We have all felt the effects of the global pandemic and experienced the profound effects on the way we work – at least those of us who are fortunate enough to still be working despite the pandemic.

COVID-19 has – at least for a while – changed how we work and how IT systems can safely support this new work style.

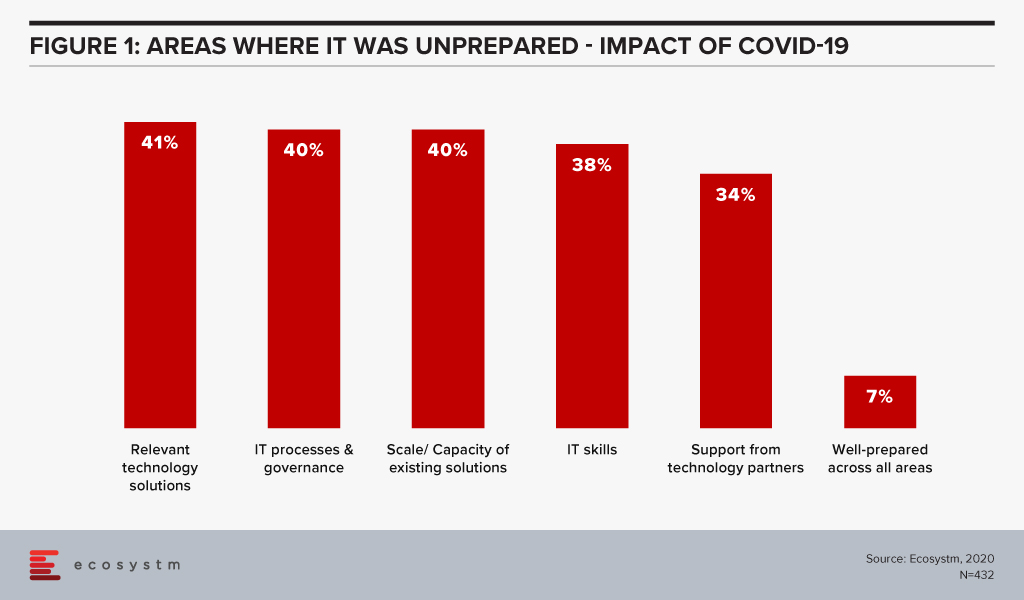

Our ongoing Ecosystm study on Digital Priorities in the New Normal shows how the crisis has forced organisations to re-evaluate their cybersecurity risks and measures. It also showed that the IT environment of most organisations was woefully unprepared for the changes that occurred (Figure 1). Perhaps unsurprisingly, fewer than 7% said that their IT environment was fully prepared and close to 40% reported lacking scale, capacity and IT skills in-house.

We are here to help you!

The combination of these shortcomings may very well push more organisations to outsource their security management to Managed Security Service Providers (MSSPs) – a service space that has been growing rapidly in recent years.

Many IT organisations are fairly familiar with MSSPs, but COVID-19 may have forced many to re-evaluate their choices as the work and threat landscapes have changed.

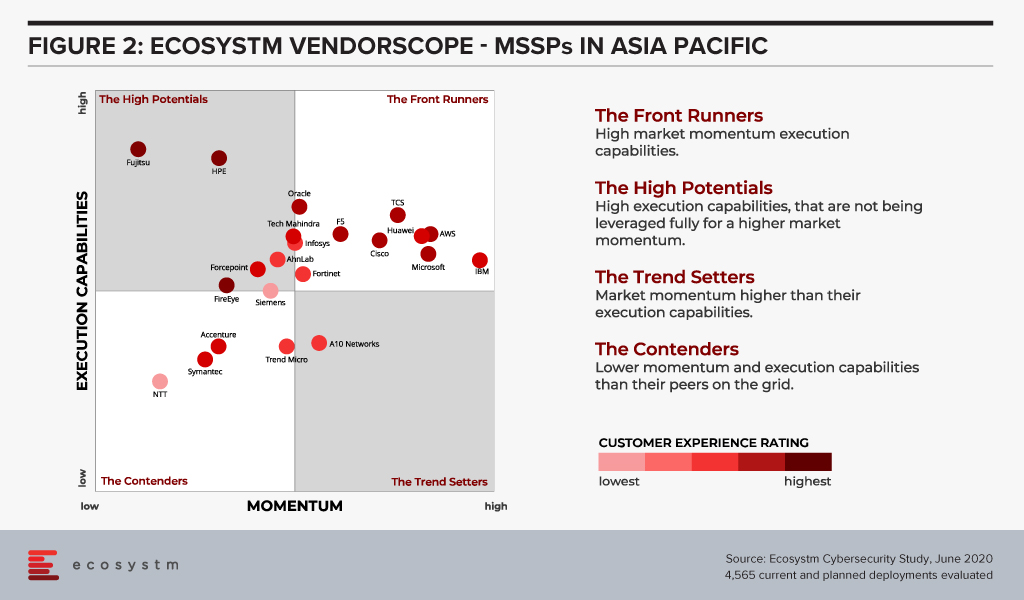

To help organisations evaluate their options going forward, we at Ecosystm are extremely excited to launch our Managed Security Service Providers VendorScope for the Asia Pacific region.

This new tool can help technology buyers understand which vendors are leading this space, which are the ones that have market momentum and which are executing and delivering on their promised capabilities. Unlike similar vendor evaluations on the market, the positioning of vendors in Ecosystm VendorScopes is based solely on quantifiable feedback given by the Tech Buyer community, in the global Ecosystm Cybersecurity Study, that is live and ongoing on the Ecosystm platform. It is thus independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

It is also free to access and share for all Ecosystm subscribers!

Fragmented Asia Pacific MSSP Market

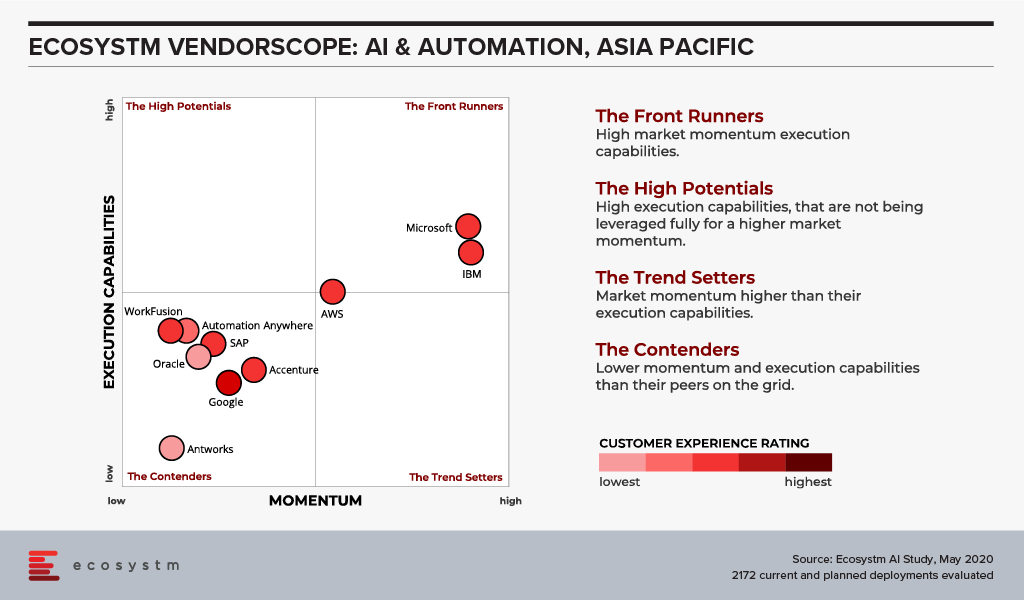

The VendorScope clearly shows how fragmented the MSSP market is. Not only is the number of vendors that have a customer base significant enough to appear on the grid very large (22) – but about half of them are in, or verging on being in, the “Front Runner” segment (Figure 2).

There are a few key factors that contribute to this picture:

- The services they offer tend to align well with the customers’ organisational strategies and to integrate well with existing systems. This, basically, can be boiled down to one word: Cloud. Most organisations have IT strategies revolving around multiple and/hybrid cloud deployments and using MSSPs makes a lot of sense.

- Momentum for this service segment is generally high. The MSSP space is experiencing high growth these days and we see a fairly high number of mentions for both current and planned deployments with many of the vendors in the study.

Despite the large number of vendors in the “Front Runner” segment, a famous few stick out. IBM appears to have a higher market momentum than its competitors and together with Microsoft, they have the largest share of mind with potential customers in this space.

But other vendors are hot on their heels. AWS and F5 stand out with their relatively high presence in the region, and TCS and Huawei appear to have stronger than average pipelines.

Where we do see weak spots with most vendors is in quality of service and the connected customer experience, which historically have proven to be a potential Achilles’ heel for many vendors in high growth areas. As the MSSP space matures, we would expect customer experience to become increasingly important when customers choose a service provider.

We would certainly encourage any organisation that is looking into managed security to not ignore or downplay the customer service and support aspect. IT security is a complex area – even if it is managed by a service provider – and the service providers’ ability and flexibility in this area can make a huge difference.

Fujitsu and HPE stick out with regards to QoS and customer service. These two are also good examples of how the vendors differ and seemingly could complement each other. In a sense, one could almost see the MSSP VendorScope as an early blueprint for which mergers and acquisitions (M&As) would make sense – at least for those that are driven by the pursuit of skill sets and competencies and not just market share.

In the Top 5 Cybersecurity and Compliance Trends for 2020, Ecosystm predicted that 2020 will witness a significant uplift in M&A activities in the cybersecurity market. Of course, with the global pandemic, all bets are off, and the predicted M&A wave may have been delayed by a year or so.

But the MSSP space certainly appears ripe for consolidation.

Ecosystm Vendorscope: Managed Security Service Providers

Signup for Free to download the Ecosystm Vendorscope: Managed Security Service Providers report

I’m really excited to launch our AI and Automation VendorScope! This new tool can help technology buyers understand which vendors are offering an exceptional customer experience, which ones have momentum and which are executing and delivering on their promised capabilities. The positioning of vendors in Ecosystm VendorScopes is independent of analyst bias or opinion or vendor influence – customers directly rate their suppliers in our ongoing market benchmarks and assessments.

The Evolution of the AI Market

The AI market has evolved significantly over the past few years. It has gone from a niche, poorly understood technology, to a mainstream one. Projects have moved from large, complex, moonshot-style “change the world” initiatives to small, focused capabilities that look to deliver value quickly. And they have moved from primarily internally focused projects to delivering value to customers and partners. Even the current pandemic is changing the lens of AI projects as 38% of the companies we benchmarked in Asia Pacific in the Ecosystm Business Pulse Study, are recalibrating their AI models for the significant change in trading conditions and customer circumstances.

Automation has changed too – from a heavily fragmented market with many specific – and often very simple tools – to comprehensive suites of automation capabilities. We are also beginning to see the use of machine learning within the automation platforms as this market matures and chases after the bigger automation opportunities where processes are not only simplified but removed through intelligent automation.

Cloud Platform Providers Continue to Lead

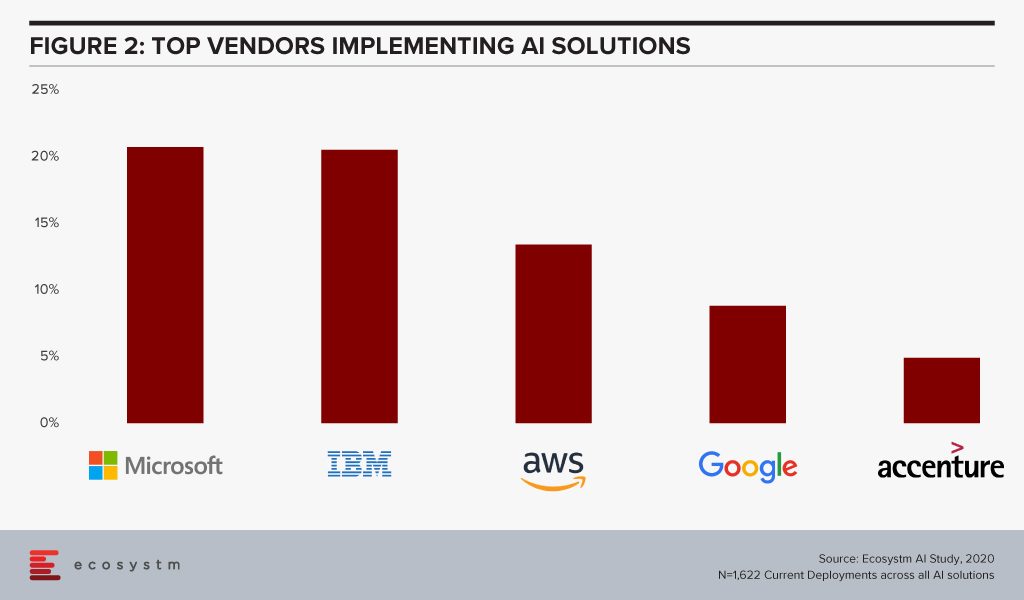

But what has changed little over the years is the dominance of the big cloud providers as the AI leaders. Azure, IBM and AWS continue to dominate customer mentions and intentions. And it is in customer mentions that the frontrunners in the VendorScope – Microsoft and IBM – set themselves apart. Not only are they important players today – but existing customers AND non-customers plan to use their services over the next 12-24 months. This gives them the market momentum over the other players. Even AWS and Google – the other two public cloud giants – who also have strong AI offerings – didn’t see the same proportions of customers and prospects planning to use their AI platforms and tools.

While Microsoft and IBM may have stolen the lead for now, they cannot expect the challengers to sit still. In the last few weeks alone we have seen several major launches of AI capabilities from some providers. And the Automation vendors are looking to new products and partnerships to take them forward.

Without the market momentum, Microsoft and IBM would still stand above the rest of the pack – just not as dramatically! Both companies are not just offering the AI building blocks, but also offer smart applications and services – this is possibly what sets them apart in an era where more and more customers want their applications to be smart out-of-the-box (or out-of-the-cloud). The appetite for long, expensive AI projects is waning – fast time to value will win deals today.

The biggest change in AI over the next few years will hopefully be more buyers demanding that their applications are smart out-of-the-box/cloud. AI and Automation shouldn’t be expensive add-ons – they should form the core of smart applications – applications that work for the business and for the customer. Applications that will deliver the next generation of employee and customer experiences.

Ecosystm Vendorscope: AI & Automation

Signup for Free to access the Ecosystm Vendorscope: AI & Automation report.

Manufacturing is estimated to account for a fifth of Singapore’s GDP and is one of its growth pillars. Singapore has been talking about re-inventing the Manufacturing industry since 2017, when the Industry 4.0 initiatives to enable digitalisation and process automation of processes and to ensure global competitiveness were first launched. As part of the long-term strategy, the Government had spoken about investment into research and development (R&D) projects, developing transformation roadmaps and strengthening the skill sets of the workforce.

Singapore’s 5G Rollout

Last month, the Infocomm Media Development Authority (IMDA) announced that Singtel and JVCo (formed by Starhub and M1) has won the 5G Call for Proposal. They will be required to provide coverage for at least half of Singapore by end-2022, scaling up to nationwide coverage by end 2025. While Singtel and JVCo will be allocated radio frequency spectrum to deploy nationwide 5G networks, other mobile operators, including MVNOs, can access these network services through a wholesale arrangement. The networks will also be supplemented by localised mmWave deployments that will provide high capacity 5G hotspots.

In October 2019, IMDA and the National Research Foundation had set aside $40 million to support 5G trials in strategic sectors such as maritime, aviation, smart estates, consumer applications, Industry 4.0 and government applications. Ecosystm Principal Advisor, Jannat Maqbool says, “Reach, performance and robustness of connectivity and devices have long held back the ability to scale with the IoT as well as successful deployment of some solutions altogether. The integration of 5G with IoT has the potential to change that immensely. However, and possibly even more importantly, 5G will see the emergence of a true ‘Internet’, defined as ‘interconnected networks using standardised communication protocols’, made up of ‘things’ enabling never-before contemplated innovation – supporting economic development and community well-being.”

“While 5G offers enormous potential to produce economic and social benefits, to reach that potential we need to evaluate from a strategic perspective what it could mean for industries, employers and communities – then we need to invest in the infrastructure, innovation and associated development required to leverage the technology.”

Singapore’s Industry 4.0 Transformation

The Government is also focused on getting the industry ready for the transformation that 5G will bring. Last week, Singapore announced its first Industry 4.0 trial, where IMDA collaborates with IBM, M1 and Samsung to design, develop, test and benchmark 5G-enabled Industry 4.0 solutions that can be applied across various industries. The trials will begin at IBM’s facility in Singapore and involve open source infrastructure solutions from Red Hat to test Industry 4.0 use cases.

The project will test 5G-enabled use cases for Manufacturing, focusing on areas such as automated visual inspection using image recognition and video analytics, equipment monitoring and predictive maintenance, and the use of AR in increasing productivity and quality. The focus is also on leveraging 5G to reduce the cost of processing, by shifting the load from the edge device to centralised systems.

Ecosystm Principal Advisor, Kaushik Ghatak says, “For some time now, the Singapore Manufacturing industry has been in the quest for higher productivity in order to regain its foothold as a destination of choice for global manufacturing outsourcing. The 5G Industry 4.0 trial is a great initiative to fast-track identification and adoption of the right use cases in Manufacturing, in the areas of automation, visibility, analytics, as well as for opening new revenue streams through servitisation of smart products.”

5G will see increased collaboration in the Tech industry

With the advent of 5G, the market will see more collaboration between government agencies, telecom providers and cloud platform providers and network equipment providers. Governments globally have invested in 5G and so have the network and communications equipment providers. However, telecom providers are unsure of how to monetise 5G and cater to the shift in their customer profile from consumers to enterprises. IBM and Samsung had already announced the launch of a joint platform in late 2019. Collaborations such as these will be key to widespread 5G deployment and uptake.

Talking about the benefits of collaborative efforts such as this, Maqbool says, “Robustness and security built into 5G deployment from the outset is essential to enable the applications and innovation that many are promising the technology will deliver, including the ability to self-scale, automate fault management and support edge processing.”

It is interesting that the solutions developed will be featured at IBM’s Industry 4.0 Studio 5G Solutions Showcase, and that IBM and Samsung will evaluate successful solutions developed during the project for possible use in their operations in a broad range of markets and sectors. “Availability of proven use cases at IBM’s Solutions Showcase centre would benefit local manufactures greatly; in terms of easy access to right skills and proven technology architectures,” says Ghatak. “This initiative is a huge step towards realising the promise of the cyber physical world. The collaboration between the leaders in communications, equipment and software will ensure that the use case development is truly cutting edge.”

In our blog, Artificial Intelligence – Hype vs Reality, published last month we explored why the buzz around AI and machine learning have got senior management excited about future possibilities of what technology can do for their business. AI – starting with automation – is being evaluated by organisations across industries. Several functions within an organisation can leverage AI and the technology is set to become part of enterprise solutions in the next few years. AI is fast becoming the tool which empowers business leaders to transform their organisations. However, it also requires a rethink on data integration and analysis, and the use of the intelligence generated. For a successful AI implementation, an organisation will have to leverage other enabling technologies.

Technologies Enabling AI

IoT

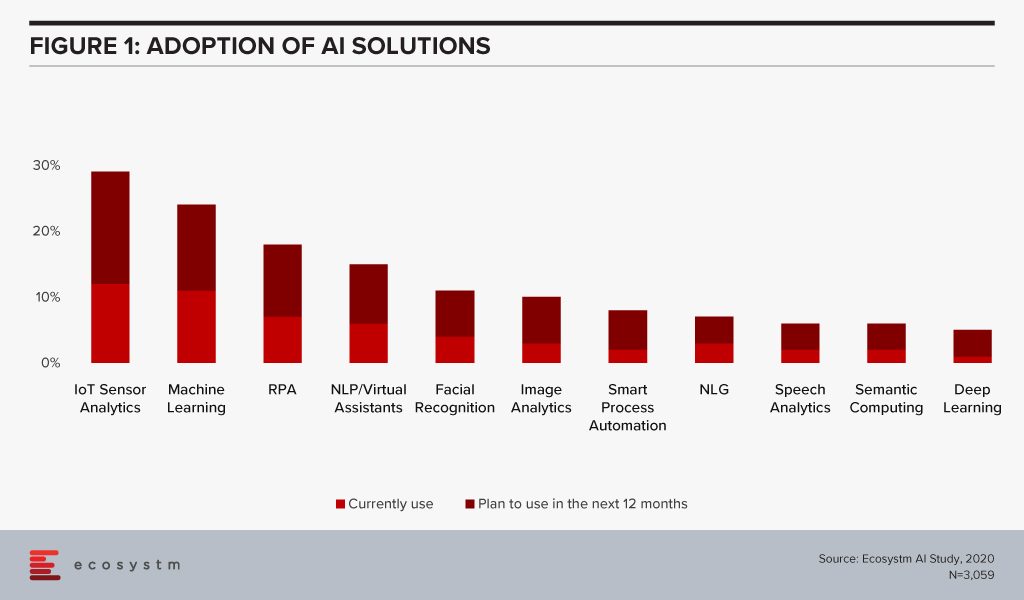

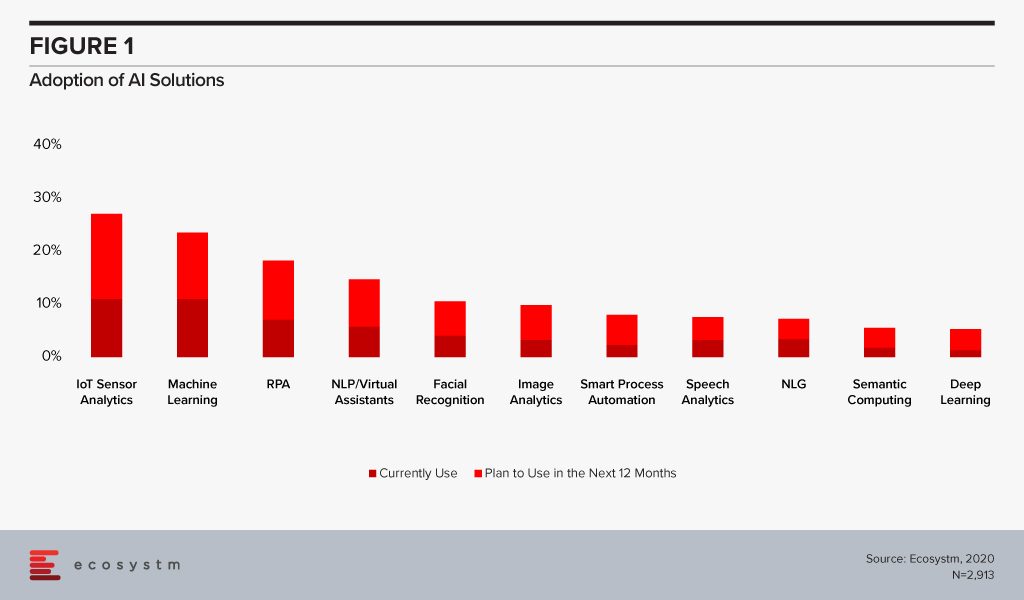

Organisations have been evaluating IoT – especially for Industry 4.0 – for the better part of the last decade. Many organisations, however, have found IoT implementations daunting for various reasons – concerns around security, technology integration challenges, customisation to meet organisational and system requirements and so on. As the hype around what AI can do for the organisation increases, they are being forced to re-look at their IoT investments. AI algorithms derive intelligence from real-time data collected from sensors, remote inputs, connected things, and other sources. No surprise then that IoT Sensor Analytics is the AI solution that is seeing most uptake (Figure 1).

This is especially true for asset and logistics-driven industries such as Resource & Primary, Energy & Utilities, Manufacturing and Retail. Of the AI solutions, the biggest growth in 2020 will also come from IoT Analytics – with Healthcare and Transportation ramping up their IoT spend. And industries will also look at different ways they can leverage the IoT data for operational efficiency and improved customer experience (CX). For instance, in Transportation, AI can use IoT sensor data from a fleet to help improve time, cost and fuel efficiency – suggesting less congested routes with minimal stops through GPS systems, maintaining speeds with automated speed limiters – and also in predictive fleet maintenance.

IoT sensors are already creating – and will continue to create large amounts of data. As organisations look to AI-enabled IoT devices, there will be a shift from one-way transactions (i.e. collecting and analysing data) to bi-directional transactions (i.e. sensing and responding). Eventually, IoT as a separate technology will cease to exist and will become subsumed by AI.

Cloud

AI is changing the way organisations need to store, process and analyse the data to derive useful insights and decision-making practices. This is pushing the adoption of cloud, even in the most conservative organisations. Cloud is no longer only required for infrastructure and back-up – but actually improving business processes, by enabling real-time data and systems access.

Over the next decades, IoT devices will grow exponentially. Today, data is already going into the cloud and data centres on a real-time basis from sensors and automated devices. However, as these devices become bi-directional, decisions will need to be made in real-time as well. This has required cloud environments to evolve as the current cloud environments are unable to support this. Edge Computing will be essential in this intelligent and automated world. Tech vendors are building on their edge solutions and tech buyers are increasingly getting interested in the Edge allowing better decision-making through machine learning and AI. Not only will AI drive cloud adoption, but it will also drive cloud providers to evolve their offerings.

The global Ecosystm AI study finds that four of the top five vendors that organisations are using for their AI solutions (across data mining, computer vision, speech recognition and synthesis, and automation solutions) today, are also leading cloud platform providers (Figure 2).

The fact that intelligent solutions are often composed of multiple AI algorithms gives the major cloud platforms an edge – if they reside on the same cloud environment, they are more likely to work seamlessly and without much integration or security issues. Cloud platform providers are also working hard on their AI capabilities.

Cybersecurity & AI

The technology area that is getting impacted by AI most is arguably Cybersecurity. Security Teams are both struggling with cybersecurity initiatives as a result of AI projects – and at the same time are being empowered by AI to provide more secure solutions for their organisations.

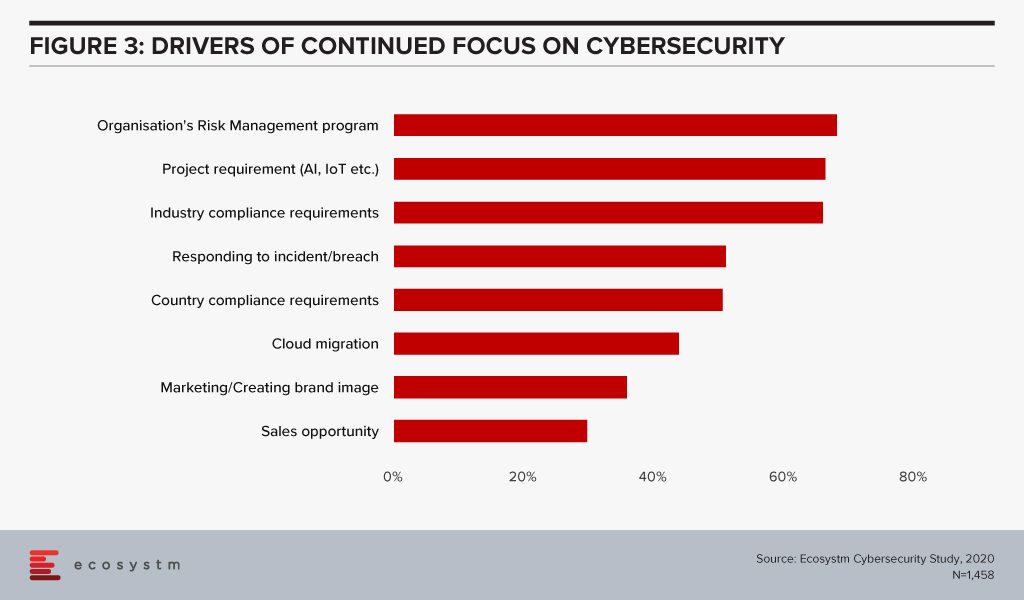

The global Ecosystm Cybersecurity study finds that one of the key drivers that is forcing Security Teams to keep an eye on their cybersecurity measures is the organisations’ needs to handle security requirements for their Digital Transformation (DX) projects involving AI and IoT deployments (Figure 3).

While AI deployments keep challenging Security Teams, AI is also helping cybersecurity professionals. Many businesses and industries are increasingly leveraging AI in their Security Operations (SecOps) solutions. AI analyses the inflow and outflow of data in a system and analyses threats based on the learnings. The trained AI systems and algorithms help businesses to curate and fight thousands of daily breaches, unsafe codes and enable proactive security and quick incident response. As organisations focus their attention on Data Security, SecOps & Incident Response and Threat Analysis & Intelligence, they will evaluate solutions with embedded AI.

AI and the Experience Economy

AI has an immense role to play in improving CX and employee experience (EX) by giving access to real-time data and bringing better decision-making capabilities.

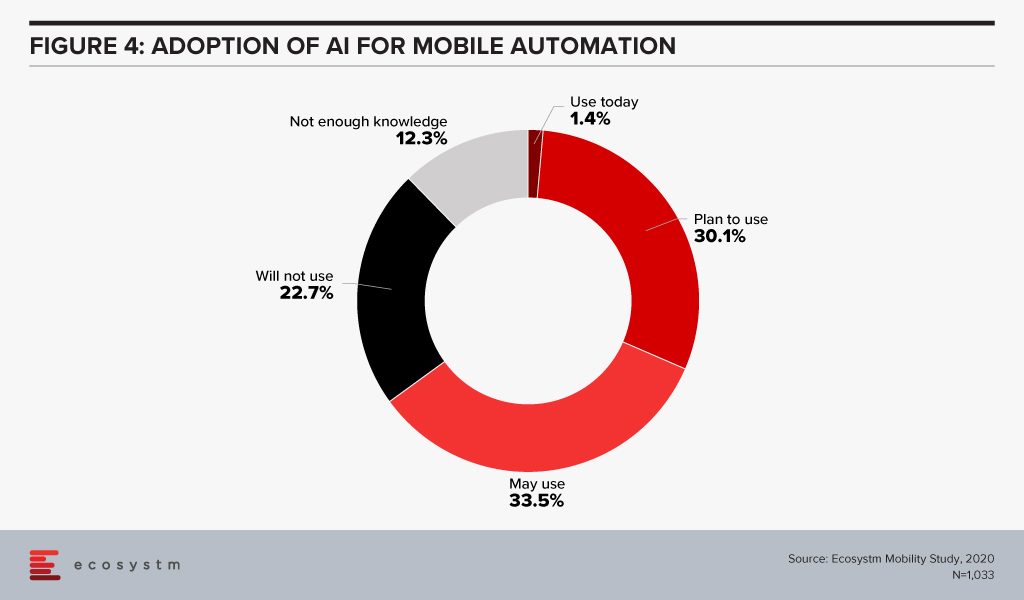

Enterprise mobility was a key area of focus when smartphones were introduced to the modern workplace. Since then enterprise mobility has evolved as business-as-usual for IT Teams. However, with the introduction of AI, organisations are being forced to re-evaluate and revamp their enterprise mobility solutions. As an example, it has made mobile app testing easier for tech teams. Mobile automation will help automate testing of a mobile app – across operating systems (Figure 4). While more organisations tend to outsource their app development functions today, mobile automation reduces the testing time cycle, allowing faster app deployments – both for internal apps (increasing employee productivity and agility) and for consumer apps (improving CX).

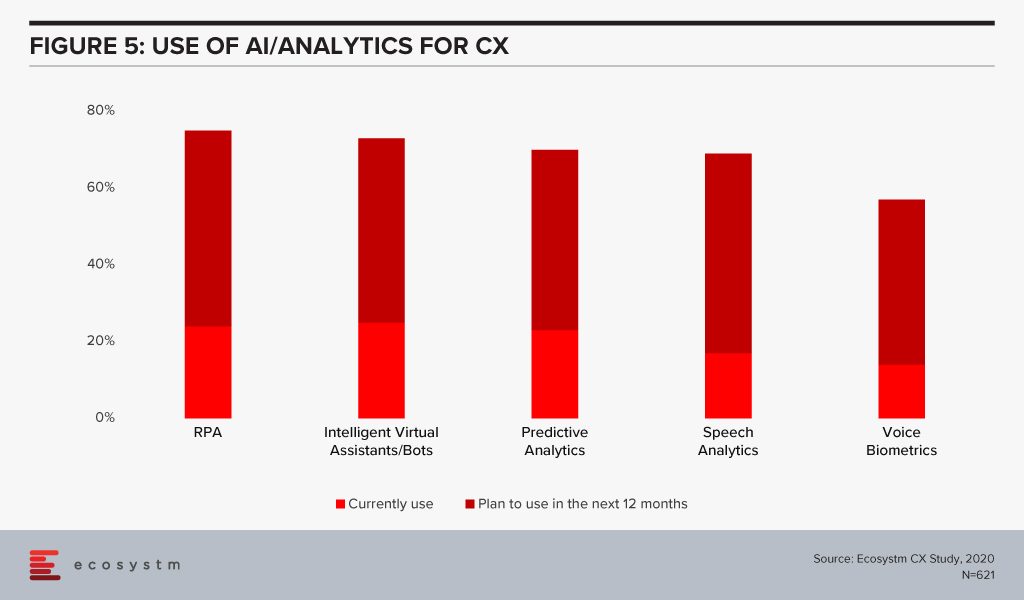

CX Teams within organisations are especially evaluating AI technologies. Visual and voice engagement technologies such as NLP, virtual assistants and chatbots enable efficient services, real-time delivery and better customer engagement. AI also allows organisations to offer personalised services to customers providing spot offers, self-service solutions and custom recommendations. Customer centres are re-evaluating their solutions to incorporate more AI-based solutions (Figure 5).

The buzz around AI is forcing tech teams to evaluate how AI can be leveraged in their enterprise solutions and at enabling technologies that will make AI adoption seamless. Has your organisation started re-evaluating other tech areas because of your AI requirements? Let us know in the comments below.

Artificial Intelligence (AI), machine learning and deep learning are buzz words that have organisations – especially the C-Suite – excited about future possibilities of what technology can do for their business. However, these are not merely buzz words and are actually being leveraged by early adopters. At the same time, there are organisations that are keen to adopt the technologies but are unsure of the benefits and the associated challenges act as a barrier to adoption. So, is AI over-hyped or is it a reality for enterprises today? Ecosystm research provides some answers.

The Buzz Around Artificial Intelligence

There are several factors that contribute to the curiosity around AI and why several organisations are evaluating the adoption of AI:

Promotion by large tech vendors

The world’s leading technology providers are in a race to incorporate innovations (mostly driven by AI) within their product and service offerings. Heavy investments in R&D and new patents are aimed at increased market share, as the top tech vendors continue to compete to consolidate and grow their global presence. The perception is that AI-related patents are directly proportional to future market potential. It is not uncommon for the providers to promote these future capabilities – long before they hit the market – as part of their go-to-market messaging. There has been a surge in the number of AI patent filings in recent years with Microsoft leading with more than 18,300 patents followed by IBM (more than 15,000) and Samsung (more than 11,000). As these tech giants keep investing in R&D, apply for newer patents and publicise them, it creates a positive buzz in the market.

Consumerisation of AI

Just like any emerging technology, AI is still, to some extent, an enigma. However, the consumer market gets constant glimpses of how AI can have a positive impact on people’s lifestyle. Amazon, Samsung, Microsoft, Apple – to name a few – have all introduced smart AI solutions to their consumer products. From smart voice assistants that help us with our voice searches to controlling homes with digital assistants, users have been impressed with their early interactions with AI. Many think that the same way as AI has percolated into their personal lives, it will one day be pervasive in enterprises as well. The requirements of an enterprise AI solution is completely different and complex. For example, wearables and wellness mobile apps can help you take control of your health, but for them to become part of the healthcare system, they require FDA approval, a well-documented workflow and policy implementations. But, wearables get people curious and create a buzz about the role of AI in healthcare.

Government initiatives

Several governments are engaging and getting serious about AI and are investing in AI R&D. Many have created an AI roadmap including governance, to promote the adoption of AI. AI.gov was launched by the US Government to centralise AI efforts, share knowledge on AI and drive adoption across government agencies and departments. Some departments have already adopted AI. The US National Oceanic and Atmospheric Administration (NOAA) has been using AI to improve their forecasts. This helps in better prediction of high-impact weather events. Smart city applications are also seeing increased adoption of AI, including in citizen engagement. Cities and government departments are investing in AI-based call centres to answer repeated or routine queries. For example, the United States Army uses an interactive virtual assistant to check qualifications and answer questions with more accuracy. When governments back a technology area, it creates an interest in the citizens.

Success stories

Every day we read about some AI implementation that has positively impacted an organisation or its customers. Twitter’s use of AI-driven text and image analytics to detect hate speeches and terrorist activities has been well-publicised. Gaming companies are actively using AI to improve user experience through Mixed Reality and AI technologies. The recent coronavirus outbreak was first detected by BlueDot, a Canadian company using AI technologies. Such success stories encourage other enterprises to evaluate the technology.

Beyond the Buzz

While we are adopting AI/automation as part of our consumer goods (such as phones, smart home systems) and services (such as search engines, online maps) the enterprise adoption of AI does not really match up to the hype around it.

Ecosystm research shows us what the popular AI solutions are and what their current adoption is globally, as well as what it is likely to be at the end of the year (Figure 1). While some solutions have become popular, especially in industries such as Manufacturing, Mining & Resources and Construction, the reality is that we have not yet reached mass adoption. Of the organisations that are planning to implement some AI solutions, 44% consider the investment as strategic to their organisational goal. The rest are mostly looking at ad-hoc implementations to test the waters.

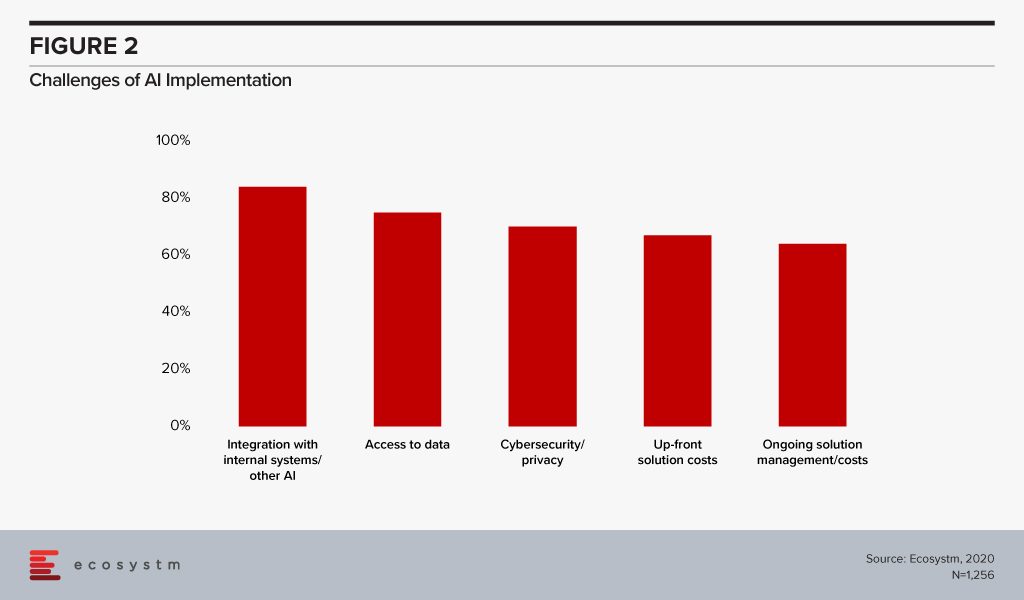

What is hampering more widespread adoption of AI? For both organisations that have embarked on their AI journeys and those who plan to in 2020, the challenges are the same (Figure 2).

AI integration is a complex process. The more organisations want to integrate AI investments into their transformation journey, the more complicated the integration becomes. There needs to be an identification of the expected outcomes, mapping of the data that will be required to help the algorithms, real-time or near real-time data sources and consistency in data infrastructure and sources. Organisations have legacy systems that run in siloes. Integration requires a clear roadmap and dedicated resources, often a third party.

Even in industries that have access to huge organisational data repositories, data access can be a challenge, for technological or compliance reasons. AI requires a huge amount of data to train and run algorithms. Data scientists are often challenged with access to quality training data at the scale required to train the AI systems.

Cybersecurity concerns are natural for any emerging technology area. AI systems have access to enormous organisational data. With threats ranging from ransomware, data breaches to hackers tampering with physical and industrial systems, it is dangerous if AI system falls in the hands of cybercriminals. Instances such as when criminals used an AI-based software to impersonate the voice of a company CEO to commit a €220,000 fraud, also add to the concerns around cybersecurity and AI.

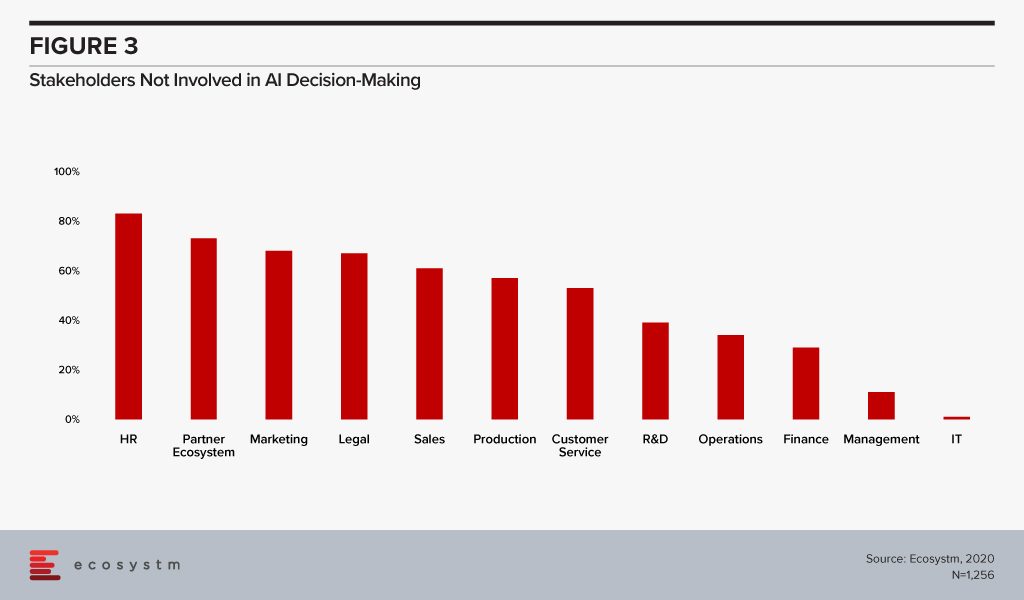

Another reason why organisations find deploying AI solutions difficult is that they do not involve the right organisational stakeholders in the AI decision-making process (Figure 3). While IT is likely to know where the data resides and have a better understanding of the systems implemented, the true success of AI deployments will be measured in user acceptance. An AI solution will obviously impact the existent workflows in an organisation, and if the stakeholders are not convinced, or are unsure of the benefits, it will be difficult for AI to have an organisation-wide impact.

Moreover, internal IT may not have the right skills to implement and maintain an AI solution. It will become important for organisations to involve strategic partners who can guide the implementations, at least in the initial stages. While 51% of organisations that have an AI solution engage an external strategic partner, only 33% of organisations that are planning to adopt AI have planned for a strategic partner to guide them. A strategic partner – with the right technical expertise and business experience – can help combat some of the challenges around integration issues and provide guidance on cybersecurity best practices.

AI clearly has immense possibilities and indeed is a revolutionary technology that will bring value to almost all industries. What is required for a successful AI implementation however is a roadmap – including a cross-departmental Centre of Excellence (CoE), a clear timeframe and KPIs to measure both business and technological success of the AI models. Unless organisations can plan their AI investments, the technology will not translate from hype to reality.

Two things happened recently that 99% of the ICT world would normally miss. After all microprocessor and chip interconnect technology is quite the geek area where we generally don’t venture into. So why would I want to bring this to your attention?

We are excited about the innovation that analytics, machine learning (ML) and all things real time processing will bring to our lives and the way we run our business. The data center, be it on an enterprise premise or truly on a cloud service provider’s infrastructure is being pressured to provide compute, memory, input/output (I/O) and storage requirements to take advantage of the hardware engineers would call ‘accelerators’. In its most simple form, an accelerator microprocessor does the specialty work for ML and analytics algorithms while the main microprocessor is trying to hold everything else together to ensure that all of the silicon parts are in sync. If we have a ML accelerator that is too fast with its answers, it will sit and wait for everyone else as its outcomes squeezed down a narrow, slow pipe or interconnect – in other words, the servers that are in the data center are not optimized for these workloads. The connection between the accelerators and the main components becomes the slowest and weakest link…. So now back to the news of the day.

A new high speed CPU-to-device interconnect standard, the Common Express Link (CXL) 1.0 was announced by Intel and a consortium of leading technology companies (Huawei and Cisco in the network infrastructure space, HPE and Dell EMC in the server hardware market, and Alibaba, Facebook, Google and Microsoft for the cloud services provider markets). CXL joins a crowded field of other standards already in the server link market including CAPI, NVLINK, GEN-Z and CCIX. CXL is being positioned to improve the performance of the links between FPGA and GPUs, the most common accelerators to be involved in ML-like workloads.

Of course there were some names that were absent from the launch – Arm, AMD, Nvidia, IBM, Amazon and Baidu. Each of them are members of the other standards bodies and probably are playing the waiting game.

Now let’s pause for a moment and look at the other announcement that happened at the same time. Nvidia and Mellanox announced that the two companies had reached a definitive agreement under which Nvidia will acquire Mellanox for $6.9 billion. Nvidia puts the acquisition reasons as “The data and compute intensity of modern workloads in AI, scientific computing and data analytics is growing exponentially and has put enormous performance demands on hyperscale and enterprise datacenters. While computing demand is surging, CPU performance advances are slowing as Moore’s law has ended. This has led to the adoption of accelerated computing with Nvidia GPUs and Mellanox’s intelligent networking solutions.”

So to me it seems that despite Intel working on CXL for four years, it looks like they might have been outbid by Nvidia for Mellanox. Mellanox has been around for 20 years and was the major supplier of Infiniband, a high speed interconnect that is common in high performance workloads and very well accepted by the HPC industry. (Note: Intel was also one of the founders of the Infiniband Trade Association, IBTA, before they opted to refocus on the PCI bus). With the growing need for fast links between the accelerators and the microprocessors, it would seem like Mellanox persistence had paid off and now has the market coming to it. One can’t help but think that as soon as Intel knew that Nvidia was getting Mellanox, it pushed forward with the CXL announcement – rumors that have had no response from any of the parties.

Advice for Tech Suppliers:

The two announcements are great for any vendor who is entering the AI, intense computing world using graphics and floating point arithmetic functions. We know that more digital-oriented solutions are asking for analytics based outcomes so there will be a growing demand for broader commoditized server platforms to support them. Tech suppliers should avoid backing or picking one of either the CXL or Infiniband at the moment until we see how the CXL standard evolves and how nVidia integrates Mellanox.

Advice for Tech Users:

These two announcements reflect innovation that is generally so far away from the end user, that it can go unnoticed. However, think about how USB (Universal Serial Bus) has changed the way we connect devices to our laptops, servers and other mobile devices. The same will true for this connection as more and more data is both read and outcomes generated by the ‘accelerators’ for the way we drive our cars, digitize our factories, run our hospitals, and search the Internet. Innovation in this space just got a shot in the arm from these two announcements.

IBM is aggressively pushing their products and services with multiple partnerships being announced over the last few months.

In the recent announcement, HCL Technologies and IBM stated that they were collaborating to assist organisations on their hybrid cloud journey. The joint services will offer seamless integration of their customers’ cloud across any private, public and on-premise environment. The hybrid cloud approach is aimed at eliminating the concerns of mixing the different cloud environments yet maintaining scalability and security. HCL will feature new refactoring and re-platforming services to allow organisations to migrate, integrate and manage apps and workloads on IBM’s cloud.

Speaking on the subject, Phil Hassey, Principal Advisor ,Ecosystm, thinks that “the most attractive aspect of this collaboration is that it will bring together the best of both vendors. IBM has such a long history in Infrastructure Management, whereas HCL has – most particularly in the past 5 years or so – built up capability in the space.”

The good news for tech buyers is that they will derive benefits from HCL’s customer knowledge and hands-on approach with the combination of IBM technology, cloud and – of course – Watson. HCL has acquired significant IBM assets that they could extract more value from. The infusion of AI into hybrid cloud will lead to increased automation, improved outcomes and effective investments by clients.

When we look at the individual benefits to IBM and HCL from this deal, Hassey says, “IBM needs new customer logos and HCL can provide that. Conversely, IBM can provide larger enterprise clients to HCL. However, it is not a straight customer swap, they will work to maintain relationships independently.”

IBM is pushing hard towards their plans to capture more market with many big deals announced recently – and undoubtedly many more yet to happen. It is well-documented that IBM has gone through many reinventions but is still deeply entrenched in many of the world’s largest organisations. “IBM is such a large machine that different aspects and offerings are always operating at different speeds”, says Phil. “It needs to accelerate the uptake of Watson, and Watson being available on any cloud will help this.”

The hybrid cloud is desperately looking for big scale integration and transformation capabilities, so this agreement between HCL and IBM will hopefully help kickstart that.

Recently IBM and Vodafone announced a new strategic commercial agreement, as a joint venture, to provide their clients with the ability to integrate multiple clouds that have a need to access emerging technologies such as 5G, AI, Edge Computing and Software Defined Networking. Under an eight-year engagement valued $550 million (€480 million), IBM will provide managed services to Vodafone Business’ cloud and hosting unit.

Businesses are becoming more and more challenged to run their operations and business processes in a seamless manner as data is distributed and managed across more and more clouds. Together, Vodafone Business and IBM aim to remove these complexities to support the basis of any digital transformation and enable a company to share data freely and securely across its organization.

On the surface, this announcement makes sense if you are a Vodafone business customer who wants to take the next step in a digital transformation journey. The convergence of multi-clouds has the ability for companies to enrich their own data management systems with external sources. With the purchase of Red Hat late in 2018, IBM now has the ability and credibility to offer that capability. However, as many IoT-based solutions create the data to fuel these cloud processes, IBM has not had a clear Edge Computing or network connectivity strategy. This is where Vodafone can help IBM connect the edge of the network to the enterprise systems. This announcement seems like a complimentary win-win situation for both sets of IBM and Vodafone customers.

Red Hat is undoubtedly one of the premier cloud management companies and IBM invested heavily in its multi-cloud connectivity assets. IBM is hoping that the deeper that Red Hat is involved in the multi-cloud connectivity market, the more it will pull through IBM’s high-value business services in cognitive computing and machine learning and other compute-intensive technologies.

However, this market is still shaking itself out and there are many other competitive offerings to Red Hat. There are startups such as RightScale and Morpheus who can offer up multi-cloud management. Alternatively, as a mature company, VMware competes head to head with Red Hat and has had a long-standing partnership with Vodafone. In particular, VMware and Vodafone have partnered in telco specific functions such as NFV and 5G.

To understand the importance of VMware in the midst of this announcement is to appreciate the end-to-end customer experience that VMware can bring to telco customers such as Vodafone. As 5G rolls out and NFV-based network slicing becomes a valuable onboarding differentiator VMware could offer its vCloud NFV solution to Vodafone’s customers. Vodafone’s customers could have access to the same multi-cloud services from VMware and not IBM while obtaining AI, cognitive and ML services available from the major public cloud providers (such as AWS, Google and Microsoft). VMware’s position at the edge of the network would, therefore, appear to leapfrog IBM’s position. Vodafone Business’ customers could bypass IBM and its cloud services strategy. At the end of the day, IBM could be left with only the managed services contract while missing out on analytics and cognitive business services.

To negate this scenario, IBM will have to lead more and more with Red Hat and be willing to downplay the cognitive and machine learning services. Business solutions in vertical markets such as agriculture are extremely price sensitive and customers will look closely at the cost of connectivity followed by the cost of data acquisition to enrich their business outcomes. We believe that if the cost to run data science and cognitive services are too expensive, then Vodafone customers will seek the same tools and services from other cloud service providers and not IBM.

Finally

Our advice to tech buyers who are in the midst of business transformation should consider how they fuel their decision-making engines for analytics, machine learning, and cognitive computing. Real-time processing and dissemination of business outcomes is one of the table stakes for a successful digital company. As a result of that, seamless end-to-end processing across a complex and distributed enterprise infrastructure is a challenge that needs to be overcome. Tech buyers should ask if IBM’s edge computing strategy and Vodafone’s connectivity are mature enough to funnel IoT-data generated smart data to a broad inter-cloud infrastructure.

Authored by attending Ecosystm Advisors and Analysts: Randeep Sudan, Amit Gupta, Tim Sheedy, Lokesh Tayal and Sash Mukherjee

IBM has been sending strong messages about their future business goals in Asia Pacific, to the analyst community and the larger market as a whole. Over the last 2 analyst briefings held in Melbourne (August 2018) and Singapore (November 2018), they have emphasised their focus on the ‘Hero Brands’, the multicloud, their Open-First policy, and their One IBM messaging.

Based on our analysis, it is clear that IBM is:

Consolidating their Portfolio into ‘Hero Brands’. IBM’s portfolio has been consolidated into IBM Services, IBM Watson, IBM Cloud, IBM Security, IBM Systems and IBM Research. This consolidation represents a holistic and cross-cutting approach to the market and is likely to give IBM an edge in implementing emerging technology solutions. As an example, the Technology Support Services (under IBM Services), leverages both Watson-enabled support and Blockchain-based billing and invoicing.

Ecosystm Comment. IBM Watson still remains a flagship brand for the organisation and should be integrated more within the stories of the other ‘Hero Brands’. While the penetration of Watson capabilities has grown, it is not what it should be, considering that IBM has first-mover advantage in the cognitive/AI market. IBM needs to actively play to their strengths and build further capabilities leveraging the Watson/ IoT/ Blockchain ecosystems.

Focusing on the Multicloud. IBM’s strong experience in cloud deployment, migration and management gives them a true understanding of the cloud adoption landscape. They are pushing the concept of the multicloud, leveraging their capabilities to manage other vendors’ clouds, acknowledging the reality that organisations are at disparate stages when it comes to cloud adoption, and that they all have their own unique journeys. While the public cloud with cloud native workloads, is the end-game, IBM understands that their clients run their workloads across public, private and hybrid clouds, and have developed a capability to support all of these environments.

Ecosystm Comment. For many of IBM’s traditional clients, this is the right approach to take – these are companies with typically highly complex environments where simple messages around “take it all to the public cloud” might be more easily said than done. IBM will work with these clients to help them modernise their business and make the most of their current on-premise and hosted applications. Moreover, data localisation requirements in some countries will also require a hybrid approach to the management of cloud assets. While the market implications of IBM’s Red Hat acquisition are being discussed at length, other initiatives such as strengthening their automation capabilities, extending their relationship with ServiceNow, and their Open-First policy will also benefit IBM and the market as a whole.

Creating a Services Differentiation. The Managed Applications division under Global Technology Services (GTS) – that works closely with Global Business Services (GBS) acknowledges that managing SAP and Oracle applications on IBM Cloud is their fastest growing market. So, given the plethora of service providers, especially in the region, how do they create a differentiation? IBM’s response is to infuse ERP deployments with change management capabilities to help companies become truly digital. This is bolstered by their Industry Impact Solutions, and the One IBM messaging. GTS and GBS coming together to deliver an end-to-end solution, can potentially give their clients a better understanding of the technological requirements, change management, and TCO.

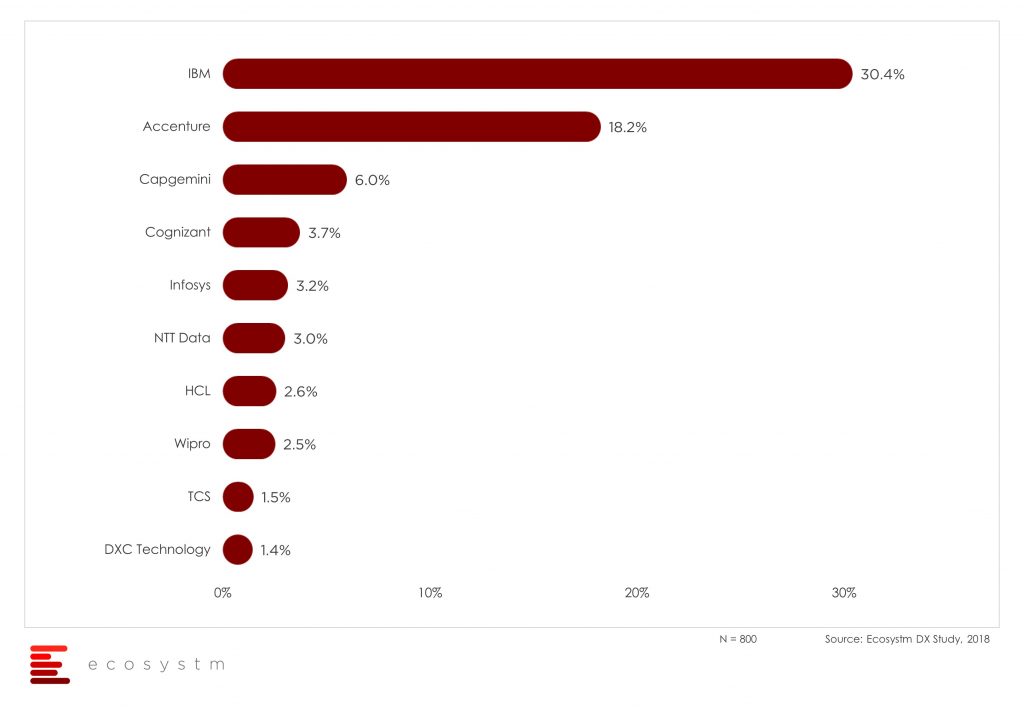

Ecosystm Comment. In the studies conducted by Ecosystm, IBM features as the vendor with the highest mindshare for IoT and Mobility and comes in at 2nd spot for AI. However, where they clearly lead the market is in being the services provider of choice when it comes to Digital Transformation (DX).

Top of Mind Services Providers for DX, Asia Pacific

As organisations make the transition to digital operating models, services providers that can provide scale and skill, will become significant partners in the journey. IBM indisputably has both scale and skill, and the One IBM messaging can further strengthen their market position as the service provider of choice for DX. However, this messaging should be far more consistent and run across IBM’s entire operations for better market positioning.

Improving their Customer Capabilities. Over the past few years IBM has invested in its delivery capabilities, with design thinking, ideation sessions and customer journey mapping, included in many of their client engagements. They have brought in experts from outside of IBM to provide many of these capabilities – uncharacteristically, many of the IBMers you meet who offer or drive these services are new to the organisation. They are also driving new technology processes and capabilities within many of their clients – moving beyond simple systems integration to helping their clients change their internal digital delivery processes.

Ecosystm Comment. In an era where change is constant, the ability to drive change within the business will be central to the ability to succeed in the market. Too many companies bring in external consultants and SIs and instead of leading the change, they let the SI lead the change. They do not take many – or any – learnings out of the engagement and are completely reliant on external consultants every time they need a big change. While this is a great opportunity for the SI and consultancy providers, many companies – IBM included – want their clients to succeed. So instead of selling them lemonade, more and more they are teaching them to make their own lemonade.