The UN’s global stocktake synthesis report underscores the need for significant efforts to meet the ambitious goals of the Paris Agreement to keep the global warming limit to 1.5ºC, compared to pre-industrial levels. Achieving this requires collective action from governments, organisations, and individuals.

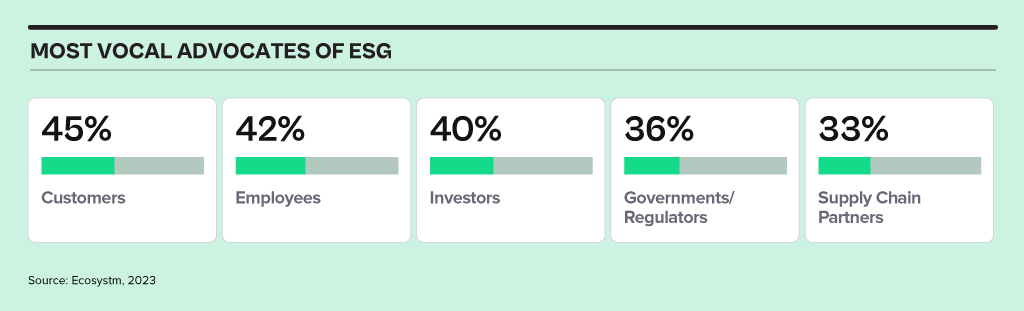

While regulators focus on mandates, organisations today are being influenced more by individual responsibility for positive impact. Customers and employees are leading ESG actions – another fast-emerging voice driving ESG initiatives are value chain partners looking to build sustainable supply chains.

Ecosystm research reveals that only 27% of organisations worldwide currently view ESG as a strategic imperative, yet we anticipate rapid change in the landscape.

Click below to find out what Ecosystm analysts Gerald Mackenzie, Kaushik Ghatak, Peter Carr and Sash Mukherjee consider the top 5 ESG trends that will shape organisations’ sustainability roadmaps in 2024.

Click here to download ‘Ecosystm Predicts: Top 5 ESG Trends in 2024’ as a PDF.

#1 Organisations Will Evolve ESG Strategies from Compliance to Customer & Brand Value

Many of the organisations that we talk to have framed their ESG strategy and roadmaps primarily in relation to compliance and regulatory standards that they need to meet, e.g. in relation to emissions reporting and reduction, or in verifying that their supply chains are free from Modern Slavery.

However, organisations that are more mature in their journeys have realised that ESG is quickly becoming a strategic differentiator and compliance is only the start of their sustainability journey.

Customers, employees, and investors are increasingly selective about the brands they want to associate with and expect them to have a purpose and values that are aligned with their own.

#2 Sustainability Will Remain a Stepping-Stone to Full ESG

Heading into 2024, the corporate continues to navigate the nuances between Sustainability and Environmental, Social, and Governance (ESG) initiatives. Sustainability, focused on environmental stewardship, is a common starting point for corporate responsibility, offering measurable goals for a solid foundation.

Yet, the transition to comprehensive ESG, which includes broader social and governance issues alongside environmental concerns, demands broader scope and deeper capabilities, shifting from quantitative to qualitative measures. The trend of merging sustainability with ESG risks is blurring distinct objectives, potentially complicating reporting and compliance, and causing confusion in the market. Nevertheless, this conflation ultimately paves the way for more integrated, holistic corporate strategies.

By aligning sustainability efforts with wider ESG goals, companies will develop more comprehensive solutions that address the entire spectrum of corporate responsibility.

#3 ESG Consulting Will Grow – Till Industry Templates Take Over

At the end of 2022, LinkedIn buzzed with announcements of Chief Sustainability Officer appointments. However, the Global Sustainability Barometer Study reveals that only around one-third of global organisations have a dedicated sustainability lead. What changed?

Organisations have recognised that ESG is intricate, requiring a comprehensive focus and a capable team, not just a sustainability leader.

Each organisation’s path to sustainability is unique, shaped by factors like size, industry, location, stakeholders, culture, and values. Successfully integrating ESG requires a nuanced understanding of an organisation’s barriers, opportunities, and risks, making it challenging to navigate the sustainability journey alone. This is complicated by the absence of clear government/industry mandates and guidelines that frame best practices.

#4 Sustainability Tech Will Finally Gain Traction

Many organisations initiate sustainability journeys with promises and general strategies. While the role of technology in accelerating goals is recognised, alignment has been lacking. In 2024 sustainability tech will gain traction.

Environmental Tech. Improved sensors and analytics will enhance monitoring of air and water quality, carbon footprint, biodiversity, and climate patterns.

Carbon-Neutral Transportation. Advancements in electric and hydrogen vehicles, batteries, and clean mobility infrastructure will persist.

Circular Economy. Innovations like reverse logistics and product lifecycle tracking will help reduce waste and extend product/material life.

Smart Grids and Renewable Energy. Smart grid tech and new solutions for renewable energy integration will improve energy distribution.

#5 Cleantech Innovation Will See Increased Funding

Cleantech is the innovation that is driving our adaptation to climate change. We expect that investments into, and the pace of innovation and adoption of Cleantech will accelerate into 2024.

As companies commit to their net-zero targets, the need to operationalise the technologies required to fuel this transition becomes all the more urgent. BloombergNEF reported that for Europe alone, nearly USD 220 billion was invested in Cleantech in 2022.

But to meet net-zero ambitions, annual investments in Cleantech will need to triple over the rest of this decade and quadruple in the next.

We are seeing a rise in social and environmental consciousness – especially in the younger generation. Their awareness of human rights, the environment and inclusion is growing exponentially – they want to create impact. Organisations are being driven to develop and demonstrate an Environmental, Social and Governance (ESG) consciousness in their actions and investments.

In this Ecosystm Snapshot, we cover some of the recent examples of how governments and individual advocates are creating a difference; and how financial organisations and tech providers are embracing ESG.

Read how organisations such as Sun Cable, Equinix, Microsoft, NVIDIA, Prologis, Zensung, Ergo, Munich Re, Natwest, JPMorgan, Credit Suisse and others are working to make the world a better place.

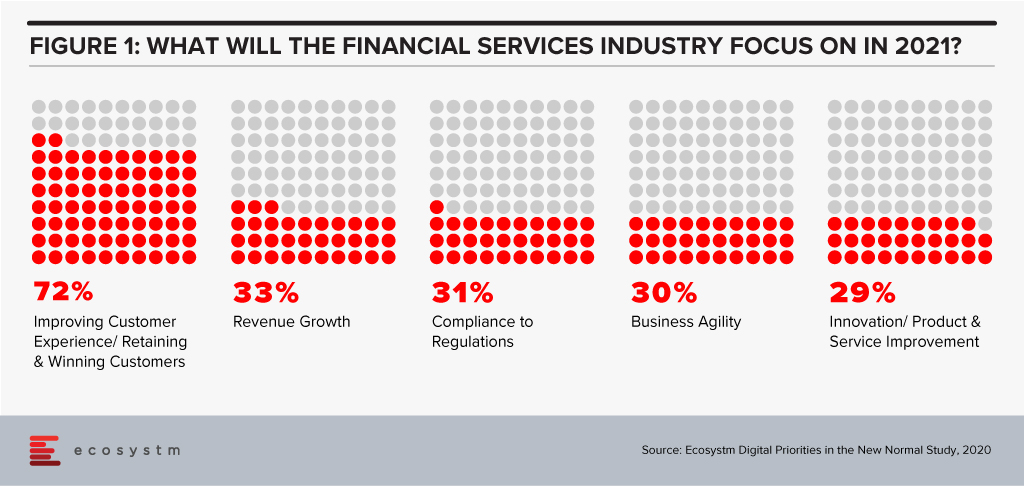

The disruption that we faced in 2020 has created a new appetite for adoption of technology and digital in a shorter period. Crises often present opportunities – and the FinTech and Financial Services industries benefitted from the high adoption of digital financial services and eCommerce. In 2021, there will be several drivers to the transformation of the Financial Services industry – the rise of the gig economy will give access to a larger talent pool; the challenges of government aid disbursement will be mitigated through tech adoption; compliance will come sharply back into focus after a year of ad-hoc technology deployments; and social and environmental awareness will create a greater appetite for green financing. However, the overarching driver will be the heightened focus on the individual consumer (Figure 1).

2021 will finally see consumers at the core of the digital financial ecosystem.

Ecosystm Advisors Dr. Alea Fairchild, Amit Gupta and Dheeraj Chowdhry present the top 5 Ecosystm predictions for FinTech in 2021 – written in collaboration with the Singapore FinTech Festival. This is a summary of the predictions; the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 FinTech Trends for 2021

#1 The New Decade of the ‘Empowered’ Consumer Will Propel Green Finance and Sustainability Considerations Beyond Regulators and Corporates

We have seen multiple countries set regulations and implement Emissions Trading Systems (ETS) and 2021 will see Environmental, Social and Governance (ESG) considerations growing in importance in the investment decisions for asset managers and hedge funds. Efforts for ESG standards for risk measurement will benefit and support that effort.

The primary driver will not only be regulatory frameworks – rather it will be further propelled by consumer preferences. The increased interest in climate change, sustainable business investments and ESG metrics will be an integral part of the reaction of the society to assist in the global transition to a greener and more humane economy in the post-COVID era. Individuals and consumers will demand FinTech solutions that empower them to be more environmentally and socially responsible. The performance of companies on their ESG ratings will become a key consideration for consumers making investment decisions. We will see corporate focus on ESG become a mainstay as a result – driven by regulatory frameworks and the consumer’s desire to place significant important on ESG as an investment criterion.

#2 Consumers Will Truly Be ‘Front and Centre’ in Reshaping the Financial Services Digital Ecosystems

Consumers will also shape the market because of the way they exercise their choices when it comes to transactional finance. They will opt for more discrete solutions – like microfinance, micro-insurances, multiple digital wallets and so on. Even long-standing customers will no longer be completely loyal to their main financial institutions. This will in effect take away traditional business from established financial institutions. Digital transformation will need to go beyond just a digital Customer Experience and will go hand-in-hand with digital offerings driven by consumer choice.

As a result, we will see the emergence of stronger digital ecosystems and partnerships between traditional financial institutions and like-minded FinTechs. As an example, platforms such as the API Exchange (APIX) will get a significant boost and play a crucial role in this emerging collaborative ecosystem. APIX was launched by AFIN, a non-profit organisation established in 2018 by the ASEAN Bankers Association (ABA), International Finance Corporation (IFC), a member of the World Bank Group, and the Monetary Authority of Singapore (MAS). Such platforms will create a level playing field across all tiers of the Financial Services innovation ecosystem by allowing industry participants to Discover, Design and rapidly Deploy innovative digital solutions and offerings.

#3 APIfication of Banking Will Become Mainstream

2020 was the year when banks accepted FinTechs into their product and services offerings – 2021 will see FinTech more established and their technology offerings becoming more sophisticated and consumer-led. These cutting-edge apps will have financial institutions seeking to establish partnerships with them, licensing their technologies and leveraging them to benefit and expand their customer base. This is already being called the “APIficiation” of banking. There will be more emphasis on the partnerships with regulated licensed banking entities in 2021, to gain access to the underlying financial products and services for a seamless customer experience.

This will see the growth of financial institutions’ dependence on third-party developers that have access to – and knowledge of – the financial institutions’ business models and data. But this also gives them an opportunity to leverage the existent Fintech innovations especially for enhanced customer engagement capabilities (Prediction #2).

#4 AI & Automation Will Proliferate in Back-Office Operations

From quicker loan origination to heightened surveillance against fraud and money laundering, financial institutions will push their focus on back-office automation using machine learning, AI and RPA tools (Figure 3). This is not only to improve efficiency and lower risks, but to further enhance the customer experience. AI is already being rolled out in customer-facing operations, but banks will actively be consolidating and automating their mid and back-office procedures for efficiency and automation transition in the post COVID-19 environment. This includes using AI for automating credit operations, policy making and data audits and using RPA for reducing the introduction of errors in datasets and processes.

There is enormous economic pressure to deliver cost savings and reduce risks through the adoption of technology. Financial Services leaders believe that insights gathered from compliance should help other areas of the business, and this requires a completely different mindset. Given the manual and semi-automated nature of current AML compliance, human-only efforts slow down processing timelines and impact business productivity. KYC will leverage AI and real-time environmental data (current accounts, mortgage payment status) and integration of third-party data to make the knowledge richer and timelier in this adaptive economic environment. This will make lending risk assessment more relevant.

#5 Driven by Post Pandemic Recovery, Collaboration Will Shape FinTech Regulation

Travel corridors across border controls have started to push the boundaries. Just as countries develop new processes and policies based on shared learning from other countries, FinTech regulators will collaborate to harmonise regulations that are similar in nature. These collaborative regulators will accelerate FinTech proliferation and osmosis i.e. proliferation of FinTechs into geographies with lower digital adoption.

Data corridors between countries will be the other outcome of this collaboration of FinTech regulators. Sharing of data in a regulated environment will advance data science and machine learning to new heights assisting credit models, AI, and innovations in general. The resulting ‘borderless nature’ of FinTech and the acceleration of policy convergence across several previously siloed regulators will result in new digital innovations. These Trusted Data Corridors between economies will be further driven by the desire for progressive governments to boost the Digital Economy in order to help the post-pandemic recovery.