When the FinTech revolution started, traditional banking felt the heat of competition from the ‘new kid on the block’. FinTechs promised (and often delivered) fast turnarounds and personalised services. Banks were forced to look at their operations through the lens of customer experience, constantly re-evaluating risk exposures to compete with FinTechs.

But traditional banks are giving their ‘neo-competitors’ a run for their money. Many have transformed their core banking for operational efficiency. They have also taken lessons from FinTechs and are actively working on their customer engagements. This Ecosystm Snapshot looks at how banks (such as Standard Chartered Bank, ANZ Bank, Westpac, Commonwealth Bank of Australia, Timo, and Welcome Bank) are investing in tech-led transformation and the ways tech vendors (such as IBM, Temenos, Mambu, TCS and Wipro) are empowering them.

To download this Ecosystm Bytes as a pdf for easier sharing and to access the hyperlinks, please click here.

Our financial system plays a central role in crystallising priorities and incentives for businesses and other stakeholders across the globe. So, many of us breathed a sigh of relief as the financial community got behind the Environmental, Social and Governance (ESG) movement in recent years, signalling a very visible acceleration in ESG as a hot button issue for investors and lenders.

Unfortunately, the growth of ESG as a priority for investors, lenders and consumers has driven many companies to oversell their green and/or social credentials in order to burnish their brands and attract investment. This is referred to as “greenwashing” and “social washing”.

As sustainability becomes a critical pillar for investors and consumers in their decision-making, data, analytics and technology play an increasingly critical role in enabling better decisions based on credible, accurate and more real-time information.

Read on to find out the three themes for technology enablement in sustainable finance, together with examples and potential use cases including companies such as IBM, Triodos Bank, Alipay, Floodmapp, and Data Gumbo.

Blockchain and Distributed Ledger Technology (DLT) is set to transform various aspects of the Financial Services industry. The technologies have a role to play in automating processes such as payments and securitisation, claims, and compliance monitoring.

Where the industry will see real value is in governance and standards around data sharing and collaboration – which lies at the core of the Open Banking revolution.

This Ecosystm Snapshot looks at how Blockchain in Financial Services is fast becoming a reality – and how different stakeholders (such as ABF, IMDA, Singapore Customs, Visa, Mastercard, TCS, Bitpanda and others) are looking to leverage it.

Innovation is at the core of FinTechs. The Financial Services industry has been disrupted over the last few years because of the innovation and customer experience that FinTechs offer. But the FinTech world has become highly competitive, and there are many companies that do not make it, despite the innovations.

There are many factors that contribute to the success of a FinTech – and creating the right market differentiation is one of the key factors. This Ecosystm Snapshot looks at how FinTechs – such Earnest, Flock, Billd, Littlepay, Willa and AffiniPay – are disrupting industries as they build solutions targeted at those specific industries, to create the market differentiation required to succeed.

The appetite to adopt Open Banking solutions has increased, largely expedited by the pandemic. As consumers look for more digital engagements and better rates and services, they are more open to giving third-party providers access to their financial information that has traditionally been held by their banks.

The success of Open Banking initiatives depends on the Banking and FinTech ecosystem coming together to create an end-to-end digital architecture.

This Ecosystm Snapshot discusses some of the evolving trends in Open Banking, such as product differentiation by FinTechs to address a competitive market; the banking industry’s need to adopt digital and foster innovation; market entry by other industry leaders; and the need for trust in Open Banking adoption.

We cover recent announcements by companies such as Lloyd’s Bank, Mastercard, Batelco Financial Services, CarFinance 247, Credit Kudos, Prometeo, APImetrics and tomato pay.

We are seeing a rise in social and environmental consciousness – especially in the younger generation. Their awareness of human rights, the environment and inclusion is growing exponentially – they want to create impact. Organisations are being driven to develop and demonstrate an Environmental, Social and Governance (ESG) consciousness in their actions and investments.

In this Ecosystm Snapshot, we cover some of the recent examples of how governments and individual advocates are creating a difference; and how financial organisations and tech providers are embracing ESG.

Read how organisations such as Sun Cable, Equinix, Microsoft, NVIDIA, Prologis, Zensung, Ergo, Munich Re, Natwest, JPMorgan, Credit Suisse and others are working to make the world a better place.

In this Insight, guest author Anupam Verma talks about the technology-led evolution of the Banking industry in India and offers Cloud Service Providers guidance on how to partner with banks and financial institutions. “It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.”

India has been witnessing a digital revolution. Rapidly rising mobile and internet penetration has created an estimated 1 billion mobile users and more than 600 million internet users. It has been reported that 99% of India’s adult population now has a digital identity in the form of Aadhar and a large proportion of the adult Indians have a bank account.

Indians are adapting to consume multiple services on the smartphone and are demanding the same from their financial services providers. COVID-19 has accelerated this digital trend beyond imagination and is transforming India from a data-poor to a data-rich nation. This data from various alternate sources coupled with traditional sources is the inflection point to the road to financial inclusion. Strong digital infrastructure and digital footprints will create a world of opportunities for incumbent banks, non-banks as well as new-age fintechs.

The Cloud Imperative for Banks

Banks today have an urgent need to stay relevant in the era of digitally savvy customers and rising fintechs. This journey for banks to survive and thrive will put Data Analytics and Cloud at the front and centre of their digital transformation.

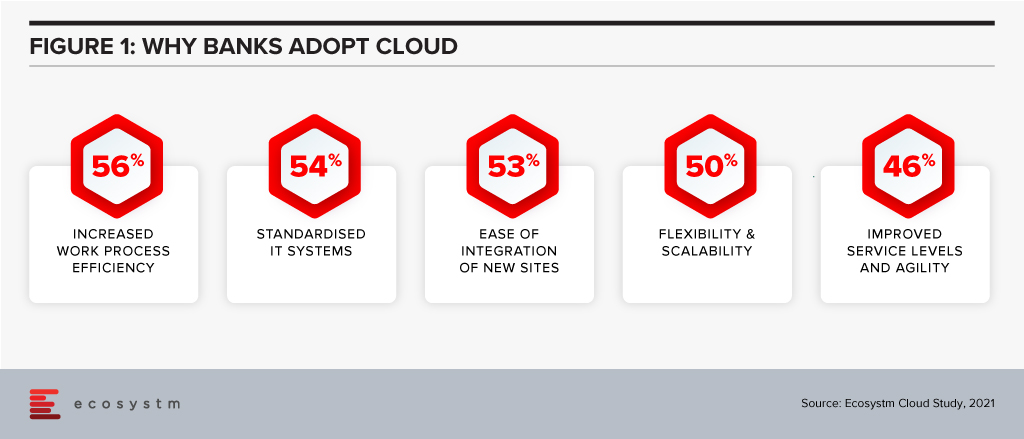

A couple of years ago, banks viewed cloud as an outsourcing infrastructure to improve the cost curve. Today, banks are convinced that cloud provides many more advantages (Figure 1).

Banks are also increasingly partnering with fintechs for applications such as KYC, UI/UX and customer service. Fintechs are cloud-native and understand that cloud provides exponential innovation, speed to market, scalability, resilience, a better cost curve and security. They understand their business will not exist or reach scale if not for cloud. These bank-fintech partnerships are also making banks understand the cloud imperative.

Traditionally, banks in India have had concerns around data privacy and data sovereignty. There are also risks around migrating legacy systems, which are made of monolithic applications and do not have a service-oriented architecture. As a result, banks are now working on complete re-architecture of the core legacy systems. Banks are creating web services on top of legacy systems, which can talk to the new technologies. New applications being built are cloud ready. In fact, many applications may not connect to the core legacy systems. They are exploring moving customer interfaces, CRM applications and internal workflows to the cloud. Still early days, but banks are using cloud analytics for marketing campaigns, risk modelling and regulatory reporting.

The remote working world is irreversible, and banks also understand that cloud will form the backbone for internal communication, virtual desktops, and virtual collaboration.

Strategy for Cloud Service Providers (CSPs)

It is estimated that India’s public cloud services market is likely to become the largest market in the Asia Pacific behind only China, Australia, and Japan. Ecosystm research shows that 70% of banking organisations in India are looking to increase their cloud spending. Whichever way one looks at it, cloud is likely to remain a large and growing market. The Financial Services industry will be one of the prominent segments and should remain a focus for cloud service providers (CSPs).

I believe CSPs targeting India’s Banking industry should bucket their strategy under four key themes:

- Partnering to Innovate and co-create solutions. CSPs must work with each business within the bank and re-imagine customer journeys and process workflow. This would mean banking domain experts and engineering teams of CSPs working with relevant teams within the bank. For some customer journeys, the teams have to go back to first principles and start from scratch i.e the financial need of the customer and how it is being re-imagined and fulfilled in a digital world.

CSPs should also continue to engage with all ecosystem partners of banks to co-create cloud-native solutions. These partners could range from fintechs to vendors for HR, Finance, business reporting, regulatory reporting, data providers (which feeds into analytics engine).

CSPs should partner with banks for experimentation by providing test environments. Some of the themes that are critical for banks right now are CRM, workspace virtualisation and collaboration tools. CSPs could leverage these themes to open the doors. API banking is another area for co-creating solutions. Core systems cannot be ‘lifted & shifted’ to the cloud. That would be the last mile in the digital transformation journey. - Partnering to mitigate ‘fear of the unknown’. As in the case of any key strategic shift, the tone of the executive management is important. A lot of engagement is required with the entire senior management team to build the ‘trust quotient’ of cloud. Understanding the benefits, risks, controls and the concept of ‘shared responsibility’ is important. I am an AWS Certified Cloud Practitioner and I realise how granular the security in the cloud can be (which is the responsibility of the bank and not of the CSP). This knowledge gap can be massive for smaller banks due to the non-availability of talent. If security in the cloud is not managed well, there is an immense risk to the banks.

- Partnering for Risk Mitigation. Regulators will expect banks to treat CSPs like any other outsourcing service providers. CSPs should work with banks to create robust cloud governance frameworks for mitigating cloud-related risks such as resiliency, cybersecurity etc. Adequate communication is required to showcase the controls around data privacy (data at rest and transit), data sovereignty, geographic diversity of Availability Zones (to mitigate risks around natural calamities like floods) and Disaster Recovery (DR) site.

- Partnering with Regulators. Building regulatory comfort is an equally important factor for the pace and extent of technology adoption in Financial Services. The regulators expect the banks to have a governance framework, detailed policies and operating guidelines covering assessment, contractual consideration, audit, inspection, change management, cybersecurity, exit plan etc. While partnering with regulators on creating the framework is important, it is equally important to demonstrate that banks have the skill sets to run the cloud and manage the risks. Engagement should also be linked to specific use cases which allow banks to effectively compete with fintech’s in the digital world (and expand financial access) and use cases for risk mitigation and fraud management. This would meet the regulator’s dual objective of market development as well as market stability.

Financial Services is a large and growing market for CSPs. Fintechs are cloud-native and certain sectors in the industry (like non-banks and insurance companies) have made progress in cloud adoption. It is well understood that the banks that were early adopters of cloud have clearly gained market share during COVID-19. Banks are keen to adopt cloud but need a partnership approach balancing innovation with risk management so that it is ‘not one step forward and two steps back’ for them.

The views and opinions mentioned in the article are personal.

Anupam Verma is part of the Leadership team at ICICI Bank and his responsibilities have included leading the Bank’s strategy in South East Asia to play a significant role in capturing Investment, NRI remittance, and trade flows between SEA and India.

If you are a digital leader in the Financial Services industry (FSI), you have already heard this from your customers: ‘Why is it that Netflix and Amazon can make more relevant and personalised offers than my bank or wealth manager?’ Digital first players are obsessed with using data to understand their customer’s commercial and consumer behaviour. Financial Services will need to become just as obsessed with personalisation of offerings and services if they want to remain relevant to their customers. Ecosystm research finds that leveraging data to offer personalised service and product offerings to their clients is the leading digital priority in more than 50% of FSI organisations.

Banks, particularly, are both in a strong position and have a strong incentive to offer this personalisation. Their retail customers’ expectations are now shaped by the experience they have received from their favorite digital first firms, and they are making it increasingly clear that they expect personalised offerings from their banks. Furthermore, they are well positioned as a facilitator of commercial relationships between two segments of customers – consumers and merchants. The amount of data they hold on consumer interactions is comprehensive – and more importantly they are a trusted custodian of their customers’ data and privacy.

The Barriers to Personalisation

So, what is stopping them? Here are three insights from over 12 years of experience driving digitisation of Financial Services:

- Systems Legacy. Often the data and core banking systems do not allow for easy access and analysis of the required data across the data sets required (eg. Consumers and Merchants).

- Investment Priorities. There is still a significant investment happening in compliance and modernisation of core banking systems. Too often the focus of these programs can be myopic, and banks miss the opportunity to solve multiple pain points with their investments driven by overly focused problem statements.

- Culture and Purpose. Are banks stuck in a paradigm of their own making – defining their business models by what has served them well in the past? Will Amazon think about its provision of working capital to their small and medium business partners the same way as a bank does?

Vendor Focus – Crayon Data

Thankfully, there is a new breed of tech vendors who is making it easier for banks to drive personalisation of their offerings and connect customers from across segments. Crayon Data is a good example, with their maya.ai engine unearthing the preferences of customers and matching them to offerings from qualified merchants. It benefits all parties:

- The Consumer receives relevant offers, is served from discovery to fulfillment on a single platform and all personal data and information guarded by their bank.

- For Merchants, it allows them to reach the right customers at the right moment, develop valuable marketing and insights and all this directly from their bank partner’s platform.

- For Banks, it provides a scalable model for offer acquisition and easily configurable and measurable consumer engagement.

maya.ai leverages patented AI to create a powerful profile of each customer based on their buying habits and comparing these with millions of other consumers drawn in from their unstructured data sets and graph-based methodology. They then use their algorithms to assist their Financial Services client to make relevant offerings from qualified merchants to consumers in the right channel, at the right moment. All of this is done without exposing personal client information, as the data sets are based on behaviour rather than identity.

Conclusion

There are significant considerations for banks in offering these types of capabilities, such as:

- Privacy. While the technology operates on non-identifiable information, the perception of clients being ‘stalked’ by their bank in order to drive business to a merchant is one that would need to be managed carefully.

- Consumer opt-out. The ability for customers to opt out of this type of service is critical.

- Consumer financial wellbeing. It may be in the best interests of some consumer to not receive merchant offers, for instance where they are managing to a strict budget. These considerations can be baked into the overall customer journey (eg. prompts when the consumer is nearing their self-imposed monthly budget for a category), but care will need to be taken to keep customers’ best interests at heart.

While there are multiple challenges to overcome, the fact remains that personalisation is quickly becoming a core expectation for consumers. How will banks respond, and will we see AI use cases like Crayon Data become more prominent?

Industries continue to innovate and disrupt to create and maintain a competitive edge – and their technology partners evolve their solution offerings to empower them.

We bring to you latest industry news from the Healthcare, Financial Services, Retail, Travel & Hospitality and Entertainment & Media industries to show you how organisations are leveraging technology. Find out more about organisations such as Services Australia, Paypal, Walmart, Zara and Amex – and how tech providers such as IBM, Oracle, Google and Uplift are supporting organisations across industries.

View the latest Ecosystm Bytes on Industries of the Future below, and reach out to our experts if you have questions.

For more ‘byte sized’ insights click on the link below