Cyber threats are growing in volume, intensity, and complexity and are here to stay. Basic endpoint attacks are becoming intricate, multi-stage operations. Cybercriminals are launching highly coordinated and advanced attacks. This evolving threat landscape affects businesses of all sizes, jeopardising data, operations, and finances.

In the face of massive data leaks, costly ransomware payments, and an ever-expanding and complex threat landscape, the need to strengthen digital defences has driven significant advancements in cybersecurity.

Read on to find out how organisations, governments, industry associations and technology providers are evolving ways to combat cybercrime.

Download ‘Securing the Future: Cyber Resiliency in the Digital World’ as a PDF

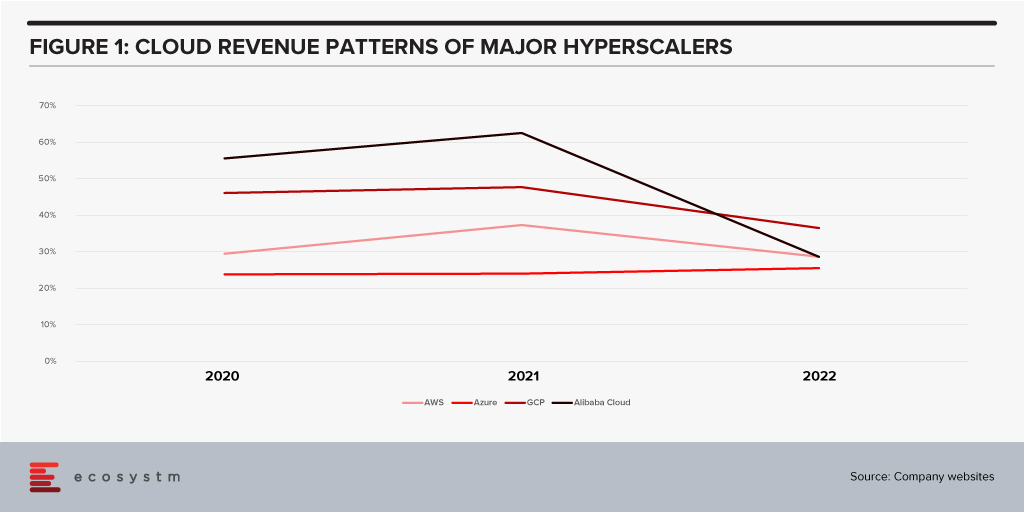

All growth must end eventually. But it is a brave person who will predict the end of growth for the public cloud hyperscalers. The hyperscaler cloud revenues have been growing at between 25-60% the past few years (off very different bases – and often including and counting different revenue streams). Even the current softening of economic spend we are seeing across many economies is only causing a slight slowdown.

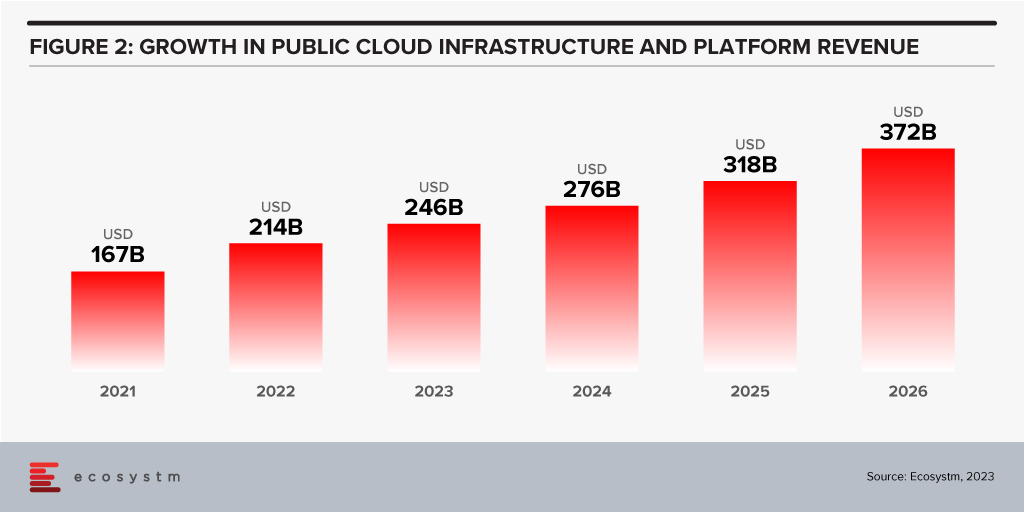

Looking forward, we expect growth in public cloud infrastructure and platform spend to continue to decline in 2024, but to accelerate in 2025 and 2026 as businesses take advantage of new cloud services and capabilities. However, the sheer size of the market means that we will see slower growth going forward – but we forecast 2026 to see the highest revenue growth of any year since public cloud services were founded.

The factors driving this growth include:

- Acceleration of digital intensity. As countries come out of their economic slowdowns and economic activity increases, so too will digital activity. And greater volumes of digital activity will require an increase in the capacity of cloud environments on which the applications and processes are hosted.

- Increased use of AI services. Businesses and AI service providers will need access to GPUs – and eventually, specialised AI chipsets – which will see cloud bills increase significantly. The extra data storage to drive the algorithms – and the increase in CPU required to deliver customised or personalised experiences that these algorithms will direct will also drive increased cloud usage.

- Further movement of applications from on-premises to cloud. Many organisations – particularly those in the Asia Pacific region – still have the majority of their applications and tech systems sitting in data centre environments. Over the next few years, more of these applications will move to hyperscalers.

- Edge applications moving to the cloud. As the public cloud giants improve their edge computing capabilities – in partnership with hardware providers, telcos, and a broader expansion of their own networks – there will be greater opportunity to move edge applications to public cloud environments.

- Increasing number of ISVs hosting on these platforms. The move from on-premise to cloud will drive some growth in hyperscaler revenues and activities – but the ISVs born in the cloud will also drive significant growth. SaaS and PaaS are typically seeing growth above the rates of IaaS – but are also drivers of the growth of cloud infrastructure services.

- Improving cloud marketplaces. Continuing on the topic of ISV partners, as the cloud hyperscalers make it easier and faster to find, buy, and integrate new services from their cloud marketplace, the adoption of cloud infrastructure services will continue to grow.

- New cloud services. No one has a crystal ball, and few people know what is being developed by Microsoft, AWS, Google, and the other cloud providers. New services will exist in the next few years that aren’t even being considered today. Perhaps Quantum Computing will start to see real business adoption? But these new services will help to drive growth – even if “legacy” cloud service adoption slows down or services are retired.

Hybrid Cloud Will Play an Important Role for Many Businesses

Growth in hyperscalers doesn’t mean that the hybrid cloud will disappear. Many organisations will hit a natural “ceiling” for their public cloud services. Regulations, proximity, cost, volumes of data, and “gravity” will see some applications remain in data centres. However, businesses will want to manage, secure, transform, and modernise these applications at the same rate and use the same tools as their public cloud environments. Therefore, hybrid and private cloud will remain important elements of the overall cloud market. Their success will be the ability to integrate with and support public cloud environments.

The future of cloud is big – but like all infrastructure and platforms, they are not a goal in themselves. It is what cloud is and will further enable businesses and customers which is exciting. As the rates of digitisation and digital intensity increase, the opportunities for the cloud infrastructure and platform providers will blossom. Sometimes they will be the driver of the growth, and other times they will just be supporting actors. But either way, in 2026 – 20 years after the birth of AWS – the growth in cloud services will be bigger than ever.

Oracle is clearly prioritising a rapid expansion across the globe. The company is in a race to catch up with the big 3 (AWS, Google, and Microsoft), and recognises that many of their customers are eager to migrate to the cloud, and they have other options. Their strategy appears to be to rely on third-party co-location providers for most of their data centres, and build a single availability zone per region, at least to start.

Oracle Cloud Rollout Ramps Up

Let us consider the following:

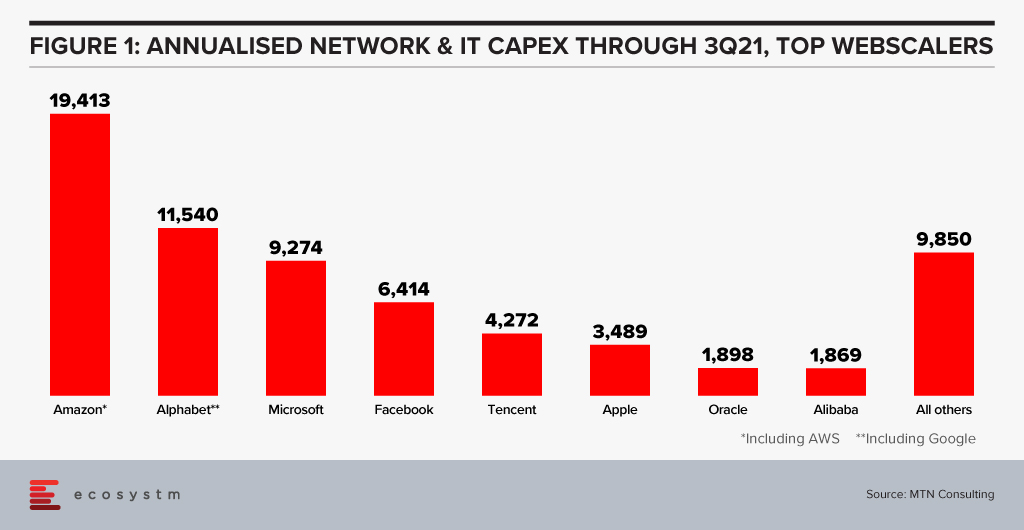

- Oracle’s network spending level puts it in the range of other webscalers. Focusing only on the Network and IT portion of their CapEx, Oracle has now passed Alibaba. Oracle is also ahead of both IBM and Baidu, which are included in the “All others” category in Figure 1.

- The coverage of the Oracle Cloud Infrastructure (OCI) is impressive. It has 36 regions today (some dedicated for government use), with a plan to reach 44 by year-end 2022. That compares to 27 overall for AWS, 65 for Azure, 29 for GCP; regional competitors Tencent and Huawei have 27 regions each, and Alibaba 25 regions. The downside is that Oracle has only one availability zone in most of its regions, while the Big 3 usually have 2 or 3 per region. Oracle needs to build out its local resiliency rapidly over the next year or two or risk losing business to the big 3, especially to AWS; but the company knows this and is budgeting CapEx aggressively to address the problem.

- Oracle’s initial reliance on leased facilities may be an interim step. The rapid growth of AWS, Azure, and GCP in the late 2010s was a surprise and Oracle started to see serious risks of losing customers to these cloud platforms. Building out their own cloud base on new data centres would have taken years and cost them business. So, Oracle did the smart thing and leaped into the cloud as fast as possible with the resources and time available. The company has scaled their OCI operations at an impressive rate. It expects capital expenditures to double YoY for the fiscal year ending May 2022, as it increases “data centre capacities and geographic locations to meet current and expected customer demand” for OCI.

- Finally, Oracle has invested heavily in designing the servers to be installed in its data centres (even if most of them are leased). Oracle was an early investor in Ampere Computing, which makes Arm-based processors, sidestepping the Intel ecosystem. In May 2021, Oracle rolled out its first Arm-based compute offering, OCI Ampere A1 Compute, based on the Ampere Altra processor. Oracle says this allows OCI customers to run “cloud-native and general-purpose workloads on Arm-based instances with significant price-performance benefits.” Microsoft and Tencent also deploy the Ampere Altra in some locations.

Reaching Global Scale

Once Oracle decided to launch into the cloud, its goal was to both grow revenues and also protect its legacy base from slipping away to the Big 3, which already had a growing global footprint. Oracle chose to quickly build cloud regions in its key markets, with the understanding that it would have to fill out individual regions as time passed. This is not that different from the big 3, in fact, but Oracle started its buildout much later. It also has lesser availability zones per region.

Oracle has not ignored this disparity. It recognises that reliability is key for its clients in trusting OCI. For example, the company emphasises that:

- Each Oracle Cloud region contains at least three fault domains, which are “groupings of hardware that form logical data centers for high availability and resilience to hardware and network failures.” Fault domains allow a customer to distribute instances so “the instances are not on the same physical hardware within a single availability domain.”

- OCI has a network of 70 “FastConnect” partners which offer dedicated connectivity to OCI regions and services (comparable to AWS DirectConnect)

- OCI and Microsoft Azure have a partnership allowing “joint customers” to run workloads across the two clouds, providing low latency, cross-cloud interconnect between OCI and Azure in eight specific regions. Customers can migrate existing applications or develop cloud native applications using a mix of OCI and Azure.

- Oracle allows customers to deploy OCI completely within their own data centers, with Dedicated Region and Exadata Cloud@Customer, deploy cloud services locally with public cloud-based management, or deploy cloud services remotely on the edge with Roving Edge Infrastructure.

- Further, Oracle clearly tries to differentiate around its Arm-based Ampere processors. Reliability is not necessarily the focus, though. The main focus is contrasting Ampere with the x86 ecosystem around overall price-performance, with highlights on power efficiency, scalability and ease of development.

Ultimately the market will decide whether Oracle’s approach makes it truly competitive with the big 3. The company continues to announce some big wins, including with Deutsche Bank, FedEx, NEC, Toyota, and Zoom. The latter is probably the company’s biggest cloud win given Zoom’s rise to prominence amidst the pandemic. Not surprisingly, Oracle’s recent Singapore cloud region launch was hosted by Zoom.

Conclusion

Over the long run, the webscale market is getting more concentrated in the hands of a few players; some companies tracked as webscalers, such as HPE and SAP, will fall by the wayside as they can’t keep up with the infrastructure spending requirements of being a top player. Oracle is aiming to remain in the race, however. CEO Larry Ellison addressed this in an earnings call, arguing the global cloud market is not just the “big 3” (AWS, Azure, and GCP), but is a “big 4” due in part to Oracle’s database strengths. Ellison also argued that the OCI is “much better for security, for performance, for reliability” and cost: “we’re cheaper.” The market will ultimately decide these things, but Oracle is off to a strong start. Its asset light approach to network buildout, and limited depth within regions, clearly have downfalls. But the company has a deep roster of long-term customers across many regions, and it is moving fast to secure their business as they migrate operations to the cloud.

Industries continue to innovate and disrupt to create and maintain a competitive edge – and their technology partners evolve their solution offerings to empower them.

We bring to you latest industry news from the Healthcare, Financial Services, Retail, Travel & Hospitality and Entertainment & Media industries to show you how organisations are leveraging technology. Find out more about organisations such as Services Australia, Paypal, Walmart, Zara and Amex – and how tech providers such as IBM, Oracle, Google and Uplift are supporting organisations across industries.

View the latest Ecosystm Bytes on Industries of the Future below, and reach out to our experts if you have questions.

For more ‘byte sized’ insights click on the link below

Microsoft introduced a second Vertical Cloud offering, last week – this time turning the focus on Retail, after having launched Microsoft Cloud for Healthcare in October 2020.

The Microsoft Cloud for Retail aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. It brings industry-specific capabilities to the Microsoft suite including Microsoft Azure, Microsoft Power Platform, Microsoft 365, and Microsoft Dynamics 365 – and is aimed at the growing need for “intelligent retail’. Microsoft’s partner ecosystem will also be involved in the new platform to address challenges in the sector and future proof the retail evolution.

In The Top 5 Retail & eCommerce Trends for 2021, Ecosystm notes that while retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough this year. From the customer experience angle, they will strongly focus on omnichannel, catering to ‘glocal’ consumption, using location-based services, and improving both their onsite and online customer experience. They will also have to work on their supply chain and pricing capabilities, as distribution woes continue. These trends are seeing a deeper need for transformational technologies and leading cloud providers are introducing solutions targeted at the industry. Google has introduced its cloud retail solutions aiming to help retailers get more from data. Similarly, AWS has cloud offerings for the retail industry leveraging its retail domain experience and cloud deployment services.

Ecosystm Comments

“Global cloud vendors continue to “move up the stack” to provide more of the technology landscape for organisations. The focus of these tech giants is on adding unique value to customers by tailoring the combination of the different cloud services they can provide to specific industries. Providing the full-stack will mean higher customer retention rates – as the implementation time should be lower than traditional on-premises implementations. Microsoft has a diverse range of capabilities. Having a software company and implementation partner that can deliver the full stack of technology and business processes should improve the time to value for organisations.

But I see three key difficulties in implementing systems such as these:

- People adapting effectively to use the new processes

- Migrating enough high-quality data to leverage the new capabilities

- Integrating the new capabilities into an organisation’s existing landscape.

This is why it is likely that initial use will come from Microsoft’s existing Retail customers as they expand the range of services they use. New adopters of these Microsoft solutions will find that much of the complexity and cost of implementing a new business solution will remain.

However, these value-added cloud services open access to smaller organisations. If Microsoft is able to work with their partners to simplify the implementation of these capabilities, it will allow smaller organisations to access these complex capabilities affordably.“

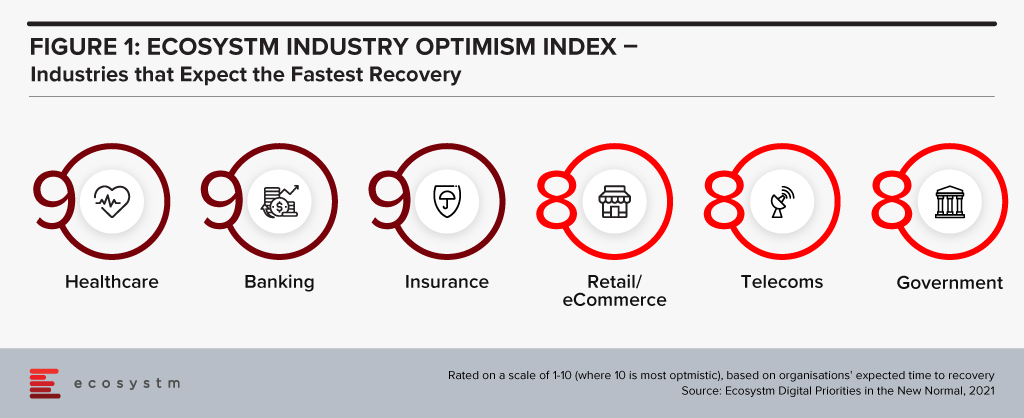

“The Ecosystm Digital Priorities in the New Normal Study aims to determine how optimistic industries are about successfully negotiating these uncertain times (Figure 1). The industries that are rated the most optimistic fall into two clear categories. In the first category, there are industries, such as Healthcare that had to transform urgently – mostly in an unplanned manner. This has led to a greater appetite for change and optimism in these industries. Then there are industries, such as Retail, that had some time to re-focus their technology roadmap when the crisis hit. These industries have a strong customer focus and had started their digital journeys before the pandemic.

Microsoft’s industry focus appears to be spot-on. Their first two vertical clouds target enterprises that have had to – and will continue to – pivot. The ‘modular’ approach taken in the Microsoft Cloud for Healthcare offering allows providers to choose the right capability for their organisation – whether it is workflow automation, patient engagement through virtual health, collaboration within care teams or better clinical and operational insights. As healthcare organisations across the world negotiate the challenges of mass vaccination, they may well find themselves leveraging these industry-specific capabilities as they revamp their workflows, processes, and data use.”

Get to know the right research, insights and technologies for you to be one step ahead in this new world of retail in our top 5 retail trends for 2021 that represent the most significant shifts in 2021

Contact centres were already on a path to modernisation – which got accelerated by the COVID-19 crisis. The need for omnichannel delivery and better insights from customer data has forced contact centres to adopt cloud solutions. Ecosystm Principal Advisor Audrey William says, “There is still a disconnect between integrating and synchronising customer data between Sales, Marketing and Customer Teams. However, the market is starting to see contact centre vendors work closer with vendors in customer experience management segment.”

Genesys and Adobe are collaborating on integrating Genesys cloud and the Adobe Experience Platform. The deeper integration of both platforms is aimed to give organisations a better omnichannel presence. The platform is live for users and Genesys and Adobe will introduce other features and capabilities throughout 2020. Genesys is already a partner of Adobe’s Exchange Program designed for technology partners to supplement Exchange Marketplace with extensions and applications for Adobe Creative Cloud users.

Augmenting the CX journey through Data Synchronization

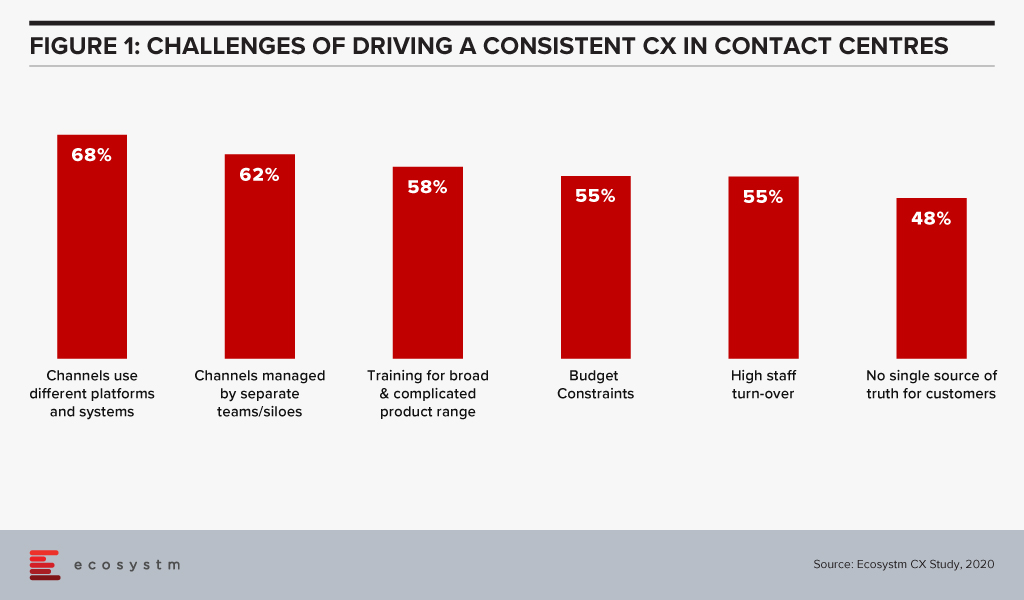

Ecosystm data finds that 62% of contact centres have driving omnichannel experience as a key customer experience (CX) priority and 57% want to analyse data across multiple data repositories. However, when asked about the challenges of driving consistent CX, data access and integration appears to be a barrier in achieving their priorities. These challenges are the reason why getting a “true view” of the customer data has been an arduous task and achieving consistent CX continues to be a struggle.

William says. “The customer data collected by a particular service or department does not always move along in real-time with the customer interactions across different touchpoints. This complicates maintaining a real-time customer profile and impacts the CX.”

“Sales and Marketing have different KPIs and tend to view customer data from different angles. The data from in-store, Marketing and Sales interactions sits within departmental silos. They may deal with the same customers and not follow them through their entire journey. This leads to missed opportunities in reaching out to them at the right time with the right products to upsell, resell or provide better CX. Data synchronisation across channels, would solve that problem.”

Integrating Genesys and Adobe Experience Platform will give organisations the capability to provide contact centre agents with real-time customer data and profiles from a single point to provide an personalised experience. The platform is powered by Genesys Predictive Engagement that uses AI to provide more intelligence based on past interactions to drive effective, data-driven conversations. In addition to this, the partnership also enables businesses and marketing departments to customise campaigns and extend their digital and voice capabilities for optimal conversions. William says, “The ability to use AI to understand customer intent, behaviour and patterns is critical as it will allow brands to re-look at how to design the customer journey. When you keep using the same and outdated profile, it will be hard to have discussions around intent, customer interest and assess how customer priorities have changed. Accurate and automate data profiling will lead to more targeted and accurate marketing campaigns.”

Genesys Deepening Industry Partnerships

Genesys is re-shaping its strategy on Contact Centre as a Service (CCaaS) offerings through partnerships and working on its vision of providing Experience as a Service to its global clients. The need for CCaaS has been accelerated by the pandemic. Last month Genesys signed a five year deal with Infosys to develop and deploy cloud CX and contact centre solutions.

Earlier this year, Genesys partnered with MAXIMUS, a US Government services provider to set up the MAXIMUS Genesys Engagement Platform, an integrated, cloud-based omnichannel contact centre solution driven by the government requirement for public sector organisations to provide seamless customer experiences similar to those offered in the private sector.

The company has also partnered with various other industry leaders like Microsoft, Google Cloud, and Zoom to roll out cloud-based innovations to benefit customers.

Click below to access insights from the Ecosystm Contact Centre Study on visibility into organisations’ priorities when running a Contact Centre (both in-house and outsourced models) and the technologies implemented and being evaluated

The National Australia Bank (NAB) and Microsoft announced a strategic partnership last week, to develop and architect a multicloud environment to be used by both NAB and its New Zealand counterpart, Bank of New Zealand (BNZ).

The five-year partnership will involve Microsoft and NAB sharing development costs and investments to migrate around 1,000 out of 2,600 applications from the NAB and BNZ stacks, on Microsoft Azure. By 2023, NAB aims to run 80% of its application on the cloud, build a robust cloud foundation, and enable customers to access applications and services on the cloud.

The partnership aims to support NAB’s commitment to continuous improvement and innovation, leveraging the Microsoft global engineering team. It also involves setting up of the NAB Cloud Guild program, where Microsoft will train 5,000 NAB and BNZ technologists to equip them on cloud and allied technology skills.

NAB and Microsoft have previously collaborated to improve the experience for NAB customers, through cloud-based applications. NAB’s cloud-based AI powered ATM was the result of a proof-of-concept (PoC) developed on Microsoft Azure’s cognitive services, in 2018. It involved general ATM security captures along with facial biometrics to enable customers to withdraw cash without a card or a phone.

Besides the partnership with Microsoft, NAB also uses Google Cloud for multicloud workloads as well as AWS for its AI competencies and resources across platforms. In February, NAB launched an AI-based voice service to boost the bank’s contact centre experience along with AWS.

Ecosystm Comments

Ecosystm Principal Advisor, Tim Sheedy says, “If ever there was a sign that multicloud is the predominant approach for businesses, this is it. NAB is a big AWS client – in Australia and New Zealand. They lead the way for businesses in training thousands of employees on AWS technologies through their Cloud Guild. But now Azure is also developing a strong foothold in NAB – the public cloud services market is not a one-horse race!”

“Many businesses that have standardised on – or preferred – a single cloud vendor will find that they will likely use multiple cloud environments, in the future. The key to enabling this will be the adoption of modern development environments and architectures. Containers, microservices, open-source, DevOps and other technologies and capabilities will help them run their applications, data and processes across the best cloud for them at the time – not just the one that they have used in the past.”

Sheedy thinks, “NAB’s competitive advantage will not come from whether they are using AWS or Azure – it will come from the significant time and effort they are investing in giving their employees the skills they need to take advantage of these environments to drive change at pace. Too many businesses are increasing their cloud usage without making the necessary investments to upskill their employees – if you know you are planning to spend more on the cloud, then start now in reskilling and upskilling your staff. There is already a real shortage of cloud skills and it is only going to get worse.”

Gain access to more insights from the Ecosystm Cloud Study

As organisations stride towards digitalisation, re-evaluate their business continuity plans and define what the Future of Work will look for them, Cloud adoption is expected to surge. In June, there were several announcements that indicate the market is responding to this increased interest.

Cloud Providers Gearing up to Enable Economic Recovery

Global economies are slowly gearing up for a technology-led recovery phase and several organisations are taking advantage of the disruption to start or accelerate their digital transformation plans. Many are looking at this as a good opportunity to replace their legacy systems. Cloud providers are expected to lead from the front when it comes to helping the economy recover.

Government agencies have been immensely impacted by the COVID-19 crisis and will need to shift fast into the recovery mode. Salesforce launched a multi-tenant dedicated Cloud infrastructure for their US Federal, state and local government customers, government contractors, and federally funded research and development centres. Hosted on AWS GovCloud and FedRAMP compliant, it provides customers with a compliant and secure environment to deploy Salesforce’s CRM platform and industry solutions. The launch is expected to empower government agencies with the ability to deliver better services, scale to unprecedented demands and connect to citizens on their channel of choice.

Initiatives such as the UK Crown Commercial Service (CCS) and Google Cloud agreement will also help in the recovery phase. This allows qualified public sector agencies to avail of a discounted price for their Google Cloud deployments. Earlier in the year CCS entered into a price arrangement with Microsoft as well. If Cloud has to be the vehicle for economic recovery, such arrangements will benefit cash-strapped public sector organisations.

The recovery will also require the entire technology ecosystem to engage not only with large enterprises but also small and medium enterprises (SMEs). Alibaba Cloud announced an investment of US$ 283 million to revamp its global partner program. They plan to introduce new partner-customer communication processes to enhance response time and bring more opportunities to independent software vendors (ISVs) managed service providers (MSPs) and system integrators (SIs) as partners.

Europe Emerging as a Cloud Hub

As a fallout of the current political scenario, Europe is pushing for more cloud independence and to become an innovation hub as a vendor-neutral network for cloud computing providers and their customers.

GAIA-X Foundation is a federated data infrastructure project initiated to build a unified system of cloud and data services to be protected by EU Laws – including GDPR, the free flow of non-personal data regulation and the Cybersecurity Act. France and Germany kicked off the GAIA-X cloud project last year and the system is open for participation to national and European initiatives for exchange of data across industries and services such as AI, IoT and data analytics. GAIA-X took another step towards becoming a real option for European organisations with the establishment as a legal entity in June. Various organisations – including Dassault, Orange, Siemens, SAP, Atos, Scaleway and Deutsche Telekom are a part of this non-profit platform, working together on Cloud applications, high-performance computing as well as edge systems. The project is expecting to release a working model by early 2021 and will be further enhanced in phases.

Global Cloud leaders are also focusing on expanding their presence in Europe. In February, Microsoft announced a new data centre in Spain leveraging Telefónica infrastructure. In a similar move, Google Cloud announced its plans to expand in the region in partnership with Telefónica. Telefonica and Google are expected to jointly work on Spain’s digitalisation through edge infrastructure and 5G for consumers and telecom infrastructure.

Cloud Providers Bolstering their Cybersecurity Capabilities

2020 has witnessed a host of cybersecurity threats and data breaches. While Cloud providers have always evolved their cybersecurity capabilities, it has become important for them to become vocal about these measures to build trust in the industry.

To complement the Microsoft Azure IoT security, Microsoft acquired IoT security specialist CyberX, last month. The acquisition will enable greater security for the IoT devices connected to the Microsoft network and will help their customers to gain visibility through a map of devices thus allowing them to gather information on security risks associated with thousands of sensors and connected devices. This will enhance smart grid, smart manufacturing and digital assets and profiles and reduce vulnerabilities across production and supply chain.

In another move which will benefit the ISV and SI ecosystem, NetFoundry’s zero trust networking API is now available on RapidAPI. RapidAPI’s marketplace enables developers to easily find, connect to, and manage the APIs they need to build a range of applications. Now the ISV and developer community can access NetFoundry’s software-only, zero trust models on RapidAPI.

More Partnerships between Software/Industry Solutions Providers and Cloud Providers

The COVID-19 crisis has had a far-reaching impact on several industries. The technologies that are expected to see the most uptake are IoT and Future of Work technologies.

Ecosystm Principal Advisor, Kaushik Ghatak says, “COVID-19 has brought to the fore the need for managing risks better. And the key to managing risks is to have better visibility and drive data-driven decisions; the sweet spot for IoT technologies.”

Last week, Microsoft and Hitachi announced a strategic alliance to accelerate the digital transformation of the Manufacturing and Logistics industries across Southeast Asia, Japan and North America. The first solutions are expected to be made available in Thailand as early as this month. Hitachi brings to the table their industry solutions, such as Lumada, and their IoT-ready industrial controllers HX Series. These solutions will be fully integrated with the Microsoft cloud platform, leveraging Azure, Dynamics 365 and Microsoft 365.

Another sector that has seen significant disruption is Real Estate. Ecosystm Principal Advisor, Andrew Milroy in his blog Proptech: Driving Digital Transformation in the Wake of COVID-19 sees a real opportunity for the sector to transform. “Many activities within the property ecosystem have remained unchanged for decades. There are several opportunities for digital engagement and automation in this sector, ranging from the use of robots in construction to the ‘uberisation’ of the residential property customer journey.”

June saw Honeywell and SAP partner to create a joint cloud-based solution based on Honeywell Forge and SAP cloud. The cloud solution is aimed at real estate operators and customers providing aggregated financial and operational insights in real-time. The solution leverages the Honeywell Forge autonomous buildings solution and the SAP Cloud for Real Estate solution, enabling facility managers and building owners to reposition their real estate portfolios through parameters such as cost savings and energy efficiency and help improve the tenant experience.

As organisations struggle to maintain operations during the ongoing crisis, there has been an exponential increase in employees working from home and relying on the Future of Work technologies. Ecosystm principal Advisor, Audrey William says, “During the COVID-19 pandemic, people have become reliant on voice, video and collaboration tools and even when things go back to normal in the coming months, the blended way of work will be the norm. There has been a surge of video and collaboration technologies. The need to have good communication and collaboration tools whether at home or in the office has become a basic expectation especially when working from home. It has become non-negotiable.”

AWS and Slack announced a multi-year partnership to collaborate on solutions to enable the Workplace of the Future. This will give Slack users the ability to manage their AWS resources within Slack, as well as replace Slack’s voice and video call features with AWS’s Amazon Chime. And AWS will be using Slack for their internal communication and collaboration.

Delivering excellent customer experience in the midst of the crisis has proved to be difficult for organisations. Customer care centres have been especially impacted by high volumes of customer interactions – through voice and non-voice channels. This will see a major rise in adoption of cloud contact centre solutions. Contact centre providers are ramping up their capabilities in anticipation. Genesys selected AWS as their preferred cloud partner to deliver new features to customers and build a global and secure infrastructure.

The industry can expect more news from Cloud providers in the next few months as they ramp up their capabilities and channel their go-to-market messaging.

Gain access to more insights from the Ecosystm Cloud Study

In our blog, Artificial Intelligence – Hype vs Reality, published last month we explored why the buzz around AI and machine learning have got senior management excited about future possibilities of what technology can do for their business. AI – starting with automation – is being evaluated by organisations across industries. Several functions within an organisation can leverage AI and the technology is set to become part of enterprise solutions in the next few years. AI is fast becoming the tool which empowers business leaders to transform their organisations. However, it also requires a rethink on data integration and analysis, and the use of the intelligence generated. For a successful AI implementation, an organisation will have to leverage other enabling technologies.

Technologies Enabling AI

IoT

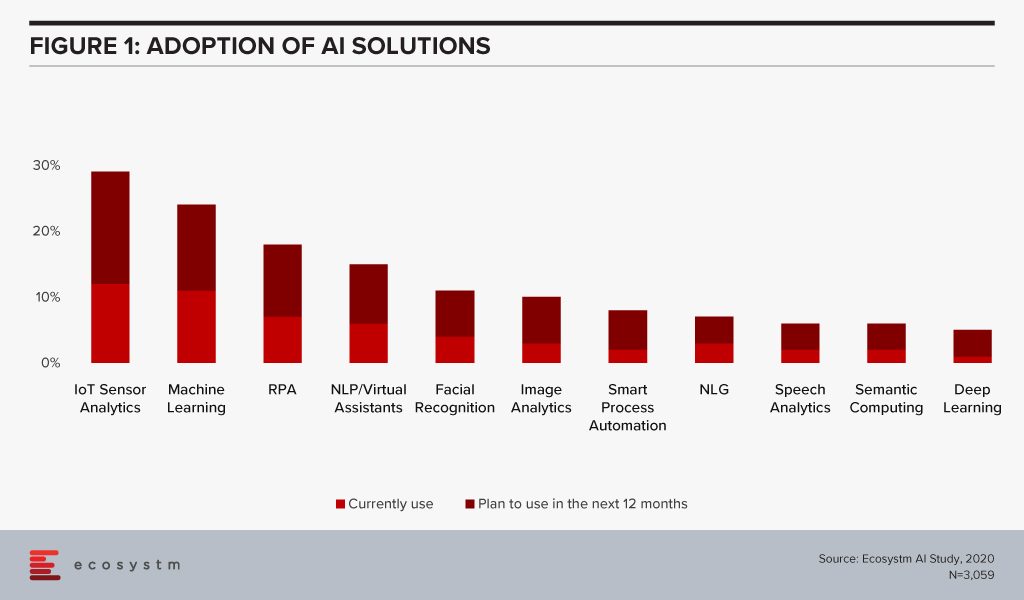

Organisations have been evaluating IoT – especially for Industry 4.0 – for the better part of the last decade. Many organisations, however, have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation to meet organisational and system requirements and so on. As the hype around what AI can do for the organisation increases, they are being forced to re-look at their IoT investments. AI algorithms derive intelligence from real-time data collected from sensors, remote inputs, connected things, and other sources. No surprise then that IoT Sensor Analytics is the AI solution that is seeing most uptake (Figure 1).

This is especially true for asset and logistics-driven industries such as Resource & Primary, Energy & Utilities, Manufacturing and Retail. Of the AI solutions, the biggest growth in 2020 will also come from IoT Analytics – with Healthcare and Transportation ramping up their IoT spend. And industries will also look at different ways they can leverage the IoT data for operational efficiency and improved customer experience (CX). For instance, in Transportation, AI can use IoT sensor data from a fleet to help improve time, cost and fuel efficiency – suggesting less congested routes with minimal stops through GPS systems, maintaining speeds with automated speed limiters – and also in predictive fleet maintenance.

IoT sensors are already creating – and will continue to create large amounts of data. As organisations look to AI-enabled IoT devices, there will be a shift from one-way transactions (i.e. collecting and analysing data) to bi-directional transactions (i.e. sensing and responding). Eventually, IoT as a separate technology will cease to exist and will become subsumed by AI.

Cloud

AI is changing the way organisations need to store, process and analyse the data to derive useful insights and decision-making practices. This is pushing the adoption of cloud, even in the most conservative organisations. Cloud is no longer only required for infrastructure and back-up – but actually improving business processes, by enabling real-time data and systems access.

Over the next decades, IoT devices will grow exponentially. Today, data is already going into the cloud and data centres on a real-time basis from sensors and automated devices. However, as these devices become bi-directional, decisions will need to be made in real-time as well. This has required cloud environments to evolve as the current cloud environments are unable to support this. Edge Computing will be essential in this intelligent and automated world. Tech vendors are building on their edge solutions and tech buyers are increasingly getting interested in the Edge allowing better decision-making through machine learning and AI. Not only will AI drive cloud adoption, but it will also drive cloud providers to evolve their offerings.

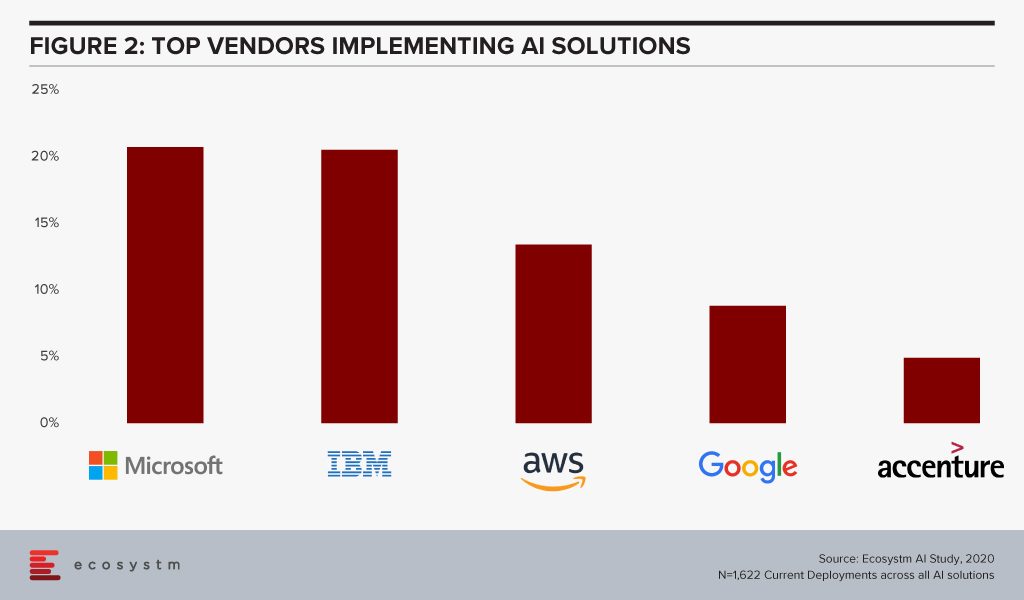

The global Ecosystm AI study finds that four of the top five vendors that organisations are using for their AI solutions (across data mining, computer vision, speech recognition and synthesis, and automation solutions) today, are also leading cloud platform providers (Figure 2).

The fact that intelligent solutions are often composed of multiple AI algorithms gives the major cloud platforms an edge – if they reside on the same cloud environment, they are more likely to work seamlessly and without much integration or security issues. Cloud platform providers are also working hard on their AI capabilities.

Cybersecurity & AI

The technology area that is getting impacted by AI most is arguably Cybersecurity. Security Teams are both struggling with cybersecurity initiatives as a result of AI projects – and at the same time are being empowered by AI to provide more secure solutions for their organisations.

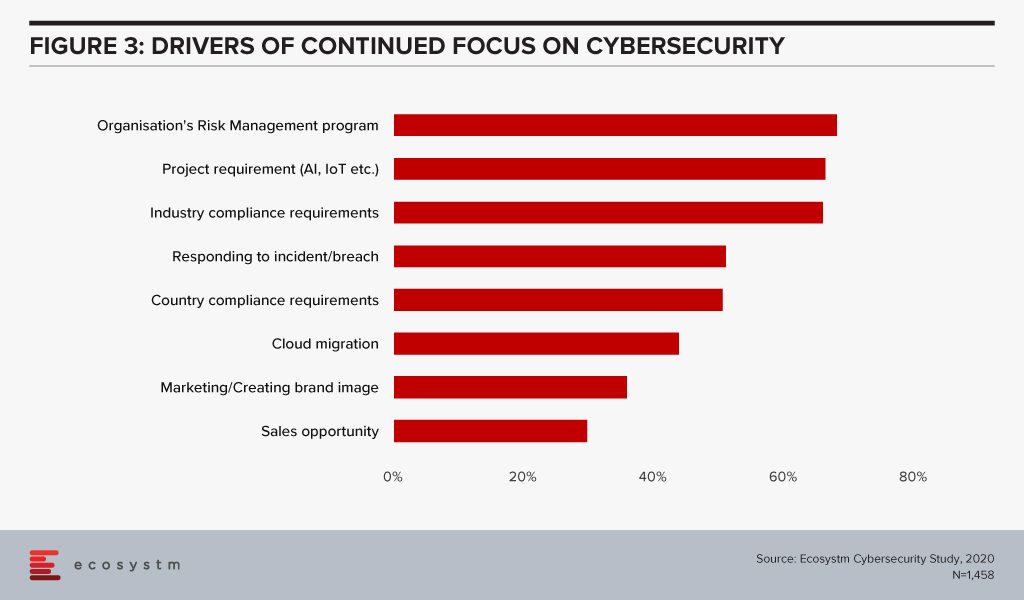

The global Ecosystm Cybersecurity study finds that one of the key drivers that is forcing Security Teams to keep an eye on their cybersecurity measures is the organisations’ needs to handle security requirements for their Digital Transformation (DX) projects involving AI and IoT deployments (Figure 3).

While AI deployments keep challenging Security Teams, AI is also helping cybersecurity professionals. Many businesses and industries are increasingly leveraging AI in their Security Operations (SecOps) solutions. AI analyses the inflow and outflow of data in a system and analyses threats based on the learnings. The trained AI systems and algorithms help businesses to curate and fight thousands of daily breaches, unsafe codes and enable proactive security and quick incident response. As organisations focus their attention on Data Security, SecOps & Incident Response and Threat Analysis & Intelligence, they will evaluate solutions with embedded AI.

AI and the Experience Economy

AI has an immense role to play in improving CX and employee experience (EX) by giving access to real-time data and bringing better decision-making capabilities.

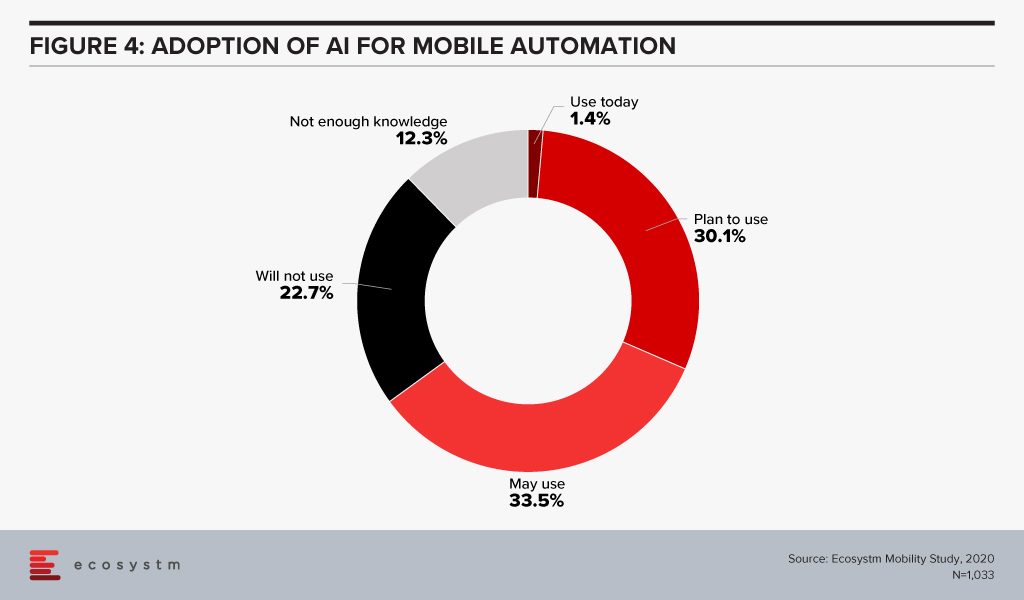

Enterprise mobility was a key area of focus when smartphones were introduced to the modern workplace. Since then enterprise mobility has evolved as business-as-usual for IT Teams. However, with the introduction of AI, organisations are being forced to re-evaluate and revamp their enterprise mobility solutions. As an example, it has made mobile app testing easier for tech teams. Mobile automation will help automate testing of a mobile app – across operating systems (Figure 4). While more organisations tend to outsource their app development functions today, mobile automation reduces the testing time cycle, allowing faster app deployments – both for internal apps (increasing employee productivity and agility) and for consumer apps (improving CX).

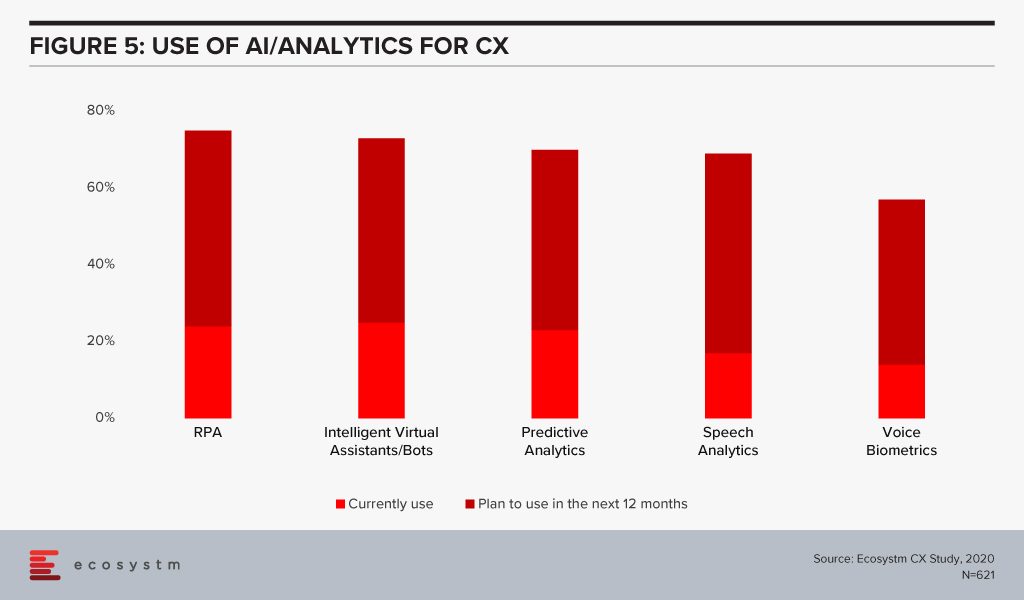

CX Teams within organisations are especially evaluating AI technologies. Visual and voice engagement technologies such as NLP, virtual assistants and chatbots enable efficient services, real-time delivery and better customer engagement. AI also allows organisations to offer personalised services to customers providing spot offers, self-service solutions and custom recommendations. Customer centres are re-evaluating their solutions to incorporate more AI-based solutions (Figure 5).

The buzz around AI is forcing tech teams to evaluate how AI can be leveraged in their enterprise solutions and at enabling technologies that will make AI adoption seamless. Has your organisation started re-evaluating other tech areas because of your AI requirements? Let us know in the comments below.