Cities worldwide have been facing unexpected challenges since 2020 – and 2022 will see them continue to struggle with the after-effects of COVID-19. However, there is one thing that governments have learnt during this ongoing crisis – technology is not the only aspect of a Cities of the Future initiative. Besides technology, Cities of the Future will start revisiting organisational and institutional structures, prioritise goals, and design and deploy an architecture with data as its foundation.

Cities of the Future will focus on being:

- Safe. Driven by the ongoing healthcare crisis

- Secure. Driven by the multiple cyber attacks on critical infrastructure

- Sustainable. Driven by citizen consciousness and global efforts such as the COP26

- Smart. Driven by the need to be agile to face future uncertainties

Read on to find out what Ecosystm Advisors, Peter Carr, Randeep Sudan, Sash Mukherjee and Tim Sheedy think will be the leading Cities of the Future trends for 2022.

Click here to download Ecosystm Predicts: The Top 5 Trends for Cities of the Future in 2022

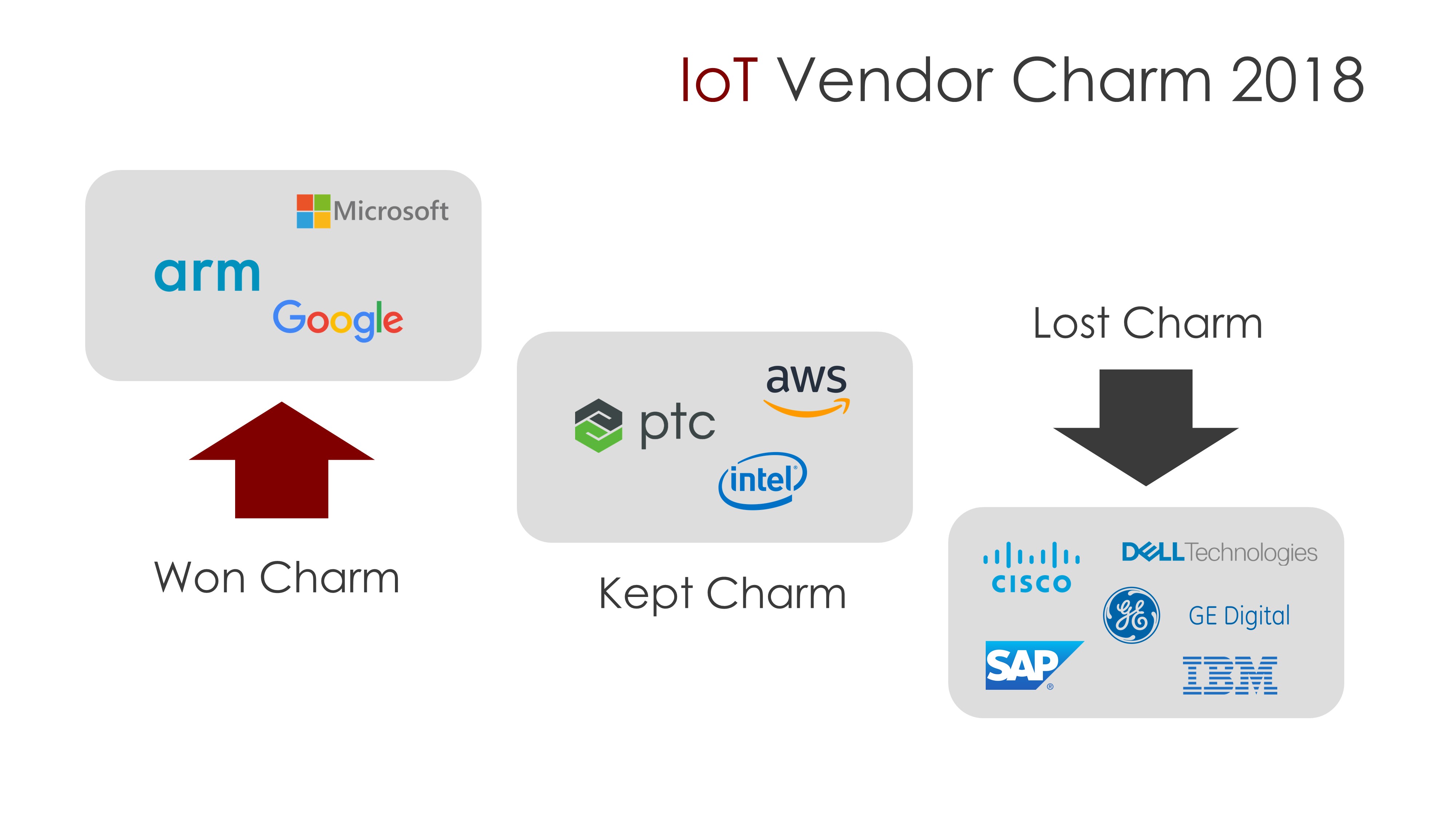

In my article “Which Top IoT companies are losing, keeping or winning its Charm in 2017?”, I reviewed the Top 10 IoT companies that lost, maintained or gained Charm in the IoT sector in 2017. Here are my updates for 2018.

Defining Charm. The power of pleasing or attracting through their strategy, investments, innovation, teams, products, events and media presence. Their attractiveness is well received all-round – by investors, customers, developers and analysts.

Which Ones Lost Charm in 2018?

The 5 Top companies that have lost IoT charm in 2018 are:

- Cisco. According to a Cisco study in 2017, only 26% of companies surveyed say they have achieved success with their IoT initiatives. And maybe executives at Cisco considered that it was time to go back to the basic. Cisco has taken their intent-based networking concept, which they first revealed in June 2017, and extended it to IoT. Maybe a cohesive IoT Strategy has begun to take shape at Cisco last year, but I did not see expected results of their Cisco Kinetic platform. I do not see any merits in the company gaining their Charm.

- GE Digital. In 2018, GE Digital´s leadership in Industrial IoT has remained in question. The parent company GE is expected to spin off the division into a standalone firm and is selling a majority stake in ServiceMax, considered a strategic acquisition only 2 years ago. All the turbulence around GE has negatively affected the sales of the Predix IoT Platform during 2018. No doubt that GE Digital lost their Charm in 2018.

- IBM. In spite of IBM Watson being named a leader in Worldwide IoT Platforms for 2017 by the IDC MarketScape, the results of IoT investment in 2016 did not show expected results. IBM continues to lose relevance in 2018 against other Cloud IoT vendors. IBM is pushing to be the driving force in IoT and become once again the most recognisable name in the IoT technology industry. I am confident that after IBM’s acquisition of Red Hat the company has the potential to recover their Charm in 2019. Great expectations for next year but in 2018 they lost their Charm.

- Dell Technologies. Dell Technologies’ Edge and IoT Solutions Division announcements in 2018 have particular resonance for channels. But maybe because the company is launching specific IoT solutions in phases with the appropriate reseller partners, I did not see the scale I had expected. Dell could not repeat the momentum of 2017 and lost their Charm in 2018.

- SAP Leonardo. After investing $2.2 billion in IoT and partner opportunities, SAP rolled out new applications and services around IoT and is making efforts to reduce the complexity of developing and deploying IoT solutions. However I did not see increased market share and new customers wins. SAP Leonardo could not keep their Charm in 2018.

Which Ones are Keeping their Charm?

The 3 Top companies that have kept their IoT Charm in 2018 are:

- PTC. Since Rockwell and PTC announced their partnership earlier 2018 at Rockwell – including a $1 billion equity investment from Rockwell into PTC – the two companies have been hard at work to bring their respective offerings into alignment. And before the end of the year they released their first collaborative offering: FactoryTalk InnovationSuite, which provides improved data insights through a single source of operations visibility and systems status. PTC also partners with Microsoft to help customers accelerate Digital Transformation in IoT. The company announced in fall 2018 that it is preparing an $18 million restructuring plan in 2019. We will probably see the impact in 2019, but PTC deserves to keep the Charm in 2018.

- Intel. IoTSWC 2018 awarded Intel-ARM-Pelion for innovative solutions jointly developed by Intel, ARM and Pelion enabling users to connect any IoT device to the cloud in a matter of seconds. Reducing the complexity of IoT development, Intel revamped their IoT roadmap to benefit developers and integrators in 2018. Other news through 2018 that helps Intel keep their charm were: Intel Capital pumps $72 million into AI, IoT, cloud and silicon startups, $115 million invested so far in 2018. Dell Technologies is combining tools from its broad portfolio with technology from Intel and partners in the Dell Technologies IoT Solutions Partner Program. Intel deserves to keep their Charm in 2018.

- AWS. In AWS re:Invent 2018, Amazon announced a variety of AWS IoT releases. Also, AWS IoT Greengrass extended functionality with connectors to external applications, hardware root of trust security, and isolation configurations , AWS IoT Device Management Now Provides New Features for Fleet Indexing and Jobs and Announcing AWS IoT SiteWise, Now Available in Preview. No doubt AWS has kept their Charm in 2018.

Which Ones are Winning Charm?

The 3 Top companies that have won IoT Charm in 2018 are:

- Microsoft. Microsoft is now the world’s most valuable company. The company made a major statement earlier in 2018 when they announced a $5 billion commitment to IoT projects for the next 4 years. That new investment has already resulted in new products, such as Azure Sphere and Azure Digital Twins. The company also launched their IoT deployment and management platform Axure IoT Central to the general public. New customers, new partners and good analyst recommendations makes them win the Charm in 2018.

- ARM. The list of ARM’s acquisitions in 2018, includes enterprise data management leader, Treasure Data (enabling device-to-data IoT platform), Stream Technologies (to expands IoT connectivity and device management capabilities) and ChaoLogix. These acquisitions and the new Pelion IoT Platform will give ARM businesses super powers. For the second consecutive year, ARM is in the Top winners of the IoT Charm list.

- Google. Google I/O 2018 marks a new era for IoT devices with new Google Assistant capabilities. In 2018 Google bought Xively to improve their IoT platform. The company invested in creating a strong ecosystem adding new IoT partners. Finally Google forays into edge computing with cloud IoT Edge and TPU. Good reasons to include Google in the winners list.

Thanks in advance for your Likes and Shares

A major consideration that I left for the end is whether to select an open source or a proprietary IoT Platform. The heart often wants open source, while the head chooses proprietary. It is near impossible to find someone who will deny that IoT Platforms are hot. It is not surprising that there are dozens of companies developing or updating their proprietary IoT platforms, with many of them using open source code in their products. I mention this to make it clear that probably most IoT platform vendors leverage some open source code.

Open Source IoT Platform

There are many people who believe that IoT needs open source to be successful. Everyone loves the promise of open source IoT platforms – It is free (or almost free); it is built by passionate communities of developers; and there is no vendor lock-in. Add to that, the rate of innovation, which is supposedly faster with open source IoT platforms. Why would anyone choose to work with anything else?

A while back the IoT Data Management (IoTDM) project showcased how a robust middleware platform can unlock innovation and fulfill the promise of IoT. I have been following up to 30 open source IoT platforms, starting with Eclipse Open Source IoT platforms project. Recently I have had conversations with members of a few of them such as Kaa and SiteWhere; but like I said there are many other enthusiastic IoT platform developers in the world, some closer than you think.

The advantages and disadvantages of open source have been repeated for years. On the advantages side we have:

- Cost

- Flexibility

- Avoiding cumbersome licensing requirements or activation headaches

- Freedom

However, it is not all roses in the realm of open source. As the saying goes, nothing is ever truly free. The disadvantages of open source include:

- Support

- Documentation

- Complexity

- Advertising

- Easily detectable vulnerabilities

I want to emphasize that sometimes, one of the advantages of open source – transparent, customizable code which is accessible by anyone – can be turned into a disadvantage. Without a proprietary vendor on the hook for releasing updates, fixes may be slower to arrive (though to be fair a strong developer community can develop solutions more readily as well).

Proprietary IoT Platform

If the decision to use and customize an open source IoT platform is complex, the decision to select a proprietary IoT platform is a nightmare. There are so many vendors out there that customers are expecting a market consolidation or running pilots before they can take a final purchase decision to invest in a proprietary IoT platform.

With companies like GE Digital failing with its Predix platform, the fear that any other big companies like Microsoft, AWS, Google, IBM or PTC can also fail is understandable.

And if this fear exists, you can imagine how customers feel when they need to decide among hundreds of proprietary IoT platforms guessing if they will survive or at least be acquired. You need to be careful of the Walking Dead of IoT

I have addressed the challenges and benefits of proprietary platforms in a previous blog: About IoT Platforms, Super Powers Methodology, Superheroes and Supervillains

Key Takeaway

I have repeated many times that the IoT is going to transform the way we live, work, and interact with each other. It’s more than a trend; it’s a revolution that will fundamentally transform the way the global economy functions, and IoT Platforms will play a key role.

Even after reading through this series it is possible that I may not have completely solved your doubts about what should be your decision regarding the most suitable IoT platform for your business. I hope at least you are not more confused! We should trust the market will consolidate very fast either by M&As or unfortunately by death of start-ups, so we will find a much clearer picture in a couple of years.

Nevertheless, should this fragmented market affect your decision to initiate or advance your IoT strategy? Clearly not. Your business cannot wait 2 or 3 years without IoT. Make sure that the IoT impacts you in your business – the IoT platform you choose will be key.

Thanks in advance for your Likes and Shares

Thoughts? Comments?

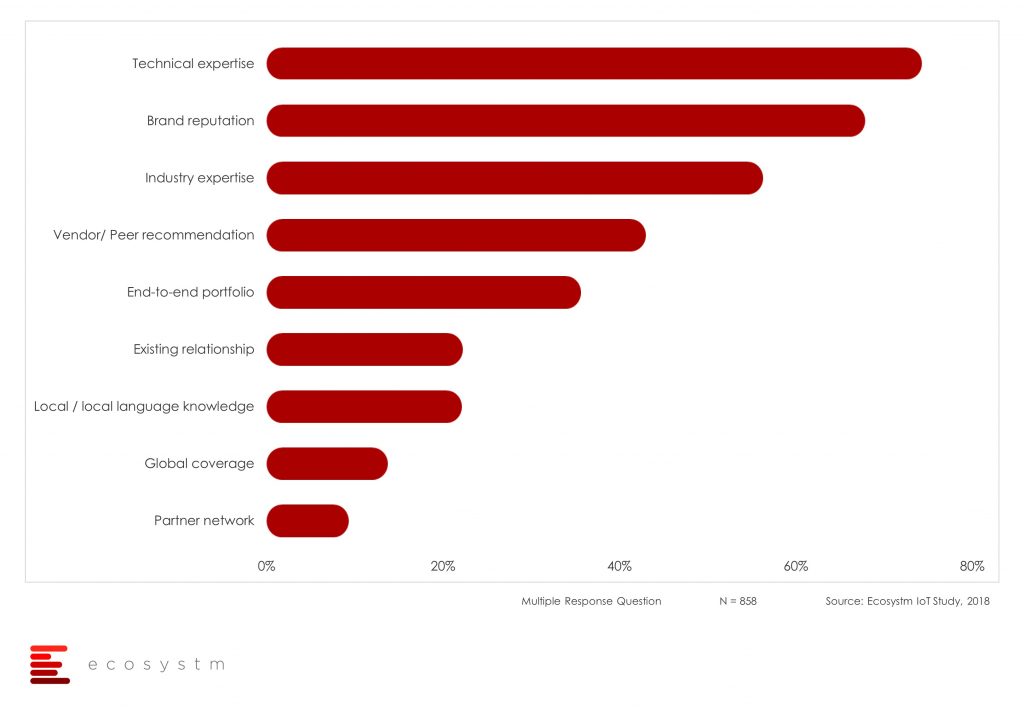

Industry knowledge is a key area of expertise that many organizations look for in their IoT platform vendor. The global Ecosystm IoT Study determined the key IoT partner selection criteria for planned deployments of IoT. While technical expertise emerges as the key criterion (and bodes well for horizontal platform vendors), industry expertise comes in at number 3.

Some industries such as the Retail, Distribution & Consumer Packaged Goods, Health & Life Sciences, and Transportation assign a higher significance to industry experience.

Vertical vs. Horizontal IoT Platforms

It is not my intention to write in detail about building a vertical or horizontal IoT platform. Though I promise to address this in a detailed post later. Nevertheless, I give you two very useful links that are relevant even today. They provide different and interesting point of views.

A good example of where a horizontal platform would be beneficial is when an organization wants to leverage the portfolio of a particular vendor – let’s say connectivity to Google Cloud Platform, giving customers the benefits of using BigQuery, Google’s analytical service, using data collected from connected devices. On the other hand, a good example of a vertical platform use would be from Healthcare where the organisation chooses an integrated cloud-based, analytics-driven solution designed to deliver real-time, actionable insights on patient care across the entire patient experience.

There are always some special industry cases, as well, such as the companies that want to participate in the home automation market. In Who Will Build The ‘God Platform’ For The Internet Of Things? the author suggests that these companies will need to create products that work compellingly in isolation and alongside competitors’ products — and somewhere in all of this, the ‘God Platform’ might emerge.

The Singular Case of Smart City Platforms

Smart Cities need Intelligent Platforms to thrive. IoT will be central to this shift from a vertical to horizontal approach, based around a new generation of powerful, unified Smart City Platforms, capable of managing different technologies and devices and supporting a wide range of applications and services. A Smart City Platform is defined as a framework for sensing, communications, integration and intelligent decision-making, delivering the minutest information and services that citizens need.

Some Other Considerations

Platforms Vs. Products

We hear IoT vendors saying that the IoT is at an inflection point. In “The Internet Of Things Race – Platforms Vs. Products”, Adrian Bridgwater raises an interesting discussion. What matters most, the platforms or the products?

“What does matter is the degree to which we recognize just how much the Internet of Things (IoT) platform-level technologies matter. We need analytics tools capable of dealing with large quantities of fast-moving data, we need cloud Platform-as-a-Service functionality that is capable of handling the immense flow of data and provide anytime access for decision and we need security systems capable of helping organizations protect IoT data as rigorously as they do their own confidential financial, IP and strategy information”.

For Adrian, today, it’s the Internet of Things (IoT) but tomorrow it will be the Internet of Analytics-Enabled Secure Automated Wearable Things (IoA-EASWT).

Platforms Vs. Frameworks

Lots of IoT frameworks and/or platforms with different enterprise offerings and alliances have come up recently to increase the connectivity of devices into private and/or public networks/cloud. Key to a successful IoT implementation is the interoperability among various devices, robust IoT frameworks and platforms that enable the same with powerful analytics that enable applications to be built on top of it.

In this instalment we explore how commercially available platforms, including M2M platforms, might be an option for you.

Once Upon a Time – A Small Group of M2M Platforms

M2M Service Providers have been using the term M2M Platform for years with their enterprise customers. The main functionality of these carrier-grade platforms was to manage connectivity through a secure, fast and reliable private network via dedicated hubs directly into each of the major network partners. They allowed control of multiple network SIM estates, management of SIMs and devices and finally management of their billing administration in line with their own systems and procedures.

Most M2M Service Providers developed in-house M2M platforms but also in parallel they acquired M2M platforms from vendors such as Cisco Jasper Control Center, Ericsson Device Connection Paltform (DCP) , Cumulocity, and Telenor Connexion , among others.

With the hype around IoT, M2M Service Providers become more interested in offering their enterprise customers an IoT application development environment that can reduce time, cost, and complexity of deployment of solutions, that can optimize their business processes and help them deliver better and faster services. An early example was Etisalat leveraging ThingWorx IoT Development Platform, announced in 2015.

Which brings me to a mobile network operator (MNOs) – Can they avoid the temptation to develop their own IoT management and application platforms? The complexity of IoT value-added service (VAS) development and deployment demands a continuing operational and commercial effort.

My recommendation: MNOs should instead consider partnering with well-established technology vendors in order to accelerate time to market and create customer value through innovation.

Buy or Build an IoT Platform – Making the Right Decision

Technology companies have spent years adapting their sales pitch to convince their customers or potential customers of the advantages of buying commercial products or ultimately IaaS, PaaS or SaaS platforms. On the other hand, many companies across industries see a risk that their business will depend on suppliers and fear being captives of these technology providers. Their management team and tech leaders have found enough arguments to develop their solutions from scratch.

The eternal dilemma, whether to build from scratch or buy a commercially available off-the-shelf (COTS) IoT Platform to support the needs of the enterprise will continue for a while. Here’s what you need to know about both approaches before making this critical project decision.

- Step 1: Validate the need for an IoT platform. Focus on validating that a business need exists prior to deciding and estimate the return on investment (ROI) or added value.

- Step 2: Identify core business requirements – Involve the right business people. This will determine the success of the process.

- Step 3: Identify architectural requirements – It is extremely important to identify any architectural requirements and follow the status of the confusing IoT standards world, before determining if a COTS or custom solution is the best choice.

- Step 4: Examine existing IoT Platforms – At this point, a business need has been pinpointed, ROI has been estimated, and both core business and architectural restrictions have been identified. Now, you should take a good look at existing IoT vendors (a short list of IoT platforms, to be more concrete).

- Step 5: Evaluate your in-house skills to support a custom IoT platform – It takes many skills to design and deploy a successful IoT platform that is both scalable and extensible.

- Step 6: Explore if a COTS IoT platform fits your need – If your organization does not include a development group comprising personnel experienced in designing IoT solutions to support your enterprise-wide business solutions, a COTS IoT platform will probably provide the best long-term ROI.

More considerations for choosing an IoT platform coming up in the next

When I published “It’s an IoT Platform, stupid!” in 2015 , I did not think that it would be one of my most visited and shared articles. I am proud that just in LinkedIn, this article has received more than 8,000 visits. That´s why I have chosen an update of that article to initiate my collaboration with Ecosystm.

When in late 2013, I decided to relaunch my company OIES Consulting with a focus this time on Advisory services for Internet of Things (IoT), I thought the selection of IoT platforms would be one of the most useful services that we would offer and certainly one that would bring more benefits to the clients wishing to accelerate the adoption of IoT.

At that time, I had identified about 60 IoT platform vendors and despite guidance from research firms, the confusion was brutal. Today it is worse – there are more than 600 platform vendors and the expected market consolidation still has not arrive. Like other analysts and bloggers, I tried to maintain, classify and publish a list of IoT platform vendors but it looks like an impossible task. However, it is a matter of 2-3 more years.

You must agree with me that the IoT platform market needs a quick and urgent consolidation. Hopefully, in the magical year of 2022, we will be talking about no more than 50 vendors at the most.

The Confusing Market of IoT Platforms

But first things first. How to define an IoT platform? How to differentiate between a Connected Device Platform (CDP) and an Application Enablement Platform (AEP) and an IoT Middleware and a Service Enablement Services (SES) platforms?

“Not All IoT Platforms are Created Equal”, it has been said before, and we must understand that the current generation of IoT platforms probably represent the first iteration in this space. But there are marked differences between the different types of platforms. As an organization looking to embrace an IoT platform, this initial diversity can result very confusing. Sean Lorenz from Xively rightly said that the “IoT Platform” is such an overloaded term that its meaning has been lost. Chipset manufacturers, sensor manufacturers, software vendors, consortia and system integrators all have their own definitions.

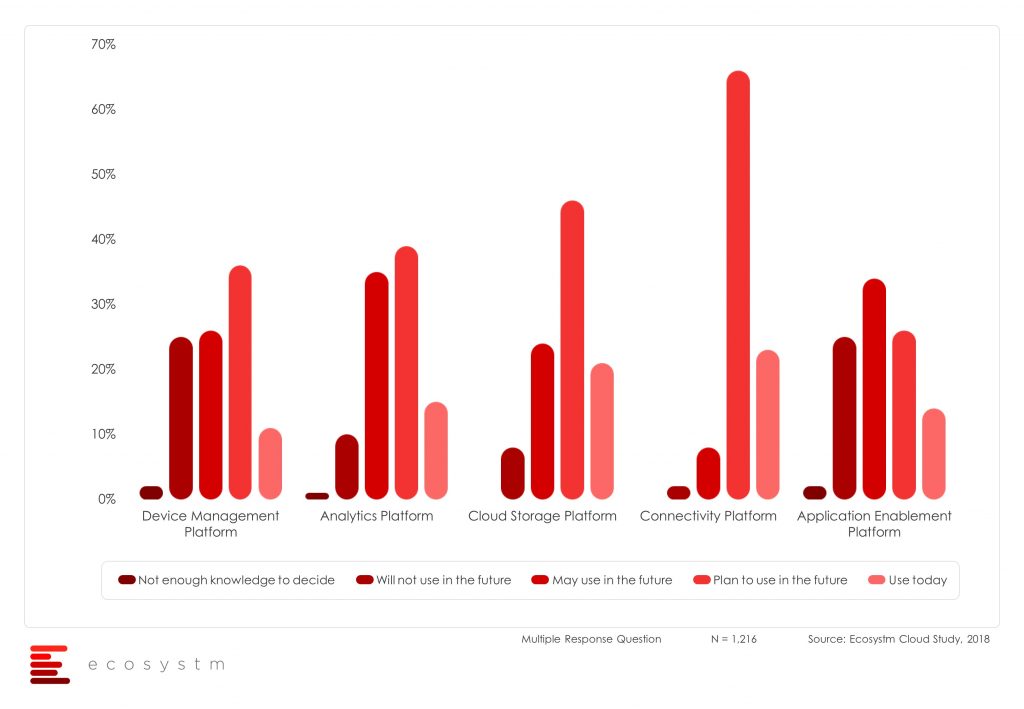

We find out there with a large number of companies that offer us IoT platforms in the cloud or on premises; for horizontal or vertical implementations; for embedded software development or industrial applications development; with data capture and real-time analytics capabilities; with devices and protocols management capabilities; with connectivity to any network; for developing applications for smart homes, for smart cities, for connected vehicles, for wearables….. the list continues! Tech buyers are understandably confused in their choice of IoT platform. The global Ecosystm IoT Study reveals this confusion.

In such circumstances it is preferable to avoid arguments about which is an IoT platform and how we categorize them. My recommendation here is to ask for help from specialized IoT consultants. They will be able to give you specific guidance based on present and future business needs and can help in the IoT platform selection.

Over my next few blogs I will attempt to guide you through the significance of the different kinds of platforms. It will surely help you in your IoT platform choice, keeping the needs and capabilities of your business in mind.

Stay tuned!