Never before has the world experienced a shutdown in both supply and demand which has effectively slammed the brakes on economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises and the telecommunications industry has been the pillar which has kept the world ticking over.

It is unthinkable just how the human race would have coped with such massive disruption, two decades ago in the absence of broadband internet. The technology and telecom sector has seen a rise in their visible importance in recent months. Various findings show that peak level traffic was about 20-30% higher than the levels before the pandemic. The rise in traffic coupled with the fervent growth of the digital economy augurs well for the technology and telecom sector in Southeast Asia.

Revenues Hit Despite Rise in Traffic

Unfortunately, the rise in network traffic has not translated to an increase in revenue for many operators in the region. The winners, that enjoyed YoY growth in Q1 2020 despite challenging circumstances were: Maxis (4.9%) and DiGi (3.4%) in Malaysia; dtac (3.3%) and True (5.7%) in Thailand; PDLT (7.5%) and Globe (1.4%) in the Philippines; and Indosat Ooredoo (7.9%) and XL Axiata (8.8%) in Indonesia. The telecom operators that struggled include: Celcom (-6.1%) and TM (-8.0%) in Malaysia; Singapore’s trio of Singtel (-6.5%), StarHub (-15.2%) and M1 (-10.3%); and AIS (-1.0%) in Thailand.

Key market trends include a dip in prepaid subscribers due to fall in tourist numbers, roaming income losses due to travel restrictions, and a general decline in average revenue per user (ARPU) due to weaker customer spend. The postpaid customer segment was resilient while the fixed broadband revenue stream was stable due to the increase in work from home (WFH) practices. With fixed tariffs, there are no incremental gains with an increase in usage. Voice revenue has been hit with the increase in collaboration-based communication applications such as Zoom and Microsoft Teams.

Equipment sales fell as global supply chains were severely disrupted and impacted new sign-ups of the more premium customers. Most markets in Southeast Asia depend on retail outlets as a key channel to the market, which has been hampered.

With the job losses across the world, bad debts and weakened customer spend is inevitable and it is imperative that the operators provide for reflective pricing strategies, listen to new customer requirements to ensure customer retention and strengthening of their market position. In May, Verizon’s CEO Hans Vestberg said nearly 800,000 of their subscribers were unable to pay their monthly bills. Discussions with operators in Southeast Asia also highlighted this as a current concern.

Enterprise Segment Target for New Growth

Ecosystm research shows that enterprises in Southeast Asia are increasingly considering telecom operators as go-to-market partners (Figure 1). Enterprises are demanding more than just devices and connectivity and with the fervent digital transformation (DX) efforts underway, services such as managed services, business application services, cybersecurity and network services are in demand. Technology vendors have an opportunity to partner with the right telecom operator in each market to enhance their IT market offerings, ahead of the 5G rollouts.

The broad 5G ecosystem inculcates cross-sector innovation and greater collaboration leading to new business models and exciting new opportunities. Singtel is the leading operator in the region and has the enterprise segment contributing approximately 65% to its revenue in its domestic market. In the World Communications Award 2019, Singtel won both “Best Enterprise Service” and “The Broadband Pioneer” awards. This places Singtel in a fine position to capitalise on the 5G enterprise services.

5G Needed Now More Than Ever

The pandemic has seen a rise in network traffic, onboarding of the digital customer and rapid DX of businesses which has whetted the appetite for faster broadband speeds and new services. Southeast Asia countries stand to profit from the trade war between the US and China and 5G features of low latency and higher security can boost adoption of IoT, Smart Manufacturing and broader Industry 4.0 goals to drive the economy.

Fixed Wireless in Southeast Asia is expected to be very popular considering the low penetration of fibre to the home (with the exception of Singapore) and will provide enterprises with a viable secondary connection to the internet. Popular applications – including video streaming and gaming – which are speed, latency and volume hungry will also be a target market for operators. Mobile operators that do not have a fixed broadband offering can enter this space and provide a serious “wireless fibre” alternative to homes and businesses.

Governments and telecom regulators ought to make spectrum available to the major telecom operators as soon as possible in order to ensure that the cutting edge 5G communications services are made available to consumers and businesses. Many experts believe 5G can raise the competitiveness of a nation.

Recent research from World Economic Forum (WEF) has found that significant economic and social value can be gained from the widespread deployment of 5G networks, with 5G facilitating industrial advances, productivity and improving the bottom line while enabling sustainable cities and communities. GSMA notes that mobile technologies and services in the wider Asia Pacific region generated USD 1.6 trillion of economic value while the mobile ecosystem supported 18 million jobs as well as contributing USD 180 billion of funding to the public sector through taxation.

US-China Trade War Threatens to Change Equipment Supplier Landscape

Despite severe pressures caused by the US-China trade war, Huawei posted an impressive 13.1% YoY growth in 1H 2020 registering revenue of USD 64.88 billion. Both Huawei and ZTE generate approximately 60% of their business from their domestic markets which is critical with the current unfavourable global sentiments. Huawei has diversified its business and built its consumer devices business which should withstand the disruptions caused by the political challenges.

Ericsson and Nokia stand to benefit from Huawei’s current global position and this was evident with the wins for the 5G contracts by Singtel and JVCo (Singtel and M1). The JVCo announced it selected Nokia to build the Radio Access Network (RAN) for the 5G standalone (SA) mmWave network infrastructure in the 3.5GHz radio frequency band. Singtel selected Ericsson to provide for the RAN on the same mmWave network.

However, while there is an opportunity for NEC and Samsung to join the party, Huawei is expected to do well in most other countries in Southeast Asia.

The Rise of the Digital Economy in Southeast Asia

A recent Google report valued the internet economy in Southeast Asia at USD 100 billion in 2019, more than tripling since 2015, and the sector is expected to hit USD 300 billion in 2025. With a population of approximately 570 million people, the region has some of the fastest-growing internet economies in the world.

The Indonesia market is the largest in the region and is expected to hit USD 133 billion from USD 40 billion in 2025. Indonesia’s lack of a world-class telecom infrastructure coupled with their slowness in 5G adoption has not impeded the country’s attractiveness for global technology investors who see the 270 million population as an immense opportunity. US tech giants, Facebook, Google, and PayPal have invested in Indonesia to reap the benefits from the growing digital economy powered by unicorns such as Gojek, Bukalapak, Tokopedia. In June 2020, Google Cloud launched in Jakarta, only the second in the region after Singapore with the four big unicorns being anchor customers.

In 2025, Google predicts Thailand to be the second-largest internet economy worth USD 50 billion. The internet economy for Singapore, Malaysia and the Philippines are estimated to be over USD 27 billion each. Shopee and Lazada are the top eCommerce apps in the region and have seen an increase in sales due to the disruption in the Retail industry. In-store shopping contributes to more than 50% of Retail in Singapore and Malaysia – this provides a tremendous opportunity for eCommerce players.

While movement restrictions are gradually being lifted, some things may never return where they were before COVID-19. Public debts have risen with numerous aids and handouts impacting economic growth forecast and rising unemployment is impacting customer spending power. On the plus side, DX of businesses and sharp onboarding of customers have redefined interactions, and sectors such as Education, are going online which will boost the digital economy. While the challenges are evident, exciting times are ahead for the technology and telecom sector in Southeast Asia.

When I wrapped up my visit to this year’s Mobile World Congress (MWC) in Barcelona, I had wondered if my pre-trip question of what would the 5G story be after several years of being told that each preceding year was ‘the’ year. However, this year had a very distinct vibe to it, and I was rewarded for my pilgrimage to the Grand Fira.

Let’s not forget that technology takes longer to roll out that all of us want to think and 5G is no different. We have had no excuses since we only have to look at how long it took 3G and LTE to become mainstream and how long the transition from the prior technology took to move to the next generation.

However, the mobile and telecom industry is not the same as it was when earlier telecommunication tech was being upgraded. In the past hardware, benchmarks feeds and speeds dominated the marketing messages, but now it is about software, cloud and ecosystem collaboration. Gone are the days when the telecom equipment vendors ruled the conversation about their technology – that has clearly been replaced by IT companies leading the charge with topics such as virtualization, IoT, analytics and new services. Once there was a US automobile commercial that touted the latest edition of its cars was ‘This is not your father’s Oldsmobile’. Well, 5G is not your father’s telecom infrastructure!

This time around, operator and equipment vendors may have to take the collaborative partner role in any new digital solution. Instead of 5G projects being dominated by Ericsson or Huawei for example, there is a role for the likes of VMware, Microsoft, and Salesforce to be the lead company. In some cases, it could be Bosch, PTC, or Siemens while in others it could be Audi, BMW or Mercedes. The overall trend here is that all of these companies are being digitally driven to deliver new services to a customer that is firmly at the center of an ecosystem. The one industry sector who might lose out could be the telco operators who could be squeezed by the surge from IT vendor relevance, despite them investing heavily on 5G licenses. However, this time the operators are in a much stronger position to be the perfect channel for the massive amount of intelligence-laden data being created by smart connected devices that are not typical mobile devices.

So what was the outcome at MWC? I visited both the Huawei and Ericsson booths following pre-MWC briefing sessions to see if the customer buzz was there – and indeed it was.

Ericsson may have won the prize for the most crowded booth, while Huawei’s sprawling booth wins the most lavish and largest booth. The two company’s 5G messages could not have been more different.

The Big Two

For me, Huawei had invested heavily in making its hardware products very compelling for operators to install. Clearly, there had been a lot of research had gone into replacing existing infrastructure with massive performance upgrades and deployment friendly attributes e.g. size and weight of base stations that could be mounted by individuals rather than by cranes. The result of this strategy is that Huawei’s customers can quickly deploy 5G platforms with lower CapEx and OpEx thus creating significant incentives for operators to migrate to 5G networks.

Ericsson’s leading story was about migrating to 5G by highlighting its key enablers (i.e. carrier aggregation, LTE-NR spectrum sharing, and dual mode 5G cloud core). It appeared that Ericsson had moved its message off hardware (which, by the way, is still table stakes in any selection process and Ericsson had plenty of new 5G related offerings) and onto a strategy of smooth evolution and deployment at scale – a much more business leader discussion than a network, driven by software. Finally, both companies had strong messages around their AI capabilities to help their service providers make sense of the growing complexity of services that will be generated by the connected smart IoT devices.

The Importance of IT Software On 5G

IT and industrial companies played an increasingly important role at this year’s MWC as service providers and they became involved in deeper partnerships. 2019 was the year when the gaps for 5G between the network and IT services were being filled in. For example, I saw AR (augmented reality) solutions by PTC supported by Microsoft and being fed by data off a 5G network. This showed how industry, cloud and network service providers will accelerate new technologies.

In another example, Salesforce showed how Edge Computing events triggered Salesforce SaaS-based enterprise management services while being supported by AT&T’s 5G network and the modules being designed and tested at AT&T’s Foundry. Here, AT&T 5G network was being used as a high-value channel for Salesforce’s customers to run their business functions at the edge of the network.

Digital twins have shown up as a digital representation of a physical device or asset. However, this year, I saw a Wipro example of how 5G could drive digital twin concepts beyond physical assets and into the workflow, supply chain management, logistics and worker safety. Every ‘asset’ that was to be used in a factory floor was digitized into a digital twin and then a 5G network was used to monitor and manage every aspect of the factory. It seemed that Industry 4.0 had arrived in its full glory.

Finally, VMware continues to be the IT company that service providers will either love or dislike – I still don’t know which one it will be. VMware’s virtualization and cloud management capabilities have been extended right into 5G networks. For example, NFV (Network Function Virtualization) is critical to operators as they slice the 5G bandwidth into the appropriate services. VMware has its strategy correct when it says that it could virtualize the network just as it has with the cloud, but in doing so is making itself either a partner or a competitor of the operators for their 5G services revenues. 2018 was the year when VMware made a big splash at MWC, 2019 was the year when they showed that they have something to offer – will 2020 be the year when they take over the network software virtualization profit pools just as they did with the enterprise server virtualization market?

Crawl, Walk, Run

In conclusion, MWC 2019 was the year that the 5G gaps to make end-to-end infrastructure solutions where clearly being filled in. Service providers had stepped up their willingness to be part of the customer-centric ecosystem that is almost certainly being led by IT software companies. Telecom equipment vendors were offering technology solutions to speed up 5G deployments while making forward compatible solutions much easier. Finally, 5G-supported applications remain the last piece of the puzzle that MWC hasn’t addressed fully. As a result of the massively varied 5G use cases, there is still a look of curiosity on which industry will be the lead for 5G – will it be the auto industry with autonomous cars, will it be Industry 4.0 and the smart factory, or will it be smart cities with video surveillance. In addition, it is certain that IoT is still very much a necessary part of any 5G strategy just as AI outcomes continue to fuel IoT-based sensors in technologies such as the self-driving cars, AR, and digital twins. 2019 may have been the year that decided that it won’t matter whether the connected IoT device used licensed (NB-IoT) or unlicensed (LoRa) spectrum protocols as both will be seamlessly connected to a 5G network. IoT was not dead, it had simply grown up and was now integrated with more valuable solutions.

Commonwealth Bank of Australia (CBA) has entered into a partnership kicking off trials of 5G and edge computing with telecommunication majors Telstra and Ericsson to explore the benefits of 5G in the banking sector.

The partnership agreement was signed at the annual Mobile World Congress (MWC) 2019, in Barcelona. The trials are projected to showcase what banking in the future might look like, and how 5G technology and edge computing can help to lower the requirements of the infrastructure presently required for banking operations.

Speaking on the subject, Ecosystm’s, Principal Advisor, Tim Sheedy, thinks that “this trial will help all parties better understand where the opportunities are for users of the mobile networks, and for the telco and equipment providers too. They will understand the potential demand for specific network slices and capabilities and get a better idea of what they need to deliver and whether or not there may be demand for these services”.

5G edge computing is still in nascent stages and there’s not much present in the market. Whether it minimises infrastructure or distributes it differently is yet to be seen. “The trials will likely determine what the shape of the new distributed architecture looks like (how close to the “edge” do the data centres need to be?)” says Tim, “There are unknowns of 5G at the moment – so the trials are invaluable to all parties to help them know where and what they need to invest in to make 5G services commercially viable.”

For a layman, 5G edge computing is all about delivering the reliability, speed, and latency that they need – or more likely – a sensor needs in order to get its job done. Once the technology becomes mainstream the end-users/banking customers will reap benefits from it. “5G is not just about delivering faster speed but it is about delivering them intelligently”, says Tim, “5G will help Telco’s to prioritise traffic AND network services – meaning that the end user can achieve their goals.”

While it’s too early to tell at this stage how will 5G benefit the banking sector, it should help banks offer their customers more reliable and relevant services – but what services need to be distributed at what times, and what can remain at the core are not yet understood.

Rightly so, the first day of the Mobile World Conference was taken up by more and more air time on the ever coming 5G networks. Was 2019 going to be the year when operators around the world would finally deploy 5G in volume? The booths in the halls at the Fira Grand would indicate that ‘if you build it, they will come’. Indeed the speculation that 5G is the next big game changer is over – it is the game changer for this next turn of the technology dial.

However, let’s assume that the 5G hype is in the rear view mirror and we look to see what could be ahead of us in the mobile and telecom industry. At the end of the first day of this year’s MWC, I may have seen the future opportunity – and it is awesome! Pat Gelsinger asked the question “why can’t we build the telco networks like the clouds have been built for with scalability, flexibility, efficiency, and agility”? It’s a very fair question. After all, we do have Network Function Virtualization (NFV), and we will have new 5G services, so why not a new telco cloud?

I spent time with two companies that may show us a glimpse of the future network and cloud infrastructure. The first is the Israeli software startup, DriveNets with its solution “Network Cloud”. DriveNets is focused on helping service providers disaggregate proprietary routers from their networks as they move to 5G. DRiveNet’s Network Cloud solution aims to disrupt the current network business model by separating network costs (e.g. proprietary hardware functions) to create network functions from its software stack and two ‘white label’ hardware building blocks. The entire network infrastructure is software-centric allowing for agility, scalability, and normalizing costs with business growth.

However, Network DriveNets is an unusual startup in that it came out of stealth mode with $110 million in its first round of funding. The company was founded in 2015 by Ido Susan who should be familiar to Cisco watchers as he sold his first startup, Intucell (self-optimising network technology), to them for $475 million in 2013. DriveNets other co-founder, Hillel Kobrinsky founded Interwise (web conferencing) which was snapped up by AT&T for $121 million. To that end, the company is well funded and has the ability to sustain itself long enough to potentially disrupt the $50 billion network hardware business.

The second is Rakuten Mobile, a well-known name in Japan, but the first mobile virtual network operator (MVNO) to launch there in over 10 years. MNOs are not new so what makes Rakuten different? The company’s CTO, Tareq Amen explained to me that they are building the world’s first end-to-end fully virtualized cloud-native network running all of its workloads in the cloud. Being a fully virtualized network enables Network Function Virtualization to take advantage of cloud computing basis assets where a service delivery platform can be implemented, customized and scaled at speed. Finally, all of Rakuten’s core technology including its Radio Access Network (RAN – a topic that has been highly discussed at this year’s MWC) on 5G thus delivering immediate and actual 5G services. This compares to most of the rest of the industry who will have to build an uncomfortable transformation roadmap from 2/3G and LTE to 5G. While Amen’s strategy is compelling, there are a few technical hurdles to overcome. For example, enterprise-grade 5G indoor coverage isn’t fully there yet so Amen will have to rely on the operators that he is competing against who have that real estate.

So why highlight DriveNet and Rakuten in the same blog? In Rakuten’s case the CAPEX and OPEX business models for operators may be turned on their heads by the fact that its network is taking all of the competitive advantages of 5G while offering customers as disruptive pricing models and services. In a country such as Japan where traditional operators have struggled to modernize their networks, this could be a competitive threat. Equally, there could be a global rise in copy-cat pure 5G/cloud-based MVNOs spring up and fiercely compete against the incumbent local operators as well as give other MVNOs a tough time. As for DriveNets – it’s simple…it’s software and virtualization of the switch and router market which is very appealing to the service providers. It will commoditize the hardware, lowering their costs while allowing them to continue to focus on new 5G services.

Recently I attended Ericsson’s Industry Analyst Day in Boston where Ericsson’s leaders updated the analyst community on the state of the company both globally and in North America. They also deep dived into the network evolution to 5G, AI, Automated Operations,5G and IoT Industry Innovation. With my focus on IoT, I was keen to hear what was new in IoT platforms, cellular connectivity, secure IoT 5G services, and Industry 4.0 use cases.

Corporate Update:

As part of the very public turnaround plan, Helena Norrman, Ericsson’s SVP and Chief Marketing and Communications Officer and Head of Marketing and Corporate Relations announced the following: Ericsson’s focused strategy continue to be based on a vision to empower an intelligent, sustainable connected world while enabling the full value of connectivity for service providers. Results of the strategy included accelerated cost cut – which was on plan to reduce expenses by 10 Billion Swedish Kroners (SEK), with an improved cash position by over 11 Billion SEK.

While not out of the woods yet, it appeared that the renewed focus on business efficiency, improved end-customer experience and new revenue streams has given Ericsson a level of optimism that hasn’t been seen for at least 4 years. For example, Norrman shared that Ericsson’s networks had become 50% more efficient in energy consumption on footprint and operations optimization. She indicated that new digital services were being rolled out 86% faster than before. Finally, she indicated that Ericsson had achieved 201% RoI in the first year for an IoT-based factory maintenance system.

In his update, Niklas Heuveldop, President and Head of Ericsson North America, suggested that there might be continued changes for the big 4 US-based telecom operators. With a background of a six-fold increase in mobile data, mobile revenue remains flat, blended ARPUs declining, and cellular connections (including IoT) growing by 4.4% from 398 million 3Q-2016 to 434 million 2Q-2018, he indicated that operators would have to look for new revenue streams to stay profitable. This was on top of a new operator market that may change structurally as a result of the T-Mobile/Sprint merger (offering a broad range of spectrum for both consumer and enterprise customers), and the arrival of new wireless network operators.

5G and IoT

The day was dominated with the business opportunities based off 5G networks, as Ericsson continues to look to expand the addressable markets by enabling new revenue streams. For example the combined Critical and Massive IoT markets based off 5G networks could range between $200 – $600 Billion as part of scale driven and performance driven opportunities in markets such as Industry 4.0.

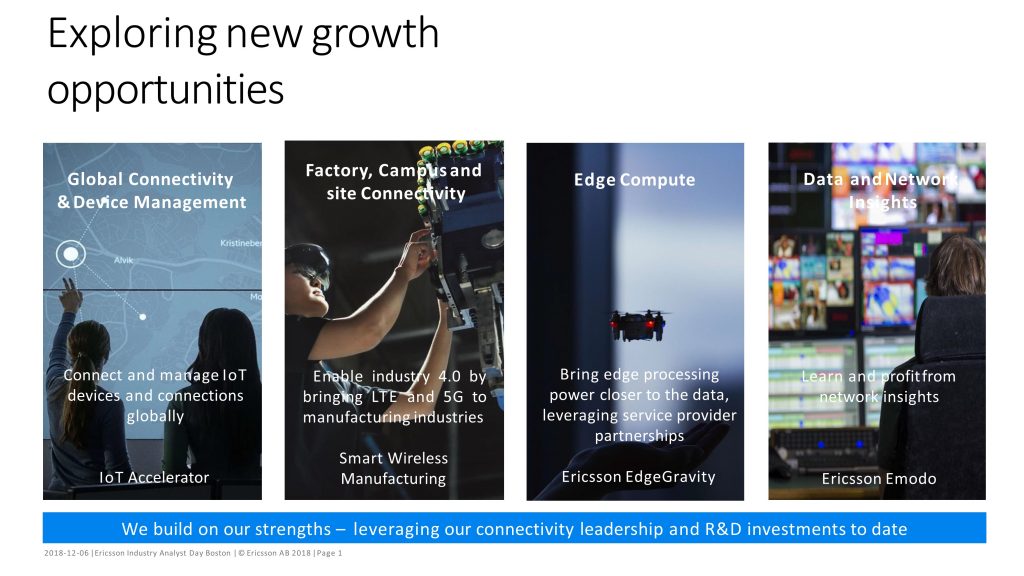

However, this is a new looking Ericsson who shared its new IoT strategy. Jeff Travers, head of IoT, was clear that IoT would follow a path of disciplined growth with goals to:

- Capture new revenues through rapid innovation building on 5G and IoT

- Make our primary customers, services providers, succeed in new value pools

- Use a lean startup approach to validate and scale ideas.

These goals would be achieved off the backs of things that Ericsson does well:

- Build a connectivity platform:- IoT Accelerator

- Be the forefront partner in Industry 4.0 wireless connectivity

- Aggressively position itself as a leading partner in Edge Computing for its operator customers and network partners: – Ericsson EdgeGravity

- Processing and providing network insights and analytics :- Ericsson Emodo

Analyst Opinion:

5G and IoT have been pushed by the major operators for some time and the industry has been holding its breath as vendor after vendor attempts to craft a profitable business strategy and identify use cases that deliver an acceptable RoI. Most have not yet either reached scale because of the lack of readiness of the whole ICT infrastructure once IoT devices are connected. Too much emphasis has been placed on too few IoT applications at the edge of the network. Too much hope has been placed on Edge Computing without meeting customers’ needs of an end-to-end solution.

However, we belief that Ericsson’s clear focus on connecting IoT devices, while maximizing the edge computing needs through local analytics while enabling operators to partners with cloud service providers will open up vertical industries such as manufacturing to IoT deployments. Ericsson’s solution for wireless capabilities within Industry 4.0 could be readily accepted by customers who want to transform themselves to digital-based businesses.