The Manufacturing industry is at crossroads today. It faces challenges such as geopolitical risks, supply chain disruptions, changing regulatory environments, workforce shortages, and changing consumer demands. Overcoming these requires innovation, collaboration, and proactive adaptation.

Fortunately, many of these challenges can be mitigated by technology. The future of Manufacturing will be shaped by advanced technology, automation, and AI. We are seeing early evidence of how smart factories, robotics, and 3D printing are transforming production processes for increased efficiency and customisation.

Manufacturing is all set to become more agile, efficient, and sustainable.

Read on to find out the changing priorities and key trends in Manufacturing; about the World Economic Forum’s Global Lighthouse Network initiative; and where Ecosystm advisor Kaushik Ghatak sees as the Future of Manufacturing.

Click here to download ‘The Future of Manufacturing’ as a PDF

Last week industry leaders, SAP and Siemens, announced a partnership to bring together their respective expertise on creating integrated and enhanced solutions for product lifecycle management (PLM), supply chain, service and asset management, in a move that is expected to accelerate Industry 4.0 globally.

The partnership between SAP and Siemens aims to develop innovative business models to break silos between manufacturing, product development and service delivery teams to establish seamless customer-centric processes. It will provide users with real-time business information, customer insights and performance data over the entire product development cycle.

As the first step of this agreement, Siemens will offer SAP’s Intelligent Asset Management solution and Project and Portfolio Management applications and SAP will offer Siemens’ PLM suite Teamcenter software for product lifecycle collaboration and data management to manufacturers and business operators across the network – complementing each other’s solutions.

Ecosystm Principal Advisor, Kaushik Ghatak says, “The convergence of the Information Technology (IT) and the Operational Technology (OT) worlds is a must for companies to operate in the cyber physical world of Industry 4.0. Historically, these two worlds have operated in silos. This is a great partnership announcement aimed towards meeting the convergence goals by integrating the capabilities of Siemens (an OT leader), and SAP (an IT leader). Together they would be able to offer an exhaustive set of very valuable offerings in the Digital Supply Chain and Digital Manufacturing domain for customers worldwide.”

Ghatak says, “This is not the first such partnership for Siemens. A strategic alliance between Siemens and Atos has been in place since 2011. In 2018 the alliance was strengthened with plans to accelerate their joint business until 2020, with a focus on building innovative solutions by combining their capabilities. However, the difference this time is that SAP has very a deep and wide set of software offerings in the supply chain and manufacturing domains, which when stitched together with Siemens’ PLM solutions can provide true end-to-end digitalisation capabilities across the ‘Design, Source, Make, Deliver and Plan’ continuum of the value chain.”

Ecosystm Comments

Ghatak, however, cautions that while this is a great partnership announcement between two giants in their respective fields, they will need to collaborate actively on three key aspects for this partnership to deliver value for the customers.

- Product Development. Building-integrated solutions with heterogenous data models is not easy. It will require very open collaboration between their product development teams to identify the use cases and build solutions that can enable seamless information flow and actions across the different software modules owned by each.

- Go-to-market. Going to market jointly will need strong collaboration too. In terms of the agreement on customer account ownership, pricing, sharing of pre-sales resources and so on.

- Implementation. And, last but not the least, it will require collaboration to ramp up the implementation capabilities of the jointly developed solutions.

The Oil and Gas industry has seen volatile times and is affected by its own set of unique challenges ranging from commodity price fluctuations, a potential supply crunch, geo-political events, and energy policies including energy transition. Moreover, the challenges and requirements are distinct at different stages of operations – upstream, midstream and downstream. The industry has been an early adopter of a few emerging technologies and is looking to leverage them to remain competitive and better employee management.

Drivers of Transformation in the Oil and Gas Industry

Remaining competitive in an evolving market

Oil and Gas companies are having to clean up old processes, as the market gets increasingly competitive. Ecosystm research finds that the top business priorities for Oil and Gas companies do not stop at cost reduction and revenue growth. The industry also has to focus on employee experience and safety, compliance, and increasingly even customer experience. And they must remain competitive through potential disruption in supply, demand and production; the rising costs of processes; and ongoing exploration costs. Oil and Gas companies are also focusing more on their downstream operations including retail in order to remain competitive.

Shortage of skilled workforce

The industry also faces the challenge of skills shortage. A survey conducted by the Global Energy Talent Index (GETI) found that nearly 70% of Oil and Gas professionals think the industry is already facing skills shortage or will be hit by it within the next 5 years. This is due to a number of reasons, including a reluctance of younger professionals to commit to a profession that has harsher conditions than many. Moreover, as energy transition becomes a topic of global discussion, many have a perception that the industry is not sustainable in the future. The industry also goes through cycles where they cut back on exploration and production, which results in the loss of skills and inadequate knowledge transfer. It has a long-term challenge around knowledge management.

Safety and environmental regulations

The industry has to contend with green energy movements and environmental regulations. There are several country-level regulations around air and water quality. Most Oil and Gas companies have cross-border operations and have to comply with a number of regulations on harmful emissions, greenhouse gases and offshore activities, in several countries. Increasingly, all leading Oil and Gas companies have to work in alignment with the Paris Agreement when developing solutions across functions – exploration, extraction and supply chain. There are also worker safety regulations and standards that they have to comply with.

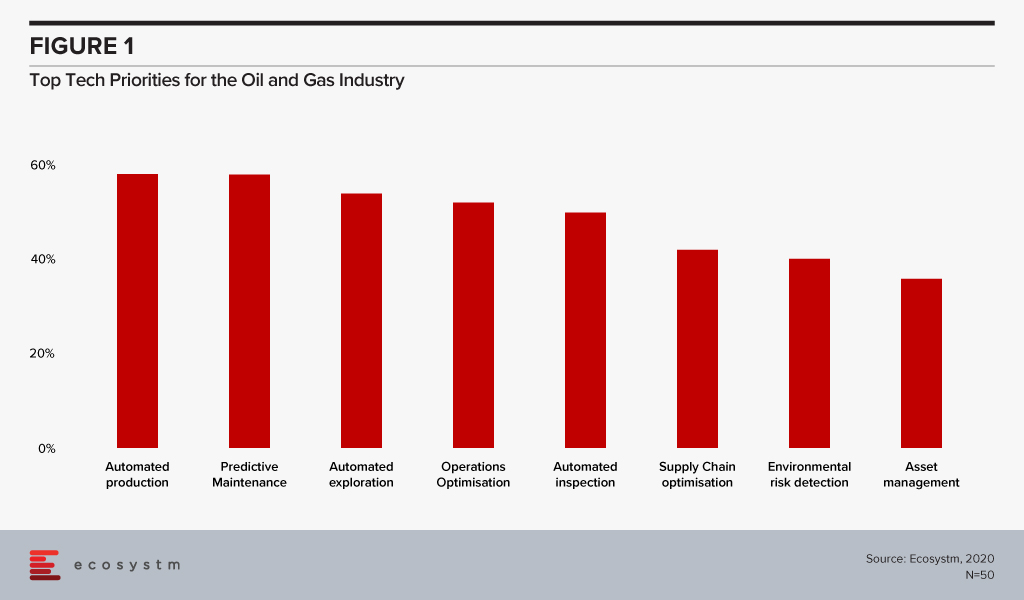

The global Ecosystm AI study reveals the top priorities for Oil and Gas companies that are focused on adopting emerging technologies (Figure 1). It is very clear that the key areas of focus are process automation, asset and supply chain management and compliance.

Technology as an Enabler of Oil and Gas Transformation

Several emerging technologies are being used by the Oil and Gas industry as they continue their struggle to remain competitive across the different stages of operations – upstream, midstream and downstream.

IIoT

As the costs of sensors go down, connectivity widens and computing power increases, the industry is seeing greater uptake of Industrial IoT (IIoT) solutions. From wearables (to monitor employee safety) to drones with smart cameras (for remote inspections, environmental monitoring), IoT solutions have an immense role to play in the Oil and Gas industry. The industry has had to be cautious about the choice of devices, however, due to pervasive inflammable hydrocarbons and the related regulations.

Not only are they implementing sensors, Ecosystm research finds that 30% of Oil and Gas companies are also leveraging the IoT sensor data for analytics and intelligence. A common application is in predictive maintenance. Two years ago, Chevron launched predictive maintenance solutions in its oil fields and refineries. While the pilot ran on heat exchangers, the company aims to connect all assets by 2024 and expects to save millions on asset management.

AI

AI and machine learning have applications across Oil and Gas operations, leveraging IoT sensor data. “Smart fields” where production is monitored centrally, has a high level of automated controls. AI/Analytics is allowing companies to run simulations, use predictive data models and identify patterns to gauge risks associated with new projects. This has an impact on production, exploration and making efficient use of existing infrastructure. Oilfield services company Baker Hughes has worked on an AI-based application that allows well operators to view real-time production data and predict future production with more accuracy.

AI is also helping organisations monitor environmental risk and has the potential to help Oil and Gas companies with their compliance requirements. Gazprom Neft, one of the largest suppliers of natural gas to Europe and Seismotech are exploring using AI for seismic data processing, for solutions that are specific to the needs of the industry.

While the applications of AI in the industry are often focused on upstream activities, AI has applications across all operations. In the midstream, transporting crude oil to refineries has always had its unique challenges. Since transport lead times are long and prices fluctuate based on the availability of products, organisations benefit from demand forecasting and price risk modelling. While the common perception of the industry does not include customer interactions, the truth is that the industry is increasingly focusing on the retail space. The need is enough for Shell to begin experimenting with virtual assistants as far back as in 2015, to interact with their retail customers. In fact, the company anticipates a higher adoption of AI in the industry and is collaborating with Udacity to bridge the skills gap.

Technologies empowering employees

As discussed earlier, one of the key challenges of the industry is the inability to manage a reliable knowledge management system that can help consistent knowledge and skills transfer. A single source of truth that can be accessed by all employees on processes, including safety requirements has an immense role to play to help with the skills shortage in the industry.

Enterprise mobility is another tech area that holds immense potential for the industry, with its huge proportion of mobile workers, many in remote locations. Mobility solutions can help in productivity, process optimisation and monitoring of health and safety of the employees and are increasingly incorporating wearables and location-based services. GIS and GPS systems are helping employees with accurate directions, easier access to drilling locations and more. Given the number of devices, platforms and OSs, the industry is seeing an increased interest in unified enterprise mobility (UEM) solutions. Ecosystm finds that more than a third of Oil and Gas companies have implemented or are evaluating UEM, while another 20% are expressing early interests.

Blockchain

The sheer quantity of documents, transaction records and contracts that a typical Oil and Gas company has to manage – including cross-border transactions – poses some difficulty for the industry. The companies have to reconcile and handle issues involving multiple contractors, sub-contractors, and suppliers. Supply chain and inventory management is also a challenge. With the adoption of Blockchain, the industry can automate the management of purchase orders, change orders, receipts, and other trade-related documentation, as well as inventory data with more efficiency and transparency. Blockchain is enabling a seamless supply chain, improved project management and simplifying contractual obligations at each point along the way. Gazprom Neft’s aviation refuelling business is an early adopter of Blockchain-based smart contracts. All refuelling operations are undertaken exclusively on the basis of digital contracts approved by both parties near real-time and eliminates the possibility of any breach of contract and makes the accounting process more transparent.

As the market continues to be volatile for Oil and Gas companies and uncertainties loom in the future, the industry will increasingly depend on technology to remain competitive.

One of the most important industry verticals that the Internet Of Things (IoT) is quickly enabling is buildings. To date most of the analyst coverage has been focused on smart building and building management systems collecting sensor data on lighting, temperature monitoring, and occupancy. While IoT device, connectivity, platform, management and integration vendors have marketed their hardware and software differences, the unsung heroes of ‘Smart Buildings’ should be the Facilities Management (FM) assets that have the most influence in the true IoT ecosystem. FM covers a lot of segments in commercial buildings – retail, restaurants, grocery/supermarkets, spas and gymnasiums, retail healthcare and many more and as such these segments create large quantities of business related data from sensors within them. Today’s FM has successfully moved from simply managing ‘boxes’ to managing smart connected facilities.

This week I attended ServiceChannel’s ServiceX19 customer event in Scottsdale, Arizona where 300 ServiceChannel customers were treated to an update on the current and future state of FM. Annually, ServiceChannel’s customers raise over 100 million work orders, across 330,000 locations, fulfilled by 50,000 contractors in 75 countries. Equally impressive is that these customers are responsible for over $37 Billion spend on keeping building clean, bathrooms working, air conditioners heating and chilling, refrigerators cooling, lights switch on and so on.

Through their Facility Management Platform, which behaves like an online market place for their customers, ServiceChannel is rapidly becoming a valuable analytics and data management software company. Work orders are an incredible source of information for every asset connected into a building that requires any level of service. Just like State Farm Insurance who ‘know a thing or two, because we’ve seen a thing or two’, ServiceChannel have seen ‘a thing or two’ such as work orders to deal with alligators and of course cars crashed into shop fronts! However, some examples of more traditional analytics use cases include the following:

- Predictive repairs on capital intensive equipment is being decided by the facilities manager before the original equipment manufacturer.

- By using ServiceChannel’s comprehensive data visualisation capability, facilities managers have the ability to identify measure the difference between spending on preventative maintenance versus post failure repair.

- Individual service fulfillment analysis can often show that engaging with the least expensive hourly rated contractor may not always provide the best outcomes.

Over time ServiceChannel’s data collection and analytics is enabling their customers to have visibility into their businesses that go beyond FM. ServiceChannel is enabling their customers to become more digital and creating higher value business outcomes. While IT and equipment manufacturers have tried to create digital ecosystems and attract participants into their network, they are still one step removed from the customer. This gap means that they are not truly able to help manage the customer experience within smart buildings. Rather, companies like Service Channel have access to the heterogeneous asset environments by working directly with facility managers. During the conference, I saw service records comparing the major HVAC vendors within a large retailer and immediately thought that individual HVAC vendors would be very interested to see how they stacked up against each other. The ServiceChannel connected asset analysis gives their customers the information that enables discussions based on transparency, trust and truth – which is a powerful negotiating tool.

Conclusion

The event showed a reality state of the IoT associated with analytics in an industry that is reinventing itself through enabled assets connected to their work flow systems. It clearly showed that the Smart Buildings industry is probably about 2 years behind the roadmap set out by the major IT research firms. Businesses are now beginning to understand what IoT is even if they do not call it by that name. Connected assets are becoming more familiar and the value from analytics is being realised to run businesses. Customer experience is now a tangible metric!

Separately, as ServiceChannel’s analytics engine matures and external data sources such a weather and environmental conditions are curated with asset management, then facility managers become more valuable to the CFO, the CIO and the customers they serve. To date equipment vendors’ attempts to build ecosystems of IoT-based partners has been met with limited success because they are still not close enough to the end customer. Original equipment vendors should make their products connected to an IoT infrastructure network as easily and as quickly as possible and then partner with companies like ServiceChannel who can curate and promote their asset data.

I had the pleasure of attending the Industry of Things World 2019 in Berlin. Berlin has always fascinated me by its contradictory image – of modernity and traditionality. Their admired industrial companies can be conservative in terms of innovation and move slowly when adopting new technologies. However, once they decide to move, they move all at once and cause a significant change in the industry. And that is what I perceived at the event.

In Berlin, companies know what Industrial IoT (IIoT) is and IIoT solution providers’ efforts focus on how to implement IIoT. The level of adoption in the DACH and Nordic regions is higher than in other European regions but still remains low, especially in small and medium enterprises (SMEs).

The first thing that was highlighted at the event is that AI has not devoured IoT. Organisers do not try to fill auditoriums and beat attendee figure records with other parallel events of AI, Blockchain, AR/VR, 5G, DevOps and so on.

It was interesting to listen to both tech buyers and vendors sharing their news and vision – clients such as Rolls Royce and thyssenkrupp sharing their implementation experiences and giving recommendations on how to succeed in IIoT projects and; IIoT vendors such as Cumulocity IoT, HPE, AWS, Siemens or Huawei presenting their capabilities. All of them are clear that IIoT must be part of a new paradigm of business systems integration.

Key Takeaways:

- In the several round tables that I attended, the ideas and conclusions presented were very educative. It was good to listen to the main actors (the actual companies implementing IIoT) talking about their challenges, requirements, solutions and desires. Most of the CEOs are in consensus on their priorities in IIoT investments: ROI, Performance and Quality.

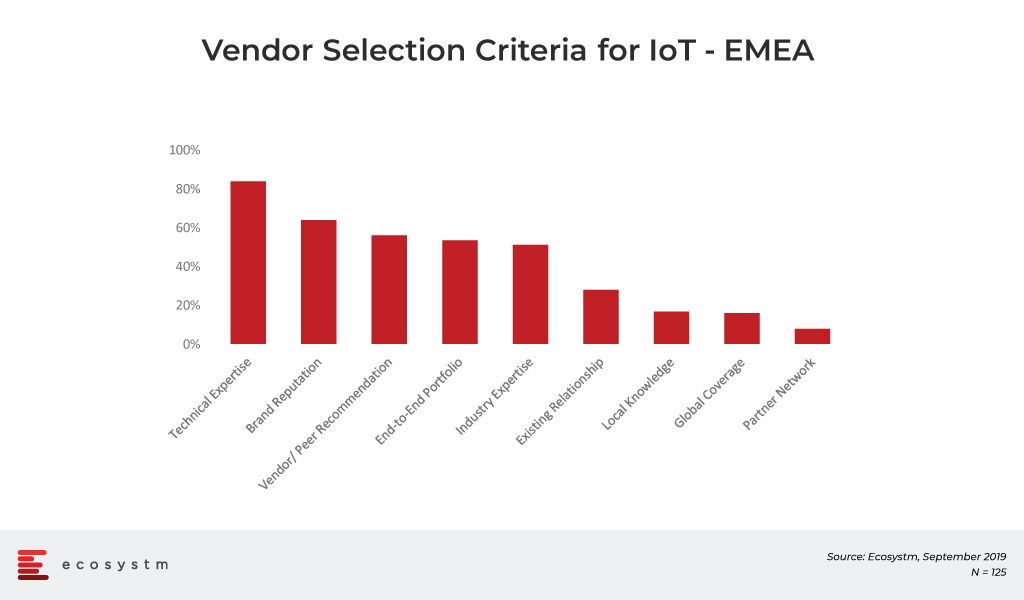

- I validated with organisations the results of the Ecosystm IoT study regarding their vendor selection criteria for IoT projects. This ties back to their IIoT investment priorities. They are likelier to choose vendors that can deliver on all 3 of their priorities.

- The most realistic statement about IIoT came from the HPE speaker, “Don’t look for disruptive companies like Uber in the Industrial Internet of Things market.” Here the new business models will take time to emerge. Other exhibitors and visitors, that I had conversations with, agreed with this idea.

- Fortunately for the IIoT market in Germany and Europe at large, China continues to adopt these technologies at a similarly slow pace. Although China may be more advanced in digitalisation (in ePayments for example), when it comes to IIoT, they are as conservative as Europe. This gives us a window of opportunity to continue to evolve our offerings, in the region.

- Another recurrent theme through the event was the inability and hesitance of the CEOs/ CFOs/ Boards to understand the potential of data-based collaboration between companies and industries and how they continue to kill any data sharing/open data initiatives. Walled gardens should not be a medium-term objective.

- The presence of start-ups and enthusiastic entrepreneurs was very heartening – and while I could not speak with all of them, CloudRail, Juconn, TechMass , Ekkono and WolkAbout stood out in my opinion. And of course there were some IIoT Platform vendors such as AWS, Cumulocity IoT, Device Insight, Relayr and Waylay. As I have said many times it is not necessary to analyse 400 platforms – for each local, regional or global enterprise there is a maximum 3-4 platform superheroes vendors to select.

- I had some conversation on IoT connectivity with LumenRadio, SigFox and Multefire However the session discussing the impact and need for 5G in IoT was shallow because the speakers only covered high level use cases and benefits of 5G and how the German government is working on security requirements for end-to-end 5G services.

- Finally, it was great to hear people talking about IoT lifecycle management. It has become clear that IoT is real and is here to stay. Some companies have already passed the Proof of Concept stage. This reassures us that IoT is not just ideas, development and pilots. IoT projects are going beyond and thinking about operations and maintenance.

Congratulations to all nominees in the first Industry of Things World Award ceremony. The winners were Fette Compacting in the category, Best Implementation of IIoT Technology on the shop floor and BAM GmbH up2parts in the category, Best IIoT Product or Service.

One final observation on the event is the disparity in the number of men and women attending. I got the impression that not many women are involved in IIoT or at least they do not attend events such as this. I hope that skills training and the market potential will attract more women to this industry in the future.

So dear friends, contacts, followers and readers: in short, the event was a positive experience and I hope to see some medium-term outcomes in

For years, I have been writing about the promise and perils of the Internet of Things (IoT). In many of my articles, I described how the IoT could help transform society and kickstart the next industrial revolution. However, still many people and enterprises are not deploying IoT. We still cannot define in a unique and clear way what IoT is, much less explain how it will change our lives, without using the example of the smart refrigerator!

Why are we still at a loss with IoT? Let´s explore.

Lost in IoT Connectivity

With so many IoT connectivity options in the market, choosing the right one for your project can be complicated. It is a scary thought that billions of devices could be connected in a few years to decentralised IoT networks, with no interconnectivity between them, unless we use millions of edge nodes that transfer messages between devices connected in multiple networks. If it is already difficult to justify the ROI of a use case using a single type of connectivity – it is almost impossible to justify that these devices will need to communicate with other devices on different IoT subnets.

It seems that it is easy to get lost in so much connectivity technology. Isn’t that true?

Lost among hundreds of IoT Platforms

At least we can already intuit some of the platforms that will survive among the 700+ that some analysts have identified. I have only been able to analyse about 100 of them in some depth. Surely my methodology of Superheroes and Supervillains will advance the end of most of them.

It is no longer just one IoT Platform. Although they want to make it easy for us, companies like AWS, Microsoft or Google add concepts such as Serverless, Data Lakes, AI, Edge Computing, DLT and all the artillery of Cloud services to the core features of the IoT platform. It is easy to get lost in the architecture.

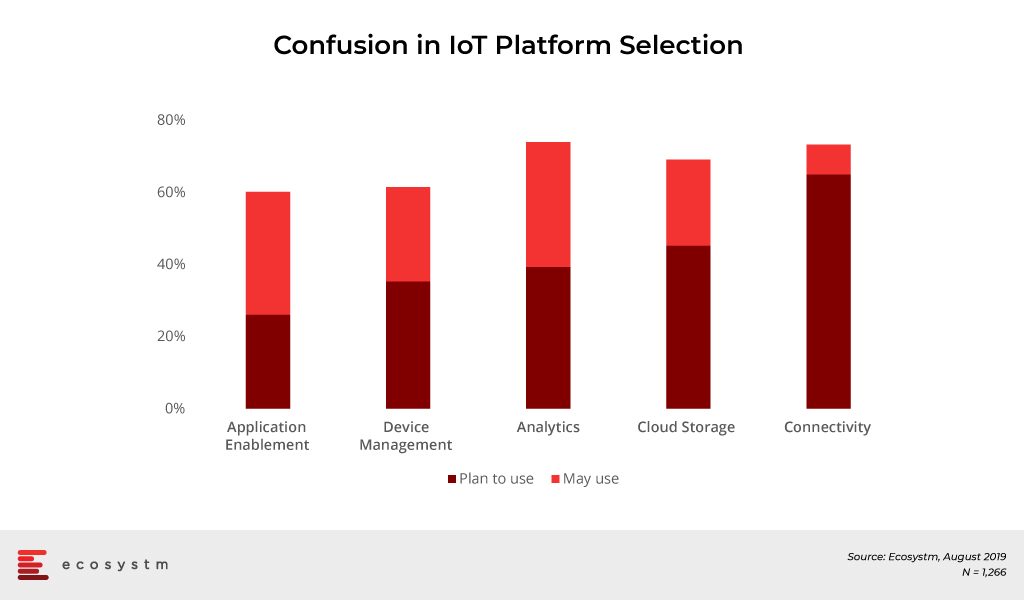

Data from the global Ecosystm IoT Study shows this confusion in selecting the right platform for future adopters of IoT. Same organisations indicate that they will use or at least evaluate several platforms.

Initiatives such as Verizon’s focus on connectivity and systems integrators abandoning their in-house developments to embrace leading vendors’ offerings, will reduce some of the confusion around IoT platforms.

Lost between the Edge and the Cloud

In “Do not let the fog hide the clouds in the Internet of Things”, I had warned about the degree of complexity that Fog /Edge Computing will add to the already complex IoT solutions. Now nothing seems to be of great value unless Edge Computing is included.

The Babel tower of alliance and consortia is consolidating, but people still get lost in the acronyms. News such as the merging of the Industrial Internet Consortium (IIC) and the OpenFog Consortium (OpenFog) to combine the two largest and most influential international consortia in Industrial IoT, fog and edge computing, has been hailed by many. The Open Group Open Process Automation Forum (OPAF) is defining the next generation edge computing standards for industrial operators.

And again, the question arises, do all organisations need Edge to start an Industrial IoT project?

Lost in Proofs of Concept

Businesses are estimated to be spending USD 426 Billion worldwide on IoT hardware and software in 2019 alone. Yet, three out of every four IoT implementations are reported to be failing.

Microsoft launched a new research report – IoT Signals – intended to quantify enterprise IoT adoption around the world. The survey of over 3,000 IT team leaders and executives provides a detailed look at the burgeoning multi-billion-dollar segment’s greatest challenges and benefits, as well as related trends. Perhaps it is not surprising that 30% of respondents say their IoT projects failed in the proof-of-concept (PoC) stage, often because the implementation became too expensive or the bottom-line benefits were unclear.

There are technical reasons – for example the use of Rasberry Pi or Arduino boards in the PoC and then later realising that more expensive hardware is needed for the actual project. There are economic reasons when organisations try to escalate their PoC to real implementations and then the ROI does not look as good as in the pilot.

There are organisational reasons when leaders are failing to go all in. If you cannot get the CEO on board, then the probability that your IoT project will end at the PoC stage is almost 100%.

If you are lost in the PoC, these tips can help you implementing IIOT.

- Solve a problem worth solving

- Keep it quick and simple

- Manage the human factor

Lost in selecting the right IoT Ecosystem

Today no significant ecosystem or network of collaborators has emerged in the IoT arena in spite of early and very interesting efforts being made by several players. Since I wrote “The value of partnership in Industrial Internet of Things”, I have heard, read and repeated hundreds of times how important it is to belong to an IoT ecosystem and how difficult it is to choose the one that suits you best.

Those who have read my articles know that there is no company in the world, no matter how great it is, that can do everything in IoT. Creating an IoT ecosystem either horizontal (technology) or vertical (industry) requires a lot of talent managers able to maintain win-win transactions over time. And according to the results, it appears to me that it is becoming very complicated.

Remember, you are not the only at a loss with IoT

When it comes to achieving an ROI from IoT, businesses really need to rethink how they are deploying it and ensure that they can manage their sensors remotely, secure their assets, use the sensors and devices data to make better real-time decisions and monetise it. However, for that to happen and to prevent the IoT projects from failing, businesses need independent and expert advice at several levels to find the right people to lead the project and the right technology and partners to make implementations successful.

The nature of the workplace has changed over the years and so has the number of devices being used by today’s employees. More and more organisations are adopting a ‘Mobile First’ strategy – designing an online experience for Mobile users before designing it for the desktop/ Web. This is a paradigm shift from the past, where enterprises modified or adapted their websites, business processes and digital means of communications, to fit Mobile users.

Mobile First Drives the Adoption of UEM

Mobile First application designs take into consideration that Mobile users are constantly on the move. Information needs to be presented to them on smaller screens/displays with multi-media interfaces (voice/video), and multiple network connectivity options (Wi-Fi, cellular, and so on).

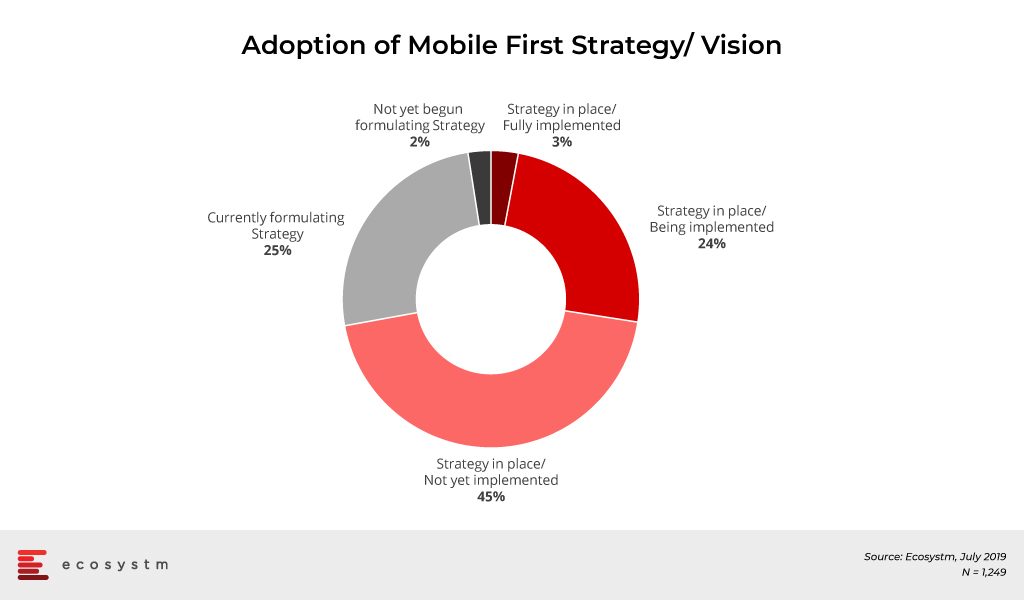

The global Ecosystm Mobility Study reveals that 73% of organisations have a Mobile First Strategy in place and are at various stages of implementation. About another 25% of organisations feel the need for a Mobile First vision and are formulating a strategy.

With Mobile First strategies, organisations are adding a wide range of devices and operating systems (OSs), regular innovative mobile-centric workload rollouts, new mobile apps across multiple functions, and IoT initiatives. As a result, organisations now have the need to support multiple devices and endpoints (including IoT sensors and wearables) multiple OSs, applications, and mobility policies such as BYOD. Organisations struggle to manage these devices, their data, apps and software updates across heterogeneous OSs and platforms. “The way companies are growing and fuelling their teams with devices now, shows the trend that these organisations will follow in the next few years, which will require a higher level of sophistication from the Unified Endpoint Management (UEM) solutions in the market,” says Amit Sharma, Principal Advisor, Ecosystm.

How does UEM Help?

An UEM solution can configure, monitor and manage multiple OSs, devices including IoT sensors, and gateways, and

- Unify application and configuration

- Manage profiles

- Monitor compliance

- Enforce Data Protection policies

- Provide a single view of multiple users

- Collate data for Analytics

It can ease the burden of management activity of internal IT teams and allow organisations to create a more streamlined lifecycle that secures mission-critical technology. It can also offer proactive threat monitoring, access control and identity, and patch management.

A good UEM solution provides IT managers with a transparent and traceable overview of all endpoints within the network as well as the power to manage all connected devices from a single platform. It maps out the network setup and structure by carrying out a complete inventory of all network devices, configurations, installed software, and the drivers for endpoint subsystems.

There are simply too many endpoints within Industrial IoT (IIoT) for IT managers to efficiently monitor manually. Mistakes will be made, and opportunities to stop breaches before they escalate will be missed. “An UEM solution not only shows the software and licensing situation but scans the IT environment for any irregularities or vulnerabilities and allows risk assessment and patch installation where it is necessary”, says Sharma. “Providing IT administrators with automated vulnerability management will enable them to filter and set search criteria by device, security vulnerability and threat level for the higher and most timely degree of protection.”

Industry Adoption of UEM

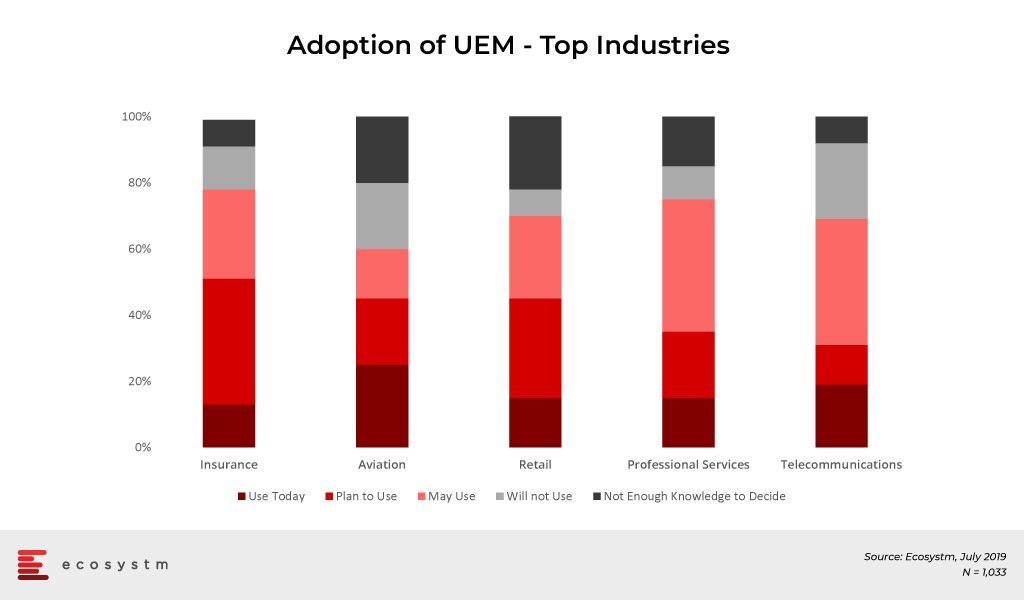

Customer-focused industries, with mobile workforces, are adopting UEM faster than other industries. The global Ecosystm Mobility study found the top industries that have implemented UEM or plan to in the near future. Most of the top industries cater to a high percentage of mobile workers. Their need to adopt UEM can come from different angles. According to the study, the Telecommunications industry leads in Mobile Content Management (MCM) adoption, and mobile apps for logistics and operations appear to be the key driver for the industry uptake of Mobile Applications Management (MAM).

Other industries to look out for in the future are Banking and Healthcare, as they lead the pack when it comes to MDM adoption. Banks are incorporating technologies, such as mobile banking, and enabling payments via smartphones to provide enhanced services to customers. We have also seen the advent of Smart Point of Sale devices which are managed remotely on cloud infrastructure and these millions of devices will also be required to be managed by the banks that issued the devices.

The healthcare industry is another vertical where we can expect a higher uptake of UEM in the coming years. Clinicians and care providers are increasingly mobile, switching from device to device, depending on the task and location. Accessing mHealth applications and patient data from any device securely enables caregivers to focus on patients and outcomes. It also allows them to complete critical tasks from any device whether they are on call or off work. UEM makes HIPAA, SOC 2 and other healthcare regulation compliance easy for the providers.

Challenges of UEM Implementation

User experience must be at the centre of any mobility initiative. If the device, app management, or content is not something users want or are able to use, then it simply will not be adopted. The success of an UEM solution lies in the ability of users to quickly authenticate and gain seamless access to corporate apps and data from their devices. Users should also have access to self-service tools that help them manage basic device features and troubleshoot problems quickly.

“We can expect most Enterprise Mobility Management (EMM) and MDM suites to migrate to complete UEM suites that manage personal computers, mobile devices and Internet of Things (IoT) and Enterprise of Things (EoT) deployments,” forecasts Sharma. “Organisations should look for a purpose-built UEM solution which is platform-neutral and which cultivates a thriving ecosystem of complimentary mobile solution providers.”

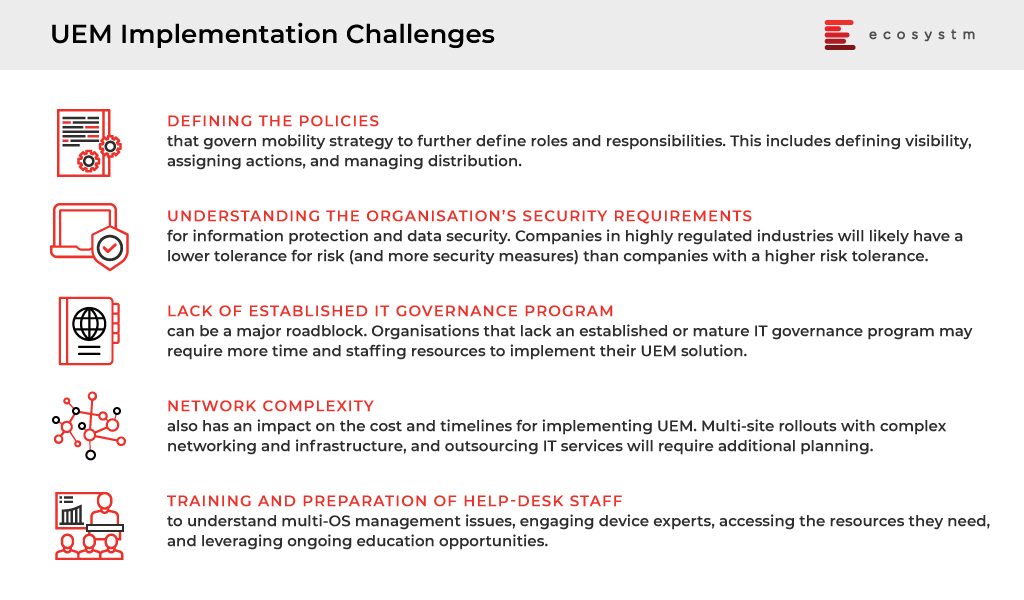

However, there are several challenges that organisations face when they are developing and deploying an UEM solution. Sharma lists the top UEM implementation challenges that can be broadly classified into the following five categories.

“As AI finds its way into mobile devices and virtual personal assistants proliferate in offices and boardrooms, IT admins will have to manage more – and more sophisticated – endpoints. AI will continue its push into mobile hardware and enterprise communication devices, challenging IT shops’ EMM capabilities while at the same time offering potential security benefits.” Sharma adds. “Also, in 2019, voice-activated assistants such as Amazon Alexa and Cisco Spark Assistant will find their way into more corporate offices and conference rooms – becoming yet one more enterprise device encouraging the adoption of an UEM strategy.”

Have you adopted an UEM strategy in your organisation yet? Share your experience with us in the comments section.

During the past 12 months, Cisco has worked hard at refining and relaunching their IoT strategy. Initial overall impressions of the progress are good with strong alignment with both Cisco and their customer needs. Launching IoT to three different audiences at Cisco Live Barcelona, Hanover Messe and Cisco Live San Diego was critical as it enabled Cisco to talk to network, industry and enterprise audiences in a focused and personalised manner. However, there are other market dynamics at play that will challenge Cisco’s IoT Edge strategy and ecosystem play. Both the progress and challenges are discussed in this review.

Overall Rating B+

Much of the 2018-2019 efforts may be collated under three main categories.

- Hardware. Establish a hardware foundation from which any IoT device or customer can reap the benefits of Cisco’s larger corporate strategy built around initiatives such as Cisco DNA Center, Intent Based Networking, ACI and Security. With the acquisition of Sentryo and the refresh and launch of their routers, Cisco is now well placed to have legitimate discussions with Industrial IoT or IIoT customers and prospects. Bringing IBN functions to the edge of the network will enable Cisco’s customers to begin to develop richer business outcomes from the network. Rating: A-

- Developers: Raise the availability of IoT-based applications through Cisco’s DevNet developer community. Cisco has a significant advantage over their competitors by having over 500,000 developers who understand how to write apps for Cisco’s product line and who now have access to new types of data that can enrich traditional network outcomes. Over time this advantage will become more and more valuable as data becomes utilised across markets as well as within markets thus creating wealth in a much larger ecosystem. Rating: B+

- Partners: Transform their partner management through the Customer Experience (CX) program. Much of Cisco’s business is conducted through partners. It is a critical success factor for Cisco to enable the partners to be IoT-data savy. IoT will enable Cisco to accelerate the transition from product sales to higher value subscription services. However, based on discussions with customers, partners and Cisco management, we believe that there is much more work to integrate an IoT strategy in to CX. Rating: B-

The Industrial IoT (IIoT) and Cisco

Cisco identified the IIoT market as one where Cisco’s strengths in hardware, software and partner ecosystem will play well with their customers and prospects. While having a strong foothold in the industrial space, we believe that Cisco’s success will be much dependent on the customer’s workloads and what they want to achieve with their data as it is reducing the complexity between IT and OT (Operations Technology) issues. Cisco has addressed the IoT connectivity and network security at the edge of the network through its ruggedized routers while their competitors are building distributed computing environments. Competitors who are adopting a full IT stack at the edge of the network aim to offer up more OT-based industrial services as well as emerging innovation services such as digital twin, augmented reality and robotic process automation. One key consequence of a customer choosing either approach will result in differing partner ecosystems to form and support the customer. These ecosystems will also be different in how they are managed and by who manages them.

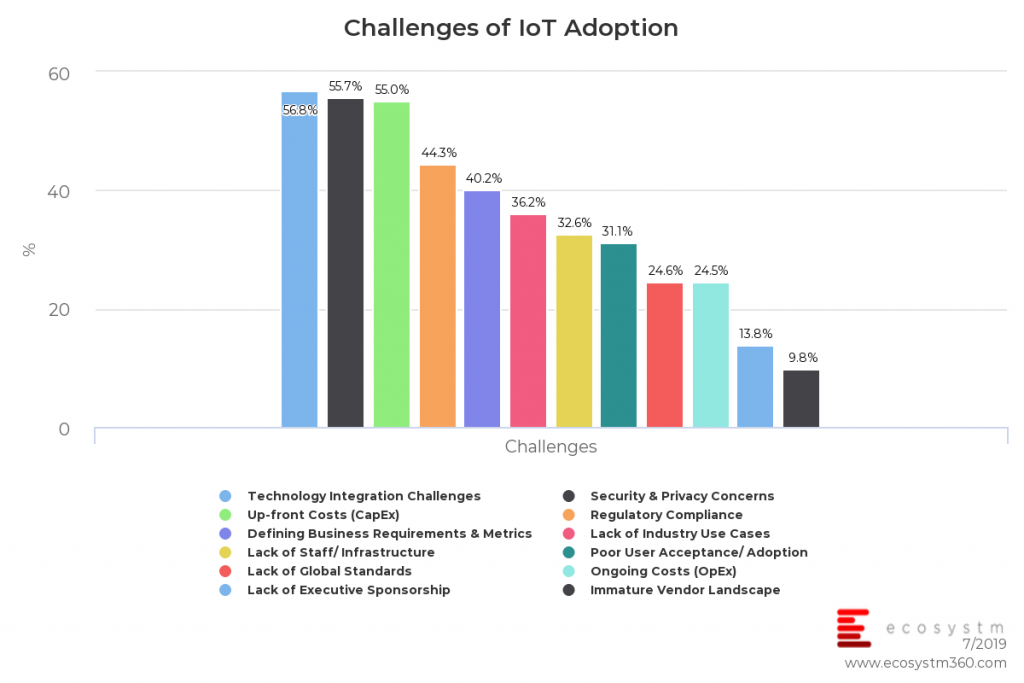

Our recent IoT study shows that while security (a sweet spot for Cisco’s strategy) remains extremely important to an organisation’s solution, technology integration is equally important. When vendors are considering implementing an industrial solution, they need to be able to provide an end-to-end solution that encompasses both the IoT Edge and the IoT Enterprise while smoothly bringing together the OT and IT procedures.

This all starts with an easy on-boarding of any IoT device that is secured and managed with confidence and reliability. The good news for Cisco is that these challenges are also a natural opportunity for Cisco’s partner organisation and systems integrators by creating a new styled IoT ecosystem. However, despite which hardware path an end-user takes, we believe that Cisco and others do not have all of the necessary components of the full ‘IoT’ stack to fulfil a complete solution. To that end, everything will pivot to the vendor who either has the better systems integrations partnership, or, plays in the strongest ecosystem.

IoT Services

Most of Cisco’s business is driven through partners and therefore any success for Cisco’s IoT strategy is dependent on how well they execute it. IoT will accelerate the shift from product based solutions to subscription/as a Service deliverables as more information is generated from the connected devices. and as such the Cisco partner community should be trained/incentivised to offer up IoT. Cisco partners are already undergoing their own business transformation as Cisco’s Customer Experience (CX) strategy is introduced to them. Having the IoT hardware align with the broader Cisco vision was critical to enabling any CX IoT strategy. However, partners may be in ‘transformation’ overload as they embrace the traditional Cisco customer needs and requirements and may be slower to take up the IoT opportunities.

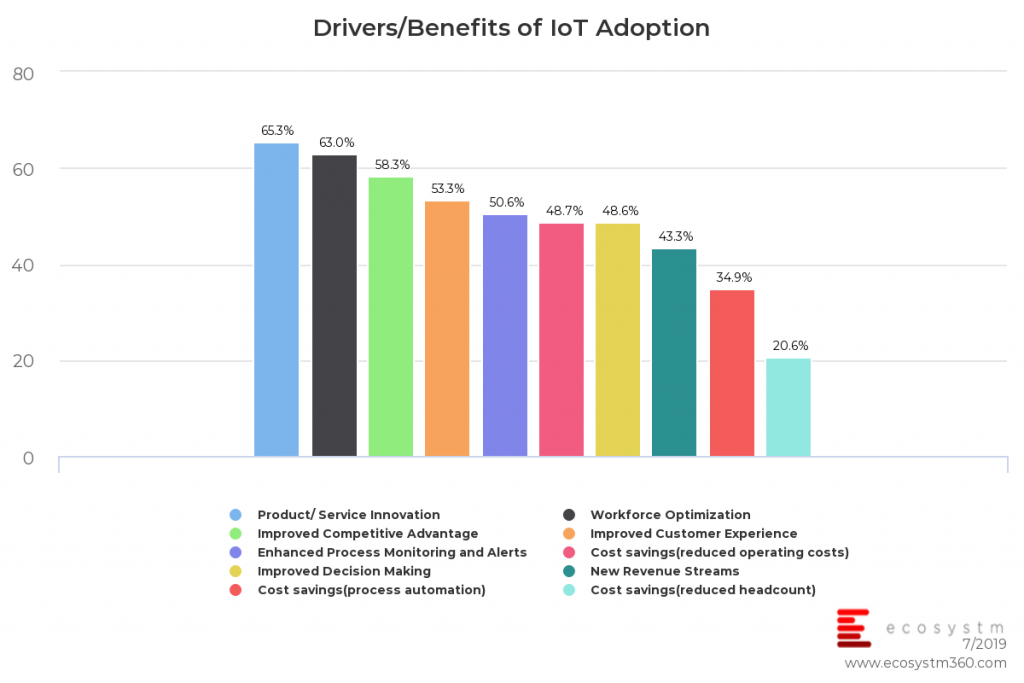

Our IoT study shows that customers believe that the transition from products to services innovation is the highest scoring benefit from an IoT implementation.

However, this is a difficult but critical part of any company aspiring to become a digitally driven business. An IoT strategy is a corner stone of this vision as it will provide the data to be able to run a services or subscription-based business model

Cisco is well positioned here but there is a maturity and readiness gap between Cisco and their customers. Patience will be a key asset as Cisco and their partners close technology gaps for their customers (e.g. adopting and implementing widespread analytics as part of the corporate digital strategy. Most customers are not ready to take advantage of IoT-based analytics outcomes and therefore the RoI case has not been fully articulated).

Finally, Cisco needs to address the mid-tier market with solutions that are compatible with budgets. While it is important to have an ecosystem of high calibre partners within systems integrators, we feel that there will be many customers who cannot afford Cisco’s end-to-end solution. As a result of this Cisco partners are still not ready to address the mid-tier market. Cisco will need to promote offerings across all markets by participating in high-, mid-, and low-end ecosystems. This may mean acknowledging non-5G licensed spectrum/ non WiFi solutions for the most cost sensitive customers for the sake of broader market and industry share.

Recommendations For Cisco IoT

The following are our recommended actions for Cisco IoT based on C-Scape and the prior 12 months of strategy rollout:

- Create stronger value proposition for network based IoT business outcomes. Customers are asking for end-to-end validation which means that Cisco needs to articulate a role with the likes of Salesforce, SAP and Microsoft to enhance customer’s enterprise management systems. This is where Cisco’s CX and partner organisation will also be challenged but can open up a lot of opportunity. Move the message up the value chain. More work has to be done with CX. More has to be done with developers.

- Articulate a stronger comprehensive Industry 4.0 solution that gives customers all of the application qualifiers to run on Cisco’s hardware. Cisco will be challenged by the IT-lead distributed IoT compute stack over its industrial strength routers. More marketing has to be invested in the IoT Edge campaigns.

- Segment the IoT market by customer maturity/readiness/size and their IoT connected assets. Based on asset churn and customer size will dictate the type of new IoT ecosystem that Cisco will either build, manage or participate. For example, an IoT solution of Capex intensive assets with longevity is very different for agriculture supply chain management. Segmentation is critical for Cisco to be successful.

Internet of Things (IoT) is changing how companies do business, across industries. Using connected sensors, better data processing capabilities and automation, industries are looking to achieve workforce optimisation, improved customer experience, and cost savings in the short term. In the long-term organisations are looking for service and product innovation, as well as a competitive edge from their IoT investments.

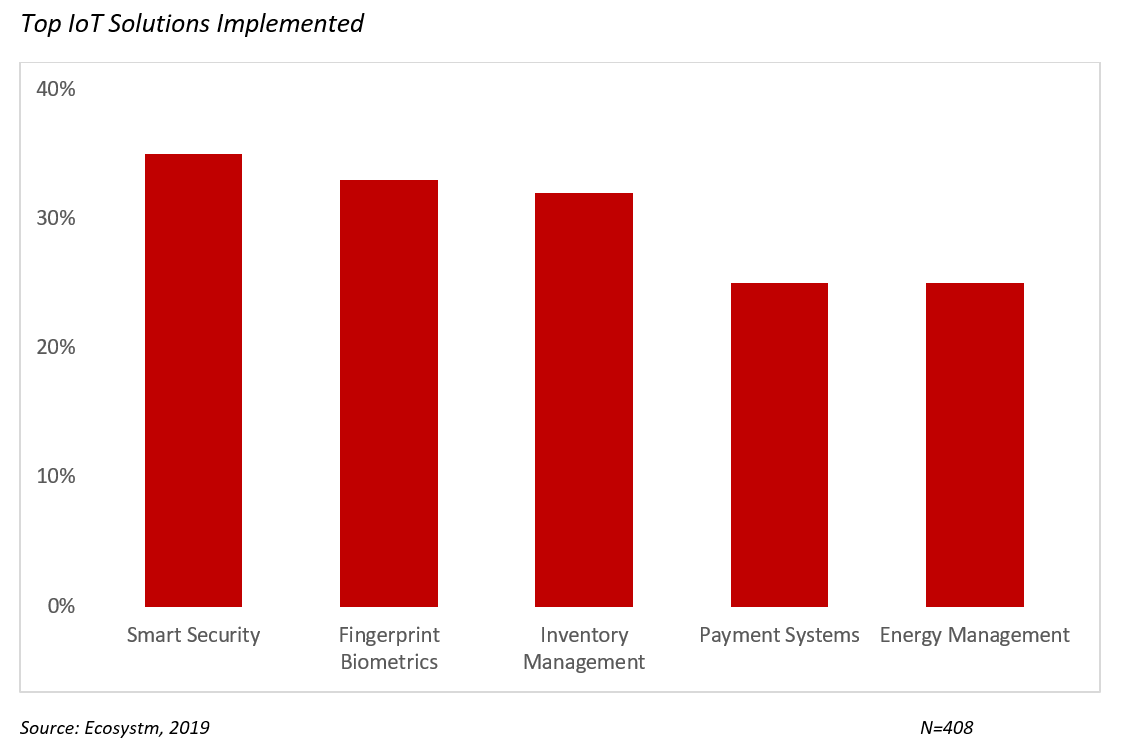

In the global Ecosystm IoT study, participants revealed the IoT solutions that are part of their larger IoT deployment projects. Here are the top 5 solutions that industries are implementing, and how they are benefitting from them.

Smart Security

Smart Security is being adopted in several enterprises, especially in the Financial and Hospitality industries. Aside from improved safety, Smart Security solutions have the potential to deliver more personalised service and better customer experience (CX).

Maintaining security for the guests is one of the top concerns for hotels and smart video surveillance systems, motion detection, audio detection, and alert systems are helping hotels to identify possible threats and get early alerts on potential events.

Hotel chains Hilton and Marriott are leveraging Smart Security IoT solutions to create better travel and stay experiences for guests. They are working on creating enhanced security for their visitors by replacing card-based door keys. Simultaneously, smartphone applications connected with hotel sensors and devices are offering a seamless experience to guests with automated room settings such as HVAC, lighting, and blinds.

The Banking industry is incorporating Smart Security as well. Banking and financial institutions attract criminals for obvious reasons and to improve security, smart CCTV surveillance, wedge barriers, laser scanner detectors, light barriers, and quick folding gates are embedded with sensors and connected to safeguard against potential attacks. IoT-enabled network security measures to provide intelligent Perimeter Security is also seeing an uptake in the industry.

However, the proliferation of ubiquitous devices also leaves organisations vulnerable to data breaches. Digital and electronic devices incorporated into a hotel’s infrastructure can be exploited by hackers or may jeopardise the security of guests. The now-famous incident of the casino in the US that was hacked into through the IoT-enabled temperature control system in the fish tank is a case in point.

Fingerprint Biometrics

While Fingerprint Biometrics is often a part of a Smart Security solution, it is being used more often for asset management, as well as access control. This is fairly common in industries where multiple people fill a particular role, such as Manufacturing, Retail, and Healthcare. In hospitals, for example, multiple clinicians work on the same patient order entry system. Using fingerprint biometrics ensures that there is full accountability for care delivery at any given point, irrespective of the clinician.

Biometrics and its application are redefining the banking experience for rural and the unbanked population – in emerging countries especially – as one of the key authentication methods. Biometrics is helping in e-KYC, often used to open a bank account, on-site cash delivery by scanning fingerprints, opening a bank’s wallet with fingerprint authentication, fingerprint-based ATM kiosks and fingerprint mobile ID all connected through the IoT Solutions.

Governments use fingerprint biometrics to accurately authenticate the identity of travelers, implement biometric voting systems for fair and credible elections, develop fingerprint-based national identification cards and create a composite individual identity. But with this advantage, there could be associated challenges of managing personal databases in a safe and secure environment.

Inventory Management

Better supply chain visibility and management is considered one of the most common benefits of IoT deployments, and has use cases in several industries, including Transport & Logistics, and Primary industries. Inventory management became a lot easier and reliable, when IoT sensors and devices can do remote stock taking and track inventory movement.

IoT will enable more holistic inventory management, as asset tracking, asset management and eventually predictive maintenance, are incorporated within the IoT system. Supply chain requirements of Manufacturing organisations can vary vastly – a discrete manufacturing supply chain will vary from a FMCG supply chain. IoT sensors have made ‘track and trace’ more reliable, and easy to customise. eCommerce giant Amazon’s inventory management and warehousing system is a good example. To manage the large stock, the storage facilities employ pickers (robots) to pick items from and replenish stock on shelves which in turn improves receiving, pick-up, and shipping times. The inventory is scanned through barcodes which also helps in aggregating information from other warehouses for stock maintenance.

Several Retail organisations make full use of IoT for inventory management. G-Star Raw, for example, uses garment RFID tags to track inventory movements across the supply chain and store shelves. Being able to locate clothes on the basis of style, colour and size in the stores makes the order fulfillment reliable and more real-time.

Payment Systems

Several industries other than Financial Services, such as Hospitality, Services, Healthcare and Government are evaluating IoT-enabled payment systems such as mobile points of sale and NFC payments.

On most occasions, these are being promoted by financial institutions. As an example, MasterCard has created a Mastercard Engage platform with technology partners resulting in innovations which include contactless payments (with Coin), smart refrigerators that can re-order groceries (with Samsung) and IoT-connected key fobs (with General Motors). Capital One has made it possible for its customers to pay bills via Alexa, whereas Starling is experimenting with integration with Google Home to enable queries on payments and balances on the Google Home platform.

There are also several use cases that are not so obvious –Amazon Go offers a shopping experience where no check-out is required. Your Amazon account, wallet and phone are all inter-connected. When a consumer arrives at a store the application allows store entry, tracks the consumer through the shopping journey and requires no formal check-out at the end of the shopping trip.

However, IoT-enabled payment systems will have to evolve as industries become increasingly services based. There needs to be a focus on the business and not just technology – defining workflows with the right alerts that will automate bill generation and the payment process, irrespective of how complicated the service delivered is.

Energy Management

Resource shortage and the ever-increasing price of energy has forced organisations to identify innovative ways of conserving energy. A Smart energy management system can help to reduce the costs and energy consumption while still meeting energy needs. IoT is helping companies to achieve their energy goals, predict maintenance needs, and increase the reliability of energy assets. Smart energy solutions continuously analyse energy data to ensure dynamic performance which in turn manages energy requirements.

Take an example of a smart building management system where date from various sensors is collected and analysed, such as from HVAC, air-quality monitors, and other equipments, and lighting, heating, air ventilation, elevators, room equipment are remotely operated according to the building energy requirements at the moment. This technology helps make smart decisions and provides energy efficiency.

Capital Tower in Singapore, a 52-storey high building, is not alone in being energy efficient. It has a number of in-built smart energy solutions for energy and water efficiency. The building has motion detectors in elevators, smart car parking system, exterior structure glasses which help reduce energy consumption, and water conservation through condensation of air conditioning units. The building has devices to monitor oxygen and carbon dioxide levels ensuring optimal air quality which results in significant energy savings while delivering comfort for tenants.

As is clear from the solutions that are being currently deployed, IoT adoption is at its nascency. As IoT deployments mature, there will be more industry-specific uses of IoT, and a shift of focus from asset management to people management (including customers).

What IoT solutions do you use/ intend to use in your organisation? Let us know in your comments section below.