Over the past year we have seen global systems integrators (SIs) – Accenture, IBM, Deloitte, Fujitsu, Capgemini and others – make many acquisitions, particularly in the public cloud, AI, cybersecurity and data space. Much of the growth in spending over the past few years have been driven by these categories: in 2020 if a software company was purely or mainly SaaS, they are likely to have witnessed strong growth. If they were on-premises software, they were lucky not to see declining revenues. While it is normal for the larger SIs and consultants to play catch up through acquisition, it is becoming harder for them to gain traction in these new areas.

Technology Shifts Drive Market Fragmentation

With every technology-driven business change new SIs, consultants, and managed services providers emerge. It happened with the move to big ERP systems, the move towards Business Intelligence, the emergence of SaaS etc. But I think we are now seeing something different. More than just the smaller players going after opportunities earlier, I believe we are seeing a changing buying behaviour from tech and business buyers – a greater willingness for larger enterprises to give their most important, business-critical strategies and implementations to smaller, less established players.

And I am not suggesting that the larger SIs are not performing well. Many are growing at 10-25% YoY – but at the same time, many are also growing at a slower rate than the markets they play in. The Ecosystm RNx for global IT services and consulting providers shows that the global providers continue to power ahead. But they need to adapt to changing market conditions.

New Cloud/AI Partners Winning Consulting and Implementation Deals

We have seen a new community of partners emerge with tech changes, such as the hyperscale cloud platforms and AI/machine learning tools. Traditionally, these companies would be good at one thing – and would learn slowly. For example, in the SAP ERP growth period, the projects were large and long. A single, mid-sized SI might only be working with 2-3 clients at a time. Therefore, the IP that they collected was limited – and they would find themselves with focused or niche skills. The large SIs had done many large, long projects across the globe and had much best-practice IP to call upon, giving them a broader and deeper knowledge of the technology and industries. Smaller providers had limited IP and industry experience.

But in this cloud and AI era, specialist providers work on hundreds of smaller projects with dozens or hundreds of clients. With the technology constantly evolving, the skills are constantly improving. While the global SIs are working on many cloud and AI engagements, they are often part of longer engagements – giving the consultants and tech teams less exposure to the new and evolving cloud platforms.

In a world where technology is changing at pace, the traditional global SI practice of “learning from peers across the globe” doesn’t happen at the pace the market requires. By the time your peers in the business have completed a project, documented it, and shared learnings, the market has moved on and technology has changed. Today it is easier and faster to learn directly from the tech vendors and cloud platform providers and their training partners. The network effect of knowledge in a team on the opposite side of the globe for a global SI is less valuable to clients. Often the smaller and mid-sized SIs have a deeper, broader knowledge of the technology platforms and toolsets than the larger providers – giving them a competitive advantage. For example, if you want the actual experience of moving SAP to Azure, or Oracle to AWS – you’ll often find the smaller providers have more experience. And this continues to play out. In many markets in the world, the top 5-10 SIs for cloud, AI and cybersecurity has a high proportion of local specialist providers.

Tech Buyers No Longer Look for Culturally Aligned Partners

Tech buyers themselves are changing too. In years gone by, the smaller tech partners would tell us that they felt they were included in bids to drive down the price from the global SIs. But today the story is different. Smaller partners are admired for their agility and innovation. Large enterprise customers will choose small providers because the small SI is NOT like them. In the past, they chose the global SI because they were just like them!

Because of this, the large SIs are mopping up their smaller competitors across the globe. Accenture has acquired 40 companies in the past 10-11 months, IBM has acquired over 10, Atos and Cognizant have also acquired many companies in the past 12 months. They are doing this for the skills as much as for the clients, along with getting a foothold in a new market or strengthening their position in geography. The challenge will be to hang on to the clients, culture, and the IP of the acquired business. Often these smaller competitors are growing at a significant pace – and the biggest risk is that the acquiring company takes their eyes off the prize.

Global SIs Still Own the Industry Play

Despite these challenges, one of the areas that the global SIs will continue to dominate is the industry play. I have discussed how as technologies mature, industry plays become more relevant.

Smaller and mid-sized SIs and consultants find it hard to create deep pools of expertise across multiple industries. While some may have a deep focus on a single or two industries, only the large players have broad and deep geography and industry experience. This puts many of the acquisitions into context – the global SIs will take these acquisitions and use that deep and broad technical and business knowledge and add it to their industry knowledge to create a more compelling offering.

Their challenge will still be one of cultural alignment. As discussed, many companies seek out tech partners who represent what they want to be, not what they are. The ability for the Global SIs to retain the culture, agility and innovation of the acquired business will determine their ability to continue to see similar or improved levels of growth from the acquired business. Using their IP in the context of industries will be the key to their ongoing success.

As organisations come to terms with the “new normal”, technology companies are presenting unique offerings to help them tide over the situation and lead them towards economic and social recovery. These companies are also leading from the front and demonstrating how to transform with agility and pace – evolving their business and delivery models.

Organisations are dependent on digital technologies more than ever before. In 2020, we have already seen unprecedented and rapid adoption of technologies such as audio and video conferencing, collaboration tools to engage with employees and clients, contactless services, and AI/automation. This will have a wider impact on the technology industry, community, and redefining the workplace of the future.

Ecosystm Principal Advisor, Tim Sheedy hosted a virtual roundtable with business leaders from some of the world’s largest technology service providers to discuss how they managed the challenges during the pandemic; and the measures they implemented to support not only their business operations and working environment, but also to help their customers negotiate these difficult times.

The Role of Technology During the COVID-19 Crisis

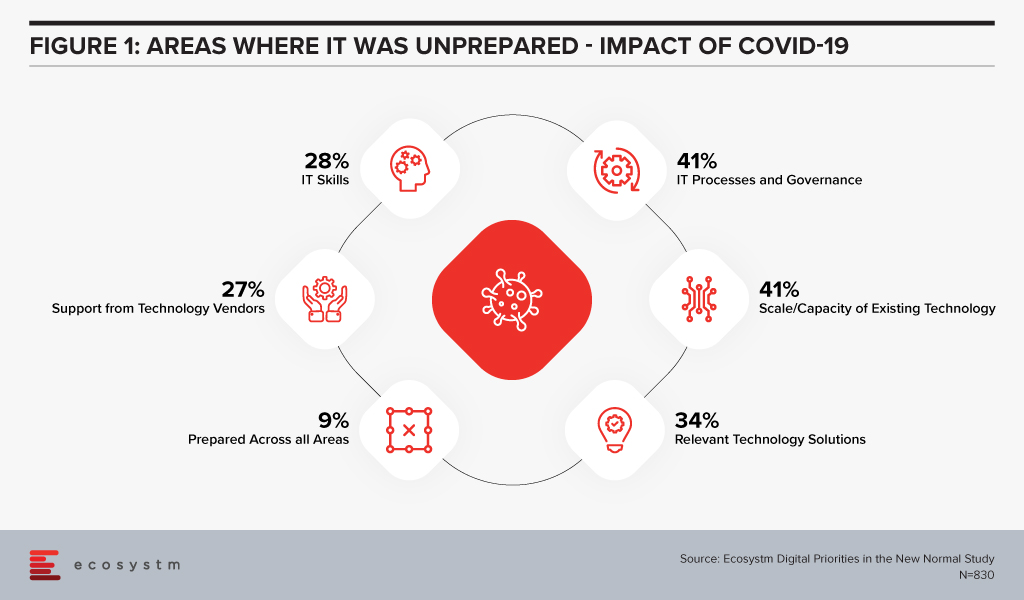

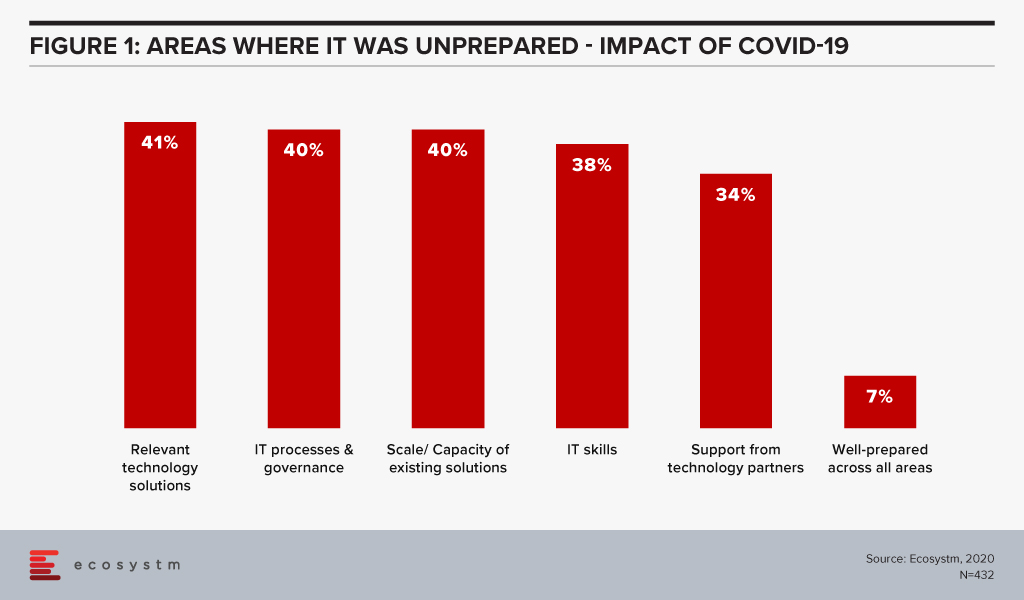

When the COVID-19 crisis hit, IT teams found themselves largely unprepared. Ecosystm research finds that only 9% of organisations considered their IT fully prepared for the changes that had to be implemented (Figure 1). More than a third did not have the right technology solutions and 41% were unprepared for the scale of the changes required and the capacity to extend the existing technology to meet client and employee needs.

While 27% of organisations felt that they needed more support from their IT provider, further questioning reveals that only 4% switched technology providers for better support during these difficult times. Organisations are looking to their technology partners for guidance, as they negotiate the new normal.

Here are some of the discussion points that emerged in the conversation with the technology providers.

Business Continuity Planning is Still Evolving

One of the early impacts on businesses was due to their dependence on outsourced services and offshore models. Several concerns emerged – how could their provider continue to operate offsite; would they be able to access the network remotely; how should fully remote teams be managed and so on. In addition to this, there were other challenges such as supply chain disruptions and a sudden change in business. Even technology providers felt that they were navigating uncharted territory.

“Remote project delivery is not new, it’s been going on for a few years; but I think that there’s been a lot of non-believers out there. This experience has moved a lot of those non-believers to the believer category. A lot of our delivery can be done from home – think of the savings of time and money that can be realised through this.” – Andrew Campbell, Partner Asia Pacific for Talent and Transformation, IBM

Moreover, the rising workload and client expectation has led businesses to move towards exploring automation and AI.

“The thing that is changing now is, when we approach a new opportunity or an existing customer with a new requirement, we look at using automation. Typically, when you go in to design a solution you always think of the human aspect. We’re working very hard to move our thinking to automation first and then supplementing it with the human side as a backup.” – Michael Horton, Executive VP, ANZ, HCL Technologies

Data has become paramount in this time of crisis. The right use of data is helping organisations fulfil customer requirements, enhance their experience, and optimise services and products.

“Those organisations that have a good understanding of the data within their business, and how that data can be used to understand the impact on their business, are starting to have much better clarity on future requirements.” – Peter Lawther, Oceania Regional Technology Officer, Fujitsu

Organisations should take the learnings from managing this situation to keep evolving their business continuity plans – keeping in mind individual business needs and growth and business strategies.

Having the Right Infrastructure Means Employees are Productive

The lockdown and social distancing measures forced organisations to focus on the infrastructure that can support their remote and hybrid work environment.

“Before the pandemic around 20-30% of our staff logged on to a VPN, but with remote working, all of a sudden, we were at 90%.” – Lawther

The adoption of digital tools and online infrastructure led businesses to re-think how they were delivering their services. While some organisations had the tools, governance and the protocols in place, there is still a long way to go for organisations to solve their infrastructure and networking challenges.

“It gets down to the quality of the equipment that the staff use – which ranges from decent laptops, phones, and network connections. If you don’t have that now, people cannot work effectively.” – Horton

Several of these organisations, focused on ergonomics as well, when evaluating their employees’ infrastructural needs when working from home. This extra focus on infrastructural needs – with the employees firmly on their mind – ensured that there was minimal impact on delivery.

Caring for Your People is More Important than Ever

The pandemic has changed the way people work, socialise, and interact. While this appears to have become the new norm, adjusting to it can create emotional stress. Simultaneously, as organisations focus on survival and recovery, workloads have increased. Employees are working extended hours, without taking adequate hours. There is an immediate need to involve organisations’ HR practices in evaluating the emotional well-being of employees and finding better ways to engage with remote staff, to reduce stress.

“A key aspect of handling the crisis has been empathy, transparency and engagement with employees. In a business environment, we have all sorts of teams, cultures, clients, and so on. The common thread in this model is that everyone’s just become a lot friendlier, more empathic, more transparent.” – Sumit Nurpuri, COO, SE Asia Hong Kong and Taiwan, Capgemini

Organisations will have to be innovative in the way they manage these people challenges. For example, a common problem that has emerged is employees attending meetings, with interruptions from family, especially children.

“One of the things that we did as a part of our team meetings is that we assigned tasks to children at the beginning of the call and in the last few minutes, the children presented back to the teams on what they’ve been up to. It was a mechanism for us to make sure that we were involving our staff and understanding their current situation – and trying to make it as easy for them to work, as possible.” – Lawther

Taking the Opportunity to Drive Positive Outcomes

The other aspect businesses are trying to overcome is meeting the rising expectations of clients. This has led them to focus on skills training, mostly delivered through e-learning platforms. Organisations find that this has translated into increased employee performance and a future-ready workforce.

The crisis disrupted economies and societies across the globe, with business and industry coming to a standstill in most countries. Unexpected business benefits emerged from the necessity to comply with country regulations. By and large, employees have been more productive. Also, many organisations re-evaluated their commercial property requirements and many were able to reduce expenses on office rentals (for many this will not be immediate, but there is a future potentiality). Similarly, there were other areas where businesses saw reduced expenses – operational costs such as equipment maintenance and travel expenses.

“When you start global projects and global implementations, you typically do some kind of global design work and maybe fly in people from all over the world, typically to a centralised location. This has changed to virtual meetings and collaborative interactions on online global design. The amount of time and money that was saved – that would typically be spent on people traveling to manage these global design workshops – was great” – Campbell

Most organisations, across industries, will have to make considerable changes to their IT environment. The Ecosystm Digital Priorities in the New Normal study finds that 70% expect considerable to significant changes to their IT environment, going forward. Technology providers will remain a significant partner in organisations’ journey to transformation, recovery and success.

We have all felt the effects of the global pandemic and experienced the profound effects on the way we work – at least those of us who are fortunate enough to still be working despite the pandemic.

COVID-19 has – at least for a while – changed how we work and how IT systems can safely support this new work style.

Our ongoing Ecosystm study on Digital Priorities in the New Normal shows how the crisis has forced organisations to re-evaluate their cybersecurity risks and measures. It also showed that the IT environment of most organisations was woefully unprepared for the changes that occurred (Figure 1). Perhaps unsurprisingly, fewer than 7% said that their IT environment was fully prepared and close to 40% reported lacking scale, capacity and IT skills in-house.

We are here to help you!

The combination of these shortcomings may very well push more organisations to outsource their security management to Managed Security Service Providers (MSSPs) – a service space that has been growing rapidly in recent years.

Many IT organisations are fairly familiar with MSSPs, but COVID-19 may have forced many to re-evaluate their choices as the work and threat landscapes have changed.

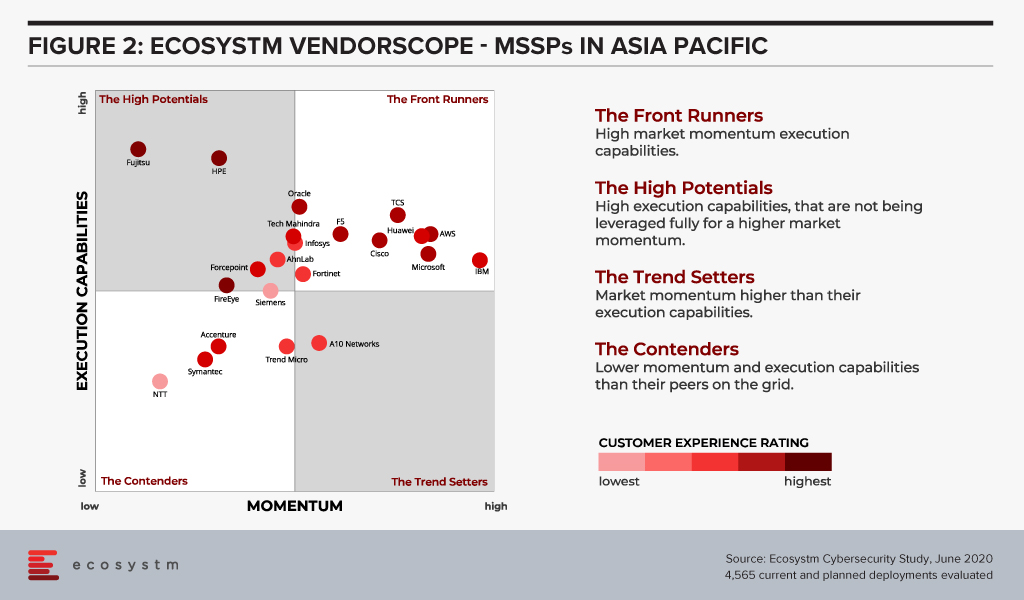

To help organisations evaluate their options going forward, we at Ecosystm are extremely excited to launch our Managed Security Service Providers VendorScope for the Asia Pacific region.

This new tool can help technology buyers understand which vendors are leading this space, which are the ones that have market momentum and which are executing and delivering on their promised capabilities. Unlike similar vendor evaluations on the market, the positioning of vendors in Ecosystm VendorScopes is based solely on quantifiable feedback given by the Tech Buyer community, in the global Ecosystm Cybersecurity Study, that is live and ongoing on the Ecosystm platform. It is thus independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

It is also free to access and share for all Ecosystm subscribers!

Fragmented Asia Pacific MSSP Market

The VendorScope clearly shows how fragmented the MSSP market is. Not only is the number of vendors that have a customer base significant enough to appear on the grid very large (22) – but about half of them are in, or verging on being in, the “Front Runner” segment (Figure 2).

There are a few key factors that contribute to this picture:

- The services they offer tend to align well with the customers’ organisational strategies and to integrate well with existing systems. This, basically, can be boiled down to one word: Cloud. Most organisations have IT strategies revolving around multiple and/hybrid cloud deployments and using MSSPs makes a lot of sense.

- Momentum for this service segment is generally high. The MSSP space is experiencing high growth these days and we see a fairly high number of mentions for both current and planned deployments with many of the vendors in the study.

Despite the large number of vendors in the “Front Runner” segment, a famous few stick out. IBM appears to have a higher market momentum than its competitors and together with Microsoft, they have the largest share of mind with potential customers in this space.

But other vendors are hot on their heels. AWS and F5 stand out with their relatively high presence in the region, and TCS and Huawei appear to have stronger than average pipelines.

Where we do see weak spots with most vendors is in quality of service and the connected customer experience, which historically have proven to be a potential Achilles’ heel for many vendors in high growth areas. As the MSSP space matures, we would expect customer experience to become increasingly important when customers choose a service provider.

We would certainly encourage any organisation that is looking into managed security to not ignore or downplay the customer service and support aspect. IT security is a complex area – even if it is managed by a service provider – and the service providers’ ability and flexibility in this area can make a huge difference.

Fujitsu and HPE stick out with regards to QoS and customer service. These two are also good examples of how the vendors differ and seemingly could complement each other. In a sense, one could almost see the MSSP VendorScope as an early blueprint for which mergers and acquisitions (M&As) would make sense – at least for those that are driven by the pursuit of skill sets and competencies and not just market share.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in M&A activities in the cybersecurity market. Of course, with the global pandemic, all bets are off, and the predicted M&A wave may have been delayed by a year or so.

But the MSSP space certainly appears ripe for consolidation.

Ecosystm Vendorscope: Managed Security Service Providers

Signup for Free to download the Ecosystm Vendorscope: Managed Security Service Providers report