Microsoft announced their intentions to acquire Activision Blizzard for USD 68.7 billion, creating quite a buzz in the Gaming and tech industry. The acquisition is set to be completed in 2023 and according to Microsoft is well set to fuel “growth in Microsoft’s gaming business across mobile, PC, console and cloud and will provide building blocks for the metaverse.”

There have been a few animated discussions at Ecosystm on Microsoft’s potential monopoly in the Gaming industry, whether it is aligned to their ‘Metaverse plans’ and the challenges that Microsoft is likely to face with the acquisition. Here is what our experts have to say.

Impact on the Gaming Industry

Activision Blizzard is the publisher of some of the most popular games around – loved by both hardcore and casual gamers. The acquisition of franchises such as Call of Duty, Overwatch, Warcraft and Diablo – as well as mobile games like Candy Crush and Hearthstone – demonstrates Microsoft’s commitment to what is now the largest medium of entertainment.

Microsoft is clearly focusing on growing their software revenue. But most importantly, they will be able to integrate these popular titles within Game Pass. This allows them to compete more actively with Steam and Epic Games Store but as a subscription-based model. The Game Pass model has proven extremely popular with gamers (with approximately 25 million gamers spending USD 10 per month to subscribe to the service), so this will continue to bolster their market position and increase users and revenue.

The latest Xbox Series X/S are the fastest-selling Xboxes ever – even with chip shortages and logistics challenges. The majority of Microsoft’s gaming revenue comes from hardware now. This acquisition will inevitably drive hardware growth, as well as increase gaming software revenue from both a subscription on Game Pass as well as outright purchases.

Microsoft’s Bigger Play

Microsoft made a great start by acquiring key titles like Doom in 2020. The go-to-market strategy through subscriptions and gaming as a cloud service is well managed. Last year when Microsoft relaunched Flight Simulator, the Ecosystm review spoke of how Microsoft wanted to be the “Netflix of Gaming”. They just fired another big shot in that battle by announcing their intention to acquire Activision. With a USD 69 billion price tag, it is probably more of a ballistic missile than a shot!

There has been a lot of conversation (including at Ecosystm!) on how this acquisition makes sense. Microsoft’s revenue from gaming sales is said to be USD 11.5 billion on an annualised basis – and Activision’s revenue is estimated to be USD 7.7 billion. The combination will obviously be huge, but is it worth so much? It is!

The reason for that is today’s leading buzzword – the Metaverse. As people live more of their lives in an online world and interact more with their peers online, being a leader in that “universe” is the key to the future. The Metaverse occupies the spaces of work, play and socialisation which have all gone increasingly virtual.

For Microsoft, this really translates into how relevant their cloud is to the Metaverse. This is a world where one can play using Game Pass, work on Office 365 and store everything on OneDrive. This pervasiveness is key to Microsoft’s consumer strategy. On the enterprise side, they have a dominant share, especially with Office 365. This will see them gaining strength in the consumer business.

Challenges for Microsoft

What a bargain for Microsoft! When Microsoft made the USD 95 per share offer this week Activision’s market value was about USD 51 billion. While the premium that they are offering was almost 50% of the share market close on the previous trading day, they are getting market-leading content for about 10% less than what Activision was worth in February 2021. A year in which the pandemic continued to increase demand for online gaming.

However, this leaves Microsoft with three significant challenges.

First, they have to get regulatory approval in the different markets in which the two companies operate. Microsoft has advised they expect the deal to close in late 2023, so it looks like they are expecting some interesting discussions over the next few months. This acquisition is a significant consolidation of the Gaming market, so regulators will look at the deal closely.

In addition, regulators will also look closely at the privacy implications, with Microsoft gaining access to millions of gamers’ personal details to add to the personal information they already hold from their other divisions.

Second, they have the challenge of addressing the sexual harassment issues that caused the drop in Activision’s market value. There are court settlements under appeal, and reports talk about 40 people leaving Activision since July. Integrating the large teams into Microsoft will need careful attention.

Third, retaining the talent in Activision may be a challenge for Microsoft as I would expect their competition to be actively approaching Activision’s key creatives.

Unless these challenges are handled well, the company they bid on may not be the company they acquire.

Last week, NVIDIA announced that it had agreed to acquire UK-based chip company Arm from Japanese conglomerate SoftBank in a deal estimated to be worth USD 40 billion. In 2016, SoftBank had acquired Arm for USD 32 billion. The deal is set to unite two major chip companies; power data centres and mobile devices for the age of AI and high-performance computing; and accelerate innovation in the enterprise and consumer market.

Rationale for the Deal

NVIDIA has long been the industry leader in graphics chips (GPUs), and a smaller but significantly profitable player in the chip stakes. With graphic processing being a key component in AI applications like facial recognition, NVIDIA was quick to capitalise. This allowed it to move into data centres – an area long dominated by Intel who still holds the lion’s share of this market. NVIDIA’s data centre business has grown tremendously – from near zero less than ten years ago to nearly USD 3 billion in the first two quarters of this fiscal year. It contributes 42% of the company’s total sales.

The gaming PC market has been the fastest-growing segment in the PC market. The rare shining light in an otherwise stagnant-to-slightly declining market. NVIDIA has benefited greatly from this with a huge jump in their graphics revenues. Its GeForce brand is one of the most desired in the industry. However, with their success in AI, NVIDIA’s ambition has now grown well beyond the graphics market. Last year NVIDIA acquired Mellanox – who makes specialised networking products especially in the area of high-performance computing, data centres, cloud computing – for almost USD 7 billion. There is clearly a desire to expand the company’s footprint and position itself as a broad-based player in the data centre and cloud space focused on AI computing needs.

The acquisition of Arm though adds a whole new dimension. Arm is the leading technology provider in the mobile chip market. A staggering 90% of smartphones are estimated to use Arm technology. Arm is the colossus of the small chip industry – having crossed 20 billion in unit shipments in 2019.

Acquiring Arm is likely to result in NVIDIA now having a play in the effervescent smartphone market. But the company is possibly eyeing a different prize. Jensen Huang, Founder and CEO of NVIDIA said “AI is the most powerful technology force of our time and has launched a new wave of computing. In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.”

With thoughts of self-driving cars, connected homes, smartphones, IoT, edge computing – all seamlessly working with each other, the acquisition of Arm provides NVIDIA a unique position in this market. As the number of connected devices explodes, as many billions of sensors become an ubiquitous part of 21st century living, there is going to be a huge demand for low power processing everywhere. Having that market may turn out to be a larger prize than the smartphone market. The possibilities are endless.

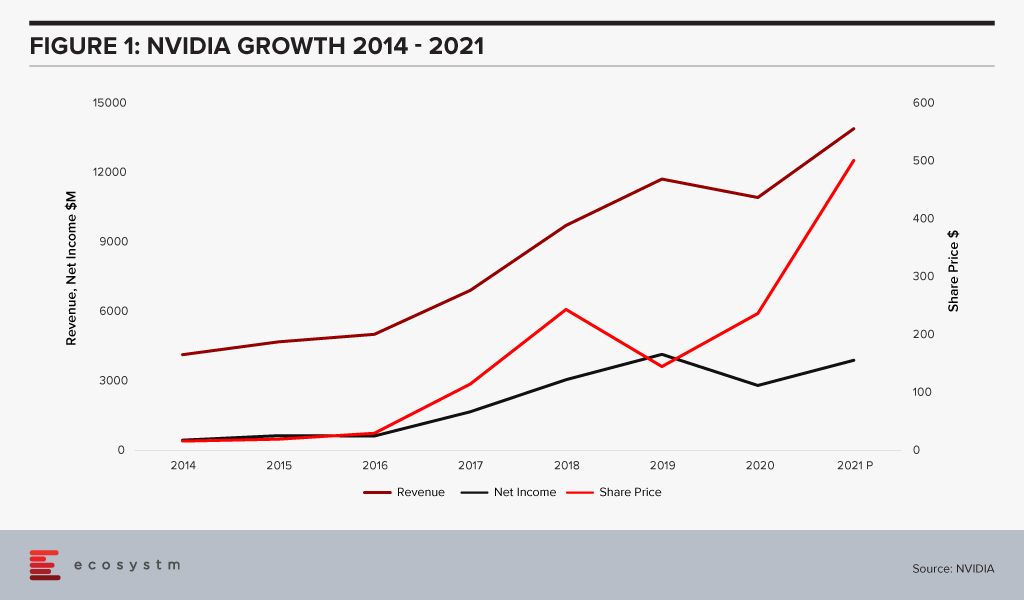

While this deal is supposed to be worth around USD 40 billion, somewhere between USD 23-28 billion is going to be paid in the form of NVIDIA stock. This brings us to an extremely interesting dynamic. At the beginning of 2016 NVIDIA’s market cap was less than USD 20 billion. Mighty Intel was at USD 150 billion. AMD the other player in the market for chips who also sell graphics was at a mere USD 2 billion. In July this year, NVIDIA’s value passed Intel’s and today it is sitting at around USD 300 billion! Intel with a recent dip is now close to USD 200 billion. AMD too with all the tech-fueled growth in recent years has grown to just shy of USD 100 billion market cap.

What this tells us is that the stock portion of the deal is cheaper for NVIDIA today by around 55% compared to if this deal was consummated on 1st January 2020. If there was a right time for NVIDIA to buy – it is now. This also shows the way the company has grown revenue at a massive clip powered by Gaming PCs and AI. The deal to buy Arm appears to be a very good idea, which would establish NVIDIA as a leader in the chip industry moving forward.

Ecosystm Comments

While there appears to be some good reasons for this deal and there are some very exciting possibilities for both NVIDIA and Arm, there are some challenges.

The tech industry is littered with examples of large mergers and splits that did not pan out. Given that this is a large deal between two businesses without a large overlap, this partnership needs to be handled with a great deal of care and thought. The right people need to be retained. Customer trust needs to be retained.

Arm so far has been successful as a neutral provider of IP and design. It does not make chips, far less any downstream products. It therefore does not compete with any of the vendors licensing its technology. NVIDIA competes with Arm’s customers. The deal might create significant misgivings in the minds of many customers about sharing of information like roadmaps and pricing. Both companies have been making repeated statements that they will ensure separation of the businesses to avoid conflicts.

However, it might prove to be difficult for NVIDIA and Arm to do the delicate dance of staying at arm’s length (pun intended) while at the same time obtaining synergies. Collaborating on technology development might prove to be difficult as well, if customer roadmaps cannot be discussed.

Business today also cannot escape the gravitational force of geo-politics. Given the current US-China spat, the Chinese media and various other agencies are already opposing this deal. Chinese companies are going to be very wary of using Arm technology if there is a chance the tap can be suddenly shut down by the US government. China accounts for about 25% of Arm’s market in units. One of the unintended consequences which could emerge from this is the empowerment of a new competitor in this space.

NVIDIA and Arm will need to take a very strategic long-term view, get communication out well ahead of the market and reassure their customers, ensuring they retain their trust. If they manage this well then they can reap huge benefits from their merger.

Last year Microsoft announced it was developing a new version of Flight Simulator which caught many of us by surprise. Flight Simulator? Really? The last launch of a new version of the game was in 2006 – 14 years ago, now!! How does something come back after all these years?

Now that it has launched about a week ago, the initial feedback has been extremely positive and it appears that Microsoft has a winner here. An analysis even claims that it will spur $2.6 billion in hardware sales of PCs, game accessories and the like!

I wanted to unpeel the onion a bit to take a closer look at what is going on and discovered a world of interesting developments around this product.

My first thoughts on hearing the announcement was that Microsoft, who has been steadily losing the battle of consoles to Sony’s PlayStation platform, was reviving this old favourite to resuscitate its drooping share.

Not a bad move. Flight Simulator has a core of die-hard fans – it even boasts of professional pilots who play the game as relaxation. It has a long history and a captive fan community. But it is old. That loyal community is not part of the demographic that a gaming company would normally look at today.

The other interesting aspect to consider is the COVID-19 situation this year. Obviously, Microsoft did not know this at the time they embarked on this project but the pandemic has turned everything on its head – hardware sales are through the roof – including accessories, at a time when people have been homebound and looking for entertainment within the four walls of one’s abode. The Ecosystm Digital Priorities in the New Normal study finds that 76% of organisations increased their hardware investments when the crisis hit – and 67% of organisations expect their hardware spending to go up in 2020-21. And that is only on the enterprise side of things. On the consumer side, at this point joysticks are in short supply – a trend that seems to have been accelerated by the Microsoft launch last week, interestingly – and so are PCs. The PC vendors are all enjoying a bumper year of growth. This is an ideal time to launch a really cool new version of the game.

Microsoft’s Bigger Game

The reality however is that while Flight Simulator will add to the revenue and also give Xbox One a fillip, Microsoft is probably after a much bigger “game” (excuse the pun!). The company has called its ‘Xbox Game Pass’ the Netflix of the gaming market. With multiple cloud-based gaming platforms having been launched – many with subscription services – the battle is on to decide the winners in a relatively new space. To this end, Microsoft has announced an intention to make Game Pass available across different devices – XBox console, PCs, tablets, phones. Having a title like Flight Simulator available through Game Pass, will act as a key hook to get customers to sign up for the subscription.

The new Flight Simulator version has been developed using AI and real-world imagery brought in with data from Bing Maps. With the newly added realistic scenery, it also seems like a great fit for use with the HoloLens Virtual Reality headsets. In one shot Microsoft is showcasing their lead in areas of technology which are likely to prove attractive to developers in a big way. I believe that this is a way for them to entice more developers on to Azure and to Microsoft cloud to develop their games – “AI SDKs anyone? Virtual Reality tools anyone?”

What seems at first glance like the launch of a new “future is here” version of a great game will turn out to be a possible big swing at multiple targets by Microsoft – at leadership in gaming with Game Pass; at reviving Xbox fortunes; at leadership in game development platforms, with Azure packing AI services, Bing Maps, AR/VR tools, among other technologies to move more development on to the Microsoft cloud. In the process Microsoft launched a highly enjoyable game and got closer to their ultimate aim to indeed become the Netflix of gaming.

Great move Microsoft! Tip: This could also give them a foothold in the virtual travel and virtual vacations market! That would be a hot seller in these times.

April saw the disruption of normal business operations due to the COVID-19 crisis. However, telecommunications companies continued initiatives to identify the best ways to serve customers and enterprises. The month saw a lot of activity in the 5G space across the globe, including partnerships, innovation in productisation and identifying 5G use cases.

Telecom providers building their 5G capabilities

Ecosystm Principal Advisor, Shamir Amanullah noted in his blog that in the new normal telecom providers have fast evolved as the backbone of business and social interactions. Telecom operators are fervently working towards 5G network and services deployment in order to be an early mover in the market. In China, China Mobile has been one of the leaders in rolling out country-wide 5G. The tender to build around 250,000 fifth-generation wireless network base stations across 28 provincial regions was put out in March and in early April, Huawei emerged as the key winner with the contract to build nearly 60% of the base stations. ZTE also won nearly a third of the contract. Global network equipment providers will find entering the China market as challenge for a number of reasons, including the strength of their local players.

Huawei continues to be under scrutiny in the global market, however British telecom provider chose Ericsson to build the core of its 5G network. BT hopes to create and define a future roadmap of new services such as mobile edge computing, network slicing, enhanced mobile broadband and various enterprise services. The US market is another arena where the battle for 5G will be fought out. The T-Mobile – Sprint merger was finalised in early April. The New T-Mobile is committed to building the world’s best nationwide 5G network, which will bring lightning-fast speeds to urban areas and underserved rural communities alike. Other vendors are also vying for a larger share of the US market. Nex-Tech Wireless, a smaller rural telecom provider based in Kansas, is planning to transition from 4G to 5G by using Ericsson’s Dynamic Spectrum Sharing (DSS) to deploy 5G on existing bands. This will help Next-Tech wireless to leverage existing assets instead of building 5G capabilities from the ground-up – enabling them to seamlessly transfer from 4G to 5G.

The 5G developments are by no means limited mostly to the US and China. Korea’s telecom provider, KT and Far EasTone Taiwan (FET) signed an MOU to collaborate and jointly develop 5G services and digital content. With this deal, KT plans to boost its 5G powered content and services presence through FET.

Tech Vendors evolving their 5G offerings

Network and communications equipment providers have much to gain and more to lose as organisations look to leverage 5G for their IoT use cases. If 5G uptake does not take off, the bigger losers will be the network and communications equipment providers – the real investors in the technology. Also, as telecom providers look to monetise 5G they will find themselves dealing with a completely different customer base – they will take help from tech vendors that have more experience in the enterprise space, as well as industry expertise. Both network equipment vendors and other tech vendors are actively evolving their product offerings. There were numerous examples of this in April.

Microsoft’s decision to acquire Affirmed Networks is an example of how the major cloud providers are trying to be better embedded with 5G capabilities. This month also saw Microsoft announce Azure Edge Zones aimed at reducing latency for both public and private networks. AT&T is a good example of how public carriers will use the Azure Edge Zones. As part of the ongoing partnership with Microsoft, AT&T has already launched a Dallas Edge Zone, with another one planned for Los Angeles, later in the year. Microsoft also intends to offer the Azure Edge Zones, independent of carriers in denser areas. They also launched Azure Private Edge Zones for private enterprise networks suitable for delivering ultra-low latency performance for IoT devices.

The examples go beyond the cloud platform providers. Samsung and Xilinx, have joined forces to enable 5G deployments, with Samsung aiming to use the Xilinx Versal adaptive compute acceleration platform (ACAP) for worldwide 5G commercial deployments. Versal ACAP offers the compute density at low power consumption to perform the real-time, low-latency signal processing needed by 5G. Following the successful pilot of 450 MHz proof of concept 5G network, Nokia has partnered with PGE Systemy, a large energy sector company in Poland to deploy industrial grade 5G solutions and to support energy distribution for its next gen power grid. It is the band of choice for machine-to-machine communications in the energy sector, including smart meters. Nokia also released an AI-as-a-service offering – Nokia AVA 5G cognitive operations – to help telecom providers transform their services with AI-based solutions to support, network, business and operations.

Use cases for 5G adoption firming up

5G promises to revolutionise various industry solutions based on required data rates, low latency, reliability, and machine-type communications. Telecom providers and tech vendors alike are working on developing industry use cases to drive up adoption.

Vodafone Qatar and Dreama Orphan Care Centre and Protection Social Rehabilitation Centre (AMAN) have collaborated to support remote learning and education using 5G technology. This is aimed to enhance virtual education through e-learning, online schools, and connecting teachers and students through high-speed learning environment. In the post-COVID 19 era remote learning is expected to become a key sector and there is immense potential for uptake.

The Manufacturing industry remains a top focus area for 5G providers, with their early adoption of sensors and sensor data analytics. The Smart Internet Lab at the University of Bristol, UK has been awarded a 2 years project by UK’s Department for Digital, Culture, Media and Sport (DCMS) to enable 5G connectivity for the manufacturing sector. The project will primarily work on improving productivity and manufacturing, easy asset tracking and management with involvement of AR/VR technologies and industrial system management.

Gaming is another sector with huge potential for 5G adoption. With cloud gaming, gamers can access a library of popular high-quality games minus the need for expensive hardware which has been the case in the past. China Mobile Hong Kong and Ubitus teamed up to launch a 5G cloud gaming service – UGAME. The application is available for download from the Google Play store. While still at a beta phase, the telecom provider promises a revolutionary gaming experience, where the need for computers or consoles will be lessened by augmented smartphone capabilities.

In the midst of the uncertainties, telecom, network equipment providers and cloud platform providers appear to be gearing up for 5G in enabling a contactless and remote economy.

Telecom operators are fervently working towards 5G network and services deployment in order to be an early mover in the market. Operators are investing in Digital Transformation (DX) as well as inking partnerships with other players in the ecosystem to monetise on exciting new use cases in the enterprise segment and make market inroads.

The consumer market has become a retention play and on the whole many operators are experiencing declining margins and it appears unlikely that the consumer will pay more for higher speeds. Device affordability for mass-market remains a challenge though Chinese smartphone vendors are expected to release sub US$ 300 5G smartphones later this year. 5G can be expected to arrest the lengthening consumer upgrade cycle due to the attractions of not only faster speeds but improved streaming and cloud gaming. Data services revenues will continue to generate growth but this will be offset by losses in mobile voice services.

5G – An enterprise value proposition

Telecom operators have thus far been largely unsuccessful in penetrating the enterprise ICT market due to a variety of reasons including the slow pace of innovation, lack of a one-stop-shop offering, insufficient channel to market to especially small and medium enterprises (SMEs), and lack of skills in offering non-network services. 5G technology presents operators with another opportunity to address this long-standing challenge with the flexible features of enhanced mobile broadband (eMBB), Ultra-Reliable Low Latency Communications (URLLC) and massive machine type communication (mMTC) enabling tailored network and services offerings. 5G promises to revolutionise various industry solutions based on required data rates, low latency, reliability, and machine-type communications.

Monetising 5G is a key topic among leading executives and new business models are being devised. Connectivity services will be offered with a mix and match of throughput, bandwidth volumes and latency requirements. Fixed Wireless in Southeast Asia will be very popular considering the low penetration of fibre to the home and will provide enterprises with a viable secondary connection to the internet. Popular applications including video streaming and gaming which are speed, latency and volume hungry will also be a target market for operators.

More speed, latency and number of connections

5G offers theoretical speeds of 20 times that of 4G, low latency of 1 millisecond (ms), a million connections per kilometre and is expected to power a new era of mobile Internet of Everything (IoE). Offering high speed is the initial offering to the market and operators are going to be offering minimum guaranteed speeds for the first time. A high definition movie could be downloaded in 10 seconds while low latency means better performance for live sports, gaming, mission-critical automation and driverless cars – among others.

Fixed Wireless Access is the new wireless fibre

5G will offer fixed wireless access (FWA) or “wireless fibre” to households as an alternative to fixed broadband. It can be ideal as a redundant second link offering when the primary link is down. FWA broadband services offer a serious alternative to fixed broadband services which is plagued by the high cost of civil works for fibre optic deployment and expansion of the network to reach the rural population. FWA is expected to make strong inroads into households in Southeast Asia with the exception of Singapore, as many nations lag in fixed broadband penetration. As a comparison, ITU reports that fixed broadband penetration in countries such as South Korea (41.6%) and Hong Kong (36.8%) lead their Southeast Asian counterparts – Singapore (28.0%), Vietnam (13.6%), Thailand (13.2%) and Malaysia (8.6%).

A boon for Video and Gaming industry

Gaming is huge in Southeast Asia, notably in Thailand and Indonesia, and operators can take advantage of this offering with partnerships and value-added services with cloud gaming, high bandwidth and low latency packages. With cloud gaming, gamers can access a library of popular high-quality games minus the need for expensive hardware which has been the case in the past. This platform allows content creators and publishers to access the huge Southeast Asian market and monetise.

B2B2x is not a new concept where operators partner with leading providers of video streaming services through direct billing and 5G will be able to offer low latency, for example for live events. This brings in not just a commission per subscriber but additional revenue for the additional network features such as low latency.

Video streaming providers such as Netflix, Viu, Hooq and Iflix are worthy partners for a subscription – so are ad-based video-on-demand services. Live sports streaming service also makes for a very lucrative opportunity with 5G features of high data throughput and low latency.

Readiness through digital transformation

Efforts for preparedness for this business shift means significant operational and technology platform improvements, operating on the cloud, ease of incorporating the partner ecosystem and supporting a multitude of pricing models. DX should run parallel to the build of 5G public and private networks for a telecom provider to be in a leadership position and for them to be able to fully monetise 5G. Operators will be making major changes to OSS and BSS to support 5G use cases with the ultimate goal of ensuring customer-centricity.

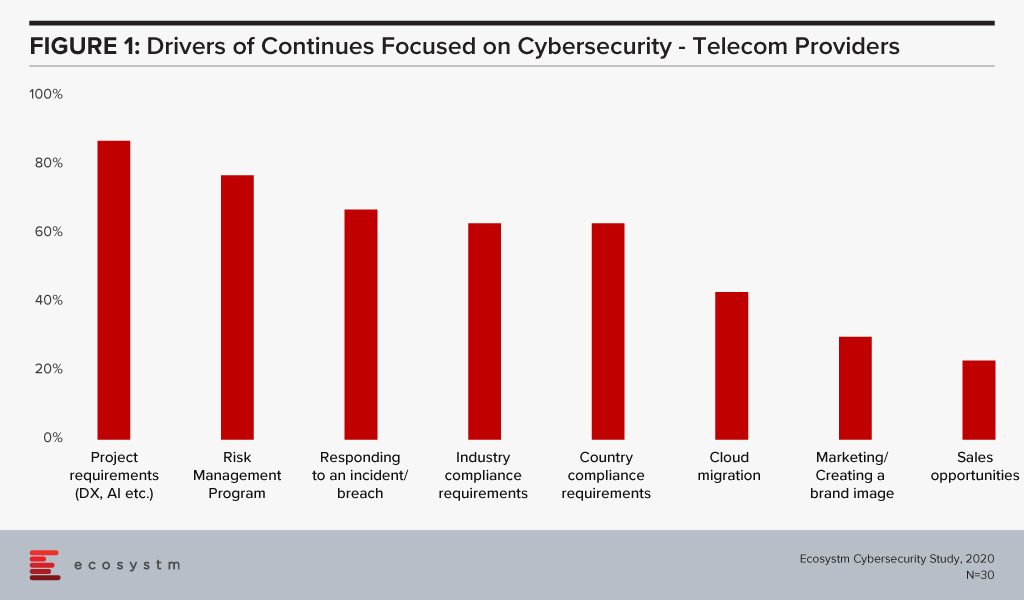

Ecosystm research finds that nearly two-thirds of telecom providers are looking to increase their cybersecurity spending in the year. It is also clear that the biggest driver of that spend are their DX projects (Figure 1).

Cybersecurity is of paramount importance more than ever now with the increase in devices, software-based network services and edge computing. It is essential that a robust cybersecurity framework is in place as 5G will drive DX in enterprises, power the Digital Economy and provide the critical core infrastructure for Industry 4.0. Operators need to ramp up investment in cybersecurity technology, processes and people. A telecom operator’s compromised security can have country-wide, and even global consequences. As networks become more complex with numerous partnerships, there is a need for strategic planning and implementation of cybersecurity, with clear accountability defined for each party.