Recognising FinTechs that are changing lives, creating impact, demonstrating innovation, and building ecosystems to shape the Digital Future.

CATEGORIES:

Global Platform. Organisations that provide a platform to bring together industry stakeholders such as financial services institutions and FinTechs to drive ease of collaboration and innovation by accelerating proof of concept deployments

Financial Inclusion Impact. Organisations that promote financial inclusion in the unbanked and the underbanked with a focus on bridging the economic divide

Sustainable Finance Impact. Organisations that promote sustainable finance and have ESG values

Global Banking. Banks and financial services organisations that embrace digital technology for excellence in customer experience, process efficiency and/or compliance

Global Payments. Innovative use of technology and business models in payment areas

Global Lending. Innovation in alternative finance in areas such as microfinance for individuals and small & medium enterprises, P2P lending and crowdfunding

Customer Experience. Organisations that are driving an exceptional experience for their customers and setting new benchmarks within the industry

Global InsureTech. Excellence and innovation in InsureTech in areas such as micro-insurance, usage-based pricing, process optimisation and underwriting efficiency

To find out about the winners, read on.

To download Ecosystm Red: Global Digital Futures Awards for FinTech Awards Winners as a PDF, please click here.

Innovation is at the core of FinTechs. The Financial Services industry has been disrupted over the last few years because of the innovation and customer experience that FinTechs offer. But the FinTech world has become highly competitive, and there are many companies that do not make it, despite the innovations.

There are many factors that contribute to the success of a FinTech – and creating the right market differentiation is one of the key factors. This Ecosystm Snapshot looks at how FinTechs – such Earnest, Flock, Billd, Littlepay, Willa and AffiniPay – are disrupting industries as they build solutions targeted at those specific industries, to create the market differentiation required to succeed.

The appetite to adopt Open Banking solutions has increased, largely expedited by the pandemic. As consumers look for more digital engagements and better rates and services, they are more open to giving third-party providers access to their financial information that has traditionally been held by their banks.

The success of Open Banking initiatives depends on the Banking and FinTech ecosystem coming together to create an end-to-end digital architecture.

This Ecosystm Snapshot discusses some of the evolving trends in Open Banking, such as product differentiation by FinTechs to address a competitive market; the banking industry’s need to adopt digital and foster innovation; market entry by other industry leaders; and the need for trust in Open Banking adoption.

We cover recent announcements by companies such as Lloyd’s Bank, Mastercard, Batelco Financial Services, CarFinance 247, Credit Kudos, Prometeo, APImetrics and tomato pay.

The global insurance industry today faces several challenges – starting from the shift in the demographic patterns and the disease burden, to managing an ever-growing agent ecosystem, to responding to customer expectations. The advancement in technologies and their adoption is creating opportunities for insurance companies to modernise and reinvent themselves through new product and services offerings and by evolving their business models.

Drivers of Transformation in the Insurance Industry

- Global Competition. Over the last few years, leading insurance providers have been looking for a share of the global market and are no longer content with their traditional domestic markets. They especially want to get into markets where there are fewer players and/or larger population. The Indian insurance industry, for example, has seen a number of new private entrants over the last decade, attracted by the large population base and by a high percentage of young population. Many of the leading global insurance providers have partnered with Indian counterparts for a presence in the market. The story is similar in several emerging economies. While the presence of insurance providers is good for the future sustainability of a country, the market is extremely competitive. Investing in technology can be the key differentiator in capturing a larger share of the pie.

- Customer Expectations. Today’s customers are tech-savvy and expect a certain level of service and at their fingertips too. Moreover, easy access to the internet equips them to do basic research to evaluate their best options. The Fintech revolution also impacts the customer base, as they expect services such as instant approval and prefer to purchase items only when they require them. This ‘on-demand’ market has fueled the microinsurance industry and opened the gates for smaller providers.

- Regulatory Requirements. In the aftermath of the financial crisis of the previous decade and with new entrants in several countries, regulatory authorities are working on an overdrive to bring better accountability to the insurance market. Moreover, in most countries the regulations have incorporated market conduct guidelines aimed at consumer protection. Reporting, service level and fraud prevention requirements will see an increased uptake of technologies that can assist in fulfilling compliance requirements.

Key InsureTech Technologies

- IoT. The auto insurance companies were the first to leverage IoT and telematics to enhance navigation, safety and communication features that could help customise the premiums payable. The home insurance sector has already leveraged it using sensors and connectivity to assess and reduce risks to the properties they insure – large providers such as Allianz, Aviva and AXA have been working on their IoT ecosystem. This has immense potential for ‘usage-based’, personalised product and premium offerings in the health and life insurance industries (provided they work within the purview of compliance requirements). Ultimately sensors are not the most important technology in an IoT solution – the analytics solutions that can derive intelligence from the sensor data are. IoT+AI will give that much-needed edge to insurance companies.

- AI – Machine Learning. AI and machine learning make it possible for insurance companies to mine both structured and unstructured data. The use cases range from underwriting, claims management and personalised offerings through behavioural data and sentiment analysis. There are examples of early adopters in the auto industry – but again there are obvious and wider use cases, that can benefit risk modelling, pricing, customer acquisition, and agent and channel efficiency.

- AI – Virtual assistants/Chatbots. This falls right in with managing customer experiences. As customers expect more self-service (yes, the future will see less agents!) several insurance providers are using chatbots at several customer touchpoints, covering departments such as Sales and Claims. This will increasingly be the norm as smart phone (and app) penetration increases and the target base becomes younger. There are online-only insurance providers where clients interact with chatbots services and they are able to cater to a larger, untapped, mass market. There are more advanced adoption examples such as USAA’s use of intelligent personal assistant equipped with an NLP engine that have been trained with a deeper knowledge of policies. Virtual insurance agents will become more of a norm in the near future.

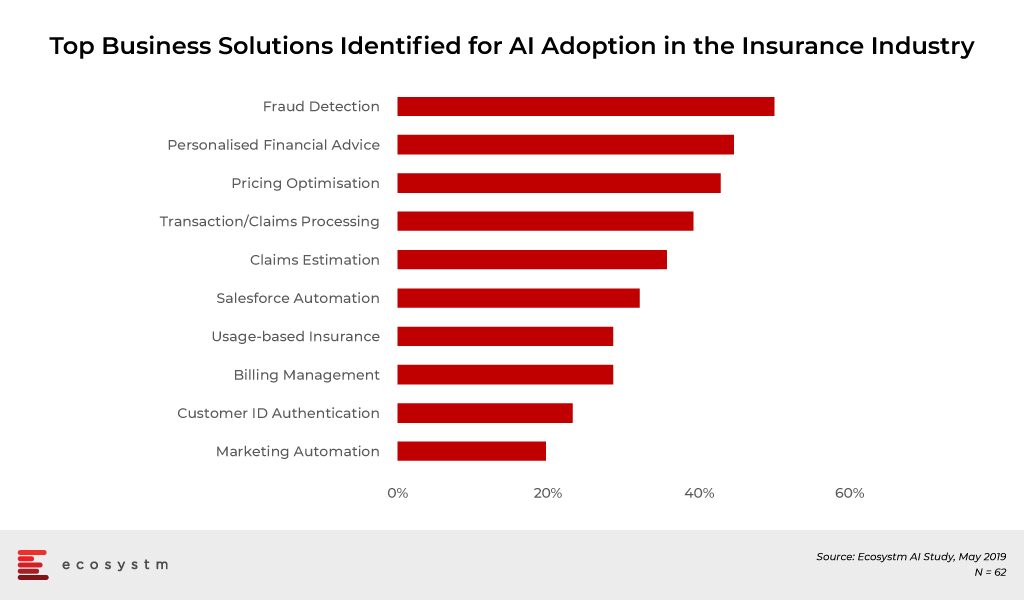

Which brings us to the important question on how insurance companies are planning to leverage InsureTech. Multiple stakeholders could benefit from InsureTech adoption. The Claims department appears to be a key stakeholder, focused both on fraud prevention and automation when it comes to transaction and processing. Sales and Customer Service appear to be next in line, where personalisation of product offerings would equip the teams better for a competitive market.

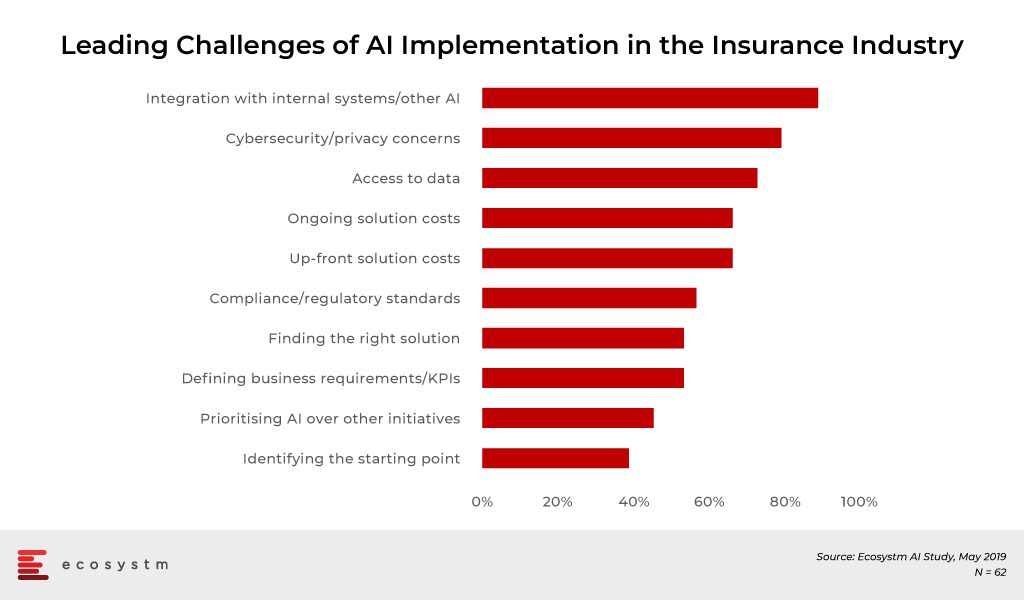

Challenges of AI Adoption in Insurance

It is obvious that the insurance companies are still at a nascent stage of adoption of AI and InsureTech. While cybersecurity is a recurrent concern (as it should be), it is a common concern across any technology area. The biggest challenge that the insurance industry faces in adoption of AI and other data-driven technologies is the actual data management – from access to integration. The industry may be data-intensive, but the data exists in silos. In the end an InsureTech implementation should benefit multiple departments – Underwriting, Claims, Sales and so on.

Several insurance companies will look to consulting firms and systems integrators to create a roadmap to their transformation journey and enable the data integration – especially as technologies evolve and when internal IT lack the right skills to manage these projects.

The technology that will be the key component of InsureTech and transform the insurance industry is AI. In spite of the challenges of adoption, the industry will be forced to transform to survive in the highly competitive market. Companies in emerging economies will especially benefit from investing in AI – in fact, India and especially China will see a surge in InsureTech investments.