At the end of last year, Ecosystm published The Top 5 IoT Trends for 2020. Principal advisors, Kaushik Ghatak and Francisco Maroto predicted that in 2020 5G providers will be forced to operate outside their comfort zone. While the impact on network and communications equipment providers will be immense, 5G will also force telecom providers to re-think their existing business models. They may not be the best equipped to take 5G technology to market, they way the operate now.

Traditionally telecom providers have been focused on horizontal technologies and on connecting people. They have not had to have conversations around connecting machines – where every industry has their own unique use cases. This verticalisation, will force telecom providers to deal with newer stakeholders in their client organisations – not just IT infrastructure and Facilities. Several telecom providers have in the past become public cloud providers, as their markets becomes smaller and they face competition from global cloud storage providers. Now, telecom providers will increasingly look to partner with cloud providers and systems integrators with relevant industry experience, to translate the value proposition of what they are offering. “Strategic partnerships between leading technology and telecom operators are taking place especially in building various 5G use cases and applications centred on the cloud computing platform,” says Shamir Amanullah, Principal Advisor Ecosystm.

Maxis Strengthening their Market Position in Malaysia

The recently announced partnership between Maxis and Microsoft is an example of how these partnerships will pan out. Maxis does not want to be viewed only as a telecom provider and wants to be the leading Malaysia-based solutions provider. As telecom providers also start to tap the enterprise market, cloud and IoT will be key technology areas, that they should focus on.

“Maxis is leading the way as a converged solutions provider in Malaysia and following the appointment of Gökhan Ogut as the CEO in 2019, there has been a focus to grow the enterprise business which promises a lucrative opportunity,” says Amanullah.

“While the mobile connectivity market is effectively about customer retention in a saturated market, new opportunities lie in enterprise needs for fixed connectivity, managed services, cloud and IoT which is largely untapped. The expected deployment of the 5G network will spur new applications, business models and partnerships.”

Maxis’ move appears to be well-thought. Amanullah thinks that the strategic partnership with Microsoft will help Maxis accelerate its enterprise solutions offering combined IoT and 5G capabilities with Microsoft’s Azure IoT technology. It will also allow for hybrid environments, which is important given the rise of hybrid and multi-cloud adoption. Ecosystm research shows that hybrid cloud adoption in Malaysia is at a nascent 7%. But if they take a lesson from their neighbour, the rise in adoption will be steep. Our research finds that hybrid cloud adoption in Singapore is around 42%.

Telecom providers are also focusing on Digital Transformation (DX). In the Top 5 Telecommunications & Mobility Trends for 2020, Liam Gunson, Director Ecosystm says, “In 2020, operators will focus on transforming the core – remove unnecessary costs, improve customer experience, capture new opportunities – and on building telecom networks with scalability, flexibility, efficiency and agility.” Microsoft’s enterprise Modern Workplace solutions including Microsoft Teams will aid Maxis’ own DX efforts. Maxis will offer fixed line voice calls with the unified communications service.

Mutually Beneficial Partnership

Amanullah also sees this as a positive move for Microsoft. “Microsoft is poised to lead efforts in 5G network deployment which promises to enhance capabilities and drive new economic growth, especially with the focus on Industry 4.0. Maxis’ position as a leading enterprise communications provider and Microsoft’s enterprise technology experience and offerings promises a mutually beneficial partnership.”

Ecosystm research finds that Microsoft is the leading cloud provider in Malaysia when it comes to brand perception, and about a third of enterprise cloud deployments use Microsoft. Amanullah thinks that, “Microsoft’s leading position in cloud platforms is an attractive proposition for enterprises that are looking at speed, performance, reliability, global scale, security and lower costs.”

Talking about the 5G applications that the Malaysia market will see, Amanullah sees tremendous business opportunities in areas such as smart city, autonomous driving, smart traffic management, virtual reality (VR), augmented reality (AR), cloud gaming, and healthcare, to name a few.

With the advancements in the technology landscape, the CIO’s role has become increasingly complex. One of the key challenges they face is in emerging and newer technology implementations, which require them to identify and partner with newer tech vendors. The common challenges that tech buyers face today include:

- The emergence of newer technologies that are catching the fancy of the C-suite and they are expected to adopt and deliver

- Getting management buy-in for IT investments (increasingly including discussions on ROI)

- Need to involve business stakeholders in tech decision-making

- Lack of sufficiently skilled internal IT

- Engagement with multiple tech vendors (including newer vendors that they have to establish a relationship with)

- Digital transformation projects that might require an overhaul (or at least a re-think) of IT systems

- Backdrop of compliance and risk management mandates

Many of these challenges will require the sourcing of new technology or a new tech partner and rethinking their vendor selection criteria. And selecting a tech vendor can be hard. The mere fact that there is an industry whose sole purpose is to help businesses select tech vendors goes to show the massive gap between what these providers sell and what businesses want. If there was easy alignment, the Tech Sourcing professionals and businesses would not have existed.

But over my time working with Tech Sourcing professionals, CIOs and business leaders, I have picked up on a few key factors that you should incorporate in your vendor selection process best practices. First and foremost, you are looking for a partner – someone who will be with you through the good and bad. Someone whose skills, products, services – and most importantly – culture, match your business and its needs.

I believe that the technology ecosystem is not really as competitive as we think. Yes, in practice Google competes with Microsoft in the office productivity space. But I often hear about companies moving from one to the other not for features, function or even price – but for a cultural match. Some traditional businesses were hoping Google can help them become more innovative, but in reality, their business culture smothered Google and meant they could not benefit from the difference in the ways of working. And I am not suggesting Microsoft is not innovative – more that Office represents the traditional ways of working – and perhaps can help a business take a more stepwise approach to change its own culture.

And I regularly hear about IT services deals (managed services, systems integration, consulting etc) going to the company that made the most sense from a cultural fit – where they were willing to take on the culture of their customer and embrace that way of working. In fact, I have been brought into many deals where a company hired a strategic consultant to create a new digital strategy or AI strategy, only to receive a document that is unworkable in their business and their culture.

So, I believe every strategic technology relationship should start and end with a cultural match. This company is a partner – not just a provider. How do you determine if they are a partner and measure cultural match? Well, that is the topic of an upcoming report of mine, so watch this space!

Questions You Should Ask Before Stepping in the Ring

There are also a number of questions that you should ask along with the partnership discussion:

- How will this solution change the organisation?

- What are the risks either way (of implementing or not implementing the solution)?

- Does the solution solve a key business problem?

- Is it likely to have more impact than the solution it is replacing?

- Where will the funding for the implementation come from?

- Have you calculated the ROI and the time to deployment?

- Have you baselined the current scenario so that you can measure improvement?

These can inform you of the business impact of the solution – and what you need to do to prepare for successful implementation (if you plan for success, you are more likely to be able to get faster benefits than if you do not plan for the change!)

Engagement Criteria for Your Shortlisting Process

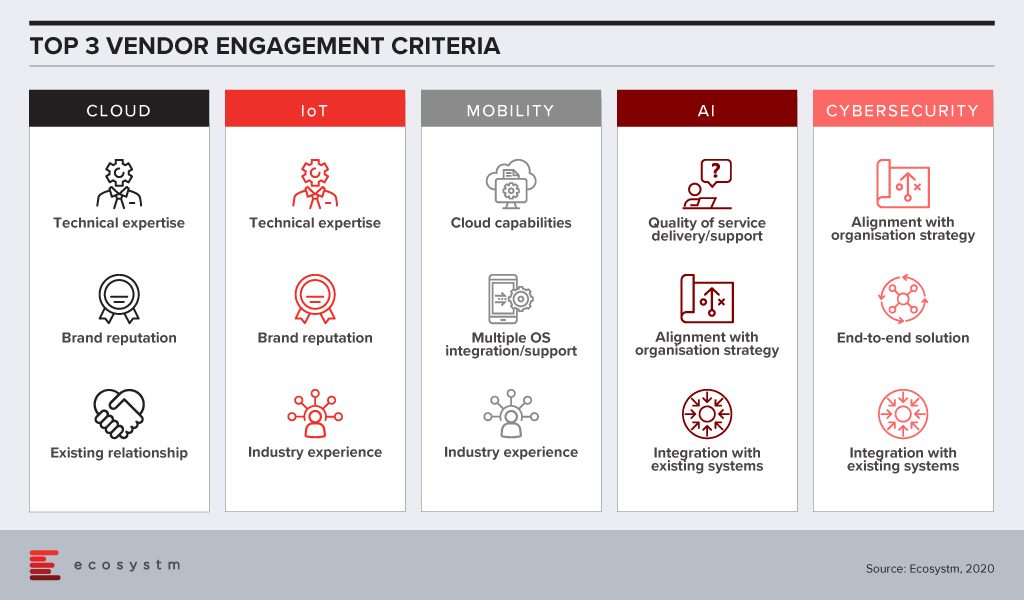

In order to determine vendor selection process best practices, Ecosystm research tries to unearth the top criteria that organisations employ when shortlisting the vendors that they want to engage, across multiple technologies.

There is still a skills gap in internal IT and organisations want technical guidance from their Cloud and IoT vendors. With the plethora of options available in these tech areas, CIOs and IT teams also tend to look at the brand reputation when engaging with the vendor. Very often, organisations looking to migrate their on-prem solutions on the cloud engage with existing infrastructure providers or systems integrators for guidance, and existing relationships are significant. IoT solutions tend to be very industry-specific and a portfolio of specific industry use cases (actual deployments – not proofs of concept) can be impactful when selecting a vendor for planned deployments.

Artificial intelligence (AI) deployments are often linked with digital transformation (DX). Organisations look for a vendor that can understand the organisational strategy and customise the AI solutions to help the organisation achieve its goal. Adoption of AI is still at a nascent stage globally across all industries. Many organisations do not have the right skills, such as data scientists, yet. They appreciate that integration with internal systems will be key to reap the full benefits of the solutions, especially if the entire organisation has to benefit from the deployments. They also anticipate that they would have to have a continuous period of engagement with their vendors, right from identifying the right data set, data cleaning to the right algorithms that keep learning. Organisations will look at vendor partners who are known for delivering better customer experience.

This is true for cybersecurity solutions as well, as organisations are driven to continue their investments to adhere to the internal risk management requirements. Given how fragmented the cybersecurity landscape has become, organisations will also wish to engage with vendors that have an end-to-end offering, especially a managed security service provider (MSSP). Cybersecurity vendors are increasingly strengthening their partner ecosystem so that they can provide their client with the single-point-of-contact that they want.

Of the technologies mentioned in the figure, mobility is arguably the most mature. As organisations revisit their enterprise mobility solution as they go increasingly ‘Mobile First’, their requirements from their mobility vendors are more specific. They have decided over the years which OSs they want to support their enterprise applications and are looking for vendors with robust cloud offerings.

The vendor selection criteria will likely be different for each technology area. And as your knowledge and understanding of the technology increases, you should be able to drill the requirements down to the solution level, while making sure you engage with a vendor with the right culture.

Tim Sheedy’s upcoming report, ‘Best Practices for Vendor Evaluation and Selection’ is due to be published in February 2020.

The telecommunications industry has long been an enabler of Digital Transformation (DX) in other industries. Now it is time for the industry to transform in order to survive a challenging market, newer devices and networking capabilities, and evolving customer requirements. While the telecom industry market dynamics can be very local, we will see a widespread technology disruption in the industry as the world becomes globally connected.

Drivers of Transformation in the Telecom Industry

Remaining Competitive

Nokia Bell Labs expects global telecom operators to fall from 10 to 5 and local operators to fall from 800 to 100, between 2020 and 2025. Simultaneously, there are new players entering the market, many leveraging newer technologies and unconventional business models to gain a share of the pie. While previous DX initiatives happened mostly at the periphery (acquiring new companies, establishing disruptive business units), operators are now focusing on transforming the core – cost reduction, improving CX, capturing new opportunities, and creating new partner ecosystems – in order to remain competitive. There is a steady disaggregation in the retail space, driving consolidation in traditional network business models.

“The telecom industry is looking at gradual decline from traditional services and there has been a concerted effort in reducing costs and introducing new digital services,” says Ecosystm Principal Advisor, Shamir Amanullah. “Much of the telecom industry is unfortunately still associated with the “dumb pipe” tag as the over-the-top (OTT) players continue to rake in revenues and generate higher margins, using the telecom infrastructure to provide innovative services.”

Bringing Newer Products to Market

Industries and governments have shifted focus to areas such as smart energy, Industry 4.0, autonomous driving, smart buildings, and remote healthcare, to name a few. In the coming days, most initial commercial deployments will centre around network speed and latency. Technologies like GPON, 5G, Wifi 6, WiGig, Edge computing, and software-defined networking are bringing new capabilities and altering costs.

Ecosystm’s telecommunications and mobility predictions for 2020, discusses how 5G will transform the industry in multiple ways. For example, it will give enterprises the opportunity to incorporate fixed network capabilities natively to their mobility solutions, meaning less customisation of enterprise networking. Talking about the opportunity 5G gives to telecom service providers, Amanullah says, “With theoretical speeds of 20 times of 4G, low latency of 1 millisecond and a million connections per square kilometre, the era of mobile Internet of Everything (IoE) is expected to transform industries including Manufacturing, Healthcare and Transportation. Telecom operators can accelerate and realise their DX, as focus shifts to solutions for not just consumers but for enterprises and governments.”

Changing Customer Profile

Amanullah adds, “Telecom operators can no longer offer “basic” services – they must become customer-obsessed and customer experience (CX) must be at the forefront of their DX goals.” But the real challenge is that their traditional customer base has steadily diverged. On the one hand, their existent retail customers expect better CX – at par with other service providers, such as the banking sector. Building a customer-centric capability is not simple and involves a substantial operational and technological shift.

On the other hand, as they bring newer products to market and change their business models, they are being forced to shift focus away from horizontal technologies and connecting people – to industry solutions and connecting machines. As their business becomes more solution-based, they are being forced to address their offerings at new buying centres, beyond IT infrastructure and Facilities. Their new customer base within organisations wants to talk about a variety of managed services such as VoIP, IoT, Edge computing, AI and automation.

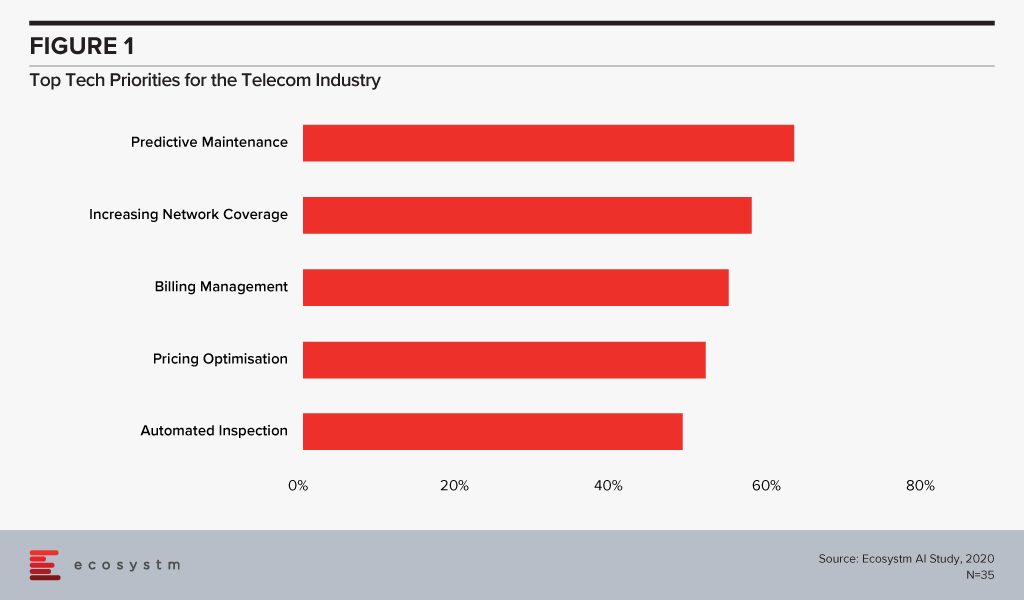

The global Ecosystm AI study reveals the top priorities for telecom service providers, focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through better coverage, smart billing and competitive pricing) and process optimisation (including asset maintenance).

Technology as an Enabler of Telecom Transformation

Several emerging technologies are being used internally by telecom service providers as they look towards DX to remain competitive. They are transforming both asset and customer management in the telecom industry.

IoT & AI

Telecom infrastructure includes expensive equipment, towers and data centres, and providers are embedding IoT devices to monitor and maintain the equipment while ensuring minimal downtime. The generators, meters, towers are being fitted with IoT sensors for remote asset management and predictive maintenance, which has cost as well as customer service benefits. AI is also unlocking advanced network traffic optimisation capabilities to extend network coverage intelligently, and dynamically distribute frequencies across users to improve network experience.

Chatbots and virtual assistants are used by operators to improve customer service and assist customers with equipment set-up, troubleshooting and maintenance. These AI investments see tremendous improvement in customer satisfaction. This also has an impact on employee experience (EX) as these automation tools free workforce from repetitive tasks and they be deployed to more advanced tasks.

Telecom providers have access to large volumes of customer data that can help them predict customer usage patterns. This helps them in price optimisation and last-minute deals, giving them a competitive edge. More data is being collected and used as several operators provide location-based services and offerings.

In the end, the IoT data and the AI/Analytics solutions are enabling telecom service providers to improve products and solutions and offer their customers the innovation that they want. For instance, Vodafone partnered with BMW to incorporate an in-built SIM that enables vehicle tracking and provides theft protection. In case of emergencies, alerts can also be sent to emergency services and contacts. AT&T designed a fraud detection application to look for patterns and detect suspected fraud, spam and robocalls. The system looks for multiple short-duration calls from a single source to numbers on the ‘Do Not Call’ registry. This enables them to block calls and prevent scammers, telemarketers and identity theft issues.

Cybersecurity

Talking about the significance of increasing investments in cybersecurity solutions by telecom service providers, Amanullah says, “Telecom operators have large customer databases and provide a range of services which gives criminals a great incentive to steal identity and payment information, damage websites and cause loss of reputation. They have to ramp up their investment in cybersecurity technology, processes and people. A telecom operator’s compromised security can have country-wide, and even global consequences. As networks become more complex with numerous partnerships, there is a need for strategic planning and implementation of security, with clear accountability defined for each party.”

One major threat to the users is the attack on infrastructure or network equipment, such as routers or DDoS attacks through communication lines. Once the equipment has been compromised, hackers can use it to steal data, launch other anonymous attacks, store exfiltrated data or access expensive services such as international phone calls. To avoid security breaches, telecom companies are enhancing cybersecurity in such devices. However, what has become even more important for the telecom providers is to actually let their consumers know the security features they have in place and incorporate it into their go-to-market messaging. Comcast introduced an advanced router to monitor connected devices, inform security threats and block online threats to provide automatic seamless protection to connected devices.

Blockchain

Blockchain can bring tremendous benefits to the telecom industry, according to Amanullah. “It will undeniably increase security, transparency and reduce fraud in areas including billing and roaming services, and in simply knowing your customer better. With possibilities of 5G, IoT and Edge computing, more and more devices are on the network – and identity and security are critical. Newer business models are expected, including those provided for by 5G network slicing, which involves articulation in the OSS and BSS.”

Blockchain will be increasingly used for supply chain and SLA management. Tencent and China Unicom launched an eSIM card which implements new identity authentication standards. The blockchain-based authentication system will be used in consumer electronics, vehicles, connected devices and smart city applications.

Adoption of emerging technologies for DX may well be the key to survival for many telecom operators, over the next few years.

Xiaomi Corporation – a Chinese electronics giant often dubbed the “Apple of China”, with specialisation in smartphones and smart devices – is now planning to focus on non-smartphone segments for growth. Last week the Beijing based company announced a planned investment of more than US$7 Billion in the areas of 5G, Artificial Intelligence (AI), and Artificial Internet of Things (AIoT). The announcement builds on last year’s pledge to invest US$1.5 billion over five years in an “All in AIoT” (AI+IoT) strategy.

Setting the scene for AI, IoT and 5G

Facing stiff competition from the likes of Huawei (with 42% of China’s smartphone market share in Q3 2019), Xiaomi is aiming to sustain business growth in the face of a challenging smartphone market. Xiaomi Corp is well versed with 5G and not a newcomer in the AI space. They already make 5G devices, and AI has been embedded in Xiaomi’s technology ecosystem such as messaging, instore applications, smartphones, laptops, TVs, routers, speakers, and other smart devices. In fact, Xiaomi Corp claims to have the world’s largest consumer IoT platform with more than 213.2 million smart devices (excluding smartphones and laptops) connected to its IoT platform.

Commenting on the Xiaomi’s competitiveness amongst Chinese smartphone makers and market potential for AI, IoT and 5G globally, Ecosystm Principal Advisor, Tim Sheedy said “Xiaomi has had some recent successes as a smart device maker, with its robot vacuums and other devices quickly earning positive reviews and gaining market recognition. Xiaomi has been able to surpass many traditional players which demonstrates their capabilities of competing in the IoT/smart devices category.”

On the 5G capability aspect of Xiaomi Corp, Sheedy said, “it is early days for 5G – even in China – and the stated position of having many 5G devices in the market could put Xiaomi ahead of some of their competitors in relation to availability. Going forward, it will be interesting to look at the integration of AI, IoT and 5G by Xiaomi.”

Sheedy further added, “we can expect Xiaomi devices to get smarter and more interconnected. Xiaomi actually has the opportunity to take some of the home-centric device hubs out of the ecosystem as they connect straight to the 5G network, and are controlled by an intelligent cloud-based hub perhaps mostly accessed through Xiaomi mobile phones.”

Meeting the Cybersecurity standards

Cybersecurity concerns are common around Chinese device makers. Recently, Xiaomi wireless devices have been disabled from connecting to Google’s Nest devices due to security flaws. On top of this, there have been concerns over the last few years about how Chinese tech companies secure their products and who has access to the data.

“Privacy and security are concerns for consumers – but they are often trumped by convenience, features and off-course price. Xiaomi Corp is aiming to make some of the best devices in each category and as long as they respond quickly and openly to privacy issues, they are likely to continue to see success both inside and outside of China. Their focus on driving down costs in order to be a price leader will help them with this challenge too” said Sheedy. “Ultimately, the privacy and security issues will impact the entire market – not just Xiaomi or other Chinese vendors as the users will steer away from all “smart, connected devices” – not just those from specific suppliers.

Market Positioning Approach

Xiaomi Corporation’s philosophy is to do more business with smaller margins, which drove it to expand its smartphone market from China to other areas like India and Europe. The company is aiming to strengthen its positioning in the consumer electronics market with further tech investments.

Sheedy explains that “considering the fact that they are losing market share in handsets in China, I would imagine that they will double down their efforts to be better at what they do now – not enter entirely new markets. I expect that we will see them produce smarter, connected devices – getting into more of the home and consumer market rather than move into the enterprise market. The enterprise market requires different sales strategies and channels, different partners, different margins, different support mechanisms etc.”

Naturally, Xiaomi is not alone in investing heavily in next-generation technologies. For example, Huawei opened a dedicated IoT consumer lab at the end of 2018 and is continuing to commit resources to the development of this industry-changing technology.

“The 5G plus AIoT strategy is the right one for Xiaomi. They need to surround their competition and make their products better, smarter and more affordable. With the growth in 5G services, a product leadership in this space, beyond smartphones – in smart devices too – will set them up for continued success in what is a very competitive market” said Sheedy.

Having recently taken a security awareness course as part of my annual requirement by my organization, I was thinking about how other assets (besides people) also tasked with roles in the business can better protect the corporate environment. This led to thoughts about the role of the smart building in deterring cyber-attacks. An organization’s information risk profile is defined through a risk assessment of organizational information infrastructure and associated data assets.

So how might the infrastructure of a smart building decrease your organizational risk profile? Can you measure this?

In terms of having an index, I am currently creating an index (like my security awareness course) to rate the level of cybersecurity a building provides to its owners (or lessees). Given we already have sustainability indices for commercial real estate in the form of the CBRE Green Building Adoption Index, my intention is to build a reference cybersecurity metric in how the infrastructure of smart buildings can be compared from the point of those either owning or renting the space. For this index, I will be defining the number of risks, type of risk and potential effects of risk on smart building infrastructural implementations.

Separating control from performance

Physical control of buildings was traditionally seen as separate from enterprise networks. The control systems domain was protected by physical separation, and facilities management was handled as a different domain. However, as global services delivery, data sharing and data acquisition for cost-effectiveness became critical functions within modern business, facilities management became tied to the corporate data network.

Smart buildings now combine legacy operational technology for building automation systems (BAS) together with enterprise IT and IoT devices. Unlike IT environments, which have developed workflows and technologies to address cyber threats, hackers can exploit the vulnerabilities of BAS to enter the IT network and get hold of restricted data located on servers and computers.

The benefits of operation and analytics available for facilities management on how the building performed have given insights into better asset management. But with connectivity has come risk exposure to external exploits and possible attacks.

Life at the Edge

Given edge computing and IoT devices create content for analysis, can they also provide misinformation or redirection for potential attacks on the corporate network? In other words, can the smart building dangle a click bait carrot or honey trap for potential hackers to pull them off the scent of the main system?

Just as we have access layers of data security based on roles within the enterprise, perhaps we should start looking at creating a separate operational data layer for physical control of the building, with the building taking an active role in its own defense. IoT technology, such as sensors, can automatically transfer an office area to ‘vacant’ security mode so potential hackers cannot gain access by moving the area to preset security settings to optimize network protection. This could also mean terminals off, USB ports disabled, and access secured with physical tokens.

Design to cloak or protect

Another way we can create a buffer to protect those assets by a slight disconnect with better perimeter management. One recent approach is the concept of Airwalls. Tempered Networks defines their Airwall edge services as “identity-defined perimeters that enforce access and segmentation for the systems protected within the Airwall”. This creates the possibility to deploy end-to-end encrypted connectivity around operational assets. An Airwall controls and enforces authenticated network communications between protected systems, while denying access to all unauthorized systems. To my understanding, authorized devices for protected access would be physical objects, not passwords. The goal is to remove the access to the IP address information for the potential hacker by creating an air pocket within the enterprise. For those Star Trek fans reading this, imagine a Klingon cloaking device for the ICS.

From the point of standards, there is the development of the IEC 62443 global set of cybersecurity standards to reduce vulnerability. This is set to improve safety, availability, integrity and confidentiality of systems used for industrial automation and control.

How much risk exists from your operational BAC systems?

Smart buildings can be efficient and effective but can also come with cybersecurity vulnerabilities that can be inadvertently introduced when smart technologies are deployed without the necessary consideration of what controls and patches are required to protect them.

In your cybersecurity planning for 2020, what active role does your operational systems play both in protection and in deterrence? Is your smart building helpful with sensor usage and alerts, or does it create hacking opportunities with disconnects and older communication protocols?

Reach out to have a conversation with me if you are interested in the index I am working on, or you’d like some advice on what cyber risk issues to consider in your infrastructural development.

The industry has been enthusiastic about the number of devices and sensors that are expected to increase exponentially in 2020 and beyond. The role of the Internet in Things (IoT) in delivering ‘Smart’ solutions is seeing unprecedented interest in technology. However, 2020 will be the year when IoT adoption will see a sharp increase in uptake as 5G rollouts gather steam and governments across the world focus on Smart City initiatives.

Here are our predictions on the Top 5 IoT Trends for 2020, that we think, will shape the Internet of Things landscape over the next 12 months.

The Top 5 IoT Trends for 2020

The Top 5 IoT Trends for 2020 are based on the findings of the global Ecosystm IoT and AI studies, and is also based on qualitative research by Ecosystm Principal Advisors Francisco Maroto and Kaushik Ghatak.

-

5G Providers Will Be Forced to Operate Outside their Comfort Zone

Network and communications equipment providers have much to gain and more to lose as organisations look to leverage 5G for their IoT use cases. Each industry will have their different and distinct use cases – the use cases for Oil & Gas will be different from Retail use cases, which will be different from Healthcare industry requirements.

Telecommunications providers will find themselves depending on systems integrators (SIs) with relevant industry experience, to translate the value proposition of what they are offering. However, the telecommunications providers are not companies with actual skin in the game. If 5G uptake does not take off, the bigger losers will be the network and communications equipment providers – the real investors in the technology.

-

Satellite IoT Connectivity Solutions Will Start to Compete Against and Work with LPWANs

Current satellite communications technologies have not been designed specifically for IoT and may fail to meet the specific requirements of the IoT market, especially when it comes to price and ease of use.

This is set to change as both incumbents and new entrants in the satellite space seek to grow their IoT markets in 2020. Satellite communications companies are designing a spectrum strategy and a go-to-market strategy that include collaboration with Low Power WAN (LPWAN) vendors.

-

IoT Sensor Analytics Will Become the Fastest Growing AI Workload

Many organisations will actually start their digital journey and their investments in AI even before they invest in automation – when they start to analyse the data from their IoT sensors and make sense of the ‘data sprawl’ that is created as the number of data collection points proliferate. Organisations’ desire to transform, starting with automation, will further drive the adoption of IoT. The global Ecosystm AI study reveals that organisations investing in IoT sensor analytics also look to invest in computer vision and automation solutions. IoT adoption will enable organisations to focus on incorporating AI/machine learning to make automation smart and intelligent.

-

Construction Will Become the Unsuspecting Influencers for IoT Adoption

The construction industry is fast emerging as the arena for end-to-end IoT-driven services especially as new-age companies link architects with contractors with building managers with facilities management to create a new meaning of ‘Smart Buildings’. Realtors become unsuspecting influencers as they establish Smart Building ecosystems. According to the findings of the global Ecosystm IoT study, the top solutions that construction companies have implemented and are evaluating, are primarily aimed at ensuring operational and employee safety. However, the industry will also see an uptake of customer management IoT solutions aimed at providing better customer experience (CX).

-

The Edge Will No Longer Be at the Edge

2020 will mark the end of the hype around the Edge and the way we think about it. Real-time analytics will be performed at so many places along with the network and infrastructure that IT management will be forced to rethink their distributed and enterprise computing strategies. The main industries that will see a growth in Edge uptake in 2020 will be Manufacturing, Retail, Energy, Healthcare, Transportation and Logistics.

As the Edge technology develops, the application of AI will steadily move away from centralised servers (on-premise or cloud) to the edge devices themselves. There are two important benefits to this – Firstly, it minimises time lag between data acquisition and secondly, any targeted hacking attempt can be immediately identified and mitigated, rather than being at the mercy of the security systems implemented by the cloud provider.While AI-enabled edge devices tend to be costlier than

their “dumb” counterparts, the value they can bring in terms of being able to immediately act upon the data, and the additional security they can potentially provide, can be significant factors that offset the high initial cost of deployment.

Download Report: The Top 5 IoT Trends For 2020

The full findings and implications of the report ‘Ecosystm Predicts: The Top 5 IoT Trends For 2020’ are available for download from the Ecosystm website. Signup for Free to download the report and gain insight into ‘the top 5 IoT trends for 2020’, implications for tech buyers, implications for tech vendors, insights, and more resources. Download Link Below ?

One of the most important industry verticals that the Internet Of Things (IoT) is quickly enabling is buildings. To date most of the analyst coverage has been focused on smart building and building management systems collecting sensor data on lighting, temperature monitoring, and occupancy. While IoT device, connectivity, platform, management and integration vendors have marketed their hardware and software differences, the unsung heroes of ‘Smart Buildings’ should be the Facilities Management (FM) assets that have the most influence in the true IoT ecosystem. FM covers a lot of segments in commercial buildings – retail, restaurants, grocery/supermarkets, spas and gymnasiums, retail healthcare and many more and as such these segments create large quantities of business related data from sensors within them. Today’s FM has successfully moved from simply managing ‘boxes’ to managing smart connected facilities.

This week I attended ServiceChannel’s ServiceX19 customer event in Scottsdale, Arizona where 300 ServiceChannel customers were treated to an update on the current and future state of FM. Annually, ServiceChannel’s customers raise over 100 million work orders, across 330,000 locations, fulfilled by 50,000 contractors in 75 countries. Equally impressive is that these customers are responsible for over $37 Billion spend on keeping building clean, bathrooms working, air conditioners heating and chilling, refrigerators cooling, lights switch on and so on.

Through their Facility Management Platform, which behaves like an online market place for their customers, ServiceChannel is rapidly becoming a valuable analytics and data management software company. Work orders are an incredible source of information for every asset connected into a building that requires any level of service. Just like State Farm Insurance who ‘know a thing or two, because we’ve seen a thing or two’, ServiceChannel have seen ‘a thing or two’ such as work orders to deal with alligators and of course cars crashed into shop fronts! However, some examples of more traditional analytics use cases include the following:

- Predictive repairs on capital intensive equipment is being decided by the facilities manager before the original equipment manufacturer.

- By using ServiceChannel’s comprehensive data visualisation capability, facilities managers have the ability to identify measure the difference between spending on preventative maintenance versus post failure repair.

- Individual service fulfillment analysis can often show that engaging with the least expensive hourly rated contractor may not always provide the best outcomes.

Over time ServiceChannel’s data collection and analytics is enabling their customers to have visibility into their businesses that go beyond FM. ServiceChannel is enabling their customers to become more digital and creating higher value business outcomes. While IT and equipment manufacturers have tried to create digital ecosystems and attract participants into their network, they are still one step removed from the customer. This gap means that they are not truly able to help manage the customer experience within smart buildings. Rather, companies like Service Channel have access to the heterogeneous asset environments by working directly with facility managers. During the conference, I saw service records comparing the major HVAC vendors within a large retailer and immediately thought that individual HVAC vendors would be very interested to see how they stacked up against each other. The ServiceChannel connected asset analysis gives their customers the information that enables discussions based on transparency, trust and truth – which is a powerful negotiating tool.

Conclusion

The event showed a reality state of the IoT associated with analytics in an industry that is reinventing itself through enabled assets connected to their work flow systems. It clearly showed that the Smart Buildings industry is probably about 2 years behind the roadmap set out by the major IT research firms. Businesses are now beginning to understand what IoT is even if they do not call it by that name. Connected assets are becoming more familiar and the value from analytics is being realised to run businesses. Customer experience is now a tangible metric!

Separately, as ServiceChannel’s analytics engine matures and external data sources such a weather and environmental conditions are curated with asset management, then facility managers become more valuable to the CFO, the CIO and the customers they serve. To date equipment vendors’ attempts to build ecosystems of IoT-based partners has been met with limited success because they are still not close enough to the end customer. Original equipment vendors should make their products connected to an IoT infrastructure network as easily and as quickly as possible and then partner with companies like ServiceChannel who can curate and promote their asset data.

I had the pleasure of attending the Industry of Things World 2019 in Berlin. Berlin has always fascinated me by its contradictory image – of modernity and traditionality. Their admired industrial companies can be conservative in terms of innovation and move slowly when adopting new technologies. However, once they decide to move, they move all at once and cause a significant change in the industry. And that is what I perceived at the event.

In Berlin, companies know what Industrial IoT (IIoT) is and IIoT solution providers’ efforts focus on how to implement IIoT. The level of adoption in the DACH and Nordic regions is higher than in other European regions but still remains low, especially in small and medium enterprises (SMEs).

The first thing that was highlighted at the event is that AI has not devoured IoT. Organisers do not try to fill auditoriums and beat attendee figure records with other parallel events of AI, Blockchain, AR/VR, 5G, DevOps and so on.

It was interesting to listen to both tech buyers and vendors sharing their news and vision – clients such as Rolls Royce and thyssenkrupp sharing their implementation experiences and giving recommendations on how to succeed in IIoT projects and; IIoT vendors such as Cumulocity IoT, HPE, AWS, Siemens or Huawei presenting their capabilities. All of them are clear that IIoT must be part of a new paradigm of business systems integration.

Key Takeaways:

- In the several round tables that I attended, the ideas and conclusions presented were very educative. It was good to listen to the main actors (the actual companies implementing IIoT) talking about their challenges, requirements, solutions and desires. Most of the CEOs are in consensus on their priorities in IIoT investments: ROI, Performance and Quality.

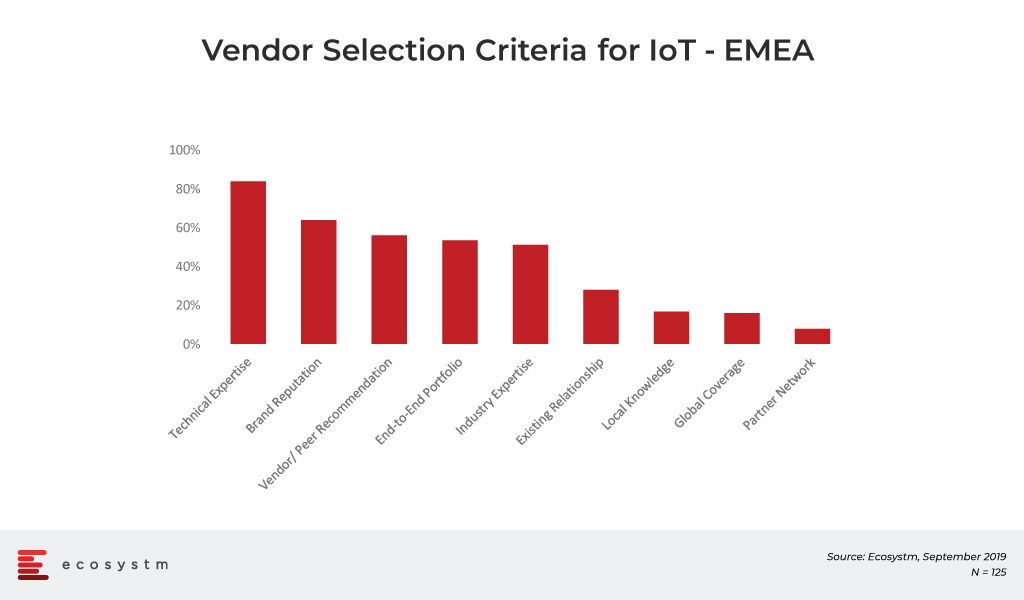

- I validated with organisations the results of the Ecosystm IoT study regarding their vendor selection criteria for IoT projects. This ties back to their IIoT investment priorities. They are likelier to choose vendors that can deliver on all 3 of their priorities.

- The most realistic statement about IIoT came from the HPE speaker, “Don’t look for disruptive companies like Uber in the Industrial Internet of Things market.” Here the new business models will take time to emerge. Other exhibitors and visitors, that I had conversations with, agreed with this idea.

- Fortunately for the IIoT market in Germany and Europe at large, China continues to adopt these technologies at a similarly slow pace. Although China may be more advanced in digitalisation (in ePayments for example), when it comes to IIoT, they are as conservative as Europe. This gives us a window of opportunity to continue to evolve our offerings, in the region.

- Another recurrent theme through the event was the inability and hesitance of the CEOs/ CFOs/ Boards to understand the potential of data-based collaboration between companies and industries and how they continue to kill any data sharing/open data initiatives. Walled gardens should not be a medium-term objective.

- The presence of start-ups and enthusiastic entrepreneurs was very heartening – and while I could not speak with all of them, CloudRail, Juconn, TechMass , Ekkono and WolkAbout stood out in my opinion. And of course there were some IIoT Platform vendors such as AWS, Cumulocity IoT, Device Insight, Relayr and Waylay. As I have said many times it is not necessary to analyse 400 platforms – for each local, regional or global enterprise there is a maximum 3-4 platform superheroes vendors to select.

- I had some conversation on IoT connectivity with LumenRadio, SigFox and Multefire However the session discussing the impact and need for 5G in IoT was shallow because the speakers only covered high level use cases and benefits of 5G and how the German government is working on security requirements for end-to-end 5G services.

- Finally, it was great to hear people talking about IoT lifecycle management. It has become clear that IoT is real and is here to stay. Some companies have already passed the Proof of Concept stage. This reassures us that IoT is not just ideas, development and pilots. IoT projects are going beyond and thinking about operations and maintenance.

Congratulations to all nominees in the first Industry of Things World Award ceremony. The winners were Fette Compacting in the category, Best Implementation of IIoT Technology on the shop floor and BAM GmbH up2parts in the category, Best IIoT Product or Service.

One final observation on the event is the disparity in the number of men and women attending. I got the impression that not many women are involved in IIoT or at least they do not attend events such as this. I hope that skills training and the market potential will attract more women to this industry in the future.

So dear friends, contacts, followers and readers: in short, the event was a positive experience and I hope to see some medium-term outcomes in

The internet was created by the US military to create a seamless self-repairing almost indestructible connection of computers and to maintain critical communications capability in the event of nuclear attacks on cities and government infrastructure. It wasn’t until the invention of the world wide web (www) that the internet became widespread. Since then, the evolution of digital and network technologies has made it possible to connect almost any device to the Internet. The Internet of Things (IoT) can include a wide range of machines, sensors, smart objects, unique identifiers (UIDs) – provided they are connected to the Internet and have the ability to send and receive data without human intervention.

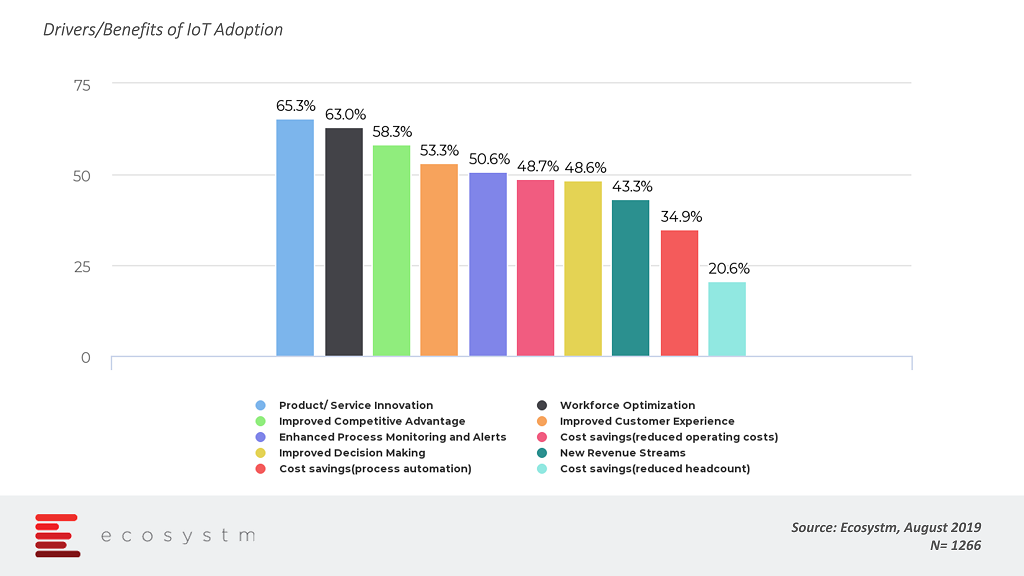

There are a plethora of ‘things’ today that can be connected to the internet and are not restricted to devices and sensors alone. Anything with an IP (Internet Protocol) address can now be connected. Wireless technologies such as Wi-Fi, Bluetooth, and 4G/5G have created more possibilities for devices to be individually connected. With the advent of IoT, remote connectivity has become the norm bringing several advantages across all industries. The global Ecosystm IoT study reveals that organisations are looking to leverage IoT not only for asset management but also to fuel innovation.

The key to IoT is connecting any physical ‘thing’ to the Internet, allowing remote control and monitoring functionalities over the network. The power of the technology comes from the fact that these devices can then be used to monitor and get data from virtually any other device or application. This opens immense avenues for the connectivity of various applications and expands the overall potential of the Internet dramatically.

The simplest way to appreciate how IoT can benefit organisations is to see its operations in some industries. The list below is not exhaustive and includes:

- Medical and Health: The key technology enabling eHealth is IoT. IoT has enabled remote diagnostics and patient monitoring even beyond the walls of the hospital. Remote monitoring has a deep impact on improving health outcomes and enables community-based healthcare and aging in place practices.

- Construction: IoT enables almost all home and office devices to be virtually connected allowing remote activation and control based on specific data gathered from the environment. This application is being utilised in ‘smart homes’ and commercial buildings, allowing the automation of security, lighting, HVAC and other systems. IoT applications have made their way into Building Information Management (BIM) systems even at the design and construction phases.

- Energy and Environment: In one of the early use case in energy efficiency and distribution, IoT is used to monitor the energy requirements of homes and industries with the help of ‘smart grids’. The technology is also helping meteorologists to predict storms, earthquakes and other natural disasters with the help of smart sensors to monitor environmental changes.

- Transportation: Autonomous Vehicles or driverless cars have become the popular face of IoT application. More significant than the vehicles or the technology itself, are the parameters that are involved in providing the right infrastructure for these vehicles. IoT is already bringing substantial improvement in the industry with connected transportation systems and controls in the applications for trains, smart cars, and airplanes

- Manufacturing: The Manufacturing industry is where the concept of process automation originated. Needless to say, the industry is seeing an uptake in IoT as automation reaches a whole new level. The adoption of IIoT (Industrial Internet of Things) is allowing manufacturers better visibility of the supply chain, more efficient inventory management, and proactive asset management through predictive maintenance. This impacts both the productivity of the plants and the quality of the products.

- Agriculture: IoT has numerous use cases in making Agriculture more productive and efficient, such as automated irrigation systems, crop monitoring, pest control, driverless tractors, and other smart farming solutions. Smart Farming practices will ensure a better outcome for environment management and promote trust in agricultural products as the entire ‘food to fork’ supply chain becomes traceable.

- Smart cities: ‘Smart city’ is an often-used term that can have different meaning depending on the maturity of the country. What is common however is the widespread deployment of IoT applications, devices, and sensors to handle various activities providing citizen services and infrastructure monitoring such as traffic management, street lighting, citizen security and monitoring, and more.

The early use cases of IoT have been in automation and asset management. As technology and connectivity evolve, the applications will be more widespread and impact every aspect of our lives.