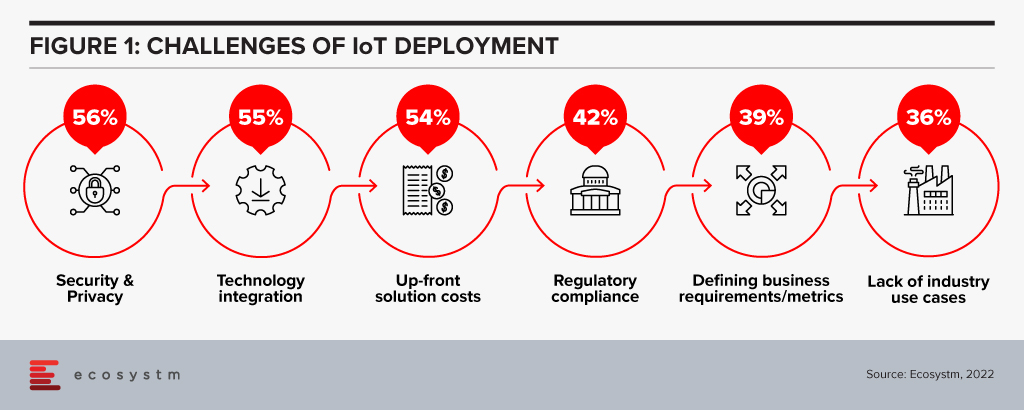

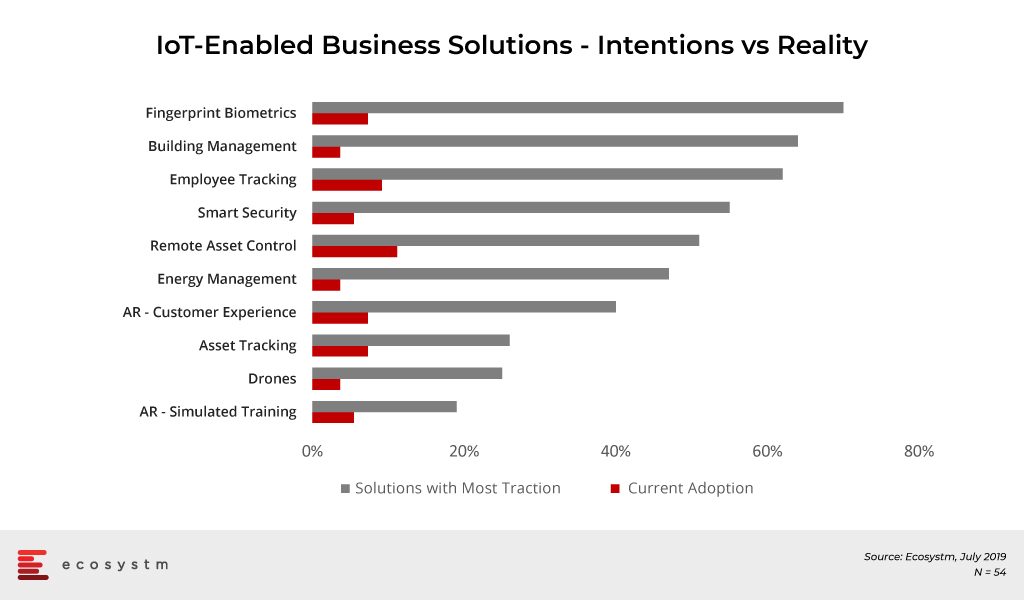

The Internet of Things (IoT) solutions require data integration capabilities to help business leaders solve real problems. Ecosystm research finds that the problem is that more than half of all organisations are finding integration a key challenge – right behind security (Figure 1). So, chances are, you are facing similar challenges.

This should not be taken as a criticism of IoT; just a wake-up call for all those seeking to implement what has long been test-lab technology into an enterprise environment. I love absolutely everything about IoT. IT is an essential technology. Contemporary sensor technologies are at the core of everything. It’s just that there are a lot of organisations not doing it right.

Like many technologists, I was hooked on IoT since I first sat in a Las Vegas AWS re: invent conference breakout session in 2015 and learned about MQTT protocols applied to any little thing, and how I could re-order laundry detergent or beer with an AWS button, that clumsy precursor to Alexa.

Parts of that presentation have stayed with me to this day. Predict and act. What business doesn’t want to be able to do that better? I can still see the room. I still have those notes. And I’m still working to help others embrace the full potential of this must-have enterprise capability.

There is no doubt that IoT is the Cinderella of smart cities. Even digital twinning. Without it, there is no story. It is critical to contemporary organisations because of the real-time decision-making data it can provide into significant (Industry 4.0) infrastructure and service investments. That’s worth repeating. It is critical to supporting large scale capital investments and anyone who has been in IT for any length of time knows that vindicating the need for new IT investments to capital holders is the most elusive of business demands.

But it is also a bottom-up technology that requires a top-down business case – a challenge also faced by around 40% of organisations in the Ecosystm study – and a number of other architectural components to realise its full cost-benefit or capital growth potential. Let’s not quibble, IoT is fundamental to both operational and strategic data insights, but it is not the full story.

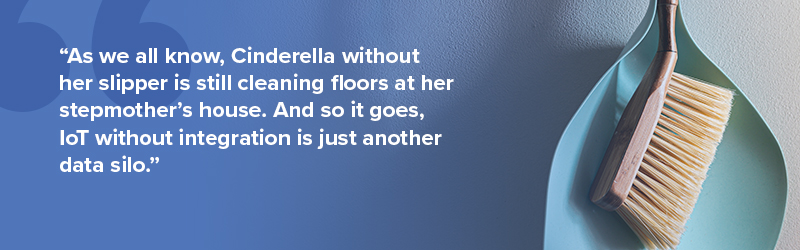

If IoT is the belle of the smart cities ball, then integration is the glass slipper that ties the whole story together. After four years as head of technology for a capital city deeply committed to the Smart City vision, if there was one area of IoT investment I was constantly wishing I had more of, it was integration. We were drowning in data but starved of the skills and technology to deliver true strategic insights outside of single-function domains.

This reality in no way diminishes the value of IoT. Nor is it either a binary or chicken-and-egg question of whether to invest in IoT or integration. In fact, the symbiotic market potential for both IoT and integration solutions in asset-intensive businesses is not only huge but necessary.

IoT solutions are fundamental contemporary technologies that provide the opportunity for many businesses to do well in areas they would otherwise continue to do very poorly. They provide a foundation for digital enablement and a critical gateway to analytics for real-time and predictive decision making.

When applied strategically and at scale, IoT provides a magical technology capability. But the bottom line is that even magic technology can never carry the day when left to do the work of other solutions. If you have already plunged into IoT then chances are it has already become your next data silo. The question is now, what you are going to do about it?

Authored by attending Ecosystm analysts, Ullrich Loeffler (Chief Operating Officer), Kaushik Ghatak (Principal Advisor, Digital Transformation and Supply Chain) and Liam Gunson (Director, Product and Solutions)

Bosch Software Innovation (Bosch SI) hosted its annual analyst briefing in Singapore on 6th December 2019 to provide an update on its business, strategy and solution portfolio in the APAC region.

Bosch has expanded its capability and reshaped its go-to-market approach in a bid to not only position itself as a world leading IoT company, but also help move the IoT market forward.

A number of new solutions were demonstrated through the day. From tenants asking their building management if the gym was busy, to smartphones detecting a manufacturing fingerprint so you could avoid buying a counterfeit.

At the heart of the business updates though was a new organisational approach to prove markets and integrate user perspectives into solution development. Bosch is looking to achieve this by setting up dedicated, cross-divisional entities which can focus on user needs to drive growth while collating requirements for the Bosch SI centres.

Bosch SI essentially will perform a role of an IoT business incubator within Bosch Group, and once a vertical within Bosch SI has reached a certain level of business, it is spun off into a separate company focusing on that area. There are three business units that have met the threshold and have spun off so far.

Broader challenges still remain for IoT adoption. Patchy connectivity, varied regulation, and a lack of standardisation will continue to hamper the IoT market. However, from a user perspective the timing is right. Ecosystm research shows that while IoT uptake is limited, intention is strong. Enterprises will be looking for partners with a willingness to understand their needs and design around them, in order to help get initial projects off the ground.

Bosch Business Update – From Innovation to Commercialisation

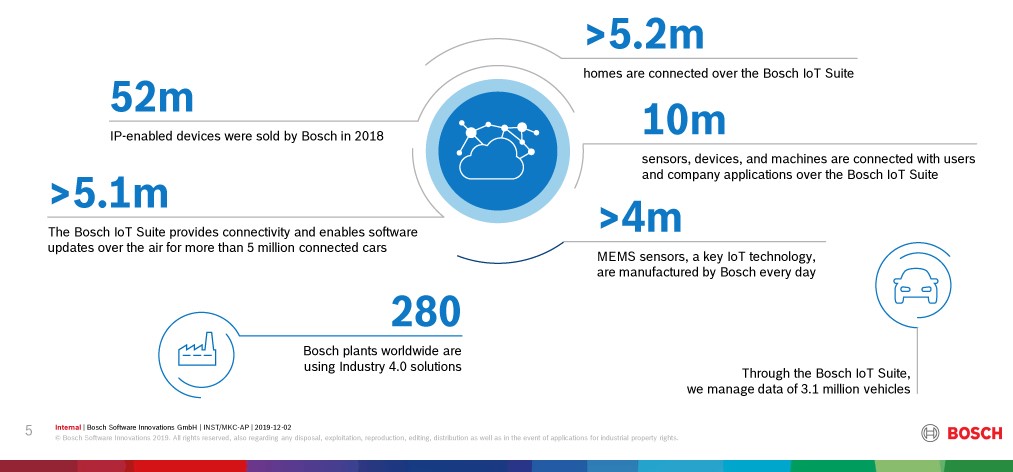

Bosch SI was created to build Internet of Things (IoT) solutions, leveraging Bosch’s 133-year experience in developing and manufacturing products for the automotive, industrial and consumer segments. Founded in 2008, by 2019 Bosch SI has established 10 global offices, of which some have solution development capabilities, employing over 700 IoT experts. Four of the Bosch SI offices are located in Asia Pacific – Singapore, Nanjing, Shanghai and Tokyo.

Figure 1: Bosch Software Innovations in Numbers

The Bosch IoT Vision and Strategy is not limited to Bosch SI’s but spans across the full Bosch Group. An indication of the dedication to the IoT story is that Bosch is committed to enabling connectivity for all existing product portfolios ranging across its industrial, automotive, manufacturing and consumer product lines by 2021.

Another indication of Bosch’s IoT business maturing is that in 2018 Bosch it formed 3 new subsidiaries, each being a dedicated entity to take targeted IoT Industry solutions to market. The new business entities focus on

- Connected Industry

- Connected Mobility

- Residential IoT

with other areas such as Agriculture, Retail, Energy, Mobility, Manufacturing and Home & Building as potential future spin-offs. The announcement is significant as it separates the innovation and commercialisation functions. Bosch SI becomes the dedicated R&D and incubation engine to take new industry solutions to a defined threshold before a dedicated entity is formed to achieve commercial scale.

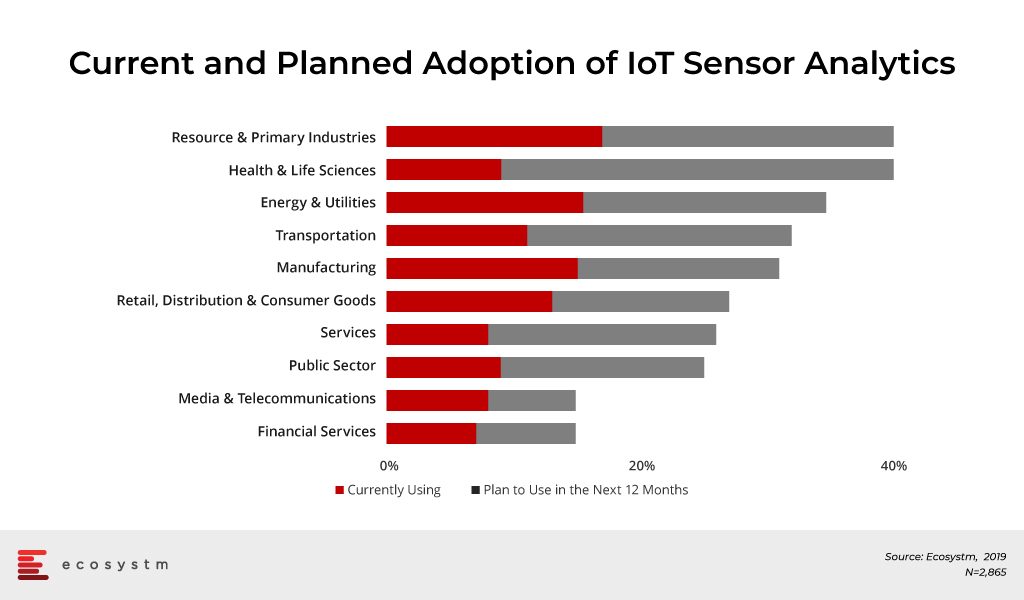

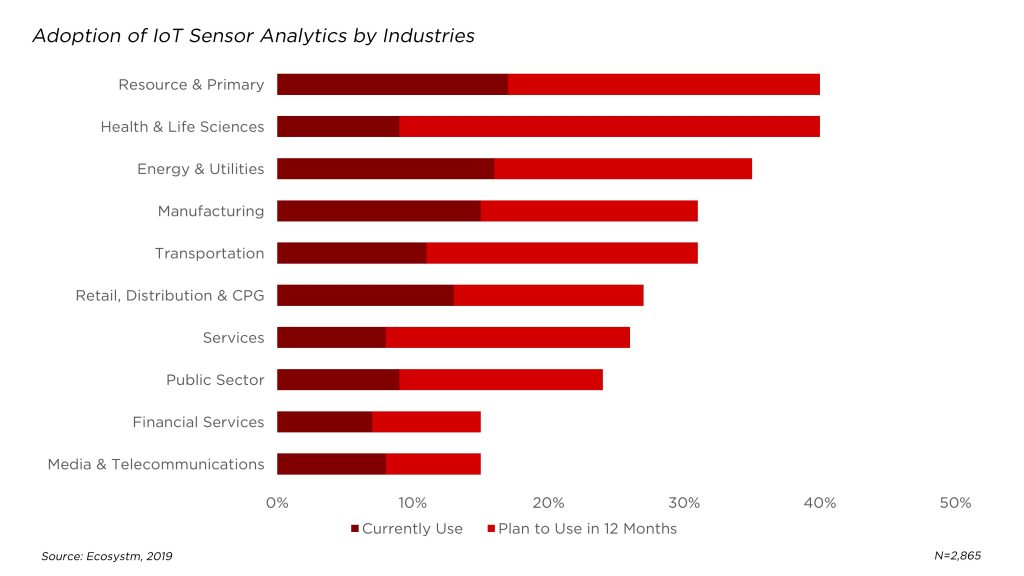

Despite the fact that IoT has been greatly overhyped since the term was coined by Kevin Ashton in 1999, Ecosystm research shows evidence that adoption is accelerating across the region. Figure 2 outlines the current and planned adoption of ‘sensor-based analytics’ within organisations. The research strongly supports Bosch’s timing for investments in scaling the commercialisation of its solutions.

Figure 2: Industry Adoption of Sensor-Based Analytics

Market Pull over Technology Push is creating proven Industry Use Cases

The locations and specialisations of Bosch’s Innovation Centres across Asia are no accident and result directly from engagements with local clients. Each innovation centre specialises in certain solutions that have arisen from the productisation of solutions developed for customers. This ‘market pull’ strategy is a clear differentiation to the commonly practiced ‘technology push’ approach which has seen many vendors struggle to gain traction for their IoT solutions. Key industry solutions developed by Bosch SI are:

- Agriculture – Bosch Plantect: (Japan). Plantect is a sensor-based monitoring system for early detection and prevention of plant diseases in greenhouses. The current solution targets greenhouse farmers for tomatoes, cucumber and strawberries.

- Smart Building – Bosch Lift Manager (Singapore). Lift Manager is an AI-supported solution that can be retrofitted in existing lifts with set algorithms to monitor and predict lift malfunctions and enable predictive maintenance.

- Smart Building – Connected Buildings (Singapore). Bosch Connected Building leverages cameras and sensors to optimise business operations such as Air Quality, Light Monitoring & Control, Lift Monitoring, Occupancy Tracking, Asset Tracking, Carpark Monitoring, and Object Tracking.

- Manufacturing – Secure Product Fingerprint Solutions (China). Secure Product Fingerprint captures a unique fingerprint for products to combat counterfeits and connect manufacturers with their users.

The Bosch IoT Ecosystem – Open Source and API enabled Platform

Bosch has realised that IoT is a concept that cannot be owned and delivered by a single entity. As such Bosch aims to establish its Bosch IoT Suite as the platform to connect any Bosch or third party “things” to deliver targeted industry services and solutions.

Bosch IoT Suite can be deployed on Bosch’s own IoT Cloud or through Cloud partners such as AWS, Microsoft or Huawei (for China only). It is a PaaS offering that packages unified device APIs to connect things with device management, software updates over the air, data management and security capabilities. An inbuilt analytics engine assists with business logic tools to drive business value out of the data collected. The open source and open standards architecture promote the development of in-house or third-party industry applications as platform add-ons and use cases.

Bosch and Market Outlook

IoT has been one of the most hyped ‘buzz words’ for the last few years but true market adoption is yet to follow suit. Ecosystm research shows that market intention is positive with more industry-focused uses cases and simpler ‘plug and play’ style solutions available that require less CapEx and shorter time to value.

Bosch is well positioned to capitalise on this trend. Its focus on developing proven use cases for targeted industry sectors and then working with anchor customers and testing the solutions internally within Bosch, is a clear differentiator in the market. Commercially scaling these solutions will remain the key challenge as decision stakeholders may not be the key beneficiary of the solution. In the connected building example, tenants will be the key beneficiary of finding quiet gym slots or having better air quality but it remains questionable whether this will convince the building owner or operator to put pen to paper and sign-off on relevant IoT investments. An area that Bosch needs to focus on, is the articulation of its business proposition and more importantly connect this to the business value to prospects and customers. As solutions scale in the market, broader sales and partner teams will need to be enabled to bring this message to the relevant stakeholders. The fact that these stakeholders may sit outside Bosch’s traditional comfort zone will not make this endeavor easier.

Bosch will also face varying market regulations that could create road bumps in scaling its solutions. The Bosch Lift Manager solution as an example provides sensor diagnostics for predictive maintenance scheduling. Many existing lift maintenance contracts however follow local regulations that require ongoing scheduled servicing of elevators which reduces the cost savings potential.

The decision to establish standalone IoT entities is seen as a strong commitment and the right move to take advantage of the presented IoT opportunity. The high degree of customer advocacy and industry experience further makes Bosch a strong contender of the Industry 4.0 revolution.

The industry has been enthusiastic about the number of devices and sensors that are expected to increase exponentially in 2020 and beyond. The role of the Internet in Things (IoT) in delivering ‘Smart’ solutions is seeing unprecedented interest in technology. However, 2020 will be the year when IoT adoption will see a sharp increase in uptake as 5G rollouts gather steam and governments across the world focus on Smart City initiatives.

Here are our predictions on the Top 5 IoT Trends for 2020, that we think, will shape the Internet of Things landscape over the next 12 months.

The Top 5 IoT Trends for 2020

The Top 5 IoT Trends for 2020 are based on the findings of the global Ecosystm IoT and AI studies, and is also based on qualitative research by Ecosystm Principal Advisors Francisco Maroto and Kaushik Ghatak.

-

5G Providers Will Be Forced to Operate Outside their Comfort Zone

Network and communications equipment providers have much to gain and more to lose as organisations look to leverage 5G for their IoT use cases. Each industry will have their different and distinct use cases – the use cases for Oil & Gas will be different from Retail use cases, which will be different from Healthcare industry requirements.

Telecommunications providers will find themselves depending on systems integrators (SIs) with relevant industry experience, to translate the value proposition of what they are offering. However, the telecommunications providers are not companies with actual skin in the game. If 5G uptake does not take off, the bigger losers will be the network and communications equipment providers – the real investors in the technology.

-

Satellite IoT Connectivity Solutions Will Start to Compete Against and Work with LPWANs

Current satellite communications technologies have not been designed specifically for IoT and may fail to meet the specific requirements of the IoT market, especially when it comes to price and ease of use.

This is set to change as both incumbents and new entrants in the satellite space seek to grow their IoT markets in 2020. Satellite communications companies are designing a spectrum strategy and a go-to-market strategy that include collaboration with Low Power WAN (LPWAN) vendors.

-

IoT Sensor Analytics Will Become the Fastest Growing AI Workload

Many organisations will actually start their digital journey and their investments in AI even before they invest in automation – when they start to analyse the data from their IoT sensors and make sense of the ‘data sprawl’ that is created as the number of data collection points proliferate. Organisations’ desire to transform, starting with automation, will further drive the adoption of IoT. The global Ecosystm AI study reveals that organisations investing in IoT sensor analytics also look to invest in computer vision and automation solutions. IoT adoption will enable organisations to focus on incorporating AI/machine learning to make automation smart and intelligent.

-

Construction Will Become the Unsuspecting Influencers for IoT Adoption

The construction industry is fast emerging as the arena for end-to-end IoT-driven services especially as new-age companies link architects with contractors with building managers with facilities management to create a new meaning of ‘Smart Buildings’. Realtors become unsuspecting influencers as they establish Smart Building ecosystems. According to the findings of the global Ecosystm IoT study, the top solutions that construction companies have implemented and are evaluating, are primarily aimed at ensuring operational and employee safety. However, the industry will also see an uptake of customer management IoT solutions aimed at providing better customer experience (CX).

-

The Edge Will No Longer Be at the Edge

2020 will mark the end of the hype around the Edge and the way we think about it. Real-time analytics will be performed at so many places along with the network and infrastructure that IT management will be forced to rethink their distributed and enterprise computing strategies. The main industries that will see a growth in Edge uptake in 2020 will be Manufacturing, Retail, Energy, Healthcare, Transportation and Logistics.

As the Edge technology develops, the application of AI will steadily move away from centralised servers (on-premise or cloud) to the edge devices themselves. There are two important benefits to this – Firstly, it minimises time lag between data acquisition and secondly, any targeted hacking attempt can be immediately identified and mitigated, rather than being at the mercy of the security systems implemented by the cloud provider.While AI-enabled edge devices tend to be costlier than

their “dumb” counterparts, the value they can bring in terms of being able to immediately act upon the data, and the additional security they can potentially provide, can be significant factors that offset the high initial cost of deployment.

Download Report: The Top 5 IoT Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 IoT Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 IoT trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources. Download Link Below ?

The internet was created by the US military to create a seamless self-repairing almost indestructible connection of computers and to maintain critical communications capability in the event of nuclear attacks on cities and government infrastructure. It wasn’t until the invention of the world wide web (www) that the internet became widespread. Since then, the evolution of digital and network technologies has made it possible to connect almost any device to the Internet. The Internet of Things (IoT) can include a wide range of machines, sensors, smart objects, unique identifiers (UIDs) – provided they are connected to the Internet and have the ability to send and receive data without human intervention.

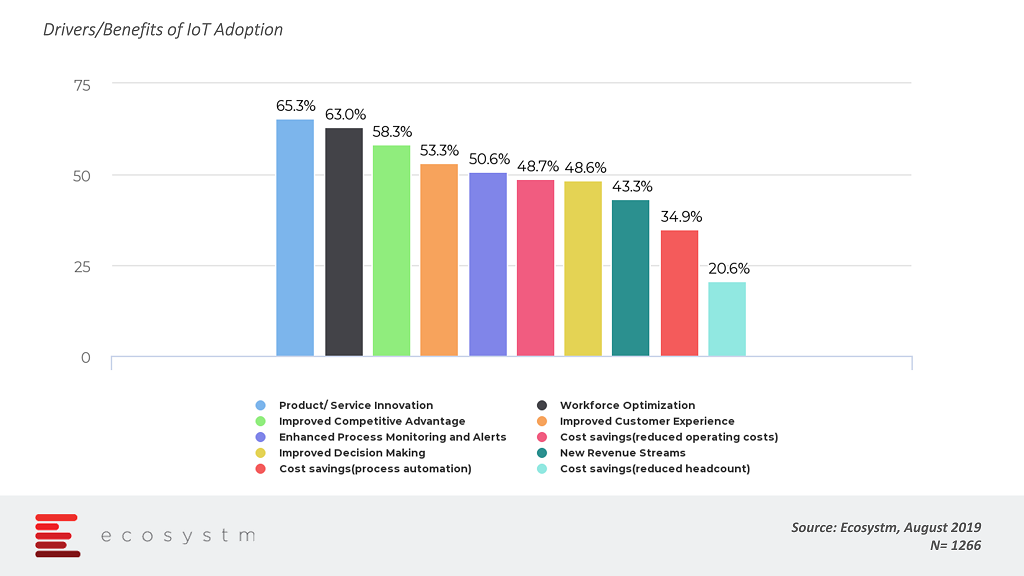

There are a plethora of ‘things’ today that can be connected to the internet and are not restricted to devices and sensors alone. Anything with an IP (Internet Protocol) address can now be connected. Wireless technologies such as Wi-Fi, Bluetooth, and 4G/5G have created more possibilities for devices to be individually connected. With the advent of IoT, remote connectivity has become the norm bringing several advantages across all industries. The global Ecosystm IoT study reveals that organisations are looking to leverage IoT not only for asset management but also to fuel innovation.

The key to IoT is connecting any physical ‘thing’ to the Internet, allowing remote control and monitoring functionalities over the network. The power of the technology comes from the fact that these devices can then be used to monitor and get data from virtually any other device or application. This opens immense avenues for the connectivity of various applications and expands the overall potential of the Internet dramatically.

The simplest way to appreciate how IoT can benefit organisations is to see its operations in some industries. The list below is not exhaustive and includes:

- Medical and Health: The key technology enabling eHealth is IoT. IoT has enabled remote diagnostics and patient monitoring even beyond the walls of the hospital. Remote monitoring has a deep impact on improving health outcomes and enables community-based healthcare and aging in place practices.

- Construction: IoT enables almost all home and office devices to be virtually connected allowing remote activation and control based on specific data gathered from the environment. This application is being utilised in ‘smart homes’ and commercial buildings, allowing the automation of security, lighting, HVAC and other systems. IoT applications have made their way into Building Information Management (BIM) systems even at the design and construction phases.

- Energy and Environment: In one of the early use case in energy efficiency and distribution, IoT is used to monitor the energy requirements of homes and industries with the help of ‘smart grids’. The technology is also helping meteorologists to predict storms, earthquakes and other natural disasters with the help of smart sensors to monitor environmental changes.

- Transportation: Autonomous Vehicles or driverless cars have become the popular face of IoT application. More significant than the vehicles or the technology itself, are the parameters that are involved in providing the right infrastructure for these vehicles. IoT is already bringing substantial improvement in the industry with connected transportation systems and controls in the applications for trains, smart cars, and airplanes

- Manufacturing: The Manufacturing industry is where the concept of process automation originated. Needless to say, the industry is seeing an uptake in IoT as automation reaches a whole new level. The adoption of IIoT (Industrial Internet of Things) is allowing manufacturers better visibility of the supply chain, more efficient inventory management, and proactive asset management through predictive maintenance. This impacts both the productivity of the plants and the quality of the products.

- Agriculture: IoT has numerous use cases in making Agriculture more productive and efficient, such as automated irrigation systems, crop monitoring, pest control, driverless tractors, and other smart farming solutions. Smart Farming practices will ensure a better outcome for environment management and promote trust in agricultural products as the entire ‘food to fork’ supply chain becomes traceable.

- Smart cities: ‘Smart city’ is an often-used term that can have different meaning depending on the maturity of the country. What is common however is the widespread deployment of IoT applications, devices, and sensors to handle various activities providing citizen services and infrastructure monitoring such as traffic management, street lighting, citizen security and monitoring, and more.

The early use cases of IoT have been in automation and asset management. As technology and connectivity evolve, the applications will be more widespread and impact every aspect of our lives.

In an industrial backdrop, drones are forming a core part of automation. Drones are Unmanned Aerial Vehicles (UAV) that can be controlled remotely or can fly autonomously with defined coordinates working with onboard GPS and sensors. The basic functionality of drones is to collect specific information about an environment and relay it back to the controller.

Industry 4.0 sees several use cases for drones. UAVs are the next-generation technology for industrial sensors and IoT. Industrial drones operate under difficult conditions – in regions where humans cannot physically inspect the environment such as in hazardous or hard to reach areas. While they are primarily sensors, they are also being programmed to act of the information gathered.

So what are the industrial applications of drones?

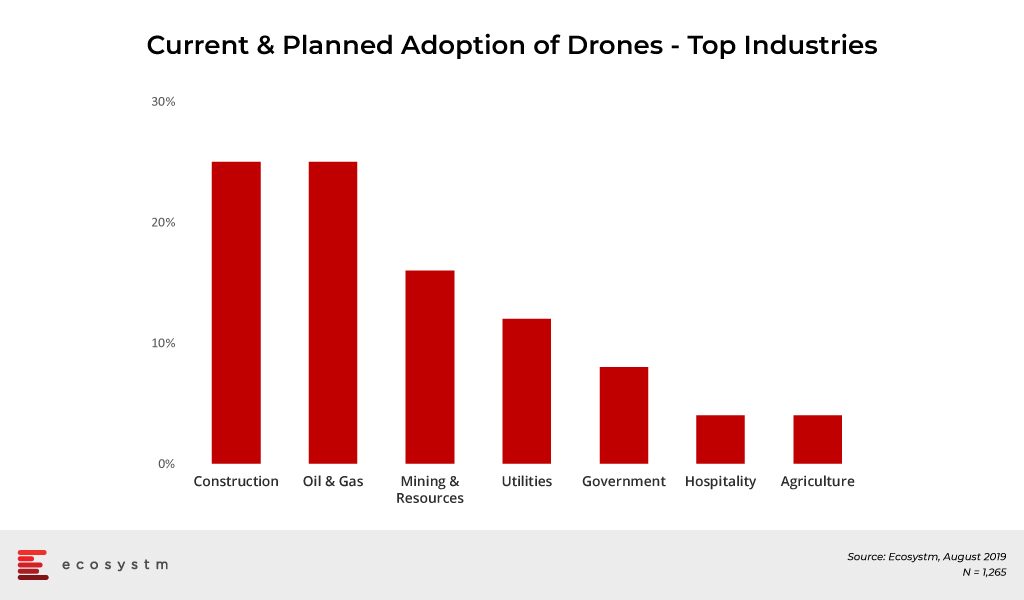

Some industries are more enthusiastic about the application of drones. In the global Ecosystm IoT Study, organisations that have implemented or plan to implement IoT in the next 12 months were asked about the adoption of drones for asset management.

Construction

Industrial IoT is opening up opportunities for construction organisations. IoT devices have the potential to increase efficiency of construction sites and drones are one of the devices that can enhance safety and site operations. Instead of deploying heavy machinery and expensive tools, drones offer the capabilities to survey industrial sites to providing greater accuracy to building maps, QC processes, documenting project details – while reducing costs and project duration.

KIER, a construction and property group in UK is utilising drones to capture project progress, take 360 photographs and use it for photogrammetry (using photographs to model real-world objects and scenes). The benefits that the company reports include digital asset management and data insights, which in turn lead to cost reductions.

Drones will become an integral part of the Construction industry, to a large part because of safety and compliance requirements – and the industry needs to be prepared for it. UK’s Engineering Construction Industry Training Board (ECITB) has launched a training course and program for industrial drone operators to attain and develop the skill to safely fly drones and operate industrial equipment that has specific operational hazards and constraints.

Energy and Utilities

This is another industry group that can benefit in a similar way from drones. Drones can perform hazardous jobs otherwise performed by humans such as surveying transmission lines, inspecting plant boilers, monitoring the health of solar panels, assessing storm damages and even repair faster. The industry has been traditionally using helicopters but drones are a lower-cost alternative – both for procurement and maintenance.

It is easy to see why Laserpas, one of the largest Utility Asset Management Companies in the EU is using drones for their workflow automation initiatives. Laserpas surveys power grid infrastructure, including power lines, transmission towers, adjacent areas and so on, with the help of drones. The drones are gathering data for AI-driven data analysis to increase the efficacy of their high-precision monitoring solutions

Laserpas is by no means alone – AT&T is using drones to avoid service disruption through aerial monitoring of towers, replace faulty parts and create portable cell towers in mission-critical areas.

Government

Perhaps the earliest adopters of drones were a military defence in several countries. However, the use cases in Government are not restricted to that – it involves public safety and logistics in several Government agencies. They have become the means for agencies to gather data – both for situational awareness and scientific purposes – in a more efficient manner.

The ability of UAVs to cover large areas in a short time is helping emergency teams in search and rescue operations. The example from UK where a man involved in a crash was rescued from freezing temperatures by police drones, is a case in point. The emergency unit equipped a drone with a thermal camera that was able to locate the man in a six-foot deep ditch more than 500 feet from the crash site. There are examples of Public Health as well. In a municipality in Spain, mosquito control programs are using drones to conduct surveillance in likely breeding sites that are hard to reach. Once larval habitats are identified, drones are also programmed to spray pesticides to the area. Transport drones are also being used by Public Health agencies. Ghana’s government uses drones to supply blood and other critical medical supplies to remote areas. It has had a positive impact on the nation’s overall medical supply chain and the Ghana Civil Aviation Authority have plans to create an air corridor for the drones to prevent collisions with larger aircraft.

Perhaps the biggest use case for drones in Government will come from public safety measures. The Washington State Patrol has built up a fleet of 100 drones and using them for maintaining law and order in the state and for wide range of purposes including surveillance of armed and barricaded suspects and search and rescue operations. This will probably see a higher uptake than other solutions in Government.

Hospitality, Retail and Logistics

Though the adoption of drones in these industries is not yet as widespread as in others, there is tremendous potential in inventory and supply chain management. Walmart has conducted pilots on drones for warehouse management which has now been moved to implementation. Using drones reduces the need for heavy assets such as forklifts and conveyor systems.

UAVs are the best new way of tracking inventory using tracking mechanisms such as RFID and QR-codes UPS has set up a subsidiary that uses drones for delivery. Companies such as DHL, Amazon, and Google are developing and experimenting with drones to speed up delivery, especially for lightweight consumer goods. Drones not only help with inventory management but also ensures last-mile delivery.

The Hospitality industry has gone beyond logistics in their business application of drones. Examples are broad including creating marketing videos for properties, aerial site maps to help guests and staff members navigate sprawling grounds and surveillance. Drones make it possible to create a 3D virtual environment for security teams to monitor hotel perimeters, parking lots and outdoor venues effectively. This is more economical than hiring a full-time security crew for surveillance cameras and 24/7 monitoring. The Seadust Cancun Family Resort has a lifeguard drone that helps real lifeguards by supplying safety equipment and emergency floatation devices.

Agriculture

Drones are a major component of smart farming techniques and operations where farmers can benefit from real-time information about large tracts of land.

“An ‘eye in the sky’ by way of a drone, can save days for farmers and help them in checking stock, crops, and fences, battling weeds, and even mustering cattle. Simultaneously, they can provide data to help farmers make more informed decisions around applying fertilizer, disease detection, and about managing health and safety on farms,” says Jannat Maqbool, Principal Advisor Ecosystm. (Read Jannat’s Report on IoT in Agriculture: Drivers and Challenges)

Yamaha is working with farming communities in several countries to use UAVs to spray weed killers. Drones are utilised to spray the crops applying small quantities of pesticide or fertilizer to crops, orchards and forested areas. GPS coordinates create flight paths to aim for maximum coverage. This is leading to process automation in Agriculture – an essential component of smart farming.

Drone have started to prove their worth in various industries across applications and organisations across the globe are working to integrate drones into their operations. As laws mandating them to become clearer, more industries will look to leverage drones for automation.

Which are the other industries that will see a steady uptake of drones in the near future? Tell us your thoughts.

The construction industry employs about 7% of the world’s working-age population and although many people think that robots will take away their work, construction workers should not be worried at this time.

In 2017, McKinsey Global Institute published a surprising report: labour productivity in construction has decreased by 50% since 1970. In addition, McKinsey believes that productivity in construction has registered zero increases in recent years. While other industries have been transformed, construction has stalled. The effect is that, when adjusting to inflation, a building today costs twice as much as 40 years ago.

And although the construction industry is a growing market, there are still some problems that need to be handled to increase profitability and productivity. The main problems facing the construction industry in 2019 are:

- Shortage of skilled labour

- Rising cost of steel, aluminium, wood and other materials.

- Decline in growth

- Low performance projects

- Sustainability

- Security

- Inconsistent use of technology

The construction sector has been positive for the past four years, mainly due to the recovery of residential construction. However, the growth can still be erratic. For example in Europe, after the precedence of the previous decade, a scenario is being predicted where 2020 still shows positive growth (3.5%) but 2021 may not (-3%).

Adoption of Technology in Construction

The construction industry is notoriously slow in adopting technologies such as IoT that could boost productivity and, ultimately, profitability.

And although it is believed that construction companies that adopt this technology would also be able to attract new labour force to work for them over others and, in general, have a significant advantage over competitors, the reality is that it is not happening. The general vision insists on a reality: construction and engineering companies see the need for change, but in one way or another they resist.

One of the biggest opportunities of the construction sector is its enormous capacity to reinvent itself. Building Information Modelling (BIM), 3D printing and Virtual Reality (VR) can help architects and builders in creating a construction model. These technologies, along with drones and IoT can be of enormous help to construction workers, increasing their efficiency and ensuring their safety. Materials science is also developing newer material that can impact the industry. The integration of technological trends such as IoT, will facilitate many of the tasks of the sector, optimising resources, improving compliance with deadlines and quality in projects and works.

The Opportunity of IoT in Construction

The appetite of investors for start-ups in the construction sector is growing, although not many are in the IoT box. There are still few examples of companies in the sector that are adopting IoT. And although I have no doubt that IoT will positively impact this industry none of the productivity, maintenance, security and safety drivers seem to be convincing them at the moment.

In the global Ecosystm IoT Study, participants from the construction industry were asked about the key business solutions targeted for IoT uptake. While the industry is aware of the IoT solutions and the role they can have in asset and people management, the actual uptake of these solutions is far lower. Around a tenth of Construction companies have some sort of an IoT-enabled asset control and management solutions.

There are ample examples of innovation with IoT in Construction.

- Machine control

- Construction site monitoring (Examples include)

- Anchor load monitoring from installation

- Control of the deformation of the ground during the construction of a tunnel

- Monitoring changes in pore water pressure during soil consolidation

- Monitoring of the settlement process during the soil recovery works

- Fleet management

- Wearables with AR capabilities and safety measures

Some practical examples of IoT in Construction have been covered in the article and include

- Remote operation

- Replenishment of supplies

- Equipment construction and monitoring tools.

- Maintenance and repair of equipment.

- Remote use monitoring

- Energy and fuel savings

Key Takeaways

IoT and other emerging technologies can improve productivity, reduce costs and security in the construction industry. Construction companies, real estate and engineering firms should continue their investments in IoT.

They should not fall back into the same mistakes of the past and should not fear the loss of jobs due to the new technologies like IoT or Artificial Intelligence (AI). The adoption of IoT is unlikely to replace the human element in Construction. Instead, it will modify business models in the industry, reduce costly mistakes, prevent injuries in the workplace and make construction operations more efficient.

Smart Construction is key to building Smart Cities and is an element in Smart Building, Smart Transportation and even Smart Healthcare. The limits of using IoT in Construction is our imagination.

Thanks for your Likes and Shares.

The Retail industry faces constant disruption because of unpredictability and seasonality for reasons ranging from economic uncertainties to festive seasons. Technology adoption has emerged as a key differentiator between the success stories and the also-rans in the industry. The biggest example of this would probably be eCommerce heavyweights in China, that were revolutionised by digital technology, forcing global Retail counterparts to transform to compete. Emerging technologies are helping organisations drive customer loyalty and improve their supply chain for better cost efficiency.

Drivers of Technology Adoption in Retail

There are several factors that have made the Retail industry one of the leaders in technology adoption.

- Evolving Customer Preferences. Understandably, customers are kings in the Retail industry and their preferences drive the industry. For many years, customer loyalty was implemented through ‘loyalty programmes’ but today’s customers are not bound by cards and points, and factors such as same-day delivery, multiple payment options, on-the-spot problem resolution, and even invitations for exclusive events have a role to play in customer retention. The focus has shifted to better customer experience (CX). Retailers have access to immense data on their customers (which in turn raises concerns around data handling and compliance – requiring further investments in cybersecurity solutions), which is collected at every point of interaction and can be analysed for personalised and just-in-time offerings.

- Maturity of the Omnichannel. Omnichannel retailing has been gaining grounds since the advent of eCommerce. However, the proliferation of mobile apps enabled not only easy access and monitoring of loyalty programmes, but also advanced capabilities such as the real-time view of inventory, and incorporation of virtual assistants for CX – and are pushing traditional players in the Retail industry to innovate and adopt the technology. However, as omnichannel has become the norm, retailers are evaluating the channels they want a presence on. While experts predicted that a brick-and-mortar presence would become redundant, retailers are realising that while consumers do research on the Internet and apps, many prefer to inspect and buy at a physical shop. This requires better integration and supply chain visibility across all touchpoints.

- Globalisation of the Market. No longer can a retailer be sure of where the actual competition lies. One just has to look at the number of platforms and websites originating from Japan that have a presence across the globe to understand that competition can come from outside your country and very easily. Nor can they be sure of the best place to source their products as the world becomes one global market. In this global world, it is very important for retailers to have complete visibility of their supply chain, whether for a brick-and-mortar store or for eCommerce.

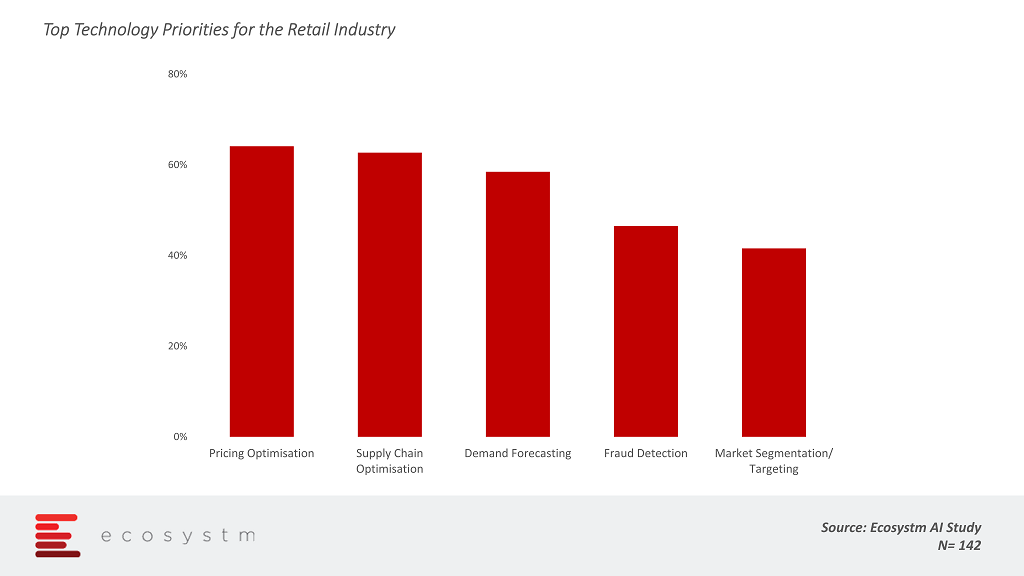

The global Ecosystm AI study reveals the top priorities for retailers (and etailers), focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through initiatives such as market segmentation and pricing optimisation) and supply chain optimisation (including demand forecasting and fraud detection, as procurement widens).

IoT as an Enabler of Retail Transformation

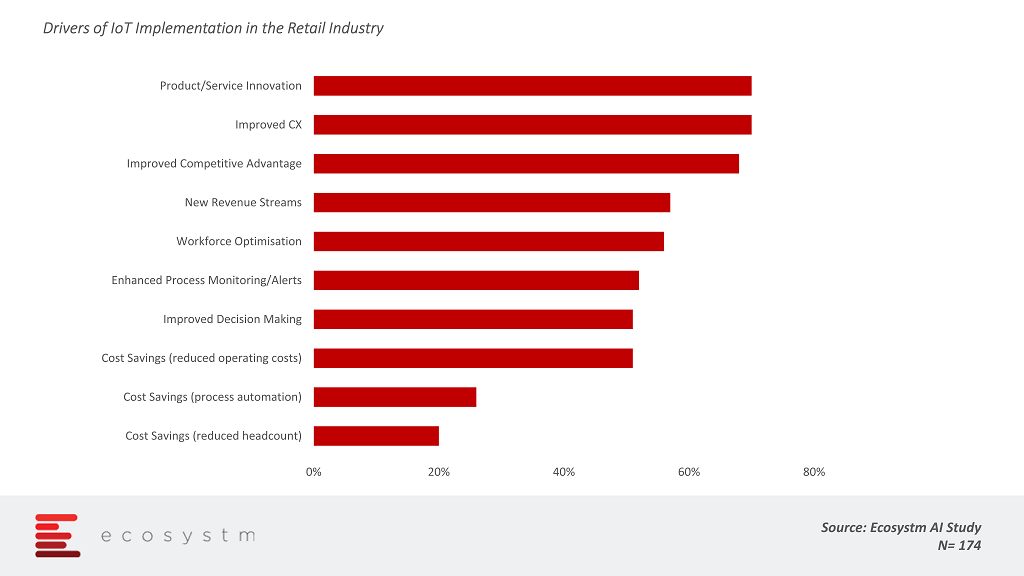

The Retail industry is particularly leveraging IoT as they are faced with the overwhelming need to transform. The global Ecosystm IoT study reveals the areas that organisations are looking to benefit from IoT implementations (Figure 2). Retail organisations are essentially looking to creating a competitive edge – cost savings are not high on the list of benefits they are looking at.

Several Retail organisations are deploying customer management IoT solutions such as payment systems, customer identity authentication (especially in eCommerce), Digital Signage, customer satisfaction measurement through smart buttons, and location-based marketing. Asset management IoT solutions such as IoT-based inventory and warehouse management are also gaining traction.

Examples of IoT Use in Retail

IoT for Customer Experience

- Automated POS terminals. Customers are put off by long queues, and automated checkout systems are improving CX. Caper’s plug-and-play cart-system is a shopping cart with a built-in barcode scanner and credit card swiper which automatically scans items when they are dropped in, with the help of image recognition cameras and weight measuring sensors.

- Smart Mirrors. Smart fitting rooms are transforming the way customers browse, try out and shop. Smart Mirrors enhance customers’ shopping experience through interactive fitting rooms which connect retailers and customers digitally. Rebecca Minkoff reinvented the dressing room using Smart Mirrors.

IoT for Marketing

- Digital Signage. Digital Signage has proved to be an effective way of target marketing, eliminating the need for employees to put up physical signs and enabling dissemination of the latest product news and promotions to the consumers. Advanced Digital Signs include heat-mapping to upsell items based on high-traffic areas. Prendi, an Australian design agency created an interactive retail experience that is intended for store managers to showcase the most popular products, provide information, and simplify the overall sales and purchase process. Customers can take time to easily navigate through store inventory on a single screen, order for items digitally, which is then sent to a salespersons’ handheld devices, allowing them to take the items over to the customers.

- Location-Based Marketing. Many retailers are collaborating with financial institutions and location-enabled apps to send push notifications on latest deals and offers straight to the customers’ devices, once they enter a demarcated location. This provides just-in-time data that increases app engagement and retention. Ukrainian hypermarket, Auchan, started a beacon pilot in Dec 2016 and kept adding new campaigns to strengthen the offerings in 2017. The hypermarket makes use of beacons to enable customers to receive notifications on navigation and promotions as they move through the store.

IoT for Supply Chain Optimisation

- Smart Shelves. Shelves have turned out to be more than just a surface for displaying and storing objects. Retail stores are utilising RFID readers, weight sensors, proximity sensors, and 3D cameras for real-time visibility on inventory, layout, and shopper preferences. For FMCG products, monitoring the shelf life of perishable goods and proactive reorder alerts are extremely useful. Kroger Smart shelves are designed to offer digital support – they show ads, digital coupons that consumers can easily add to their mobile devices and changed prices as stores calibrate their product pricing. The shelves are built on top of sensors that keep track of products and real-time in-store inventory counts.

- Remote Supply Chain. Retailers are looking to create a competitive edge and grow profits by optimising and digitising their supply chain management through IoT. Tive helps users keep real-time tabs on the condition of their shipped goods, notifying them about shock, vibration, tilt and other factors that might detrimentally affect those goods. Doing so allows retailers to expedite a replacement shipment and give customers a heads-up, and also tells when and where the delay occurred so future shipping routes can be adjusted if necessary.

- Warehouse Automation. Devices, sensors and RFID tags help warehouse managers to know the exact details, location, and progress of any product at any time. This gives higher visibility into the inventory and the entire supply chain. UPS is using smart glasses in test programmes to reduce the amount of labelling on packages. Robots are used by the worldwide shipping company DHL in some of the company’s more modern facilities to reduce labour costs and improve order fulfillment speed and accuracy, all without disrupting ongoing warehouse operations.

The Retail industry already has several IoT use cases and AI-enabled IoT will further transform the industry. What are some interesting use cases that you can think of for the Retail and allied industries? Let us know in your comments below.

The largest agricultural event in the southern hemisphere has just come to a close in Waikato New Zealand, across 114 hectares, with over 1,050 exhibitors, more than 125,000 visitors, including delegates from over 40 countries, and total sales revenue of around half a billion over the four days. Fieldays, an idea from the late 1960s focused on connecting farmers with innovative products and services, was officially opened by the Rt. Hon. Jacinda Ardern who spoke of the strength of New Zealand’s primary industry and its importance to the people of New Zealand. Of specific interest to me as I joined the crowds on day two, was the emerging technology innovations in agriculture on show at the Innovation Centre.

A preview of the New Zealand Agritech Story, developed along with New Zealand Trade and Enterprise (NZTE), was kicked off on a foggy Waikato morning on day two of Fieldays, providing insights into the country’s competitive advantage in Agritech along with perceptions of key global players. This was then followed by the New Zealand government announcing a new $20 million Agritech investment venture fund.

NZ Tech reports that the tech sector in New Zealand is the third largest and fastest growing export sector, worth $6.3 billion in 2015, and according to the TIN100, the Waikato, has had the fastest growing tech sector in the country two years in a row. New Zealand Agritech exports stand at $1.4 billion in 2018 and is growing – and together with a strong tech sector overall, the investment will help position New Zealand at the forefront of Agritech innovation globally.

Day two also revealed Fieldays Innovation Award winners across a range of categories including Modusense who took out the Gait International Innovation Award for Product Design and Scalability. Modusense, developed here in the Waikato, is a secure, scalable and reliable Internet of Things (IoT) device platform that provides everything needed to deploy remote data collection. In the primary industries sector, Modusense enables complete apiary health monitoring.

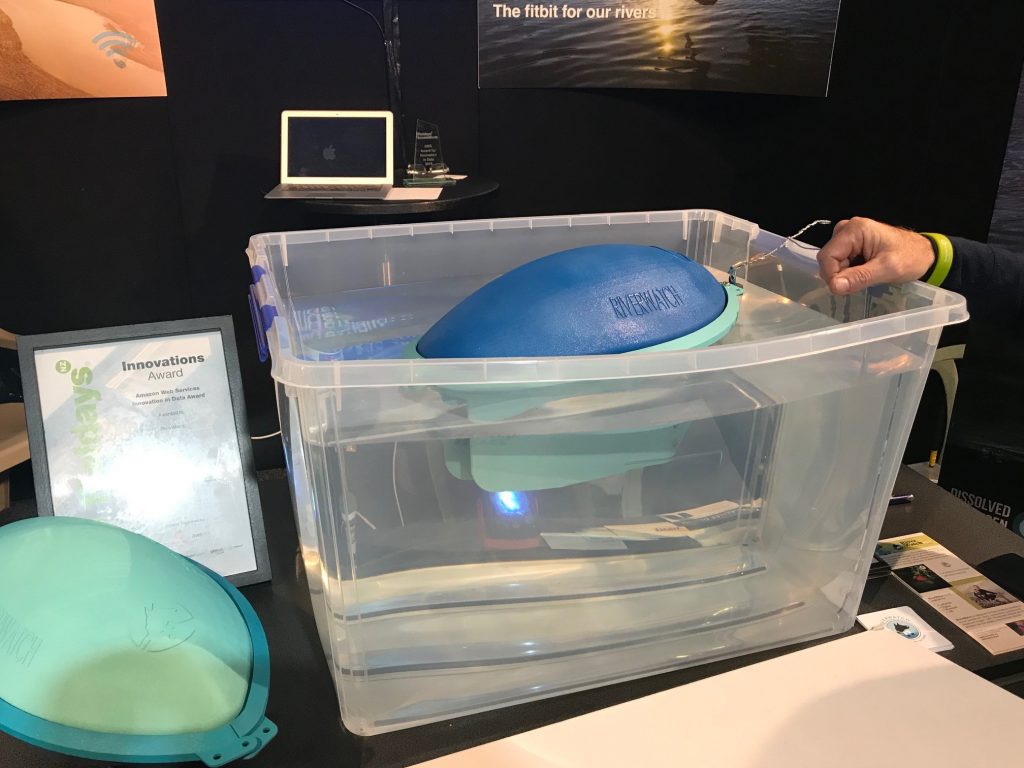

Another IoT enabled solution, RiverWatch, was awarded the AWS Innovation Award in Data for their “Fitbit for water” – an inexpensive water quality monitoring device. RiverWatch is currently running trials in the upper Waikato River in partnership with Te Arawa River Iwi Trust to look at the impacts of industry and farming on water health.

Agritech will transform the industry, and innovations such as those mentioned will further advance New Zealand’s position in the agriculture industry. The true value of Agritech will be realised when AI-enabled IoT is leveraged for cost savings through process automation, and for greater visibility of the entire supply chain. And leading organisations in the industry are aware of it. In the global Ecosystm AI study, Resource & Primary industries (including Agriculture) emerged as a leader when it comes to current and future deployments of IoT Sensor Analytics.

Innovations in IoT

Shipping and logistics in the agricultural sector present unique challenges including a lack of transparency, something that Sparrows.io is working to solve with a hardware and software solution that provides actionable insights using custom sensor modules and live tracking to enable visibility over the supply chain.

The recently launched TRex – IoT, Telemetry, Data and Messaging I/O Transceiver, was also being showcased in the Innovation Centre. Designed to be used for long range monitoring and control, the solution enables two-way messaging and is customisable to meet the needs of applications across various industry sectors including agriculture and farming.

Another innovation that caught my attention at the Innovation Centre was a water monitoring and management device designed to be connected to the irrigation system to enable effective management of water through a mesh network. Hailing from the deep south Next Farm has developed two solutions, with their Remote Irrigation Mesh (RIM) product utilising integrated farm sensor technology together with cloud-based dashboards allowing farmers to maximise the efficiency of water usage while minimising runoff.

Innovations in AI

One of my favourites from last year, Halter, were in the Mystery Creek Pavillion this year and after raising $8 million in funding to refine and further trial their solar-powered collar, for herding cows and monitoring their health, in the Waikato they are close to hitting the open market. Head of Data Science at Halter, Harry She, previously employed by NASA, oversees the development of what the team calls “cowgorithms” which form the basis of the AI underpinning much of the product functions. The collars, which can receive signals up to 8 kms away, is available free and farmers then subscribe on a monthly basis, at a cost per cow, to enable the features they require.

Another product back for another year was the PAWS® Pest Identification Sensor Pad from Lincoln Agritech which is able to identify pests, differentiating these from native species, and transmit the result to the Department of Conservation staff. Utilising machine learning and AI, amongst other technologies, the device greatly reduces surveillance workload and enables staff to detect and respond to re-invasion more rapidly.

However, as exciting as the idea of a Fitbit for cows and innovation in the pursuit of a predator-free New Zealand is, I must admit the highlight of my Fieldays visit was a team of Agribusiness students from Hamilton’s St Paul’s Collegiate school who were awarded the Fieldays Innovations Young Innovator of the Year Award for their floating electro unit “Bobble Trough” designed to keep animal water troughs clean by preventing the growth of algae and microorganisms through the release of copper ions into the water.

I am now working to secure the team’s innovation as a display in a Smart Space being launched in July as part of the Hamilton City Council’s smart cities initiative, Smart Hamilton. A space designed to provide an opportunity for the wider community to engage with technology innovation and be involved in co-creating solutions that enhance the wellbeing of Hamiltonians.

For information on emerging technology innovation in the agriculture sector in New Zealand access my other reports on technology in agriculture in New Zealand.

This is an abstract of my presentation in Dubai on 23rd April 2019. I want to convey my special thanks to Dr. Eesa Bastaki, President of the University of Dubai for inviting me on the occasion. It was a magnificent experience delivering at such a great University.

In the year 2016, I considered Rio as the first Internet of Things (IoT) Olympic games in my article “The future of “The Internet of Olympic Games”. In Rio, we saw how athletes, coaches, judges, fans, stadiums, and cities benefited from IoT technology and solutions which transformed the way we see and experience sports. Next year we will have another opportunity to validate my predictions for the upcoming Tokyo 2020 Summer Olympics. Therefore, we may designate Tokyo as the first Artificial Intelligent (AI) Olympic Games.

During my presentation at the University of Dubai, I explained to the audience how incredible IoT and AI technologies are and to what extent they are impacting our sports experience. I elaborated on IoT and AI’s significant role in health management, improving aptitude, coaching, and training. These technologies are enabling athletes to improve performance, coaching for better preparation, fewer judgment errors, and a better experience for spectators. I also commented on the importance of IoT and AI to enhance the security of teams, audience, stadium, and cities altogether.

With the use of IoT and AI we are creating a world of smart things transforming sports business where every thousandth part of a second is crucial to predict the outcomes of a race, a match or a bet. I cited various examples on how different sports are utilising IoT and AI, and not in the least I shared a vision of the future that’s like 10-15 years onwards from the present – Can you envision a world of a real and virtual world of sports integrated together? Can you visualise robots and humans or super-humans playing together?

On the other side, speaking of the challenges involved with AI, IoT, and machine learning models for sporting, I conveyed the dark side of these technologies. We cannot forget the fact that the sports industry is a market and therefore enterprises, Governments, and individuals may make erroneous uses of these technologies.

In summary, it in this session I shared my point of view on-

- How IoT and AI will transform coaches, athletes, judges, and fans.

- How IoT and AI will attract the audience to the stadiums

- How IoT and AI will transform the Industry?

- How AI is changing the future of sports betting?

How IoT and AI will transform athletes, coaches, judges and fans?

Athletes

While the true essence of a sport still lies in the talent and perseverance of athletes, it is often no longer enough. Therefore, athletes will continue to demand increasingly sophisticated technologies and cutting-edge training techniques to improve performance. For example, we may see biomechanical machine learning models of players to predict and prevent potential career-threatening physical and mental injuries or can even detect early signs of fatigue or stress-induced injuries. It can also be used to estimate players’ market values to make the right offers while acquiring new talent.

Coaches

Coaches are consuming AI to identify patterns in opponents’ tactics, strengths and weaknesses while preparing for games. This helps coaches to devise detailed game plans based on their assessment of the opposition and maximise the likelihood of victory. In many leading teams, AI systems are used to constantly analyse the stream of data collected by wearables to identify the signs that are indicative of players developing musculoskeletal or cardiovascular problems. This will enable teams to maintain their most valuable assets in prime condition through long competitive seasons.

Judges

We tend to think that technology is helping us to make decisions in sports more accurate and justified. That´s why we look at the inventions such as from Paul Hawkins – creator of Hawk-Eye, a technology that is now an integral part of the spectator’s experience when watching sport live or more recently VAR in soccer.

The use of technology is allowing the decision makers to experience the game with multiple cameras angles in real-time combined with the aggregated data from various sensors (stadiums, things, and athletes) thus making them make more objective and accurate decisions.

We as spectators or fans need more transparency about the exercise’s difficulty, degree of compliance and final score. And we have the technology to do it.

The IoT and AI technology don’t claim to be infallible – just very, very reliable and judges also need to be adapted to new technologies.

Fans

Without fans, sports would find it difficult to exist. It is understandable companies are also targeting fans with IoT and AI to keep them engaged whether in the stadium or at home.

How IoT and AI will attract the audience to the stadiums?

The stadiums, sports clubs and many leagues across the globe are incorporating technologies both inside and outside the stadium areas to boost the unique experiences for fans and not only during the gameplay.

The challenge is how to combine the latest technologies with old-school stuff to please supporters from both newer and older gen. people looking forward to witnessing a game in a stadium?

How will the stadiums of the future be? I read numerous initiatives of big clubs and leagues, but I am excited about the future stadium of Real Madrid. I wish the club would allow me to advise them how to create a smart intelligent Global environment to provide each fan with an individual experience, know who is in the crowd, learn fan behaviors to anticipate their needs.

How IoT and AI will transform the Industry?

“As long as sports remain a fascination for the masses, businesses will always have the opportunity to profit from it. As long as there is profiting to be gained from the world of sports, the investment in and incorporation of technology for sports will continue.”

I went through an article warning about an entirely new world order that is being formed right now. The author explained how 9 companies are responsible for the future of AI. Three of the companies are Chinese (Baidu, Alibaba, and Tencent, often collectively referred to as BAT), while the other six are American (Google, Amazon, IBM, Facebook, Apple, and Microsoft, often referred as the G.Mafia). The reason is obvious, as far as AI is about optimisation using the data that’s available, these 9 companies will manage most of the sports data generated in the world.

Collaboration is needed now to stop this threat and to address the democratisation of AI in sports. It is important that companies and Governments around the globe work together to create guiding principles for the development and use of AI and not only in Sports. This means we need regulations but in a different way. We do not want AI power to lie only in a handful of lawmakers, renowned and smart people who lack skills in IoT and AI.

Will AI change the future of sports betting?

The impact of technology on sports cannot be specifically measured, but some technological innovations do raise questions about fairness. Are we still comparing apples with apples? Is it right to compare the speed of an athlete wearing high-tech running shoes to one without?

Whether we like it or not, technology will continue to enhance the athlete’s performance. And at some point, we will have to put specific rules and regulations in place about which tech enhancements are allowed.

There is a downside to advanced technology being introduced to sports. Nowadays, Machine Learning models are routinely used to predict the results of games. Sports betting is a competitive world itself among fans, but AI can substantially tilt that playing field.

I am afraid that IoT and AI companies may spoil the result predictions but more concerned about the manipulation of competitiveness that AI algorithms could bring with the Terabytes of data collected with IoT devices and other sources like social media networks, without the permission of the users.

The sports industry is already generating billions of dollars every year and without control and awareness, we could find the future generation of ludopaths and a small number of service providers controlling the game.

Let me know what else would you like to see in my future posts. Leave your comments below.