Microsoft introduced a second Vertical Cloud offering, last week – this time turning the focus on Retail, after having launched Microsoft Cloud for Healthcare in October 2020.

The Microsoft Cloud for Retail aims to offer integrated and intelligent capabilities to retailers and brands to improve their end-to-end customer journey. It brings industry-specific capabilities to the Microsoft suite including Microsoft Azure, Microsoft Power Platform, Microsoft 365, and Microsoft Dynamics 365 – and is aimed at the growing need for “intelligent retail’. Microsoft’s partner ecosystem will also be involved in the new platform to address challenges in the sector and future proof the retail evolution.

In The Top 5 Retail & eCommerce Trends for 2021, Ecosystm notes that while retailers will focus on the shift in customer expectations, a mere focus on customer experience will not be enough this year. From the customer experience angle, they will strongly focus on omnichannel, catering to ‘glocal’ consumption, using location-based services, and improving both their onsite and online customer experience. They will also have to work on their supply chain and pricing capabilities, as distribution woes continue. These trends are seeing a deeper need for transformational technologies and leading cloud providers are introducing solutions targeted at the industry. Google has introduced its cloud retail solutions aiming to help retailers get more from data. Similarly, AWS has cloud offerings for the retail industry leveraging its retail domain experience and cloud deployment services.

Ecosystm Comments

“Global cloud vendors continue to “move up the stack” to provide more of the technology landscape for organisations. The focus of these tech giants is on adding unique value to customers by tailoring the combination of the different cloud services they can provide to specific industries. Providing the full-stack will mean higher customer retention rates – as the implementation time should be lower than traditional on-premises implementations. Microsoft has a diverse range of capabilities. Having a software company and implementation partner that can deliver the full stack of technology and business processes should improve the time to value for organisations.

But I see three key difficulties in implementing systems such as these:

- People adapting effectively to use the new processes

- Migrating enough high-quality data to leverage the new capabilities

- Integrating the new capabilities into an organisation’s existing landscape.

This is why it is likely that initial use will come from Microsoft’s existing Retail customers as they expand the range of services they use. New adopters of these Microsoft solutions will find that much of the complexity and cost of implementing a new business solution will remain.

However, these value-added cloud services open access to smaller organisations. If Microsoft is able to work with their partners to simplify the implementation of these capabilities, it will allow smaller organisations to access these complex capabilities affordably.“

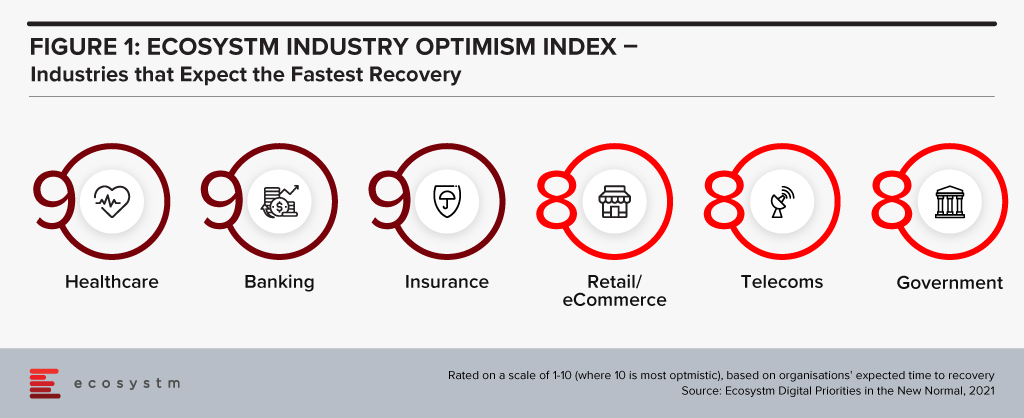

“The Ecosystm Digital Priorities in the New Normal Study aims to determine how optimistic industries are about successfully negotiating these uncertain times (Figure 1). The industries that are rated the most optimistic fall into two clear categories. In the first category, there are industries, such as Healthcare that had to transform urgently – mostly in an unplanned manner. This has led to a greater appetite for change and optimism in these industries. Then there are industries, such as Retail, that had some time to re-focus their technology roadmap when the crisis hit. These industries have a strong customer focus and had started their digital journeys before the pandemic.

Microsoft’s industry focus appears to be spot-on. Their first two vertical clouds target enterprises that have had to – and will continue to – pivot. The ‘modular’ approach taken in the Microsoft Cloud for Healthcare offering allows providers to choose the right capability for their organisation – whether it is workflow automation, patient engagement through virtual health, collaboration within care teams or better clinical and operational insights. As healthcare organisations across the world negotiate the challenges of mass vaccination, they may well find themselves leveraging these industry-specific capabilities as they revamp their workflows, processes, and data use.”

Get to know the right research, insights and technologies for you to be one step ahead in this new world of retail in our top 5 retail trends for 2021 that represent the most significant shifts in 2021

In 2020, much of the focus for organisations were on business continuity, and on empowering their employees to work remotely. Their primary focus in managing customer experience was on re-inventing their product and service delivery to their customers as regular modes were disrupted. As they emerge from the crisis, organisations will realise that it is not only their customer experience delivery models that have changed – but customer expectations have also evolved in the last few months. They are more open to digital interactions and in many cases the concept of brand loyalty has been diluted. This will change everything for organisations’ customer strategies. And digital technology will play a significant role as they continue to pivot to succeed in 2021 – across regions, industries and organisations.

Ecosystm Advisors Audrey William, Niloy Mukherjee and Tim Sheedy present the top 5 Ecosystm predictions for Customer Experience in 2021. This is a summary of the predictions – the full report (including the implications) is available to download for free on the Ecosystm platform.

The Top 5 Customer Experience Trends for 2021

- Customer Experience Will Go Truly Digital

COVID-19 made the few businesses that did not have an online presence acutely aware that they need one – yesterday! We have seen at least 4 years of digital growth squeezed into six months of 2020. And this is only the beginning. While in 2020, the focus was primarily on eCommerce and digital payments, there will now be a huge demand for new platforms to be able to interact digitally with the customer, not just to be able to sell something online.

Digital customer interactions with brands and products – through social media, online influencers, interactive AI-driven apps, online marketplaces and the like will accelerate dramatically in 2021. The organisations that will be successful will be the ones that are able to interact with their customers and connect with them at multiple touchpoints across the customer journey. Companies unable to do that will struggle.

- Digital Engagement Will Expand Beyond the Traditional Customer-focused Industries

One of the biggest changes in 2020 has been the increase in digital engagement by industries that have not traditionally had a strong eye on CX. This trend is likely to accelerate and be further enhanced in 2021.

Healthcare has traditionally been focused on improving clinical outcomes – and patient experience has been a byproduct of that focus. Many remote care initiatives have the core objective of keeping patients out of the already over-crowded healthcare provider organisations. These initiatives will now have a strong CX element to them. The need to disseminate information to citizens has also heightened expectations on how people want their healthcare organisations and Public Health to interact with them. The public sector will dramatically increase digital interactions with citizens, having been forced to look at digital solutions during the pandemic.

Other industries that have not had a traditional focus on CX will not be far behind. The Primary & Resources industries are showing an interest in Digital CX almost for the first time. Most of these businesses are looking to transform how they manage their supply chains from mine/farm to the end customer. Energy and Utilities and Manufacturing industries will also begin to benefit from a customer focus – primarily looking at technology – including 3D printing – to customise their products and services for better CX and a larger share of the market.

- Brands that Establish a Trusted Relationship Can Start Having Fun Again

Building trust was at the core of most businesses’ CX strategies in 2020 as they attempted to provide certainty in a world generally devoid of it. But in the struggle to build a trusted experience and brand, most businesses lost the “fun”. In fact, for many businesses, fun was off the agenda entirely. Soft drink brands, travel providers, clothing retailers and many other brands typically known for their fun or cheeky experiences moved the needle to “trust” and dialed it up to 11. But with a number of vaccines on the horizon, many CX professionals will look to return to pre-pandemic experiences, that look to delight and sometimes even surprise customers.

However, many companies will get this wrong. Customers will not be looking for just fun or just great experiences. Trust still needs to be at the core of the experience. Customers will not return to pre-pandemic thinking – not immediately anyway. You can create a fun experience only if you have earned their trust first. And trust is earned by not only providing easy and effective experiences, but by being authentic.

- Customer Data Platforms Will See Increased Adoption

Enterprises continue to struggle to have a single view of the customer. There is an immense interest in making better sense of data across every touchpoint – from mobile apps, websites, social media, in-store interactions and the calls to the contact centre – to be able to create deeper customer profiles. CRM systems have been the traditional repositories of customer data, helping build a sales pipeline, and providing Marketing teams with the information they need for lead generation and marketing campaigns. However, CRM systems have an incomplete view of the customer journey. They often collect and store the same data from limited touchpoints – getting richer insights and targeted action recommendations from the same datasets is not possible in today’s world. And organisations struggled to pivot their customer strategies during COVID-19. Data residing in silos was an obstacle to driving better customer experience.

We are living in an age where customer journeys and preferences are becoming complex to decipher. An API-based CDP can ingest data from any channel of interaction across multiple journeys and create unique and detailed customer profiles. A complete overhaul of how data can be segregated based on a more accurate and targeted profile of the customer from multiple sources will be the way forward in order to drive a more proactive CX engagement.

- Voice of the Customer Programs Will be Transformed

Designing surveys and Voice of Customer programs can be time-consuming and many organisations that have a routine of running these surveys use a fixed pattern for the data they collect and analyse. However, some organisations understand that just analysing results from a survey or CSAT score does not say much about what customers’ next plan of action will be. While it may give an idea of whether particular interactions were satisfactory, it gives no indication of whether they are likely to move to another brand; if they needed more assistance; if there was an opportunity to upsell or cross sell; or even what new products and services need to be introduced. Some customers will just tick the box as a way of closing off a feedback form or survey. Leading organisations realise that this may not be a good enough indication of a brand’s health.

Organisations will look beyond CSAT to other parameters and attributes. It is the time to pay greater attention to the Voice of the Customer – and old methods alone will not suffice. They want a 360-degree view of their customers’ opinions.

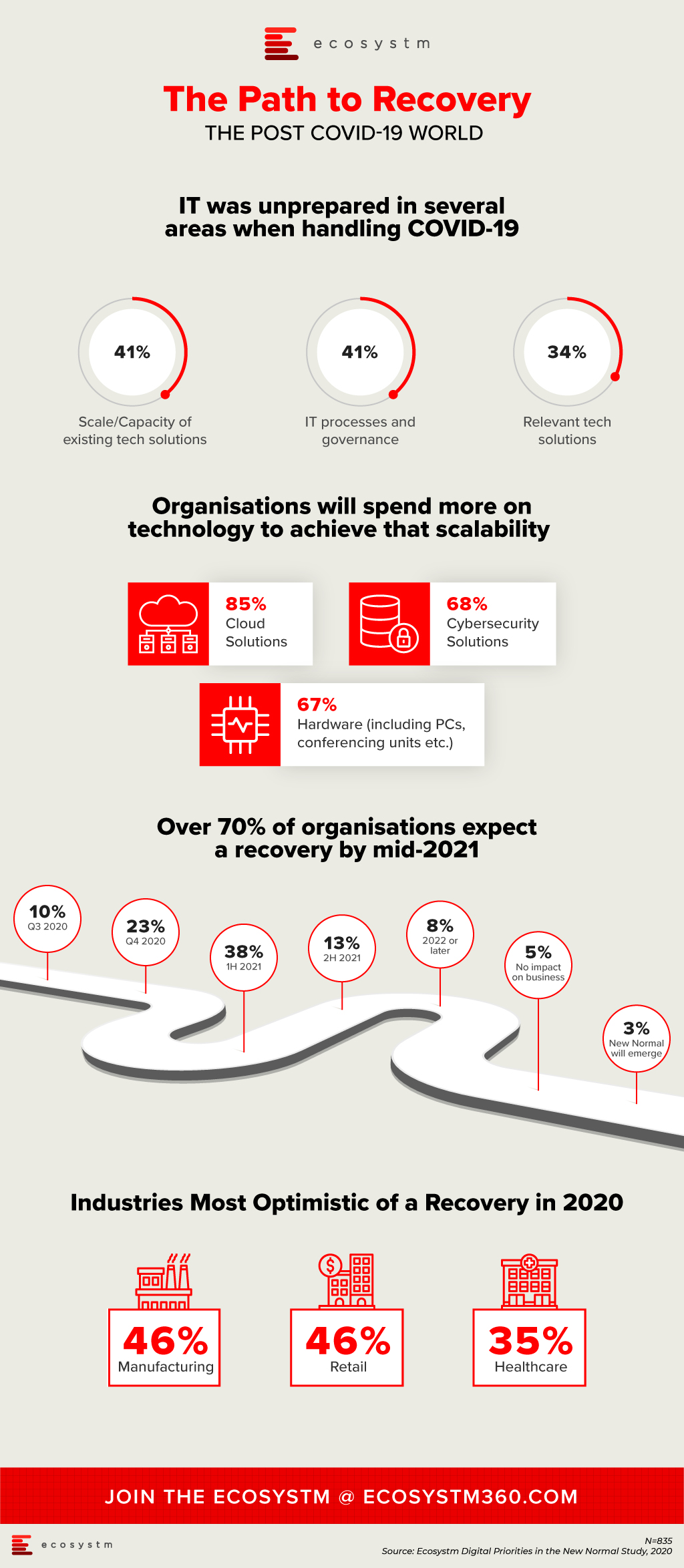

We continue to receive responses from the tech buyer community on the impact of COVID-19 on Digital Transformation initiatives, and the early business and technology measures that were implemented to combat the crisis. As the months go by, it is becoming apparent that organisations have implemented the early measures and are now looking ahead to their journey to recovery.

IT Teams realised that even if they had the right technology solutions, they were unprepared for the scale or capacity to extend these technology offerings to handle the sudden and enormous changes required to manage the crisis. Their cloud business applications, cybersecurity and collaboration solutions were simply not sufficient to meet the needs of the remote workforce. As organisations become more conscious of business continuity planning (BCP) for future eventualities, they will boost their technology capabilities, over the next 12 months.

Another area the study aims to explore is how optimistic is the business outlook, when it comes to expecting a return to normalcy. Only 3% of organisations are expecting a New Normal that is very different from where things were at the beginning of the year. About a third of organisations are expecting a return to normalcy by the end of the year, while the majority expect to recover by the middle of 2021. Also, some industries are more optimistic of a recovery than others. As an example, 35% of healthcare organisations expect a return to normalcy by the end of the year. This is a positive indicator, given that the industry has been in the forefront of the crisis, for nearly 6 months now.

More insights on the impact of the COVID-19 pandemic and technology areas that will see continued investments, as organisations get into the recovery phase, can be found in the Digital Priorities in the New Normal Study.

2020 is a significant year for Singapore’s Smart Nation vision, as the Government takes stock of what they have achieved and shape their journey forward till 2025 (or 2030, in some instances). Singapore Digital (SG:D) has introduced several initiatives to empower small and medium enterprises (SMEs) with cloud-native solutions and digital payments. Cybersecurity remains a concern and the Cyber Security Agency (CSA) was established in 2015 with the express purpose of making cybersecurity a foundation for digital adoption in enterprises and citizens. Late last year the CSA and TNB Ventures announced the 2019 Cybersecurity Industry Call for Innovation in collaboration with 10 participating organisations, including the Integrated Health Information Systems (IHiS), Jurong Town Corporation (JTC), Keppel Data Centres, Ministry of Defence (MINDEF), and Ministry of Health (MOH). The aim is to build capability in areas such as:

- Cyber Readiness. To support cyber self-assessment and ensure overall cyber preparedness

- Industrial Protection. To defend Operational Technology (OT) systems against potential cyber threats

- Secure Access. To help users manage authentication and ensure safe systems access

- Smart Detection. To identify anomalies and intrusions and provide intelligent threat analysis.

CSA recently announced that 9 cybersecurity organisations have been selected to receive USD 0.70 million to build security capabilities to boost Singapore’s defences in critical industries such as Healthcare, Energy & Utilities, Smart City and Public Sector, under the Co-innovation and Development Proof-of-Concept Funding Scheme.

The organisations selected – Group-IB; Secure IC; Acronis; Amaris AI; Scantist; SecureAge; Insider security; EY Advisory; and Emerson – bring a range of cybersecurity capabilities product and service capabilities, to address critical cybersecurity challenges in analysing and predicting attacks from various sources, threat actors and cybercriminal identities.

Singapore’s Continued Focus on Cybersecurity

Singapore has witnessed various threats and breaches at industrial and Government level. Ecosystm Principal Advisor Andrew Milroy says, “The Singapore Government faces an increasing risk for malicious cyber activity. The SingHealth breach of 2018 highlighted the importance of up-to-date cybersecurity within Singapore government agencies. Of particular concern is the growing threat from nation state actors – this is particularly difficult to guard against. These advanced and persistent threats are common and often difficult to detect.”

“Of particular importance is taking a zero-trust approach to cybersecurity – once someone gets into your network, their access to resources must be restricted. Tight control of privilege is also often overlooked so Privileged Access Management (PAM) is critical. CSA is working with these 9 local cybersecurity companies to provide ‘best-of-breed’ customised cybersecurity solutions that will strengthen the cybersecurity posture of government agencies and minimise operational, reputational and legal risk.”

In October last year, CSA announced it’s Operational Technology (OT) masterplan to secure systems in the OT environment, develop OT cybersecurity training programs, strengthen OT policies and mitigate emerging OT cyber threats. One of the key challenges that organisations face in implementing cybersecurity measures is the lack of cyber skills. CSA’s Cybersecurity Career Mentoring Programme provides career guidance to young aspiring professionals and tertiary students who are keen to pursue their career in cybersecurity. In June CSA partnered with SCS to organise the program.

Through such programs and initiatives, Singapore aims to strengthen its cyber resilience and make cyber capability a foundation for its Smart Nation vision.

In the report, Ecosystm Predicts: The Top Healthcare Trends for 2020, we had noted the similarities between the healthcare and the financial services industries and that Healthtech will take lessons from the Fintech industry.

In the report, Ecosystm Principal Analyst, Sash Mukherjee said, “Fintech plays a significant role in driving greater inclusion, especially to drive the induction of the unbanked into the mainstream economy, give the underbanked more options to leverage the broader financial services available, and reduce disparity in the adoption of financial services by bridging the gender gap and differences based on ethnicity and socio-economic status. It is not hard to imagine a similar fate for Healthtech. As the industry focuses on value-based outcomes, governments put in more regulations around accountability and transparency in the industry, and people expect the customer experience that they get out of their retail interactions, Healthtech start-ups will become as mainstream as Fintech start-ups.”

However, Mukherjee notes that there might be some pitfalls in this journey, especially when organisations focus more on the technology and less on the actual application and benefits of the technology. “Innovators and start-ups need to align themselves early, with corporates and technology providers to gain a better understanding of the market and regulatory landscape.”

Singapore bringing key industry stakeholders together

The MoU between Alibaba Cloud, Pfizer and Singapore’s Fintech Academy announced yesterday, is a move in the right direction that promises to give early and necessary guidance to Healthtech start-ups. Under the newly formed Healthcare Fintech Alliance (HFA), Alibaba will provide infrastructural support and technological mentorship to the Healthtech and Fintech start-ups to help them leverage cloud, AI and other technologies for their future requirements. The Fintech Academy will guide these start-ups through talent management and venture building programs. Pfizer will provide thought leadership through its network of healthcare experts and opinion leaders, including guidance on commercialisation of the products and services. The Healthcare Fintech Alliance initiative will begin with a pilot in Singapore, Indonesia, and Vietnam before expanding to other regions – Malaysia and the Philippines.

Mukherjee says, “The healthcare industry, for all the cutting-edge research, that it represents, has been remarkably slow to transform. But the COVID-19 crisis has forced the industry to transform, without the luxury or time to think about it. While the implications on the life sciences and provider organisations is clearer, there has simultaneously emerged a need for transformation in the healthcare payer industry. There will be greater demand from consumers for micro-financing to tide over sudden healthcare crises and greater transparency in how these funds are managed. Again, there is an immense potential here for the industry to learn from Fintech.”

Healthcare Fintech Alliance Focus Areas

The focus areas for Healthcare Fintech Alliance shows the deep connection between Healthtech and Fintech.

- Healthcare Affordability. Micro-financing and other financial models involving patients, family members, payers, and other healthcare stakeholders

- Value Based Healthcare. Linking payment schemes to a drug’s effectiveness, health outcomes or utilisation

- Outcome Monitoring. Tracking and reporting of outcomes derived from patients, wearables, healthcare providers, R&D databases and real-world evidence.

- Personalised Healthcare. Using digital technology to tailor healthcare to individual needs

- Innovative Healthtech Devices. Driving adoption in digital tools, such as diagnostic tools linked to medicine access and reimbursement

- Population Health Management. Leveraging patient and associated data in a compliant way to better understand population health characteristics, for effective wellness programs, treatment protocols and cost management.

“Alliances such as these have potential benefits for the industry stakeholders such as Alibaba and Pfizer. Alibaba has been focusing on the Southeast Asia market – earlier in the month the Alibaba Cloud Philippines Ecosystem Alliance was formed to support digital transformation in start-ups and small and medium enterprises. Initiatives such as this is an effective way to associate themselves with the evolving start-up community in the region,” says Mukherjee. “Life sciences companies operate in an extremely competitive global market where they have to work on new products against a backdrop of competition from generics and global concern over rising healthcare expenditure. Against that backdrop, this alliance is the right go-to-market messaging for Pfizer as well.”

“However, the deepest positive impact of alliances such as these will be on the Healthcare industry as a whole. It makes concepts such as value-based healthcare, remote care and personalised healthcare achievable in the near future.”

I was recently part of a virtual session with my fellow Ecosystm analysts, discussing what transformation will look like for various industries. One of the points that emerged is that the one industry that has had to transform itself completely, without having the luxury or time to think about it is Healthcare. Healthcare will emerge from this a transformed industry – in their rapid tech adoption; in their business processes and; in the mindset of the clinicians and administrative staff who’ve been at the frontline of this crisis. Will this be a revolution, or will the industry have to step back, once the immediate crisis is over?

Here are my thoughts on what is happening to the industry now and where we might be headed.

#1 Are we closer to our remote care dream?

I know I don’t sound very futuristic when I say that the biggest win from this crisis for the Healthcare industry will be the widespread adoption of telemedicine. We have heard the term bandied around for more than half a century now and over the years we have coined terms such as eHealth, digital health, mHealth and remote care, with the evolution of technology. Several healthcare providers in the Asia Pacific have implemented teleconsultation facilities to provide healthcare to remote, underserved regions and to out-of-country patients (especially those that actively seek to serve in the medical tourism space). Even for healthcare organisations that have the technology capabilities, it did not always make financial or regulatory sense to push for widespread adoption.

They have had to rush into it now, often throwing caution about cybersecurity and compliance to the winds. I am not saying that their hesitation will not return once this immediate crisis dies down – but what will happen is that governments will work with cybersecurity and legal experts to mandate it better. Once these guidelines are clearer, healthcare providers will be forced to create workflows and assign responsibilities. So, remote care where your healthcare provider will liaise with the data from your personal devices is not far off.

#2 Will we see a second wave of health and wellness apps?

With the rise of the use of smartphones, the last decade has seen a steady rise in healthcare apps. Most of these apps sync with health and wellness devices, but some use data from FDA-approved clinical devices, targeting chronic health conditions. This pandemic and the allied challenges of surviving in uncertain times, locked down in their homes, has also seen a rise of mental and emotional challenges. There will be a consumer uptake of these apps, as people realise that mental and emotional health can be as critical as physical illnesses. We will, therefore, see a proliferation of mental well-being apps.

Several organisations are having to deal with a remote workforce, with no clear visibility on how their employees are coping. It is not too far-fetched to imagine HR practices in some organisations, leveraging wellness apps – if not to monitor their employees’ mental state (that would be unethical), but – to engage with their remote employees and motivate them. These communications will largely be around the business, but some will use gamification to keep employees connected to the organisation’s visions and goals.

#3 Will healthcare providers realise the importance of evolving their supply chain management?

The healthcare industry, for all the cutting-edge research, that it represents has been remarkably slow to transform. The common perception of healthcare transformation is better clinical outcomes, genomics etc. But the reality is that most tech adoption in hospitals happens in Operations. The earliest impact of this crisis, when it was still confined to China was the disruption of the supply chain. Can you imagine how hard it must have been for the Healthcare industry to not be able to halt operations because of lack of resources? Premier healthcare institutions, mostly in the US, had realised the importance of better supply chain management long back – some implementing Lean and Six Sigma. Now healthcare organisations the world over – even in emerging economies – will adopt more technology in managing their supply chain.

However, what the COVID-19 crisis has exposed is the need for better collaboration and better visibility of external resources, to handle unprecedented scenarios. Countries that have done well to manage the crisis are those where the government took the vital step of encouraging and being the hub for cross-agency collaboration. Horror stories of US states outbidding each other for PPEs have emerged. On the other hand, we have had countries where governments have been able to guide healthcare providers on bed availability – across the public and private sector – so that affected patients could move seamlessly from one facility to another without any impact on the clinical outcome. Having a siloed view of your supply chain may not be sufficient in combating larger challenges – some healthcare organisations at least will opt for a more collaborative supply chain.

#4 Did super specialisation leave us underprepared?

Healthcare professionals have also been impacted in hugely different ways. On the one hand, we have nurses and doctors working 7-day shifts (without breaks), and healthcare systems looking to bring back retired clinicians to counter the shortage of healthcare staff. The Irish prime minister re-joined the healthcare workforce, making international headlines. On the other hand, we have several specialists who have practically no patient volume. Many of them are using teleconsultations to give basic healthcare advice and to guide patients on when to actually go into a hospital and when not. Several of these doctors actually want to help combat the COVID-19 crisis. But they will be the first to acknowledge that they are hesitant because they may have lost the skills needed to handle emergency situations.

While specialised knowledge in a particular disciple has helped improve clinical outcomes and often keep healthcare costs down – the rise of speciality hospitals in India is a good example – does it also leave doctors unprepared in times of crisis? Many doctors across the globe get subsidised education – partly funded by citizen taxes. Is it time for countries to look at a process where these doctors, irrespective of their specialisation, have to get re-trained in emergency services for a fixed period every year?

#5 What happens when the focus shifts to re-building other industries?

While the Healthcare industry has undoubtedly transformed, one must bear in mind that often transformation is a slower, steadier and more detailed journey. A transformation that rises out of disruption may not be successful in the longer term. Moreover, every healthcare provider organisation has had to evolve their processes almost in an isolated manner. Once the immediate crisis is over, the industry needs to take a pause (if they are able to) and take stock of the new practices and processes and evaluate what can continue and what has enormous associated risks.

But realistically, the Healthcare crisis is far from over. Once the threats from COVID-19 subside, healthcare providers will have to focus on elective procedures and other healthcare issues that are being put on hold now. People will visit hospitals more to consult about the health issues that they have been ignoring during these times. This will also coincide with when governments focus on re-building other industries – so Healthcare may not have access to emergency funds that they have now.

While we are all focused on handling the current crisis, now is also the time for healthcare policymakers to think ahead on how to sustain and evolve the Healthcare industry.

Identifying and selecting a vendor for your tech project can be a daunting task – especially when it comes to emerging technologies or when implementing a tech solution for the first time. Organisations look for a certain degree of alignment with their tech vendors – in terms of products and pricing, sure, but also in terms of demonstrable areas of expertise and culture. Several factors are involved in the selection process – vendors’ ability to deliver, to match expected quality standards, to offer the best pricing, to follow the terms of the contract and so on. They are also evaluated based on favourable reviews from the tech buyer community.

Often businesses in a particular industry tend to have their unique challenges; for example, the Financial Services industries have their specific set of compliance laws which might need to be built into their CRM systems. Over the years, vendors have built on their industry expertise and have industry teams that can advise organisations on how their business requirements can be met through technology adoption. These experts speak in the language of the industry and understand their business and technology pain points. They are able to customise their product and service offerings to the needs of the industry for a single client – which can then be repeated for other businesses in that industry. Vendors arm themselves with a portfolio of industry use cases, especially when they are entering a new market – and this often gives them an upper hand at the evaluation stage. In the end, organisations want less customisations to keep the complexity and costs down.

Do organisations evaluate vendors on industry experience?

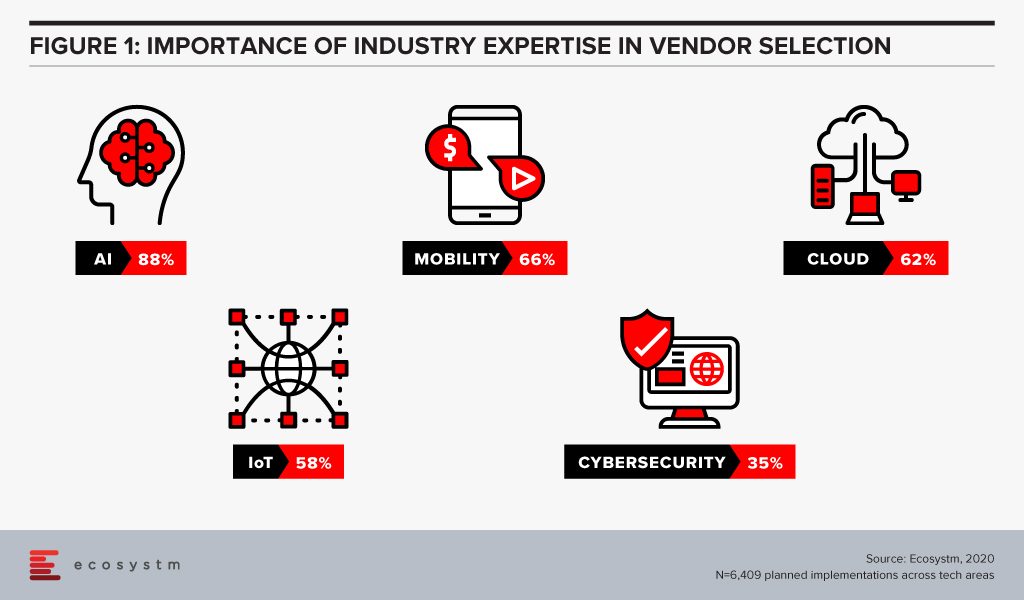

Ecosystm research finds that industry experience can be a significant vendor selection criterion for some tech areas (Figure 1), especially in emerging technologies such as AI. AI and automation applications and algorithms are considered to be distinctive to each industry. While a vendor may have the right certifications and a team of skilled professionals, there is no substitute for experience. With that in mind, a vendor with experience in building machine learning models for the Telecommunications industry might not be perceived as the right fit for a Utilities industry implementation.

Whereas, we find that cybersecurity is at the other end of the spectrum, and organisations perceive that industry expertise is not required as network, applications and data protection requirements are not considered unique to any industry.

Is that necessarily the right approach?

Yes and no. If we look at the history of the ERP solution, as an example, we find that it was initially meant for and deeply entrenched in Manufacturing organisations. In fact, the precursor to modern-day ERP is the Manufacturing Resource Planning (MRP II) software of the 1980s. Now, we primarily look at ERP as a cross-industry solution. Every business has taken lessons on inventory and supply chain management from the Manufacturing industry and has an enterprise-wide system. However, there are industries such as Hospitality and Healthcare that have their niche vendors who bundle in ERP features with their industry-specific solutions. This will be the general pattern that all tech solutions will follow: a) an industry use case will become popular; b) other industries will try to incorporate that solution, and in the process; c) create their own industry-specific customisations. It is important, therefore, for those who are evaluating emerging technologies to cast their net wide to identify use cases from other industries.

AI and automation is one such tech area where organisations should look to leverage cross-industry expertise. They should ask their vendors about their implementations in other allied industries and, in some cases, in industries that are not allied.

For cybersecurity, their approach should be entirely different. As companies move on from network security to more specific areas such as data security and emerging areas such as GRC communication, it will be important to evaluate industry experience. Data protection and compliance laws are often specific to industries – for example, while customer-focused industries are mandated on how to handle customer data, the Banking, Insurance, Healthcare and Public Sector industries have the need to store more sensitive data than other industries. They should look at solutions that have in-built checks and balances in place, incorporating their GRC requirements.

So, the answer to whether organisations should look for industry expertise in their vendors is that they should for more mature tech areas. An eCommerce company should look for industry experience when choosing a web hosting partner, but should look for experience in other industries such as Banking, when they are looking to invest in virtual assistants.

Are some industries more focused on industry experience than others?

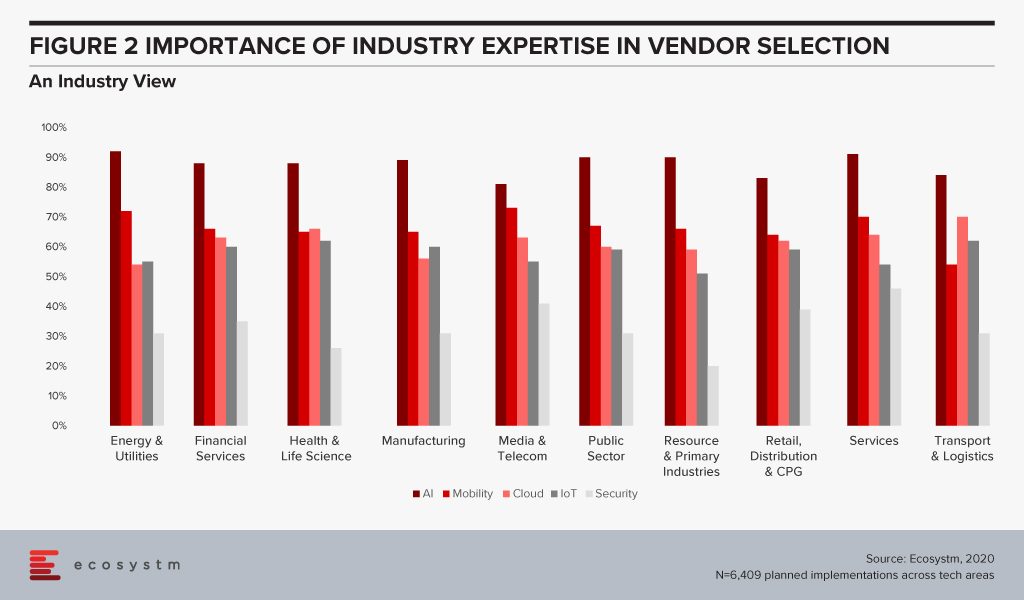

Ecosystm research also sought to find out which industries look for industry expertise more than others (Figure 2). Surprisingly, there are no clear differences across industries. The Services, Healthcare and Public Sector industries emphasise marginally more on industry expertise – but the differences are almost negligible.

There are some differences when we look at specific tech areas, however. For example, industries that may be considered early adopters of IoT – Transportation, Manufacturing and Healthcare – tend to give more credit to industry experience because there are previous use cases that they can leverage. There are industries that are still formulating standards when it comes to IoT and they will be more open to evaluating vendors that have a successful solution for their requirement – irrespective of the industry.

The Healthcare Industry Example

Ecosystm Principal Analyst, Sash Mukherjee says, “In today’s fast-evolving technology market, it is important to go beyond use cases in only your industries and look for vendors that have a demonstrated history of innovation and experience in delivering measurable results, irrespective of the industry.” Mukherjee takes the example of the Healthcare industry. “No one vendor can provide the entire gamut of functionalities required for patient lifecycle management. In spite of recent trends of multi-capability vendors, hospitals need multiple vendors for the hospital information systems (HIS), ERP, HR systems, document management systems, auxiliary department systems and so on. For some areas such as electronic health records (EHR) systems, obviously industry expertise is paramount. However, if healthcare organisations continue to look for industry expertise and partner with the same vendors, they miss out on important learnings from other industries.”

Talking about industries that have influenced and will influence the Healthcare industry in the very near future, Mukherjee says, “Healthcare providers have learnt a lot from the Manufacturing industry – and several organisations have evaluated and implemented Lean Healthcare and Six Sigma to improve clinical outcomes. The industry has also learnt from the Retail and Hospitality industries on how to be customer focused. In the Top 5 Healthtech trends for 2020, I had pointed out the similarities between the Financial and Healthcare industries (stringent regulations, process-based legacy systems and so on). As the Healthcare industry focuses on value-based outcomes, governments introduce more regulations around accountability and transparency, and people expect the experience that they get out of their retail interactions, Healthtech start-ups will become as mainstream as Fintech start-ups.”

It is time for tech buyers to re-evaluate whether they are restricting themselves by looking at industry use cases, especially for emerging technologies. While less industry customisations mean easier deployments, it may also hamper innovation.

Authored by Mervyn Cheah, Aga Manhao and Sash Mukherjee

In January we wrote a blog on How Technology is Helping to Combat the Coronavirus – since then the COVID-19 outbreak has fast become a global threat, disrupting healthcare systems and economies. As the world struggles to contain the spread, Singapore’s response to the crisis shows how governments can use policies and technology to combat emergencies. While it is true that Singapore’s size is its advantage, and most of what it was able to do cannot be replicated in larger, more spread-out countries, there are still lessons there – in the simplicity and responsiveness of the measures. The threat is by no means behind us and the Government will need to implement many more policy changes in the near future. But it is worthwhile to look at what Singapore has done so far to contain the spread.

#1 Identifying and acknowledging the threat early

Like other Asian countries, Singapore suffered during the SARS outbreak in 2003. While the number of people infected during SARS was less at 238, at the end of the outbreak the country had recorded 33 deaths. Having learnt from that experience, Singapore knew that early response is key. Acknowledging the threat early allowed Singapore to have test kits made available to all major hospitals through the Agency of Science, Technology and Research (A*STAR). A*STAR is a statutory board under the Ministry of Trade and Industry, Singapore. The agency supports R&D that is aligned to areas of competitive advantage and national needs. By the time the first case was reported on 23rd January, health professionals were equipped with testing capabilities. Health authorities and biotech companies have continued to modify and launch newer testing technology – like the fast-track swab test kits launched in early March – as global research continues.

#2 Focusing on contact tracing

Right from the start, Singapore has been focused on contact tracing. Following the chain of the virus allows government agencies to identify and isolate people at risk, including their close contacts. This became more important as the virus spread into the local community with the first reported case on the 4th February. The contact tracing process has been a concerted effort using technology, manpower and dedication. As Singapore faces a second wave of spread from returning travellers, the Government launched Trace Together, an app that records distancing between users and the duration of their encounters. Individual consent is required to share the data which is encrypted and deleted by the Ministry of Health (MOH) after 21 days. This allows the MOH to contact citizens in the case of possible contact with an infected individual.

#3 Keeping the citizens in the loop

The speed in imposing border controls, meticulous tracing of known carriers and aggressive testing are all positive steps in combating a crisis like this. But arguably the most productive strategy was to get citizen buy-in. The need was felt most when the country’s Disease Outbreak Response System Condition (DORSCON) level was raised from yellow to orange on 7th February. With the raised DORSCON level, buildings and public facilities with a high volume of people were required to do fever screening and collect personal details for further communication and alerts, if required. Simultaneously, the Government started sharing clear, transparent, daily public communication through mobile phones. The messages contain anonymised details of the patients (to make people aware of their own possible exposure), as well as an update of the number of patients being treated and released. The 2 deaths were also reported promptly – but enough details were shared to avoid panic. Demonstrating cross-agency collaboration, the information disseminated comes from multiple government agencies – the same channel is also used to drip-feed hygiene guidelines and the evolving government policies on travel, trade and so on.

The message from the leadership has also been clear and timely, and an economic stimulus package was announced fairly early. The Government is currently working on a second stimulus package, as the threat to the economy continues.

#4 Dispelling misinformation

Taking this daily communication to the next level, the Government has been prompt in stopping the spread of rumours. Not only does the MOH website share all the latest details, any spread of misinformation (usually through social media) is being quelled by official statements. It is extremely important to be able to address issues such as these, because it impacts trust in the government and the healthcare system. The daily updates are now a ‘single source of truth’ on all COVID-19 related information. The Cyber Crime Portal has also been activated with the intention to track unverified messages especially regarding the treatment and cure of COVID-19.

#5 Empowering healthcare professionals and citizens with digital tools

Unfortunately, the community spread appears to be happening in waves, especially as Singapore has a high volume of returning travellers. Healthcare facilities continue to be stretched. Although Singapore has adequate healthcare facilities to cope with the number of current cases, the Government is also prepared with additional quarantine facilities. Meanwhile, hospitals have set up makeshift triage centres in their car parks to deal with the growing number of patients needing to get tested. To counter the need for more infrastructure and the cost to get additional facilities ready, the use of digital health, remote patient monitoring and online care planning is being explored to limit patients presenting themselves to providers. KK Women’s and Children’s Hospital has launched UPAL – Urgent Paediatric Advice Line – as a pilot online consultation channel. It is expected that more healthcare facilities will offer services such as these. Being cloud based, these solutions can be deployed within days and high-risk patients can be immediately onboarded, easing the burden on the healthcare system and providing relief to patients and families. Telemedicine and remote monitoring are not new, having been proven and tested by several healthcare systems. In these extraordinary times, technology will help the healthcare system keep all in Singapore safe.

#6 Having a strong Data and Digital infrastructure

Singapore’s data and digital services infrastructure is the overarching factor that has allowed the Government to act quickly and efficiently to fight this community threat. While this is not linked directly to the current response measures against COVID-19, it is the true enabler. Firstly, the electronic health record system has access to records of all patients who have availed of the public healthcare system (private, primary care organisations have also started contributing to the system – enabling the vision of complete longitudinal health records). This is the backbone of the Government’s healthcare measures in these difficult times. Secondly, the network infrastructure allows the introduction of online consultation services. Moreover, people are able to work from remote locations seamlessly using collaboration tools such as Zoom, Skype and WebEx. This allows the Government to encourage people to work from home, to stay away from healthcare facilities and other measures to reduce overcrowding of public spaces to prevent the spread. And finally, Singapore has a strong access to eCommerce and online platforms, allowing people to access almost anything they choose to, online.

While the battle against the pandemic is far from over, Singapore has so far managed to avoid complete disruption by using technology to be responsive to the community’s needs.

Deep Tech companies are aiming to transform the world through scientific, engineering and technological advances. As technology evolves, researchers are looking to apply engineering and technological advances in areas such as processing and computing architecture, semiconductors and electronics, materials science, vision and speech technologies, artificial intelligence (AI) and machine learning, and so on – for the greater good. For example, finding a cure to a disease, developing new medical devices, sensors and analytics to help farmers increase yield, or developing clean energy solutions to reduce the environmental impact are some of the areas that Deep Tech is finding real-world applications.

Deep Tech Impacting Industries Today

There are several industries that are benefitting from Deep Tech innovations today. Here are only a few examples of Deep Tech innovations in some industries:

Healthcare

The combination of computational and biotechnology is accelerating the development of new cures, augmenting R&D and improving health outcomes. Deep Tech in healthcare has multiple applications from the manufacturing of affordable medical devices to redefining healthcare. Vibrosonic, has designed what they call a “contact lens for the ear” which can be directly placed on the eardrum. Unlike other hearing aids speakers are not used to transport sound through the ear canal but the eardrums are stimulated through electric impulses. A Singapore-based biotech company X Zell has patented a “liquid biopsy”- detecting cancer from a 10ml blood sample by measuring the presence of tumour-derived Circulating Endothelial Cells (tCEC) – which reduces the need for invasive cancer detection processes.

Food and Agriculture

Food crisis is a reality today with factors such as overpopulation, urbanisation, decreasing land per capita, extreme climates and so on impacting the food and agriculture industry immensely. Deep Tech companies are working to bring us sustainable food options and building climate resilience. Cell-based meat options are being researched globally, and companies such as foodtech start-up Shiok Meats is producing meat by harvesting cells from animals with a view to be environmentally friendly and to reduce the impact on biodiversity. In agriculture, Deep Tech companies are working on technologies to develop better farming methods to improve yield and precision sensors for weather forecasting. Examples such as UbiQD, that has worked on a greenhouse quantum dot film that improves crop quality by optimising sunlight spectrum for plants to improve production, show how Deep Tech will continue to transform the industry.

Environment and Energy

Deep Tech continues to come up with solutions that will help us in climate change mitigation, development of sustainable energy and energy efficiency. Innovations include Carbon Upcycling Technologies’ solution to capture and neutralise carbon dioxide. The carbon dioxide-enriched nanoparticles are used to make commercial construction materials and even consumer products such as jewellery. Celadyne Technologies has developed hydrogen fuel cells and electrolysers with nanocomposite membranes for a more efficient, cost-effective and eco-friendly energy source.

Advanced Computing

As technology evolves, there will be a need to support even greater compute and data-intensive tasks. Deep Tech has impacted and will continue to impact advanced computing. The semiconductor and microchip industry is getting disrupted by cutting-edge global research, many by the top universities. MIT, for example, has developed a process called “remote epitaxy” to manufacture flexible chips. Potential use cases include VR-enabled contact lenses, electronic fabrics that respond to the weather, and other flexible electronics. Atom Computing is working on scalable quantum computing that will be able to scale millions of qubits using individual atoms – without scaling up the physical resources – in a single architecture.

Communication and Security

Communication and connectivity have seen a sea change in the last decade. As we wait for 5G to take off, this industry has become a playground for inventions. Aircision, is working on making 5G more accessible using its laser-based communications technology. The technology is developed to enable high-bandwidth communication and beam data between buildings thus aiming to eliminate the need for optical fibre installations and microwave. Another area that will keep getting a lot of attention from Deep Tech firms is communication security. Speqtral is working on space-based quantum networks to deliver secure encryption keys.

Examples such as these are an indication that Deep Tech is a reality today and has the potential to disrupt several industries and impact the lives of millions.

Where is Deep Tech Headed?

Government Interest in Deep Tech

Since Deep Tech is aimed at leveraging technology and engineering for sustainability and greater good, several countries are promoting Deep Tech R&D and initiatives. From emerging to mature economies, governments are supporting their Deep Tech industry. The New Zealand Government has formed a Deep Tech Incubator program. The program is headed by the Government’s innovation agency to help Deep Tech companies and to create new tech jobs.

Singapore has created a strong Deep Tech ecosystem leveraging the funding ecosystem, the presence of global corporations, research and higher learning organisations and the Government that promotes innovation and entrepreneurship. Agencies such as SGInnovate and Enterprise Singapore are working with Deep Tech startups in advanced manufacturing, urban solutions and sustainability, and healthcare and biomedical sciences. Partnerships between universities, industry bodies and research organisations further fuel this ecosystem – the Critical Analytics for Manufacturing Personalised-Medicine (CAMP) is a partnership between Singapore-MIT Alliance for Research and Technology (SMART) and A*STAR for cell therapy manufacturing. The Government also funds and incentivises Deep Tech startups. The 2020 budget announced additional funding to support Deep Tech companies under the Start-up SG Equity scheme.

As global governments get serious about the quality of their citizens’ lives and sustainability goals, they will invest in Deep Tech research.

Challenges of the Deep Tech Industry

While Deep Tech has enormous potential, mainstream adoption is still some way off. There are some unique challenges that the industry faces today. Future uptake will depend heavily on how fast the industry can circumvent these challenges. The key challenges are:

- Securing Finances. Despite initiatives by several global governments, Deep Tech projects often find it difficult to secure funding. Very often the research duration can stretch without any real guarantee of success. Funding is likelier to go to organisations developing consumer products as the ROI are seen earlier and are easier to quantify, especially in the early stages.

- Identifying Market Opportunities. Researchers who develop Deep Tech solutions and products might not be able to identify opportunities to present their development from a marketing as well as an economic perspective. Very often these companies rely on other channels or third-party services for a proper marketing and planning strategy. This is where working with incubators or government bodies becomes crucial – countries that give that opportunity through a well-defined ecosystem, will lead the Deep Tech revolution.

- Scalable Development. Many Deep Tech innovations get stuck at the proof-of-concept stage – not because they are not innovative enough, but because they are not scalable to mass production. That requires the right infrastructure as well as a deep understanding of how the products and services can be commercialised.

There are several global companies trying to disrupt entire industries with their inventive offerings. We are witnessing some novel innovations in autonomous vehicles, foodtech, computer vision, AI, weather predictions, Clean Energy solutions – the list continues – that we will benefit from in the future.

Let us know which Deep Tech companies have impressed you in the comments below.