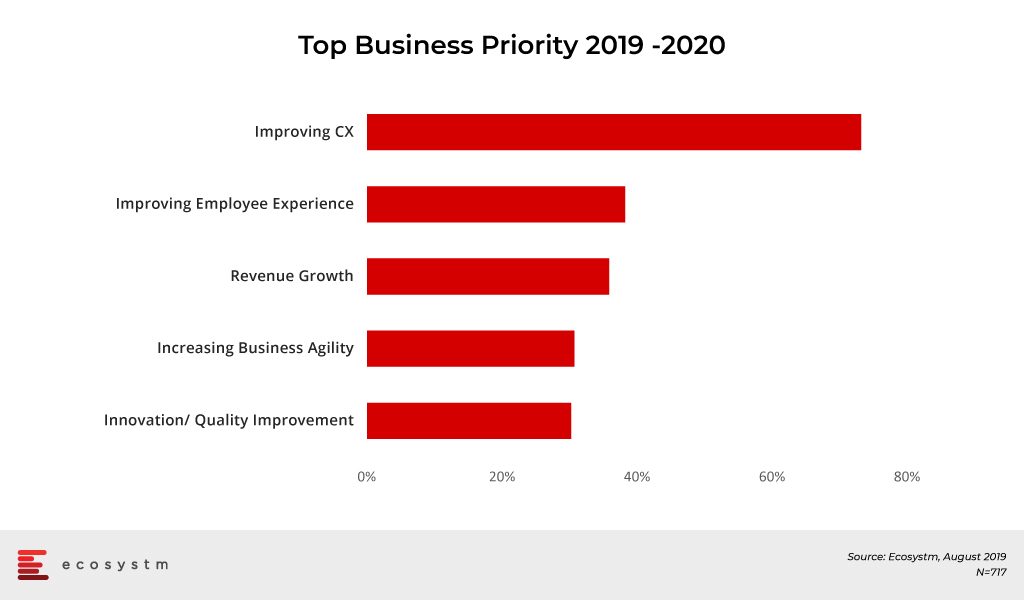

Organisations are increasingly focusing on customer experience (CX), and it is overtaking pricing and product development as the key brand differentiator. The global Ecosystm CX study discovered that improving customer satisfaction is the key business priority across industries – even in industries that have not had a traditional focus on customers such as Manufacturing and Construction.

IoT is already impacting CX

We should keep in mind that IoT customers are not just those who enjoy the advantages of a Smart Home or the patients that share health and wellness data from wearables and medical devices with medical professionals. IoT customers are also the Maintenance Director of a Manufacturing plant floor, the Field Service technician using a predictive maintenance application, the Purchasing Director, the Marketing Director or the Product Director who use sensor data from connected products around the world in an intuitive and easy-to-use platform to improve usability or to sell more.

IoT can improve CX on multiple counts

Let’s see some examples:

- The right IoT sensor and actuator can boost customer satisfaction. For instance, by installing intelligent IoT sensors in the physical store environment, retailers can collect contextual data such as sound, temperature, or traffic patterns and will uncover how physical elements of a location correlate to customer satisfaction.

- IoT devices like wearables or smart home devices with good features improve the quality of life and have revolutionised CX.

- Effective IoT connectivity management is key to a successful IoT deployment. IoT connectivity enriches communication with customers too. The sensors and IoT devices that are inbuilt into products can feed data back regarding usage patterns and even detect problems. This data can be used to the manufacturer’s advantage allowing them to send across personalised communication to customers.

- IoT platforms with Artificial Intelligence (AI) components facilitate analysis of the ways customers are interacting with their devices over time, and helps identify frequently and rarely used features, allowing the building of better devices and applications fitted better to customer needs.

- IoT applications like condition-based monitoring allows the prevention of failures before they occur rather than waiting for problems to arise first. Connected devices can schedule predictive maintenance, detect issues before they debilitate functionality and diagnose problems accurately. When connected to a powerful AI-based workforce-management solution, companies can optimally schedule a technician by balancing skills, asset location, parts, technicians’ locations and traffic.

- IoT aids CX through faster Customer Service/Customer Support. Intelligent IoT devices itself could communicate an issue to a support team, even if the customer is unaware of one. Based on this information, a support team could then take several pre-emptive actions, which could include either notifying the customer or even rectifying the issue before the customer is affected. IoT sensors may be able to predict problems before they surface. Perhaps a piece of equipment exhibits certain symptoms before it breaks down. If the IoT device could send an alert to an engineer warning them about the potential problem, the equipment could be fixed before the problem leads to any downtime.

Designing an IoT Product Strategy centred around CX

Here are some points points to keep in mind when designing IoT products with a better user experience.

- The data that you havee gathered from the usage of your products can be used to develop new products. You can figure out what part of your products can be improved upon and then pass on this information to your product development team.

- Never introduce a User Experience (UX) based functionality that does not comply with the core values that the IoT product aims to provide.

- Since IoT-enabled devices come equipped with several sensors, they can easily capture loads of data regarding product motion, biometrics, air moisture, temperature, weather, etc. The product should be designed in such a way that the device makes optimum use of this data to learn deeply about the user and start taking smart and automated decisions on its own.

- Focus on making it easy for the customer to personalise the interface of smart products.

- Think beyond the usual interfaces that are based around screens. Combine with other technologies like AR, Voice Recognition, etc to obtain the desired output functions.

- Your IoT device design should make things simpler and not introduce more complexity into the equation. They should be designed in a way that it involves a minimal amount of training.

- Design with the intent of keeping machine-to-machine interaction at the maximum and autonomous behaviour at the minimum.

- Place the centre of control in the hands of the users. The interface design should make them feel like they run the show. One of the best ways to do this is by enabling remote user interfaces.

- Get information about the time gap between procuring a product and using it, and the date when the product is up for replacement.

- Combine IoT and AI for a better CX.

IoT is no longer in its infancy. The technology is here, available and ready to help organisations connect better to their audiences. There are already millions of users enjoying the benefits of and working with IoT devices. The possibilities of improving CX via IoT are indeed monumental. To keep up with market expectations, IoT vendors must be convinced that IoT will have tremendous positive impact on their relationships with their customers.

IoT vendors should be transparent and inform customers that they are using their usage data to optimise the design of products and services and to significantly improve customer satisfaction.

What are your views? Let me know in the comments.

In an industrial backdrop, drones are forming a core part of automation. Drones are Unmanned Aerial Vehicles (UAV) that can be controlled remotely or can fly autonomously with defined coordinates working with onboard GPS and sensors. The basic functionality of drones is to collect specific information about an environment and relay it back to the controller.

Industry 4.0 sees several use cases for drones. UAVs are the next-generation technology for industrial sensors and IoT. Industrial drones operate under difficult conditions – in regions where humans cannot physically inspect the environment such as in hazardous or hard to reach areas. While they are primarily sensors, they are also being programmed to act of the information gathered.

So what are the industrial applications of drones?

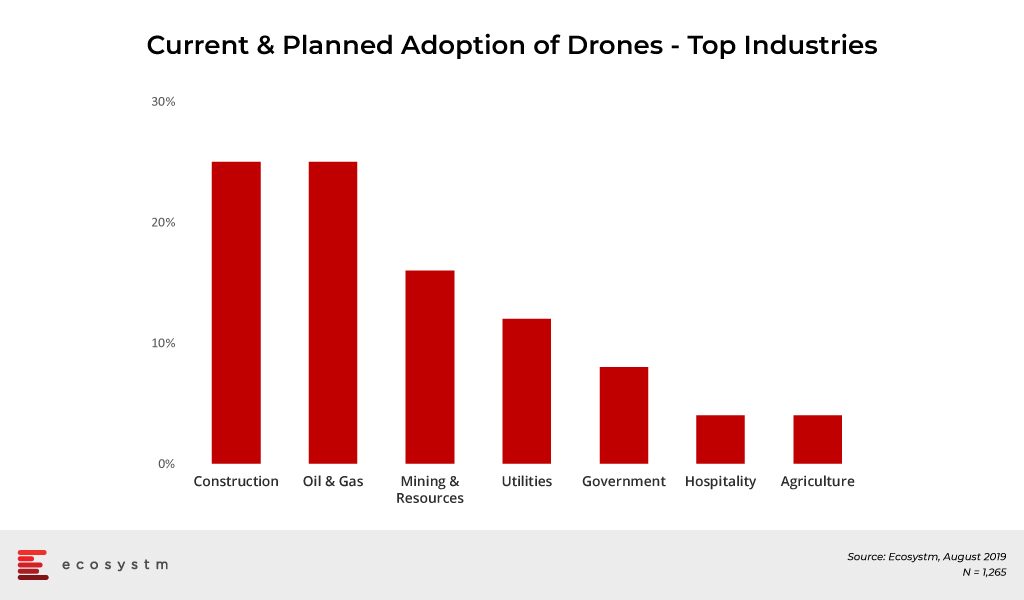

Some industries are more enthusiastic about the application of drones. In the global Ecosystm IoT Study, organisations that have implemented or plan to implement IoT in the next 12 months were asked about the adoption of drones for asset management.

Construction

Industrial IoT is opening up opportunities for construction organisations. IoT devices have the potential to increase efficiency of construction sites and drones are one of the devices that can enhance safety and site operations. Instead of deploying heavy machinery and expensive tools, drones offer the capabilities to survey industrial sites to providing greater accuracy to building maps, QC processes, documenting project details – while reducing costs and project duration.

KIER, a construction and property group in UK is utilising drones to capture project progress, take 360 photographs and use it for photogrammetry (using photographs to model real-world objects and scenes). The benefits that the company reports include digital asset management and data insights, which in turn lead to cost reductions.

Drones will become an integral part of the Construction industry, to a large part because of safety and compliance requirements – and the industry needs to be prepared for it. UK’s Engineering Construction Industry Training Board (ECITB) has launched a training course and program for industrial drone operators to attain and develop the skill to safely fly drones and operate industrial equipment that has specific operational hazards and constraints.

Energy and Utilities

This is another industry group that can benefit in a similar way from drones. Drones can perform hazardous jobs otherwise performed by humans such as surveying transmission lines, inspecting plant boilers, monitoring the health of solar panels, assessing storm damages and even repair faster. The industry has been traditionally using helicopters but drones are a lower-cost alternative – both for procurement and maintenance.

It is easy to see why Laserpas, one of the largest Utility Asset Management Companies in the EU is using drones for their workflow automation initiatives. Laserpas surveys power grid infrastructure, including power lines, transmission towers, adjacent areas and so on, with the help of drones. The drones are gathering data for AI-driven data analysis to increase the efficacy of their high-precision monitoring solutions

Laserpas is by no means alone – AT&T is using drones to avoid service disruption through aerial monitoring of towers, replace faulty parts and create portable cell towers in mission-critical areas.

Government

Perhaps the earliest adopters of drones were a military defence in several countries. However, the use cases in Government are not restricted to that – it involves public safety and logistics in several Government agencies. They have become the means for agencies to gather data – both for situational awareness and scientific purposes – in a more efficient manner.

The ability of UAVs to cover large areas in a short time is helping emergency teams in search and rescue operations. The example from UK where a man involved in a crash was rescued from freezing temperatures by police drones, is a case in point. The emergency unit equipped a drone with a thermal camera that was able to locate the man in a six-foot deep ditch more than 500 feet from the crash site. There are examples of Public Health as well. In a municipality in Spain, mosquito control programs are using drones to conduct surveillance in likely breeding sites that are hard to reach. Once larval habitats are identified, drones are also programmed to spray pesticides to the area. Transport drones are also being used by Public Health agencies. Ghana’s government uses drones to supply blood and other critical medical supplies to remote areas. It has had a positive impact on the nation’s overall medical supply chain and the Ghana Civil Aviation Authority have plans to create an air corridor for the drones to prevent collisions with larger aircraft.

Perhaps the biggest use case for drones in Government will come from public safety measures. The Washington State Patrol has built up a fleet of 100 drones and using them for maintaining law and order in the state and for wide range of purposes including surveillance of armed and barricaded suspects and search and rescue operations. This will probably see a higher uptake than other solutions in Government.

Hospitality, Retail and Logistics

Though the adoption of drones in these industries is not yet as widespread as in others, there is tremendous potential in inventory and supply chain management. Walmart has conducted pilots on drones for warehouse management which has now been moved to implementation. Using drones reduces the need for heavy assets such as forklifts and conveyor systems.

UAVs are the best new way of tracking inventory using tracking mechanisms such as RFID and QR-codes UPS has set up a subsidiary that uses drones for delivery. Companies such as DHL, Amazon, and Google are developing and experimenting with drones to speed up delivery, especially for lightweight consumer goods. Drones not only help with inventory management but also ensures last-mile delivery.

The Hospitality industry has gone beyond logistics in their business application of drones. Examples are broad including creating marketing videos for properties, aerial site maps to help guests and staff members navigate sprawling grounds and surveillance. Drones make it possible to create a 3D virtual environment for security teams to monitor hotel perimeters, parking lots and outdoor venues effectively. This is more economical than hiring a full-time security crew for surveillance cameras and 24/7 monitoring. The Seadust Cancun Family Resort has a lifeguard drone that helps real lifeguards by supplying safety equipment and emergency floatation devices.

Agriculture

Drones are a major component of smart farming techniques and operations where farmers can benefit from real-time information about large tracts of land.

“An ‘eye in the sky’ by way of a drone, can save days for farmers and help them in checking stock, crops, and fences, battling weeds, and even mustering cattle. Simultaneously, they can provide data to help farmers make more informed decisions around applying fertilizer, disease detection, and about managing health and safety on farms,” says Jannat Maqbool, Principal Advisor Ecosystm. (Read Jannat’s Report on IoT in Agriculture: Drivers and Challenges)

Yamaha is working with farming communities in several countries to use UAVs to spray weed killers. Drones are utilised to spray the crops applying small quantities of pesticide or fertilizer to crops, orchards and forested areas. GPS coordinates create flight paths to aim for maximum coverage. This is leading to process automation in Agriculture – an essential component of smart farming.

Drone have started to prove their worth in various industries across applications and organisations across the globe are working to integrate drones into their operations. As laws mandating them to become clearer, more industries will look to leverage drones for automation.

Which are the other industries that will see a steady uptake of drones in the near future? Tell us your thoughts.

For years, I have been writing about the promise and perils of the Internet of Things (IoT). In many of my articles, I described how the IoT could help transform society and kickstart the next industrial revolution. However, still many people and enterprises are not deploying IoT. We still cannot define in a unique and clear way what IoT is, much less explain how it will change our lives, without using the example of the smart refrigerator!

Why are we still at a loss with IoT? Let´s explore.

Lost in IoT Connectivity

With so many IoT connectivity options in the market, choosing the right one for your project can be complicated. It is a scary thought that billions of devices could be connected in a few years to decentralised IoT networks, with no interconnectivity between them, unless we use millions of edge nodes that transfer messages between devices connected in multiple networks. If it is already difficult to justify the ROI of a use case using a single type of connectivity – it is almost impossible to justify that these devices will need to communicate with other devices on different IoT subnets.

It seems that it is easy to get lost in so much connectivity technology. Isn’t that true?

Lost among hundreds of IoT Platforms

At least we can already intuit some of the platforms that will survive among the 700+ that some analysts have identified. I have only been able to analyse about 100 of them in some depth. Surely my methodology of Superheroes and Supervillains will advance the end of most of them.

It is no longer just one IoT Platform. Although they want to make it easy for us, companies like AWS, Microsoft or Google add concepts such as Serverless, Data Lakes, AI, Edge Computing, DLT and all the artillery of Cloud services to the core features of the IoT platform. It is easy to get lost in the architecture.

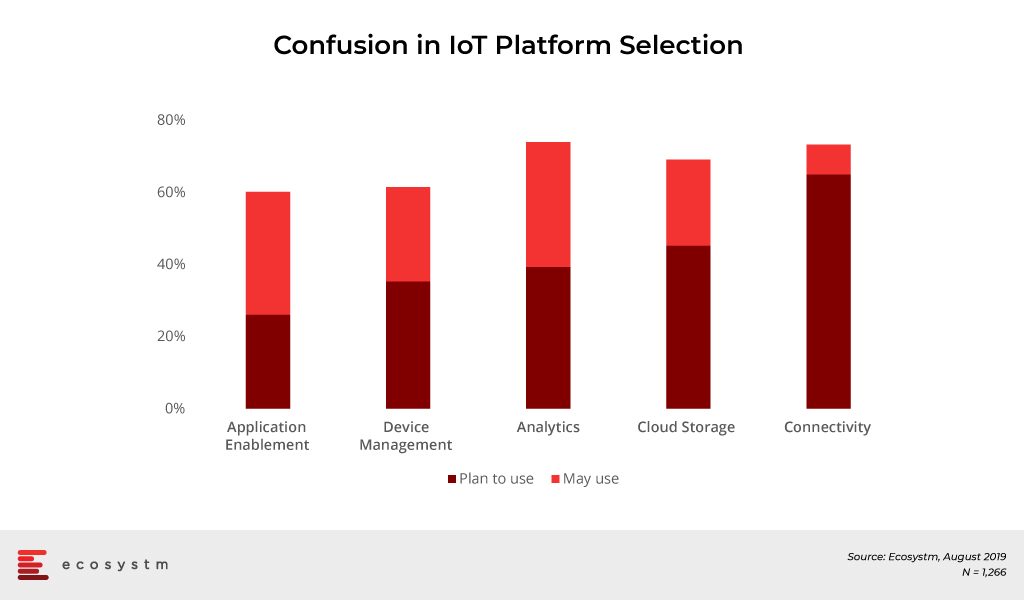

Data from the global Ecosystm IoT Study shows this confusion in selecting the right platform for future adopters of IoT. Same organisations indicate that they will use or at least evaluate several platforms.

Initiatives such as Verizon’s focus on connectivity and systems integrators abandoning their in-house developments to embrace leading vendors’ offerings, will reduce some of the confusion around IoT platforms.

Lost between the Edge and the Cloud

In “Do not let the fog hide the clouds in the Internet of Things”, I had warned about the degree of complexity that Fog /Edge Computing will add to the already complex IoT solutions. Now nothing seems to be of great value unless Edge Computing is included.

The Babel tower of alliance and consortia is consolidating, but people still get lost in the acronyms. News such as the merging of the Industrial Internet Consortium (IIC) and the OpenFog Consortium (OpenFog) to combine the two largest and most influential international consortia in Industrial IoT, fog and edge computing, has been hailed by many. The Open Group Open Process Automation Forum (OPAF) is defining the next generation edge computing standards for industrial operators.

And again, the question arises, do all organisations need Edge to start an Industrial IoT project?

Lost in Proofs of Concept

Businesses are estimated to be spending USD 426 Billion worldwide on IoT hardware and software in 2019 alone. Yet, three out of every four IoT implementations are reported to be failing.

Microsoft launched a new research report – IoT Signals – intended to quantify enterprise IoT adoption around the world. The survey of over 3,000 IT team leaders and executives provides a detailed look at the burgeoning multi-billion-dollar segment’s greatest challenges and benefits, as well as related trends. Perhaps it is not surprising that 30% of respondents say their IoT projects failed in the proof-of-concept (PoC) stage, often because the implementation became too expensive or the bottom-line benefits were unclear.

There are technical reasons – for example the use of Rasberry Pi or Arduino boards in the PoC and then later realising that more expensive hardware is needed for the actual project. There are economic reasons when organisations try to escalate their PoC to real implementations and then the ROI does not look as good as in the pilot.

There are organisational reasons when leaders are failing to go all in. If you cannot get the CEO on board, then the probability that your IoT project will end at the PoC stage is almost 100%.

If you are lost in the PoC, these tips can help you implementing IIOT.

- Solve a problem worth solving

- Keep it quick and simple

- Manage the human factor

Lost in selecting the right IoT Ecosystem

Today no significant ecosystem or network of collaborators has emerged in the IoT arena in spite of early and very interesting efforts being made by several players. Since I wrote “The value of partnership in Industrial Internet of Things”, I have heard, read and repeated hundreds of times how important it is to belong to an IoT ecosystem and how difficult it is to choose the one that suits you best.

Those who have read my articles know that there is no company in the world, no matter how great it is, that can do everything in IoT. Creating an IoT ecosystem either horizontal (technology) or vertical (industry) requires a lot of talent managers able to maintain win-win transactions over time. And according to the results, it appears to me that it is becoming very complicated.

Remember, you are not the only at a loss with IoT

When it comes to achieving an ROI from IoT, businesses really need to rethink how they are deploying it and ensure that they can manage their sensors remotely, secure their assets, use the sensors and devices data to make better real-time decisions and monetise it. However, for that to happen and to prevent the IoT projects from failing, businesses need independent and expert advice at several levels to find the right people to lead the project and the right technology and partners to make implementations successful.

The global insurance industry today faces several challenges – starting from the shift in the demographic patterns and the disease burden, to managing an ever-growing agent ecosystem, to responding to customer expectations. The advancement in technologies and their adoption is creating opportunities for insurance companies to modernise and reinvent themselves through new product and services offerings and by evolving their business models.

Drivers of Transformation in the Insurance Industry

- Global Competition. Over the last few years, leading insurance providers have been looking for a share of the global market and are no longer content with their traditional domestic markets. They especially want to get into markets where there are fewer players and/or larger population. The Indian insurance industry, for example, has seen a number of new private entrants over the last decade, attracted by the large population base and by a high percentage of young population. Many of the leading global insurance providers have partnered with Indian counterparts for a presence in the market. The story is similar in several emerging economies. While the presence of insurance providers is good for the future sustainability of a country, the market is extremely competitive. Investing in technology can be the key differentiator in capturing a larger share of the pie.

- Customer Expectations. Today’s customers are tech-savvy and expect a certain level of service and at their fingertips too. Moreover, easy access to the internet equips them to do basic research to evaluate their best options. The Fintech revolution also impacts the customer base, as they expect services such as instant approval and prefer to purchase items only when they require them. This ‘on-demand’ market has fueled the microinsurance industry and opened the gates for smaller providers.

- Regulatory Requirements. In the aftermath of the financial crisis of the previous decade and with new entrants in several countries, regulatory authorities are working on an overdrive to bring better accountability to the insurance market. Moreover, in most countries the regulations have incorporated market conduct guidelines aimed at consumer protection. Reporting, service level and fraud prevention requirements will see an increased uptake of technologies that can assist in fulfilling compliance requirements.

Key InsureTech Technologies

- IoT. The auto insurance companies were the first to leverage IoT and telematics to enhance navigation, safety and communication features that could help customise the premiums payable. The home insurance sector has already leveraged it using sensors and connectivity to assess and reduce risks to the properties they insure – large providers such as Allianz, Aviva and AXA have been working on their IoT ecosystem. This has immense potential for ‘usage-based’, personalised product and premium offerings in the health and life insurance industries (provided they work within the purview of compliance requirements). Ultimately sensors are not the most important technology in an IoT solution – the analytics solutions that can derive intelligence from the sensor data are. IoT+AI will give that much-needed edge to insurance companies.

- AI – Machine Learning. AI and machine learning make it possible for insurance companies to mine both structured and unstructured data. The use cases range from underwriting, claims management and personalised offerings through behavioural data and sentiment analysis. There are examples of early adopters in the auto industry – but again there are obvious and wider use cases, that can benefit risk modelling, pricing, customer acquisition, and agent and channel efficiency.

- AI – Virtual assistants/Chatbots. This falls right in with managing customer experiences. As customers expect more self-service (yes, the future will see less agents!) several insurance providers are using chatbots at several customer touchpoints, covering departments such as Sales and Claims. This will increasingly be the norm as smart phone (and app) penetration increases and the target base becomes younger. There are online-only insurance providers where clients interact with chatbots services and they are able to cater to a larger, untapped, mass market. There are more advanced adoption examples such as USAA’s use of intelligent personal assistant equipped with an NLP engine that have been trained with a deeper knowledge of policies. Virtual insurance agents will become more of a norm in the near future.

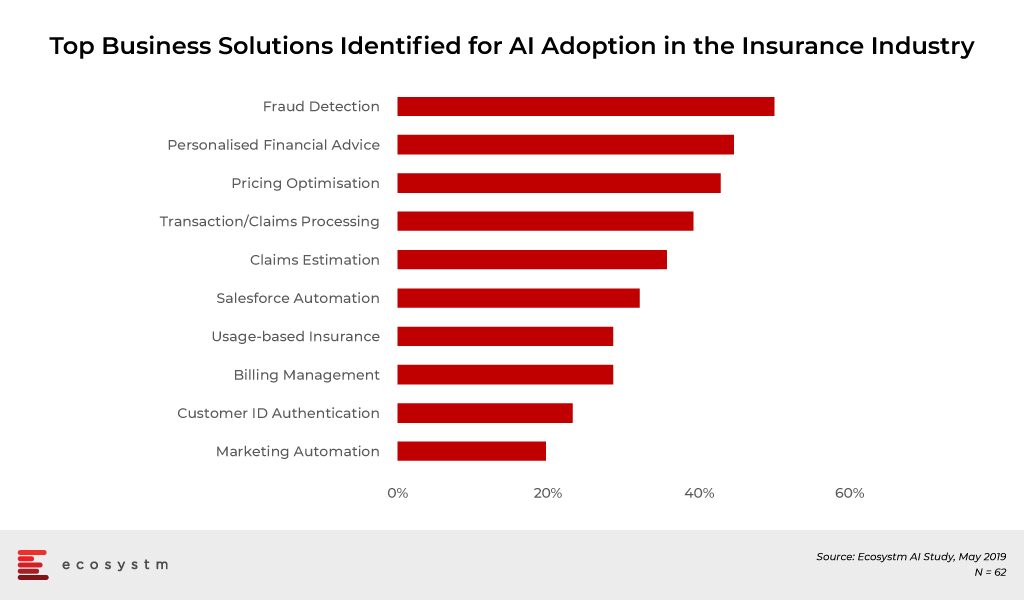

Which brings us to the important question on how insurance companies are planning to leverage InsureTech. Multiple stakeholders could benefit from InsureTech adoption. The Claims department appears to be a key stakeholder, focused both on fraud prevention and automation when it comes to transaction and processing. Sales and Customer Service appear to be next in line, where personalisation of product offerings would equip the teams better for a competitive market.

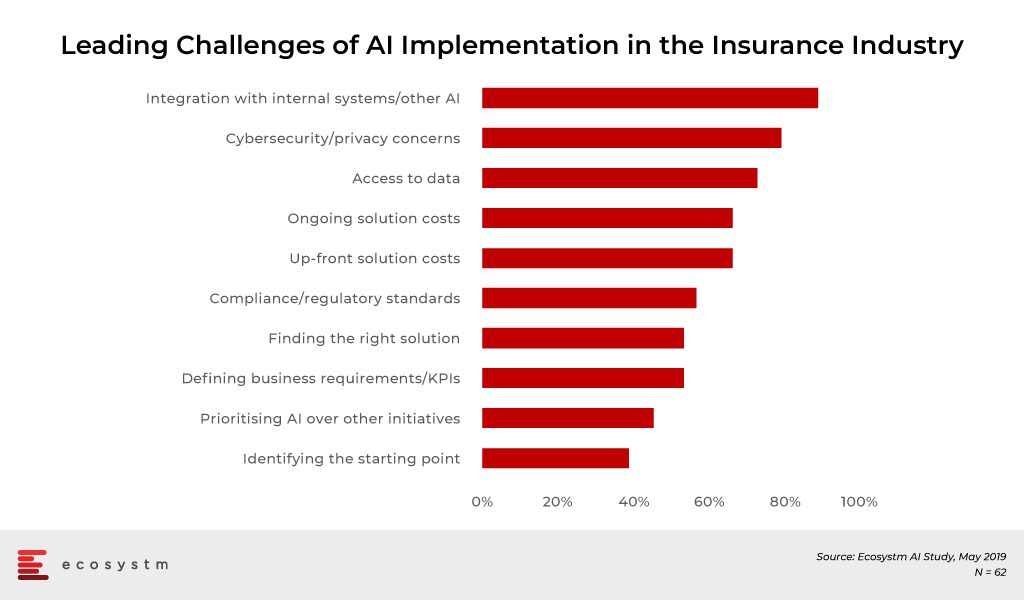

Challenges of AI Adoption in Insurance

It is obvious that the insurance companies are still at a nascent stage of adoption of AI and InsureTech. While cybersecurity is a recurrent concern (as it should be), it is a common concern across any technology area. The biggest challenge that the insurance industry faces in adoption of AI and other data-driven technologies is the actual data management – from access to integration. The industry may be data-intensive, but the data exists in silos. In the end an InsureTech implementation should benefit multiple departments – Underwriting, Claims, Sales and so on.

Several insurance companies will look to consulting firms and systems integrators to create a roadmap to their transformation journey and enable the data integration – especially as technologies evolve and when internal IT lack the right skills to manage these projects.

The technology that will be the key component of InsureTech and transform the insurance industry is AI. In spite of the challenges of adoption, the industry will be forced to transform to survive in the highly competitive market. Companies in emerging economies will especially benefit from investing in AI – in fact, India and especially China will see a surge in InsureTech investments.

The nature of the workplace has changed over the years and so has the number of devices being used by today’s employees. More and more organisations are adopting a ‘Mobile First’ strategy – designing an online experience for Mobile users before designing it for the desktop/ Web. This is a paradigm shift from the past, where enterprises modified or adapted their websites, business processes and digital means of communications, to fit Mobile users.

Mobile First Drives the Adoption of UEM

Mobile First application designs take into consideration that Mobile users are constantly on the move. Information needs to be presented to them on smaller screens/displays with multi-media interfaces (voice/video), and multiple network connectivity options (Wi-Fi, cellular, and so on).

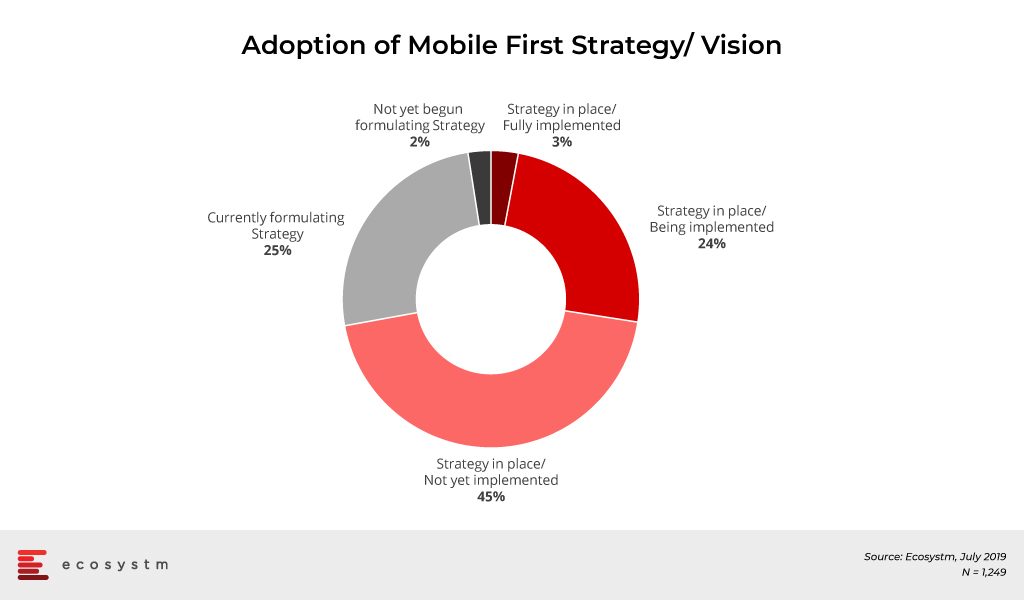

The global Ecosystm Mobility Study reveals that 73% of organisations have a Mobile First Strategy in place and are at various stages of implementation. About another 25% of organisations feel the need for a Mobile First vision and are formulating a strategy.

With Mobile First strategies, organisations are adding a wide range of devices and operating systems (OSs), regular innovative mobile-centric workload rollouts, new mobile apps across multiple functions, and IoT initiatives. As a result, organisations now have the need to support multiple devices and endpoints (including IoT sensors and wearables) multiple OSs, applications, and mobility policies such as BYOD. Organisations struggle to manage these devices, their data, apps and software updates across heterogeneous OSs and platforms. “The way companies are growing and fuelling their teams with devices now, shows the trend that these organisations will follow in the next few years, which will require a higher level of sophistication from the Unified Endpoint Management (UEM) solutions in the market,” says Amit Sharma, Principal Advisor, Ecosystm.

How does UEM Help?

An UEM solution can configure, monitor and manage multiple OSs, devices including IoT sensors, and gateways, and

- Unify application and configuration

- Manage profiles

- Monitor compliance

- Enforce Data Protection policies

- Provide a single view of multiple users

- Collate data for Analytics

It can ease the burden of management activity of internal IT teams and allow organisations to create a more streamlined lifecycle that secures mission-critical technology. It can also offer proactive threat monitoring, access control and identity, and patch management.

A good UEM solution provides IT managers with a transparent and traceable overview of all endpoints within the network as well as the power to manage all connected devices from a single platform. It maps out the network setup and structure by carrying out a complete inventory of all network devices, configurations, installed software, and the drivers for endpoint subsystems.

There are simply too many endpoints within Industrial IoT (IIoT) for IT managers to efficiently monitor manually. Mistakes will be made, and opportunities to stop breaches before they escalate will be missed. “An UEM solution not only shows the software and licensing situation but scans the IT environment for any irregularities or vulnerabilities and allows risk assessment and patch installation where it is necessary”, says Sharma. “Providing IT administrators with automated vulnerability management will enable them to filter and set search criteria by device, security vulnerability and threat level for the higher and most timely degree of protection.”

Industry Adoption of UEM

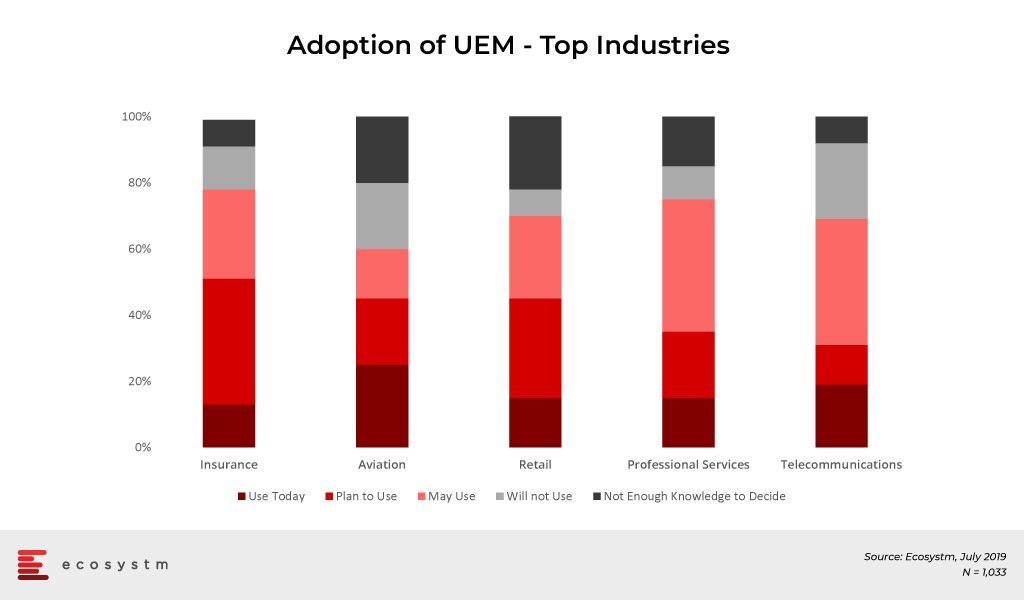

Customer-focused industries, with mobile workforces, are adopting UEM faster than other industries. The global Ecosystm Mobility study found the top industries that have implemented UEM or plan to in the near future. Most of the top industries cater to a high percentage of mobile workers. Their need to adopt UEM can come from different angles. According to the study, the Telecommunications industry leads in Mobile Content Management (MCM) adoption, and mobile apps for logistics and operations appear to be the key driver for the industry uptake of Mobile Applications Management (MAM).

Other industries to look out for in the future are Banking and Healthcare, as they lead the pack when it comes to MDM adoption. Banks are incorporating technologies, such as mobile banking, and enabling payments via smartphones to provide enhanced services to customers. We have also seen the advent of Smart Point of Sale devices which are managed remotely on cloud infrastructure and these millions of devices will also be required to be managed by the banks that issued the devices.

The healthcare industry is another vertical where we can expect a higher uptake of UEM in the coming years. Clinicians and care providers are increasingly mobile, switching from device to device, depending on the task and location. Accessing mHealth applications and patient data from any device securely enables caregivers to focus on patients and outcomes. It also allows them to complete critical tasks from any device whether they are on call or off work. UEM makes HIPAA, SOC 2 and other healthcare regulation compliance easy for the providers.

Challenges of UEM Implementation

User experience must be at the centre of any mobility initiative. If the device, app management, or content is not something users want or are able to use, then it simply will not be adopted. The success of an UEM solution lies in the ability of users to quickly authenticate and gain seamless access to corporate apps and data from their devices. Users should also have access to self-service tools that help them manage basic device features and troubleshoot problems quickly.

“We can expect most Enterprise Mobility Management (EMM) and MDM suites to migrate to complete UEM suites that manage personal computers, mobile devices and Internet of Things (IoT) and Enterprise of Things (EoT) deployments,” forecasts Sharma. “Organisations should look for a purpose-built UEM solution which is platform-neutral and which cultivates a thriving ecosystem of complimentary mobile solution providers.”

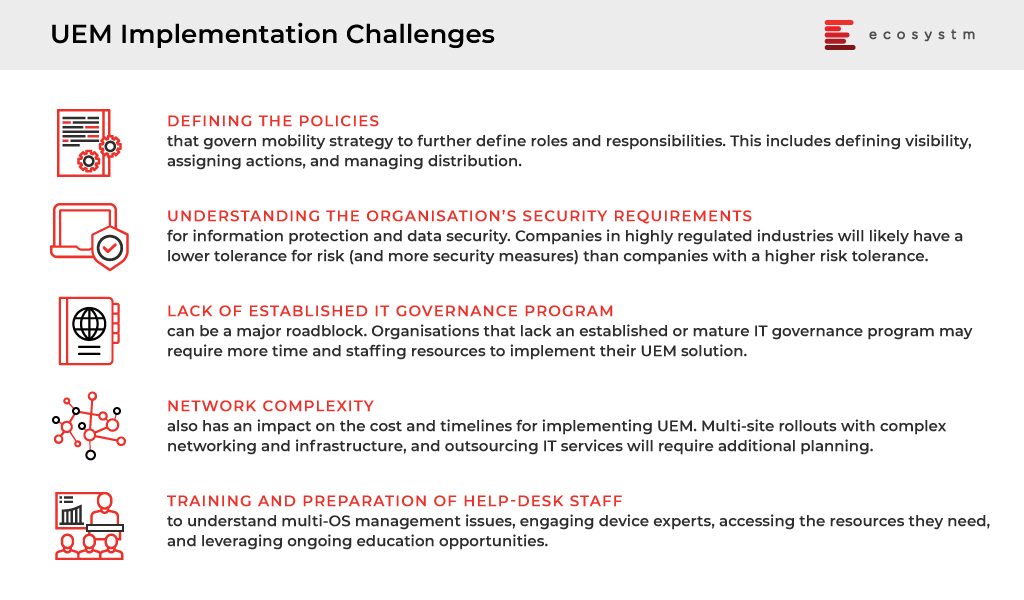

However, there are several challenges that organisations face when they are developing and deploying an UEM solution. Sharma lists the top UEM implementation challenges that can be broadly classified into the following five categories.

“As AI finds its way into mobile devices and virtual personal assistants proliferate in offices and boardrooms, IT admins will have to manage more – and more sophisticated – endpoints. AI will continue its push into mobile hardware and enterprise communication devices, challenging IT shops’ EMM capabilities while at the same time offering potential security benefits.” Sharma adds. “Also, in 2019, voice-activated assistants such as Amazon Alexa and Cisco Spark Assistant will find their way into more corporate offices and conference rooms – becoming yet one more enterprise device encouraging the adoption of an UEM strategy.”

Have you adopted an UEM strategy in your organisation yet? Share your experience with us in the comments section.

The construction industry employs about 7% of the world’s working-age population and although many people think that robots will take away their work, construction workers should not be worried at this time.

In 2017, McKinsey Global Institute published a surprising report: labour productivity in construction has decreased by 50% since 1970. In addition, McKinsey believes that productivity in construction has registered zero increases in recent years. While other industries have been transformed, construction has stalled. The effect is that, when adjusting to inflation, a building today costs twice as much as 40 years ago.

And although the construction industry is a growing market, there are still some problems that need to be handled to increase profitability and productivity. The main problems facing the construction industry in 2019 are:

- Shortage of skilled labour

- Rising cost of steel, aluminium, wood and other materials.

- Decline in growth

- Low performance projects

- Sustainability

- Security

- Inconsistent use of technology

The construction sector has been positive for the past four years, mainly due to the recovery of residential construction. However, the growth can still be erratic. For example in Europe, after the precedence of the previous decade, a scenario is being predicted where 2020 still shows positive growth (3.5%) but 2021 may not (-3%).

Adoption of Technology in Construction

The construction industry is notoriously slow in adopting technologies such as IoT that could boost productivity and, ultimately, profitability.

And although it is believed that construction companies that adopt this technology would also be able to attract new labour force to work for them over others and, in general, have a significant advantage over competitors, the reality is that it is not happening. The general vision insists on a reality: construction and engineering companies see the need for change, but in one way or another they resist.

One of the biggest opportunities of the construction sector is its enormous capacity to reinvent itself. Building Information Modelling (BIM), 3D printing and Virtual Reality (VR) can help architects and builders in creating a construction model. These technologies, along with drones and IoT can be of enormous help to construction workers, increasing their efficiency and ensuring their safety. Materials science is also developing newer material that can impact the industry. The integration of technological trends such as IoT, will facilitate many of the tasks of the sector, optimising resources, improving compliance with deadlines and quality in projects and works.

The Opportunity of IoT in Construction

The appetite of investors for start-ups in the construction sector is growing, although not many are in the IoT box. There are still few examples of companies in the sector that are adopting IoT. And although I have no doubt that IoT will positively impact this industry none of the productivity, maintenance, security and safety drivers seem to be convincing them at the moment.

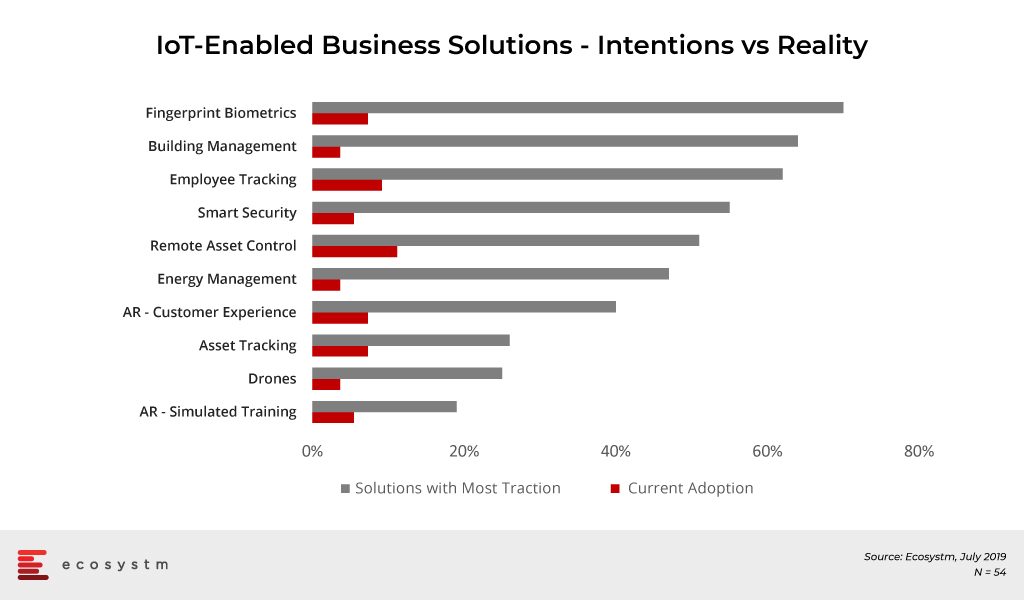

In the global Ecosystm IoT Study, participants from the construction industry were asked about the key business solutions targeted for IoT uptake. While the industry is aware of the IoT solutions and the role they can have in asset and people management, the actual uptake of these solutions is far lower. Around a tenth of Construction companies have some sort of an IoT-enabled asset control and management solutions.

There are ample examples of innovation with IoT in Construction.

- Machine control

- Construction site monitoring (Examples include)

- Anchor load monitoring from installation

- Control of the deformation of the ground during the construction of a tunnel

- Monitoring changes in pore water pressure during soil consolidation

- Monitoring of the settlement process during the soil recovery works

- Fleet management

- Wearables with AR capabilities and safety measures

Some practical examples of IoT in Construction have been covered in the article and include

- Remote operation

- Replenishment of supplies

- Equipment construction and monitoring tools.

- Maintenance and repair of equipment.

- Remote use monitoring

- Energy and fuel savings

Key Takeaways

IoT and other emerging technologies can improve productivity, reduce costs and security in the construction industry. Construction companies, real estate and engineering firms should continue their investments in IoT.

They should not fall back into the same mistakes of the past and should not fear the loss of jobs due to the new technologies like IoT or Artificial Intelligence (AI). The adoption of IoT is unlikely to replace the human element in Construction. Instead, it will modify business models in the industry, reduce costly mistakes, prevent injuries in the workplace and make construction operations more efficient.

Smart Construction is key to building Smart Cities and is an element in Smart Building, Smart Transportation and even Smart Healthcare. The limits of using IoT in Construction is our imagination.

Thanks for your Likes and Shares.

During the past 12 months, Cisco has worked hard at refining and relaunching their IoT strategy. Initial overall impressions of the progress are good with strong alignment with both Cisco and their customer needs. Launching IoT to three different audiences at Cisco Live Barcelona, Hanover Messe and Cisco Live San Diego was critical as it enabled Cisco to talk to network, industry and enterprise audiences in a focused and personalised manner. However, there are other market dynamics at play that will challenge Cisco’s IoT Edge strategy and ecosystem play. Both the progress and challenges are discussed in this review.

Overall Rating B+

Much of the 2018-2019 efforts may be collated under three main categories.

- Hardware. Establish a hardware foundation from which any IoT device or customer can reap the benefits of Cisco’s larger corporate strategy built around initiatives such as Cisco DNA Center, Intent Based Networking, ACI and Security. With the acquisition of Sentryo and the refresh and launch of their routers, Cisco is now well placed to have legitimate discussions with Industrial IoT or IIoT customers and prospects. Bringing IBN functions to the edge of the network will enable Cisco’s customers to begin to develop richer business outcomes from the network. Rating: A-

- Developers: Raise the availability of IoT-based applications through Cisco’s DevNet developer community. Cisco has a significant advantage over their competitors by having over 500,000 developers who understand how to write apps for Cisco’s product line and who now have access to new types of data that can enrich traditional network outcomes. Over time this advantage will become more and more valuable as data becomes utilised across markets as well as within markets thus creating wealth in a much larger ecosystem. Rating: B+

- Partners: Transform their partner management through the Customer Experience (CX) program. Much of Cisco’s business is conducted through partners. It is a critical success factor for Cisco to enable the partners to be IoT-data savy. IoT will enable Cisco to accelerate the transition from product sales to higher value subscription services. However, based on discussions with customers, partners and Cisco management, we believe that there is much more work to integrate an IoT strategy in to CX. Rating: B-

The Industrial IoT (IIoT) and Cisco

Cisco identified the IIoT market as one where Cisco’s strengths in hardware, software and partner ecosystem will play well with their customers and prospects. While having a strong foothold in the industrial space, we believe that Cisco’s success will be much dependent on the customer’s workloads and what they want to achieve with their data as it is reducing the complexity between IT and OT (Operations Technology) issues. Cisco has addressed the IoT connectivity and network security at the edge of the network through its ruggedized routers while their competitors are building distributed computing environments. Competitors who are adopting a full IT stack at the edge of the network aim to offer up more OT-based industrial services as well as emerging innovation services such as digital twin, augmented reality and robotic process automation. One key consequence of a customer choosing either approach will result in differing partner ecosystems to form and support the customer. These ecosystems will also be different in how they are managed and by who manages them.

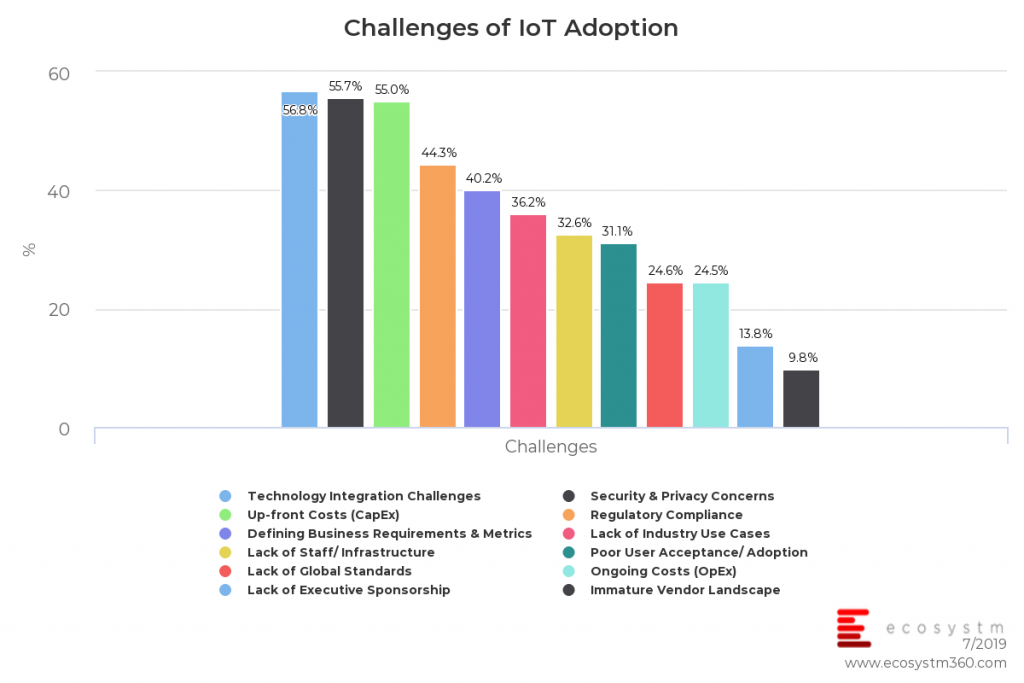

Our recent IoT study shows that while security (a sweet spot for Cisco’s strategy) remains extremely important to an organisation’s solution, technology integration is equally important. When vendors are considering implementing an industrial solution, they need to be able to provide an end-to-end solution that encompasses both the IoT Edge and the IoT Enterprise while smoothly bringing together the OT and IT procedures.

This all starts with an easy on-boarding of any IoT device that is secured and managed with confidence and reliability. The good news for Cisco is that these challenges are also a natural opportunity for Cisco’s partner organisation and systems integrators by creating a new styled IoT ecosystem. However, despite which hardware path an end-user takes, we believe that Cisco and others do not have all of the necessary components of the full ‘IoT’ stack to fulfil a complete solution. To that end, everything will pivot to the vendor who either has the better systems integrations partnership, or, plays in the strongest ecosystem.

IoT Services

Most of Cisco’s business is driven through partners and therefore any success for Cisco’s IoT strategy is dependent on how well they execute it. IoT will accelerate the shift from product based solutions to subscription/as a Service deliverables as more information is generated from the connected devices. and as such the Cisco partner community should be trained/incentivised to offer up IoT. Cisco partners are already undergoing their own business transformation as Cisco’s Customer Experience (CX) strategy is introduced to them. Having the IoT hardware align with the broader Cisco vision was critical to enabling any CX IoT strategy. However, partners may be in ‘transformation’ overload as they embrace the traditional Cisco customer needs and requirements and may be slower to take up the IoT opportunities.

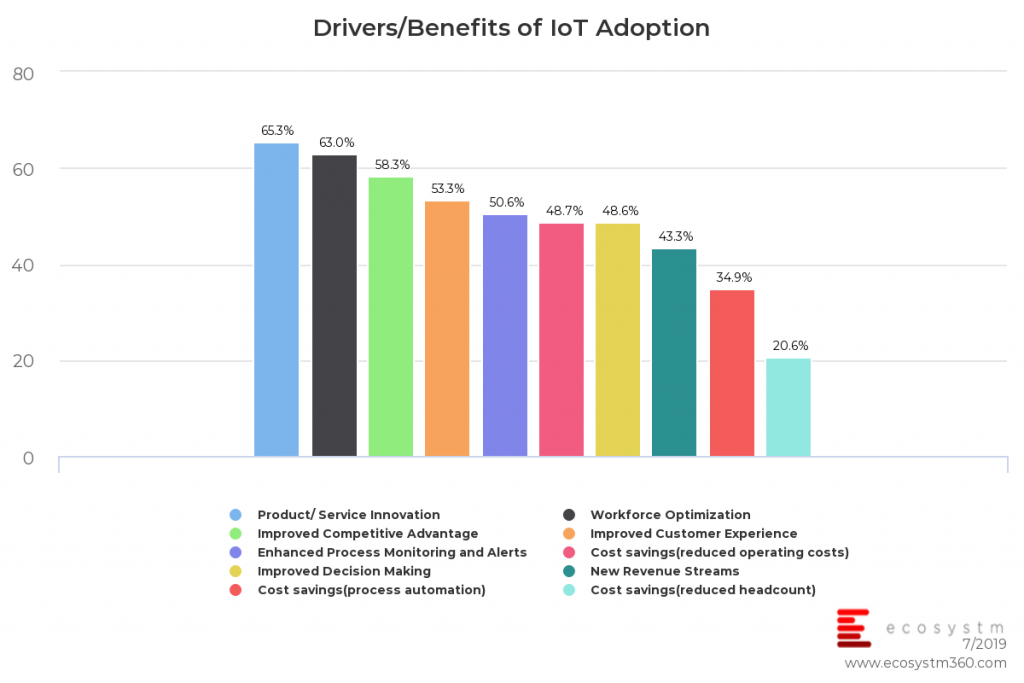

Our IoT study shows that customers believe that the transition from products to services innovation is the highest scoring benefit from an IoT implementation.

However, this is a difficult but critical part of any company aspiring to become a digitally driven business. An IoT strategy is a corner stone of this vision as it will provide the data to be able to run a services or subscription-based business model

Cisco is well positioned here but there is a maturity and readiness gap between Cisco and their customers. Patience will be a key asset as Cisco and their partners close technology gaps for their customers (e.g. adopting and implementing widespread analytics as part of the corporate digital strategy. Most customers are not ready to take advantage of IoT-based analytics outcomes and therefore the RoI case has not been fully articulated).

Finally, Cisco needs to address the mid-tier market with solutions that are compatible with budgets. While it is important to have an ecosystem of high calibre partners within systems integrators, we feel that there will be many customers who cannot afford Cisco’s end-to-end solution. As a result of this Cisco partners are still not ready to address the mid-tier market. Cisco will need to promote offerings across all markets by participating in high-, mid-, and low-end ecosystems. This may mean acknowledging non-5G licensed spectrum/ non WiFi solutions for the most cost sensitive customers for the sake of broader market and industry share.

Recommendations For Cisco IoT

The following are our recommended actions for Cisco IoT based on C-Scape and the prior 12 months of strategy rollout:

- Create stronger value proposition for network based IoT business outcomes. Customers are asking for end-to-end validation which means that Cisco needs to articulate a role with the likes of Salesforce, SAP and Microsoft to enhance customer’s enterprise management systems. This is where Cisco’s CX and partner organisation will also be challenged but can open up a lot of opportunity. Move the message up the value chain. More work has to be done with CX. More has to be done with developers.

- Articulate a stronger comprehensive Industry 4.0 solution that gives customers all of the application qualifiers to run on Cisco’s hardware. Cisco will be challenged by the IT-lead distributed IoT compute stack over its industrial strength routers. More marketing has to be invested in the IoT Edge campaigns.

- Segment the IoT market by customer maturity/readiness/size and their IoT connected assets. Based on asset churn and customer size will dictate the type of new IoT ecosystem that Cisco will either build, manage or participate. For example, an IoT solution of Capex intensive assets with longevity is very different for agriculture supply chain management. Segmentation is critical for Cisco to be successful.

Critical Communications World, 2019 – TCCA’s largest event in global public safety communication – was held in Kuala Lumpur in June. Mission-critical communications are essential to maintaining safety and security across a range from daily operations to extreme events including disaster recovery. A UN report estimated that economic losses from natural disasters could reach USD 160 billion annually by 2030.

I attended the event as a guest of Motorola Solutions – one of the leaders in this field. Many people associate Motorola only with phones not knowing that they have been the cornerstone of some of the largest critical communications deployments around the globe. For instance, Victoria Police completed its AUD 50M+ rollout of Motorola Solutions managed services, enabling almost 10,000 police officers across Victoria access to mobile devices loaded with smart apps, and data when and where they need it most.

Motorola’s ability to provide customers with a private network which is secure, robust and redundant in the event of disaster has also been one of the reasons for their success in the industry. In the event of natural disasters or terrorist attacks, situations can arise where networks will not be available to send and transport any information. Having a secure and private network is critical. That explains why some of the largest police departments in Asia work with Motorola and these include Singapore, Malaysia and Indonesia.x

Motorola acquired Australian mobile application developer Gridstone in 2016 and Avigilon, an advanced video surveillance and analytics provider in 2018. These acquisitions demonstrate how Motorola is innovating in the areas of software, video analytics and AI.

Key Takeaways:

Public Safety Moving to a Collaborative Platform with AI and Machine Learning

Andrew Sinclair, Global Software Chief for Motorola Solutions sees AI enhancing future command and control centres and allowing greater analytics of emergency calls. Call histories and transcriptions, the incident management stack, community engagement data and post incidence reporting are all important elements for command and control centres. Using AI to sieve through the information will empower the operator with the right data and to make the right on-the-spot decisions.

The Avigilon acquisition, enhances Motorola’s AI capabilities and less time is spent monitoring videos, giving first responders more time to do their jobs. The AI technology can make “sense” of the information by using natural language technology. For example, if asked to find a child in a red t-shirt, the cameras can detect the child and also create a fingerprint of the child. The solution enables faster incidence detection by using an edge computing platform. It gathers the information and processes it to relevant agencies making the search operation faster and more streamlined. The application of AI in the video monitoring space is still in its early days and the potential ahead for this technology is enormous.

The other area that can empower first responders better are voice activated devices. The popularity of Alexa and Echo in the consumer world will see greater innovation in the application of public safety solutions. For example, police officers responding to an emergency may have very little time to look at screens or attend to other applications that need touching or pressing of a button as time and attention is essential is such scenarios. The application of voice activated devices will be critical for easing the job of the police officer on the ground. This will not only save administrative work on activities such as transcription, but also help in creating better accounts of the actual happenings for potential court proceedings.

While it is still early days for a full-fledged AR deployment in public safety, there are potential use cases. For example, firemen standing outside a building to make sense of the surrounding area could use AR to send information back to the command and control centres.

The Growth of Cloud-driven Collaboration

Seng Heng Chuah, VP for Motorola APJ talked about the importance of all agencies in public safety to be more open and collaborative. For instance, currently most ambulance, police and fire departments work in silos and have their own apps and legacy systems. To achieve the Smart City or Safe City concept, collaborating and sharing information on one common platform will be key. He talked about the “Home Team” concept that the Singapore Government has achieved. Allowing all agencies to collaborate and share information will mean the ability to make faster decisions during a catastrophe. Making “sense” of the IoT, voice and video data will be important areas of innovation. Normally when a disaster happens, operators at command and control centres – as well as onsite staff – face elevated stress levels and accurate information can help alleviate that.

The move towards the public cloud is also becoming more relevant for agencies. In the past there was resistance and it was always about having the data on their own premises. In recent years more public safety agencies are embracing the cloud. When you have vast amounts of data from video, IoT devices and other data sources, it becomes expensive for public safety agencies to store the data on premise. Seng Heng talked about how public safety agencies are starting to “trust’’ the cloud more now. According to him, Microsoft has done a good job in working with local governments around the world, and their government clouds have many layers of certifications as well as a strong data centre footprint in countries. The collaboration between agencies and more importantly agencies embracing the cloud will drive greater efficiency in analysing, transcribing and storing the data.

The Rise of Outcome-based, Services-led Opportunities

Steve Crutchfield, VP of Motorola Solutions for ANZ, talked about how Motorola is a services-led business in the ANZ market. 45% of Motorola’s business in ANZ is comprised of managed services. The ANZ region is unique as it is seen as early adopters and innovators around public safety implementations. Organisations approach Motorola for the outcomes. Police and Ambulance for example in the state of Victoria use their services on a consumption model. Customers across Mining, Transportation, and Emergency Services want an end-to-end solution across the network, voice, video and analytics.

The need for a private and secure network is significant in several industries. In the mines, safety is of priority and as soon as the radio goes down it impacts productivity and when production stops that can results in huge losses for the mines. Hence the need for a reliable private network that is secure for the transportation of voice and video communication is critical.

Crutchfield talked about how the partner ecosystem is evolving with Motorola working with partners such as Telstra and Orion but increasingly looking for specialised line of business partners and data aggregation partners. Motorola works with 55 channel partners in the region.

Ecosystm Comment:

Motorola Solutions is an established player in providing an end-to-end solution in the critical communications segment. The company is innovating in the areas of software and services coupled with the application of AI. Dr Mahesh Saptharishi, CTO at Motorola Solutions talked about how AI will eventually evolve into “muscle memory”. That will mean that there is far greater “automatic’’ intelligence in helping the first responders make critical decisions when faced with a tough situation.

In the end the efficacy of critical communications solutions will not just be the technology stack, but the desire and ability for cross-agency collaboration. As public safety agencies analyse large volumes of data sets from the network right to the applications, they will have to embrace the cloud, and which will help them achieve scale and security when storing information in the cloud. From the discussions, it was clear that the public safety agencies have started acknowledging the need to do so and we can expect that shift to happen soon.

Motorola will need to keep evolving their channel partner model and start partnering with new providers that can help in delivering some of the end-to-end capabilities across Mobility, AI, software, analytics and IoT. Many of their traditional partners may not be able to be that provider as the company evolves into driving end-to-end intelligent data services for their clients. The company is playing in a unique space with very few competitors that can offer the breadth and depth of critical communications solutions.

The Retail industry faces constant disruption because of unpredictability and seasonality for reasons ranging from economic uncertainties to festive seasons. Technology adoption has emerged as a key differentiator between the success stories and the also-rans in the industry. The biggest example of this would probably be eCommerce heavyweights in China, that were revolutionised by digital technology, forcing global Retail counterparts to transform to compete. Emerging technologies are helping organisations drive customer loyalty and improve their supply chain for better cost efficiency.

Drivers of Technology Adoption in Retail

There are several factors that have made the Retail industry one of the leaders in technology adoption.

- Evolving Customer Preferences. Understandably, customers are kings in the Retail industry and their preferences drive the industry. For many years, customer loyalty was implemented through ‘loyalty programmes’ but today’s customers are not bound by cards and points, and factors such as same-day delivery, multiple payment options, on-the-spot problem resolution, and even invitations for exclusive events have a role to play in customer retention. The focus has shifted to better customer experience (CX). Retailers have access to immense data on their customers (which in turn raises concerns around data handling and compliance – requiring further investments in cybersecurity solutions), which is collected at every point of interaction and can be analysed for personalised and just-in-time offerings.

- Maturity of the Omnichannel. Omnichannel retailing has been gaining grounds since the advent of eCommerce. However, the proliferation of mobile apps enabled not only easy access and monitoring of loyalty programmes, but also advanced capabilities such as the real-time view of inventory, and incorporation of virtual assistants for CX – and are pushing traditional players in the Retail industry to innovate and adopt the technology. However, as omnichannel has become the norm, retailers are evaluating the channels they want a presence on. While experts predicted that a brick-and-mortar presence would become redundant, retailers are realising that while consumers do research on the Internet and apps, many prefer to inspect and buy at a physical shop. This requires better integration and supply chain visibility across all touchpoints.

- Globalisation of the Market. No longer can a retailer be sure of where the actual competition lies. One just has to look at the number of platforms and websites originating from Japan that have a presence across the globe to understand that competition can come from outside your country and very easily. Nor can they be sure of the best place to source their products as the world becomes one global market. In this global world, it is very important for retailers to have complete visibility of their supply chain, whether for a brick-and-mortar store or for eCommerce.

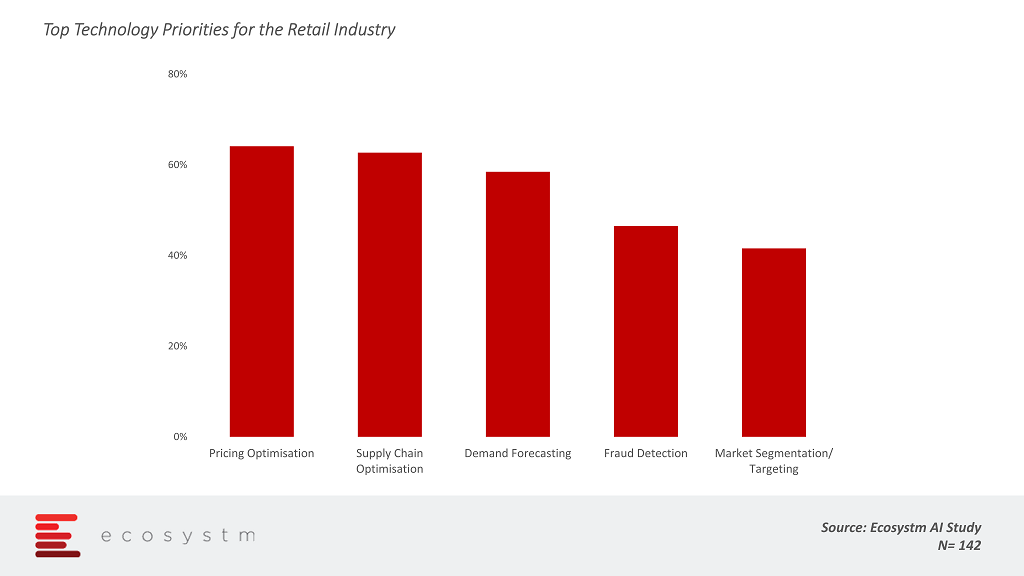

The global Ecosystm AI study reveals the top priorities for retailers (and etailers), focused on adopting emerging technologies (Figure 1). It is very clear that the top priorities are driving customer loyalty (through initiatives such as market segmentation and pricing optimisation) and supply chain optimisation (including demand forecasting and fraud detection, as procurement widens).

IoT as an Enabler of Retail Transformation

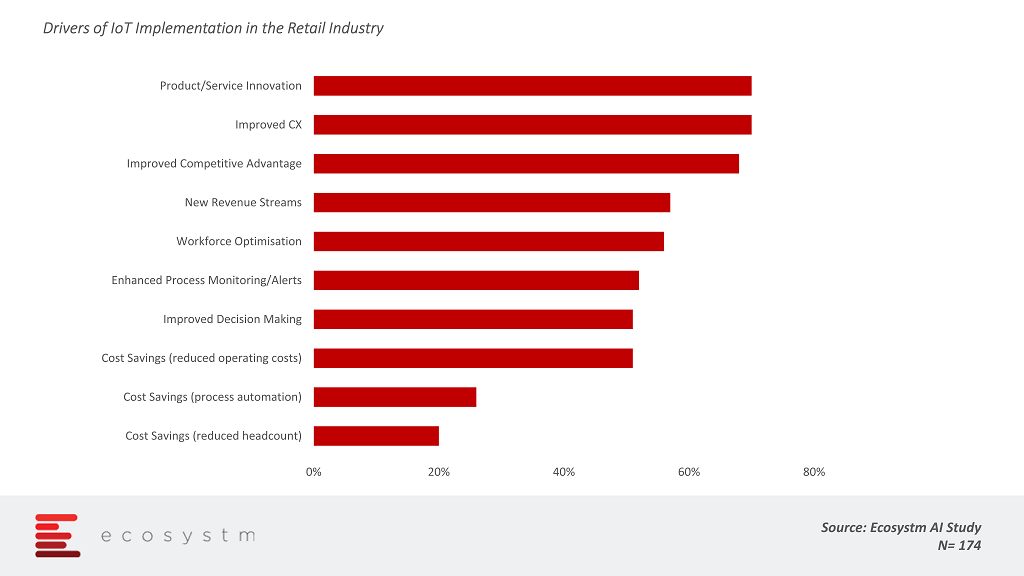

The Retail industry is particularly leveraging IoT as they are faced with the overwhelming need to transform. The global Ecosystm IoT study reveals the areas that organisations are looking to benefit from IoT implementations (Figure 2). Retail organisations are essentially looking to creating a competitive edge – cost savings are not high on the list of benefits they are looking at.

Several Retail organisations are deploying customer management IoT solutions such as payment systems, customer identity authentication (especially in eCommerce), Digital Signage, customer satisfaction measurement through smart buttons, and location-based marketing. Asset management IoT solutions such as IoT-based inventory and warehouse management are also gaining traction.

Examples of IoT Use in Retail

IoT for Customer Experience

- Automated POS terminals. Customers are put off by long queues, and automated checkout systems are improving CX. Caper’s plug-and-play cart-system is a shopping cart with a built-in barcode scanner and credit card swiper which automatically scans items when they are dropped in, with the help of image recognition cameras and weight measuring sensors.

- Smart Mirrors. Smart fitting rooms are transforming the way customers browse, try out and shop. Smart Mirrors enhance customers’ shopping experience through interactive fitting rooms which connect retailers and customers digitally. Rebecca Minkoff reinvented the dressing room using Smart Mirrors.

IoT for Marketing

- Digital Signage. Digital Signage has proved to be an effective way of target marketing, eliminating the need for employees to put up physical signs and enabling dissemination of the latest product news and promotions to the consumers. Advanced Digital Signs include heat-mapping to upsell items based on high-traffic areas. Prendi, an Australian design agency created an interactive retail experience that is intended for store managers to showcase the most popular products, provide information, and simplify the overall sales and purchase process. Customers can take time to easily navigate through store inventory on a single screen, order for items digitally, which is then sent to a salespersons’ handheld devices, allowing them to take the items over to the customers.

- Location-Based Marketing. Many retailers are collaborating with financial institutions and location-enabled apps to send push notifications on latest deals and offers straight to the customers’ devices, once they enter a demarcated location. This provides just-in-time data that increases app engagement and retention. Ukrainian hypermarket, Auchan, started a beacon pilot in Dec 2016 and kept adding new campaigns to strengthen the offerings in 2017. The hypermarket makes use of beacons to enable customers to receive notifications on navigation and promotions as they move through the store.

IoT for Supply Chain Optimisation

- Smart Shelves. Shelves have turned out to be more than just a surface for displaying and storing objects. Retail stores are utilising RFID readers, weight sensors, proximity sensors, and 3D cameras for real-time visibility on inventory, layout, and shopper preferences. For FMCG products, monitoring the shelf life of perishable goods and proactive reorder alerts are extremely useful. Kroger Smart shelves are designed to offer digital support – they show ads, digital coupons that consumers can easily add to their mobile devices and changed prices as stores calibrate their product pricing. The shelves are built on top of sensors that keep track of products and real-time in-store inventory counts.

- Remote Supply Chain. Retailers are looking to create a competitive edge and grow profits by optimising and digitising their supply chain management through IoT. Tive helps users keep real-time tabs on the condition of their shipped goods, notifying them about shock, vibration, tilt and other factors that might detrimentally affect those goods. Doing so allows retailers to expedite a replacement shipment and give customers a heads-up, and also tells when and where the delay occurred so future shipping routes can be adjusted if necessary.

- Warehouse Automation. Devices, sensors and RFID tags help warehouse managers to know the exact details, location, and progress of any product at any time. This gives higher visibility into the inventory and the entire supply chain. UPS is using smart glasses in test programmes to reduce the amount of labelling on packages. Robots are used by the worldwide shipping company DHL in some of the company’s more modern facilities to reduce labour costs and improve order fulfillment speed and accuracy, all without disrupting ongoing warehouse operations.

The Retail industry already has several IoT use cases and AI-enabled IoT will further transform the industry. What are some interesting use cases that you can think of for the Retail and allied industries? Let us know in your comments below.