Oracle is clearly prioritising a rapid expansion across the globe. The company is in a race to catch up with the big 3 (AWS, Google, and Microsoft), and recognises that many of their customers are eager to migrate to the cloud, and they have other options. Their strategy appears to be to rely on third-party co-location providers for most of their data centres, and build a single availability zone per region, at least to start.

Oracle Cloud Rollout Ramps Up

Let us consider the following:

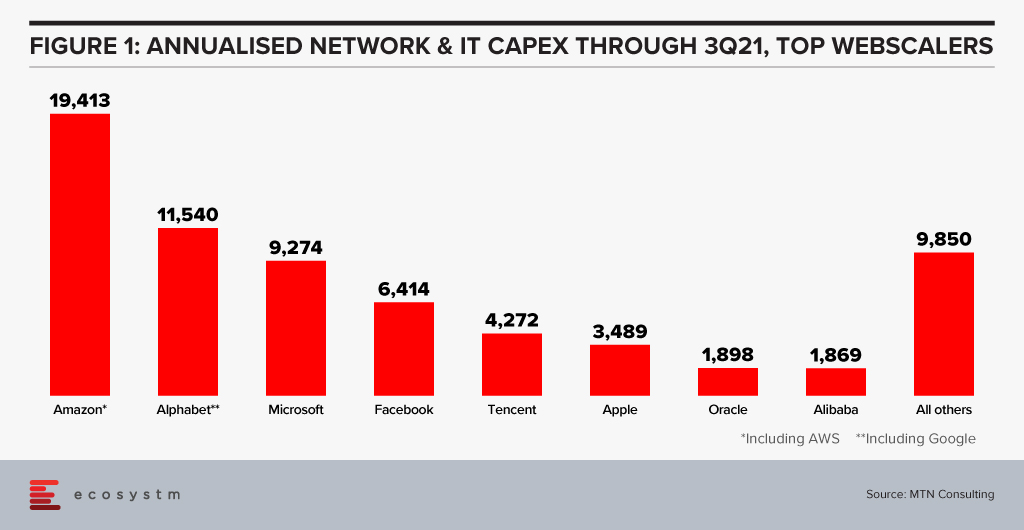

- Oracle’s network spending level puts it in the range of other webscalers. Focusing only on the Network and IT portion of their CapEx, Oracle has now passed Alibaba. Oracle is also ahead of both IBM and Baidu, which are included in the “All others” category in Figure 1.

- The coverage of the Oracle Cloud Infrastructure (OCI) is impressive. It has 36 regions today (some dedicated for government use), with a plan to reach 44 by year-end 2022. That compares to 27 overall for AWS, 65 for Azure, 29 for GCP; regional competitors Tencent and Huawei have 27 regions each, and Alibaba 25 regions. The downside is that Oracle has only one availability zone in most of its regions, while the Big 3 usually have 2 or 3 per region. Oracle needs to build out its local resiliency rapidly over the next year or two or risk losing business to the big 3, especially to AWS; but the company knows this and is budgeting CapEx aggressively to address the problem.

- Oracle’s initial reliance on leased facilities may be an interim step. The rapid growth of AWS, Azure, and GCP in the late 2010s was a surprise and Oracle started to see serious risks of losing customers to these cloud platforms. Building out their own cloud base on new data centres would have taken years and cost them business. So, Oracle did the smart thing and leaped into the cloud as fast as possible with the resources and time available. The company has scaled their OCI operations at an impressive rate. It expects capital expenditures to double YoY for the fiscal year ending May 2022, as it increases “data centre capacities and geographic locations to meet current and expected customer demand” for OCI.

- Finally, Oracle has invested heavily in designing the servers to be installed in its data centres (even if most of them are leased). Oracle was an early investor in Ampere Computing, which makes Arm-based processors, sidestepping the Intel ecosystem. In May 2021, Oracle rolled out its first Arm-based compute offering, OCI Ampere A1 Compute, based on the Ampere Altra processor. Oracle says this allows OCI customers to run “cloud-native and general-purpose workloads on Arm-based instances with significant price-performance benefits.” Microsoft and Tencent also deploy the Ampere Altra in some locations.

Reaching Global Scale

Once Oracle decided to launch into the cloud, its goal was to both grow revenues and also protect its legacy base from slipping away to the Big 3, which already had a growing global footprint. Oracle chose to quickly build cloud regions in its key markets, with the understanding that it would have to fill out individual regions as time passed. This is not that different from the big 3, in fact, but Oracle started its buildout much later. It also has lesser availability zones per region.

Oracle has not ignored this disparity. It recognises that reliability is key for its clients in trusting OCI. For example, the company emphasises that:

- Each Oracle Cloud region contains at least three fault domains, which are “groupings of hardware that form logical data centers for high availability and resilience to hardware and network failures.” Fault domains allow a customer to distribute instances so “the instances are not on the same physical hardware within a single availability domain.”

- OCI has a network of 70 “FastConnect” partners which offer dedicated connectivity to OCI regions and services (comparable to AWS DirectConnect)

- OCI and Microsoft Azure have a partnership allowing “joint customers” to run workloads across the two clouds, providing low latency, cross-cloud interconnect between OCI and Azure in eight specific regions. Customers can migrate existing applications or develop cloud native applications using a mix of OCI and Azure.

- Oracle allows customers to deploy OCI completely within their own data centers, with Dedicated Region and Exadata Cloud@Customer, deploy cloud services locally with public cloud-based management, or deploy cloud services remotely on the edge with Roving Edge Infrastructure.

- Further, Oracle clearly tries to differentiate around its Arm-based Ampere processors. Reliability is not necessarily the focus, though. The main focus is contrasting Ampere with the x86 ecosystem around overall price-performance, with highlights on power efficiency, scalability and ease of development.

Ultimately the market will decide whether Oracle’s approach makes it truly competitive with the big 3. The company continues to announce some big wins, including with Deutsche Bank, FedEx, NEC, Toyota, and Zoom. The latter is probably the company’s biggest cloud win given Zoom’s rise to prominence amidst the pandemic. Not surprisingly, Oracle’s recent Singapore cloud region launch was hosted by Zoom.

Conclusion

Over the long run, the webscale market is getting more concentrated in the hands of a few players; some companies tracked as webscalers, such as HPE and SAP, will fall by the wayside as they can’t keep up with the infrastructure spending requirements of being a top player. Oracle is aiming to remain in the race, however. CEO Larry Ellison addressed this in an earnings call, arguing the global cloud market is not just the “big 3” (AWS, Azure, and GCP), but is a “big 4” due in part to Oracle’s database strengths. Ellison also argued that the OCI is “much better for security, for performance, for reliability” and cost: “we’re cheaper.” The market will ultimately decide these things, but Oracle is off to a strong start. Its asset light approach to network buildout, and limited depth within regions, clearly have downfalls. But the company has a deep roster of long-term customers across many regions, and it is moving fast to secure their business as they migrate operations to the cloud.

Ecosystm RNx is an objective vendor ranking based on in-depth, quantified ratings from technology decision-makers on the Ecosystm platform. In this edition, we rank the Top 10 Global AI & Automation Vendors.

If you are an End-User, you are realising that the right investments in Data & AI now will be the key to your future success. This vendor ranking will help you evaluate your buying decisions based on key evaluation ratings by your peers across a number of key metrics and benchmarks, including customer experience.

If you are an AI & Automation Vendor, it’s an opportunity to understand how your customers rate you on capabilities and their overall customer experience.

Never before has the world experienced a shutdown in both supply and demand which has effectively slammed the brakes on economic activities and forced a complete rethink on how to continue doing business and maintain social interactions. The COVID-19 pandemic has accelerated digitalisation of consumers and enterprises and the telecommunications industry has been the pillar which has kept the world ticking over.

It is unthinkable just how the human race would have coped with such massive disruption, two decades ago in the absence of broadband internet. The technology and telecom sector has seen a rise in their visible importance in recent months. Various findings show that peak level traffic was about 20-30% higher than the levels before the pandemic. The rise in traffic coupled with the fervent growth of the digital economy augurs well for the technology and telecom sector in Southeast Asia.

Revenues Hit Despite Rise in Traffic

Unfortunately, the rise in network traffic has not translated to an increase in revenue for many operators in the region. The winners, that enjoyed YoY growth in Q1 2020 despite challenging circumstances were: Maxis (4.9%) and DiGi (3.4%) in Malaysia; dtac (3.3%) and True (5.7%) in Thailand; PDLT (7.5%) and Globe (1.4%) in the Philippines; and Indosat Ooredoo (7.9%) and XL Axiata (8.8%) in Indonesia. The telecom operators that struggled include: Celcom (-6.1%) and TM (-8.0%) in Malaysia; Singapore’s trio of Singtel (-6.5%), StarHub (-15.2%) and M1 (-10.3%); and AIS (-1.0%) in Thailand.

Key market trends include a dip in prepaid subscribers due to fall in tourist numbers, roaming income losses due to travel restrictions, and a general decline in average revenue per user (ARPU) due to weaker customer spend. The postpaid customer segment was resilient while the fixed broadband revenue stream was stable due to the increase in work from home (WFH) practices. With fixed tariffs, there are no incremental gains with an increase in usage. Voice revenue has been hit with the increase in collaboration-based communication applications such as Zoom and Microsoft Teams.

Equipment sales fell as global supply chains were severely disrupted and impacted new sign-ups of the more premium customers. Most markets in Southeast Asia depend on retail outlets as a key channel to the market, which has been hampered.

With the job losses across the world, bad debts and weakened customer spend is inevitable and it is imperative that the operators provide for reflective pricing strategies, listen to new customer requirements to ensure customer retention and strengthening of their market position. In May, Verizon’s CEO Hans Vestberg said nearly 800,000 of their subscribers were unable to pay their monthly bills. Discussions with operators in Southeast Asia also highlighted this as a current concern.

Enterprise Segment Target for New Growth

Ecosystm research shows that enterprises in Southeast Asia are increasingly considering telecom operators as go-to-market partners (Figure 1). Enterprises are demanding more than just devices and connectivity and with the fervent digital transformation (DX) efforts underway, services such as managed services, business application services, cybersecurity and network services are in demand. Technology vendors have an opportunity to partner with the right telecom operator in each market to enhance their IT market offerings, ahead of the 5G rollouts.

The broad 5G ecosystem inculcates cross-sector innovation and greater collaboration leading to new business models and exciting new opportunities. Singtel is the leading operator in the region and has the enterprise segment contributing approximately 65% to its revenue in its domestic market. In the World Communications Award 2019, Singtel won both “Best Enterprise Service” and “The Broadband Pioneer” awards. This places Singtel in a fine position to capitalise on the 5G enterprise services.

5G Needed Now More Than Ever

The pandemic has seen a rise in network traffic, onboarding of the digital customer and rapid DX of businesses which has whetted the appetite for faster broadband speeds and new services. Southeast Asia countries stand to profit from the trade war between the US and China and 5G features of low latency and higher security can boost adoption of IoT, Smart Manufacturing and broader Industry 4.0 goals to drive the economy.

Fixed Wireless in Southeast Asia is expected to be very popular considering the low penetration of fibre to the home (with the exception of Singapore) and will provide enterprises with a viable secondary connection to the internet. Popular applications – including video streaming and gaming – which are speed, latency and volume hungry will also be a target market for operators. Mobile operators that do not have a fixed broadband offering can enter this space and provide a serious “wireless fibre” alternative to homes and businesses.

Governments and telecom regulators ought to make spectrum available to the major telecom operators as soon as possible in order to ensure that the cutting edge 5G communications services are made available to consumers and businesses. Many experts believe 5G can raise the competitiveness of a nation.

Recent research from World Economic Forum (WEF) has found that significant economic and social value can be gained from the widespread deployment of 5G networks, with 5G facilitating industrial advances, productivity and improving the bottom line while enabling sustainable cities and communities. GSMA notes that mobile technologies and services in the wider Asia Pacific region generated USD 1.6 trillion of economic value while the mobile ecosystem supported 18 million jobs as well as contributing USD 180 billion of funding to the public sector through taxation.

US-China Trade War Threatens to Change Equipment Supplier Landscape

Despite severe pressures caused by the US-China trade war, Huawei posted an impressive 13.1% YoY growth in 1H 2020 registering revenue of USD 64.88 billion. Both Huawei and ZTE generate approximately 60% of their business from their domestic markets which is critical with the current unfavourable global sentiments. Huawei has diversified its business and built its consumer devices business which should withstand the disruptions caused by the political challenges.

Ericsson and Nokia stand to benefit from Huawei’s current global position and this was evident with the wins for the 5G contracts by Singtel and JVCo (Singtel and M1). The JVCo announced it selected Nokia to build the Radio Access Network (RAN) for the 5G standalone (SA) mmWave network infrastructure in the 3.5GHz radio frequency band. Singtel selected Ericsson to provide for the RAN on the same mmWave network.

However, while there is an opportunity for NEC and Samsung to join the party, Huawei is expected to do well in most other countries in Southeast Asia.

The Rise of the Digital Economy in Southeast Asia

A recent Google report valued the internet economy in Southeast Asia at USD 100 billion in 2019, more than tripling since 2015, and the sector is expected to hit USD 300 billion in 2025. With a population of approximately 570 million people, the region has some of the fastest-growing internet economies in the world.

The Indonesia market is the largest in the region and is expected to hit USD 133 billion from USD 40 billion in 2025. Indonesia’s lack of a world-class telecom infrastructure coupled with their slowness in 5G adoption has not impeded the country’s attractiveness for global technology investors who see the 270 million population as an immense opportunity. US tech giants, Facebook, Google, and PayPal have invested in Indonesia to reap the benefits from the growing digital economy powered by unicorns such as Gojek, Bukalapak, Tokopedia. In June 2020, Google Cloud launched in Jakarta, only the second in the region after Singapore with the four big unicorns being anchor customers.

In 2025, Google predicts Thailand to be the second-largest internet economy worth USD 50 billion. The internet economy for Singapore, Malaysia and the Philippines are estimated to be over USD 27 billion each. Shopee and Lazada are the top eCommerce apps in the region and have seen an increase in sales due to the disruption in the Retail industry. In-store shopping contributes to more than 50% of Retail in Singapore and Malaysia – this provides a tremendous opportunity for eCommerce players.

While movement restrictions are gradually being lifted, some things may never return where they were before COVID-19. Public debts have risen with numerous aids and handouts impacting economic growth forecast and rising unemployment is impacting customer spending power. On the plus side, DX of businesses and sharp onboarding of customers have redefined interactions, and sectors such as Education, are going online which will boost the digital economy. While the challenges are evident, exciting times are ahead for the technology and telecom sector in Southeast Asia.

We have all felt the effects of the global pandemic and experienced the profound effects on the way we work – at least those of us who are fortunate enough to still be working despite the pandemic.

COVID-19 has – at least for a while – changed how we work and how IT systems can safely support this new work style.

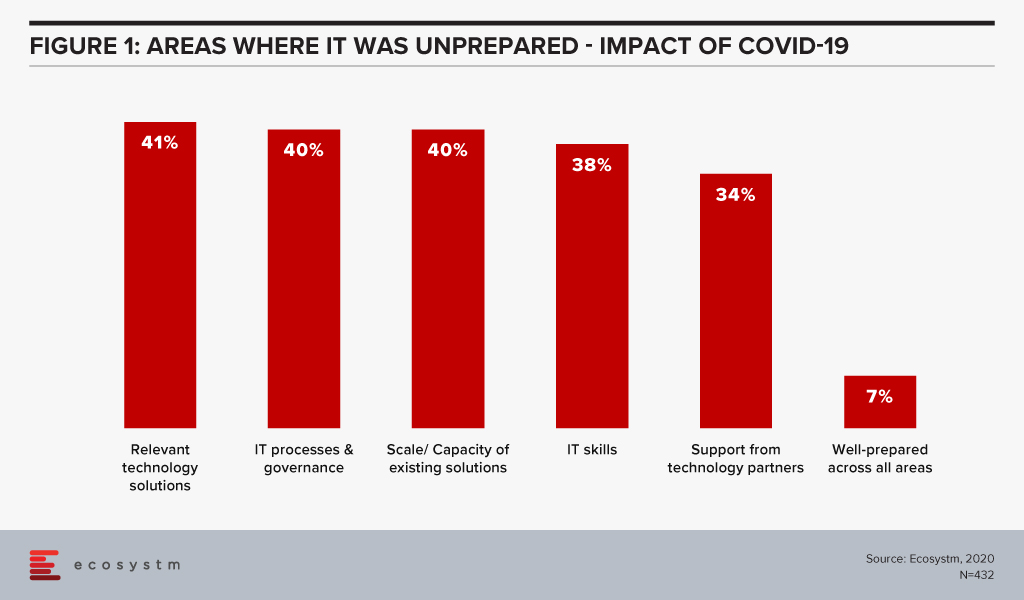

Our ongoing Ecosystm study on Digital Priorities in the New Normal shows how the crisis has forced organisations to re-evaluate their cybersecurity risks and measures. It also showed that the IT environment of most organisations was woefully unprepared for the changes that occurred (Figure 1). Perhaps unsurprisingly, fewer than 7% said that their IT environment was fully prepared and close to 40% reported lacking scale, capacity and IT skills in-house.

We are here to help you!

The combination of these shortcomings may very well push more organisations to outsource their security management to Managed Security Service Providers (MSSPs) – a service space that has been growing rapidly in recent years.

Many IT organisations are fairly familiar with MSSPs, but COVID-19 may have forced many to re-evaluate their choices as the work and threat landscapes have changed.

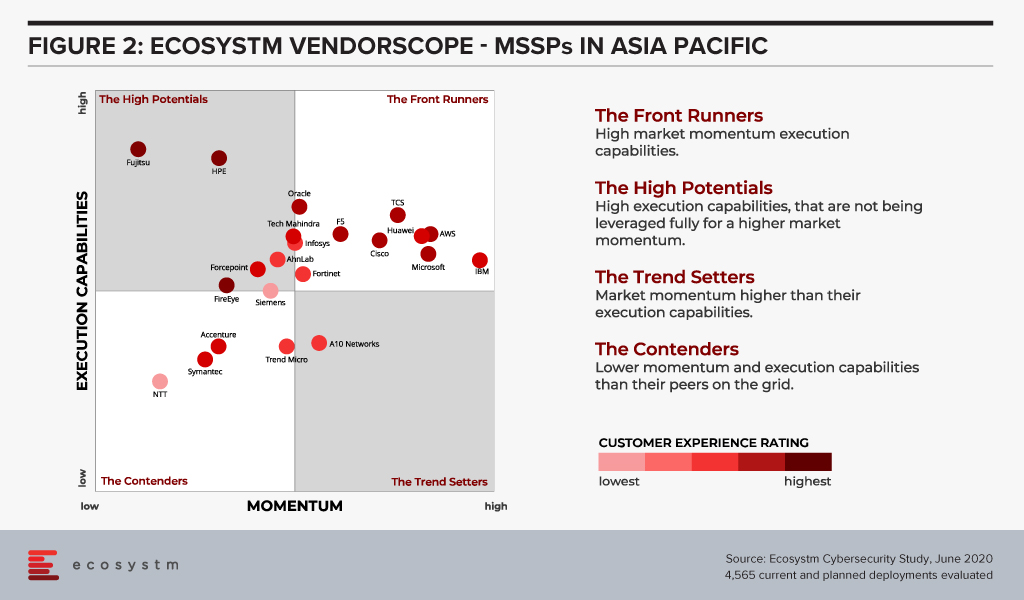

To help organisations evaluate their options going forward, we at Ecosystm are extremely excited to launch our Managed Security Service Providers VendorScope for the Asia Pacific region.

This new tool can help technology buyers understand which vendors are leading this space, which are the ones that have market momentum and which are executing and delivering on their promised capabilities. Unlike similar vendor evaluations on the market, the positioning of vendors in Ecosystm VendorScopes is based solely on quantifiable feedback given by the Tech Buyer community, in the global Ecosystm Cybersecurity Study, that is live and ongoing on the Ecosystm platform. It is thus independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

It is also free to access and share for all Ecosystm subscribers!

Fragmented Asia Pacific MSSP Market

The VendorScope clearly shows how fragmented the MSSP market is. Not only is the number of vendors that have a customer base significant enough to appear on the grid very large (22) – but about half of them are in, or verging on being in, the “Front Runner” segment (Figure 2).

There are a few key factors that contribute to this picture:

- The services they offer tend to align well with the customers’ organisational strategies and to integrate well with existing systems. This, basically, can be boiled down to one word: Cloud. Most organisations have IT strategies revolving around multiple and/hybrid cloud deployments and using MSSPs makes a lot of sense.

- Momentum for this service segment is generally high. The MSSP space is experiencing high growth these days and we see a fairly high number of mentions for both current and planned deployments with many of the vendors in the study.

Despite the large number of vendors in the “Front Runner” segment, a famous few stick out. IBM appears to have a higher market momentum than its competitors and together with Microsoft, they have the largest share of mind with potential customers in this space.

But other vendors are hot on their heels. AWS and F5 stand out with their relatively high presence in the region, and TCS and Huawei appear to have stronger than average pipelines.

Where we do see weak spots with most vendors is in quality of service and the connected customer experience, which historically have proven to be a potential Achilles’ heel for many vendors in high growth areas. As the MSSP space matures, we would expect customer experience to become increasingly important when customers choose a service provider.

We would certainly encourage any organisation that is looking into managed security to not ignore or downplay the customer service and support aspect. IT security is a complex area – even if it is managed by a service provider – and the service providers’ ability and flexibility in this area can make a huge difference.

Fujitsu and HPE stick out with regards to QoS and customer service. These two are also good examples of how the vendors differ and seemingly could complement each other. In a sense, one could almost see the MSSP VendorScope as an early blueprint for which mergers and acquisitions (M&As) would make sense – at least for those that are driven by the pursuit of skill sets and competencies and not just market share.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in M&A activities in the cybersecurity market. Of course, with the global pandemic, all bets are off, and the predicted M&A wave may have been delayed by a year or so.

But the MSSP space certainly appears ripe for consolidation.

Ecosystm Vendorscope: Managed Security Service Providers

Signup for Free to download the Ecosystm Vendorscope: Managed Security Service Providers report

Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.

When I wrapped up my visit to this year’s Mobile World Congress (MWC) in Barcelona, I had wondered if my pre-trip question of what would the 5G story be after several years of being told that each preceding year was ‘the’ year. However, this year had a very distinct vibe to it, and I was rewarded for my pilgrimage to the Grand Fira.

Let’s not forget that technology takes longer to roll out that all of us want to think and 5G is no different. We have had no excuses since we only have to look at how long it took 3G and LTE to become mainstream and how long the transition from the prior technology took to move to the next generation.

However, the mobile and telecom industry is not the same as it was when earlier telecommunication tech was being upgraded. In the past hardware, benchmarks feeds and speeds dominated the marketing messages, but now it is about software, cloud and ecosystem collaboration. Gone are the days when the telecom equipment vendors ruled the conversation about their technology – that has clearly been replaced by IT companies leading the charge with topics such as virtualization, IoT, analytics and new services. Once there was a US automobile commercial that touted the latest edition of its cars was ‘This is not your father’s Oldsmobile’. Well, 5G is not your father’s telecom infrastructure!

This time around, operator and equipment vendors may have to take the collaborative partner role in any new digital solution. Instead of 5G projects being dominated by Ericsson or Huawei for example, there is a role for the likes of VMware, Microsoft, and Salesforce to be the lead company. In some cases, it could be Bosch, PTC, or Siemens while in others it could be Audi, BMW or Mercedes. The overall trend here is that all of these companies are being digitally driven to deliver new services to a customer that is firmly at the center of an ecosystem. The one industry sector who might lose out could be the telco operators who could be squeezed by the surge from IT vendor relevance, despite them investing heavily on 5G licenses. However, this time the operators are in a much stronger position to be the perfect channel for the massive amount of intelligence-laden data being created by smart connected devices that are not typical mobile devices.

So what was the outcome at MWC? I visited both the Huawei and Ericsson booths following pre-MWC briefing sessions to see if the customer buzz was there – and indeed it was.

Ericsson may have won the prize for the most crowded booth, while Huawei’s sprawling booth wins the most lavish and largest booth. The two company’s 5G messages could not have been more different.

The Big Two

For me, Huawei had invested heavily in making its hardware products very compelling for operators to install. Clearly, there had been a lot of research had gone into replacing existing infrastructure with massive performance upgrades and deployment friendly attributes e.g. size and weight of base stations that could be mounted by individuals rather than by cranes. The result of this strategy is that Huawei’s customers can quickly deploy 5G platforms with lower CapEx and OpEx thus creating significant incentives for operators to migrate to 5G networks.

Ericsson’s leading story was about migrating to 5G by highlighting its key enablers (i.e. carrier aggregation, LTE-NR spectrum sharing, and dual mode 5G cloud core). It appeared that Ericsson had moved its message off hardware (which, by the way, is still table stakes in any selection process and Ericsson had plenty of new 5G related offerings) and onto a strategy of smooth evolution and deployment at scale – a much more business leader discussion than a network, driven by software. Finally, both companies had strong messages around their AI capabilities to help their service providers make sense of the growing complexity of services that will be generated by the connected smart IoT devices.

The Importance of IT Software On 5G

IT and industrial companies played an increasingly important role at this year’s MWC as service providers and they became involved in deeper partnerships. 2019 was the year when the gaps for 5G between the network and IT services were being filled in. For example, I saw AR (augmented reality) solutions by PTC supported by Microsoft and being fed by data off a 5G network. This showed how industry, cloud and network service providers will accelerate new technologies.

In another example, Salesforce showed how Edge Computing events triggered Salesforce SaaS-based enterprise management services while being supported by AT&T’s 5G network and the modules being designed and tested at AT&T’s Foundry. Here, AT&T 5G network was being used as a high-value channel for Salesforce’s customers to run their business functions at the edge of the network.

Digital twins have shown up as a digital representation of a physical device or asset. However, this year, I saw a Wipro example of how 5G could drive digital twin concepts beyond physical assets and into the workflow, supply chain management, logistics and worker safety. Every ‘asset’ that was to be used in a factory floor was digitized into a digital twin and then a 5G network was used to monitor and manage every aspect of the factory. It seemed that Industry 4.0 had arrived in its full glory.

Finally, VMware continues to be the IT company that service providers will either love or dislike – I still don’t know which one it will be. VMware’s virtualization and cloud management capabilities have been extended right into 5G networks. For example, NFV (Network Function Virtualization) is critical to operators as they slice the 5G bandwidth into the appropriate services. VMware has its strategy correct when it says that it could virtualize the network just as it has with the cloud, but in doing so is making itself either a partner or a competitor of the operators for their 5G services revenues. 2018 was the year when VMware made a big splash at MWC, 2019 was the year when they showed that they have something to offer – will 2020 be the year when they take over the network software virtualization profit pools just as they did with the enterprise server virtualization market?

Crawl, Walk, Run

In conclusion, MWC 2019 was the year that the 5G gaps to make end-to-end infrastructure solutions where clearly being filled in. Service providers had stepped up their willingness to be part of the customer-centric ecosystem that is almost certainly being led by IT software companies. Telecom equipment vendors were offering technology solutions to speed up 5G deployments while making forward compatible solutions much easier. Finally, 5G-supported applications remain the last piece of the puzzle that MWC hasn’t addressed fully. As a result of the massively varied 5G use cases, there is still a look of curiosity on which industry will be the lead for 5G – will it be the auto industry with autonomous cars, will it be Industry 4.0 and the smart factory, or will it be smart cities with video surveillance. In addition, it is certain that IoT is still very much a necessary part of any 5G strategy just as AI outcomes continue to fuel IoT-based sensors in technologies such as the self-driving cars, AR, and digital twins. 2019 may have been the year that decided that it won’t matter whether the connected IoT device used licensed (NB-IoT) or unlicensed (LoRa) spectrum protocols as both will be seamlessly connected to a 5G network. IoT was not dead, it had simply grown up and was now integrated with more valuable solutions.

Rightly so, the first day of the Mobile World Conference was taken up by more and more air time on the ever coming 5G networks. Was 2019 going to be the year when operators around the world would finally deploy 5G in volume? The booths in the halls at the Fira Grand would indicate that ‘if you build it, they will come’. Indeed the speculation that 5G is the next big game changer is over – it is the game changer for this next turn of the technology dial.

However, let’s assume that the 5G hype is in the rear view mirror and we look to see what could be ahead of us in the mobile and telecom industry. At the end of the first day of this year’s MWC, I may have seen the future opportunity – and it is awesome! Pat Gelsinger asked the question “why can’t we build the telco networks like the clouds have been built for with scalability, flexibility, efficiency, and agility”? It’s a very fair question. After all, we do have Network Function Virtualization (NFV), and we will have new 5G services, so why not a new telco cloud?

I spent time with two companies that may show us a glimpse of the future network and cloud infrastructure. The first is the Israeli software startup, DriveNets with its solution “Network Cloud”. DriveNets is focused on helping service providers disaggregate proprietary routers from their networks as they move to 5G. DRiveNet’s Network Cloud solution aims to disrupt the current network business model by separating network costs (e.g. proprietary hardware functions) to create network functions from its software stack and two ‘white label’ hardware building blocks. The entire network infrastructure is software-centric allowing for agility, scalability, and normalizing costs with business growth.

However, Network DriveNets is an unusual startup in that it came out of stealth mode with $110 million in its first round of funding. The company was founded in 2015 by Ido Susan who should be familiar to Cisco watchers as he sold his first startup, Intucell (self-optimising network technology), to them for $475 million in 2013. DriveNets other co-founder, Hillel Kobrinsky founded Interwise (web conferencing) which was snapped up by AT&T for $121 million. To that end, the company is well funded and has the ability to sustain itself long enough to potentially disrupt the $50 billion network hardware business.

The second is Rakuten Mobile, a well-known name in Japan, but the first mobile virtual network operator (MVNO) to launch there in over 10 years. MNOs are not new so what makes Rakuten different? The company’s CTO, Tareq Amen explained to me that they are building the world’s first end-to-end fully virtualized cloud-native network running all of its workloads in the cloud. Being a fully virtualized network enables Network Function Virtualization to take advantage of cloud computing basis assets where a service delivery platform can be implemented, customized and scaled at speed. Finally, all of Rakuten’s core technology including its Radio Access Network (RAN – a topic that has been highly discussed at this year’s MWC) on 5G thus delivering immediate and actual 5G services. This compares to most of the rest of the industry who will have to build an uncomfortable transformation roadmap from 2/3G and LTE to 5G. While Amen’s strategy is compelling, there are a few technical hurdles to overcome. For example, enterprise-grade 5G indoor coverage isn’t fully there yet so Amen will have to rely on the operators that he is competing against who have that real estate.

So why highlight DriveNet and Rakuten in the same blog? In Rakuten’s case the CAPEX and OPEX business models for operators may be turned on their heads by the fact that its network is taking all of the competitive advantages of 5G while offering customers as disruptive pricing models and services. In a country such as Japan where traditional operators have struggled to modernize their networks, this could be a competitive threat. Equally, there could be a global rise in copy-cat pure 5G/cloud-based MVNOs spring up and fiercely compete against the incumbent local operators as well as give other MVNOs a tough time. As for DriveNets – it’s simple…it’s software and virtualization of the switch and router market which is very appealing to the service providers. It will commoditize the hardware, lowering their costs while allowing them to continue to focus on new 5G services.