everywhere, and Blue Prism – and other acquisition-hungry software providers. This is unlikely to be the last RPA acquisition that we see this year with smaller players looking to either go niche or sell out while the market is hot.

Expanding AI/Automation Capabilities

Intellibot is the latest in a string of purchases by ServiceNow that reveals their intention to embed AI and machine learning into offerings. In 2020, they acquired Loom Systems, Passage AI (both January), Sweagle (June), and Element AI (November) in addition to Attivio in 2019. These acquisitions were integrated into the latest version of their Now Platform, code-named Quebec, which was launched earlier this month. As a result, Predictive AIOps and AI Search were newly added to the platform while the low-code tools were expanded upon and became Creator Workflows. This means ServiceNow now offers four primary solutions – IT Workflows, Employee Workflows, Customer Workflows, and Creator Workflows – demonstrating the importance they are placing on low-code and RPA.

ServiceNow was quick to remind the market that although they will be able to offer RPA functionality natively once Intellibot is integrated into their platform, they are still willing to work with competitors. They specifically highlighted that they would continue partnering with UiPath, Automation Anywhere, and Blue Prism, suggesting they plan to use RPA as a complementary technology to their current offerings rather than going head-to-head with the Big Three. Only a month ago, UiPath announced deeper integration with ServiceNow, by expanding automation capabilities for Test Management 2.0 and Agile Development projects.

Expansion in India

The acquisition of Intellibot, based in Hyderabad, is part of ServiceNow’s expansion strategy in India – one of their fastest growing markets. The country is already home to their largest R&D centre outside of the US and they intend to launch a couple of data centres there by March 2022. The company plans to double their local staff levels by 2024, having already tripled the number of employees there in the last two years. The expansion in India means they can increasingly offer services from there to global customers.

Market Consolidation Accelerates

In the Ecosystm Predicts: The Top 5 AI & AUTOMATION Trends for 2021, Ecosystm had talked about technology vendors adding RPA functionality either organically or through acquisitions, this year.

“Buyers will find that many of the automation capabilities that they currently purchase separately will increasingly be integrated in their enterprise applications. This will resolve integration challenges and will be more cost-effective.”

ServiceNow’s purchase is one of several recent examples of low-code vendors acquiring their way into the RPA space. Last year, Appian acquired Novayre Solutions for their Jidoka product and Microsoft snapped up Softomotive. Speculation continues to build that Salesforce could also be assessing RPA targets. Considering RPA market leader, UiPath recently announced that their Series F funding round values the company at USD 35 billion, there is pressure on acquirers to gobble up the remaining smaller players before they are all gone or become prohibitively expensive.

The cloud hyperscalers are also likely to play a growing role in the RPA market over the next year. Microsoft and IBM have already entered the market, coming from the angle of office productivity and business process management (BPM), respectively. Google announced just last week that they will work closely with Automation Anywhere to integrate RPA into their cloud offerings, such as Apigee, AppSheet, and AI Platform. More interestingly, they plan to co-develop new solutions, which might for now satisfy Google’s appetite for RPA rather than requiring an acquisition.

Here are some of the trends to watch for RPA, AI and Automation in 2021. Signup for Free to download Ecosystm’s Top 5 AI & Automation Trends Report.